In 2023, Indian social media apps such as Trell, ShareChat, Josh, Roposo and others are sliding in terms of downloads and engagement as compared to their boom months after the TikTok ban

The troubles for social media apps range from a loss of core business propositions to exits and cost-cutting, which has made the acquisition and retention of users an uphill battle

More than two years after the post-TikTok hype, the social commerce and live commerce plans by short video apps are in disarray and most of them are bleeding users

Amid escalating border tensions with China, the Indian government on June 29, 2020, banned a slew of Chinese-origin apps, including TikTok. The ban on one of the most popular short video apps in India fuelled the entry of dozens of Indian social media and short video alternatives.

Now, nearly two and a half years later, many of these apps have not only failed to match up to the TikTok mania but also are in danger of fading away. Inc42 delved into the app usage and downloads data of players such as MX Takatak, Trell, Roposo, ShareChat’s Moj, DailyHunt’s Josh, Chingari and others to see how far they have come ever since TikTok has been banned.

The short answer is that in 2023, these apps are in a worse place than they were in January 2021, months after the TikTok ban.

Amid the hype and enthusiasm about the potential of Indian short video apps filling the TikTok vacuum, a slew of startups pivoted to the short video model from their original avatars. But these pivots were clearly born out of a fear of missing out on what TikTok had already created.

The troubles for social media and short video apps in India range from a loss of core business propositions to exits and cost-cutting, which has made the acquisition and retention of users an uphill battle.

ShareChat has seen two founders exit, while Trell has seen one of its key backers Sequoia walk away with a huge loss. After rising to popularity in 2020, Mitron is now on the verge of getting acquired by Koo.

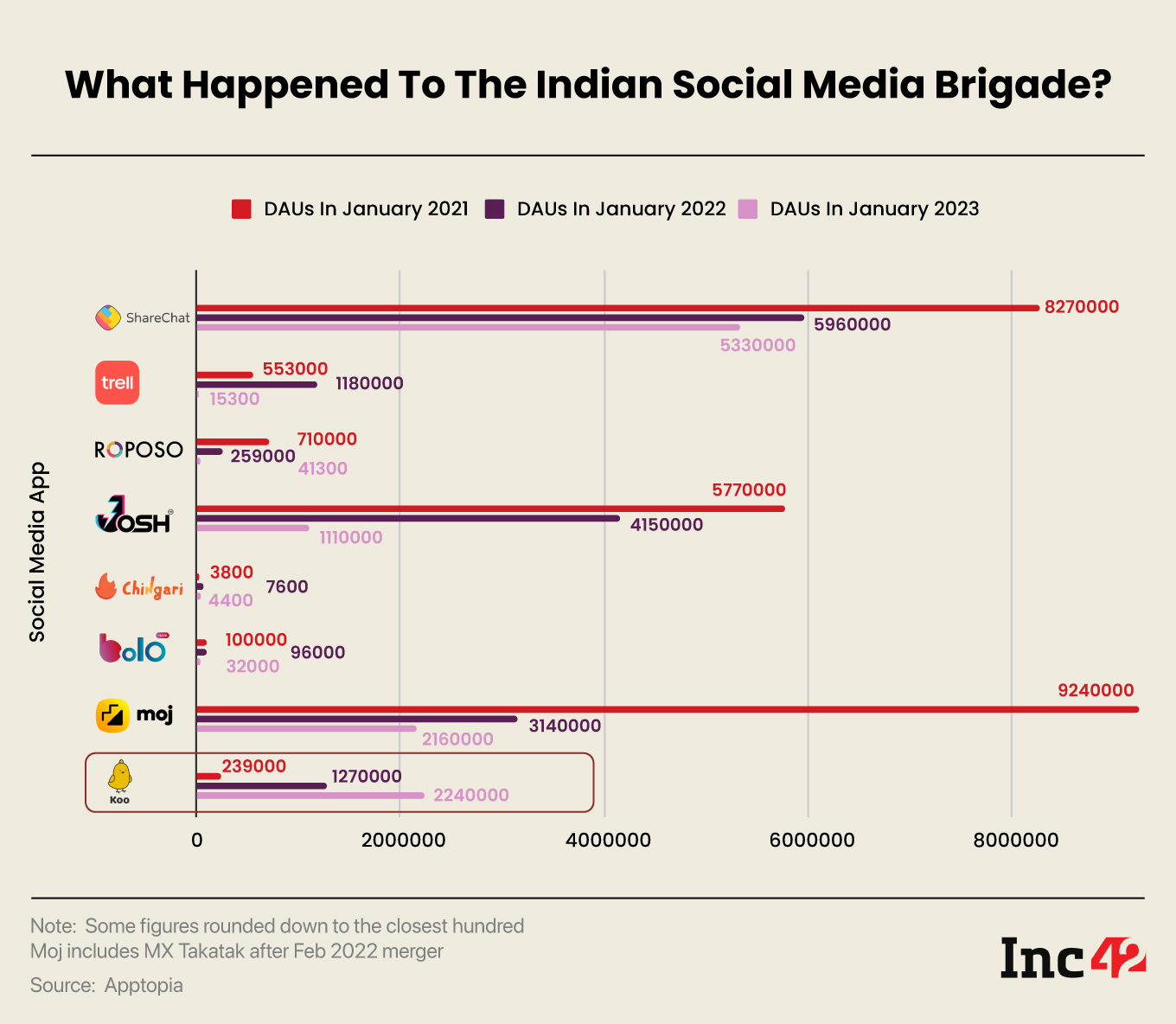

MX Takatak merged with Moj, but this did not compound their combined scale, but as we will see the ShareChat-run short video app has seen a more than 4X fall in the daily active users, as per data sourced from app analytics platform Apptopia.

So, what exactly happened that Indian social media and short video apps have started to fade away? It’s a combination of the Indian internet consumer as well as the lack of monetisation on the part of these apps.

The Post-TikTok Indian Short Video Frenzy

Indian social media apps had been around even before TikTok mania hit its peak in India around 2019.

Sharechat, which was founded in October 2015, started as a vernacular content-sharing platform but later moved to user-generated content with a big focus on videos in April 2016. This was just around the time that ByteDance-owned TikTok was entering the Indian market.

As soon as it launched, TikTok spread like a wildfire in India and the app got 277.6 Mn downloads from India out of 614 Mn total downloads worldwide in 2019, according to Sensor Tower. Users in India spent a staggering 5.5 Bn-plus hours on Tiktok in 2019, a startling 6x increase from 900 Mn hours in 2018.

Riding on this massive surge in popularity and usage, TikTok also became a brand favourite with massive amounts of money being spent on the app. It created a new wave of influencers in India, which brands looked to leverage for ecommerce sales.

The TikTok mania inspired a host of me-too short video apps in India, including Trell and Bolo Indya, which pivoted from their original propositions such as hyperlocal discovery and Q&A to make short video the core focus.

Roposo, MX Takatak, Gaana Shots, Zee HiPi, Chingari, Mitron and others joined the fray at the same time. They also tried to rope in the influencers that had already shot to fame with TikTok.

But TikTok’s huge presence meant these apps barely got any traction in the initial months. That’s until the ban on the ByteDance app in June 2020.

In the days after, Indian social media apps reported a steep rise in users and engagement. Other apps such as Vee Tok, Veer, TipTop and Punch formed the longtail of this market, with each app eyeing a share of the over 200 Mn Indians that were forced to migrate from TikTok.

Trell, for instance, claimed to have witnessed more than 12 Mn downloads in the five days after the ban. Similarly, Mitron reported that its daily traffic had jumped 11-fold after the ban on TikTok.

Roposo, which stood on the sidelines when TikTok was ruling the market, came to the fore, and was among the biggest gainers in India in July 2020, after the ban on TikTok.

Sharechat launched a dedicated short video app in the form of Moj, followed by Dailyhunt launching Josh. Meta’s Instagram, which had introduced Reels to counter TikTok’s growth, also saw a big spurt, while YouTube launched Shorts to take on the short video brigade.

Short Video Apps Court VCs

The short video app boom in India attracted investors too.

Mitron, which was launched in April 2020, months before TikTok’s exit, claimed 17 Mn downloads and also raised seed funding from Bengaluru-based 3one4 Capital and others.

Chingari, which claimed to have recorded more than 23 Mn downloads after June 2020, raised $1 Mn in seed funding from LogX Ventures, Village Global and other angel investors a month after the ban.

Similarly, for Trell, which was betting on social commerce and the marketplace model, the move to short videos is what brought in those big VC dollars. In July 2021, the startup raised $45 Mn in its biggest round from the likes of fashion retail giant H&M and electronics major Samsung’s VC arm.

Bolo Indya (now called Bolo Live) wanted its short video platform to become a marketplace for experts whom users would pay for courses and insights. Among the frenzy of short video apps in India, Meesho, Flipkart, Amazon and others joined the live commerce bandwagon with their own takes on short videos or social commerce.

But the primary contention among investors was that the overlap in feature set and UX of most of these apps would make it difficult for them to sustain and scale up without huge cash burnout in the initial stages.

Aggressive marketing strategies and cash burn for user acquisition fuelled the initial growth, but beyond this, there were plenty of questions about the monetisation models.

Even as they backed these short video apps, Indian VCs cautioned against undue optimism. Amit Kumar, partner at Ah! Ventures and an investor in Bolo Indya, told Inc42 in August 2020, “For anyone who is trying to replace TikTok, technology is not very important, you can put in some money and make the platform. But the kind of money required to market such products is where the game is going to be.”

In a similar vein, Siddarth Pai, founding partner of Mitron investor 3one4 Capital, had then said that attempting to become a general platform with no differentiation requires large amounts of capital and unsustainable business practices like buying users or acquiring them at a high cost.

VCs that backed short video apps had conservative estimates about the future of the short video and social media segments, given that it entails high cashburn and monetisation of users is a problem when ad revenue is taken out of the picture.

Failed Ecommerce Experiments Hurt Short Video Apps

The question of monetisation is what prompted many of these apps to venture into ecommerce through social commerce and live commerce models. This was the most logical evolution of these models, given the rise of Pinduoduo, Wechat, JD, and TaoBao in China.

The success of these Chinese social and live commerce apps had driven the thesis around social and live commerce in India too. This only spurred investors to back these apps in a bigger way, as we saw above.

But now more than two years after the hype, most of these ecommerce offshoots by marketplaces and startups are dead in the water. Social commerce is a wasteland of also-rans, while live commerce never even took off.

The rise of short video apps in India also gave prominence to the creator economy. But as the market at large has swung from bullish to bearish, so have the fortunes of these short video and social media apps. And with this, the creator economy has also slowed down, in what many are calling the ‘marketing winter’.

With the exception of microblogging app Koo, all Indian social media apps have seen a massive decline in daily active users (DAU) in the past two years, as highlighted below. The decline is particularly bad in the case of the Indian short video apps.

Even before the decline in user numbers, apps such as Chingari had come under the spotlight for using dark patterns and inflated view counts to attract users. This tactic worked for a while before a major attrition of users.

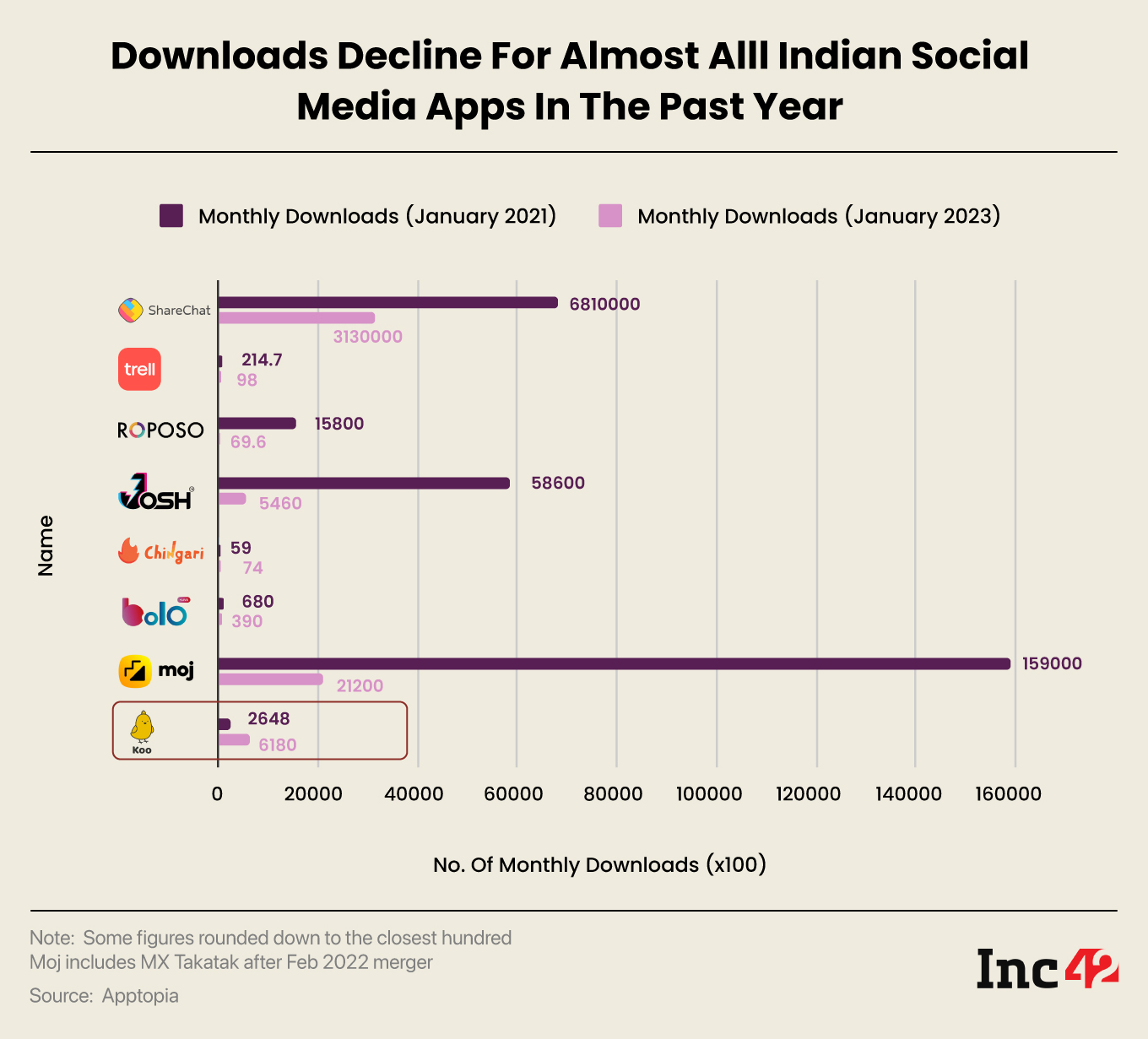

When one looks at the number of monthly downloads, there is a similar downturn when compared to January 2021, the heyday of many of these apps, when they had raised funding to acquire new users.

The situation is pretty grim for Trell, Roposo, ShareChat, Josh and other apps in the space, once considered to be the pacesetters. The fact that three of these are operated by unicorns once again underlines the fickle nature of paper valuations that cannot be matched by revenue growth.

As we had written earlier this week, in the absence of profitability, startups tend to highlight vanity metrics such as GMV, subscriber base, engagement and more. But in the case of the Indian short video apps, even these crutches may not be enough to convince anyone.

Where Will Social Media Apps Go In 2023?

When things went sour in early 2022 for Bengaluru-based Trell, with allegations of irregularities and heavy cash burn, the startup was forced to make another pivot to an ad-first revenue model.

After seeing two cofounders exit and hundreds of layoffs, ShareChat shed its live commerce ambitions as Inc42 reported exclusively earlier this month.

This after claiming last October that the virtual gifting feature launched for its creators had reaped in $50 Mn in annual recurring revenue or ARR. The revenue was said to be earned by the company as commissions from users sending virtual gifts in digital tokens to creators.

But ARR is a factor of a monthly revenue at any given point in a year, so while the revenue from one month could indeed show a potential yearly revenue of $50 Mn, it is not necessarily a guarantee. It’s also pertinent to note that ShareChat’s ARR claims were made in October, during the festive season which always sees an uptick in gifting.

Given the decline in usage across all Indian short video apps, it’s not clear how much of this ARR was actually realised. The current engagement for ShareChat and Trell tells a totally different story about the potential of these companies.

One wonders whether there are any more pivots left for these short video apps in India. The introduction of paid verified user badges for Twitter, Meta platforms linked to richer features could be a way out.

But then again, the question is why would someone pay to use ShareChat, Moj, Josh or other short video apps that hardly bring anything new to the table? These apps also do not have the critical mass of high-profile users or the halo effect that is necessary to drive monetisation through paid features.

Where apps such as Trell, Moj, Josh, Roposo and others have failed, the likes of Meta’s Instagram and YouTube have capitalised on their short video plays. The success of Instagram Reels and YouTube Shorts highlight the need for scale to drive short videos as a potential monetisation opportunity.

YouTube was bullish about live commerce in 2022 and partnered with Shopify to launch this feature for its creators. It’s not yet clear how this has lifted YouTube’s revenue, but the Alphabet-owned platform has also introduced revenue sharing for creators using Shorts.

On the other hand, Instagram, with an active user base of over 1.3 Bn, has shuttered its live commerce operations.

The fact that YouTube is the only one still pushing for live commerce on its platform in the global internet ecosystem, excluding China, is an indicator of an end of an era.

Outside these two behemoths, the Indian short video and social media apps are going through a major churn. Users have departed and monetisation is still a struggle. Will the cost-cutting of the past 12-14 months be enough to sustain these apps before the next monetisation opportunity emerges?

Ad-lite browsing experience

Ad-lite browsing experience