After multiple pivots in the past, ecommerce unicorn Meesho’s latest bet is on the marketplace model ahead of a key festive season and changes in its revenue model

The retreat from SuperStore is symptomatic of Meesho’s appetite for entering buzzing segments, even though the company lacks the right resources or expertise for them

As it focusses on ad revenue for profitability, Meesho will need to acquire a ton of users and sellers from Tier 2/3/4 cities where inflationary pressures are most severe

Reseller platform, social commerce, B2B commerce, live commerce, a brief fling with grocery delivery, and finally a marketplace — there’s no ecommerce model that Meesho

And now the company founded by Vidit Aatrey and Sanjeev Barnwal and backed by Y Combinator, Sequoia Capital, SoftBank, Prosus, Meta, Fidelity Management and B Capital among others is on a precipice, similar to many hulking giants of the startup ecosystem.

In late 2021, reports claimed that Meesho hired investment banker Morgan Stanley to lead talks for a $500 Mn-$1 Bn funding round at a valuation of $8 Bn. But that seems to be another time and era now. Like BYJU’S and others, Meesho is also said to be facing a downround — as much as a 25% haircut on its previous $4.9 Bn valuation — according to a report by The Morning Context.

After raising nearly $1 Bn, Meesho is, in many ways, starting from scratch again — as revenue from social commerce remains untenable given the 0% commission promise, Meesho’s new focus is on becoming a platform akin to Amazon and Flipkart and earning ad revenue.

While Meesho has always been an ecommerce marketplace, it’s focus has been on sellers and resellers selling through social media links, but now, it’s looking to bring consumers to its platform.

CEO and cofounder Vidit Aatrey has come under the spotlight and not just due to the intense pressure to prove its marketplace pivot. Aatrey has entered social media battles in the past few months, particularly railing against critics, and also alleging smear campaigns against Meesho, and even sending legal notices.

Part of the reason for this intense pressure is because of how many times the company has overhauled its model. Through its many experiments in ecommerce, Meesho continues to claim that it is making a huge impact in the ecommerce space, but how many of these claims hold water and can the SoftBank-backed company actually live up to its huge valuation?

The Case For Meesho: Why It Raised Nearly $1 Bn

Founded in 2015, Meesho became the poster boy for social commerce and the anti-marketplace models that were emerging in the Indian market between 2016 and 2018. A lot of these companies raised millions of dollars from investors looking to break the duopoly of Amazon India and Flipkart, particularly as one-time equals Snapdeal and Paytm Mall moved away from directly competing with these two giants.

This allowed room for platforms such as Meesho and others. Even till 2020, the social commerce segment in India was growing rapidly, with YouTube-acquired SimSim, GlowRoad, Sequoia-backed Trell, Tiger Global-backed DealShare, Elevation Capital-backed CityMall and Bulbul garnering more than enough attention from customers and investors.

Meesho’s model involved bringing on board mini-influencers or resellers that sold products within their close network or their friends and family. In exchange for products bought through affiliate links shared through social media platforms, Meesho resellers would get a commission on the sale. The startup primarily targetted women who aspired to run their own business from the comfort of their home, but lacked the funds or expertise to get the reach or the products.

The model was indeed promising for its time. Ecommerce was flourishing in post-demonetisation India — UPI and cashless payments had solved some of the hurdles, while on the logistics front, technology and automation had organised some parts of the largely unorganised market. The short video and social media boom had given way to social commerce.

Indeed, many media and content businesses were being built around the potential for earning revenue through affiliate marketing. It was a tried and tested model that seemed to work as long as there was a right push from the content creator.

So it’s no wonder then that these marquee investors joined the bandwagon in the hope of unearthing the next Flipkart from India.

But social commerce did not stand the test of time. Meesho-like platforms have had to pivot several times or look for acquisitions to exit the space. The lack of positive unit economics due to high logistics costs and operational challenges, as well as the lack of trust among the mainstream ecommerce audience for non-branded resold items, meant that Meesho had to target a different segment outside the metros and Tier 1 cities.

But reaching the Tier 2/3/4 audiences and getting them to transact does not come cheap. And not enough attention was paid to the quality of products, which led to cases where customers filed police complaints about fake orders and counterfeit products.

Keeping Up With Meesho’s Avatars

At the time of raising its unicorn round in April 2021, Sumer Juneja, who leads SoftBank’s investments in India said that Meesho has shown growth in daily engagement metrics, unit economics and the ability to create a strong team in the last 18 months. “We believe Meesho provides an efficient platform for SME suppliers and social resellers to onboard the ecommerce revolution in India and help them provide personalised experience to consumers,” he added.

Following that round, the company’s valuation more than doubled to $4.9 Bn in less than five months after it raised another $570 Mn.

At the time the startup claimed to be on track to reach 100 Mn monthly transacting users by December this year, and said the funds will be used to grow the technology and product teams by 2.5x and increase its roster to 50+ Mn products. Meesho also said it would be looking to expand its groceries and FMCG offerings (now named Meesho SuperStore) to 200+ cities.

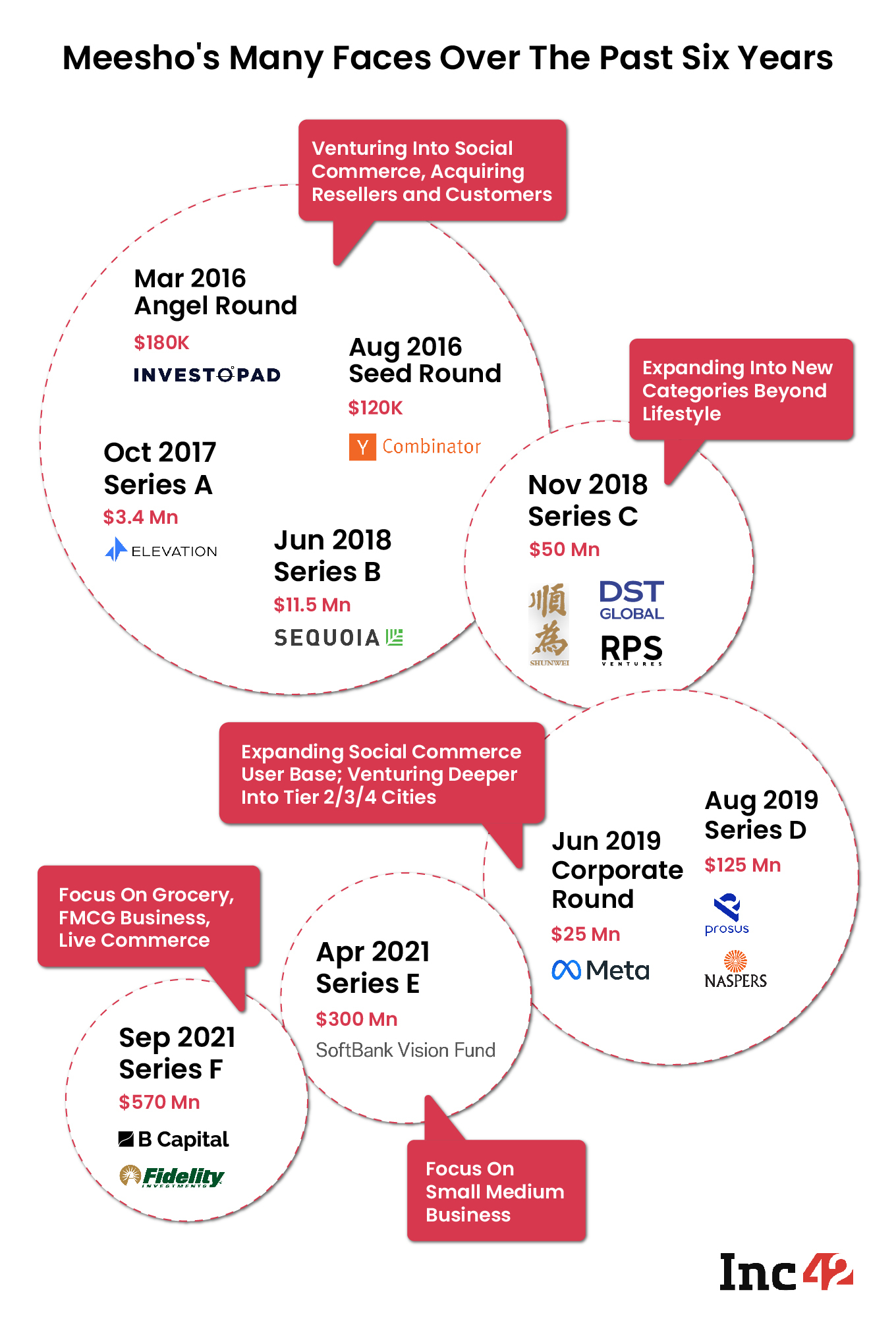

To date, Meesho has raised about $985 Mn funding, but with each new round, it has tweaked its model — going from a pure social commerce focus to a marketplace and dabbling in grocery and FMCG supply and has plans to enter live commerce too by the end of 2022.

But none of its big bets have really worked so far considering the state of Meesho’s financial performance.

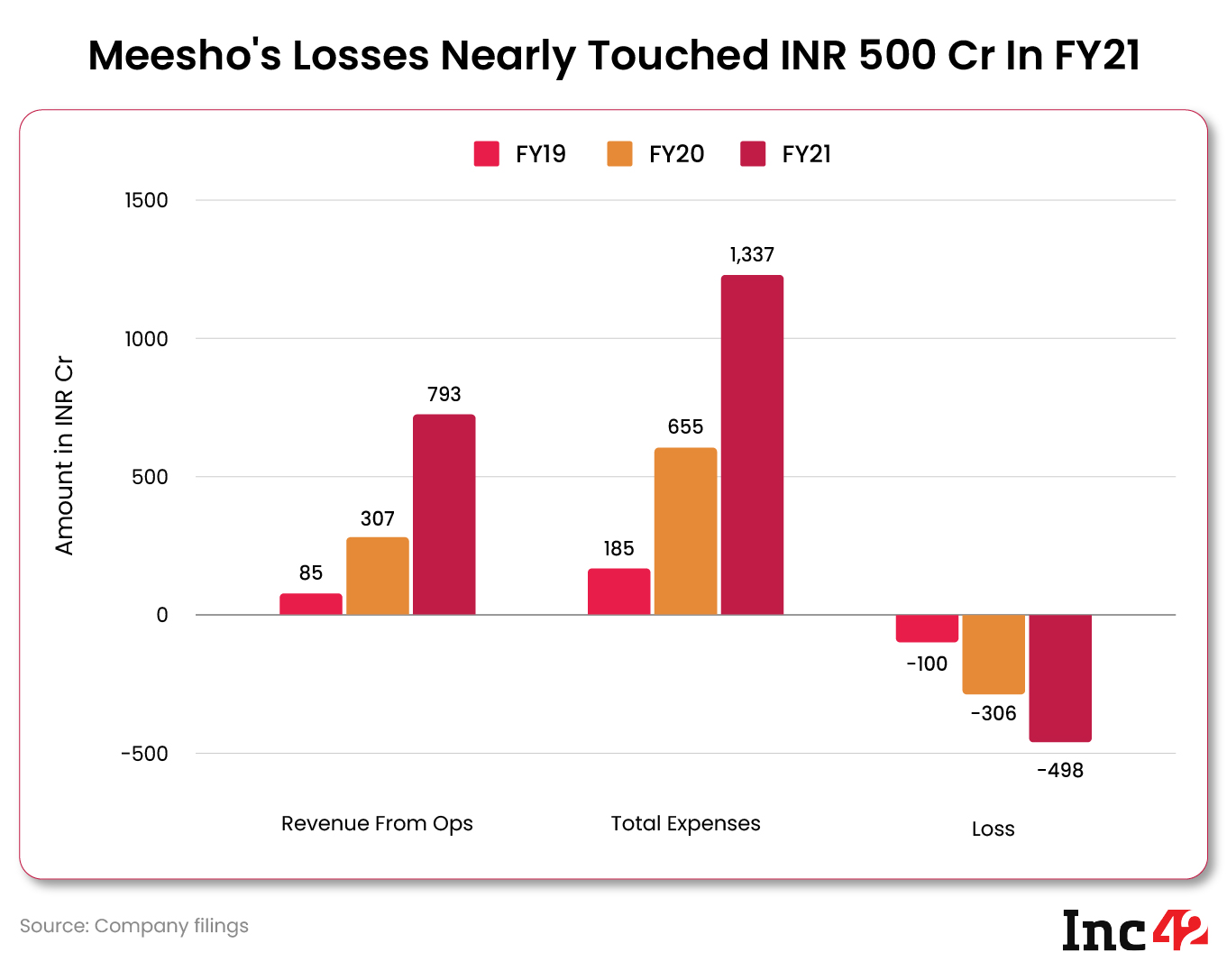

Despite plans to go public soon, Meesho is mired in losses — the loss after tax of INR 498.6 Cr in FY21 was 62.5% higher than FY20. The company has not yet released its financials for FY22, but if the down round is a real possibility, then it does not fill us with too much confidence about lower losses.

The company claims that it noticed an uptick in platform orders in 2020 and 2021, which forced it to cater to this consumer base, in addition to its seller-based model.

“In January 2021, for example, we saw a 1,600% year-on-year increase in direct-to-platform orders. As a business, we saw immense potential in catering to this demand and started to fulfil consumer orders directly. Put simply, it wasn’t a pivot, but organic growth seen from our end-users,” a Meesho spokesperson claimed in response to our queries.

Meesho did not respond to many questions about the business performance of its core platform or SuperStore. Inc42 has not carried Meesho’s replies in full due to the long-winded nature of some of the responses, however, the numbers claimed by the company have been added wherever relevant.

Ecommerce Shivers In Funding Winter

Super high valuations that were so routine in 2021 are simply not around in 2022. Not only has the pace of unicorn creation slowed down, but those startups that do not have a steady product-market fit are struggling to even bring investors to the table, no matter what reputations the startup or their founders carry.

Investors have already warned about these challenges becoming roadblocks for startups looking to raise. And we have seen several companies lay off employees as talk to raise funds failed. Downrounds are a reality in 2022 even for well-funded and scaled-up startups.

Specifically for Meesho, ecommerce funding in India seems to have slowed down, despite plenty of dry powder in terms of capital for VC funds. According to Inc42 data for this year, ecommerce funding in Q2 2022 declined by 36.84% to $1.2 Bn, while the number of deals also fell 18.55%, in comparison to Q1 2022.

Despite the launch of 78 new and topped-up VC funds in H1 2022 with $12.3 Bn in total corpus, investors are playing the wait and watch game for many sectors and are not rushing into deals.

The ecommerce sector saw its peak in Q3 2021, with the funding surging 1,072% to a whopping $5.8 Bn from $0.7 Bn in Q2 2021. Coincidentally, this is when Meesho raised its last large round.

However, ecommerce funding has been on a decline since Q3, while the number of deals also declined in the last two quarters. This has complicated the scaling-up efforts around potentially lucrative but capital-intensive segments, such as B2B grocery delivery for instance, where there is a lot of competition.

It’s hardly surprising then that Meesho had to shutter its B2B grocery delivery ops in about 90% of the cities where the Meesho SuperStore service was available.

Why SuperStore Went Bust

As reported by Inc42 in the past, Meesho’s retreat from the grocery business has impacted more than 300 contracted and full-time employees in the form of layoffs. Meesho terminated employment of city launch managers for SuperStore, warehouse managers, employees from the sales, operations and sourcing teams, as well as business intelligence executive as per our sources.

In many ways, the SuperStore failure is symptomatic of Meesho’s appetite for entering new, buzzing segments, even though it may not have the right resources or expertise for them.

One of the biggest problems with SuperStore is that its model was warped because it was akin to Meesho reinventing the wheel by looking to create individual sellers into online grocers. The product was launched to fill the earnings gap that Meesho’s resellers saw during the peak of the pandemic, but it seems to have been an ill-planned foray given the retreat.

Typically speaking, the B2B grocery supply chain connects produce and food processors to retail stores, greengrocers and kirana owners. But Meesho was looking to introduce a new stakeholder at the end of the supply chain in the form of its resellers and entrepreneurs. Essentially combining social commerce with grocery supply.

Not only did Meesho have to target grocery stores to come aboard amid stiff competition from long-time incumbents — Jumbotail, Ninjacart, Udaan as well as legacy retail supply players — but it also had to acquire new resellers to turn them into online grocery touchpoints.

Simply put, Meesho bit off more than it could chew with its proposition that it could extend its ‘social commerce’ model to grocery delivery. While one might agree that social commerce solved the trust problem in Tier 2/3/4 markets, the same cannot be said for the grocery category, where trust is even harder to solve.

Meesho’s acquisition model meant that SuperStore was a high cash burn business, but the startup raised its largest round last November on the back of the promise of expanding this business. And months later, it laid off more than 300 employees and scaled back.

“We were burning a lot of money for this business. Meesho started business in six states without proper planning. The supply chain was an issue, so was the logistics,” a source that used to work at SuperStore told Inc42.

Even before the scaling back of SuperStore, Meesho had laid off around 150 employees due to ‘role redundancy’ when the service was still called Farmiso.

While we do not have the revenue numbers for Meesho’s SuperStore business, the company’s rather open stance on talking about its product development process gives us a glimpse of the revenue structure.

As explained in a July 2022 blog post titled “Origin Story of Meesho SuperStore‘, the pilot was launched with a host of logistics and supply chain ecosystem partners.

Product manager Milan Partani writes,

“Instead of investing in a warehouse (a path taken by most grocery businesses), we leased out a space within one of our vendors’ warehouses while outsourcing packaging to another vendor. Always ask: Is this wide-scale investment needed?

Additionally, at the time, no one in our team had last-mile (delivery stretch from the seller/retailer to the consumer) delivery experience. So, we outsourced the last mile delivery operations to a couple of other vendors including Shadowfax, BlowHorn, and Let’s Transport among others. Always ask: Can we outsource?”

Besides this, the startup also roped in Zomato and Vishal Mega Mart as partners and vendors to fulfil the deliveries to the resellers. Clearly, the model involved layers of commissions for Meesho’s partners that would have eaten into the margin, while marketing costs to acquire users would have further skewed the unit economics.

Meesho’s biggest attraction for sellers and resellers is the 0% commission, which further made it hard for the company to make money on sales, and means it relies completely on ad revenue.

In its statements to Inc42, Meesho admits that grocery remains a segment where globally no one has been able to crack profitability. “In our efforts to solve e-grocery for Tier 2+ markets, we will continue to iterate the model until we find the right product market fit and with the right unit economics to scale the business successfully,” a company spokesperson told us.

Meesho’s Big Hope: Ad Revenue

While SuperStore and the social commerce model might not have exactly paid off, Meesho’s next focus and big bet is ad revenue from its marketplace. In a way, Aatrey and Meesho are betting that the audience focus on Tier 2/3/4 customers will enable the company to garner a larger slice of the ecommerce marketing dollars from this segment.

Flipkart and Amazon are also looking at this segment for the next phase of growth and have much bigger operations. As it focusses on ad revenue for profitability, Meesho will need to acquire a ton of users and sellers from Tier 2/3/4 cities where inflationary pressures are most severe in late 2022.

In April this year, Meesho detailed its efforts to boost ad revenue by simplifying the marketing workflow for sellers on its marketplace. It claimed “Sellers were able to reach more customers while monitoring their best selling catalogues. Consequently, this caused our ad revenue to shoot up by a sharp 30%.”

One presumes this growth in ad revenue has come on a relatively lower base. “We currently have close to 16 Mn entrepreneurs on the platform (a scale unparalleled in India),.” the company claimed in its statement to Inc42

In July this year, it introduced a referral programme to boost seller conversions in January 2022, and claimed the conversion rate increased with 50% suppliers that onboarded via the referral program, seeing more than 100 orders delivered.

Again, these are small gains towards the scale that Meesho aspires to meet. Marketplaces need a huge customer base and an incentivised flywheel of sellers and buyers for long-term success — Flipkart, Amazon India and others have had to bear years of losses, but Meesho is ultra bullish about its prospects.

Amid reports that the company is investing to build its own logistics platform/product to handle deliveries, Meesho has claimed that it has always been contribution margin positive and its goal is to turn cash flow positive by March next year. “In fact, in our understanding, we are one of the only scaled horizontal ecommerce platforms in India that is contribution margin positive,” a company spokesperson told us.

It must be noted that being contribution margin positive is not an analogue for profitability, but an indication that in the long run, the product could pay for itself. However, this is not a solid indicator of long-term profitability, if scale and revenue do not grow faster than operational expenses.

For marketplaces, in particular, heavy promotional expenses and discounting eat into the contribution margins, but Meesho is looking to hedge these costs with revenue from sellers.

Aatrey claims Meesho’s inspiration is Alibaba and not Amazon, and the focus on ad revenue is in line with how marketplaces and ecommerce businesses have earned profits around the world. A spokesperson for the company said it is on an ARR of $100 Mn for the ads business as of August 2022, but ARR projections typically fluctuate with changes in business momentum.

However, the fact is that ad revenue is just 3% of Flipkart’s total revenue of INR 43,357 Cr at INR 1,305 Cr for FY21 and Amazon India earned $320 Mn (INR 2,554 Cr) from its marketplace business on a total revenue of INR 16,200 Cr. Meesho’s claimed ARR would put it close to these two majors, but whether this momentum from August will last the year is yet to be ascertained.

The festive season will prove to be the biggest litmus test for Meesho — not just from the point of view of ad revenue from sellers, but also as an attractive marketplace for consumers. Keeping this flywheel going will be key for Meesho’s prospects.

Meesho claims that it has solved a huge problem in India’s hinterlands —- that of trust in online shopping — through its reseller model. But now with the same faceless seller model as any other marketplace, Meesho is hoping that the users it converted into first-time online shoppers will once again pose faith in the company.

After raising nearly a billion dollars and claiming to have revolutionised ecommerce in India, Meesho is in many ways starting all over again. Many might wonder how long investors will continue to back a startup that is always seemingly two steps away from the right product-market fit. Is its latest bet Meesho’s final chance?

Ad-lite browsing experience

Ad-lite browsing experience