With dozens of TikTok clones in India, will any of the new short video apps make a long-term impact?

Hey,

And round and round we go.

After 59 apps — meticulously named by the IT ministry — a further 47 apps have been given the hammer by the Indian government, but this time no names have been released, almost as if the government does not want any publicity. Apps are the new not-to-be-named miscreants, but the biggest impact of the ban so far seems to be on TikTok.

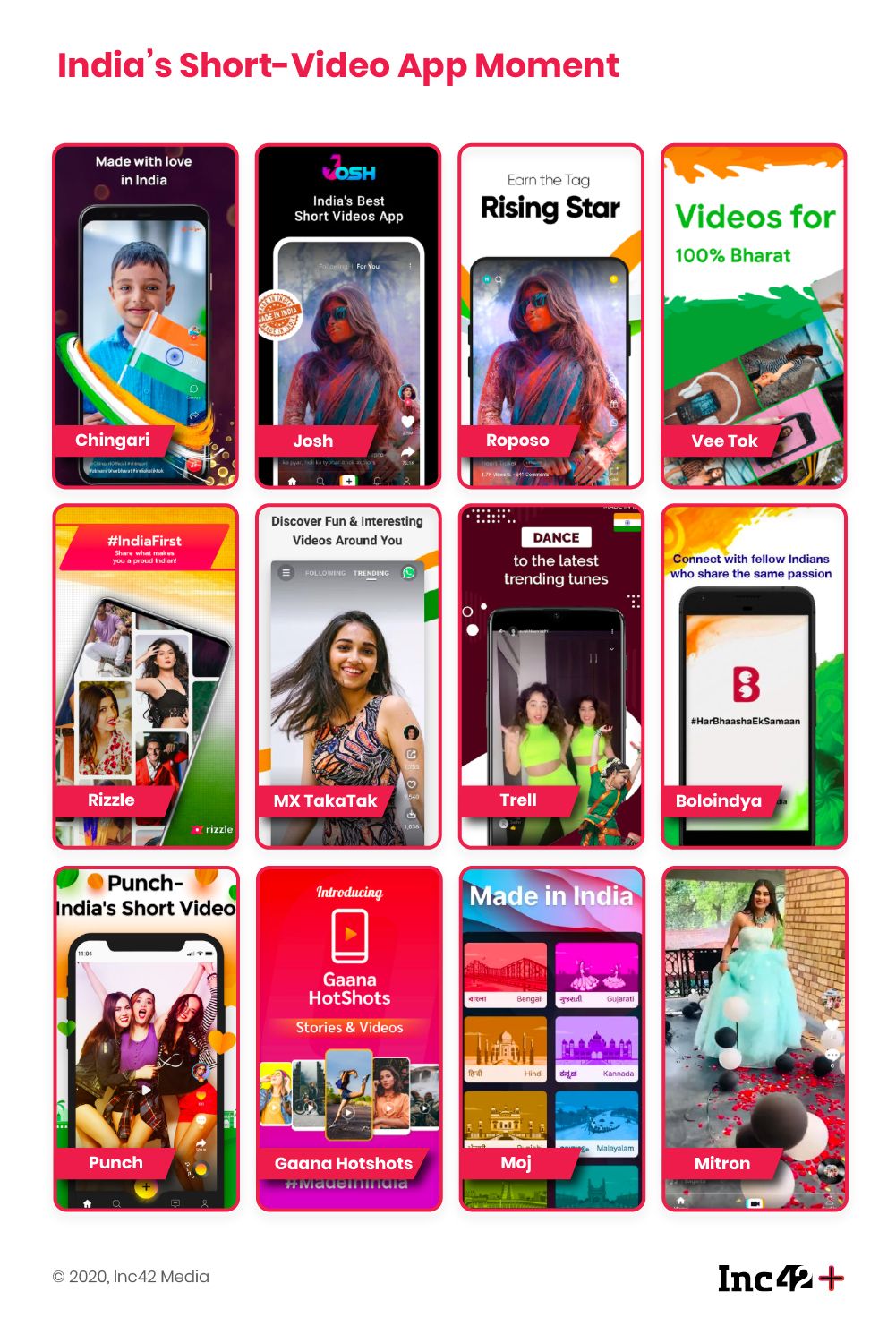

Of course, the rise of the ‘Made in India’ TikTok clones has made the TikTok ban a less bitter pill to swallow for some. Ever since the ban, the Google Play Store seems to be adding a new TikTok-like app from India every other day. Although they are developed by different companies and startups, their foremost proposition is the same. Banking on the ‘Made In India’ and ‘Atmanirbhar Bharat’ wave, these ‘multilingual’ short video feeds might as well be clones of each other.

The ban on Chinese apps has proved to be a gold mine for Indian app makers. The likes of Chingari, Mitron, Bolo Indya and Trell — barely heard of in February — have reported steep rises in the number of users. Even erstwhile laggards like Roposo, which stood on the sidelines when TikTok was ruling the market, have come to the fore. Considering that Inmobi acquired Roposo only in November 2019, it has indeed been a fortuitous turn of events for the adtech unicorn.

The feeding frenzy has attracted short video plays by ShareChat, which launched Moj, Gaana which debuted HotShots, MX Player with MX Taka Tak and Dailyhunt, which launched Josh. Indie apps like Vee Tok, Veer, TipTop and Punch form up the tail of this market, with each app eyeing a share of the over 200 Mn Indians that were forced to migrate from TikTok.

Making The Perfect Clone

Making a short video app from India does solve the issue of data localisation, even though the data practices of these new apps are yet to be scrutinised (more on that later), but that was not the only concern with TikTok.

When it was first banned in 2019 by the Madras HC, TikTok was alleged to have exposed underage users to pornography and make them vulnerable to sexual predators online through grooming. It was also accused of helping spread fake news and other so-called objectionable content, so the ban on TikTok may have been attributed to data sovereignty but the app had fallen foul of authorities for various reasons.

In response, TikTok claimed to have put in place a content moderation technology with a local human moderation team. With the growing user traction, Chingari, Mitron, Trell and others are also working on similar multilevel moderation systems, but it will take considerable resources and financial muscle to pull off what TikTok did over several years.

In addition to objectionable content, two of the popular short-video apps Chingari and Mitron have been found vulnerable to security flaws. According to a cybersecurity researcher Girish Kumar, Chingari’s login process had an authentication bypass flaw which could have allowed hackers to take over any user account. The flaw was later fixed by Chingari. Prior to this report, Mitron was also found to have a similar flaw allowing anyone to breach user accounts without entering a password.

While the government might have addressed some of the data security concerns around the Chinese apps, the new wave of homegrown apps might also prove to be a threat in terms of user privacy and data collection.

Who Will Fund The Clones?

This wave of short video platforms mirrors the tidal wave of payments, hyperlocal delivery, and digital lending startups during their heyday. But the big difference is that the TikTok-like Indian apps are pure-play digital platforms with no ties to the physical market. But it’s about more than just the tech.

Amit Kumar, partner at Ah! Ventures and investors in Bolo Indya, said, “For anyone who is trying to replace TikTok, technology is not very important, you can put in some money and make the platform. But the kind of money required to market such products is where the game is going to be.”

He further stressed that the reason behind TikTok’s success was that it is a ByteDance company and ByteDance is worth over $100 Bn. Chinese video apps like TikTok, Helo were reportedly splurging around $15 Mn-$20 Mn monthly to acquire users in India.

Siddarth Pai of 3one4 Capital (investor in Mitron) also agreed that attempting to become a general platform from day-one with no differentiation will require large amounts of capital, unsustainable businesses practices like user subsidies and further divisions of an existing pie as opposed to the creation of a new market.

He added that this will entail high cashburn and a threat of being usurped by those with larger pockets or even the banned apps, if the ban is lifted. Instead, the new apps need to figure out anchor segments and niches such as comedy, fashion, lifestyle, music, Bollywood and even lock-in age groups like Instagram did in its early days. The idea is to find the groove that works for you.

However, Amit Kumar argued that even if niches are built up, sustaining these segments will be a challenge because today people get bored very easily, especially the generation Z and millennials that are the primary audience for these short-video apps.

Social media behemoths such as TikTok, Facebook, Twitter are high cash-burn businesses that need large VCs to sustain them in the early phase. But the investment in the new brigade of short video apps is from more conservative sources that do not have the appetite for that kind of risk, noted Murali Talasila, leader, innovation and startups, PwC India. For instance, in the first three years of its launch, Facebook raised around $340.7 Mn from investors like Peter Thiel, Microsoft, Greylock and Accel.

However, Former CTO of Coinbase and general partner at Andreessen Horowitz, Balaji S. Srinivasan believes that there is plenty of capital for purely digital businesses even in the Indian domestic market. “We know that there is a pot of gold at the end of the rainbow for those who execute well operationally. The reason is that existing scaled tech platforms show that with good management, eventually the marginal revenues overcome the fixed costs of setting up the platform and the marginal costs of operating it,” Srinivasan told Inc42.

Time Running Out For TikTok Clones

The success of any user-generated content platform depends on the quality of content, the variety of creators along with the velocity of content generation. Content pieces need to be pumped out by the millions for users to feel as if they are part of a living, breathing community, rather than just a sterile feed. This is where TikTok made its mark. It perfected this cycle of growth in every market it entered. It managed to reach the virality threshold much faster than other platforms and naturally everyone wanted to be a part of it. TikTok had already inspired so many clones that each managed to garner millions of loyal users that these new ones from India seem rather sweet in comparison.

But in order to achieve this network effect, platforms first need to onboard the first set of creators and influencers. Influencer marketing agencies and paid campaigns solve this to a certain extent, thanks to a parallel economy created by TikTok itself.

So now the easiest model for any company is to raise a huge amount of money and burn all that money in acquiring users or bringing content creators on board. But it doesn’t actually build a sustainable business or any loyalty among the user base, and creators are unlikely to focus much without a plan for measurable revenue like TikTok did.

According to Pai, what will differentiate new short video apps from their competitors is their ability to attract advertisers, which not only brings the videos from the platform to the mainstream media’s attention, but also increases how much money the company has to play with. This is dependent on the app’s compliance with law, the quality of its recommendation engine or algorithm and strong content moderation policies.

Talking about what could help the new short video apps gain success in India, Srinivasan said that multilingual support is key. But the first step is to acquire the customer base that TikTok has left in its wake. And, one strategy to do that is to first clone and win on distribution, before figuring out the innovation piece.

Lightspeed India’s Akshay Bhushan also believes that short-video apps need to look like TikTok in the ultra short-term because users are looking for a familiar UI. “But as things mature, these apps will definitely take on a very different look, provide features that were different from Tiktok and be very different apps. It takes time to change user behaviour,” he added.

On the other hand, Ah! Venture’s Kumar said, “For somebody to become a TikTok, it requires a huge amount of money and I am not even sure that any of these apps will be able to do that. It will be a long shot in my opinion.”

If/When TikTok Returns

Moreover, there’s the possibility that TikTok will return to India in sometime. As recently as July 2020, TikTok signed a flexible office-space deal for 1,250 seats at WeWork Nesco in Mumbai. Also, in a letter to the Indian government, TikTok reiterated its plans of storing data of Indian users locally along with setting up an engineering centre to develop indigenous products. Make no mistake, TikTok is not bowing out of the race just yet.

In comparison to TikTok, the likes of Chingari, Mitron, Roposo, Trell and others definitely fall short in terms of global reach and the advertiser base. So, if and when TikTok does make a comeback, will users still choose to stick with an Indian alternative, just because it’s Indian?

It’s hard to say and if TikTok indeed returns in a short span, then Indian clones would struggle to find relevance, but if they have a few months of time to carve out a niche, they could end up with around 10 Mn-20 Mn users from around 60 Mn-70 Mn today to build a new base around. But as investors have pointed out, as the early capital needs of today’s social media giants suggests and as common logic dictates, survival for even the fittest among the new lot will be no short video.

Search For Digital India

The Covid-induced shift in the consumer market has tested the strength of not only every digital platform, product and service in India, but even long-standing economic powerhouses such as the education and the healthcare sector. But just as it did with the telemedicine policy for healthcare, the Indian government has tried to fix the gaps in the education infrastructure in a somewhat timely manner.

Recognising the growing dependence of Indians on digital products and services, Indian government has approved a forward-looking National Education Policy (NEP). This policy will have a special focus on digital education and remote learning along with the question of equitable access to education given the digital divide in India.

Along with education, a large portion of payments have also moved to the digital space. Responding to which, National Payments Corporation of India (NPCI) has capped UPI transactions for digital payments players like Google Pay, PhonePe, Paytm and others. Though the transaction limit will hamper the growth of the players operating in the segment, it will ensure that there is no major impact on the Indian payments ecosystem in case UPI collapses.

Meanwhile, a new digital payments player is getting ready to enter India’s booming payments space. NPCI has given the thumbs up to WhatsApp Payments, confirming that WhatsApp fulfills all the data localisation norms for a payments service in India. However, the Reserve Bank of India (RBI) is yet to give its nod to WhatsApp Pay.

Search For Indian D2C Model

In the last few years, hundreds of Indian new-age brands have bid farewell to middlemen and taken the D2C route. Boosted by digital payments, app technology, cheaper data plans and the big push for digital consumers during the Covid-19 lockdown, more brands are going the direct-to-consumer (D2C) route, looking to control the whole stack with vertical integration — just like tech companies.

Amid the pandemic, more brands are bypassing intermediaries to reach consumers faster and with more efficiency. Traditional retail giants have also woken up to the benefits of D2C and are ditching the old ways to become hip, modern and tech-driven.

As part of our fifth Playbook, exclusively available for Inc42+ members, we will be talking to multiple brands, logistics tech players, industry experts to get a 360-view on India’s D2C Rush. We are starting things off with a look at the vibrant D2C landscape, with over 500 D2C brands jostling for attention.

But as with most things in India, there’s a definite twist to the D2C model. Not only is pure-play D2C as a model hard to achieve in the Indian context, but also not generally advisable given the huge logistics hurdle and competition with ecommerce marketplace giants for eyeballs.

Having end-to-end control or vertical integration of the entire value chain is like gold dust in the Indian market. According to most brands Inc42 spoke with, in the immediate future, we will see a hybrid of own website and online marketplaces (like Amazon, Flipkart) as the only way.

One thing is certain, ecommerce enablers and software makers have made it far easier for just about any brand to at least take the first steps towards becoming a D2C player. With D2C driving the second wave of ecommerce, it is surely a win-win for brands and ecommerce software platforms such as Shopify, Magento, Ecwid, BigCommerce, Volusion, Wix and others. With thousands of brands competing in the D2C space, these D2C enablers are targetting India with laser-sharp vision.

There’s a lot more certainty for the D2C brands than short video apps when it comes to future prospects. But somewhere along the way their paths might converge and that could very well define the future of both segments. As D2C brands grow in size and stature, they might very well need the reach of short video apps in Tier 2/3/4 India to grow out of the metro-dominant models. And for short video apps, advertisers and brands could be the gateway to some sort of permanency, as investors have hinted at.

Let the games begin,

Yatti Soni

Ad-lite browsing experience

Ad-lite browsing experience