In 2021, Indian startups raised over $42 Bn in funding

Over 2,487 investors participated in the Indian startup funding in 2021

Not just this, about $6.2 Bn was raised by different investors and funds in 2021 to back Indian startup story

The current list only includes the most active investors based on their deal participation in the Indian startup ecosystem in 2021.

This is a running article, if you would like to nominate more investors for this list, write to us at [email protected].

The pandemic is like two sides of a coin, as it brought two types of impacts broadly; encompassing all sectors and heralding fresh changes in the social and economic framework of the country. Like the other sectors, the startup ecosystem in the country too has gone through massive changes due to this lifetime event.

The pandemic could be recognised as a growth catalyst for the segment, as we saw capital worth $6.2 Bn raised by 62 funds across categories (VC, Debt, CVC, Micro VCs) to back the rising Indian startup economy. A massive impetus to the startup growth one can say!

In 2021, Indian startups raised more than $42 Bn which is a figure that is much higher than the $37 Bn raised by startups in the previous three years combined. Over 42 new unicorns were minted last year, and over $7.3 Bn was raised by tech startups through IPOs.

In this article, we have collated the list of most active investors (venture capital funds, venture debt funds, angel networks, and others) which participated in startup funding in 2021 for our readers.

The list below is not meant to be a ranking of any kind. We have listed the investors in alphabetical order under each category.

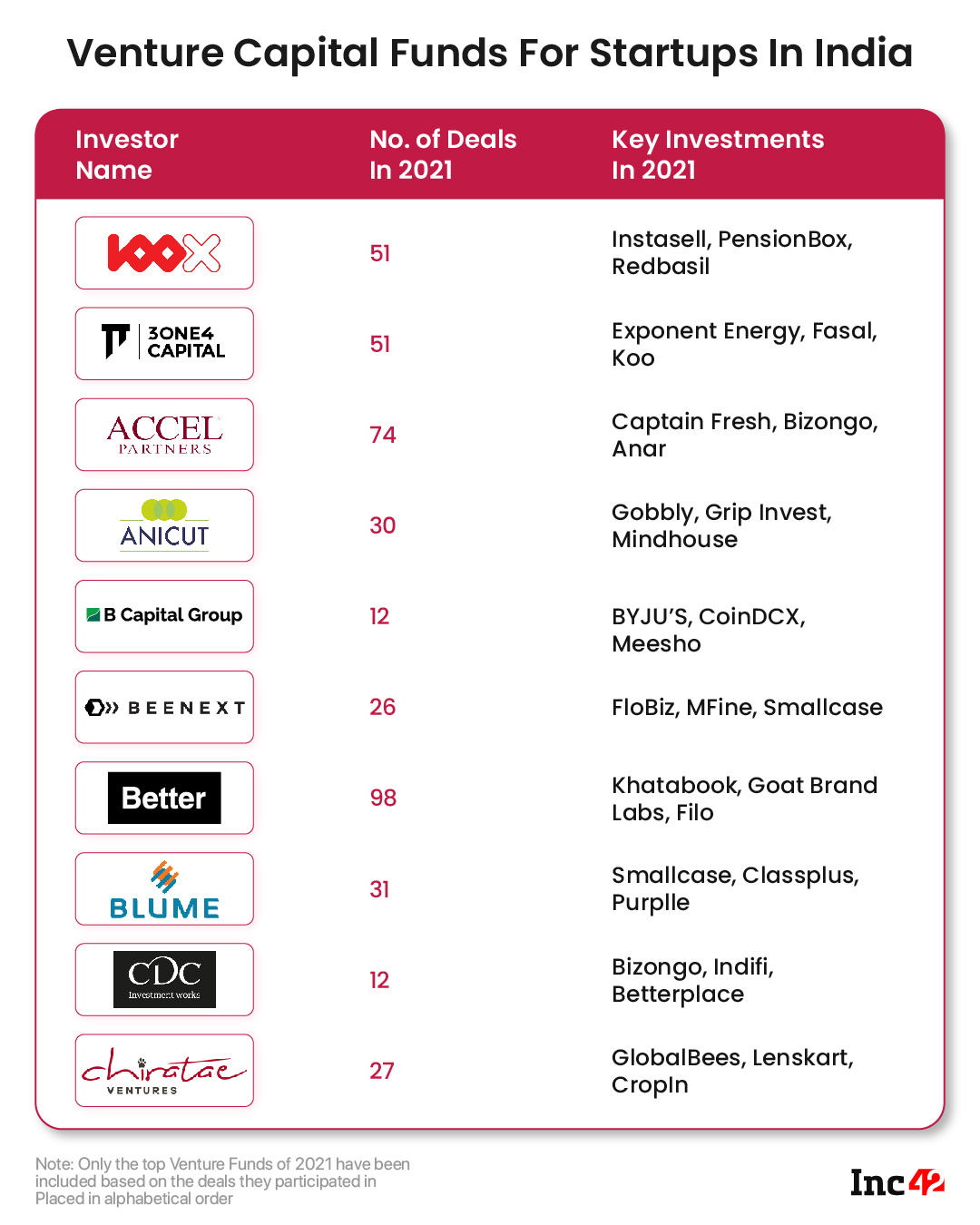

Venture Capital Funds For Startups In India

100X.VC

Entrepreneur and angel investor Sanjay Mehta launched the micro venture capital fund 100X.VC in 2019, with the aim to invest in 100 startups every year. According to the firm, it is a sector agnostic investor that also aims to provide founders with the networking, expertise and resources they require to scale up their business.

Last year, 100X.VC participated in 51 startup funding deals including Healthy Barks, PensionBox, Super Scholar, Broomees, Wizzy.ai, Red Basil Technologies, Utsav among others.

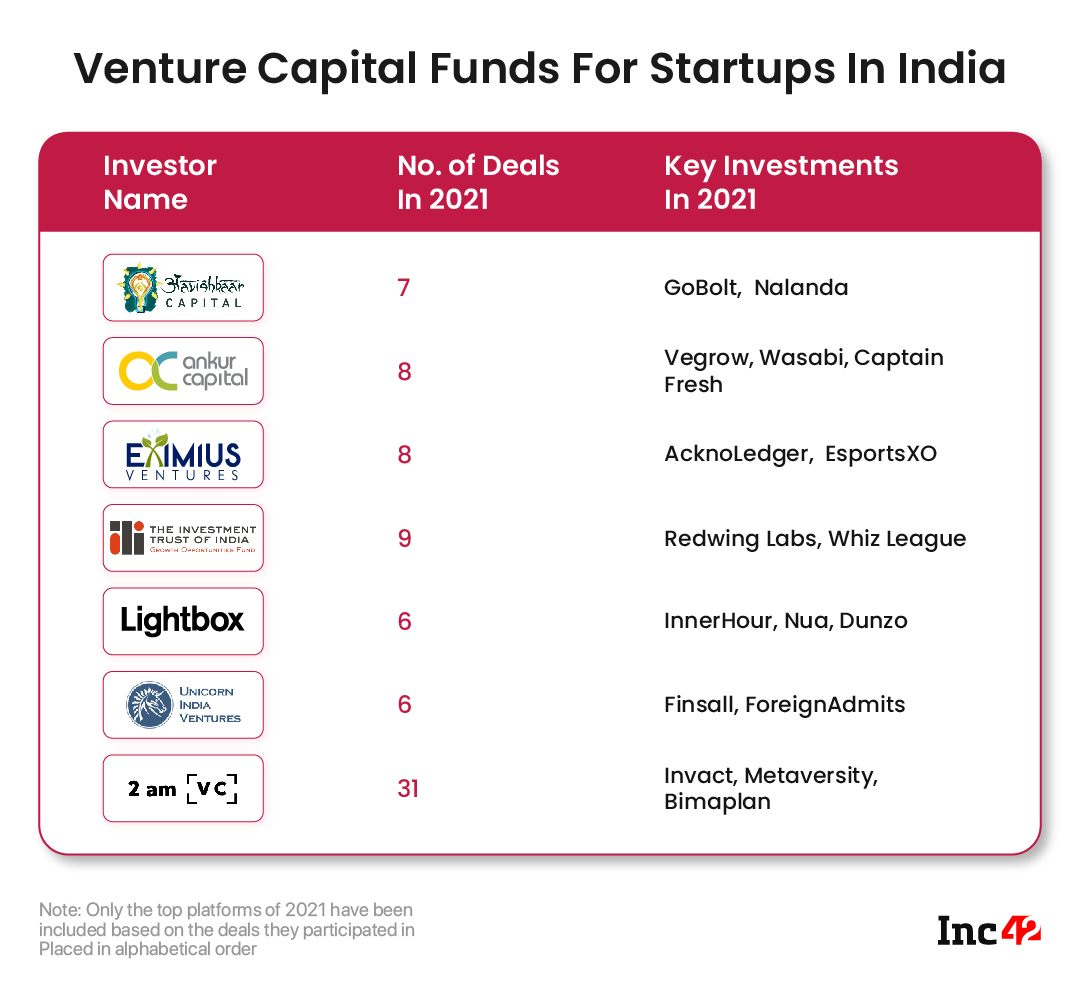

2am VC

Founded in early 2021 by Brendan Rogers and Hershel Mehta, 2am VC is focused on investing in early-stage startups in India. The firm invests in startups across sectors such as edtech, fintech, healthtech, ecommerce, enterprisetech, media & entertainment, and consumer services. Its list of portfolio companies includes — fintech startup Karbon Card, and digital health and fitness platform BurnCal. In addition, 2am VC has co-invested with Titan Capital, 3one4 Ventures, Inflexor VC, 100X.VC, LSIP, Y-Combinator, India Quotient, Orios Ventures, and iSeed.

In 2021, US-based venture capital firm announced its plans to invest $10 Mn in more than 50 Indian startups. Last year also saw the fund making investments in 31 startups such as Invact Metaversity and Bimaplan.

3one4 Capital

Founded in 2015 by brothers Pranav Pai and Siddarth Pai, 3one4 Capital is Bengaluru-based early-stage venture capital fund that primarily invests in AI/ML-driven actionable intelligence services, enterprise automation, ambient intelligence technologies, consumer products, fintech, media, multilingual content and digital health startups.

It typically invests between $500k and $4 Mn in early-stage startups. It participated in more than 51 funding deals last year including Betterplace, Open, Zorro, Koo, WeRize, Everstage, Dozee and Breathe Well.

Aavishkaar Capital

Founded in 2001 by Vineet Rai and Swati Rai, Aavishkar Group comprises five entities — microfinance institution Arohan; Aavishkaar Capital, which runs a slew of venture capital funds; Intellecap, which undertakes consulting, research, investment banking and social entrepreneurship; fin-tech-focused lender Tribe3, and SME-focused debt finance provider IntelleGrow.

Aavishkaar Capital invests in growth-stage enterprises across sectors such as fintech, agritech, transportech. The firm supports the companies by advising on strategy, governance, operational processes, human resources, and fundraising.

Its portfolio of brands includes such as AgroStar, chqbook.com, fabelio, Grasshoppers, Paywell, and Vortex among others. Last year, it invested in seven Indian startups including GoBolt and Nalanda.

Accel Ventures

Founded in 1983, Accel Partners has a global presence in Palo Alto, London, New York, China and India. It typically makes multi-stage investments in the range of $500k and $50 Mn in startups that operate in sectors including internet and consumer services, infrastructure, cloud-enabled services, and mobile and software. Last year, it participated in 74 deals including Koo, Agrostar, Anar, Breathe Well, Captain Fresh, Powerplay and others.

Anicut Capital

Founded in 2016 by Ashvin Chadha and IAS Balamurugan, who have spent years in commercial, private and investment banking at senior levels. The team has lent to 450+ Cr Indian SME companies. Anicut Capital currently manages two debt funds with an AUM of INR 1,400 Cr and an equity-based angel fund, Anicut Angel Fund. The debt fund provides structured debt to growth-stage companies and has a portfolio of companies such as Bira 91, Wow Momos, Sugar, and Wingreens. is an angel fund that offers debt financing to small and medium businesses.

The angel fund started investment in early 2020. To date, Anicut Angel Fund has deployed INR 230 Cr in early-stage startups through a network of 700+ individual investors. Some of their portfolio companies comprised of names such as Neeman’s, Deepsync Technologies, Burgerama, Blue Tokai Coffee, ShareChat, Astrogate Labs, Agnikul and Grip Invest. Angel Fund invested across 30 deals last year.

Ankur Capital

Established in 2011 by Ritu Verma, Ankur Capital is an early-stage venture capital fund that invests in edtech, fintech, agritech, healthtech, SaaS, EVs, and D2C brands. Its average ticket size last year was $1,500K. Its portfolio of startups include names like mycaptain, WASABI, Captain Fresh, Krishify, Cropin, String Bio, Niramai, BigHaat, and Jiny, VeGrow, Health Sutra, Offgrid Energy Labs, and numen among others.

The calendar year 2021 saw the Mumbai-based firm invest in eight startups.

Antler India

Global early-stage venture capital firm Antler entered the Indian market in late 2020. The sector-agnostic fund invests in the range of $175K to $250K at 10% at the earliest stages and commits capital within 4 weeks. It has invested in sectors such as ecommerce, edtech, mobility, fintech, and web3.

2021 saw Antler India making investments in 17 Indian startups such as Flow Club, Humit, and PeakPerformer.

Artha Venture Fund (AVF)

Started in 2018 by Anirudh Damani, Artha Venture Fund (AVF) is an early-stage micro venture capital (VC) fund. It is backed by Artha India Ventures (AIV) — Damani’s family fund. AVF invests in startups from the seed stage through Series A and has investments in over 85 startups across India, the US, and Israel. The fund has invested in startups such as Agnikul, HobSpace, PiggyRide, Daalchini, and Kabbadi Adda. It had also announced the final close of its debut fund at INR 220 Cr in 2021.

Damani has mentioned in past conversations that AVF’s investment strategy involves being the first investor in early-stage companies. It usually invests in the range of INR 1 Cr to INR 2 Cr with INR 10 Cr and INR 15 Cr held in reserve for follow-on rounds. The VC fund prefers to invest across sectors such as edtech, fintech, ecommerce, enterprisetech, media and entertainment, and consumer services. In 2021, it participated in 17 deals including Agnikul, InstaAstro, Immensitas and StarClinch.

B Capital Group

Facebook cofounder Eduardo Saverin’s B Capital is a global multi-stage investment firm that invests in growth and late stage startups that transform and disrupt large traditional industries. It has participated in more than 12 startup funding deals last year including Byju’s, Innovaccer , and CoinDCX.

Beenext

Beenext is a global venture capital firm that invests in early-stage technology startups in India, Southeast Asia, Japan and the United States. It had closed its emerging asia fund at $110 Mn in 2020, committing more than half to Indian startups. It participated in more than 26 funding deals, including AppsForBharat, Agrikul, and Jupiter.

Better Capital

Founded in 2018 and run by Vaibhav Domkundwar, Better Capital is backed by founders, operators and other investors. Some of its backers include prominent leaders at Meta, Google, Uber, LinkedIn, Tiger Global, TPG and The World Bank among others.

The sector-agnostic fund invests 40-50 pre-seed and seed stage startups with a median cheque size of $300k. It has already invested in more than 125 companies across categories such as neobanks, fintech infrastructure, edtech and SME digitisation.

It is now planning to back Crypto and Web 3.0, cleantech and creator-economy focused startups. Better Capital participated in 98 funding deals last year including startups such as OneCard, Zingbus, and Virohan.

Blume Ventures

Founded by Karthik Reddy, Ashish Fafadia and Sanjay Nath in 2010, Blume Ventures closed its debut fund in 2011 at $20 Mn. More than five years later, it closed its second fund with a corpus of $60 Mn. Its fourth fund that had its first close last year targets double the corpus of its $102 Mn third fund raised in 2020.

Its portfolio of more than 150 startups include Smartstaff, Exotel, Euler, Yulu, Koo, Purplle, Cashify, among others and has had more than 20 exits. It typically invests between $1 Mn and $2.5 Mn in consumer internet, SMB marketplace, SaaS and enterprise tech startups but plans on writing bigger cheques with its fourth fund.

It participated in 31 funding deals, some of the startups that it backed in 2021 included — smallcase, Purplle, Stage3, ElectricPe, and Battery Smart.

CDC Group

Established in 1948, CDC group is the development finance institution of the United Kingdom government. It had announced its plans to inject more than $1.7 Bn into India and other developing countries.

In 2021, it had invested in startups such as Bizongo, Indifi, and Betterplace.

Chiratae Ventures

Chiratae Ventures India Advisors is a venture capital fund that has over $700 Mn under management in more than 80 startups across consumer media and technology, cloud and software, healthtech and fintech sectors. Last year, it had invested in 27 startups such as Questt, BeepKart, and ShopSe.

DSG Consumer Partners

Established in 2012, DSG Consumer Partners invests in consumer brands and other startups in India and Southeast Asia. It has backed more than 60 startups till date including hospitality unicorn OYO (later sold to SoftBank), Zipdial (sold to Twitter), Redmart (sold to Lazada), Veeba, Epigamia, Chai Point, EazyDiner and others.

Last year, it participated in 12 startup funding deals, including Vista Rooms, Koparo and Ugaoo.

Eight Roads Ventures

Established in 1969, Eight Roads is a venture capital firm that invests in technology and healthcare companies. Along with funding, it also aims to support startups and their founders with scaling, expertise and market reach. Last year, it participated in 35 funding deals, including Quizizz, Uni, and PharmEasy.

Elevation Capital

Elevation Capital is a Gurugram-based venture capital firm that invests in consumer brands, consumer tech, enterprise, SaaS, financial services and logistics startups. Some of the startups in its portfolio include Chaayos, Country Delight, The Souled Store, Urban Ladder, AppsForBharat, ixigo, MakeMyTrip and others. Last year, it had invested in startups such as CityMall, Yellow Class, Sugar Cosmetics.

Endiya Partners

Founded by Sateesh Andra, Ramesh Byrapaneni, and Abhishek Srivastava, Endiya Partners invests between $1 Mn and $1.5 Mn for new investments and between $4 Mn and $5 Mn in follow-on rounds in startups in the field of healthtech, enterprise SaaS, cybersecurity and other allied sectors. It looks to invest in between 18 and 20 startups every year.

Last year, it had invested in 20 startups including Zluri, Upside AI, and SuperBeings.

Eximius Ventures

Established in 2020 by Pearl Agarwal, Eximius Ventures is a micro venture capital fund that invests in fintech, edtech, healthtech, gaming, B2B SaaS, and media & entertainment. The Haryana-based fund focuses on early-stage startups looking for their first institutional investor typically with a cheque size of $150K to $300K.

Late last year, it launched ‘The Gaming Lounge’ to take more bets in the gaming and esports sector. Its first investment was in the gaming startup EsportsXO’s seed funding round. Overall, the fund invested in eight startups last year.

Alpha Wave

Founded in 2012 as Falcon Edge, Alpha Wave Global is a venture capital firm active in a few markets including the United States and India. It has deployed more than $2 Bn in the Indian startup ecosystem and has invested in unicorns such as CRED and Mensa. In 2021, it participated in 19 funding deals and backed startups such as Ola Electric, Mensa Brands, and Lenskart.

Fireside Ventures

Launched in 2017 by Kanwaljit Singh, Vinay Singh and V.S. Kannan Sitaram, Fireside Ventures focuses on investing in early-stage consumer brands across sectors such as food and beverages, personal care, lifestyle and home products.

Fireside Ventures’ portfolio includes brands such as Azani, Yoga Bar, Bombay Shaving Company, boAt, MamaEarth, The Ayurveda Experience, Samosa Singh, and Kapiva. Last year, the venture capital firm participated in startup funding ten deals including Wellbeing Nutrition, Pilgrim, and Fitterfly among others.

First Cheque

First Cheque is a pre-Seed, seed-stage fund under the umbrella of India Quotient, headed by exited founders, product and growth leaders and angels. It helps really early-stage startups create data-driven organisations and set up teams etc.

It typically invests between INR 25 Lakhs ($40k) and INR 75 Lakhs ($100k), usually in the first funding round of startups where founders are raising between INR 50 Lakh and INR 3.5 Cr. Some of the startups it invests in are at a paper-plan stage while others already have either a minimum viable product or a working product with paying customers.

It participated in 72 deals last year, including investments in startups such as Loopin, ClainBuddy, Questt and others.

Gemba Capital

Founded in 2019 by Adith Podhar, Gemba Capital started as a family office making angel investments but has now made pre-seed and seed round investments in more than 30 startups. Some of the startups in its portfolio include Plum, BimaPe, SleepyCat, Gripinvest, Strata, Unnati, Crejo, Zuper, ClickPost and Cleardekho.

It also launched a $10 Mn Micro VC fund this year to invest in SaaS, consumer tech, fintech, and deeptech startups, typically with cheque size of $250k. It participated in 14 deals including startups such as ClearDekho, Smartstaff, and others.

Goodwater Capital

California-based Goodwater Capital is a venture capital firm that has more than $4 Bn of assets under management and has invested in over 12 unicorns in the last seven years. It primarily invests in social, education, healthcare, housing, transportation, fintech and commerce startups.

In 2021, it backed startups such as ByteLearn, Snazzy, and Stack Finance.

India Quotient

India Quotient is a Bengaluru-based early-stage venture capital firm that participated in 30 startup funding deals, including SUGAR, ShareChat, ànd FRND.

It counts startups such as Saveo, WebEngage, Fleetx, Vyapar, Pagarbook, and Powerplay, in its portfolio.

Inflection Point Ventures

Founded in 2018, Inflection Point Ventures is an angel investor network with a claimed membership of more than 6,000 angel investors. It participated in 45 funding deals in 2021, including the funding rounds of Vested Finance, Stylework, and LoanKuber.

Info Edge Ventures

Info Edge Ventures is the investment arm of Info Edge, a publicly listed Indian internet company that runs job portal Naukri.com, matrimony website Jeevansathi.com, and real estate classifieds platform 99Acres.com among others.

It participated in 12 investment rounds in 2021, and some of its investments include Geniemode, Lumiq, and Attentive.

Insight Partners

Insight Partners (Insight Venture Partners previously) is a New York-based venture capital and private equity firm. It invests in growth-stage technology, software and internet businesses across the world. Some startups in its portfolio include Twitter, Shopify, Tumblr, and Wix.

Last year, it participated in 13 deals and backed startups such as Slice, Postman and CRED.

iSeed

AngelList India head Utsav Somani launched micro-fund ‘iSeed’ in 2020. The sector-agnostic fund has invested in startups leveraging technology for SaaS, remote work enabling tools and tech enterprise software.

Somani had closed iSeed fund I in May 2020 and it has invested in over 35 startups at an average check of $150K. This includes HR management startup PagarBook, insurtech startup BimaPe, ecommerce solutions platform GoKwik, revenue-based financing platform Velocity, SMB digitisation platform FloBiz and customer onboarding platform RocketLane, among others.

He had also launched a $15 Mn micro-fund iSeed II last year to support 50 Indian early-stage tech startups across sectors in the next two years. In 2021, it participated in more than 52 deals including Velocity, DELOS, and Park+.

ITI Growth Opportunities Fund

Incorporated in 1991 by J.T. Poonja and Nimish C. Shah, the Investment Trust of India (ITI) group launched an early-stage venture capital fund—ITI Growth Opportunities Venture Fund in 2018. It is a venture capital fund that invests in edtech, fintech, media & entertainment. The fund invests in pre-seed and seed rounds with a ticket size ranging between $100K and $600K.

Its portfolio includes names such as REVOS, ten3THealthcare, Evolve Snacks, and Redwing among others. Last year, it invested in nine startups.

IvyCap Ventures

Founded by Vikram Gupta in 2011, IvyCap is a Mumbai-based venture capital firm whose portfolio includes startups such as Purplle (part-exited), Clovia, Bewakoof and Biryani By Kilo. In 2018, it had raised an $8.2 Mn (INR 60 Cr) angel fund to invest in 30-40 tech startups.

Around the same time, it was also in talks to set up a $100 Mn (INR 640 Cr at the time) cross-border venture capital fund between India and Israel. In 2021, it participated in 13 funding deals, including the rounds of Get My Parking, Bewakoof, and Biryani By Kilo.

Kae Capital

Launched in 2010 by Sasha Mirchandani, Kae Capital is a venture capital fund that invests in early-stage startups across sectors such as fintech, gaming, healthtech, logistics, SaaS and ecommerce.

The Mumbai-based firm’s portfolio includes names such as HandyHome, Myntra, InMobi, Fynd Truebil, Nudgespot, and The Porter among others. In 2021, it invested in 14 deals including Disprz, Nua, 1k Kirana Bazaar, Yojak, and Zetwerk among others.

Kalaari Capital

Founded in 2011, Kalaari Capital has made successful exits from startups including Myntra, Dream11, Medplus and Snapdeal. In March last year, Kalaari onboarded Mukesh Ambani-led Reliance Industries as an anchor investor for its fourth fund.

Last year, it participated in 19 funding deals, including investments in startups such as Skit, Koo, and Elevar.

Lightbox Ventures

Launched in 2014 by Sandeep Murthy and Sid Talwar Lightbox focuses on investing in late-stage across sectors such as fintech, traveltech, transportech, agritech, healthtech, and consumer services.

The Mumbai-based venture capital fund’s portfolio includes names such as Truecaller, Cityflo, WayCool, Bombay Shirt Company, Flinto, Zeno Health, and Furlenco. In 2021, it participated in six deals including InnerHour, Nua, and Dunzo.

Lightspeed

Lightspeed Venture Partners is a global venture capital firm focusing on multi-stage investments in the fields of enterprise technology, consumer, and health sectors. In 2021, it participated across 29 funding deals in Indian startup ecosystem and backed startups such as GlobalBees, Hubilo, and ShareChat.

Matrix Partners

Matrix Partners is a United States-based equity investment firm that invests in seed and early-stage companies in the US and India. Last year, it participated in 49 funding deals in India. Some of the startups that it backed in 2021 included — Dukaan, Captain Fresh and Rocketlane.

Moore Strategic Ventures

Founded in 2014, Moore Strategic Ventures is a New York-based venture capital firm that typically invests in startups in the field of electronics, advanced materials, energy, cleantech, information technology, transportation, and distribution sectors. It participated in 12 funding deals in the Indian startup ecosystem last year. Some of the startups that it backed in 2021 included — ShareChat, Shiprocket, and Khatabook.

Nexus Venture Partners

Founded in 2006, Nexus Venture Partners is an India-US venture fund started by entrepreneurs who worked in the fields of enterprise technology and consumer internet. It typically invests in global technology products and technology-led businesses in India. In 2021, it backed startups such as Quizizz, Postman, and Zepto.

Omidyar Network India

Founded in 2004 by eBay founder Pierre Omidyar and his wife Pam, Omidyar Network claims to be a ‘philanthropic investment firm’ composed of a foundation and an impact investment firm. Last year, it backed Doosra, Kutuki, and CredFlow in India.

Omnivore

Omnivore typically invests in agritech and foodtech startups including farmer fintech, B2B agri marketplaces, farm to consumer brands, precision agriculture, post-harvest technologies and agrifood life sciences. It participated in 14 funding deals last year including Pixxel, ReshaMandi, and Onato.

Orios Venture Partners

Founded in 2013, Orios Venture Partners make early-stage investments in startups that target the Indian market in the B2C, B2B and software spaces. It usually makes 10 to 15 investments every year. Last year, it participated in 14 deals including the funding rounds of Battery Smart, Krishify, and ShopG.

Prosus Ventures

Prosus is a global consumer internet investment group that has a primary listing on Euronext Amsterdam (AEX:PRX) and a secondary listing on the Johannesburg Stock Exchange (XJSE:PRX). Last year, it participated in 10 funding deals in Indian startup ecosystem. Some of its investments of 2021 include — Meesho, Urban Company and DeHaat among others.

Redcliffe Capital

Started in 2008 by Alpesh Doshi, Redcliffe Capital is a tech-focussed firm (Telecom, Enterprise IT, Fintech, Digital Media) involved in venture capital projects across India, the UK and selected emerging markets in Asia and Africa.

Targeting seed and early-stage investments in mid-cap to large businesses globally, the venture capital firm invested across 12 deals last year, in startups such as Shoopy and RevFin.

Ribbit Capital

Founded in 2012, Ribbit Capital is a global investment organisation that claims to have one primary goal—‘to change the world of finance’. It participated in 10 funding deals last year including Groww, Razorpay, and CoinSwitch Kuber.

RTP Global

RTP Global is a venture capital firm that makes early-stage investments in tech startups. It claims to support young companies with strategic know-how and a broad global network. It has invested in companies in more than ten countries across Europe, Asia and North America.

Last year, it backed startups such as DeHaat, Khatabook and MPL among others in India.

Sauce.vc

Sauce.vc is an early-stage venture capital firm based in Mumbai, India. Founded in 2019 by Manu Chandra, the firm invests in consumer sectors such as food and beverages, personal care, apparel and lifestyle.

Over the last year, it participated in 10 startup funding deals including Gobbl, AroLeap, and Perfora.

Sequoia Capital India

Sequoia Capital is a global investment firm that has worked with companies including Airbnb, Alibaba, Apple, Dropbox, Google, Linkedin, Meituan and Stripe. Sequoia Capital India has partnered with a wide variety of startups across categories, including BYJU’s, Carousell, Druva, Gojek, OYO Rooms, Tokopedia, Truecaller, Zilingo, Zomato, and others.

Last year, it participated in 88 deals including Mamaearth, BharatPe, Purplle among others.

Sixth Sense Ventures

Founded in 2014 by Nikhil Vora, Sixth Sense Ventures is a domestic, consumer-centric venture fund. Last year, it participated in 18 funding deals. Some of its last year’s investments include — Neeman’s, Bombay Shaving Company, and Open Secret among others.

SoftBank

Founded in 1981 by Masayoshi Son, SoftBank is a Japanese multinational conglomerate holding company that primarily invests in startups operating in technology, energy, and fintech sectors. Its Vision Fund is one of the world’s largest tech-focused venture capital funds with more than $100 Bn in capital. Last year, it participated in 17 funding deals in India, including rounds of GlobalBees, Zeta and Swiggy among others.

Soma Capital

Since its launch in 2015, Soma Capital claims to have invested in over 20 unicorns and startups with a total valuation of $70 Bns. In 2021, it invested in 16 startups including TagMango, Stack Finance, and PropReturns among others.

SOSV

SOSV is a venture capital and investment management firm that provides seed, venture and growth stage funding to startup companies in the technology sector. The company’s focus is on accelerating startups via their market-specific seed accelerator programs located in Europe, Asia and the United States.

It made 17 investments last year including Kiko Live, The Money Club, and Supplynote.

Steadview Capital

Steadview is a London-based investment management company that makes concentrated, long-term investments in high-growth public and private technology startups. In 2021, it participated in ten investment deals, including startups such as Innovaccer, PharmEasy, and MoEngage.

Stellaris Venture Partners

Stellaris has invested in more than 19 startups after raising its maiden fund in 2017. Companies in its portfolio include personal care products startup Mamaearth, SaaS startup Whatfix, MFine, Splinter, LoadShare, Signzy, and Propelld. In 2021, it backed LimeChat, Swiflearn, and BeepKart.

Temasek

Founded in 1974, Temasek is a global investment firm that makes long-term investments in growth to late-stage startups. Its portfolio was valued at $381 Bn in March 2021. In 2021, it participated in as many as 16 funding deals in India including upGrad, ShareChat, and Unacademy.

Think Investments

Founded by Shashin Shah in 2013, Think Investments is an investment firm that seeks to fund public and private companies with an emphasis on creative primary research. It specialises in early-stage tech businesses.

Last year, it participated in 11 startup funding deals, including the funding rounds of unicorns such as Gupshup, Swiggy, and PharmEasy.

Tiger Global

Tiger Global is an American investment firm that has both public and private equity businesses. With its private equity business, it focuses on internet, software, consumer tech and fintech companies. It invested in as many as 58 funding deals last year, including in startups such as Pristyn Care, Apna, and Captain Fresh.

Unicorn India Ventures

The early-stage venture fund invests in seed and early-stage startups across sectors such as SaaS, fintech, healthtech, robotics, gaming and digital content. Unicorn India Ventures was founded in 2015 by Anil Joshi and Bhaskar Majumdar. The fund supports the ventures with initial and follow-on investments in the range of INR 50 Lakh to INR 10 Cr.

The Mumbai-based venture fund’s brand portfolio includes startups such as ChitMonks, boxx.ai, Finsall, libryo, Open, and SmartCoin among others. It participated in 6 deals in 2021.

W Health Ventures

Established in 2019 by Sunil Wadhwani, W Health Ventures is a venture capital fund that invests in early-stage healthtech companies in the US and India. The Boston-based fund usually invests in the Series A round with an average ticket size of $3.5 Mn.

Its portfolio includes names such as Ryse Health and Jasper. Last year, it invested in six healthtech startups such as BeatO, Wysa and Mars by GHC.

WestBridge Capital

WestBridge Capital is an investment firm that manages more than $5.6 Bn worth of assets and primarily makes investments in growth to late-stage startups in India and the rest of South Asia. Last year, it invested in DealShare, Vedantu, Rapido.

Whiteboard Capital

Whiteboard Capital is an early-stage investment fund started by Freecharge founder Sandeep Tandon. It is a sector-agnostic fund with investments across diverse segments including fintech, consumer and healthtech startups. In 2021, it backed startups such as ApnaKlub, Supertails, Zeda.io.

YourNest Venture Capital

YourNest Venture Capital is a $75 Mn venture capital fund that invests in startups across deeptech domains including artificial intelligence, IoT (internet of things), AR/VR/MR, developer tools, and other digital products.

In 2021, it invested in Practically, UptimeAI, and Exponent Energy.

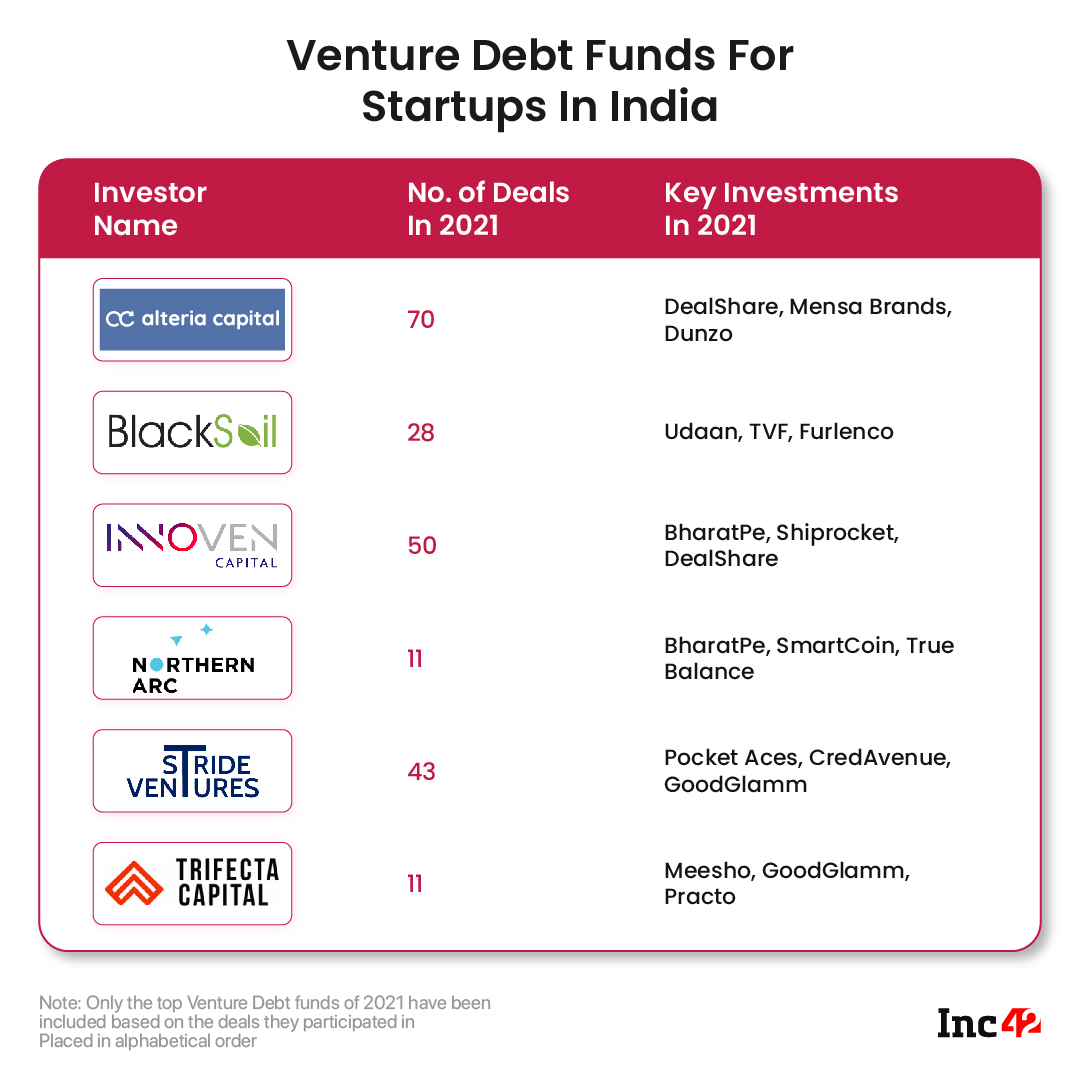

Venture Debt Funds For Startups In India

Alteria Capital

Promoted by Ajay Hattangdi and Vinod Murali, Alteria Capital is one of the most active venture debt investors in the country. It manages a corpus of more than INR 2,300 Cr ($307 Mn) across two funds. Its second fund closed last year will invest up to INR 150 Cr ($20 Mn) in startups that are in their early and growth stages and have already raised venture capital. In the past, the venture capital firm has backed startups including Rebel Foods, BharatPe, Lendingkart, Zestmoney, Dunzo, Portea, Toppr, Spinny, Stanza, Vogo, Melora, Mfine, Generico, Loadshare, LBB, Beato, Maverix, Country Delight, Clover, Happay, Cropin, Cityflo, Onco, Nua, Damensch, Bombay Shirt Company and others.

Last year, it participated in 70 deals.

BlackSoil

Founded in 2010, BlackSoil is an alternative NBFC (non-banking financial company) and AIF (alternative investment fund) that provides advisory and financing solutions for developers and startups. It helps startups with structured lending, fundraising and restructuring while taking both debit and equity funding to startups. In 2021, BlackSoil participated in 28 deals.

InnoVen Capital

According to InnoVen Capital, it began its life as SVB India Finance in 2008, India’s first venture debt and lending firm. It was acquired by Temasek Holdings in 2015 and rebranded to InnoVen Capital India. It is backed by Temasek, which is a Singapore-based investment company and the United Overseas Bank, a Singaporean multinational bank.

In 2021, it participated in 50 funding rounds in the Indian startup ecosystem and made investments in PepperFry, Udaan, and Mensa Brands.

Northern Arc

Northern Arc Capital is a diversified debt platform that taps into a network of financial institutions, technology platforms and other entities to invest in ‘underserved sectors’ in India.

Last year, it participated in 11 funding deals including True Balance, BharatPe, slice.

Stride Ventures

Stride Ventures provides credit solutions to new-age businesses in India. It strives to play a strategic role in the long term journey of its portfolio company by leveraging a deep penetration in the banking and venture ecosystem.

In 2021, it invested in Pocket Aces, TenderCuts, and The Good Glamm Group.

Trifecta Capital

In November last year, Trifecta Capital announced the first close of its third venture debt fund with an investment commitment of INR 750 Cr. It claimed that the fund has a target corpus of INR 1,000 Cr and a greenshoe option of another INR 500 Cr. Last year, it participated in 11 funding deals including Practo, The Good Glamm Group, and ixigo.

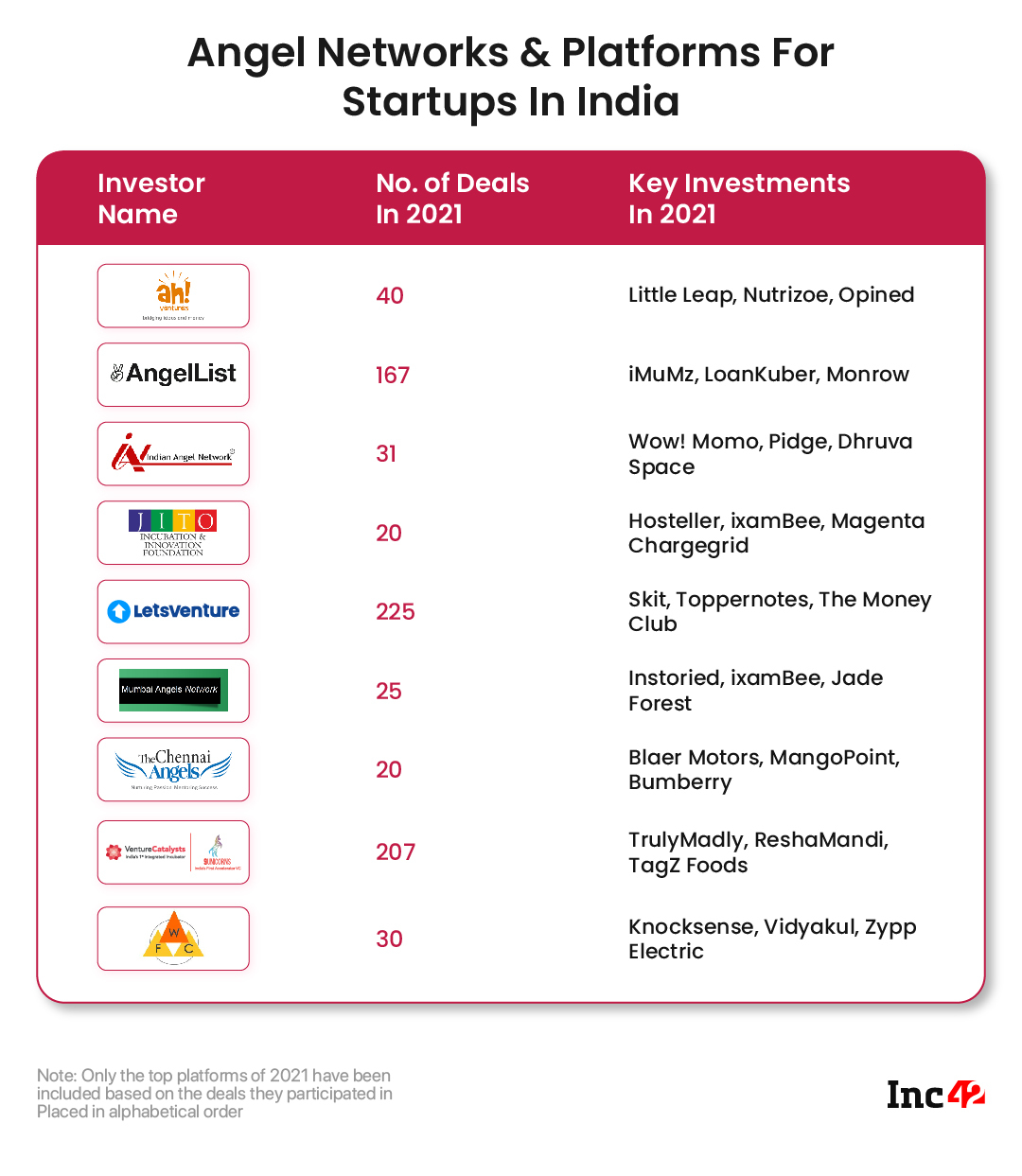

Angel Networks & Platforms For Startups In India

ah! Ventures

Founded in 2010 by Harshad Lahoti, ah! Ventures is a curated, sector-agnostic fundraising platform for early-stage startups that raises funds up to $10 Mn and invests small amounts in startups, while also helping them with customised services, skill, industry and domain experience resources. It invested in early-stage startups including Barbrew, Klassroom, and Playo among others.

AngelList India

Founded in 2009 by Naval Ravikant, AngelList has a ‘Syndicates’ model where angel investors can bring in more capital from their personal network. It allows investors to put in as little as $1k alongside accredited investors through these investment syndicates. In exchange for this facility, investors pay the lead investor a part of the future profits. In 2021, it participated in more than 167 deals in India and backed startups such as TrulyMadly, Pitstop and Bluepad.

Indian Angel Network (IAN)

Founded in 2006, it is a network of angel investors who invest in early-stage startups. According to the network, most of its members have entrepreneurial experience having worked as founders, CEOs or other operational executives.

It invested in startups such as Dhruva Space, Unotag and Fyllo.

JITO Angel Network

The JITO Angel Network is a subsidiary of the Jain International Trade Organisation, which is registered as a company under section 25 of the Companies Act, 1956 (now under section 8 of the Companies Act, 2013). The angel network has backed over 50 startups to date. Last year, it invested in 20 startups including HomeCapital, Siply, Blusmart, vidyakul, S3V Vascular Technologies, Galaxy Card, Finance Peer, Taquanal Energy, Epigeneres, and Fello.

JPIN Venture Catalysts Ltd

Founded by Nayan Gala and Gaurav Singh, JPIN Venture Catalysts Ltd is an angel network platform. It invests in early-stage and growth-stage startups across sectors such as fintech, healthtech, media and entertainment, enterprisetech, consumer services and traveltech.

Headquartered in London, JPIN works across the world’s emerging markets — India, Africa, Latin America, Israel, Singapore, CIS, US and Europe. The platform claims to have invested in 40 startups in 2021, including Chingari, CreditEnable, and TSLC among others.

LetsVenture

Last year, deal syndication startup LetsVenture had launched a new business entity named Trica, which provides a single platform for equity management and private market investments targeted at independent investors and founders.

Last year, it participated in 225 funding deals, and backed startups such as MentorKart, Dukaan and Meddo.

Mumbai Angels Network

Founded in 2006, the Mumbai Angels Network is an angel investment platform for early-stage investing. It has a portfolio of more than 190 enterprises. Last year, the network made investments across 24 deals in the Indian startup ecosystem. Pixuate, goSTOPS, and Unlu raised funding from the network last year.

The Chennai Angels

Founded in 2007 by Ramaraj R, The Chennai Angels is an angel network that funds startups that have gained market traction and are in the early revenue stage. The fund invests in early stage and growth stage startups across sectors such as edtech, healthtech, ecommerce, enterprisetech, traveltech, media & entertainment, agritech, and consumer services. It counts startups such as TrulyMadly, POPxo, Purplle, The Postbox, and Ketto in its portfolio.

It participated in more than 20 startup funding deals last year.

Venture Catalysts

Venture Catalysts is an Indian ‘integrated’ startup incubator that aims to help build successful startups with a combination of capital, knowledge and its extensive network. In 2021, it backed startups such as TagZ Foods, TrulyMadly, and leap. club.

9Unicorns

9Unicorns identify potential early-stage startups across sectors including electric vehicles, mobility, augmented reality, VR, AI and ML, fintech and retail. It aims to become a one-stop mentoring, networking and growth facilitation platform that enables emerging startups to grow to their full potential. It backed startups such as Fleek, Rage Coffee and LegalPay.

We Founder Circle

We Founder Circle is a digital-first community-based investment platform whose community members include corporate executives, founders and investors who have been part of the startup ecosystem.

Last year, it invested in 30 startups including YPay, Vidyakul, and Knocksense.

Family Offices, Accelerators, CVCs And More

Axilor Ventures

Axilor Ventures invests between $300k and $500k each in 15-20 startups in their seed and Pre-Seed funding stages. It claims to offer early capital with founder-friendly terms. It also leverages a network of investors, corporates and partners in an effort to help startups in its portfolio accelerate growth, achieve product-market fit and raise follow-on funding quickly. In 2021, it participated in 11 funding deals and backed startups such as DropShop, CanPe and Wiz Freight.

Capier Investments / Cloudnine Hospitals

Founded in 2015 by Gautham Kalro and Rohit M.A., the fund is an early-stage venture fund providing investment to tech-focused ventures. It has invested in sectors such as healthtech, insurtech, fintech, agritech, social media, B2B SaaS, and D2C brands.

In the past, the Bengaluru-based fund has backed startups such as Ambee, Cloudnine Hospitals, Doxper and Parentlane. Overall, it participated in 64 deals last year.

Entrepreneur First (EF)

Launched in 2011 by Matt Clifford and Alice Bentinck, London-based global talent investor and accelerator Entrepreuner First focuses on early-stage startups and helps them create high-growth trajectories.

Startups that get funded by EF are also given access to a large community of global investors to raise seed funding. Last year, it invested in Indian startups such as UngearVR, Neuropixel, and Immunito AI in more than 12 deals.

Huddle Accelerator

Delhi NCR-based early-stage startup accelerator, Huddle co-invests in startups with small cheques of approximately $150K – $200K. On select ventures, the ticket size has gone as high as $300K.

Founded in 2017 by Ishaan Khosla and Sanil Sachar, the accelerator has backed over 45 startups in sectors such as D2C, EV, agritech, healthtech, among others. Its current portfolio includes startups such as Bold Care, Cell Propulsion, Wellversed, RACEnergy, F5, Celcius, The New Shop, Hapramp, StepSetGo, Yobee Research.

Over the last year, it has participated in 18 startup funding deals including StepSetGo, NeuroPixel, and F5 Refreshment.

Titan Capital

Founded in 2019, Titan Capital is an investment firm set up by Snapdeal founders Kunal Bahl and Rohit Bansal. Some of the startups in its portfolio include Ola, Snapdeal, Mamaearth, and UrbanCompany. In 2021, it participated in 105 deals in the Indian startup ecosystem including Supertails, kindlife.in, and Anar.

Y Combinator

US-based Y Combinator is one of the most successful startup accelerators in history and has launched more than 3,000 startups including Stripe, Airbnb, Cruise, PagerDuty, DoorDash, Coinbase, Instacart, Dropbox, Twitch, Flightfox, and Reddit. In January 2021, the combined valuation of top YC companies amounted to $300 Bn. Last year, it participated in 27 startup funding deals in India including Karbon Card, Snazzy and Gobillion.

Update | 11th March | 12:05 AM

Trifecta Capital’s fund details updated to reflect the right fund size.

The current list only includes the most active investors based on their deal participation in the Indian startup ecosystem in 2021.

This is a running article, if you would like to nominate more investors for this list, write to us at [email protected].

Ad-lite browsing experience

Ad-lite browsing experience