Despite being a publicly listed company, Zomato can’t seem to shed its startup DNA including vanity metrics such as adjusted EBITDA

It’s been 13 years since Zomato was incorporated and nearly two years since its public listing — why then do we cover the company as if it’s a startup? That’s because the company has time and again shown its startup DNA — the latest example being ’adjusted EBITDA’.

You’ve seen the memes and the funny takes on Twitter, but if there’s one thing that the ‘adjusted EBITDA’ talk has highlighted, it’s that vanity metrics are hard to shake off.

To be fair, EBITDA by itself is very much not a vanity metric and considered fundamental to arrive at the right price multiple for listed companies and is an indicator of profitability. But ‘adjusted EBITDA’ is like a Frankenstein creation brought into the world only when needed. Some might even joke that it’s a very startup thing.

And that’s what we are looking to understand this weekend. How did startups get here and what can be done to fix it? But after these three exclusive stories from our newsroom:

- ? Sequoia Exits Trell: Trell has gone from a potential unicorn to a dud investment for Sequoia which exited the company last year with a 78% loss. Here’s our story

- ? Phablecare’s Woes: Bengaluru-based healthtech startup Phablecare seems to be the latest VC funded startup to succumb to the funding winter after hundreds of layoffs and claims about delayed salaries. We look at the state of the startup

- ? ShareChat Shuts Live Commerce: After pulling the plug on Jeet 11, firing 20% of its workforce and the exit of two founders, we look at how ShareChat has ended its live commerce experiments.

Zomato’s Game Of Adjusted EBITDA

Before we dive into the wild west of startup accounting, let’s look at the Zomato problem. Essentially, the Deepinder Goyal-led company has discounted some of its costs from the standard calculation of EBITDA and presented a better figure under the adjusted heading.

In its investor presentation for Q3 FY2023, Zomato financials, the word ‘adjusted’ was mentioned 32 times with 22 mentions for ‘adjusted EBITDA’. Profit or loss, on the other hand, just appears thrice.

Metrics such as ‘adjusted EBITDA’ are not by any means conceptualised by Zomato, the fact is that such gymnastics and creative accounting start at a young age for startups. Incidents such as GoMechanic’s misreporting and fraud, fake sales and inflated GMV at Zilingo, BharatPe and other companies show that startups have something of a reputation for dressing up their financial state.

Of course, this does cast a shadow over those companies that are sticking to the traditional metrics. But this is a minority in the startup ecosystem.

Zomato is far from the only company that uses such gymnastics to arrive at metrics that create a positive narrative around the business.

For instance, earlier this year, hospitality unicorn OYO reportedly told its employees that the company is likely to be EBITDA positive for the first time in its life. But again this was based on ‘adjusted EBITDA’. The IPO-bound company said it expects this ‘mystical figure’ to grow by about 3X during the second half of FY23 to INR 185 Cr compared to the first half of the fiscal.

Of course, without a peek at the full P&L breakdown, it’s impossible to know which cost headers have been pushed below the EBITDA line. “Right now, the focus is on Zomato and rightly so, because in my decade-long experience, I have not seen such a huge reliance on adjusted metrics. It’s very creative,” added the CFO of a Bengaluru-based insurance tech startup.

Will SEBI Strike Back?

The same CFO was quick to add that creative does not mean right, and there’s some credence to the criticism of Zomato’s numbers. “To put it plainly, they have used this to disguise the degrowth in revenue,” the source added.

As a publicly-listed company, Zomato has to follow strict disclosure norms. And while ‘adjusted EBITDA’ may indeed be creative, it does not mean that SEBI and other regulators are smirking.

At the moment, SEBI has not spoken about Zomato’s numbers, but the feeling is that after the meme moment for ‘Adjusted EBITDA’, a return to traditional reporting might not be out of the question — even if Zomato may scoff at tradition with its rather unconventional investor presentation that tends to border on poetic at times.

Smoke & Mirrors

“We don’t know what will happen, but given that these are attractive new-age listings, we can expect some notifications from regulators on these disclosures. At least for investor protection. Companies make cosmetic changes to their accounts for investor presentations, while regulators are shown a different picture,” a Gurugram-based chartered accountant told Inc42.

The more experienced investors might see through the charade, but there is the fact that Zomato financials grab headlines across mainstream media and this is where some of the less experienced retail investors might fall for the adjusted EBITDA metrics, the CA quoted above added.

Plus, a day before Zomato’s results, CEO Deepinder Goyal tweeted about the company is working on its profitability. Given the silent period before the release of financials, these practices are also going to come under the radar.

While private startups might fall under the SEBI radar, listed new-age companies are likely to be pulled up for their creativity.

When Startup Vanity Metrics Go Wild

That’s just another way of saying ‘signalling’, and in the world of startups that’s hardly uncharted territory. Startups have signalled their growth through various vanity metrics that are said to be a proxy for future growth.

In fact, vanity metrics have become a marketing tool for startups looking to bring in investors. If there are no profits, startups turn to GMV, and when even GMV does not seem worthy of talking, they turn to metrics such as paying subscribers, daily active users or even number of downloads, or even adjusted EBITDA.

“The joke in the startup ecosystem is that if you can’t report profits, talk about adjusted numbers, scale and margins such that profit is an afterthought. Startup valuations have been built for years on GMV, so it’s not surprising to see such vanity metrics continue even in their life as a public company,” says a founding partner of a deeptech-focussed fund.

GMV has been called out time and again as a harmful vanity metric because the topline is hardly the problem given the large TAMs in many cases, it’s actually the unit economics puzzle that has not been solved.

The fact is that many startups have jumped on to the IPO bandwagon because of pressure from key investors despite no easy path to profitability. The Paytm-SoftBank case is a prominent example, but the rush often comes at the cost of fundamentals and core financial metrics.

The Age Of Hypervigilance

This pressure to deliver high growth and then the next large funding round (that could allow early investors to exit) has resulted in plenty of problems and debacles in the startup ecosystem in the past two years. One cannot rely on blitzscaling and juking the stats to see off this pressure.

“Expecting 4X revenue growth, aggressive customer acquisition in an impending recession environment – when some of the most profitable tech giants like Google, Microsoft and Apple have announced conservative allocations and laid off employees – is simply unachievable. This is when you resort to unethical practices,” the founder of a D2C startup told Inc42 earlier this month.

Accounting experts call for a return to basics for new-age companies. The fundamentals have been around forever for a reason.

Investors are being asked questions by limited partners about where their money is invested given frauds and irregularities. There’s a lot of pressure from government agencies as well to prevent tax evasion.

Simply put, startups cannot afford to cut corners and go creative in their accounting in this age of hypervigilance.

Sunday Roundup: Startup Funding, Tech Stocks & More

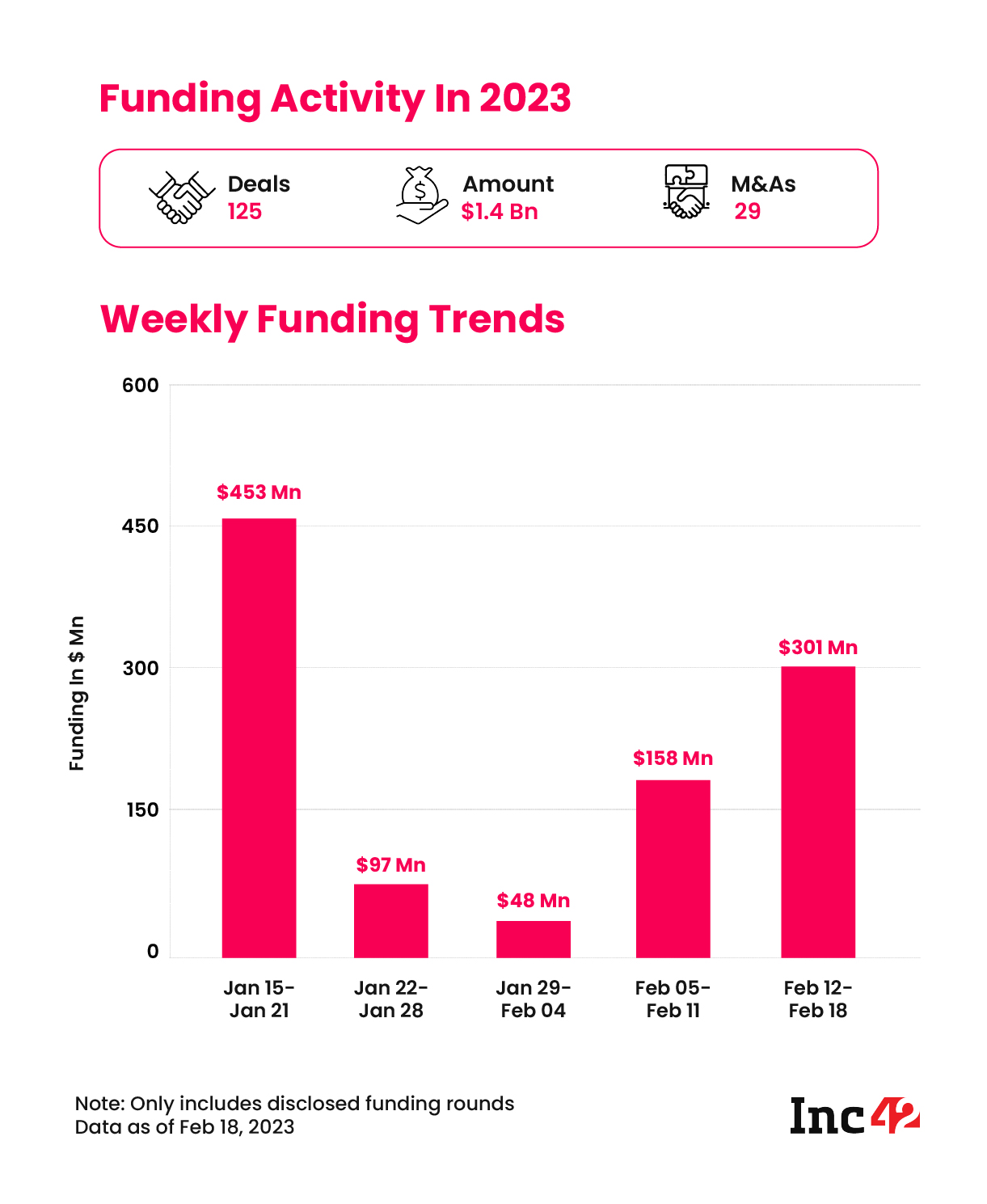

? InsuranceDekho Leads Weekly Funding: This week’s funding tally was dominated by InsuranceDekho, which raised $150 Mn even in the current slowdown. Overall, Indian startups raised $301 Mn across 19 deals, largely thanks to the aforementioned round

? Twitter Disrupts TFA: Twitter has asked free or non-Twitter Blue users to switch from SMS to other solutions for two-factor authentication, two months after a reported leak impacting 40 Mn users

? Droneacharya’s Path: How did a drone tech startup become a favourite for new-age tech stock investors and what does the future hold for Droneacharya? Our Q&A with Prateek Srivastava, the company’s founder and MD

? Google Layoffs Hit India: Internet giant Google has reportedly fired 453 employees from various departments in India as part of its global downsizing involving 12,000 layoffs

Ad-lite browsing experience

Ad-lite browsing experience