India’s ban on 59 Chinese apps brings tech products into the Indo-China geopolitical battle

Namaste,

The anti-China sentiment in India touched a peak this week as the Indian government cherry-picked 59 Chinese apps and banned them from India over alleged data security concerns. Some saw it as the win for nationalism, others called it a regressive protectionist move — whichever camp you fall in, one cannot deny that it is arguably the first ever instance of India flexing its digital consumer muscle in a geopolitical fight.

India is using the promise of a billion users to turn the screw on Chinese companies that have been thriving in India. After negative headlines over the martyred soldiers in Ladakh throughout June, the Indian government turned the debate on its head with the ban. The fact that the ban was announced under Section 69A of the IT Act which empowers the government to block any content in the interest of the country’s defence. Given that, is the underlying sentiment behind the ban one of national security or data sovereignty? That’s the question many are now asking.

For one, it’s not only these 59 apps from China that have questionable data storage and data sharing policies. Apps and companies outside China such as Zoom, Facebook, Twitter, WhatsApp, Amazon, Google and Apple have also been central figures in well-publicised data scandals — whether surreptitiously listening to users on smart devices, tracking their location or using user data to feed propaganda. And yet these US tech giants continue to operate in the country without any threat of a ban, other than the government’s advisory against the use of Zoom for official purposes and pending cases against WhatsApp and Facebook.

Even if we just concentrate on the threat from Chinese government, the list does not seem exhaustive by any means. The biggest link in the data value chain are cloud servers and Chinese companies such as Alibaba and Whale Cloud have been completely left out of the discourse. So as far as bans go, the 59 unfortunate apps seem to have been cherry-picked to garner the biggest headlines.

In fact, many other Chinese apps with similar publicly-debated data security concerns continue to operate in India. This includes the likes of Mafiacity, Turbo VPN, Last Empire, ZakZak Pro, UpLive, Togetu, Guns of Glory, and the most interesting one Bytedance-owned Resso — ByteDance also owns TikTok and Helo, both of which were banned.

While the press release gives us some indication of the reasoning behind this ban, it’s not clear how the government will rationalise the decision in the actual orders. “Section 69A only allows national security and related grounds to be used for a ban, but the government still has the onus to make a proximate connection between user privacy and national security,” noted Gurshabad Grover of the Centre for Internet and Society.

However, Rule 16 of the law places a confidentiality obligation on intermediaries (online services) that receive such orders. Which means that the actual orders in this case might never be released in public.

Influencers Reboot

Beyond the implications for the companies behind the apps — at least the ones present in India — the decision has impacted millions of Indian influencers who were earning a living directly through TikTok, Kwai, Helo, Likee and Bigo Live, or those Clash Of Kings players that had a substantial following on social media.

According to a Techcrunch report, the 59 banned Chinese apps were installed about 330 Mn times till the last quarter (ending June, 2020) and had a combined monthly active user base of 505 Mn in June. TikTok, which has been reported to have 200 Mn monthly active users in India, made up the bulk of these numbers.

Out of these, about a million Indian TikTok users are estimated to be dependent on the platform for income, according to influencer marketing platform Zefmo Media. The firm also added that average earnings per post for a TikTok creator is around INR 1,000. But that’s just scratching the surface. Top Indian influencers like Riyaz have reportedly even earned $125K per post. According to OnlineCasinos.co.uk, Riyaz, who has over 25 Mn followers, is among the top ten earners on TikTok this year and he’s not the only Indian on the list.

According to Zefmo CEO Shudeep Majumdar, influencers will now have to slug it out for a piece of the hyper-competitive market on Facebook, Instagram and YouTube. And standing out here is far tougher than TikTok. Creators will have to rethink their content strategy accordingly.

Bolo Indya, which is billed as another Indian alternative to TikTok, noted that it has over 50 influencers on the platform with over 3 lakh followers. This is a drop in the ocean compared to TikTok as seen in the list of top creators above. New TikTok influencers joining Bolo Indya would not only have to compete with existing creators, but also establish their audience anew.

The Hunt For Alternatives

Following the ban, investors like Balaji S Srinivasan, the former Coinbase CTO and board member of Andreessen Horowitz, Nexus Venture Partners’ Pratik Poddar and Accel India’s Prayank Swaroop publicly declared their intentions to back Indian alternatives to the banned apps. This seems justified considering that at least 15 of these Chinese apps used to regularly feature on the top 50 lists on the Play Store, and had a sizeable audience.

The demand for these apps is also apparent in the overnight surge in the user base of Indian alternatives. On Monday evening, TikTok rival Chingari cofounder Sumit Ghosh noted that the platform was witnessing 100K downloads per hour. Similarly, Sequoia Surge-backed Trell, which is also building a social engagement platform, garnered 1 Mn downloads, while Mitron, one of the TikTok alternatives that shot to fame earlier, raised a fresh round of funding from 3one4 Capital. Homegrown social media platform ShareChat also launched a TikTok alternative called Moj.

TikTok was so hugely popular because it penetrated deep into the Indian market and allowed regional language creators to shine. Even from the perspective of brands, TikTok served as a window to reach Tier 2 and 3 cities in India and even small villages. While influencers may attempt to make the shift, will global brands be attracted to these alternative Indian platforms?

Further, if these alternative platforms are not able to offer TikTok-like reach and revenue opportunities, why would any Indian consumer stick to these platforms in the long term? As SlideShare cofounder Amit Ranjan pointed out recently, tailwinds like nationaist sentiment and the app vacuum won’t last forever.

It is only a matter of time before global companies like Facebook or Google add features similar to TikTok and then the whole competitive advantage for Mitron, Chingari and others of their ilk will be lost. “No country ever became a source of innovation by taking protective measures. That just rewards mediocrity as it happened during License Raj. Build solutions around genuine people problems, not copy cats,” said Kunal Khattar, partner at AdvantEdge VC.

What Is Indian?

The second order impact of this ban is the stigma that’s suddenly attached to Chinese apps or Chinese-funded startups — not unlike how non-conformists are branded ‘Pakistani’ in online political debates. But, is it right to boycott Indian companies just because they took money from Chinese funds? Should it not be enough that the company is making for India and driving value in the Indian market?

Ayush Jaiswal of Pesto argues that global investments are necessary to drive startup growth and help new models mature. Without foreign investors, startups have to concentrate on the smaller pool of investors from India. David Dollar of the World Bank concluded in his paper titled Globalization, Poverty, and Inequality since 1980 that global investments have helped developing countries like India achieve rapid GDP growth and bring down poverty to a large extent.

It is important to understand that while protectionist moves such as bans on foreign apps and products might seem appealing in the short term, in the longer run, they could impact the growth trajectory of many tech products and startups.

As Alok Mittal of Indifi said, “This is a regressive step, and scary that startups are now a foreign policy tool. First, banning Chinese venture capital, and now apps. The axe swings both ways. #BuildRealCompetitiveness.”

Digital Bharat

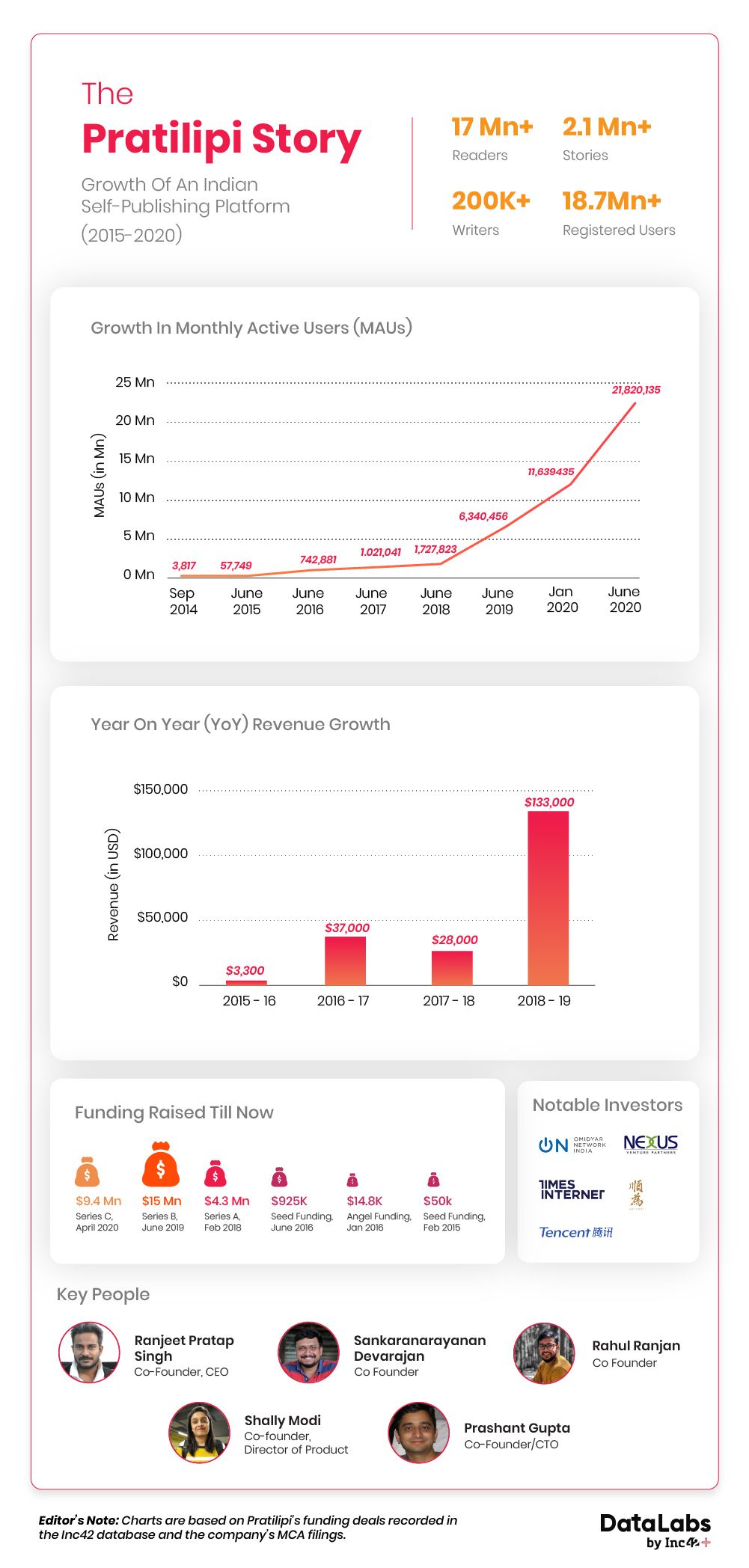

The broader anti-China sentiment is expected to continue to fuel Indian app and product adoption for the next few months. When it comes to growth though, it is the lockdown that has been the bigger catalyst, as witnessed at Bengaluru-based Indian language self-publishing platform Pratilipi. CEO Ranjeet Pratap Singh recently tweeted, “20 Mn+ Monthly Active Readers on Pratilipi, it took us about 5 years to get to 10 Mn MAU and then about 5 months to get to 20. Slowly, slowly then all at once.”

Here’s a look at Pratilipi’s growth story so far:

Watch out for our upcoming inside story on Pratilipi’s growth.

Digital Debates

Zoom is not one of the apps that has been banned by India over alleged data security concerns, despite the fact that Zoom admitted to sharing data with the Chinese government in the past. But now that Reliance Jio has launched JioMeet, perhaps Zoom needs to rethink its strategy in India. Given the uncanny resemblance between JioMeet and Zoom’s, Mukesh Ambani seems to be positioning JioMeet as a like-for-like replacement to the world’s most famous video conferencing app.

As border tensions between India and China spill into other domains, Indian news publishers asked the centre to ban all news platforms in India that have Chinese investments. This is in response to the Chinese government blocking access to Indian news portals. Further, union minister Ram Vilas Paswan, instructed officials that any item made in China should not be purchased through the government e-marketplace (GeM) or any other sources.

There is also a plea in the Delhi high court seeking to display the country of origin for all products on ecommerce platforms like Amazon and Flipkart. Many have also expressed concerns that India’s ban could invite retaliation from China, impacting Indian IT companies as well as startups such as OYO and RateGain, that have operations in China.

However, China’s ministry of commerce spokesperson Gao Feng confirmed on Thursday that China has not adopted any restrictive or discriminatory measures against Indian products and services. But, he did claim that India’s actions are in violation of WTO rules. In addition to Feng, Chinese foreign ministry spokesperson Zhao Lijian had said that India has a responsibility to uphold the legal rights of international investors including Chinese ones.

“The practical cooperation between China and India is actually mutually beneficial and win-win. Such a pattern has been artificially undermined and it is not in the interest of the Indian side,” Lijian added.

Meanwhile, some of the 59 banned Chinese apps including TikTok and ClubFactory are reportedly set to approach the Indian government to clarify their position in relation to Indian data laws and regulations. Meanwhile, TikTok India spokesperson confirmed that the company has no plans to pursue legal action, and could even invest further in India towards engineering and R&D.

Digital Future

While this month might be dominated by TikTok-like Indian apps, the month of June brought some interesting Covid-specific innovations to light — particularly in edtech, fintech, enterprise tech, media and entertainment, and agritech.

As in the past few months, Inc42 has curated a list of 30 early-stage startups that show the most promise in recent times. These startups not only have momentum on their side through traction and seed investments, but many have found the right product-market fit as well. A whopping 63% of the startups on this month’s list have B2B models, while more than half are from fintech, enterprisetech, media and entertainment, and agritech.

After our message of hope last week, we have been trying to look at the world with a sunnier disposition. So even as our smartphones look a lot different at the end of this week, we hope to see inspirational growth stories such as Pratilipi emerging from India in the months to come.

Bye-Bye,

Yatti Soni

Ad-lite browsing experience

Ad-lite browsing experience