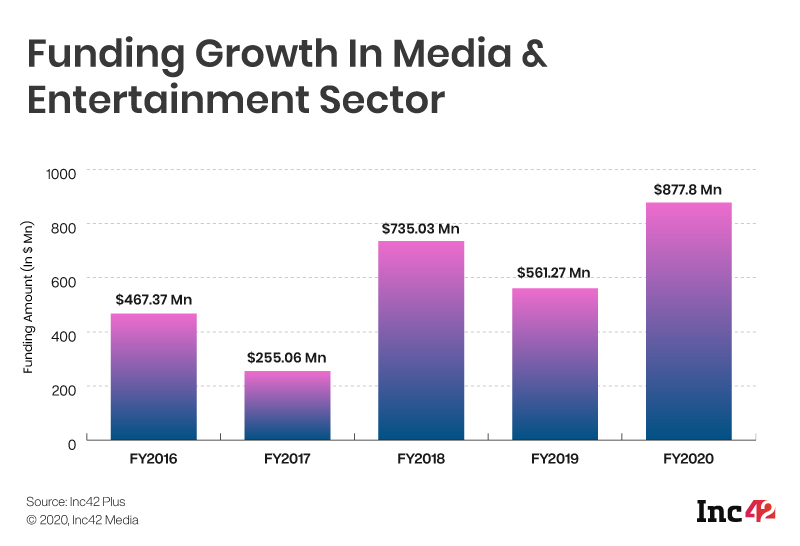

The media and entertainment sector received a total funding of $877.8 Mn across 85 funding deals in 2020, according to Inc42 Plus analysis

Online video and gaming startups emerged as winners in 2020 funding spree

Kuku FM, NewsBytes, Trell and The Better India among others have been shortlisted in this year’s Media and Entertainment Startup Watchlist 2021

Startup Watchlist 2021

The Inc42’s annual series, Startup Watchlist brings together the list of top growth stage startups to watch out for in 2021 across various industries.

This article is part of the fifth edition of Inc42’s Startup Watchlist series, an annual series in which we list the top growth-stage startups to watch out every year from some of the most trending industries in the Indian startup ecosystem. Explore all the stories from the ‘Startup Watchlist’ 2021 series here.

You can view our early-stage discovery watchlist here.

The media and entertainment industry in India put up a great show in 2020. From adults who wanted an escape from their mundane work-from-home life to kids who were trying to get used to playing indoors, the pandemic opened up a whole new world for media and entertainment startups.

There were a myriad of opportunities for new-age startups and investors to tap into, given the rise in demand for services like short-video apps, music and gaming platforms across demographics.

For instance, after the ban on the popular Chinese short-video app TikTok under 69A of the IT Act, its alternatives including Trell, ShareChat, Chingari, Bolo Indya, Mitron, Roposo, Moj and Josh among others started gaining massive popularity and traction in the market. Similarly, games like FAU-G, Mask Gun and others emerged as alternatives for many users in India after PUBG Mobile’s ban.

According to Inc42 Plus, the media and entertainment sector received a total funding of $877.8 Mn across 85 funding deals last year, compared to $561.27 Mn in 2019, led by online video startups like SimSim, Trell and other TikTok alternatives, followed by gaming startups such as SquareOff, Gamezop, WinZO among others. India stands in the sixth position in the global mobile gaming market with estimated market size of $1.2 Bn in 2020, as per Inc42 Plus analysis.

Besides video apps and gaming platforms, over-the-top (OTT) also emerged as one of the hottest sectors in the space, with close to 95+ OTT platforms such as Disney+ Hotstar, ZEE5, Netflix, Amazon, and Prime Video, along with local players such as BIGFlix, Alt Balaji, Voot, Spuul, Eros Now, SonyLIV, Sun NXT, Hoichoi, Ullu, MXPlayer among others, mushrooming in the space. Read the full report on India’s OTT landscape here.

According to industry estimates, India’s media and entertainment industry is expected to grow at a compound annual growth rate of 3.24%, touching $25.56 Bn by 2022. The industry is said to be fueled by digital adoption among users across geographies.

Highlighting some of the growing trends in the media and entertainment industry, Inc42 has curated a list of some of the promising startups that are expected to make it big this year and have the potential to beat the competition in 2021.

Editor’s Note: The startups listed below are in alphabetical order, and do not represent the ranking of the companies in any manner.

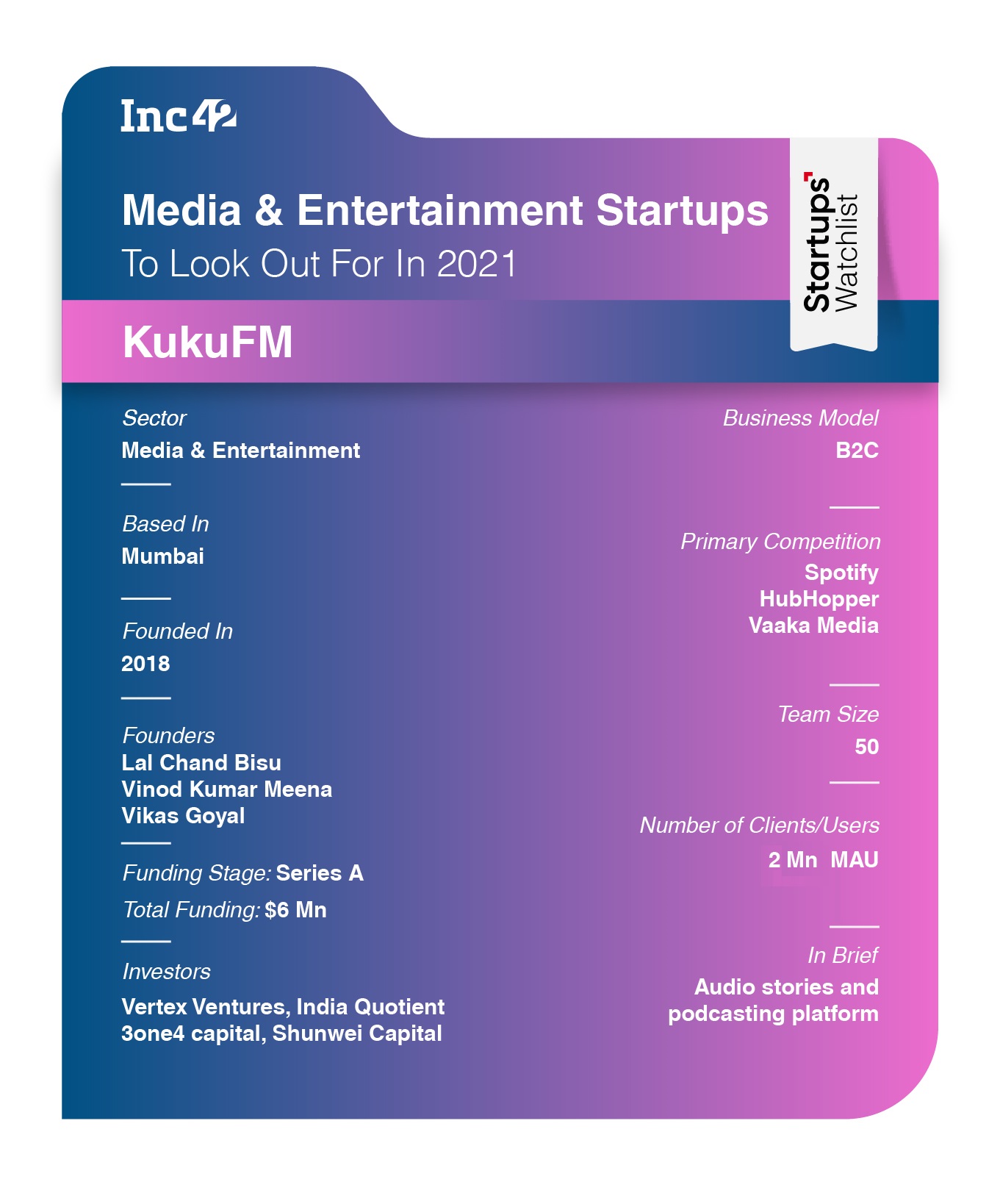

Kuku FM: A Vernacular Non-Music Audio & Podcast Platform

Reinventing traditional radio is Mumbai-based vernacular audio platform Kuku FM, which offers localised, relatable content via easy-to-use technology to its users. The company provides access to fictional and non-fictional shows and books via freemium and subscription models. Currently, the company offers one plan at INR 399 per year.

After witnessing increased screen-time during the lockdown period, Kuku FM views the shift vividly, and is now looking at focussing on the right utilisation of off-screen time by people by providing meaningful content off-screen. “Since the dependency on screen is so much, we tend to ignore the value of off-screen time, and therefore, there is no effective use of technology during this time,” said Lal Chand Bisu, the cofounder of Kuku FM.

Also, with the boom in the edtech sector, Kuku FM is banking on the same trend in the entertainment space by offering content for casual learning across categories. Similar to Youtube and other music streaming apps, the company is also looking at ‘income sharing’ model, where it is collaborating with non-music audio show creators across the country.

Further, Kuku FM told Inc42 that it is not yet profitable as it recently released its subscription model, and said that it was looking to introduce ads for monetisation. In FY20, the company recorded zero revenue. “Since the launch of the subscription plan, our weekly subscribers are increasing. We are targeting to have about 100K paid users in 2021,” shared Bisu.

In the last ten months, the company said that it witnessed a 4.5x growth in terms of users, with over 1.5 Mn monthly active users (MAUs), alongside growing its team size from 20 to 50 employees, working remotely.

Sharing the roadmap ahead of the company, Kuku FM aims to produce about 200 exclusive shows in collaboration with various community creators, alongside making its services available in ten new Indian languages, including Telugu, Kannada, Malayalam, Oriya, Punjabi, Bhojpuri among others. “We will be the go-to platform for podcasters in India,” said Bisu, optimistically.

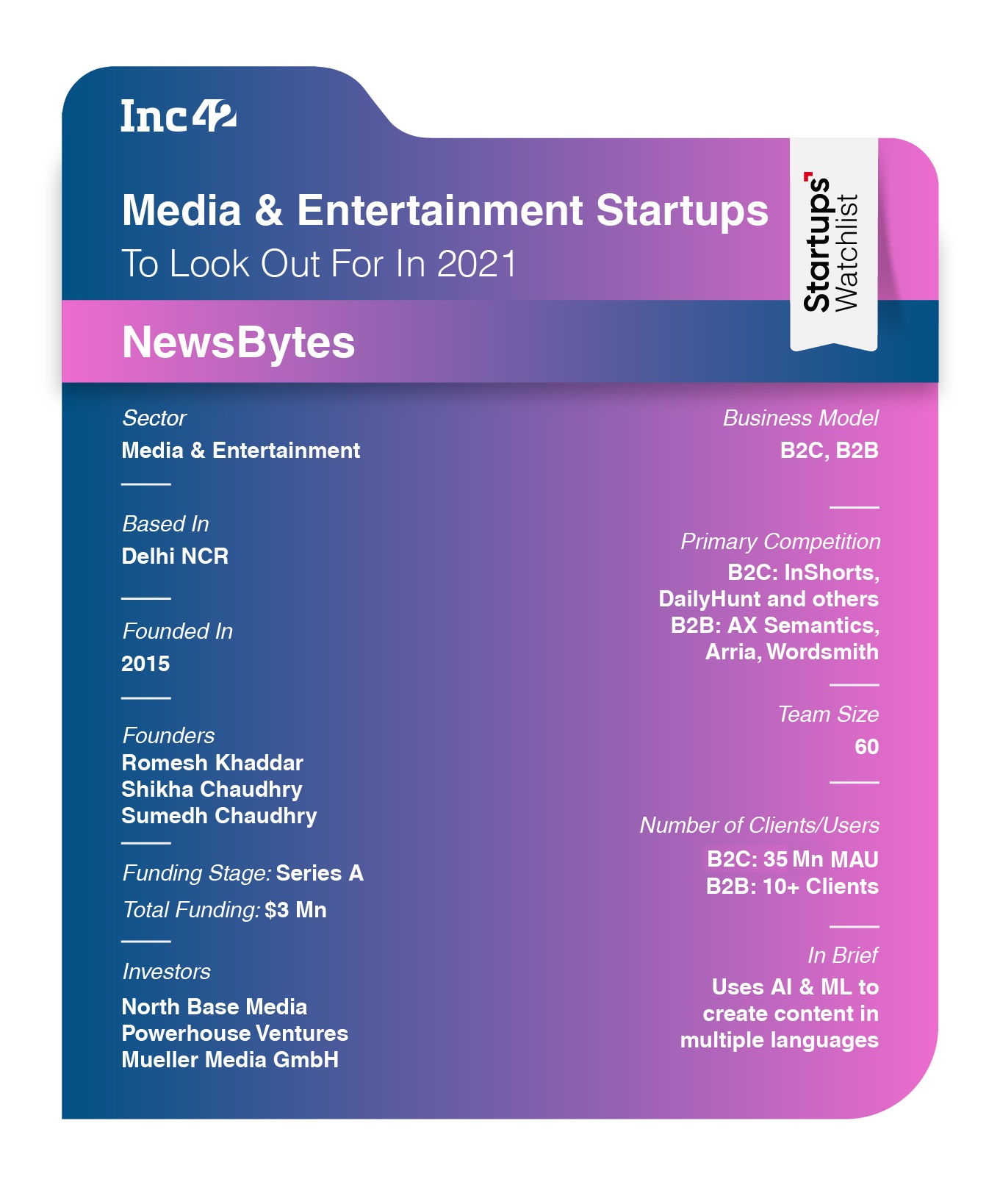

NewsBytes: Leverages AI To Create Content Across Media Formats

As a next-gen mediatech startup, NewsBytes is positioned differently from other digital media publishing houses, including InShorts, DailyHunt and others, where it claims to leverage AI and ML to create content in multiple languages. “We are solving the biggest problem engulfing the media market: producing good quality content, across media formats, with negligible human intervention,” said Romesh Khaddar, cofounder of NewsBytes.

In essence, NewsBytes is an amalgamation of two companies: one managing consumer-facing media platforms, which leverage content engineers to produce content, and the other is a B2B technology company, which is helping companies across sectors including media, ecommerce, edtech and others to create content at scale. The split of its business into two parts also came during the pandemic.

“The pandemic reinforced our core thesis, AI will be used extensively to create content. And, sooner or later, all companies will look for solutions to automate their content creation process and we want to be among the first ones to grab the market,” said Sumedh Chaudhry, cofounder of NewsBytes.

In September 2020, NewsBytes’ media business reached profitability, and looks to turn profitable at a company level by March this year. Further, the company revealed that it is in the process of closing another funding round to fuel growth in the coming months. “We intend to launch multiple products in 2021, starting with Fantasy XI users. Also, we have another surprise in line for our B2B customers, which would solve their ‘video problems,” said Shikha Chaudhry, cofounder of NewsBytes.

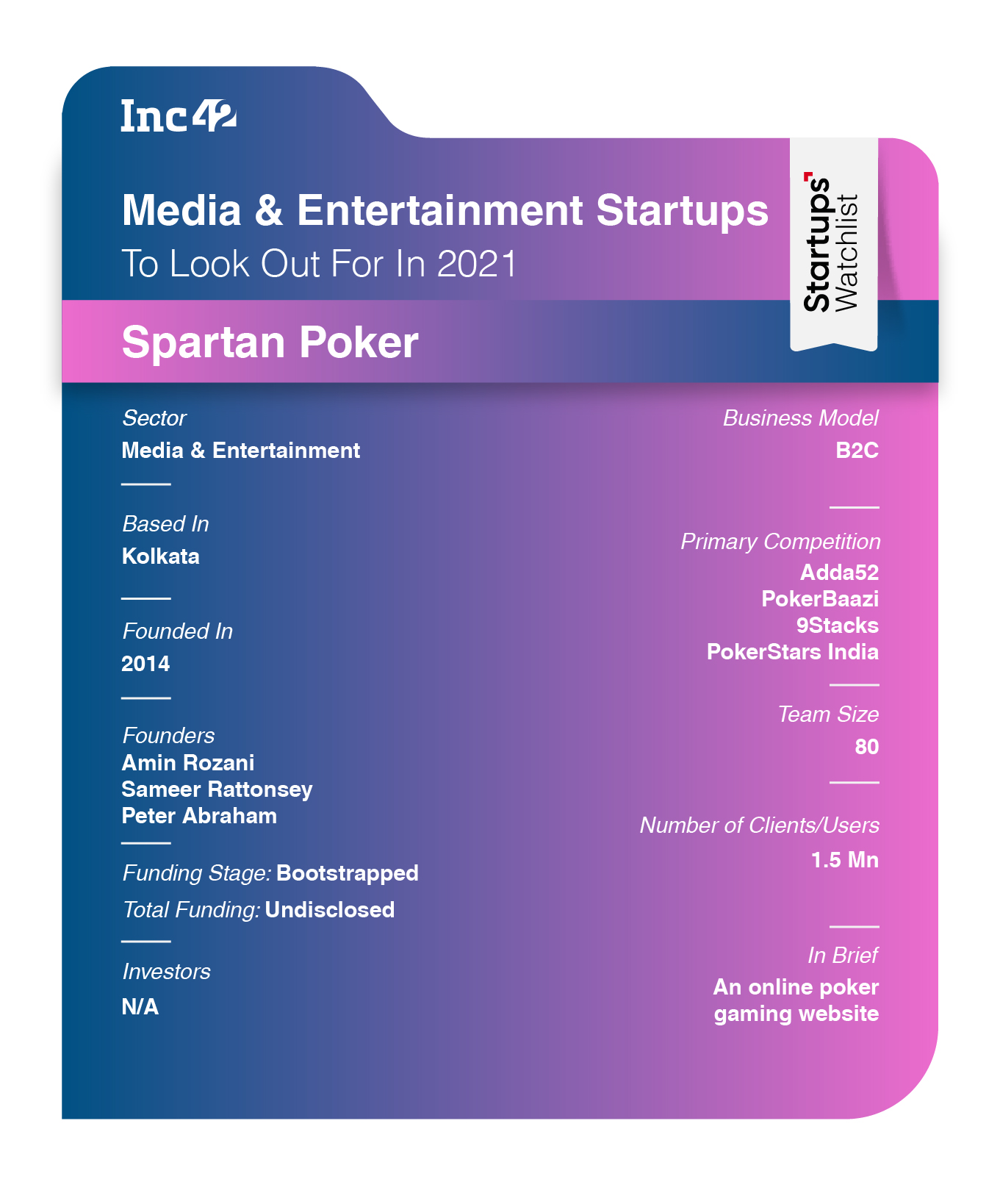

Spartan Poker: Offers Cash Games & Tournaments To Gaming Enthusiasts

Having been associated with the poker industry for over a decade, starting with live poker events in Goa, for Spartan Poker, hitting the online route was quite natural. As an online poker platform, the company offers cash games and tournaments to gaming enthusiasts across the country. One such tournament organised by Spartan Poker includes ‘India Online Poker Championship’, where it claims to register close to 2K players every year.

During the pandemic, Spartan Poker said that it witnessed a significant spike in traffic and new users. The company claimed that it serves a community of registered players with Random Number Generator (RNG) certification and CAPTCHA protection with an aim to provide a safe and secure platform. It earns revenue by charging a small commission against the entry fee or buy-ins.

Further, revealing the revenue numbers, Spartan Poker told Inc42 that the company’s revenue turnover in FY20 stood at INR 61 Cr, and aims to touch INR 80 Cr for FY21. With a database of 1.5 Mn users at present, Spartan is looking to attain over 10 Mn in the online poker ecosystem.

Recently, the company also became a part of India’s biggest poker network, Quadnet, which offers a white label solution to an online poker room. “Going ahead, we are looking to branch out into other gaming verticals to offer a full suite of games to players. We hope to expand our footprint into other regions around the globe,” said Amin Rozani, founder of Spartan Poker.

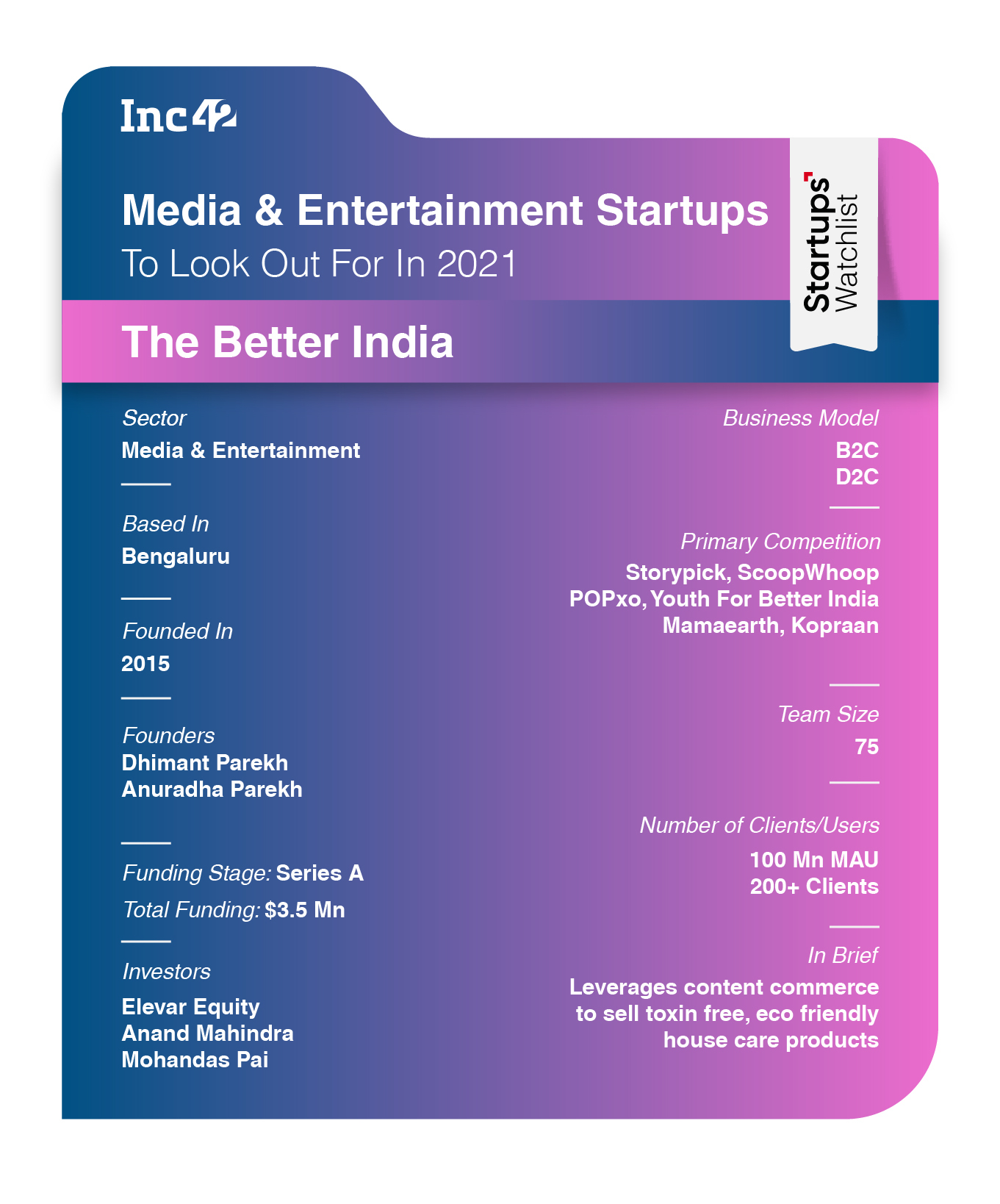

The Better India: Leveraging Content & Community For D2C Commerce

Digital media company The Better India, which writes stories in various languages including English, Hindi, Gujarati, Malayalam, around unsung heroes, changemakers, innovations, education, children, women empowerment, travel and other social impact sectors, currently has about 100 Mn MAU (180% growth from last year), where it engages with the users at a community level, sharing ideas and joining the environmental and social causes.

The outcome of multiple such engagements and research led to the start of eco-friendly, home care brand, ‘The Better Home’. With this latest integration, the company looks to target internet consumers, particularly the pet owners, young parents and eco-conscious individuals, who are environmentally conscious and are aware of the harmful side-effects of toxic chemicals and plastic waste generated by existing house cleaning brands.

The subscription-model has helped the company to remain sustainable and profitable, alongside raising the awareness of eco-friendly practices. In fact, in months of being operational, the company hit a monthly gross revenue of INR 1 Cr, and claims to have helped save 150 Mn litres of harmful chemicals, getting into the water bodies. Till date, the company has shipped products to over 402 cities across the country, and served 20K households.

Dynamic in its revenue streams, ‘The Better India’ earns revenue from brands it partners with to create content, while its home care brand ‘The Better Home’ earns from online sales of its products and monthly subscription from customers. Further, The Better India told Inc42 that its media business has been profitable for the last three years. On the other hand, its commerce entity, which was started early last year, is growing at a massive rate, with a clear path to profitability in the coming years.

“In the coming months, we will continue to scale the platform by fostering the community of 100 Mn users, alongside adding more and more regional audiences, and further push the adoption of home care brand ‘The Better Home’ to replace every household item with an eco-friendly alternative,” said Dhimant Parekh, the cofounder of The Better India.

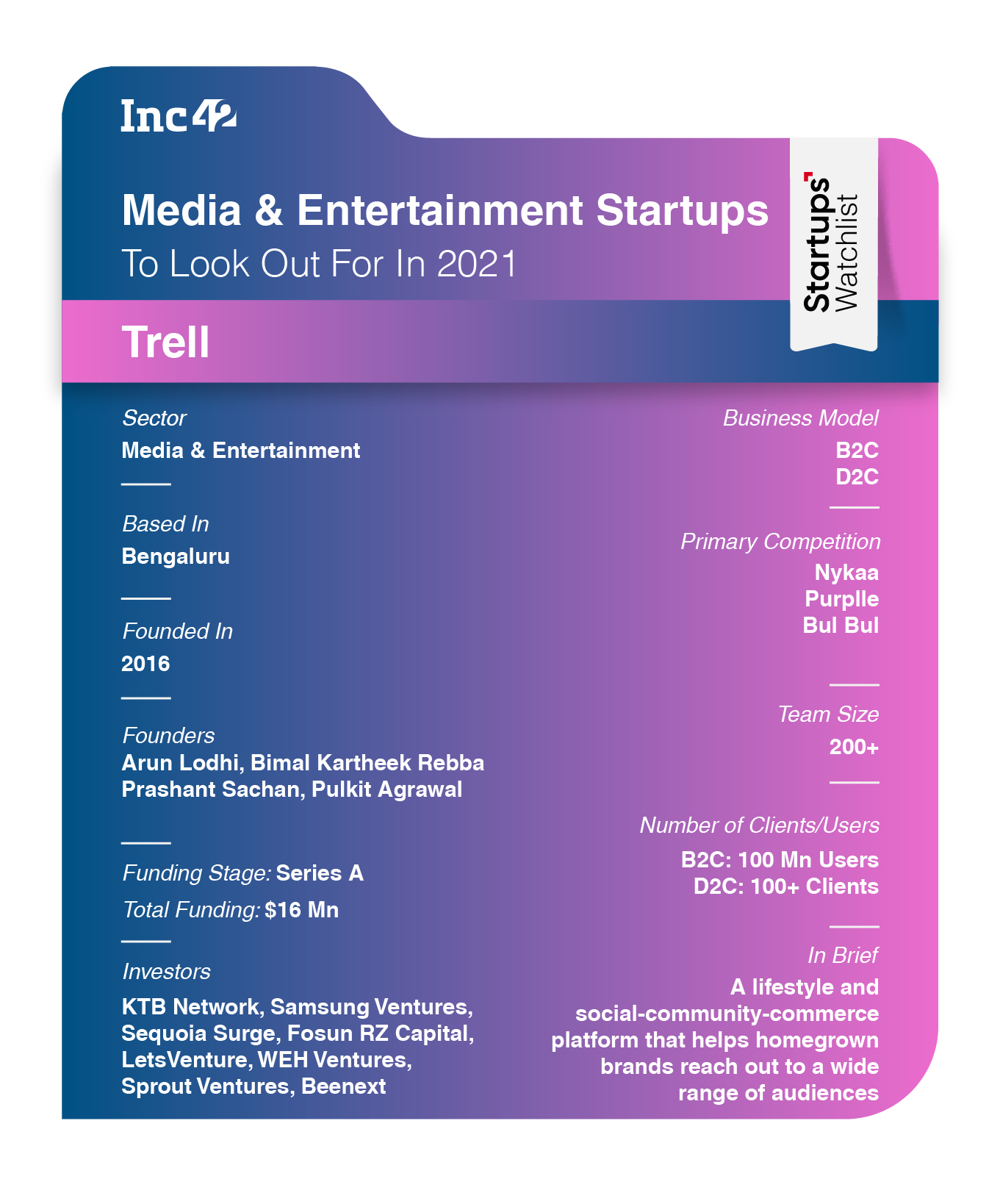

Trell: Lifestyle Community Commerce Platform

The popularity of Bengaluru-based lifestyle content commerce platform Trell surged last year after the government announced the ban on TikTok. At the time, the homegrown app was trending at number one spot on the Google Play Store under the ‘Free Lifestyle Apps’ segment, with over 45 Mn downloads. 2020 has definitely been an exceptional year for Trell in terms of growth.

“We grew to a community of 100 Mn+ users with over 40 Mn active users and 18 Mn content creators. We are currently present in over 75% of the country and have added three more languages to the platform,” shared Bimal Kartheek Rebba, the cofounder of Trell, stating that, parallelly, its team also grew 4x in the past few months to 200+ members, predominantly in the tech, data science, intelligence and community teams.

Similar to TikTok and a slew of other short-video alternatives, Trell also lets users share three minutes vertical videos around their experiences and interests across 20+ categories like fashion, personal care, food recipes, technology and gadgets among others. Users can create content in eight Indian languages. At present, Trell’s target audience is largely dominated by Indian women in Tier 2 and Tier 3 cities, particularly between the age group of 18-34.

But, the competitive edge for Trell is its social commerce integration, which enables users to gain insightful information, recommendations, and reviews from relatable peers around makeup, skincare, and personal care products that they can purchase directly from within the app.

Currently, its revenue model is based on community-led content commerce, where Trell acts as a curated marketplace for brands and their potential customers, and earns a small commission from the brand partnership/collaboration that happens on the platform. Some of the clients that it has worked with in the past few months, include Tinder, Plum, Vi, POCO, The Man Company, Games 24*7, Adda52, Dominoes, and Dr Vaidya among others.

Further, the company said that it launched the social commerce and monetisation vertical four months ago and is currently witnessing 100% growth MoM. With its current growth rate, the company is expecting to become operationally profitable in the next 24 months. “We aim to grow it further and provide the ability for millions of Indians to make a sustainable living from the platform and become ‘micro-entrepreneurs,” said Prashant Sachan, cofounder of Trell.

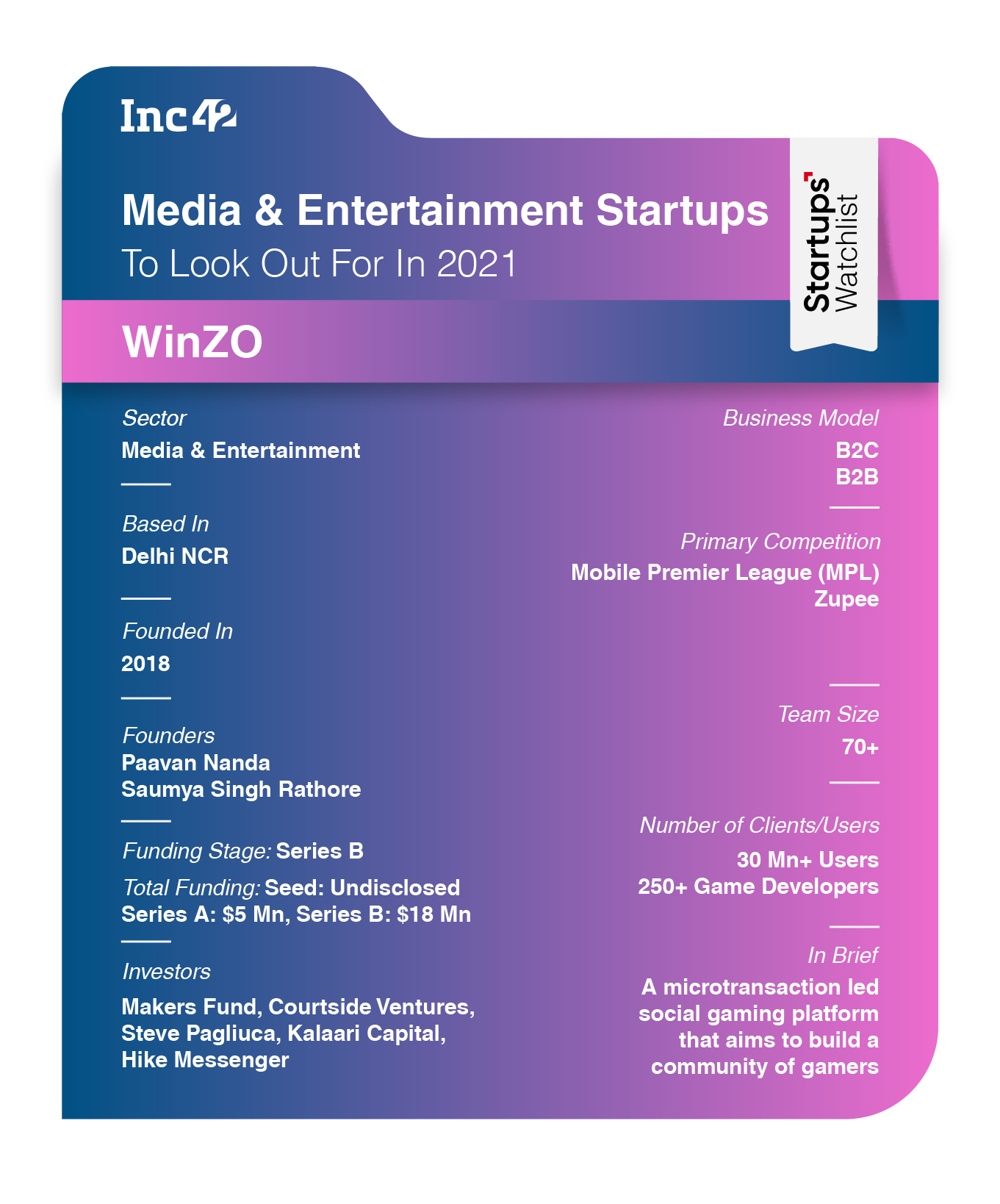

WinZO: Social Gaming Platform For Casual Gamers

With people locked in houses in most of 2020, and looking for avenues to connect with their families and friends in a more engaging manner, Delhi based online gaming platform WinZO quickly identified the opportunity and launched various board games like Ludo, Rummy, Snake and Ladder among others.

Besides board games, WinZO also quickly responded by adding features like tables/groups on the platform so that its users could invite friends, family members to chat and play. “This was an instant hit for us and we saw a 30% surge in our engagement during the first three months of lockdown,” said Paavan Nanda, cofounder of WinZO.

Another interesting aspect of WinZO’s business is to provide alternative and more efficient models of monetisation for the game developers’ community. “Our micro-transaction based monetisation model offers much higher efficacy as compared to the traditional models of game monetisation such as In-app purchases (IAP) and advertisements,” claimed Nanda, stating that its Games Console has helped developers earn up to 10x more revenues from the same games compared to their Google Play Store and App Store revenues.

Today, WinZO has registered user base of 30 Mn+, who are clocking 1 Bn+ micro-transactions in a month, added Nanda, stating that 90% of the traffic comes from Tier 2 Tier 3 and 4 cities, where it is used in local languages by more than 80% of its users.

From launching one mobile game, with 1 Mn total registered users and seven employees in 2018, WinZO has come a long way from where it all started. In 2019, the company grew to 30 employees, 10 Mn+ registered users and added 25 mobile games. Last year, it grew to 70 employees, 30 Mn+ registered users and added over 70 mobile games. In FY20, its revenue clocked $350 Mn.

Recently, with the announcement of its $5 Mn Game Developer Fund II, WinZO looks to double its user base by 2021. “In 2021 our top priorities would be to provide a more diversified portfolio of games, democratising esports to all casual gamers, and building a sustainable micro-influencer community,” concluded Nanda.

Editor’s Note: The startups were selected on the basis of editorial discretion, keeping in mind various factors such as revenue growth, profitability, funding stage, pivot and growth of the companies in the preceding year among other factors, and have been weighted thoroughly on the basis of the performance of the companies, and some of the information was also gathered from public and private sources.

Ad-lite browsing experience

Ad-lite browsing experience