SUMMARY

India currently has 95 OTT platforms across video, music, podcast and audio streaming category

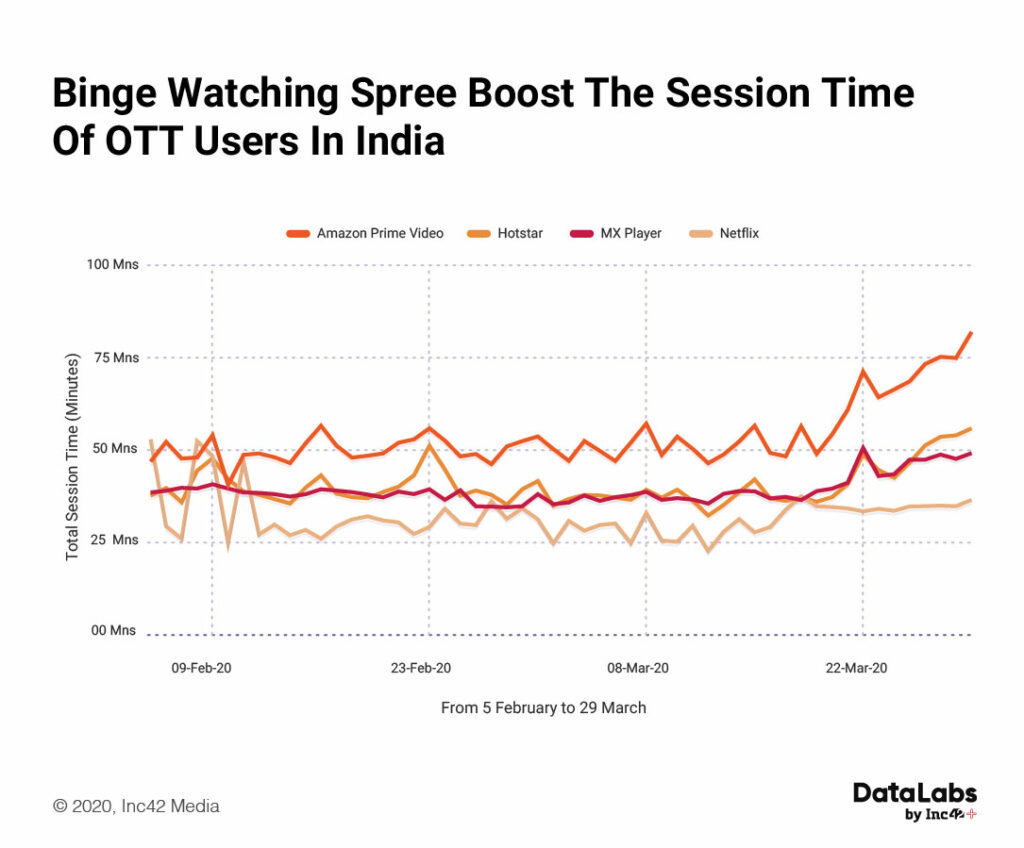

The average time spent by Indian users on OTT platforms has increased by 30-60% since early March

In our latest report, we have provided a detailed analysis of India’s OTT landscape, players, business models, future trends and much more

Gone are the days when we had to wait for blockbuster movies to be released on the big screens or had to wait for an entire week to catch up on the latest episode of favourite television shows. Over the top (OTT) streaming platforms such as Disney+ Hotstar, ZEE5, Netflix, Amazon Prime Video, along with local players such as BIGFlix, Alt Balaji, Voot, Spuul, Eros Now, SonyLIV, Sun NXT, Hoichoi, Ullu, MXPlayer among others have redefined the way Indian audience consume content.

Binge-watching which is an even-popular trend among the millennials and Gen-Z has taken centre-stage. With Covid-19 in the picture, the OTT platforms have witnessed a massive boost in terms of increased viewerships, new subscribers and newer audiences are flocking towards on-the-go content, much differently, be it music, video and podcast consumption.

In our latest report — ‘India’s OTT Market Landscape Report 2020” we have provided an in-depth analysis of the rapidly evolving OTT market in India, along with a detailed overview of the future growth opportunities in this segment.

The report touches upon various aspects of India’s OTT landscape (video, music, audio and podcast), the key players, business models, content offerings and consumer preferences, Covid-19 impact, vernacularisation, and future trends among others. In addition to this, the report covers the landscape of music streaming platforms, kids OTT market and more.

Explore This Report With Inc42+

Glimpse Of DataLabs’ India’s OTT Market Landscape Report, 2020

With high bandwidth internet, low mobile data tariffs and access to the best smartphones and upcoming technologies, the urge to consume content on-the-go is growing faster than most content creators can keep up with. This has opened up an ever-rising opportunity for over-the-top (OTT) streaming players in India for both B2B and B2C segments.

Between March and November 2019, around 30 Mn internet users came online for the first time from rural areas. This is in addition to around 71 Mn users (out of total 504 Mn internet users) in the age bracket of five to 11 years using internet services on devices owned by family members.

This is a whole new segment for OTT players to target as well. The available untapped market is too big for a few players to capture, which explains the high density of startups and companies in the OTT space. The addressable base for these platforms is still largely untapped and even new users are trying new platforms to test the waters through discounted plans and free trials.

Today, the consumers are spoilt for choice as OTT and music streaming platforms are providing seamless access to on-the-go content consumption, along with the personalised experiences targeting the right mix of audience based on their streaming habits and profile. This, in a way, has created a stickiness among the users, wanting for more.

Each OTT player in the Indian market is finding its own niche and struggling with its own challenges. International players like Netflix, Amazon Prime, MUBI, SonyLIV, Apple TV+ and others are trying to balance pricing with their content library, whereas the likes of MX Player, Airtel Xstream, YuppTV, JioTV, ZEE5, Voot, Disney+ Hotstar, JioCinema, Sun NXT, ShemarooMe, Hungama, Hoichoi and others are fighting it out over regional language content and Indian originals.

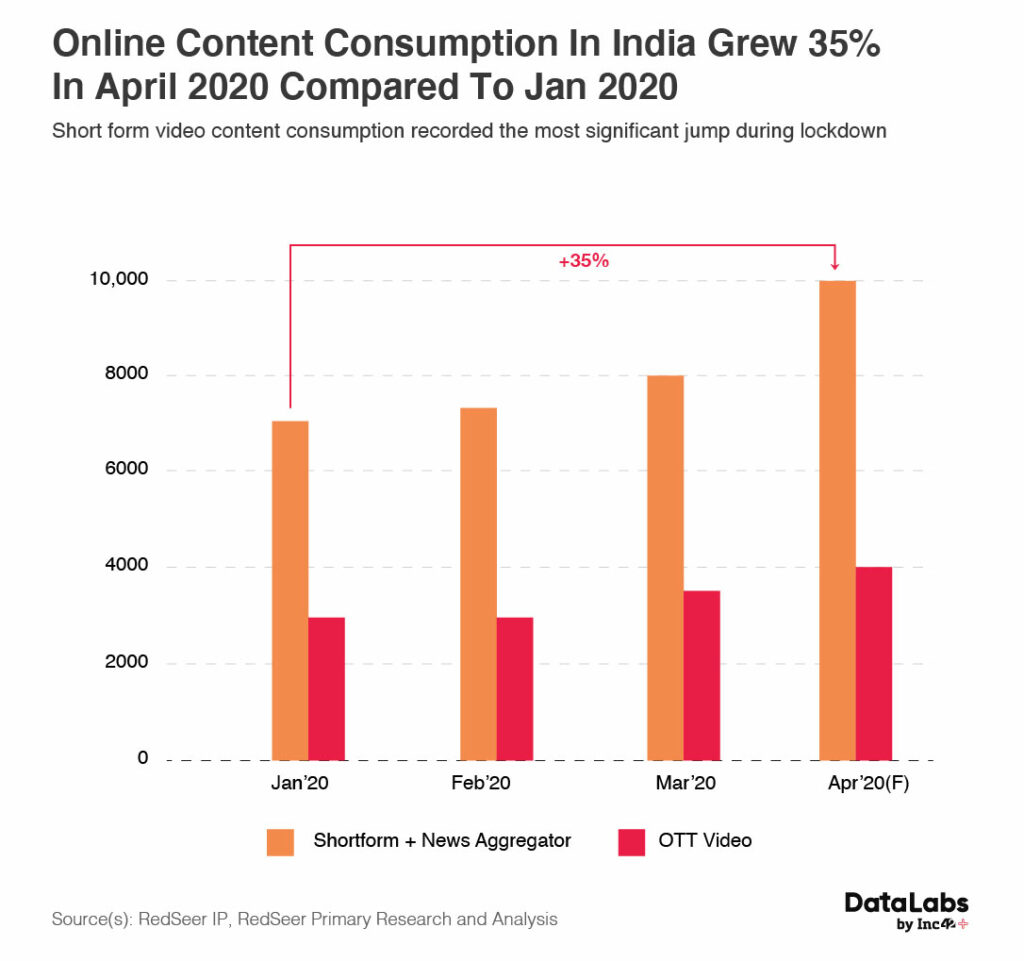

According to Redseer, the online content consumption in India grew 35% in April 2020 compared to January 2020. It further stated that short-form video content consumption recorded the most significant jump during the lockdown.

How Much Time Are Indians Spending On OTT Platforms?

According to the Boston Consulting Group (BCG) and CII report, the average digital video consumption in India witnessed a 2X growth in the last two years. The report also mentioned that on average time spent in video consumption by Indians increased from 11 minutes to 24 minutes per day (as of November 2019).

The time spent on OTT streaming has increased significantly, where the content consumption across most platforms, including OTT, podcast, gaming have witnessed an average increase of 30-60% since early March.

How Are Indian Users Paying OTT Platforms?

Indian users as we know are more inclined towards consuming free content over paid subscription platforms. Keeping this in mind, many OTT players, today, are experimenting with subscription-based video-on-demand (SVOD) business models, be it monthly, yearly or bundled with telcos and other distributed platforms etc. This includes the likes of Amazon Prime Videos, Netflix and others.

At the same time, many OTT players are sticking to advertising-based video-on-demand (AVOD), while a few are sticking to freemium business models, and hoping to convert them into paid users, once they are hooked onto the platform.

Content Offering & Language Segmentations

A lot of OTT players are shifting their focus towards localisation of their platforms, to be able to connect with the Indian users, be it in terms of regional languages, geography and user experience etc. Predominantly, most OTT video streaming players are looking at Hindi, Tamil, Telugu, Marathi and Bengali as the most-preferred languages.

DataLabs by Inc42+ revealed that except for the seven core regional content providers, including ALTBalaji, Sun NXT and Ullu and others, 21 other OTT players have English as a core content focus.

When Binge-Watching Goes Viral

As social distancing and work-from-home continue to prevail, the shows watched on the OTT platforms have turned into conversation starters across the country, and globally. Also, many movies are now being released on OTT platforms and are creating a lot of buzz on social media platforms. According to industry experts, this trend is going to stay as the fear of pandemic continues to keep people away from the theatres and cinema halls.

According to KalaGato, OTT platforms are experiencing a surge in demand that’s never seen before. Streaming platforms are taking the complete advantage of the situation and coming up with newer content strategies and shows to keep users hooked onto the platform. For example, Eros Now reported close to 80% growth in data consumption and it is up by 200% on subscriptions in just a couple of weeks.

Also, Disney+ within five months of its launch claimed that it has reached 50 Mn+ subscribers, which includes 8 Mn+ subscribers in India.

Covid-19 Impact And Future Trends

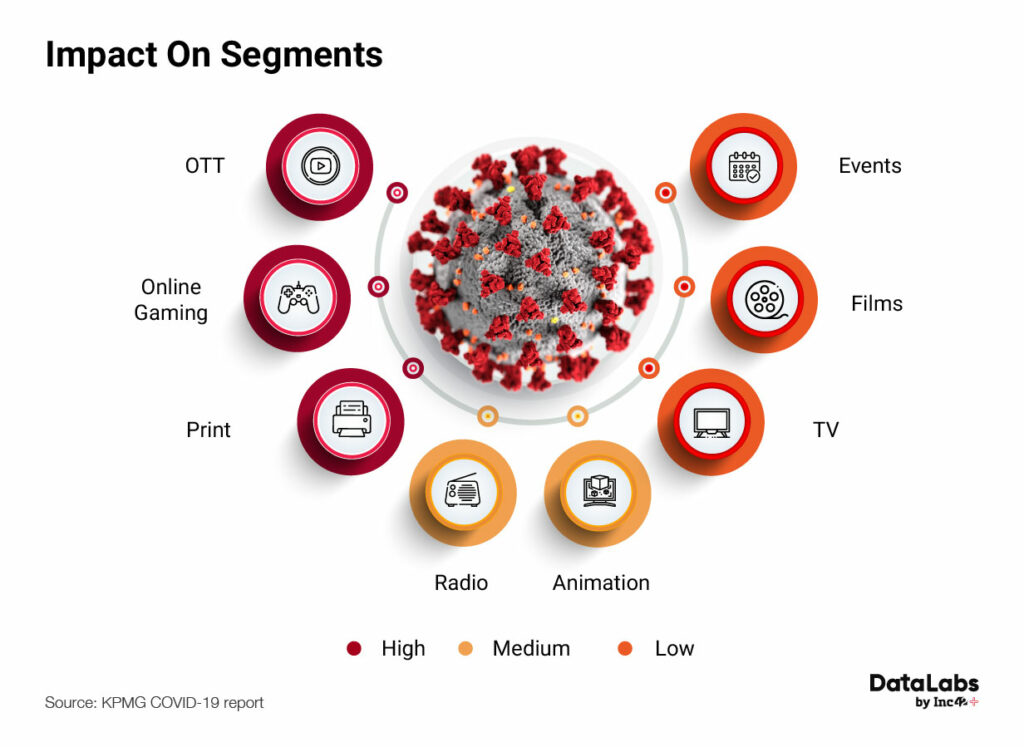

With people being homebound, consumption of media and entertainment – and digital entertainment in particular has seen tremendous growth. TV, online gaming, music streaming, podcasts and video streaming platforms are becoming the top choices for at-home consumers to kill their time.

The OTT landscape looks promising with a lot of players, both local as well as international companies trying to come up with innovative ways to attract new users and retain existing users on the platform, and are creating an immersive experience with the integration of AR/VR technology; new business models; new content strategy, where influencers are turning into OTT content creators and more.

Find out all the predictions about the future of the OTT industry in India.

Explore This Report With Inc42+