In 2018, a total of 118 acquisition deals were recorded in the Indian startup ecosystem

Of these 118 deals, the enterprise tech raked in the maximum number

Walmart's $16 Bn purchase of a 77% stake in Flipkart was the biggest acquisition deal of the year

This article is part of Inc42’s special year-end series — 2018 In Review — in which we will refresh your memory on the major developments in the Indian startup ecosystem and their impact on various stakeholders — from entrepreneurs to investors. Find more stories from this series here.

Indian startups have been on fire in 2018. Last year, we celebrated the $123 Mn acquisition of fintech company Itzcash by US-based Ebix as the highest-value deal in the Indian startup ecosystem. This year, all records were broken, all boundaries crossed when US-based retail giant Walmart acquired Indian ecommerce unicorn Flipkart in a deal worth $16 Bn.

The difference between these two deals is massive — 130x! What is common, though, is the fact that both of them had a game-changing impact on the overall sentiment in the ecosystem at the respective times of their occurence.

In the meantime, the ecosystem has matured — moving from the blind fundings of the early 2010s to the funding winter of 2016, to a measured, cautious, but optimistic approach in 2017-18.

In terms of exits as well, investors continued to adopt a cautious approach amid market correction, thereby making lower but profitable exits from their investments. The result: a fall in the number of startup acquisitions in India this year (based on data till November 2018) as compared to previous years. In 2018, a total of 118 acquisition deals were recorded in the Indian startup ecosystem as compared to 129 deals in the previous year.

Of these 118 deals, the enterprise tech raked in the maximum number, which may be attributed to the clear revenue line and product innovation this sector offers, making for better synergies between companies and sectors.

As 2019 knocks on our doors, here is a quick look back to the top 10 startup acquisition deals that grabbed the attention of the Indian startup ecosystem.

Walmart Adds Flipkart To Shopping Bag

This acquisition was big in all senses of the term: deal size, investor returns, as well as emotional drama and controversies it triggered. On one hand, the (forced) exit of Flipkart cofounders Sachin Bansal and Binny Bansal left the startup ecosystem in despair. On the other hand, it expanded the territory of the US-based Walmart-Amazon ecommerce war to India — a market projected to be worth $200 Bn by 2026.

The deal brought mixed reactions in the country — elation, applause, praise, as well as criticism and anger. Offline retailers termed the deal the ‘death of Indian retail’ even as the tax authorities got busy calculating the tax liabilities of the gains made by investors.

After the initial euphoria over the deal quelled, the cofounders’ exit served as an important lesson for Indian entrepreneurs. Taking cues from it, Ola founder Bhavish Aggarwal has already taken measures to keep dominating investors from gaining greater control of his decade-old venture. New and existing entrepreneurs can be expected to play a safer game in 2019!

Capital Float Counts On Walnut

Capital Float operates in the crowded digital lending segment, wherein to stay afloat, it clearly needs to keep its innovation game going while keeping its customer acquisition costs tight. Acquiring Walnut helped it kill both the birds with a single stone.

Capital Float operates in the crowded digital lending segment, wherein to stay afloat, it clearly needs to keep its innovation game going while keeping its customer acquisition costs tight. Acquiring Walnut helped it kill both the birds with a single stone.

To begin with, it acquired its customers — Walnut has 7 Mn app downloads, 1 Mn monthly active users, and 300K daily active users.

Capital Float gained on the tech side, too, on two counts: Walnut Prime, which enables its users to access consumer loans of up to INR 1 lakh that can be directly moved into their bank accounts, and its credit assessment model, which captures data from alternative sources. Capital Float is certainly counting on these gains to move forward in the tough fintech space.

Nevertheless, with big players like Paytm and Flipkart flexing their muscles in fintech, one needs a lot more than just acquisitions to get the numbers rolling. With Walnut’s 35-member team, its customers, and tech on its side, will Capital Float be able to leverage this acquisition to its best advantage?

Zomato Gobbles Up TongueStun

After being sidelined by Swiggy, Zomato is back with a bang. This year, Zomato crossed $1 Bn in GMV and the credit goes to its 2017 acquisition — Runnr. No wonder then, that Zomato placed another costly bet on foodtech startup and e-marketplace TongueStun in 2018. The move came soon after Zomato raised a total of $410 Mn in two rounds (1 and 2).

After being sidelined by Swiggy, Zomato is back with a bang. This year, Zomato crossed $1 Bn in GMV and the credit goes to its 2017 acquisition — Runnr. No wonder then, that Zomato placed another costly bet on foodtech startup and e-marketplace TongueStun in 2018. The move came soon after Zomato raised a total of $410 Mn in two rounds (1 and 2).

According to reports, Zomato acquired TongueStun to provide a high-frequency use case for its users by enabling them to order food for pickup from cafeterias through the Zomato app.

Zomato is allowing Tonguestun to work independently even after the deal as the latter has its user retention down pat. As a Zomato spokesperson said, “Customers are very sticky as they end up placing more than 20 orders a month on the TongueStun.”

Having tasted blood through acquisitions, Zomato is on the prowl again. Just a few days ago, it acquired drone delivery startup TechEagle for an undisclosed amount to strengthen its delivery service. Seems like Zomato is anticipating a huge increase in its orders soon!

Amazon Hopes Tapzo Buy Will Pay Off

The fintech boom in India cannot be ignored. With the increasing dominance of players like Google Pay, PhonePe, and Paytm, among others, Amazon was in search of a new weapon to arm its own payments offering — Amazon Pay. The search ended with Tapzo — an “all-in-one” app that aggregates 35+ different apps in one place, across categories such as cabs, food, recharge, bill payment, news, cricket, horoscopes, and more.

According to analysts, the acquisition saved Amazon more than two years that it might have taken to build an entire stack of services like the ones Tapzo offers. Tapzo’s numbers were definitely impressive: 14,000 daily user base, 55K daily transactions, and an annual run rate (ARR) of INR 210 Cr in GMV/bookings.

After the acquisition, Amazon has merged the entire Tapzo team with Amazon Pay, and it will be working in the backend. Will Tapzo prove to be an efficient bet for Amazon in the bloodbathed fintech segment of India? Something worth tracking in 2019.

Mettl Proves Its Mettle, Bought By Mercer

The acquisition of online assessment platform Mettl by US-based human resource (HR) tech company Mercer was important from two angles. One, it was the first major exit in the Indian software-as-a-service (SaaS) segment. Second, the gains were calculated to be almost 7x the amount of funding raised by the startup since its launch in 2010.

The acquisition of online assessment platform Mettl by US-based human resource (HR) tech company Mercer was important from two angles. One, it was the first major exit in the Indian software-as-a-service (SaaS) segment. Second, the gains were calculated to be almost 7x the amount of funding raised by the startup since its launch in 2010.

Mettl assists over 2,000 global companies, 24 Sector Skill Councils, and 15 educational institutes in 80+ countries conduct online skill assessments for hiring and training and development. Clearly, the Indian startup ecosystem needs more such players that can grow while keeping their pocket strings tight, build their product-market fit, and scale and exit when the right opportunity knocks on the door.

The acquisition marks the entry of HR consulting giant Mercer in the Indian assessment services market, projected to cross $750 Mn by 2021.

Foodpanda Steams Ahead With HolaChef

HolaChef was an aggregator that connected customers with chefs across the city, offering a new menu selection every day as per its website. The startup was shut down around May 2018 amid a cash crunch. Foodpanda pounced on the chance, acquiring the startup cheap — the deal was said to fetch minimal returns HolaChef investors. For Foodpanda, the acquisition was an attempt to test waters in the cloud kitchen space, which its bigger rivals Swiggy and Zomato are already exploring.

HolaChef was an aggregator that connected customers with chefs across the city, offering a new menu selection every day as per its website. The startup was shut down around May 2018 amid a cash crunch. Foodpanda pounced on the chance, acquiring the startup cheap — the deal was said to fetch minimal returns HolaChef investors. For Foodpanda, the acquisition was an attempt to test waters in the cloud kitchen space, which its bigger rivals Swiggy and Zomato are already exploring.

Despite having an early-mover advantage, with the entry of other online foodtech players, Foodpanda was pushed to the brink of failure. It got a fresh lease of life when cab aggregator Ola acquired it in December 2017. Ola’s idea was to get a frontier for its rival Uber’s food delivery service, UberEats.

After a few months on pause, Foodpanda is riding high on its expansion spree and is currently active in 100 cities across India. Also, it now has an access to Ola’s 150 Mn customer base, giving it at an edge over its competitors.

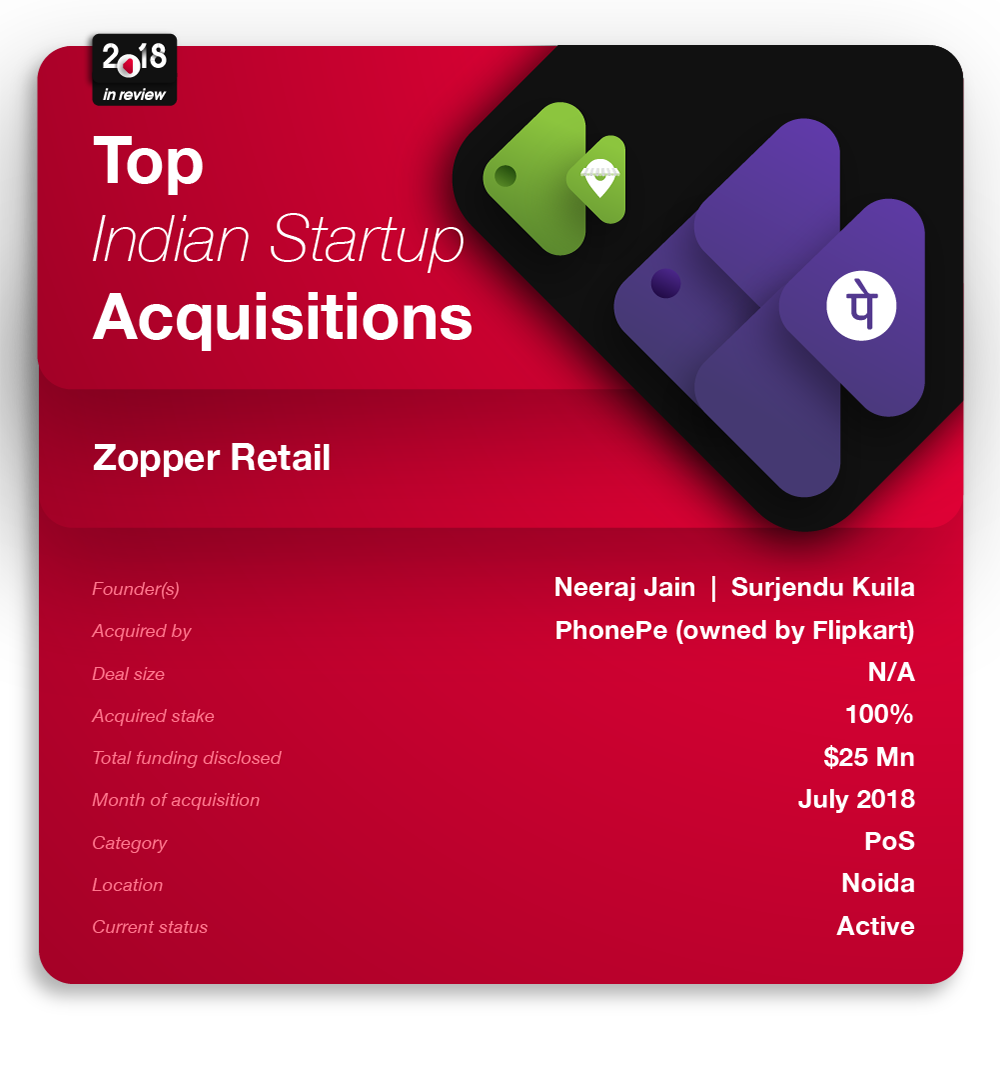

PhonePe Puts Its Money On Zopper Retail

Zopper Retail’s journey is the stuff startup fables are made of: a failure, a comeback, and finally a redeeming exit. Starting out as a hyperlocal ecommerce platform in 2015, Zopper Retail was hit by losses. On the advice of Flipkart cofounder Binny Bansal, the startup pivoted to a point-of-sale SaaS model.

Zopper Retail’s journey is the stuff startup fables are made of: a failure, a comeback, and finally a redeeming exit. Starting out as a hyperlocal ecommerce platform in 2015, Zopper Retail was hit by losses. On the advice of Flipkart cofounder Binny Bansal, the startup pivoted to a point-of-sale SaaS model.

Three years down the line, the founders were able to earn revenues, reduce losses, and when the time came, hit a profitable exit with PhonePe taking over Zopper.

PhonePe, the digital payments subsidiary of Flipkart, was keen to deepen its presence in offline retail and was looking to offer PoS devices to enhance the adoption of digital payments among merchants. In November 2017, PhonePe launched its own PoS device and set a target to instal a million POS devices across 50 Indian cities in 2018. The acquisition made perfect sense as Zopper Retail had the right team to complement PhonePe’s existing offerings.

In the post-demonetisation era, fintech has emerged as one the hottest sectors and is seeing aggressive competition with almost every company wanting a piece of the pie. PhonePe hopes to remain on top by offering value-added services such as PoS devices and certainly got a leg up with Zopper.

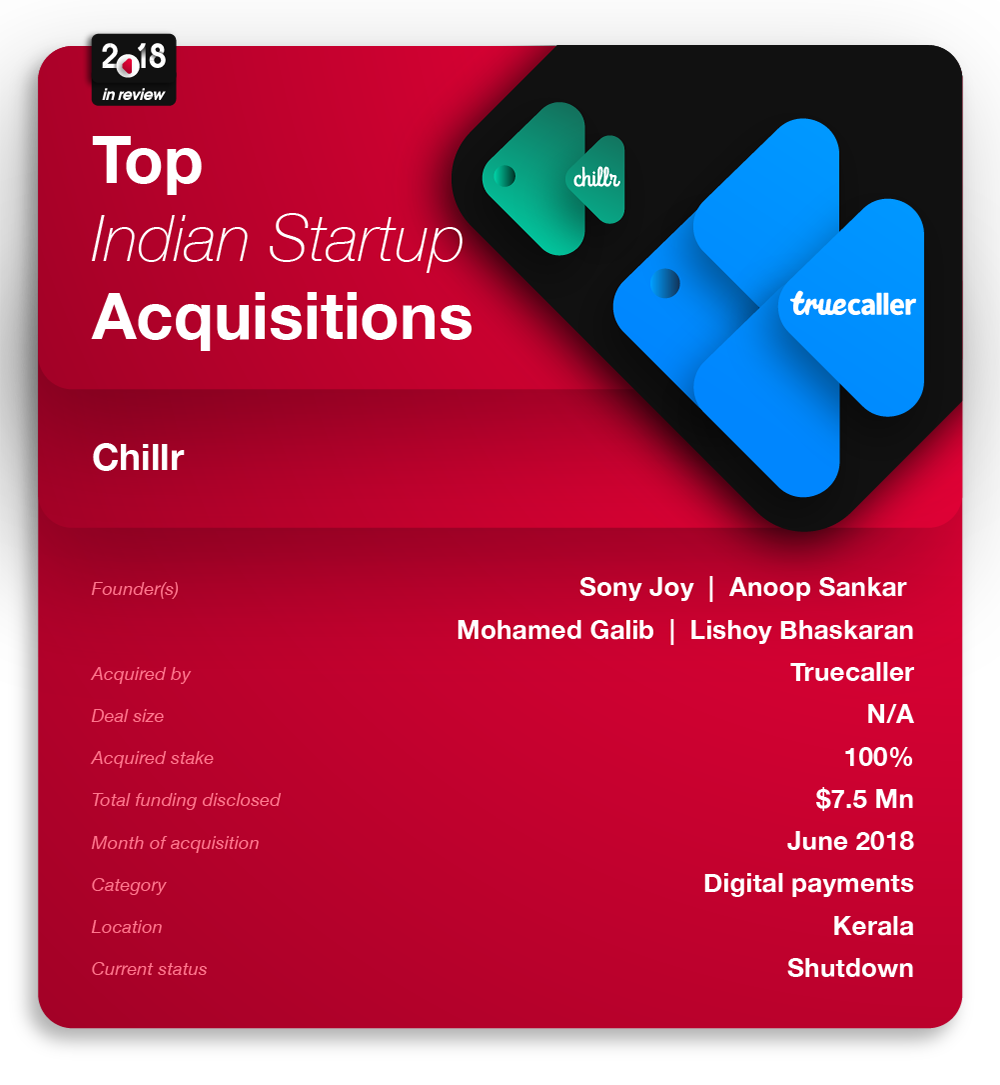

Will Truecaller Pay Make It Truly Big With Chillr?

In April 2017, Chillr made the headlines when HDFC Bank launched the Unified Payments Interface (UPI) on the startup’s peer-to-peer payments app. Chillr was operating on Immediate Payment Service (IMPS) with 33 banks and was expecting to see 10 Mn active transacting users as of December 2017.

But considering the pace at which other UPI apps were growing, as well as the entry of global players like Amazon and Google in the space, Chillr made an early exit from the market after finding synergies with Truecaller, which was looking to launch its payment service.

Chillr founder Sony Joy is now the VP of Truecaller Pay, which certainly has a long way to go to meet its ambitious target of bringing on board a total of 25 Mn users by March 2019, and that too organically. Truecaller Pay is currently active only in India and is onboarding 100K users on a daily basis at present.

TicketNew Gets A New Ticket To Ride With Paytm

Paytm, Vijay Shekhar Sharma’s digital payments company, is one of Alibaba’s biggest bets in India. Buoyed by the burgeoning success of Paytm in the post-demonetisation era, Alibaba has opened up its fundgates to startups from new segments.

Paytm, Vijay Shekhar Sharma’s digital payments company, is one of Alibaba’s biggest bets in India. Buoyed by the burgeoning success of Paytm in the post-demonetisation era, Alibaba has opened up its fundgates to startups from new segments.

Last year, Alibaba acquired online ticket booking services TicketNew for $30 Mn. However, unlike other segments — groceries (BigBasket), logistics (XpressBees) — where it offered a partnership opportunity, Alibaba offloaded TicketNew to Paytm and made a quick exit from the company within just a year.

Now that it’s saddled with the acquisition, Paytm, might as well make the most of it. It is planning to further invest in TicketNew to help grow its occupancy and revenues, besides connecting its over 300 Mn customers to TicketNew partner cinemas. The ticket booking startup is currently active in more than 660 cities.

Ola Seeks Faster Ride With Ridlr

Even as Indian startups that have broken new ground get lapped up foreign investors — resulting in their founders being sidelines or ousted in the process — Ola’s Bhavish Aggarwal is holding on strong to the reins of India’s leading homegrown cab aggregator. Not only that, he is taking the unicorn from strength to strength with continuous innovation, overseas expansion, and adoption of new technologies.

Even as Indian startups that have broken new ground get lapped up foreign investors — resulting in their founders being sidelines or ousted in the process — Ola’s Bhavish Aggarwal is holding on strong to the reins of India’s leading homegrown cab aggregator. Not only that, he is taking the unicorn from strength to strength with continuous innovation, overseas expansion, and adoption of new technologies.

The acquisition of Ridlr, a public transport commuting and ticketing app, was a step to further strengthen Ola’s tech backbone. The aim was to combine Ridlr’s innovations in mass transit with Ola’s mobility products with a view to enable true multi-modal mobility solutions for Ola’s users at scale.

Not only that, Ridlr also provides real-time navigation information on roadblocks, diversions, cancellations, etc, through its GPS-installed probes. Integrating this technology in its cab-aggregator app will certainly give Ola an edge in improving driver and rider safety as well as communication.

After the acquisition, cofounder Brijraj Vaghani will continue to lead Ridlr’s 64-employee team, all of whom will be joining Ola.

While these were the biggest acquisitions. Here’s the list of some of the other acquisitions that mattered this year

- RIL acquired a majority stake in edtech startup Embibe for $180 Mn

- CureFit acquired Fitness First to expand its presence in Delhi and Mumbai

- Paytm acquired tech Startup Cube26 to add more social engagement features to Paytm’s products and services

- Samara Capital and Xponentia Fund partnered to acquire logistics startup Spoton for $78.48 Mn (INR 550 Cr).

- Times Internet acquired South Korea’s MX Player in a $144 Mn deal

- Swiggy acquired on-demand delivery platform Scootsy in an all-cash deal in line with its vision to provide the widest restaurant choices for the consumers

As we close our doors on 2018, Indian entrepreneurs will remember this year for one unforgettable lesson it taught them:

Howsoever attractive billion-dollar cheques may seem, equity funding comes with a liability. And the only way to have a truly successful exit is to build a revenue-led venture, which you can cash in on at the right time.

Here’s hoping Indian startups ride into the sunset wiser, stronger, and better off for this learning.

[Edited by Prakriti Singhania]

Ad-lite browsing experience

Ad-lite browsing experience