SUMMARY

15 Startup Funding Took Place In The Indian Startup Ecosystem This Week

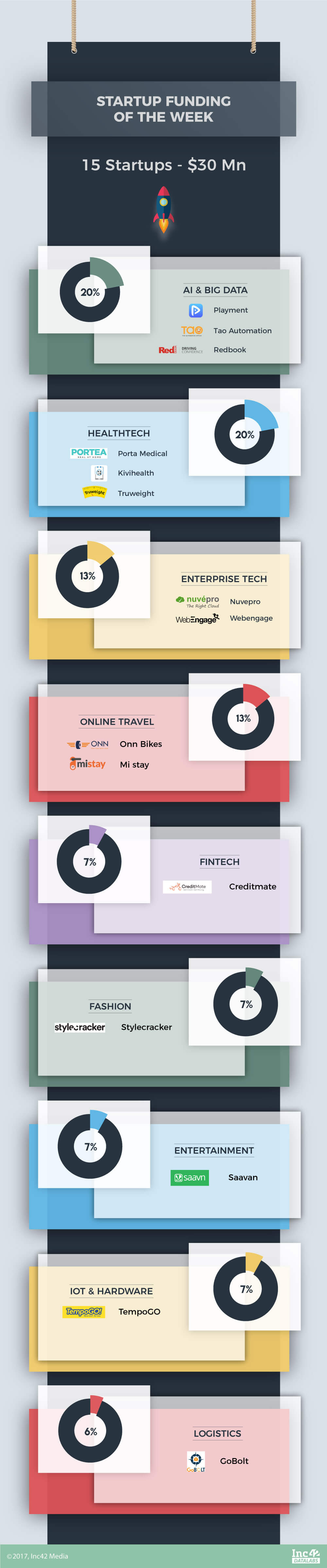

We bring to you the latest edition Funding Galore: Indian Startup Funding of the week. This week 15 Indian startups raised about $30 Mn in funding altogether in the Indian startup ecosystem. (The startup funding calculations are based on the startups that disclosed their funding amounts)

Making it this week’s biggest Indian startup funding, Portea Medical raised $26 Mn funding in a Series C round led by Sabre Partners and MEMG CDC Ventures. Existing investors Accel, Washington-headquartered International Finance Corporation (IFC) and Qualcomm Ventures also participated in the round. Portea Medical is planning to utilise the investment to bolster its product offerings.

Indian Startup Funding Of The Week

![]() Playment: This week the second highest funding in the Indian startup ecosystem took place in Bengaluru-based Playment. An AI-driven mobile crowdsourcing platform, the Indian startup raised $1.6 Mn as part of its Pre-Series A funding. The investment was led by YCombinator, Sparkland Capital and Silicon Valley angel investors such as Ryan Petersen (CEO, Flexport), Max Altman and others. Playment was part of Y Combinator’s Winter 2017 batch. Saif Partners did a super pro-rata in this round to take the total funding raised in the Pre Series A round to $2.2 Mn. The Playment team will use the newly raised funding to build its engineering, product, and data science teams, build an internal AI research lab, and set up an office in Bay area.

Playment: This week the second highest funding in the Indian startup ecosystem took place in Bengaluru-based Playment. An AI-driven mobile crowdsourcing platform, the Indian startup raised $1.6 Mn as part of its Pre-Series A funding. The investment was led by YCombinator, Sparkland Capital and Silicon Valley angel investors such as Ryan Petersen (CEO, Flexport), Max Altman and others. Playment was part of Y Combinator’s Winter 2017 batch. Saif Partners did a super pro-rata in this round to take the total funding raised in the Pre Series A round to $2.2 Mn. The Playment team will use the newly raised funding to build its engineering, product, and data science teams, build an internal AI research lab, and set up an office in Bay area.

![]() Saavn: Saavn, an Indian music distribution app which operates globally through New York, raised an undisclosed amount of funding from two new strategic investors, Senvest Management LLC and Endeavor. For Senvest, this will be the company’s first investment in India. Endeavor’s involvement would help strengthen ties between East-West music industries and further enable Saavn to grow its unique collaborations between Western and South Asian artists and producers.

Saavn: Saavn, an Indian music distribution app which operates globally through New York, raised an undisclosed amount of funding from two new strategic investors, Senvest Management LLC and Endeavor. For Senvest, this will be the company’s first investment in India. Endeavor’s involvement would help strengthen ties between East-West music industries and further enable Saavn to grow its unique collaborations between Western and South Asian artists and producers.

![]() CreditMate: Paytm made an undisclosed amount of investment in Mumbai-based fintech startup CreditMate. The raised funds will help the Indian startup in expanding its operations, distribution, lending partnerships, and technology.

CreditMate: Paytm made an undisclosed amount of investment in Mumbai-based fintech startup CreditMate. The raised funds will help the Indian startup in expanding its operations, distribution, lending partnerships, and technology.

![]() KIVIHealth: Mumbai-based KiviHealth raised $400K in its Pre-Series A round led by Claris Capital, with the participation of Chandigarh Angels Network (CAN), few HNIs and existing investors. The raised funding will be utilised by the Indian startup to further strengthen its product offering and scale sales operations.

KIVIHealth: Mumbai-based KiviHealth raised $400K in its Pre-Series A round led by Claris Capital, with the participation of Chandigarh Angels Network (CAN), few HNIs and existing investors. The raised funding will be utilised by the Indian startup to further strengthen its product offering and scale sales operations.

![]() StyleCracker: This week another bollywood actor entered into the Indian startup funding space. Bollywood actress Alia Bhatt picked up a minority stake in fashion-tech startup StyleCracker for an undisclosed amount. Beside Alia, a couple of undisclosed investors also participated in this Pre-Series A startup funding round. Post this round of funding, the founders will jointly hold a 65% stake in the company.

StyleCracker: This week another bollywood actor entered into the Indian startup funding space. Bollywood actress Alia Bhatt picked up a minority stake in fashion-tech startup StyleCracker for an undisclosed amount. Beside Alia, a couple of undisclosed investors also participated in this Pre-Series A startup funding round. Post this round of funding, the founders will jointly hold a 65% stake in the company.

TAO Automation: Bengaluru-based TAO Automation raised an undisclosed amount of seed funding from 3one4 Capital and Arihant Patni. The startup also announced that Swaminathan Dandapani, former managing director and chief executive of Infosys BPO and former executive chairman of Manipal Health Enterprises, has joined its board of directors.

TAO Automation: Bengaluru-based TAO Automation raised an undisclosed amount of seed funding from 3one4 Capital and Arihant Patni. The startup also announced that Swaminathan Dandapani, former managing director and chief executive of Infosys BPO and former executive chairman of Manipal Health Enterprises, has joined its board of directors.

![]() MiStay: Bengaluru-based MiStay, a travel-tech startup raised a round of investment lead by Axilor Ventures along with participation from a group of angel investors. The funds will be utilised in growing the team, marketing and scaling up operations across India. MiStay was part of Axilor’s Winter ’16 accelerator batch.

MiStay: Bengaluru-based MiStay, a travel-tech startup raised a round of investment lead by Axilor Ventures along with participation from a group of angel investors. The funds will be utilised in growing the team, marketing and scaling up operations across India. MiStay was part of Axilor’s Winter ’16 accelerator batch.

![]() RedBook: Mumbai-based AI enabled pharmacy platform RedBook raises Seed Funding round led by Vida Ventures and Dr. Aniruddha Malpani. The company will use the funds to scale RedBook pan India.

RedBook: Mumbai-based AI enabled pharmacy platform RedBook raises Seed Funding round led by Vida Ventures and Dr. Aniruddha Malpani. The company will use the funds to scale RedBook pan India.

Nuvepro: Mumbai-based Nuvepro, a managed cloud environment solutions provider raised $400K funding led by 1Crowd and its investor community. The investment will be used to deepen their R&D efforts and continue to expand into the worldwide market.

Nuvepro: Mumbai-based Nuvepro, a managed cloud environment solutions provider raised $400K funding led by 1Crowd and its investor community. The investment will be used to deepen their R&D efforts and continue to expand into the worldwide market.

ONN Bikes: Mumbai-based self-drive bike rental startup ONN Bikes raised $696K (INR 4.5 Cr) in a Pre-Series A round of funding led by Z Nation Lab, JITO Angels, and Venture Catalysts. Several VCats angels such as Jayesh Parekh (Sunidhi Securities), Pankaj Harlalka (Narnolia Capital), Gaurav Gandhi, Nikunj Pachisia, and Vijay Lakhani also participated in the startup funding round. The funding will be utilised by ONN Bikes to build a stronger technology base, increase the fleet size, expand to more cities, and promote its franchise model. The startup also plans to expand its range of electric vehicles in the coming months.

ONN Bikes: Mumbai-based self-drive bike rental startup ONN Bikes raised $696K (INR 4.5 Cr) in a Pre-Series A round of funding led by Z Nation Lab, JITO Angels, and Venture Catalysts. Several VCats angels such as Jayesh Parekh (Sunidhi Securities), Pankaj Harlalka (Narnolia Capital), Gaurav Gandhi, Nikunj Pachisia, and Vijay Lakhani also participated in the startup funding round. The funding will be utilised by ONN Bikes to build a stronger technology base, increase the fleet size, expand to more cities, and promote its franchise model. The startup also plans to expand its range of electric vehicles in the coming months.

![]() TempoGO: Goa-based Internet of Things (IoT) and software-as-a-service (SaaS) solutions provider for the transportation industry, TempoGO raised $250K (INR 1.6 Cr) from Javelin Startup-O Victory Fund. It also raised an additional funding from Dubai-based NB Ventures, which is a $50-Mn fund. This funding round takes the total amount of capital raised by TempoGO to over $1.35 Mn. TempoGo was incubated at Goa-based Prototyze.

TempoGO: Goa-based Internet of Things (IoT) and software-as-a-service (SaaS) solutions provider for the transportation industry, TempoGO raised $250K (INR 1.6 Cr) from Javelin Startup-O Victory Fund. It also raised an additional funding from Dubai-based NB Ventures, which is a $50-Mn fund. This funding round takes the total amount of capital raised by TempoGO to over $1.35 Mn. TempoGo was incubated at Goa-based Prototyze.

GoBolt: Delhi-based logistics startup GoBolt raised an undisclosed amount of funding from BlackSoil Capital. The investment has been made in the form of short-term working capital demand loans.

GoBolt: Delhi-based logistics startup GoBolt raised an undisclosed amount of funding from BlackSoil Capital. The investment has been made in the form of short-term working capital demand loans.

![]() WebEngage: Marketing automation startup Webengage raised an undisclosed amount of funding from BlackSoil Capital. The investment has been made in the form of short-term working capital demand loans.

WebEngage: Marketing automation startup Webengage raised an undisclosed amount of funding from BlackSoil Capital. The investment has been made in the form of short-term working capital demand loans.

Truweight: Weight loss counseling provider Truweight wellness raised an undisclosed amount of funding from BlackSoil Capital. The investment has been made in the form of short-term working capital demand loans.

Truweight: Weight loss counseling provider Truweight wellness raised an undisclosed amount of funding from BlackSoil Capital. The investment has been made in the form of short-term working capital demand loans.

Note: BlackSoil Capital together invested $771K in Truweight, GoBolt, and WebEngage. The individual amounts in each could not be assessed.

Indian Startup Acquisitions Of The Week

This week, just one acquisition took place in the Indian startup ecosystem. Bengaluru-based HomeLane acquired Capricoast for $13.8 Mn (INR 90 Cr). The acquisition will enable HomeLane to leverage Capcricoast’s tech stack to provide customers with a more streamlined home designing experience.

Other Developments Of The Week

- Mumbai-based Unilever Ventures, the PE vertical of Unilever and Amazon Internet Services Pvt. Ltd. (AISPL) invested $10 Mn (INR 65 Cr) into IDG Venture India Fund. The raised funds will be used by IDG Ventures India Fund to invest in consumer-technology, innovative, and digital startups.

- California-based VC firm March Capital Partners is now considering to set up an India office and team to source, identify and close its investments in India. The sector and stage agnostic VC will close its next set of investments in India within next few months and is looking to invest in tech startups pertaining to data science, machine learning (ML) and artificial intelligence (AI).

- Mumbai-headquartered Tapaswi Group Ventures launched Billennium Divas Angel Fund, in collaboration with Navi Mumbai Angel Network (NAMAN). It is geared towards encouraging and empowering women entrepreneurs in Maharashtra.

- GOInternational Finland, a Nordic International Accelerator will be hosting Smart City Bizhack India at its headquarters in Helsinki. The three-day event aims to explore the untapped opportunities in the Indian market for smart city innovation.

- Mumbai-based PE firm Epiq Capital announced the first close of its $200 Mn-$250 Mn maiden tech startup fund. The firm has raised $100 Mn so far entirely from global institutional investors to invest in tech startups. Epiq Capital, with the newly raised fund, aims to invest in technology and tech-enabled startups with the ticket size of $10 Mn-$20 Mn.

- Gurugram-based GSF Accelerator announced the launch of its sixth batch and is currently inviting applications from tech startups across the country. As part of the programme, which will commence in December 2017, GSF would be investing $200K each in five selected startups. Apart from this, the startup accelerator has committed an additional $1 Mn as co-investments in Seed/Series A rounds at the end of the programme.

- Unicorn India Ventures announced the launch of its second fund, a venture debt fund with a corpus of $92.3 Mn (INR 600 Cr). The fund will be making its first close in March 2018. The sector-agnostic fund will be used to back later-stage startups that have a certain amount of cash flow.

- FundTonic, an angel network with over 700 angel investors announced the launch of Pune Startup Marathon. In another development, FundTonic has also unveiled a 15,000-sq-ft coworking space in Baner.

- Invest India along with International Accelerator entered into a strategic alliance to launch an incubator, India Tech-Bridge to help Indian startups and entrepreneurs succeed by connecting them with the best ”in-class incubation support” in India, followed by a go-to-market acceleration program in the US along with support from regional industry leaders, mentors as well as accelerator.

- RBL Bank selected 10 startups at the grand finale of The Big Pitch 2.0 — a major startup incubation and funding contest held at Amity University, Noida. The 10 finalists; FullTank Technologies, LittlePixi, SocioGraph Solutions, Team Rentezee, Tnine, GalaxyCard, ilove9months, NDAX, Loktra and Veda Labs were selected for funding and incubation opportunities.

- Zone Startups India is coming up with a new initiative called PitchRight, a professionally shot, 13-episode series, wherein 13 founders, selected through an application-based process, will be in a real-elevator with Sanjay Mehta – one of India’s most prolific Angel Investor, 1-on-1, for a 45 seconds pitch.

- 3M signed a memorandum of understanding (MoU) with the Government of Karnataka at the ongoing three-day Bengaluru Technology Summit. As per the MoU, 3M will provide a ‘Booster Service Kit’ and conduct, on a ‘pro-bono’ basis, mentoring sessions to startups in the areas of commercialisation process, stage gate discipline, building a business case and accelerating product launch, competitive and pricing analysis, and differential value and options analysis.

- The AnitaB.org India, a non-profit organisation focused on the advancement of women in computing and technology announced the Top 10 winners of the 7th edition of the Women Entrepreneur Quest (WEQ) 2017. Winners were selected from 257 applications received from across India. The list includes Bhavjot Kaur, Co-Founder at Clinikk Healthcare (Bengaluru); Kausambi Manjita, Co-Founder at Kubric (Bengaluru); Madhulika Mukherjee, Co-Founder & CTO at Survaider (Bengaluru); Monika Shukla, Co-founder & CEO at LetsEndorse (Bengaluru); Meghna Saraogi, Founder & CEO at StyleDotMe (Delhi); Pallavi Bishnoi, Co-Founder & COO at Real Time Renewables (Lucknow); Radhika Choudary, Co-Founder at Freyr Energy Services (Hyderabad); Sai Gole, Co-Founder & COO at LeanAgri (Pune); Supriya Rathi, Founder & CEO at RoboVR (Mumbai); and Vishakha Singh, Co-founder at Vicit Infot Tech (Mumbai).

- Xiaomi is looking to invest $1 Bn in 100 Indian startups in next 5 years. As stated by CEO Lei Jun, the company is looking to create an ecosystem of apps around its own smartphone brand. The investments into Indian startups will be made in association with Xiaomi’s sister company Shunwei Capital in areas such as content, fintech, and hyperlocal services.

- The Corporate Affairs ministry may exempt crowdfunding activities from the Companies Act and bring it under the regulatory authority of SEBI. With this move, the Indian govt aims to ease the way startups raise funding through this route.

- Sequoia Capital, one of the early investors in local search service Just Dial also sold almost 1% of its stake in the company through open market transactions, making an earning of around $5.4 Mn (INR 35.55 Cr). This diluted Sequoia Capital’s stake to 3.16%, from the earlier 4.10% in Just Dial, an exact 0.94% reduction.

Stay tuned for the next edition of the Funding Galore: Indian Startup Funding Of The Week!

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![Funding Galore: Indian Startup Funding Of The Week [20 -25 Nov]-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)