Once said to be on track to become a unicorn, Trell’s fortunes have turned and early backer Sequoia Capital has walked away from the company with a loss on investment

Sequoia held 5.23% of Trell but is said to have been unhappy at the allegations of irregularities at Trell and also not being accommodated in its Series C funding round

Now Trell has shifted its focus from social commerce to an ads-centric model for its short video app but still faces a huge challenge in scaling up ad volumes in the current market

From a startup that was set to lead India’s social media wave to just another footnote — Trell’s fortunes have changed dramatically since last year, and, along the way, it has also seen the exit of Sequoia Capital India, as per two independent sources close to the development.

Founded by Pulkit Agrawal, Bimal Kartheek Rebba, Arun Lodhi and Prashant Sachan (who left the startup in 2020), Trell earned a huge reputation due to the array of VCs it attracted.

But in the past year, controversies have dogged Trell, and what was once said to be the next unicorn for investors such as Sequoia Capital, H&M, Samsung Ventures, Fosun, Mirae Asset and others, has become a hot potato.

Allegations of financial irregularity at Trell emerged in March 2022, and, since then, the company has let go of 300 employees or 75% of its workforce. Even as the founders denied the claims and continue to be at the helm today, the startup has changed its core focus from social commerce to an ads-centric business model for its short video app. And it was during this transition that Sequoia made a beeline for an exit from Trell, even taking a huge loss.

Sequoia Walks Away From Trell

According to one of our sources, Sequoia sold its shares in mid-2022 to a “small investor” while the other added that the VC had sold its stake to investment banking firm Merisis Advisors for $500K.

Sequoia & Trell did not comment on the questions related to this secondary transaction. Trell’s regulatory filings since last year do not indicate this deal either.

Having invested around $2.25 Mn (INR 18.1 Cr) in Trell’s Pre-Series A and Series A rounds through its seed fund Surge, Sequoia is said to have sold its shares for roughly $500K (INR 4 Cr) to Merisis, which had invested in Trell through its MA Theta Fund.

MA Theta had invested in Trell’s Series B round, picking up 10,496 shares from the total pool of 1,75,163 shares. It poured in INR 17.65 Cr to get these shares, as per Trell’s regulatory filings.

On an absolute basis, that is a loss of nearly 78% on the amount invested, however, Inc42 could not independently confirm the number from either the VC or the company.

While Sequoia or Surge did not invest in Trell’s Series B round, the VC fund held 5.23% of Trell, which was last valued at $120 Mn in March 2021, surging from around $40 Mn post-money valuation reported after the Series A in August 2020.

This shows that the value of Sequoia’s Trell stake had appreciated greatly in less than a year, so the potential loss for the VC giant could be much larger than 78%.

According to our source, Sequoia was being left out of the Series C funding round for Trell which was said to be in the works in late 2021 and early 2022. And that was also when allegations of irregularities cropped up. The VC was wary of getting into a legal tangle given these allegations.

Our source added that the startup was close to signing a term sheet in early 2022 when the allegations of irregularities broke out and halted Trell’s momentum.

For Trell, the marketplace play was the key to raising funds. It was reportedly in talks with Amazon to raise a large unicorn valuation round that would have given it the same kind of momentum that Meesho had seen.

“Sequoia wanted to invest in Trell’s Series C round in early 2022, but there was no room. The round was already oversubscribed,” said the second source, indicating that Sequoia had not been happy with the development.

Sources added that Sequoia was unhappy about not being accommodated in Trell’s Series C funding round. It must be noted that Sequoia did not invest in Trell’s Series B round either.

The Trell Story Falls Apart

Buoyed by the great momentum for short videos and social media apps in the aftermath of the TikTok ban in 2020, Trell was among a host of Indian startups looking to fill the TikTok-sized gap.

As it turned out, most of these short video apps fell short (pun wholly intended) of the mark, while big tech products such as Instagram Reels and YouTube Shorts are now the dominant players.

Trell had already raised over $60 Mn to tap the short video-driven social commerce opportunity. It launched marketplace operations and on-boarded sellers, and even ventured into so-called live commerce in a matter of months between August 2020 and July 2021.

That is also when it raised $45 Mn in its biggest round from the likes of fashion retail giant H&M and electronics major Samsung’s VC arm. Representatives from H&M and Samsung are today on Trell’s board.

The Trell juggernaut seemed to be on the right track, but India was not ready for social commerce. The thesis that India’s consumers would latch on to these platforms like their Chinese counterparts was way off the mark.

Social commerce experiments bombed badly. The likes of Meesho, once the flag bearers of this model, have also now abandoned it for a marketplace play.

But with the funding round out of the picture, Trell went back to the drawing board and has since stripped itself off the operational overhead of running a marketplace.

From Social Commerce To Ad Channel

The Trell of today is nothing but an ad channel for brands. The company primarily earns ad revenue from the views it gains on its app, and also gets a sales or affiliate commission for any sales it can convert based on the ad’s clickthrough rate.

“Customers come to the app, watch the ad and click on the products to be taken to either the Trell Shop or a third-party website,” our source said.

Even in the case of customers buying the product on the Trell Shop, the fulfilment is handled by the brands, we were told. In essence, Trell has gone from a marketplace to a middleman that subsists on affiliate ad revenue.

A major factor for the switch to this relatively asset-light model is the need to reduce the operational overheads and costs of scaling up a marketplace, for which the startup would need to burn a lot of VC money. With funding drying up for such operations, Trell has chosen to shed expensive parts of the operations that were critical for the marketplace model.

A third source close to the shareholders indicated that Trell investor Mirae Asset is leading the transition from a social commerce app to this ad-reliant model. But even here, there are a lot more questions about the future of Trell.

The current ecommerce operations do not involve any delivery or customer service burden. All of this is handled by the brand under this model, with Trell doing the heavy lifting in terms of the content discovery algorithm.

But this also means Trell would need to show user volumes (or scale in other words) to establish relevance in the wide world of ecommerce marketing. And it doesn’t have the capital to do that.

Running On Reserves

To cut costs last year, Trell laid off 300 employees. Today, a team of 100 employees is carrying forward the operations.

The startup saw losses more than triple to INR 268.34 Cr in FY22 from INR 78 Cr in FY21, largely on account of soaring employee benefit expenses. The startup’s total expenses saw a 4X hike in FY22 to INR 413.04 Cr, but revenue from operations only grew 7.5X as the cash burn did not bring in the desired revenue bump.

The three cofounders — Pulkit Agrawal, Bimal Kartheek Rebba, and Arun Lodhi — drew a salary of INR 74.78 Lakh each in FY22.

Sources close to Trell’s founders claim that since pivoting to the agency model, the direct expenses have come down to roughly INR 12 Cr to INR 14 Cr on an annualised basis. But this cannot be verified independently until the company files its FY23 financial statements.

Given the monthly salary costs for the three founders alone, this claim has to be taken with a pinch of salt, and any optimism around the ad business fuelling a recovery rests on Trell being able to maximise its user base.

Where Are The Users?

“Simply put, without users, this model does not work unless you have a native shop or a very large user base. Trell has competition such as YouTube, Instagram and even Twitter wants to monetise. The number of users that Trell has pales in front of this competition,” said the founder of an influencer marketing agency that works with these platforms.

Indeed, Trell’s social media accounts are also more or less dormant, with a few Instagram posts peppered in every now and then, and no tweets since April 2022. The Instagram account, which claimed over 300K followers in 2017, now has less than 150K followers.

The website and app still take visitors to curated short videos, but there is no indication of a high engagement or video creation on these channels. In 2020, the startup claimed to have over 100 Mn users and over 5 Mn videos. But today, Trell is a shadow of this former self.

On the app, for instance, all the trending posts are by accounts which have zero followers. These videos are not particularly engaging and many seem to be videos already uploaded on rival platforms.

It’s also not clear how many of the accounts with a large number of followers are genuine. For instance, Trell claims to have an account for Jay Shetty, who has 12.6 Mn followers on Instagram but just over 11K on Trell. On Trell, Shetty only follows 32 accounts and none of them seems to be of noted personalities or influencers.

Shetty did not respond to questions from Inc42 about the legitimacy of this account.

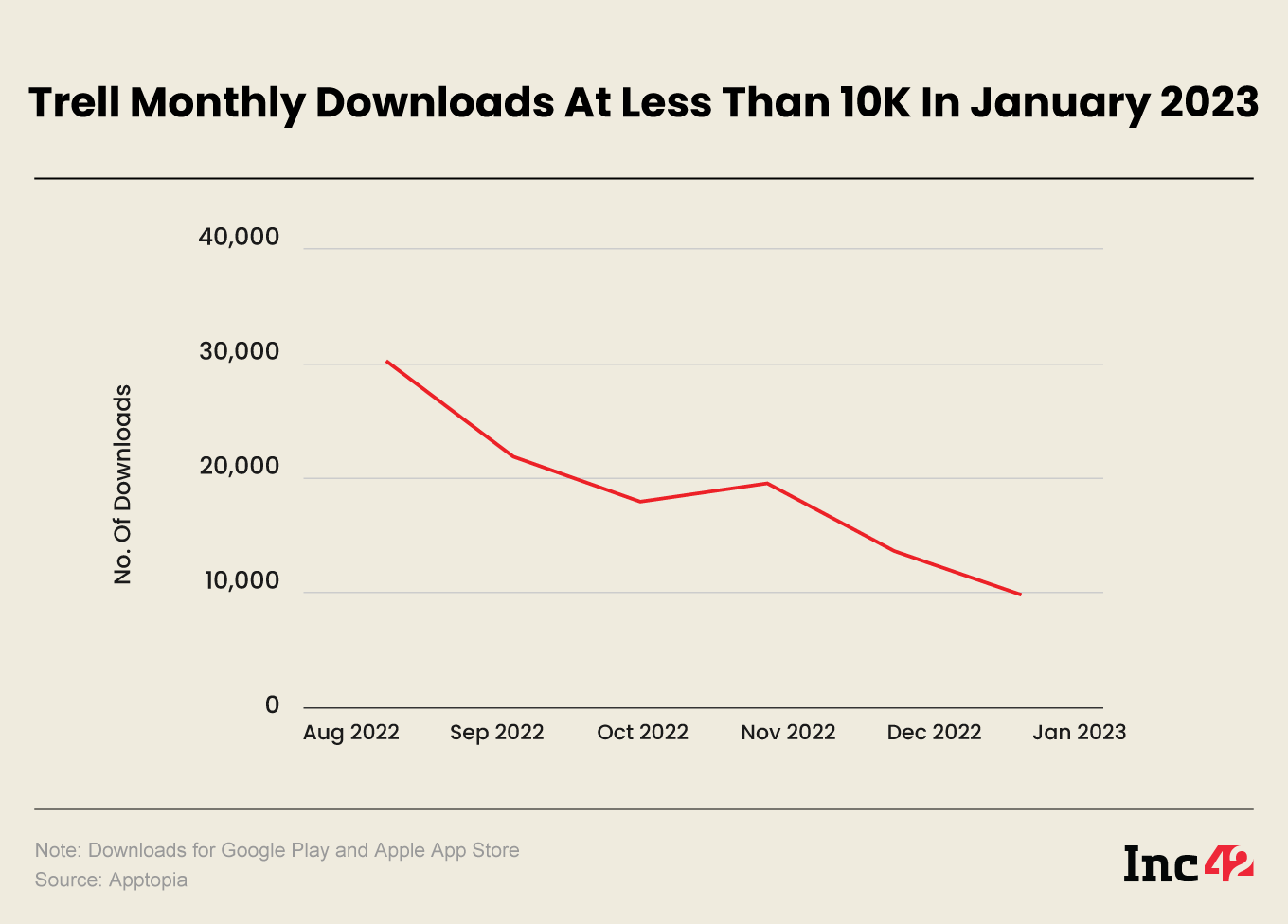

Let’s take a look at the user base numbers for Trell over the past six months. Based on analysis of Apptopia data, we can see that the total number of downloads has fallen from 30K in August 2022 to 20K in November 2022 to less than 10K in January 2023.

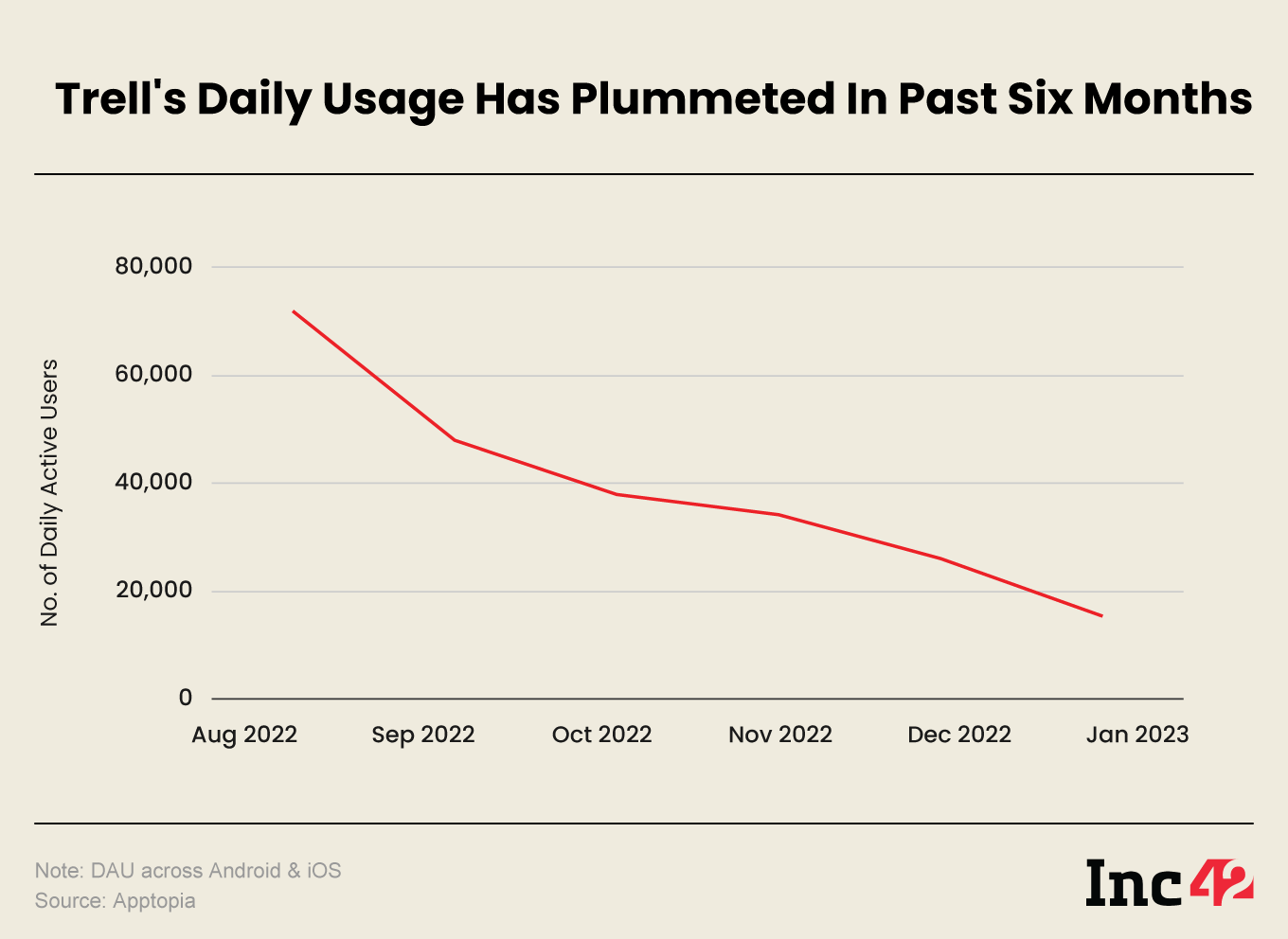

A similar consistent decline can be seen in the engagement figures as well, where daily active users have gone from around 72K in August last year to just over 13K in January 2023.

Given that some form of ecommerce marketing, short video monetisation and the technology driving the discovery algorithm are still around and being supported by the company, it is not clear exactly whether Trell’s identity has changed from a burn-heavy model to a sustainable business in the past 12 months.

Without quality content, the app is not drawing in the users and without users, its ads business is hanging on by a thread. And this is arguably the worst time in the market for an ads-centric model.

Reports indicate a double-digit decline in the digital ad space. Behemoths such as Reliance suffered an 86% drop in ad revenue EBITDA in its media business, and even Google has suffered a revenue decline from its search and ad business.

If these massive companies are struggling to bring in the ad moolah, the path in front of Trell is even steeper.

Ad-lite browsing experience

Ad-lite browsing experience