SUMMARY

Paytm mired in controversies over an alleged data leak and the Sonia Dhawan extortion case

Startups exempted from Angel tax but still complain they are getting IT notices

Sachin Bansal’s exit and Binny Bansal's resignation from Flipkart also made big news this year

This article is part of Inc42’s special year-end series — 2018 In Review — in which we will refresh your memory on the major developments in the Indian startup ecosystem and their impact on various stakeholders — from entrepreneurs to investors. Find more stories from this series here.

Hoaxes. Hunches. Scandals. Misinterpretation or misrepresentation of facts. Or simply the truth. There is no reason or season for controversies. In Trump o’ times, when fake news is being increasingly perceived by society at large as an alternate fact, it’s a strenuous affair to filter facts from a controversy. Almost a century ago, Harvard professor and American author Oliver Wendell Holmes nailed it when he said: “Controversy equalizes fools and wise men — and the fools know it.”

While no one can beat US president Donald J Trump when it comes to infamy and controversies, 2018 panned out to be a rocky, super scandalous year for corporate and technology giants. Here are a few: Intel’s slow response to chip firmware flaws and its CEO resignation; Facebook and its massive data leaks; Xerox for boardroom war over its merger with Fujifilm; ZTE, sandwiched in the US-China trade war; Apple purposely slowing down its batteries; Broadcom’s failed $130 Bn deal with Qualcomm; and Tesla going private.

The corporate world was rife with controversy. How, then, could startups be left untouched?

This year, the bigger the deal, the bigger were the controversies. The $16 Bn Walmart-Flipkart deal, touted as the most successful deal in the Indian startup ecosystem, sparked off a smear campaign among Indian ecommerce vendors and India-first lobbies who questioned, “Where’s the ‘Indian’ in Indian ecommerce”?

Bitcoin, which has been making a lot of buzz across the world for its continued slowdown, was fraught with controversy in India thanks to the arrest of Bitcoin scammers, starting with Amit Bhardwaj. And this was just the beginning.

As the year comes to a close, Inc42 revisited some of the biggest controversies that shook the Indian startup ecosystem in 2018. Here’s a lowdown:

Paytm: A Data Leak & An Alleged Extortion Case

After ecommerce posterboy Flipkart, digital payments decacorn Paytm is touted as the most successful startup in India, and with good reason. Once just a digital payments company, Paytm has seen not only 10X growth after demonetisation (November 8, 2016) but it has also grabbed itself a piece of every pie it laid its eyes on — from ecommerce and insurance to lending. The company is expected to generate a gross transaction volume of $50 Bn in 2019.

Paytm hit the headlines many times this year. But, apart from earning the distinction of becoming Warren Buffett-owned Berkshire Hathaway’s first Indian investment, it was also neck deep in controversies.

The Data Leak Controversy

First, in May, an investigative news agency named Cobrapost released a 13-minute-long sting video which showed Sudhanshu Gupta, a VP at Paytm, and founder Vijay Shekhar Sharma’s brother Ajay Shekhar Sharma, also a senior VP, saying that the company had shared its data with the Prime Minister’s office without users’ consent.

Interestingly, this came at a time when Paytm was fighting for the cause of data privacy and localisation among Indian startups. In a press statement, later, it clarified that no user data was shared with any third party.

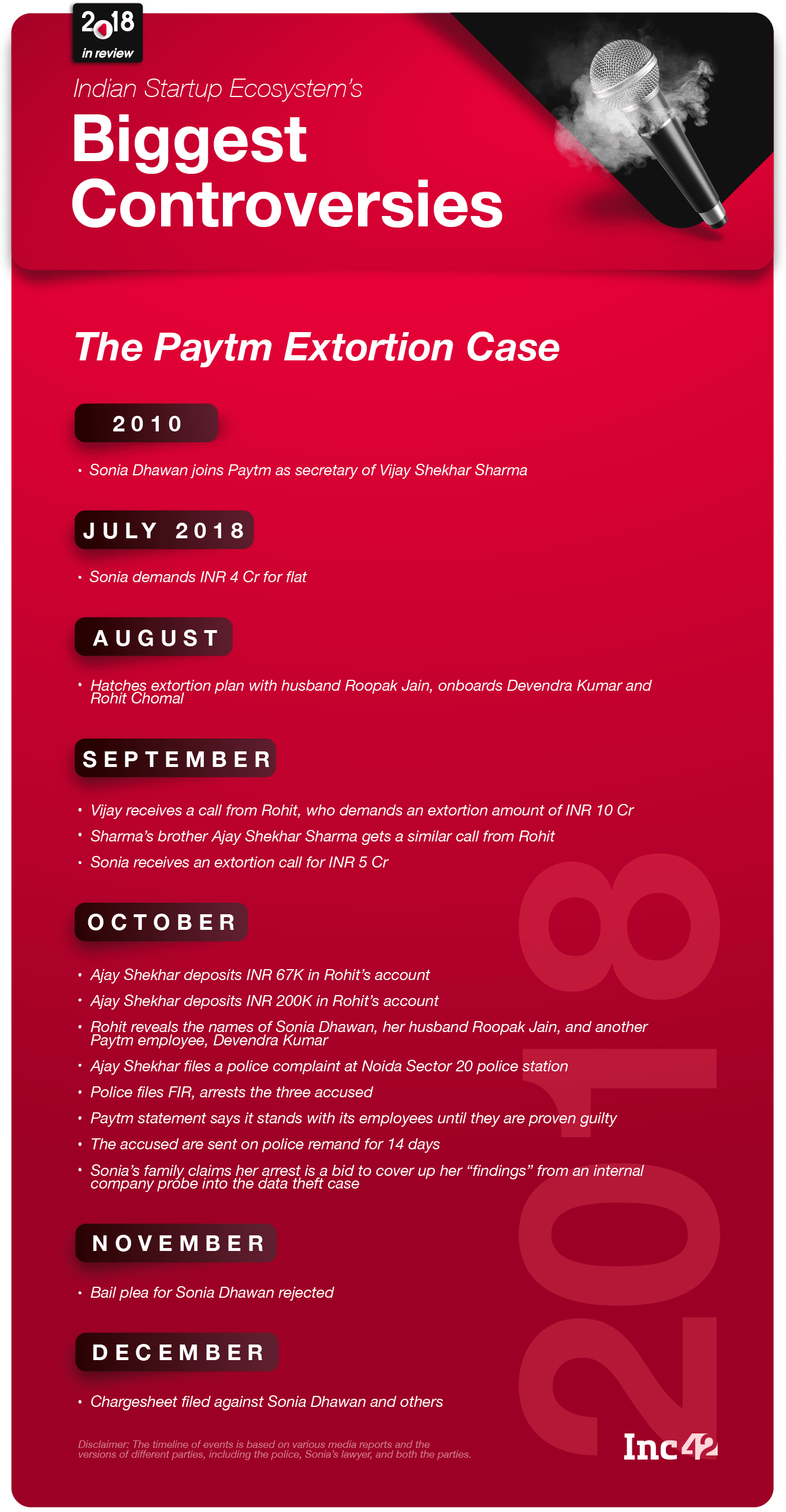

The Data Theft & Extortion Charge On Paytm VP Sonia Dhawan

Recently, Paytm was in the news again for the alleged theft of sensitive, personal data from Vijay Shekhar’s personal computer and an extortion attempt by an employee. On October 22, Vijay’s brother Ajay had filed a police complaint against Paytm corporate communications VP Sonia Dhawan, her husband Roopak Jain, another Paytm employee Devendra Kumar, and his friend Rohit Chomal alleging that they had ganged up to extort $1.4 Mn (INR 10 Cr) from Vijay, threatening to release the “personal data” in public otherwise.

As the case unfolded, it turned into a twisted spiral of allegations and counter allegations. While Sonia’s lawyer Satish Kumar defended her by saying that she too had got a similar extortion call and that it was Vijay who actually masterminded the case to frame her, police claimed to have more-than-enough proof to prove Sonia and others guilty.

Status Quo

A 250-page chargesheet has been filed against all the four accused. While Rohit Chomal was granted a stay order from the high court over his arrest, the remaining three are still in jail. The Noida Police claimed that they have made a breakthrough in the Paytm extortion case, and that they have multiple witnesses testifying against the three alleged conspirators. Meanwhile, Satish Kumar, Sonia Dhawan, and her husband’s lawyer claimed that the charges are bogus.

Let’s see what other controversies the company courts in the coming year.

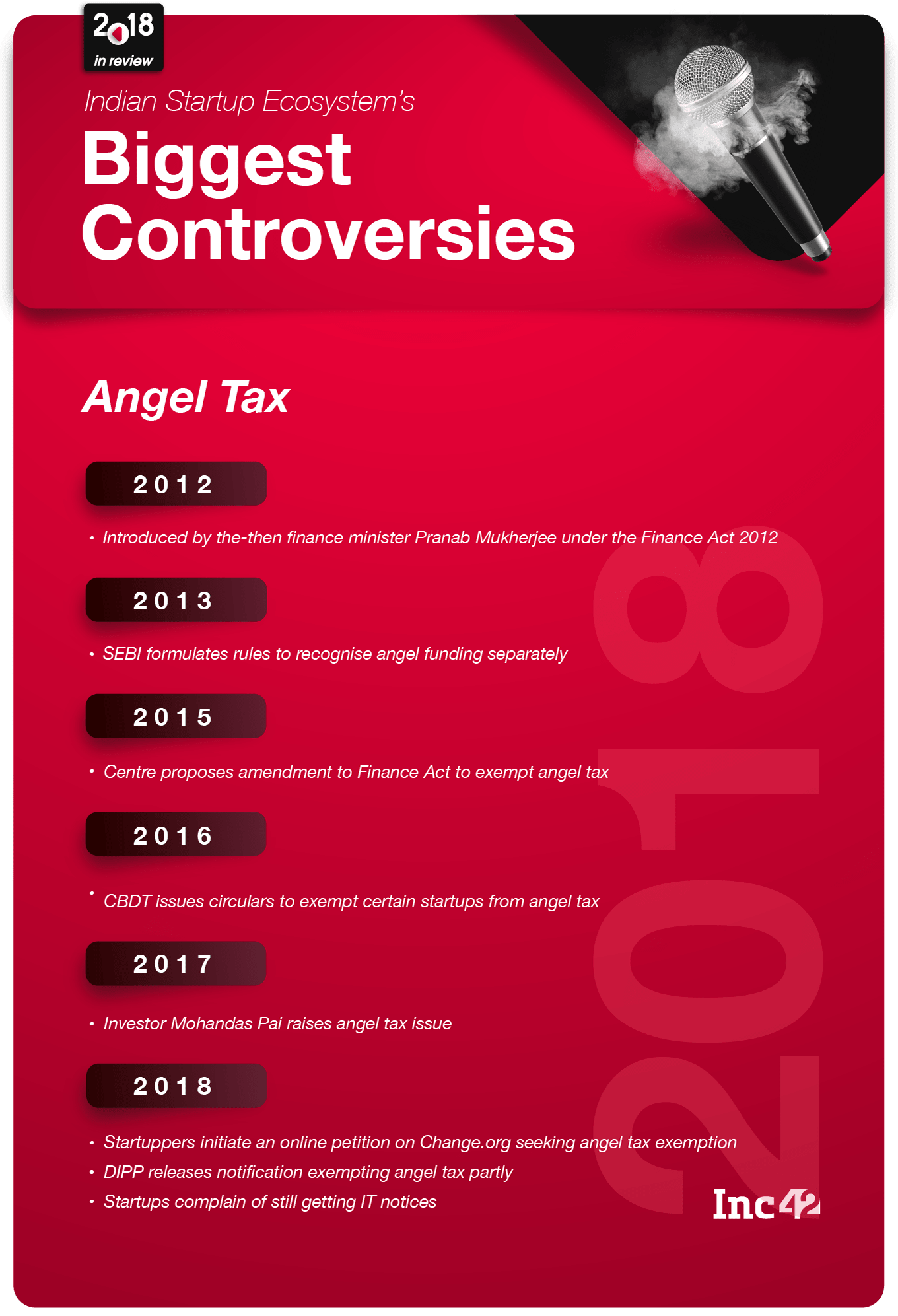

Angel Tax: Still Clipping Startups’ Wings?

Angel tax, classified as ‘income from other sources’ under Section 56 (II) of the Income Tax Act of India, has been a nightmare for startups. Startups and angel investors both have been equally facing the wrath of the Income Tax department since its implementation in 2013.

Exempting Startups From Angel Tax

This year, the startup community finally got some relief when, in a notification issued on April 11, the Indian government paved the way for startups to avoid paying angel tax.

The Centre made amendments to Section 56 of the Income Tax Act to exempt angel tax on angel investments not exceeding $1.56 Mn (INR 10 Cr). Further, on May 24, the Income Tax department issued a notification, superseding its June 2016 notification.

The provisions of Clause (viib) of Sub-Section (2) of Section 56 of the Income Tax Act would not apply to “a consideration received by a company for issue of shares that exceeds the face value of such shares, if the consideration has been received for issue of shares from an investor in accordance with the approval granted by the Inter-Ministerial Board of Certification,” the Central Board of Direct Taxes (CBDT) said in the May notification.

As an added relief for startups, the Income Tax department stayed the recovery proceedings of angel tax levied on companies that are recognised as startups by the Department of Policy and Promotion (DIPP).

Status Quo

However, did the I-T department really halt its tax recovery proceedings against startups, stopped issuing notices to them over angel taxes? Have the changes happened on the ground?

The answer is both yes and no. While some startups do claim to have benefitted from the initiative, many startups are still getting IT notices against their filed returns. Further, the insertion of Section 50CA into the Income Tax Act has created certain other barriers that might block the development of the startup ecosystem.

Investors were so far required to file their “capital gains” once every fiscal year while filing their tax returns. However, the new rulebook changes the scenario. Now onwards, every time a transaction occurs, the company or the buyer has to ask for a fair market value from a chartered accountant that is based on audited financials.

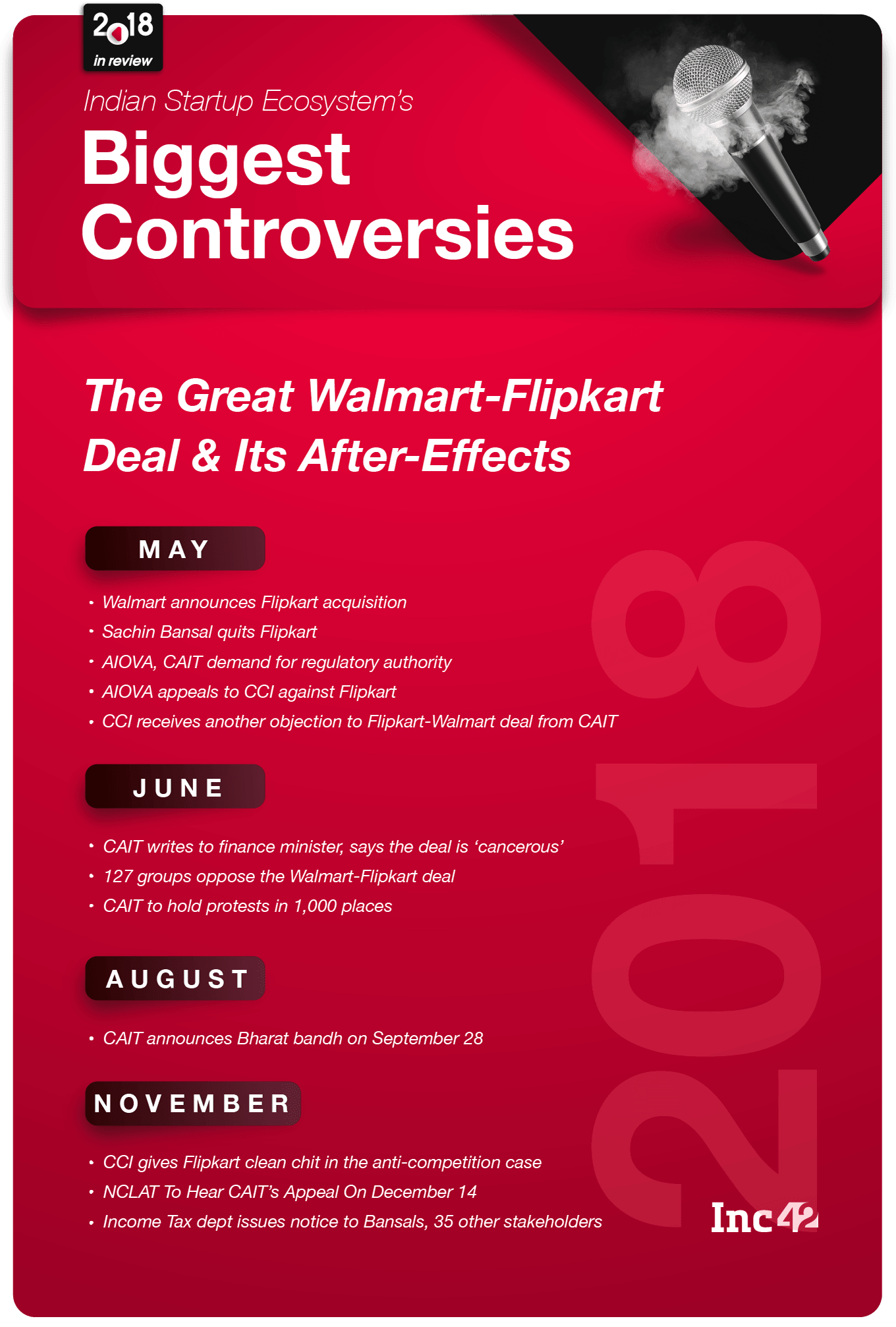

Did Walmart-Flipkart Deal Violate Competition Act & FDI Norms?

On May 9, Walmart confirmed that it has entered into an agreement to acquire an approximately 77% stake in Indian ecommerce company Flipkart for $16 Bn, while the remainder of the business was to be held by other shareholders, including Flipkart co-founder Binny Bansal, global late-stage investors Tencent, Tiger Global, and Microsoft Corp.

However, the largest-ever ecommerce deal in the world’s history (purportedly) sparked a myriad of controversies relating to India’s policy flaws, vendor issues, founders’ say in company matters, and tax-related issues. Here’s what and why:

Accusation 1: Walmart Violated Competition Act 2002

The acquisition was a eureka moment for the entire ecosystem, with entrepreneurs and investors viewing it as a giant leap forward in the Indian startup story. However, there were as many detractors of the deal as applauders. As many as 127 groups, including the the Confederation of All India Traders (CAIT) and All India Online Vendors Association (AIOVA) made a lot of noise against the deal, saying that Walmart had violated the Competition Act 2002.

Accusation 2: Walmart Evaded FDI norms

Trader associations, as well as the RSS-affiliated Swadeshi Jagran Manch, termed the deal as a backdoor entry for Walmart into multi-brand retail in India. Walmart has been trying to enter India since 2007. Foreign Direct Investment (FDI) in multi-brand retail is currently capped at 51%. However, in 2016, the Indian government had allowed 100% FDI in Indian eommerce, paving the way for Flipkart’s acquisition by Walmart.

Accusation 3: Flipkart’s former stakeholders evaded taxes

There were also accusations of Flipkart stakeholders evading taxes. In November, the Income Tax department issued notices to the Bansals and 35 other stakeholders who had sold their shares in Flipkart to Walmart.

Status Quo

In November, the Competition Commission of India (CCI) gave a clean cheat to Walmart on the Competition Act violation allegation. However, the CCI maintained that the FDI issue was beyond its ambit. The CAIT has now gone to the National Company Law Appellate Tribunal (NCLAT), which will hear the petition on December 14.

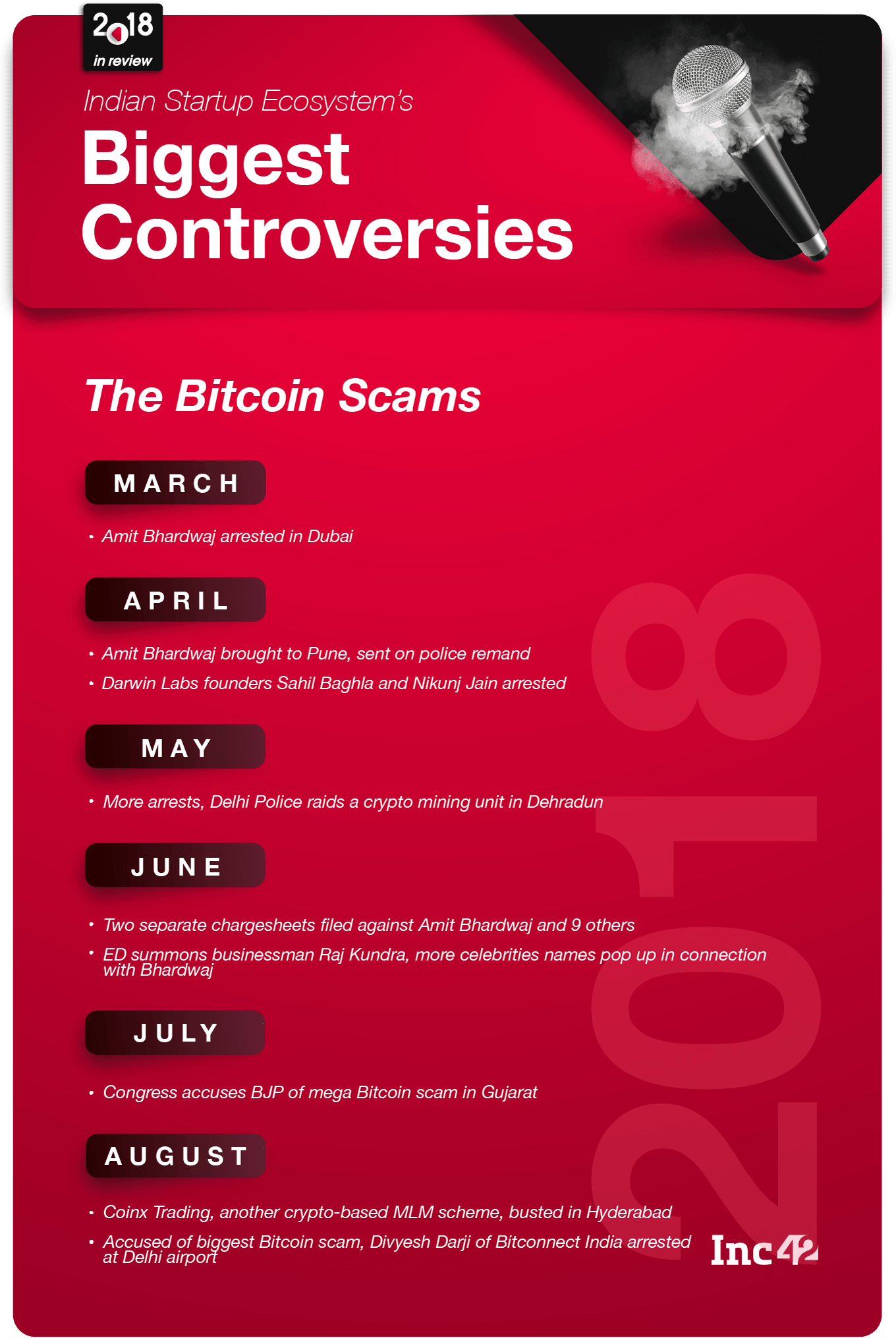

Amit Bhardwaj: The Arrest That Exposed MLM Schemes Worth Billions

If 2017 saw Bitcoin skyrocketing to $20K, 2018 made the cryptocurrency bite the dust. However, in India, it was the arrest of Amit Bhardwaj and a host of others running multi-level marketing schemes (MLM schemes) that made headlines this year.

Bhardwaj, who calls himself a cryptocurrency guru and visionary, had established a slew of companies that were dealing with all the aspects of cryptocurrencies — mining, exchange, wallet, R&D, and MLM schemes.

Bhardwaj reeled in his victims in style, inviting well-heeled people to his seminars, yacht parties, etc, and spiking their interests in Bitcoin and cryptocurrencies. However, many of these investors hardly understood the Bitcoin game. This was the beginning of the making of a scamster.

The $300 Mn MLM Fraud

Bhardwaj would promise 10% returns while asking people to invest in Bitcoin through his MLM schemes. It could have been a win-win situation for both if it would have been in a fiat currency. However, Bhardwaj would collect the investors’ money in Bitcoin and promise the 10% return in Bitcoin itself. This was not just an inflated offer but actually a fraud one — no one can return more Bitcoins than they actually collect.

Similar fraud schemes were soon reported by crypto traders in the media.

Status Quo

On March 30, Bhardwaj was arrested and eight others were held later in the then biggest Bitcoin scam in the country worth $300 Mn. After this, the police made two more arrests — Sahil Baghla (former Bluegape founder) and Nikunj Jain (former Frankly.me founder and an angel investor), founders of crypto mining startup Darwin Labs, were also arrested in connection with Bhardwaj’s crypto Ponzi scheme.

Police also arrested Divyesh Darji, accused of duping investors of $12.7 Bn through Bitconnect.in, the Indian division of the UK-based Bitconnect(.com) which was launched right after demonitisation (November 2016).

Since the Bhardwaj scam, India’s cryptocurrency sector has been hit by a number of other such frauds, mostly MLM schemes, busted by the police and investigative agencies of different states.

Meanwhile, the Indian government made it clear that cryptocurrencies are neither a legal tender nor an asset backed by any physical property. Cryptocurrencies remain unregulated till date and hence cryptocurrency-backed MLM schemes are illegal in India.

Did #MeToo Taint Startup Founders And Investors?

The #MeToo movement, which supports survivors of sexual abuse, assault, and harassment, was actually started over 10 years ago by Tarana Burke. Burke, who hails from Harlem, a neighbourhood in New York City, had set up an activist group named Me Too to help underprivileged women of colour affected by sexual abuse.

In late 2017, the name was appropriated on social media as a hashtag — #MeToo — by women sharing personal stories of sexual abuse in the aftermath of the Harvey Weinstein expose by the New York Times and The New Yorker, which brought down Weinstein and sparked off the modern #MeToo movement.

The campaign since then has compelled 201 powerful men step down.

In India, however, the campaign, was triggered exactly a year later in October 2018, when film actress Tanushree Dutta filed an FIR against veteran actor Nana Patekar accusing him of sexually abusing her on the sets of a film in 2008.

Soon, an outpouring of sorts followed on social media, with first celebrities and then women from all walks of life naming and shaming directors, actors, comedians, journalists, editors, corporate honchos, and others in cases of sexual abuse. One of the biggest names who was accused in the #MeToo campaign was the minister of state for external affairs MJ Akbar. Around 20 women journalists accused Akbar of sexual harassment; he finally resigned on October 17.

The Startup Connection

The startup ecosystem has witnessed several #MeToo moments intermittently over the last few years. This year again, it started with Mahesh Murthy — the angel and seed investor who has been named and shamed by multiple women in sexual abuse cases. Against a sexual harassment complaint made in April, 2017, Murthy was jailed on February 9, 2018, and received anticipatory bail on the same day.

Exposing System Weaknesses

The #MeToo movement exposed the unpreparedness of the Indian startup ecosystem — the third-largest in the world — in safeguarding women. A number of startups, along with some big corporates, have failed to implement the Vishakha Guidelines (1997) or Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013. As per a survey of 600 enterprises, around 40% didn’t have the Act in place.

The recent and past exposés of AIB comedian Utsav Chakraborty, TVF founder Arunabh Kumar, Scoopwhoop co-founder, investor Mahesh Murthy, and OML cofounder Vijay Nair only confirm the above finding.

Thanks to #MeToo, many of them have had to step down, apologised to the women they preyed upon and been brought to book by the legal system for their misconduct and crimes.

The Bansals’ Ouster From Flipkart

Sachin’s Exit

Walmart acquisition or not, Flipkart had already raised around $5 Bn in 2017 and was doing well even on its own with Flipkart cofounders Sachin Bansal and Binny Bansal leading the charge.

Come 2018, things started changing. In January, Flipkart CEO Kalyan Krishnamurthy and Tiger Global’s Lee Fixel reportedly initiated talks with Walmart. While it excited the Bansals for obvious reasons, the move also laid the foundation for their exit from the company.

The first head to roll was Sachin Bansal’s, as the deal was based on the precondition that only one founder would remain on the board. But was it a really necessary move, considering Walmart was the majority stakeholder and would have its say in any case? Or was it incited to oust Sachin?

In May 2018, the acquisition announcement of Flipkart by Walmart also saw an unceremonial exit of Sachin Bansal

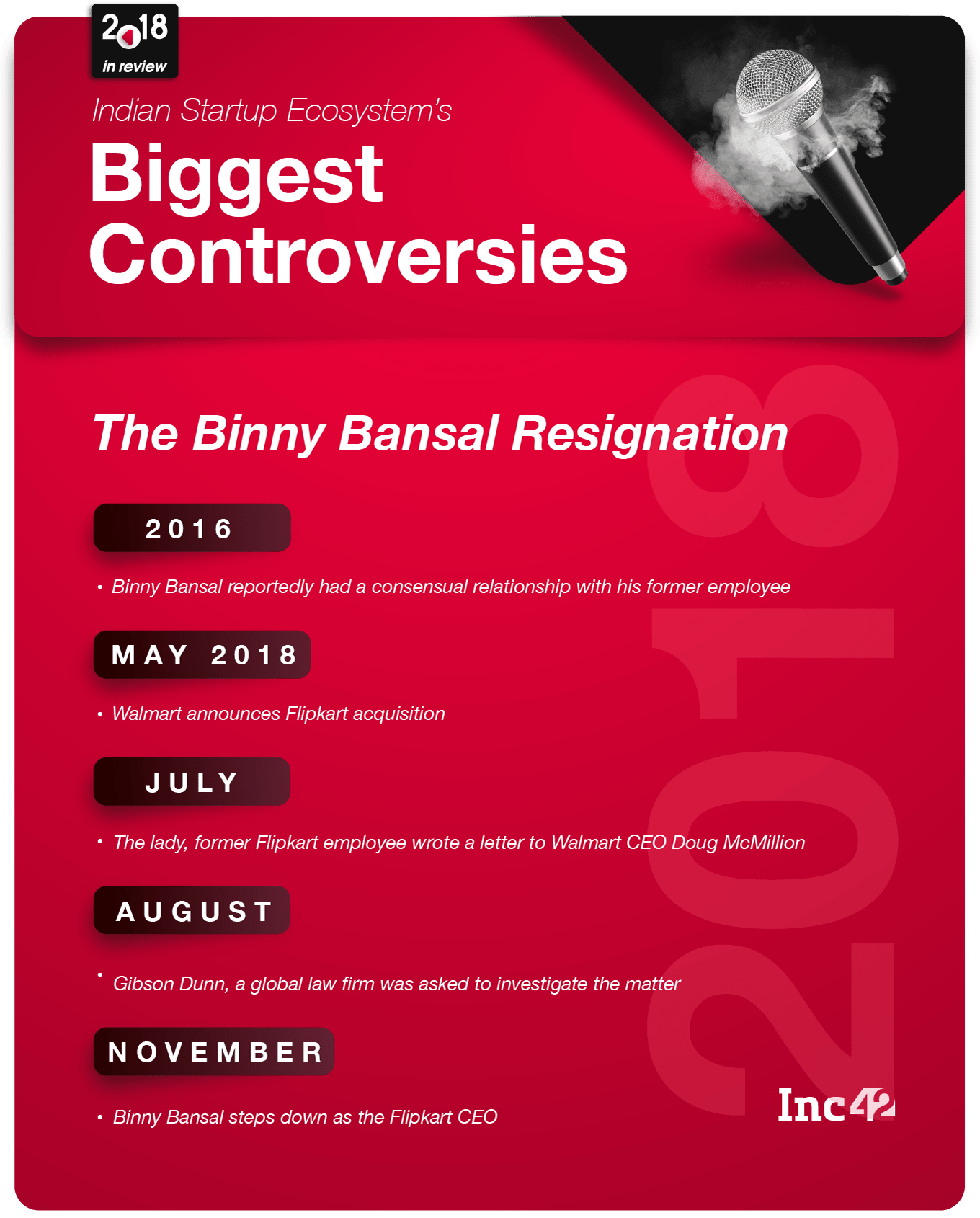

The Binny Bansal Controversy

While Sachin’s exit was par for the course, Binny Bansal stepping down as the CEO of Flipkart Group within months of the acquisition came as quite a shocker. Digital Media website Founding Fuel’s founding editor Indrajit Gupta writes in detail about the whys and the wherefores of the ouster.

According to reports, about two years ago, Binny had a consensual relationship with a former employee who allegedly tried to blackmail him later. Binny, however, tackled the matter at a personal level and didn’t inform the Flipkart board. He, however, did tell Sachin.

Right after the acquisition, in July, the woman in question reportedly wrote a letter to Walmart CEO Doug McMillion complaining about Binny. McMillion then asked Gibson Dunn, a global law firm, to investigate the matter.

The probe, which concluded in November, gave a clean chit to Bansal, accepting that the relationship was consensual. However, the board considered Binny’s decision to keep the board in the dark as a serious lapse in judgement.

There was another twist to the story. Dunn reported that Binny had hired a security firm to sweep the matter under the carpet. One of the employees of the security firm even physically assaulted his former lady love.

Now the big question: What made the woman write to the Walmart CEO directly, and that too at this time? Apart from Sachin, who is said to be no more on talking terms with Binny, who else had this information?

Guess, we will never know.

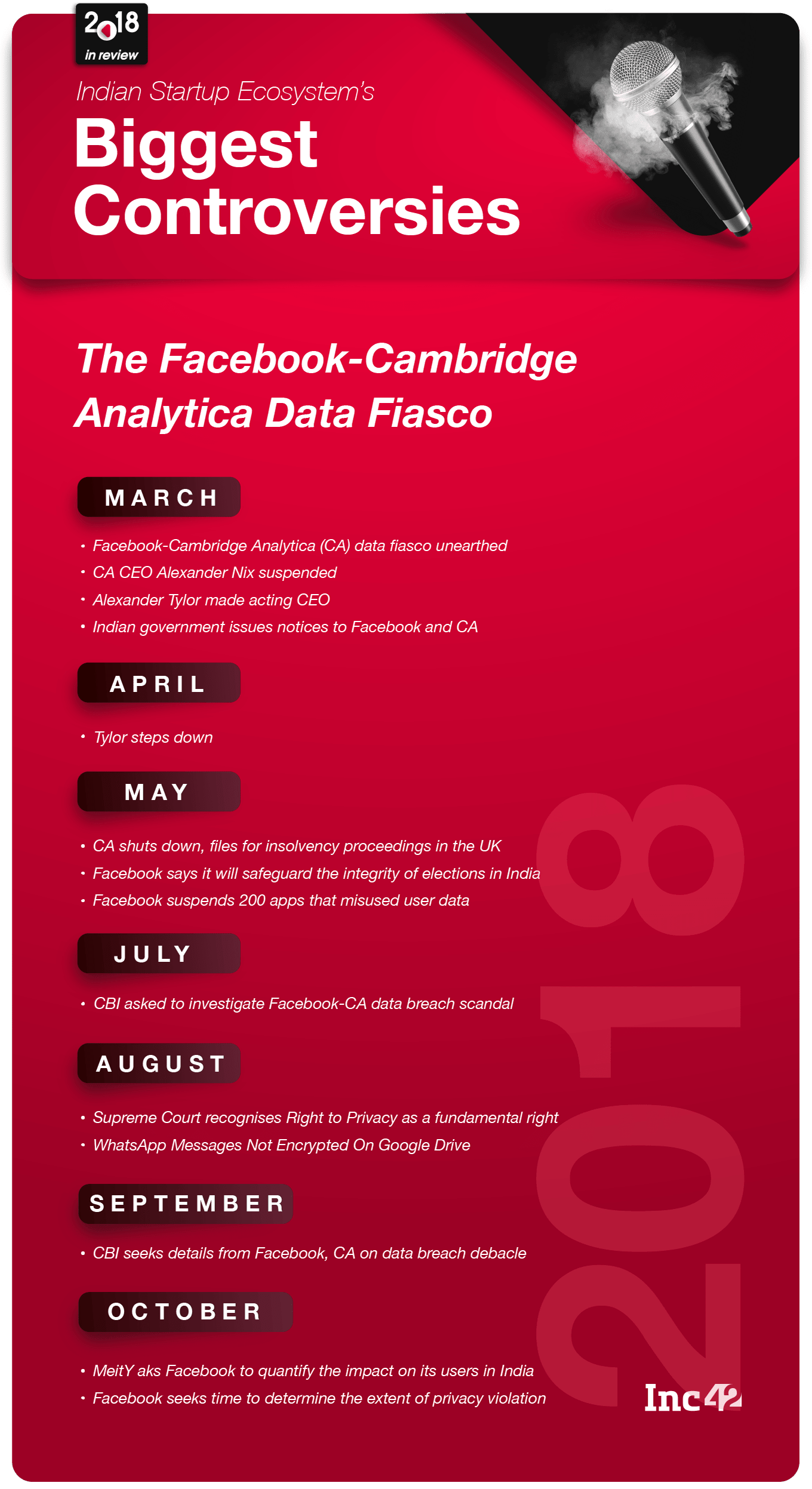

Facebook-Cambridge Analytica Fiasco: Manipulating Minds

Data is the new omniscient power in the world. And Facebook, the omnipresent social media platform which has 2.27 Bn people’s data in its servers, clearly has an omnipotent influence on people’s thought processes.

In the 2016 US presidential election, UK-headquartered political consulting firm Cambridge Analytica (CA) gained access to 87 Mn Facebook users’ data across the world. It then used the data to sway people’s minds — and votes — in US President Donald Trump’s favour. Interestingly, Steve Bannon, the Trump team’s election campaigner who later became his White House chief strategist, was then the vice-president of Cambridge Analytica.

The Facebook-CA fiasco was first exposed by The New York Times, The Observer, and Channel 4 in March this year. The US National Security Agency submitted a report on the scandal and policy professor at University of Pennsylvania Kathleen Hall Jamieson later wrote an entire book on it — Cyberwar: How Russian Hackers and Trolls Helped Elect a President What We Don’t, Can’t, and Do Know.

The Data Fiasco Hits Home

Out of the globally affected 87 Mn people, Facebook disclosed that 562K Indians were “potentially affected” by this global data leak crisis.

The CA fiasco exposed many deep-rooted unethical data practices in India. According to the website of CA’s Indian arm, Ovleno Business Intelligence (OBI) — now suspended by the Indian government — CA had run a research and communication campaign and carried out an in-depth electorate analysis for the BJP-led NDA in the Bihar assembly elections, way back in 2010.

OBI, which is led by Amrish Tyagi, the son of a senior political leader of the JDU, an NDA alliance, boasted BJP, Congress, JDU, and the ICICI bank among its clients. Reportedly, the Congress had reached out to Cambridge Analytica for its reputation building solutions.

CA was just the tip of the iceberg. The Congress party’s app, as well as PM Narendra Modi’s Namo App, has also been accused of sending data to third parties without users’ consent.

The Facebook-Cambridge Analytica fiasco also exposed data leaks of Indian fiduciaries at various other levels — most importantly, Indian apps sharing their data with third parties. While Ministry of Electronics and Information Technology (MeitY) minister Ravi Shankar Prasad in a press conference stressed that data security and right to privacy were the top priorities of the Indian government, the same government, during the Aadhaar case, was caught fighting against people’s right to privacy in the Supreme Court.

Status Quo

Since the newsbreaks, the Indian government has issued multiple notices to Facebook and to CA on the data leak. The matter was later referred to the CBI, which has been fighting its own internal war for last six months. While the CBI investigation is still on, there has not been any further development in the case.

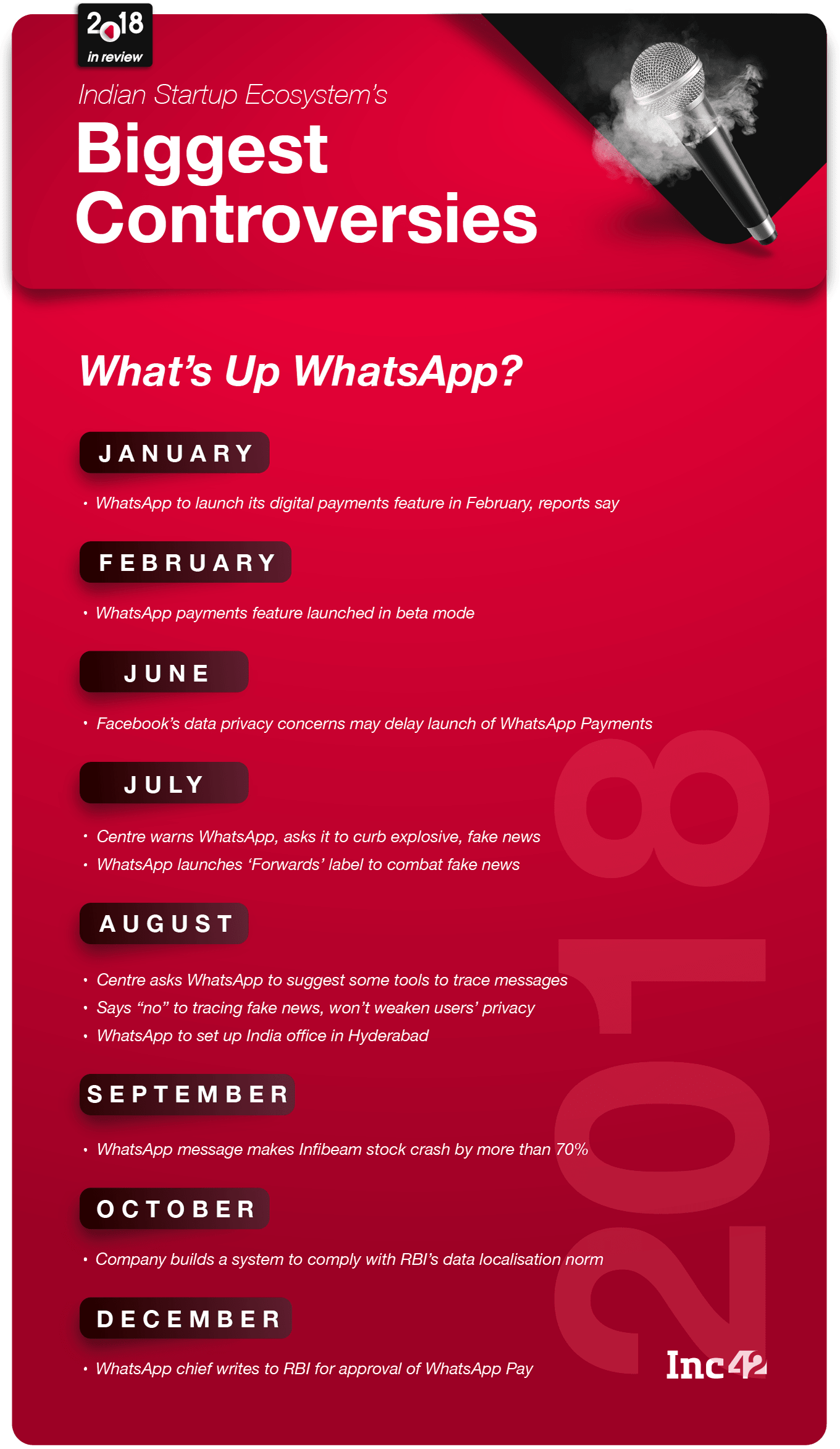

WhatsApp Follows In Parent Facebook’s Footsteps

Two months before the Facebook-CA data fiasco, in January, it was widely reported that WhatsApp would soon launch its WhatsApp Pay in India. In February, news reports said that WhatsApp was finally started rolling out its payments app in beta.

In April, after the WhatsApp payments feature became operational in a limited capacity in India, it was alleged that WhasApp was sharing its Payments-related information with Facebook. Much before India, in December, 2017, the authorities of France, Germany, the UK, and many other countries had ordered Facebook to stop collecting WhatsApp data.

The WhatsApp privacy clause, which read — “To provide Payments to you, we share information with third-party services including PSPs, such as your mobile phone number, registration information, device identifiers, VPAs (virtual payments addresses), the sender’s UPI PIN, and payment amount” — increased people’s anxiety about the matter.

WhatsApp, however, clarified that no one can read user messages as they are encrypted end-to-end. Users also have the option of opting out of information sharing with Facebook as they can reject the new Terms & Conditions and even if they click on Agree, they will have up to 30 days to revise their position.

Jumping into the matter, MeitY asked WhatsApp and its partner banks to furnish more details on the payments system. The ministry officials also sought a response from the National Payments Corporation of India (NPCI) on whether WhatsApp Pay was fully compliant with the Unified Payments Interface (UPI)’s terms and conditions and expected the Reserve Bank of India (RBI) to take necessary measures in this regard.

The MeitY warning came after a petition was filed before the Supreme Court seeking a direction to the Centre to compel WhatsApp to appoint a grievance officer in India for redressal of local complaints, as mandated by the RBI.

Data Leak Not The Only Problem For WhatsApp

The year was by and large one a troublesome one for WhatsApp in India. MeitY also accused WhatsApp of allowing circulation of irresponsible and explosive messages. The ministry issued a stern warning to the Facebook-owned messaging app to stop the spread of such messages by applying appropriate technology.

According to reports, at least 31 people were killed in the last year in 10 different Indian states by lynch mobs mobilised by rumours of child lifting that were spread over WhatsApp. The incidents were reported mostly from Assam, Maharashtra, Karnataka, Tripura, and West Bengal.

Caught in the controversy, WhatsApp issued a statement in this regard: “The company cares deeply about people’s safety and their ability to freely communicate. We don’t want our services to be used for spreading harmful misinformation and believe this is a challenge that companies and societies should address.”

Status Quo

After the Centre cracked down on WhatsApp on the fake messages issue and asked it to set up an India office, the company took a series of measures, including adding the ‘Forwards’ label to messages forwarded on its platform and appointing an India chief. WhatsApp is also in the process of setting up its India office in Telangana.

Although 2018 is drawing to a close, these controversies and issues have not been laid to rest. They are likely to be spilled over into the next year and continue to see new twists and turns. What will happen to Sonia Dhawan and Amit Bhardwaj? Will WhatsApp learn from its mistakes and start treating data privacy and fake news as serious issues? Will Facebook come out clean in the CBI investigation? Will the tax department continue to harangue entrepreneurs over angel tax? Will the #MeToo pick up steam again or continue to simmer or die down?

Inc42 will be on the top of these developments, as and when they come, and bring to you Season II of these controversies.

[Edited by Prakriti Singhania]