SUMMARY

Healthtech, Fintech And AI Are Some Of The Promising Sectors In The Indian Startup Ecosystem

This article is part of Inc42’s Year-End Stories for 2017 where we’ll highlight the major developments, issues, controversies of 2017 and their impact on the Indian startup ecosystem. Find all the stories of this series here.

“Innovation distinguishes between a leader and a follower.”- Apple co-founder and former CEO Steve Jobs

Driving innovation in India is an army of tech-enabled startups that are working to revolutionise various sectors like healthcare, education, financial services, travel and tourism and logistics, among others. Thanks in part to the sudden burst of interest from industry giants, aspiring entrepreneurs and international investors, the country has evolved into the third largest startup ecosystem in the world, boasting around 5,000-5,200 promising tech startups.

By leveraging emerging technologies like IoT, Big Data and analytics, artificial intelligence, blockchain and machine learning, these startups are completely restructuring the way business is done in the country. Today, startups in India have become mainstream. Lofty valuations, big cash and multimillion-dollar Seed rounds have become the norm.

Taking the lead in 2017 were ecommerce and fintech. In ecommerce, for instance, homegrown unicorn Flipkart picked up a whopping $2 Bn-$2.5 Bn funding from Japanese investment giant SoftBank. Its biggest rival, Amazon, has committed a staggering $5 Bn to bolster its Indian arm. Post demonetisation and the launch of IndiaStack, the fintech sector underwent a sea change, with digital payments companies reaping huge returns.

So, before we step into another eventful year of exciting possibilities, here are top eight sectors that set the Indian startup ecosystem abuzz in 2017!

The Hot Sectors Of 2017

HealthTech

“In the next 10 years, data science and software will do more for medicine than all of the biological sciences together.” – Vinod Khosla, founder of Khosla Ventures.

Home to over 1.31 Bn individuals, India continues to be a country where quality healthcare is largely confined to tier I and tier II cities. Despite massive technological advances in recent decades, more than 75% of the country’s pharmacies, around 60% of hospitals and 80% of doctors are currently located in urban areas, as per a report by KPMG and the Organisation of Pharmaceutical Producers of India (OPPI). In the last couple of years, a growing number of healthtech startups have come up to bridge the gap the currently exists between healthcare providers and patients, across urban, semi-urban and rural areas.

Traditionally, healthtech startups have largely focussed on providing diagnostic, enterprise, medicine delivery services, etc. However, a new breed of tech startups has emerged in the Indian startup ecosystem in recent times, with the goal of solving issues on the root causes such as the consumer lifestyle, mental stress, early diagnosis of genetic disorders and even reducing the after effects of painful processes such as chemotherapy.

By leveraging digital technologies, these startups are ensuring easy access to patient medical records and family history, while also providing deep insights into the lifestyle choices of patients for increased transparency and more effective treatment.

In the Indian startup ecosystem, companies that are trying to revolutionise healthcare include Practo, Healthkart, Zoctr, Tricog, Care24, 1mg, Portea, Lybrate, JustDoc, DoctorInsta, MedGenome, Pharmeasy, Netmeds and Mera Medicare, to name a few.

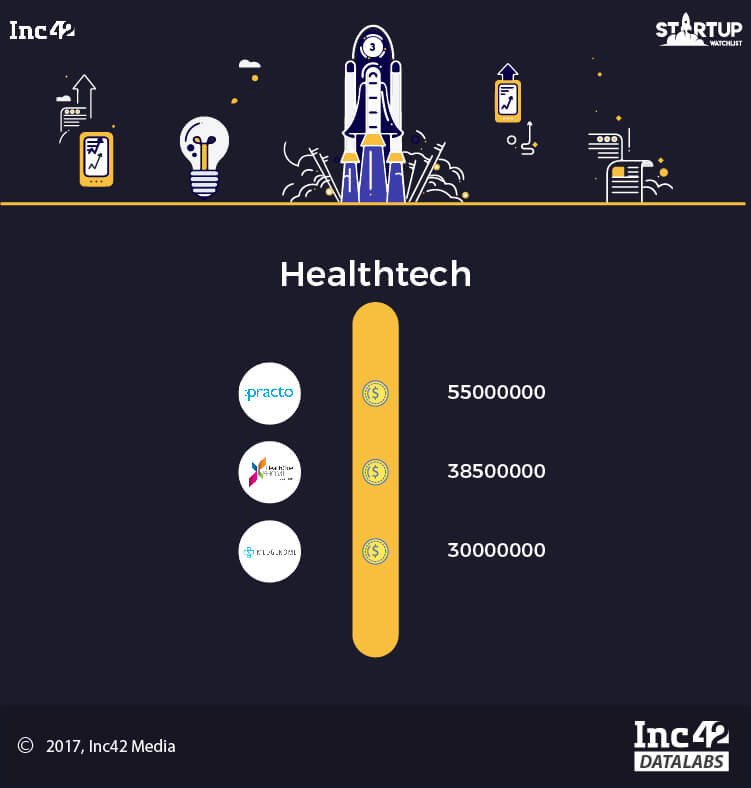

Fundings Galore In The Indian Healthtech Sector

According to an IBEF report, the overall Indian healthcare market is estimated at $100 Bn. It is expected to touch $280 Bn by 2020, growing at a CAGR of 22.9%. As per Inc42 Data Labs, healthtech startups in India cumulatively raised about $338 Mn across 107 deals till November 2017.

Some of the biggest fundings in this space were made by online pharmacy startups such as Netmeds, which secured $14 Mn funding in a round led by Cambodian investment holding company Tanncam and Sistema Asia Fund in October 2017.

According to the latest edition of the NASSCOM-Zinnov report, healthtech is currently one of the most promising sectors in the Indian startup ecosystem along with fintech and ecommerce/aggregators. Witnessing a 28% YoY growth in 2017, the number of healthtech startups grew to an estimated total base of 320 startups.

While areas like health information management, aggregator/ecommerce have continued to mature, areas like anomaly detection, disease monitoring, and telehealth/telemedicine continued to emerge. Almost 31% of healthtech funding went towards artificial intelligence, IoT, and analytics

What Will 2018 Have In Store For Healthtech Startups?

In 2016 and early 2017, a major chunk of investments in healthcare went into startups that are essentially working on telemedicine, doctor appointments and health apps, but lately, we have seen a rapid growth in wearable tech, genetic research and smart diagnostics space.

The digitisation wave has helped in increasing the pace of innovation in the healthtech space. 2017, for instance, saw an extensive use of artificial intelligence and machine learning by healthtech startups for accurate screen testing of diseases like diabetes, breast cancer, TB, etc.

2018 will likely see smart wearables being used increasingly for sleep, heart and cholesterol tracking and so on. More and more startups will likely turn to genetics and gene therapy to develop effective treatment solutions. Some of the healthtech startups to watch out for in 2018 include Consure Medical, DocTalk, CureFit, iGenetics, MedGenome and NIRAMAI, among others.

Logistics

“The line between disorder and order lies in logistics.” – Sun Tzu, author of The Art Of War.

Since the middle ages, logistics has been a determining factor in winning or losing any war. Today, efficient logistics is crucial to the success of any business. Poised to touch $307 Bn by 2020, the Indian logistics sector has always been crucial to the country’s infrastructure and economic development.

In recent years, an army of tech-enabled startups has emerged in the country, thereby bringing innovation and disruption into the mainstream. Looking back, logistics startups started gaining a foothold in India only after the onset of the ecommerce industry.

As players like Flipkart, Snapdeal, Amazon turned to establishing their in-house logistics services, a number of startups started tapping other areas to support the existing supply chain solutions or to fill the gaps in the otherwise fragmented and unorganised logistics industry.

The technological intervention introduced by these startups has, in turn, paved the way for dramatic improvements in productivity, transparency, end-to-end visibility, warehouse and yard management, fleet management, fuel cost management, customer relations and accessibility, real-time tracking and accountability.

Equipped with advanced technologies like IoT, Big Data, artificial intelligence and machine learning, the country’s logistics startups have ushered in a sea change in the last few years. No wonder then, India jumped 19 places in the Global Logistics Performance Index from 54 in 2014 to 35 in 2016, as per a June 2016 report by World Bank.

Within the logistics sector of the Indian startup ecosystem, there are big players like the online marketplace for logistics transactions Blackbuck; Grey Orange, which provides intelligent solutions for warehouse management by hi-tech robots; Delhivery and Rivigo, both of which are potential unicorns.

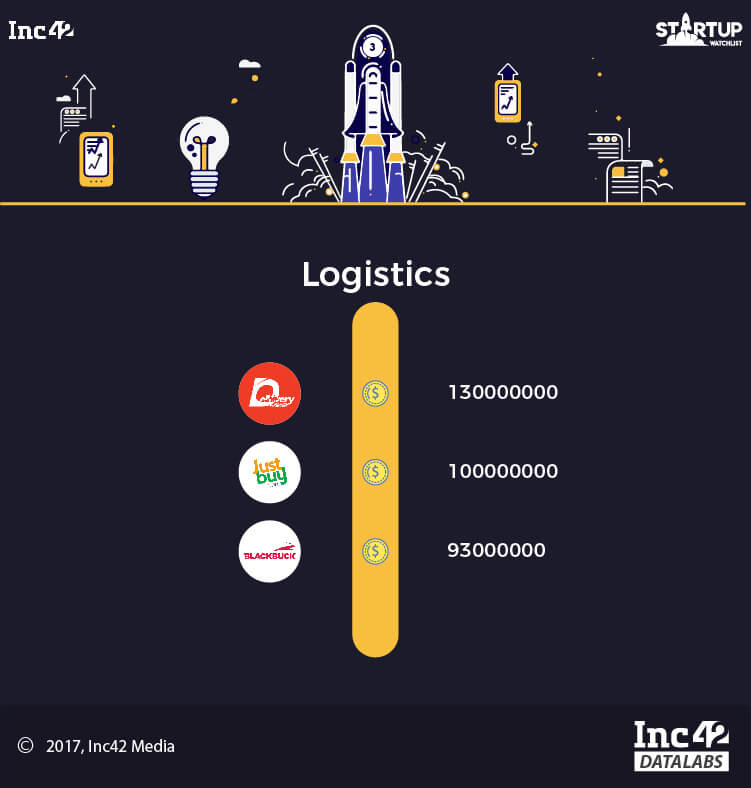

Fundings Galore In The Indian Logistics Sector

As per Inc42 Datalabs, there has been very little growth in terms of the number of deals in logistics sector as compared to 2016. While funding has increased by 205% in 2017, 22% of deals took away 85% of the total funding. As of November 2017, about $405 Mn was invested in the logistics sector in India across 25 deals.

Apart from small ticket size fundings ranging between $1 Mn -$10 Mn, there are startups like Delhivery, which raised $100 Mn from US-based investment fund Carlyle Asia Partners in March and BlackBuck, which secured over $90 Mn funding this year. Then there is Rivigo, which after raising $75 Mn in November 2016, has now become a potential contender to enter the Indian unicorn club, as SoftBank has set its eyes upon the company to invest $200 Mn-$400 Mn.

2017 also witnessed a discernible growth in funding at later stages. However, compared to last year, the sector saw a 52% drop in deals and funding at Seed and early stages, which could mean that investors are more keen on driving the Indian logistics sector to a stage of maturity.

Interestingly, one of the biggest acquisitions in the logistics space this year was made by foodtech unicorn Zomato when it took over Bengaluru-based hyperlocal delivery startup Runnr. The move was aimed at strengthening Zomato’s food delivery capacity.

What Will 2018 Have In Store For Logistics Startups?

Driving growth in this sector in 2018 and beyond will be a multitude of foreign investors and funds that have been launched with a special focus on logistics startups. For logistics startups operating in the country, the focus will likely be on integrating new and advanced technologies to develop more pervasive solutions that are can fill the existing gaps in the supply chain, especially in tier II and tier III regions of the country.

Internet of Things (IoT), for instance, will make real-time tracking and data collection more efficient for route optimisation. On the other hand, technologies like artificial intelligence and machine learning could help implement intelligent route optimisation and develop cloud-based logistics management solutions.

Fintech

“Digital technology provides a low-cost way for people in developing countries to send money to each other, buy and sell goods, borrow and save as long as the financial-regulation environment is supportive.” – Bill Gates, co-founder and former CEO of Microsoft.

In India, the need for technological disruption in the banking sector is all the more acute, given that over 19% of the country’s population still remains unbanked. This is where fintech startups come in. Touted as the year of financial services, 2017 saw the emergence of a legion of promising fintech startups that are working to bring innovation and disruption to the otherwise conservative Indian banking sector.

Since early 2015, the fintech sector has undergone massive changes, chief among them being the move towards a cashless economy. The government’s enthusiastic promotion of cashless technologies – digital wallets, Internet banking, the mobile-driven point of sale (POS) and others – as well as the launch of IndiaStack including Aadhaar, eKYC, UPI and BHIM have also managed to restructure the financial sector, disrupting the long-held monopoly of traditional institutions like banks.

Another factor that has played an integral part in the rise of the fintech industry was demonetisation. Forecasted to cross $2.4 Bn by 2020, as per a report by KPMG India and NASSCOM, India is currently home to more than 500 fintech startups, whose collective aim is to attain financial inclusion. At one end of the digital payments spectrum of the Indian startup ecosystem, there are wallets like Paytm, FreeCharge, and MobiKwik.

Simultaneously, a brigade of related startups has also emerged in different sub-sectors of fintech, such as in loan and insurance, mobile-based Point of Sale (POS) providers, alternative lending, among others.

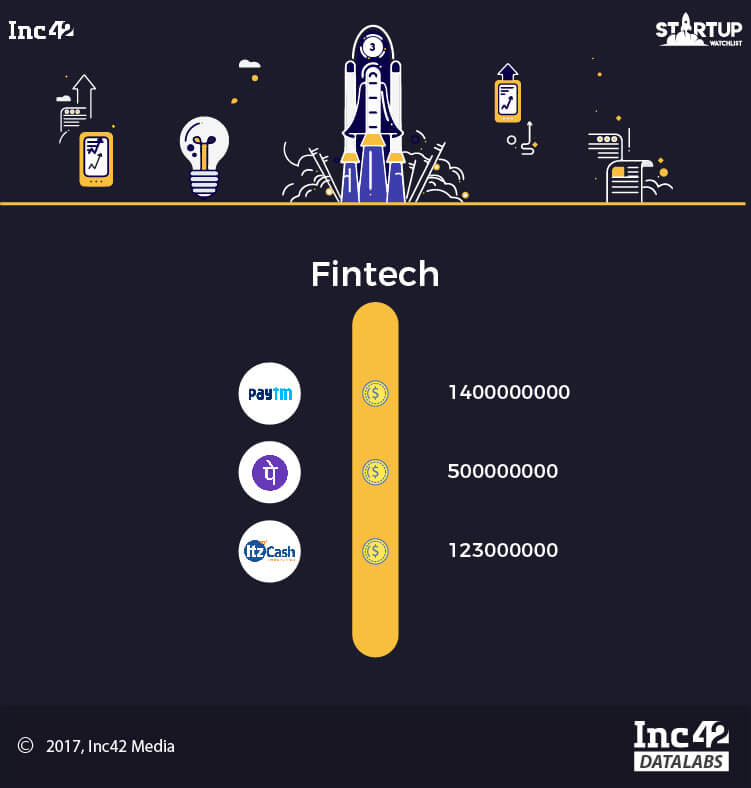

Fundings Galore In The Indian Fintech Sector

According to Inc42 DataLabs, the Indian fintech sector reported 102 funding deals this year till November, worth $2.59 Bn. As per data available, fintech startups grew by 31% Year-on-Year (YoY) to almost to 360 in 2017, with almost $200 Mn funding received in H1 of this year, recording a growth of 135% since H1-2016.

As far as Seed funding is concerned, $42 Mn was infused into early-stage startups in 2017 as compared to the $67 Mn in 2016. Almost 33% of funding raised by fintech startups was in the areas of artificial intelligence and analytics.

This year, maximum investments took place in this segment at the late stage, with Paytm topping the charts with a staggering $1.4 Bn funding, followed by Flipkart-owned PhonePe, which reportedly secured $500 Mn from its parent entity.

Then there was US-headquartered Ebix Inc that made headlines when it poured $123 Mn (INR 800 Cr) in Mumbai-based payments solution firm ItzCash, making it the biggest acquisition in the Indian fintech sector this year. Another high-profile acquisition came in July 2017 when Snapdeal sold FreeCharge to Axis Bank for $60 Mn. The acquisition was made around the time merger talks between Flipkart and Snapdeal fell through.

Later in October, Hyderabad-based payment and customer retention solution provider Payswiff, earlier known as Paynear, announced the acquisition of Singapore-based GoSwiff, as part of a deal estimated at $100 Mn.

What Will 2018 Have In Store For Fintech Startups?

A lot has been happening in the Indian fintech sector. At present, sub-segments like digital payments and lending are currently maturing, while wealth management and insur-tech emerging as growth areas.

With the entry of big players like Amazon, Google, PayPal and Uber, India’s digital payments space has morphed into a $500 Bn behemoth in the making, according to a report by Google and Boston Consulting Group.

Post the demonetisation drive, giants like Paytm, Airtel and India Post came up with their respective payment banks. With the aim of reaching 500 Mn customers by 2020, Paytm Payments Bank recently committed an investment of over $500 Mn in KYC.

Since the launch of UPI, over 61 banks and several private fintech companies have integrated the interface into their platforms. Last month, the UPI platform hit a record high of 105 Mn transactions last month, a nearly 38% jump from the 76.8 Mn transactions clocked in October.

Within fintech, blockchain, the underlying technology/platform of Bitcoin, is all set to disrupt the way we keep records, data and share the same. The distributed ledger technology/platform (DLT) has found huge applications in banking, Insurance, government services, digital payments, logistics, etc.

In India, corporates and startups have come together to integrate the platform at a greater pace such Banckchain, where 27 banks have collaborated with blockchain startup Primechain Technologies. ICICI bank and Mahindra have extended their incubation services to accelerate blockchain startups at Fintech Valley Vizag

2017 also saw an India-based startup Indicoin, going for an Initial Coin Offering (ICO). However, it should be noted that, in India, there isn’t much clarity on this, since the government doesn’t seem to be in favour virtual currency.

TravelTech

“To travel is to take a journey into yourself.” – Danny Kaye, American musician and comedian.

Currently ranking 7th globally in terms of its contribution to the country’s GDP, the Indian tourism and travel sector underwent an impressive 8.5% jump last year, with 2017 witnessing an additional 6.7% leap. Interestingly, domestic travel is what currently leads the charge, accounting for a staggering 88% of the total revenue generated by the tourism sector in 2016.

According to a Google India-BCG report, the country’s travel market (both offline and online) is expected to become a $48 Bn industry within the next three years. Riding on India’s growing tourism wave is a legion of startups that are embracing emerging technologies to develop innovative solutions in the market. As per an IBEF report, the online travel space will likely account for 40% to 50% of total transactions by 2020.

Despite this enormous potential, the Indian online hotel booking sector has a penetration of only around 19%, according to a report by Deutsche Bank AG. Most customers in Tier II and Tier III cities around the country still prefer to book hotels and accommodations through offline means in the travel space.

To counter this problem, a number of startups based on the online travel aggregator (OTA) model have surfaced in the Indian startup ecosystem. Among these are online search engines and travel booking platforms such as Naspers and Tencent-backed MakeMyTrip, Cleartrip, Ibibo Group, Goomo, Expedia, Yatra, ixigo, and others.

Then, there are hospitality companies and budget hotel chains like SoftBank-backed OYO, Treebo, FabHotels, Wudstay Hotels, GoStays and NightStay, among others. In recent years, majors like Taj and Hyatt are also competing against traveltech startups by offering cheaper rates, complementary services and loyalty points on direct booking through their website.

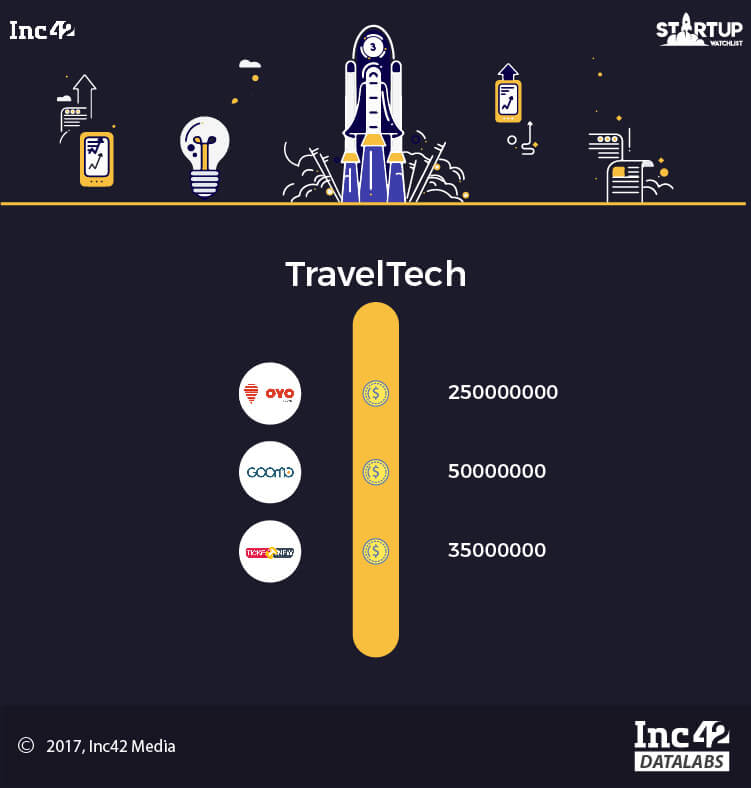

Fundings Galore In The Indian Traveltech Sector

According to Inc42 DataLabs, the online travel sector saw a total funding of $790 Mn through 30 deals up to November 2017. Out of this, a total of $43 Mn was infused in early-stage startups across 13 deals till November 2017. This is a massive increase compared to last year when around $13.5 Mn was pumped into Seed and early-stage traveltech startups.

The biggest round of funding in the traveltech space this year was raked up by Ritesh Agarwal-founded OYO. This happened in September when the startup raised $250 Mn in a Series D funding round led by SoftBank Vision Fund with participation from existing investors Sequoia India, Lightspeed Venture Partners and Greenoaks Capital.

This was followed by Goomo, which secured $50 Mn in June from PE firm from PE firm Emerging India. Other big-ticket investments include Yatra’s $15.4 Mn fundraise. Last, there was Ebix taking over Bengaluru based omnichannel online travel and assisted ecommerce exchange, Via.com.

What Will 2018 Have In Store For Traveltech Startups?

Over the past one year, there has been major growth in the budget accommodation space. With $541.6 Mn-funded OYO leading the race, rivals such as FabHotels, Treebo have also witnessed a discernible increase in funding activities.

One of the biggest consolidations in the Indian online travel industry took place in October 2016, when MakeMyTrip merged with Ibibo. The deal has since been estimated to be worth over $720 Mn. According to a report by Morgan Stanley, the valuation of the combined entity stands at $1.8 Bn. With large ticket fundings from Naspers, Tencent and others, how the combined entity performs in 2018 will be interesting to watch.

Edtech

“Technology can become the ‘wings’ that will allow the educational world to fly farther and faster than ever before—if we will allow it.” – Jenny Arledge of Sulphur Springs ISD.

Being the second most populous country in the world, India comes with a lot of baggage that other nations are not subjected to. Lack of quality education is one of the biggest shortcomings that the Indian government is still struggling to overcome.

This is where edtech startups come up. By wielding up-and-coming technologies, Indian edtech startups are working to enhance access to affordable quality education across primary, secondary and higher levels.

However, the dynamics of the edtech sector are very different as compared to other sectors like ecommerce. Although there is an enormous market to cater, edtech startups in India are currently held back due to inadequacies in infrastructure and awareness.

But in 2017, the country’s education market underwent substantial growth, with a lot of startups expanding into tier II and tier III cities in order to create a social impact. Instead of focussing on the academic curriculum, a number of startups are now working to provide personality development and career counselling services.

Players in the edtech space of the Indian startup ecosystem include BYJU’S, Unacademy, UCLID, Avagmah, Embibe, iProf, Simplilearn, Meritnation, Toppr, NeoStencil and Englishleap, among others.

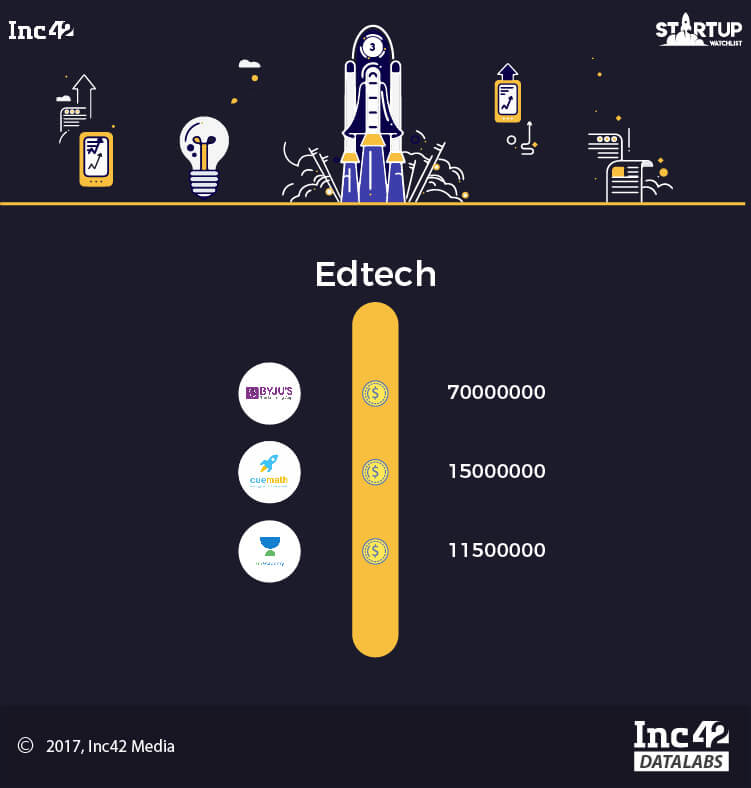

Fundings Galore In The Indian Edtech Sector

Online education in India will see approximately 8x growth in the next five years, says a recent report by Google, KPMG. This will have a significant impact on the edtech market that has a potential to touch $1.96 Bn by 2021 from where it stands now i.e. $247 Mn.

As per Inc42 Datalabs, the sector this year saw a total infusion of $165.5 Mn through 48 deals till November 2017 and the funding amount was almost similar in 2016. When it comes to Seed funding, 2017 saw a total infusion of $6 Mn as growth capital for early-stage startups while the number of around $13 Mn in 2016. This suggests that investors are looking to bet on well-established startups rather than investing in new ideas that do not have a considerable market share.

Among the startups that raised fundings recently are Univariety ($1.9 Mn from Info Edge), Bengaluru-based online edtech platform Springboard ($9.5 Mn), elearning firm Meritnation ($5.8 Mn from Infoedge), Toppr ($6.92 Mn from SAIF Partners and others) and many others. As part of one of the biggest edtech acquisitions in November, Bengaluru-based edtech firm AEON Learning took over Acadgild in an all-stock deal worth $10 Mn.

What Will 2018 Have In Store For Edtech Startups?

As per a report by Google and KPMG, India currently has 234 Mn Indian language users online, compared to 175 Mn English users. The user base of local languages will continue to grow at 18% annually to reach 536 Mn in the next four years, compared to the English Internet user base growing at 3% to reach 199 Mn.

In 2018, edtech startups will likely try to push the reach of elearning to semi-urban and rural areas across the country. By leveraging vernacular languages, these startups are looking to make education more accessible to the masses.

There will also be increased adoption of artificial intelligence by edtech startups in the country. Geared towards making the learning process more efficient and streamlined, AI also helps in enhancing student engagement in classrooms. Currently, edtech startups that are utilising AI to impart education include Embibe, Tiger Global-backed Vedantu and OpenEd.ai, among others.

Education is of paramount importance in a developing nation like India. While the government’s slogan of Digital India is slowly taking shape, with fintech and big data segment (among others) benefiting from the move and investors’ sentiments going in the positive direction for edtech, the future looks bright for the sector.

EnterpriseTech

“If there could’ve ever been a magical time to build an enterprise software company, now is absolutely that time.” – Aaron Levie, co-founder and CEO of Box.

Enterprise tech, as a sector, is moving forward in India with businesses getting more specialised help from SaaS and ERP management startups. With technological advancements in India, numerous SMEs are now leveraging SaaS and related technologies to optimise their overall performance. In 2017, the major contribution in the enterprise software sector was made by SaaS (software-as-a-service) startups. At the top of the SaaS game are two giants, Zoho and Freshworks, with over 4,000 total employees and a combined revenue of over $350 Mn.

Startups like Deskera, which develop cloud-based ERP software for accounting and inventory have also taken a giant leap in 2017 and are effectively catering to ecommerce sellers with warehousing facilities.

Other players in the Indian startup ecosystem like Happay are helping employers to manage the expenses of their employees by using an expense management software. Then there are companies like Peel-Works that are working to connect local grocery stores with brands via technology that can manage sales force beyond distributors through SaaS and big data analytics. Pune and Bengaluru-based MindTickle, on the other hand, offer sales enablement services aimed at improving sales of clients.

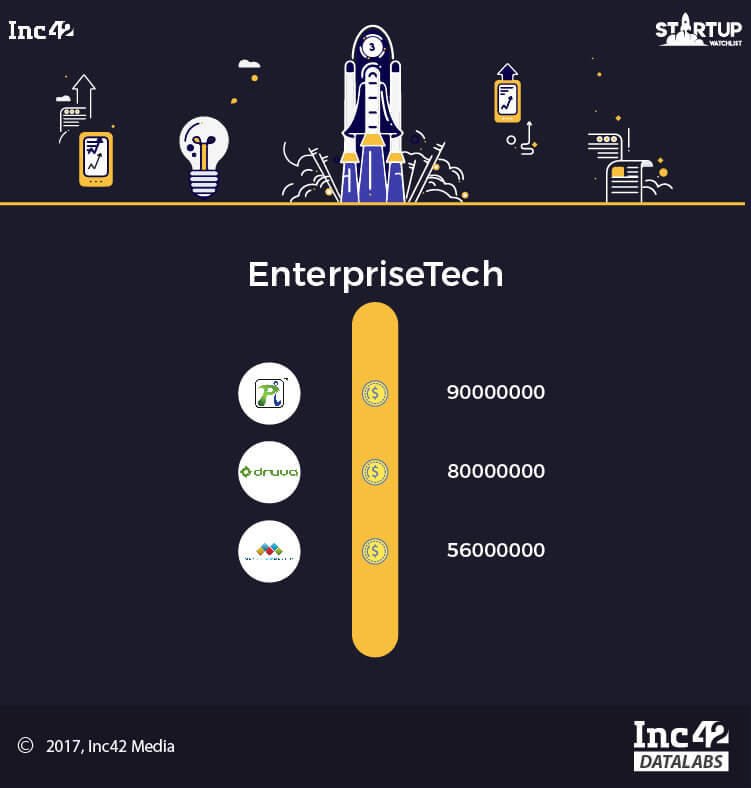

Fundings Galore In The Indian EnterpriseTech Sector

As per Inc42 Datalabs, Indian enterprise sector received a cumulative funding of $525 Mn in 129 deals till November 2017. Out of this, $35 Mn was infused in Seed and early-stage startups, a massive rise of 140% as compared to the seed funding figures in 2016.

In August this year, Andhra Pradesh-based enterprise class data centre and cloud service provider Pi Datacenters raised $90 Mn in a Series B round, marking the biggest funding raised by an enterprise startup in 2017. In the second place Druva, which secured $80 Mn led by Riverwood Capital.

In one of the biggest acquisitions in the enterprise sector, SaaS-based business software provider Freshworks announced its ninth acquisition in two years in August this year, with marketing software startup, Zarget.

What Will 2018 Have In Store For EnterpriseTech Startups?

Expected to reach $1 Bn by 2020, the Indian SaaS/enterprise software market currently accounts for 9% of all software sales. Among the sub-sectors that are likely to gain traction over the next few years are BI/analytics, CRM and CCC.

According to our predictions, enterprise solutions for smarter supply chain management and SaaS-based ERP and cloud solutions will see substantial growth in 2018.

However, most SaaS founders believe that India is the best place to build SaaS products but not an ideal market to sell. Zoho, one of the giants in the SaaS sector, has over 12 Mn users, most of whom are based in the US and Europe. How the Indian enterprise sector matures in the coming years will be interesting to watch.

Consumer Services

“E-commerce companies won’t be able to compete with the cost structure of hyperlocal.” – Neeraj Jain, Zopper co-founder.

Consumer services, as in hyperlocal food and grocery delivery, has been the hottest ticket in the Indian startup ecosystem since 2015. However, it saw a dramatic fall in 2016, as funding dropped almost overnight and more than 100 startups shut their shops.

However, 2017 was more generous to consumer services startups in the country. Two of the most promising sub-sectors this year were food delivery and only grocery. On the one hand, foodtech unicorn Zomato became profitable throughout the 24 countries where it operates, and across all its businesses in September.

On the other, big players like Amazon, Flipkart and Paytm are now taking their first steps into the country’s online grocery delivery and food retail market.

As per a Goldman Sachs report, the Indian online grocery market is estimated to reach $40 Mn (INR 270 Cr) by FY19 growing at a CAGR of 62% from 2016 to 2022. Morgan Stanley expects the online food and grocery segment to become the fastest-growing segment, expanding at a compounded annual growth rate of 141% by 2020 and contributing $15 Bn, or 12.5%, of overall online retail sales.

The food delivery space of the Indian startup ecosystem is populated by big names like Zomato, Swiggy, foodpanda, and others, while players in the online grocery sector include ZopNow, Satvacart, Godrej Nature’s Basket, Grofers and DailyNinja, among others. The newest entrant in the online grocery segment is Quikr, the classifieds platform founded by Pranay Chulet in 2008.

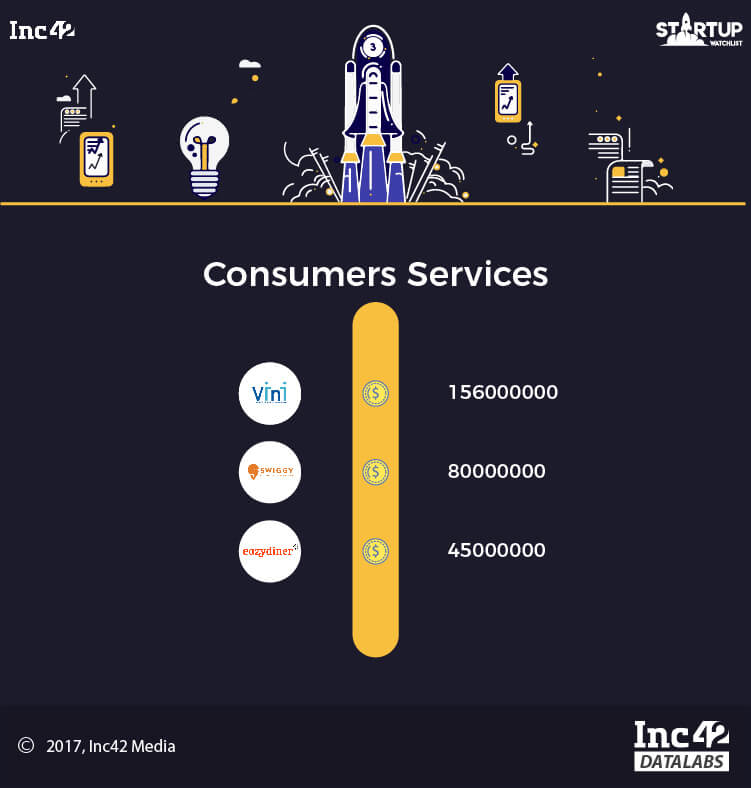

Fundings Galore In The Indian Consumer Services Sector

Over $300 Mn was raised across 83 deals as of November 2017. It should be noted that, though there has been a considerable rise in funding in the sector this year as compared to 2016, it is still less than half of what it secured in 2015 i.e. $656 Mn.

The biggest fundraise in the consumer services sector was made by Swiggy, when it secured $80 Mn from Naspers, SAIF Partners and others. As far as M&As are concerned, the consumer services sector took the top slot with 17% M&As falling under it.

What Will 2018 Have In Store For Consumer Services Startups?

A lot has been happening in the Indian consumer services sector. While investment giants like SoftBank and Tencent are gearing up to pump a massive investment of $250 Mn in foodtech startup Swiggy, Alibaba recently received CCI’s approval to pour $300 Mn in Bengaluru-based hyperlocal grocery delivery startup Bigbasket.

In the grocery segment, ecommerce unicorn Flipkart made a soft launch of its online groceries category in Bengaluru’s Supermart last month. On the other hand, its biggest rival Amazon is gearing up to enter food retail soon.

Due to market saturation, something similar to corporate consolidation will likely be observed in this sector this coming year. Are Swiggy and Zomato heading for a merger like it was speculated last month? Let’s wait and watch!

DeepTech

“AI will be the best or worst thing ever for humanity.” – Elon Musk, Tesla Inc CEO.

Artificial intelligence and Big Data were quite possibly the most talked about sectors in the Indian startup ecosystem this year. Be it in ecommerce, fintech, banking, surveillance, customer service and support or analytics, or from intelligent shopping assistants to helpful conversational bots, deeptech is finding wider usage in our daily lives and will continue to do so.

AI is has emerged as a promising technology that can help to deliver services across different segments efficiently and effectively, to a higher number of consumers at a very low cost. Big Data is the foundation of AI, since it enables AI to come up with predictive and prescriptive analysis.

Globally, revenues from the big data and analytics industry are expected to soar from $130.1 Bn in 2016 to $203 Bn by 2020 growing at a CAGR of 11.7%, as per a report by International Data Corporation (IDC).

According to a study carried out by Analytics India Magazine and AnalytixLabs titled ‘Analytics India Industry Study 2017’, the sector is currently generating $2.03 Bn in yearly revenues in India alone. Growing at a compound annual growth rate of 23.8%, the market for big data and analytics is slated to almost double by 2020. On the other hand, globally, the AI sector is poised to grow to $16.06 Bn by 2022.

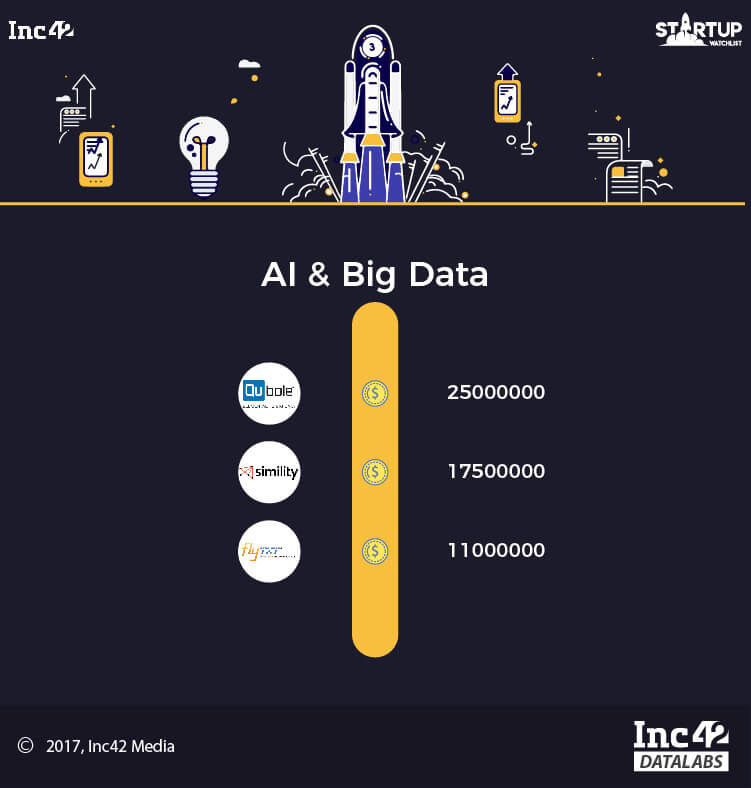

Fundings Galore In The Deeptech Sector

As per Inc42 DataLabs H1 2017 report, the sector picked up by 100% in H1 2017 in comparison to H2 2016, in terms of deals. With Bengaluru being the major breeding ground for AI startups in India, about $87.85 Mn was raised across 58 deals in the AI space.

In 2017, the biggest amount of funding raised by an Indian AI startup was bagged by Big Data startup Qubole that raised $25 Mn in a round led by Singtel Innov8, Harmony Partners among others. Next came customer data analytics software company Flytxt that raised about $11 Mn funding from DAH Beteiligungs GmbH.

The AI sector also saw quite a few acquisitions this year as well because of rising interest in the space both from homegrown and foreign companies alike. In the month of March, e-Zest Solutions, a digital transformation solutions provider acquired SmarterMe, a personal assistant for sales. Similarly, Chinese mobile Internet company APUS Group acquired AI-driven photography curation platform SIFTR Labs for an undisclosed amount.

July saw global tech giant Google dialling in the Indian startup ecosystem, snapping up merely four months old Bengaluru-based AI (Artificial Intelligence) startup Halli Labs for an undisclosed amount. The acquisition will allow Google to utilise Halli Labs’ advanced AI and ML (Machine Learning) technologies to upgrade older domains and platforms for better performance.

What’s Will 2018 Have In Store For Deeptech Startups?

In 2018, we will likely see more startups leveraging AI and Big Data to develop 3D modelling solutions for better monitoring of warehouses and retail floors. There will also be the increased cross-sector application of AI in healthtech and fintech. Furthermore, deeptech will find use in defence and agritech for building efficient computer vision and mapping solutions.

Some of the startups from this sector to watch out for in 2018 include AR/VR platform Absent VR, Bengaluru-based Niki.ai, IoT startup Flutura and AI-enabled surveillance startup Uncanny Vision, among others. If tech giants are biting into the Indian AI startups, it definitely means that Indian startups are beginning to create noteworthy products in deeptech. 2018 will also see launch and greater adoption of blockchain technology in variety of sectors.

This article was written with assistance from Shail Daswani and Suprita Anupam.

While these were the hot sectors in the Indian startup ecosystem this year, we have a few more interesting stories in store for our 2017 In Review Series. So, stay tuned for the next story – A Overview of 2017.