SUMMARY

Hospitality chain OYO fuels its international expansion with a billion-dollar cheque

More than 13 startups raised fundings worth over $100 Mn in 2018

The unicorn club got seven new entries

This article is part of Inc42’s special year-end series — 2018 In Review — in which we will refresh your memory on the major developments in the Indian startup ecosystem and their impact on various stakeholders — from entrepreneurs to investors. Find more stories from this series here.

This was a year of fancy, OTT (over the top) deals (we’re talking billion-dollar fundings here), grand acquisitions and exits, emotional step downs, and a lot of drama and controversies in the Indian startup ecosystem.

The total funding this year did not match up to last year’s, but Indian startups raked in the moolah in style. Ritesh Agarwal-led hospitality chain OYO brought in mammoth cheques worth a total of billion dollars, earning the much-coveted unicorn tag for itself.

Another big cheque this year came for edtech startup BYJU’s (also a unicorn), which raised $540 Mn in a Series F funding round. And even as we were wrapping up work for the Christmas-NYE holidays ahead, Swiggy delivered the icing on the cake — a whopper $1 Bn funding led by Naspers.

According to Inc42 Datalabs, Indian startups raised $9.57 Bn in 2018 (up to December 22) across 717 deals, while they had raised $13.5 Bn across 885 deals in 2017. Also, only two companies got billion-dollar cheques this year, while last year, Flipkart, Ola, and Paytm alone had raked in $6.5 Bn across four deals.

The unicorn club was buzzing with entries, with seven startups including Swiggy, PolicyBazaar, and Paytm Mall added to the list. Chennai-based SaaS company Freshworks not only joined the club but also went on to record $100 Mn ARR with its $100 Mn funding.

The Indian startup ecosystem finally proved its earnestness to mature with increasing growth-stage investments coming in. As a result, investors showed Indian startups a lot of love and trust, putting their money in many growth- and late-stage ventures. They were also ready to take the plunge with new innovative ideas.

Even as we saw serial entrepreneurs raising capital in the stealth mode, several early-stage ideas with innovation at its peak attracted major investors. No wonder, global companies like Amazon, Google and Walmart were acquiring and investing in the Indian startup ecosystem.

According to Inc42 Datalabs, in 2018, investors placed 313 bets on early-stage startups, a 41% decline compared to the previous year. Also, interestingly, growth- and late-stage startup fundings continued to do well. However, the value of these deals fell by almost 50% as compared to FY17.

With 2019 projected to be the year of digital transformation led by startups, Inc42 takes a look back at the major startup fundings of the past year.

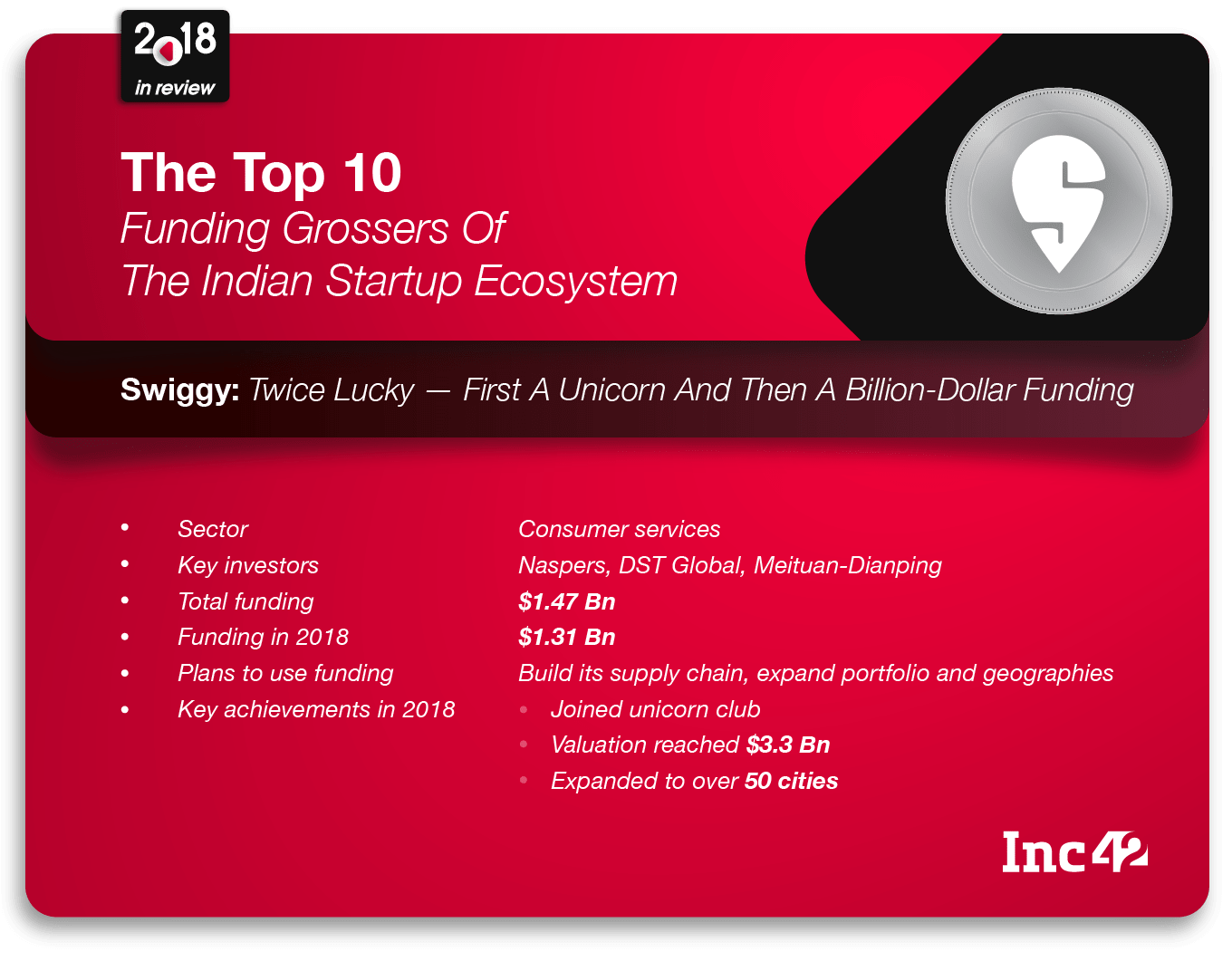

Swiggy: Twice Lucky — First A Unicorn And Then A Billion-Dollar Funding

For food delivery startup Swiggy, 2018 was a year to write home about. It boosted its performance manifold and snagged a position in the unicorn club.

To start with, Swiggy posted a 220% jump in revenue for FY18, launched a slew of new offerings, including Swiggy Super, Scheduled, Access, long-distance deliveries, and Capital Assist.

While it enables delivery of food from restaurants from over 40K restaurants via its 55K delivery fleet across India, the company is eyeing portfolio expansion and plans to dabble with hyperlocal delivery of medicines and grocery under Dash. It is also running pilots to expand into B2B food aggregation services under the brand name Swiggy Café or Swiggy Food Court.

Riding high on its future plans, Swiggy also acquired on-demand delivery platform Scootsy to further strengthen its presence in the market.

However, as a cherry on the cake, Swiggy ended the year on a blockbuster note with a $1 Bn funding led by Naspers. Tencent, Hillhouse Capital, Wellington Management Company, DST Global, Meituan Dianping, and Coatue Management also participated in the round.

The valuation for the company spiked to $3.3 Bn from $1.3 Bn in June when it raised $210 Mn led by Naspers and DST Global. Prior to this, the four-year-old Bengaluru-based startup raised $100 Mn led by Naspers and Meituan-Dianping in February.

No doubt, Swiggy is ready to give its arch rivals Zomato and UberEATS a tough fight in the online food delivery market, expected to grow by 34-36% from 2015 to 2020.

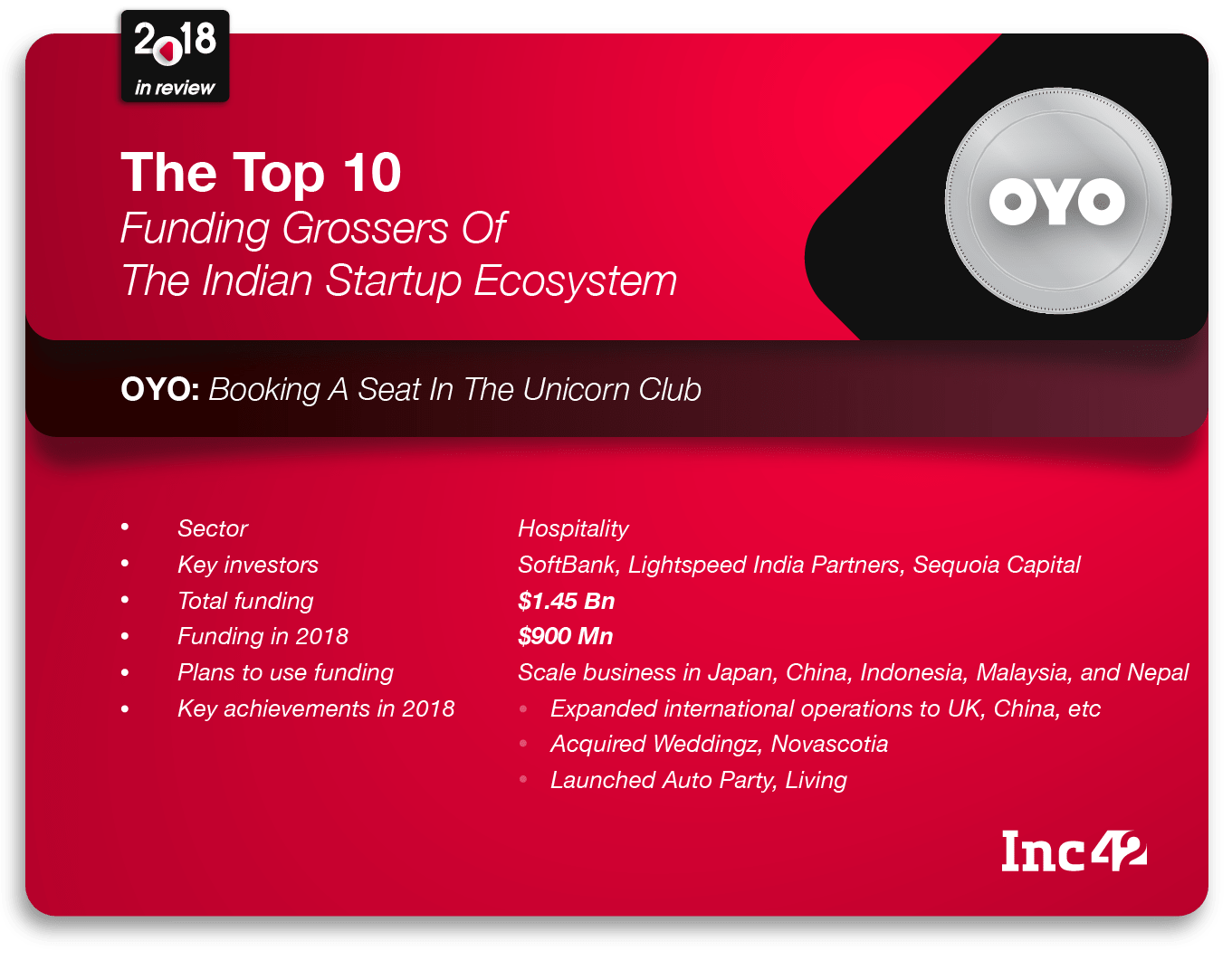

OYO: Booking A Seat In The Unicorn Club

Set Goals. Reach. Repeat.

OYO has been doing exactly this — picking up goals, reaching them, and repeating them. This year was a big year for the Ritesh Agarwal-owned hospitality company, which started out as a hotel room aggregator and then shifted to a franchise model.

The first goal this year was to expand its footprints internationally. So, the list started from China and grows to Japan, Indonesia, and other Southeast Asian countries along with the UK, where it launched with four properties in London with more than 80 rooms.

With this expansion, OYO became an apple of the investor’s eye, thereby seeking the unicorn status. The five-year-old Bengaluru-based company raised $800 Mn from SoftBank and other investors in September, with $100 Mn funding from Indonesia’s Grab, taking the total to $900 Mn. It has also received a commitment for another $100 Mn from undisclosed investors.

OYO also made a few acquisitions to aid its growth as well as to test new segments. This included Mumbai-based Weddingz, Chennai-based Novascotia Boutique Homes, and AblePlus. The company also expanded its portfolio to add banqueting and wedding planning services under OYO Auto Party and long-term fully-managed housing rentals under OYO Living.

The company offers hotels and homes with its full-stack technology hospitality model. Currently, over 12,000 franchised or leased hotels and 3,000 homes are a part its chain, with over 330K rooms in over 500 cities.

Amid all this, the Federation of Hotel and Restaurant Associations of India (FHRAI) has levelled allegations of large-scale breach of contract and predatory pricing on OYO. While OYO claimed that these allegations are misplaced and misguided, FHRAI is not easing up the pressure on the company.

Commenting on this, Aloke Bajpai, cofounder, ixigo, told Inc42 that bigger players charge high commissions from hotels and offer deep discounting to customers, which is unhealthy for the market. So, for the sector to have be economically healthy and sustainable, such players will have to cede their huge market shares. The Indian hospitality industry is expected to grow to around $13 Bn by 2020.

In 2019, Bajpai expects “a lot of budget properties and independently-owned chains to starting spending more on direct customer acquisition.”

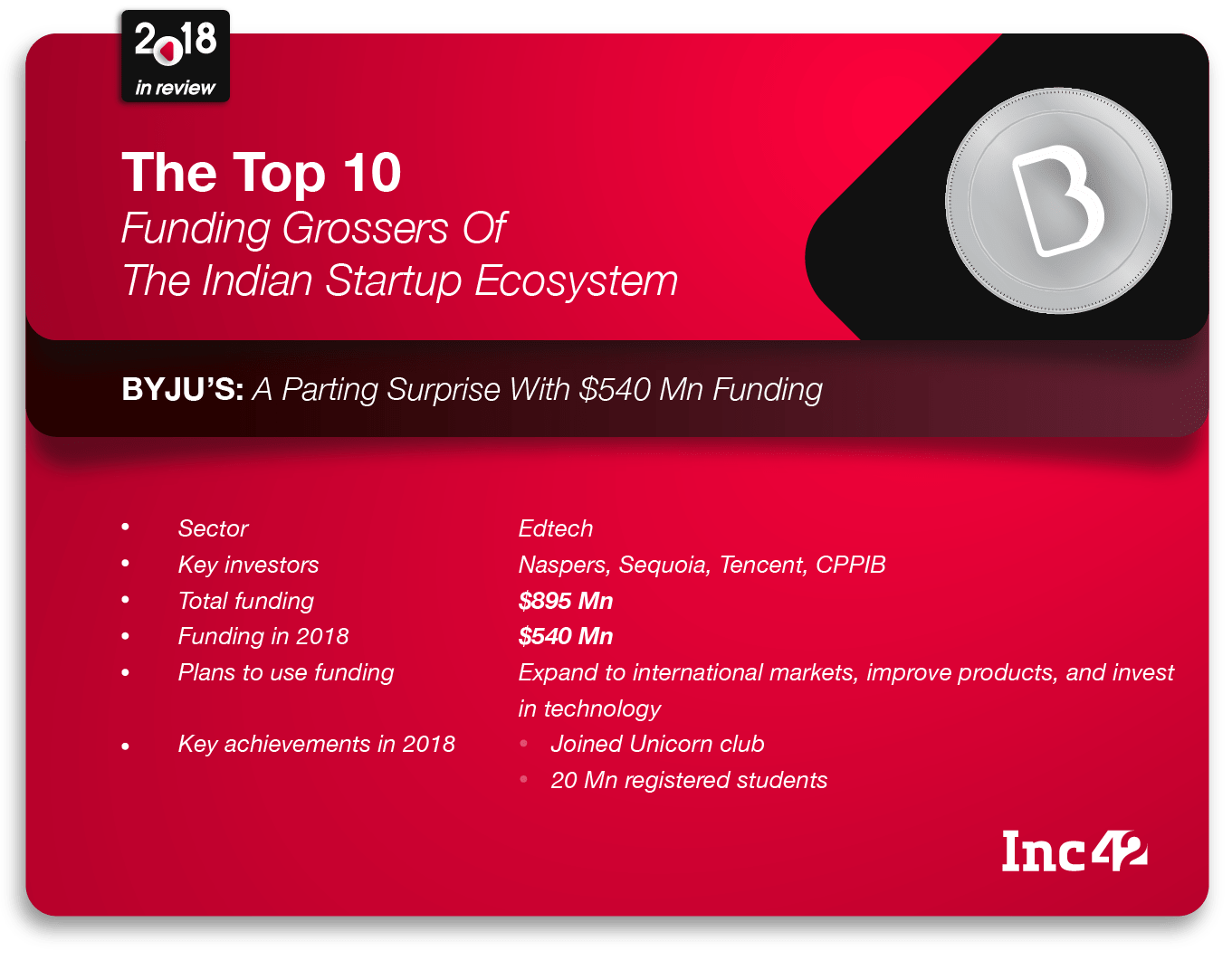

BYJU’S: A Parting Surprise With $540 Mn Funding

Founded in 2011 by Byju Raveendran, BYJU’S has disrupted the edtech industry with its use of original content, rich animation, interactive simulations, and engaging video lessons. BYJU’S offers learning programmes for Classes VI-XII and test preparation for JEE, AIPMT, CAT, IAS, GRE & GMAT. It launched BYJU’s — The Learning App in 2015.

The company, with more than 20 Mn registered students and 1.26 Mn annual paid subscriptions, adds 1.5 Mn registrations to its kitty every month.

With such a high growth rate, BYJU’S was bound to enter the unicorn club sooner or later. The big day came in March this year after the startup raised an undisclosed amount in funding.

The company ended the year on a big bang note with $540 Mn funding from Naspers with a significant contribution from Canada’s pension fund’s investment arm, Canada’s Pension Plan Investment Board (CPPIB).

At the same time, its early investor, Sequoia Capital is selling 7% of its stake in BYJU’S for $185 Mn – $190 Mn. It has invested $50 Mn in the company so far and will continue to be the major investor with a stake of 13-15%, second only to the founders, who control 38%.

Prior to this round, BYJU’S had raised approximately $244 Mn since 2008.

The company also hit a valuation of $4 Bn, achieving a growth rate of 100% in the last three years. In What The Financials, Inc42 Datalabs noted that in FY18, BYJU’S projected a high growth and was looking to almost double its gross revenue to $69 Mn.

While keeping its eye on international markets, BYJU’S is also looking to lead the Indian online education sector, which may witness up to 8X growth in the next five years.

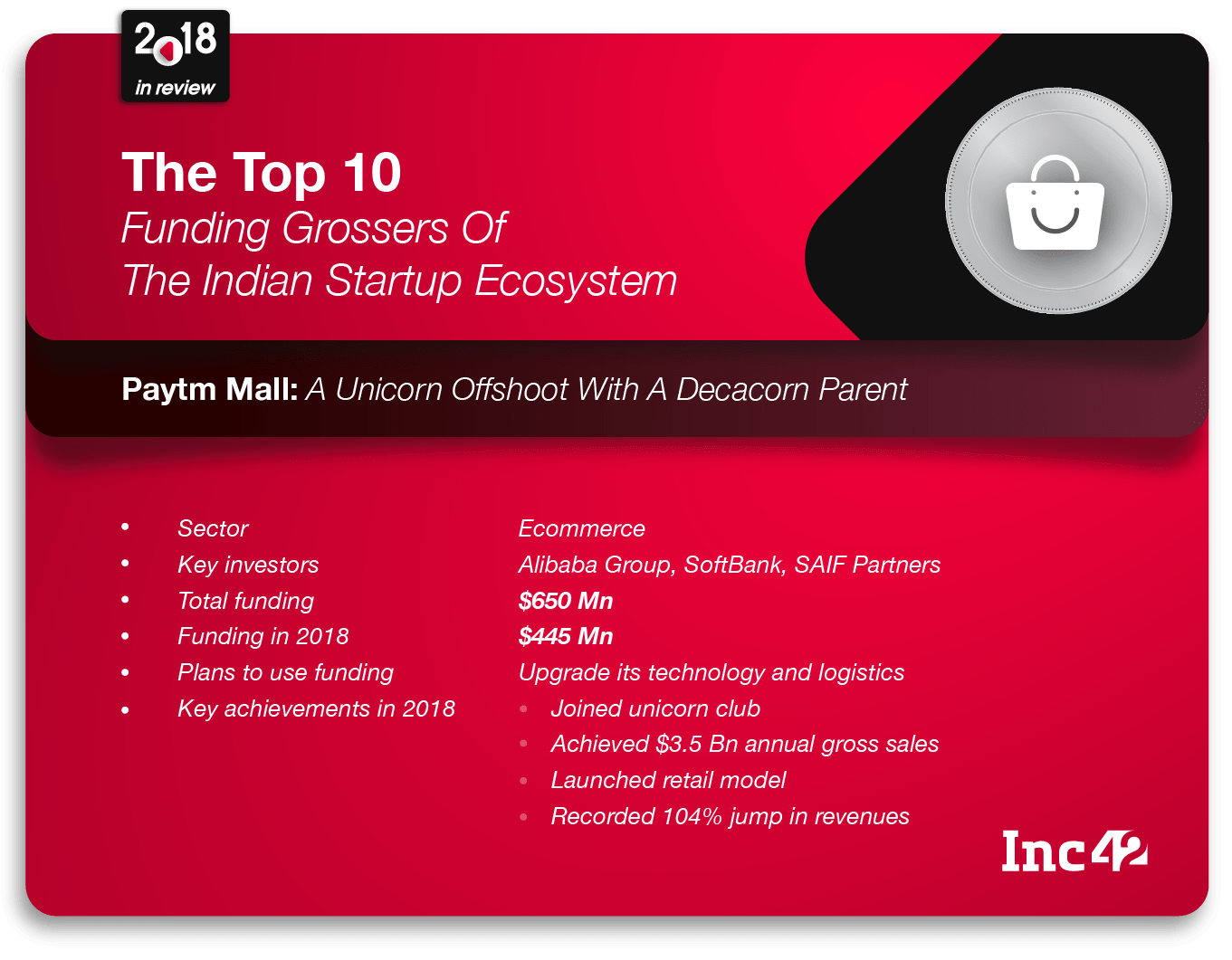

Paytm Mall: A Unicorn Offshoot With A Decacorn Parent

It’s been a blockbuster year for Noida-based Paytm and its group companies. While Paytm became a decacorn (a company valued at $10 Bn or over) in January, its ecommerce subsidiary Paytm Mall became a unicorn in April, after raising $445 Mn in a funding round led by SoftBank and Alibaba. Paytm Mall reached a valuation of $1.9 Bn in just over a year of operations.

Paytm Mall is a consumer shopping app offering products across categories like appliances, laptops, mobiles, and daily needs.

Paytm Mall achieved many more milestones this year — it achieved $3.5 Bn in annual gross sales and set a target of $10 Bn by March 2019, launched a new retail model, and recorded a jump of 104.42% in its revenues for FY18, among others. In its first festive season sale, Paytm Mall registered a three-fold jump in transactions.

Within such a short time, Paytm Mall is viewed as the third major player in the Indian ecommerce market after Flipkart and Amazon. However, K Vaitheeswaran who is popularly known as ‘Father of ecommerce in India’ as he launched IndiaPlaza in 1999, told Inc42 that he is still waiting to see a unique service from Paytm Mall, which he hopes will be revealed with time.

We’re sure parent Paytm is sharing its secrets of success (beyond demonetisation) with its ecommerce arm. With the ecommerce market expected to reach $200 Bn by 2026, Paytm Mall may just head the decacorn way.

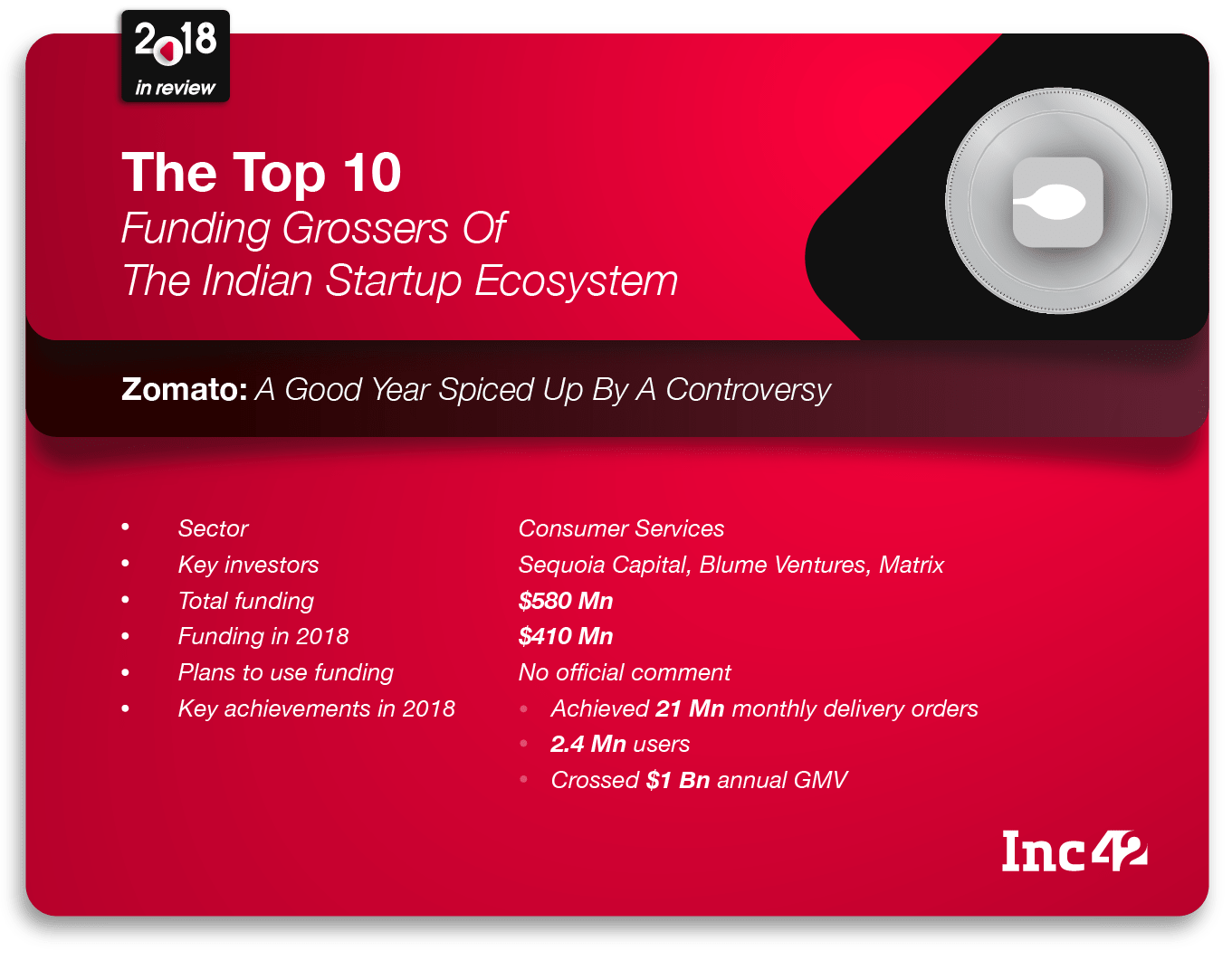

Zomato: A Good Year Spiced Up By A Controversy

Gurugram-based foodtech unicorn Zomato was on a high in 2018. It crossed $1Bn in annual GMV this year and raised $410 Mn in two tranches: $200 Mn led by Ant Financial in February and $210 Mn from Alibaba’s digital payments subsidiary Alipay in October. Global investors like SoftBank are also reportedly looking to invest further in the company.

The decade-old company recorded a 40% growth in its revenues for FY18 and targeted expansion to 100 cities across India. It also made two new acquisitions this year — Bengaluru-based TongueStun Food and Lucknow-based drone startup TechEagle Innovation, with which it plans to explore drone-based food delivery.

As it wrapped up the year, Zomato found itself in the eye of a social media outrage when a video of a Zomato delivery executive eating food from boxes he was carrying in a company delivery bag went viral. The company decided to fire the delivery person and introduce tamper-proof tapes. There was also some backlash on this move from people who empathised with the delivery boy.

India’s food delivery and takeaway market has been pegged at $19 Bn by Morgan Stanley. With companies like Swiggy, Foodpanda, UberEATS gradually increasing their dominance in this space, we may see more innovation and unique features from Zomato’s end in the coming year.

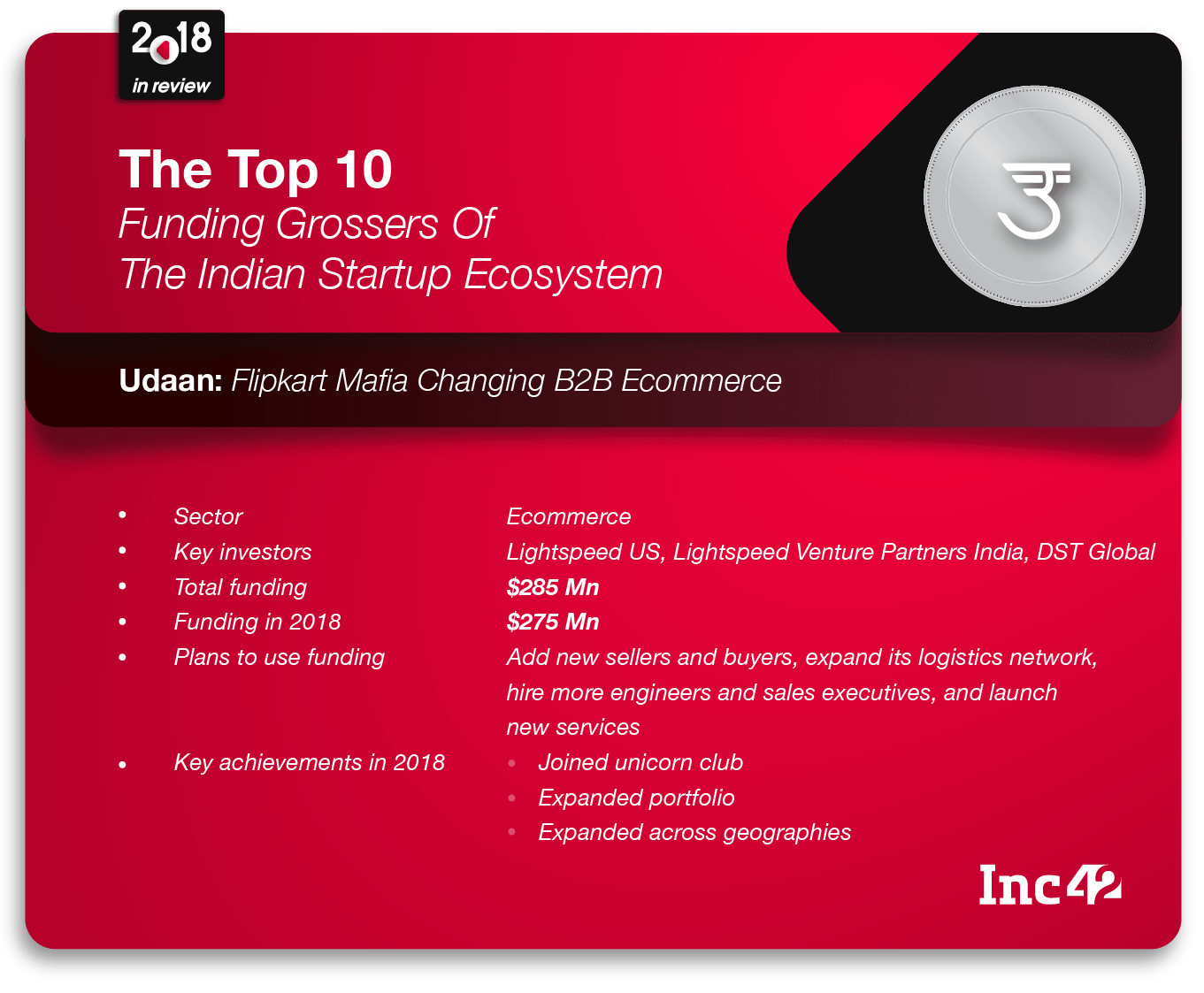

Udaan: Flipkart Mafia Changing B2B Ecommerce

Udaan is yet another offspring of the Flipkart mafia. Three ex-Flipsters founded Udaan in 2016 as a B2B online marketplace and led it to the unicorn club within 26 months of its inception.

Udaan is a network-centric B2B trade platform for small and medium businesses in India and enables 150K buyers on its platform across categories like fashion, FMCG, and electronics.

The company raised two tranches of funding this year — $50 Mn led by Lightspeed Venture and $225 Mn from DST Global and Lightspeed Venture Partners’ global fund.

With more than 150K traders, wholesalers, and retailers using its platform, Udaan has a seller base across 80 cities and delivers to more than 500 cities. Its average order value is between $85-$99. It also claims seven average repeat transactions in a month.

Vaitheeswaran told Inc42 that B2B ecommerce in India has been there for long and with companies like Udaan leveraging technology, he is hopeful of some innovation in the space.

A study by industry body NASSCOM in 2017 revealed that 40% of Indian startups are focused on the business-to-business segment. The overall B2B market size is expected to grow to around $700 Bn by 2020.

As Udaan looks for a bigger piece of the Indian B2B industry, which is expected to reach $700 Bn by 2020, the company needs to add to its current product categories to keep up with the competition in the sector.

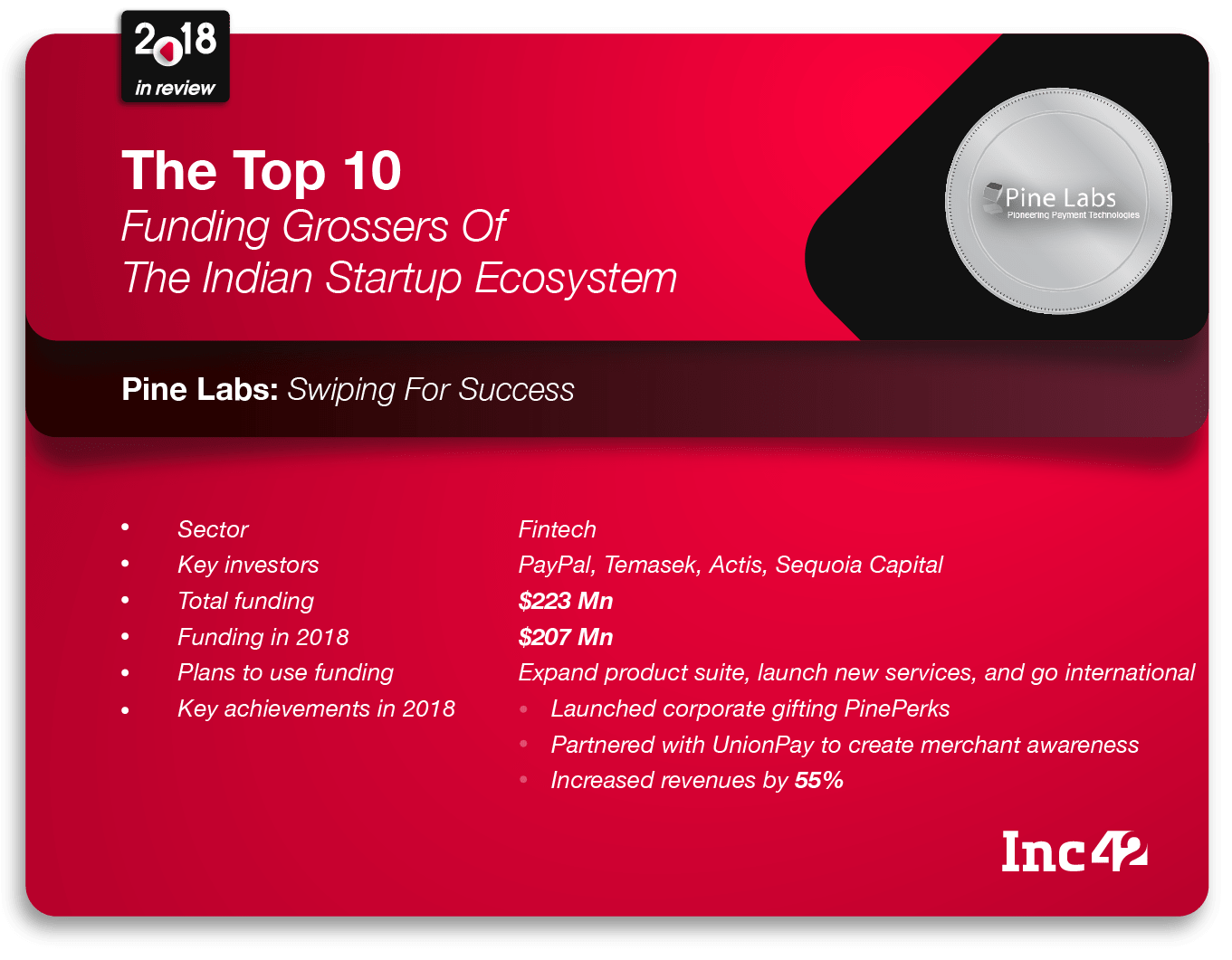

Pine Labs: Swiping For Success

In its 20 years of its existence, point-of-sale payments enabler Pine Labs finally had a year to boast of. In 2018, the company raised $125 Mn in funding from Temasek and PayPal Holdings and $82 Mn from Actis Capital and Altimeter Capital.

Pine Labs delivers active point-of-sale payments in India through its smart cloud-based payments platform. With its smart cloud-based payments platform, the company claims to be processing about 450 Mn transactions worth over $15 Bn annually, as of March 2018. It claims to have over 300K POS machines installed across India.

The company launched a corporate gifting solution — PinePerks — which corporates and merchants can use to deliver a ‘gift of choice’ to their employees, partners, and customers. It claims that its payment solutions are used by more than 85K merchants in India, Malaysia and the UAE across diverse sectors such as retail, ecommerce, electronics, F&B, fashion, and telecom.

Even though the company posted a 55% increase in revenues and 64.6% hike in expenses in FY18, it remained caught in a loss trap, reporting $342.8K in net loss, against a net profit of $518.4K in the previous year. In What The Financials, Inc42 Datalabs noted that fintech startup Pine Labs has been able to keep its revenue growth consistent over the years and remains the top player in the market.

The Indian POS terminal market is pegged to reach $450 Mn at a CAGR of over 10% from 2017 to 2024.

Sanjay Swamy, managing partner, Prime Venture Partners, told Inc42 that the three categories of fintech startups — marketplace, cooperation with banks, and the NBFC model — will continue to grow in the coming year as financial services are very important in India.

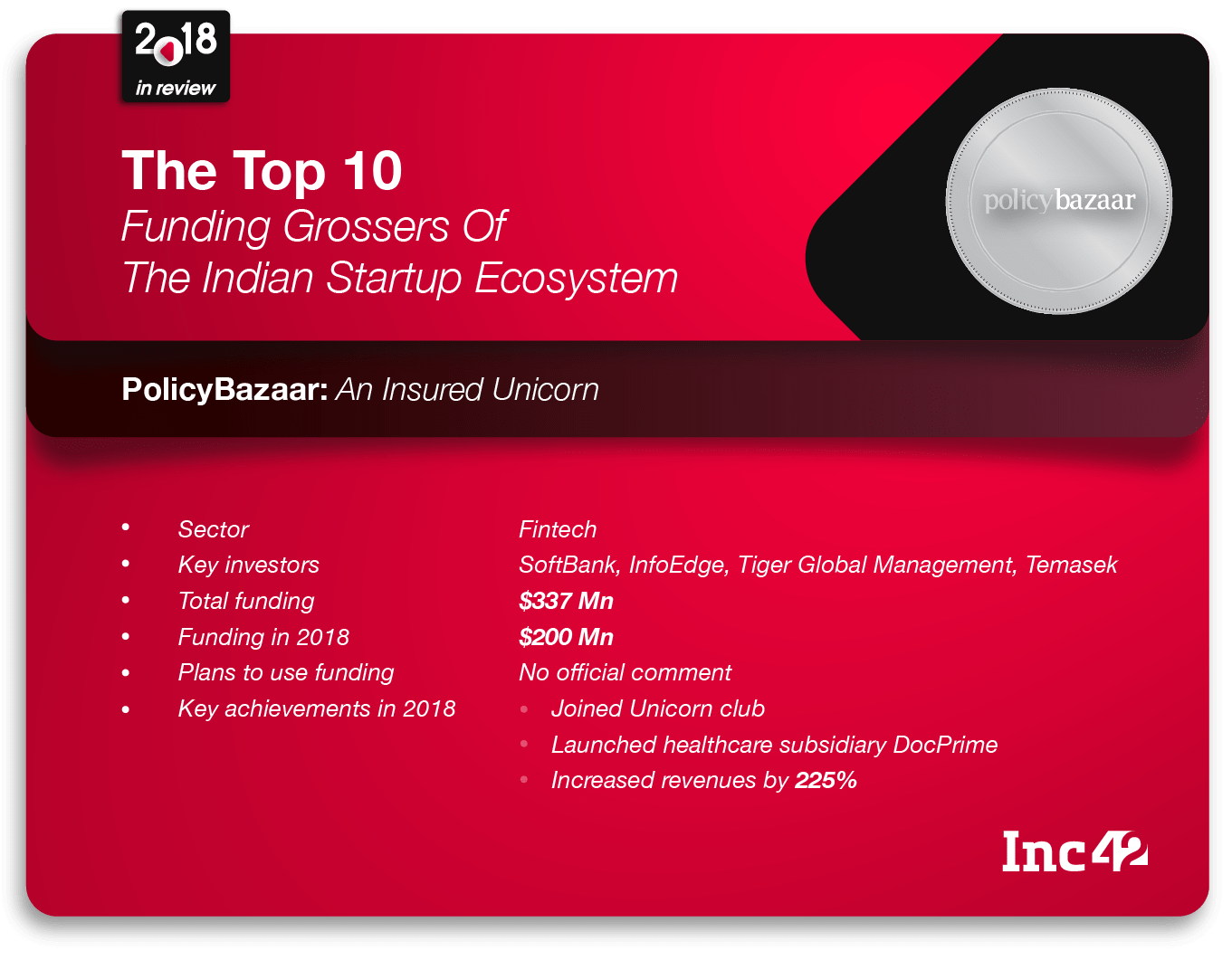

PolicyBazaar: An Insured Unicorn

In its 10-year journey in the Indian startup ecosystem, PolicyBazaar has changed the game of insurance industry. This year, however, was a landmark year for PolicyBazaar. The company entered the unicorn club in June with more than $200 Mn in funding led by SoftBank Vision Fund.

PolicyBazaar enables users to compare life insurance and general insurance products. The startup features products of all major insurance companies in India on its platform to help its users decide which ones suit them best.

It was also a good year financially for PolicyBazaar. In FY18, it saw a growth of 225% in its revenues and, at the same time, controlled its losses by 78%. With its two subsidiaries — PaisaBazaar, a financial advisory platform, and DocPrime, a healthcare venture — the PolicyBazaar group as a whole has been seeing increasing growth and control in its operations.

The company claims to be growing 100% Y-o-Y. It aims to underwrite premium worth $1.4Bn, expand its unique customer base to 10 Mn, and increase its revenue to $213.9 Mn by 2020.

Sanjay Swamy of Prime Venture Partners told Inc42 that the market is always either underserved or unserved, and since India is a huge market, there are ever-increasing solutions for newer users coming online. He emphasised that the day of one-size-fits-all is gone and that the focus is shifting to targeted solutions for micro-segments.

A BCG report estimated that digital influence on insurance purchases will grow to 50% for life insurance and 75% for general insurance by 2020.

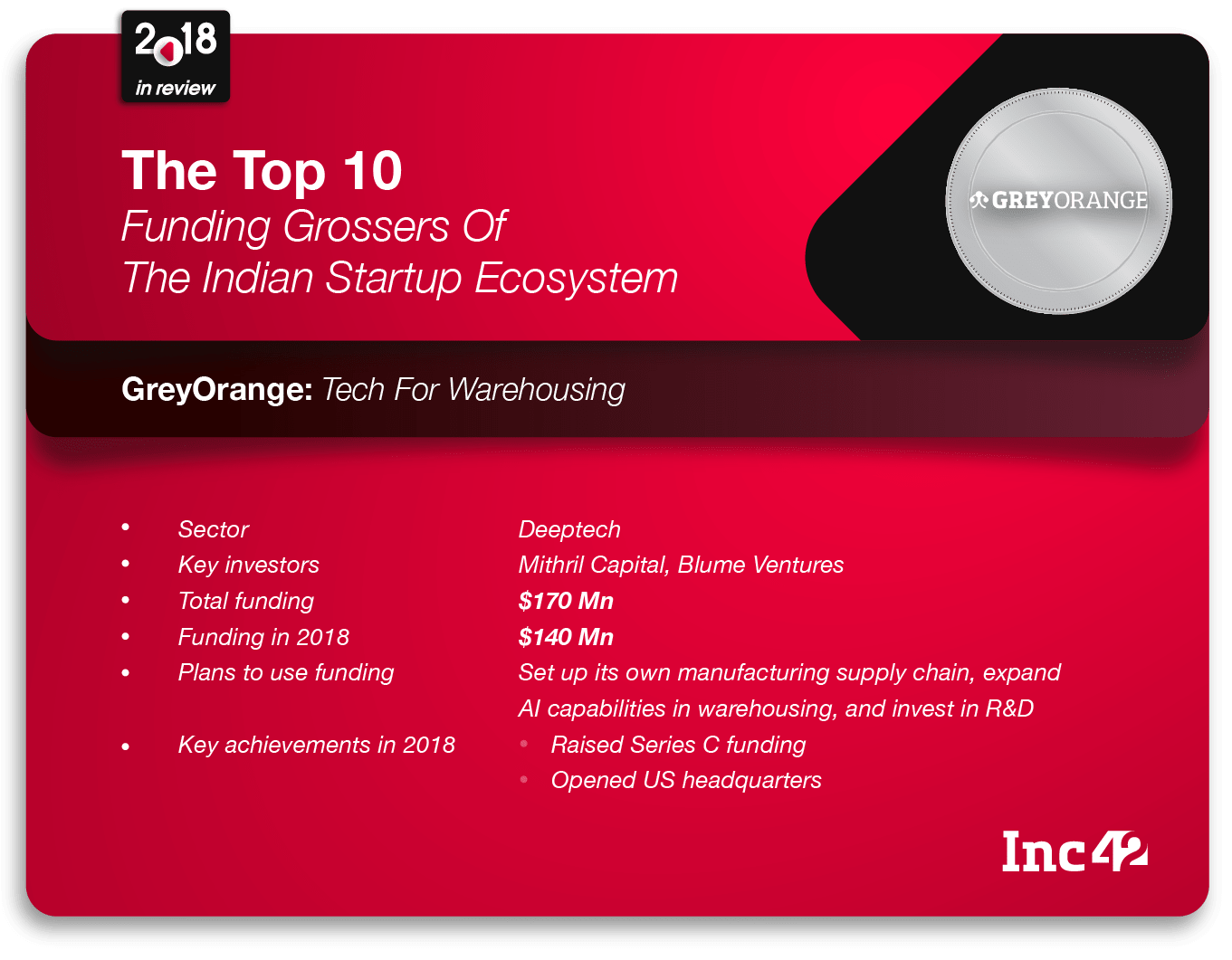

GreyOrange: Tech For Warehousing

The seven-year-old brainchild of Akash Gupta and Samay Kohli, AI startup GreyOrange has been disrupting warehousing for major ecommerce players and retailers with its artificial intelligence (AI)-based robotic systems.

The company leverages technology to automate routine tasks at warehouses and fulfilment centres of large ecommerce and retail firms. It has manufacturing units in India, China, and the US, with research and development (R&D) units in India and Singapore.

GreyOrange raised $140 Mn in fresh capital led by Mithril Capital, with the participation of a new investor — Flipkart co-founder Binny Bansal — and some existing investors, including Blume Ventures.

Headquartered in Gurugram, AI startup GreyOrange claims to handle 20 Mn packages monthly with more than 60 installations and five regional offices. Some of its clients are Flipkart, DTDC, and Myntra, among others.

The industrial automation industry in India is projected to grow at a CAGR of 10-12% during 2015-2020 and is expected to touch $3.49 Bn by 2020.

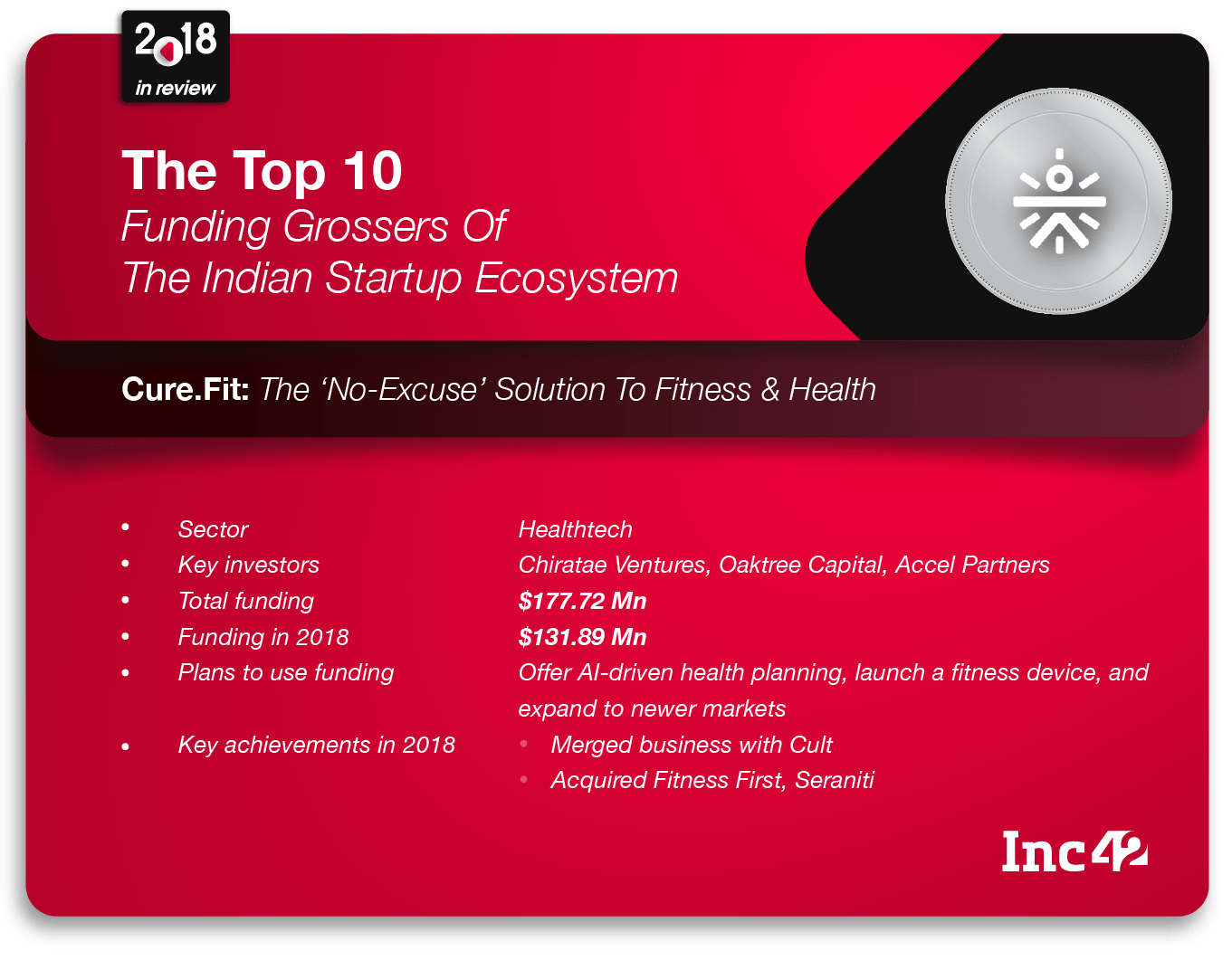

Cure.Fit: The ‘No-Excuse’ Solution To Fitness & Health

There are few healthtech startups that have disrupted the health and fitness space like Cure.fit has. Barely two years old, healthtech startup Cure.fit is yet another company launched by the Flipkart mafia — former Flipkart executives Mukesh Bansal and Ankit Nagori.

With its vision to make holistic health and well-being easily accessible to people, the Cure.Fit platform intelligently integrates an online-offline model to offer physical fitness (Cult.fit), mental fitness (Mind.fit), healthy food (Eat.fit), and to-be-launched primary care (Care.fit) — all on one app.

In January, Cure.fit raised $10 Mn in debt funding from HDFC Bank and Axis Bank. In May this year, Cure.fit brand ambassador, actor Hrithik Roshan turned investor with a funding of $878.2K in the startup.

In July, it raised $120 Mn in a Series C funding round led by IDG Ventures, Accel Partners, and Kalaari Capital. Chiratae Ventures and Oaktree Capital, along with Accel’s Growth Fund and Chiratae’s new fund, also participated in this round. This brought the total funding in the company to $177.72 Mn.

Healthtech startup Cure.fit, with its multiple offerings across online and offline formats, wants to be the new-age answer to the health, fitness, and wellness needs of people from all walks of life and all age groups. The startup has been expanding aggressively and is looking at opening over 200 Cult and Mind.fit centres by next year-end and 500 centres by 2020.

The company has adopted an acquisition-led strategy to further its growth and scale faster— this includes Cult, Tribe Fitness, Seraniti, Kristys Kitchen, and a1000yoga. It intelligently integrates an online-offline model to offer physical fitness (Cult.fit), mental fitness (Mind.fit), healthy food (Eat.fit), and primary care (Care.fit) — all on one app.

The sports, fitness, and wellness industry in India is poised to be a $90 Bn industry by 2022, growing with a CAGR of 17%.

All in all, it’s been a good year for the Indian startup ecosystem — many expanded their geographical presence across the globe, brought in global investments, signed international agreements with governments, even as India identified itself as an innovation hub on the world map.

At the crux of this symbiotic growth, it helped that Indian startups were flushed with investments from leading venture capitalists, corporates, and angel investors.

As we enter 2019, we look forward to reporting even bigger, more dramatic startup fundings from the ecosystem as innovative entrepreneurs take their startups to greater heights.

[Edited by Prakriti Singhania]