SUMMARY

Founder Of A Slew Of Crypto Companies, Amit Bhardwaj Was Arrested At The Bangkok Airport And Has Been Brought To Pune; Will The Investors Get Their Money Back?

Che Guevara to Osho, the parabolic curve of their successes was largely dependent upon manipulating people’s mind, “making the common man feel that he or she can tame the entire world out there”.

Promising a highly inflated 10% monthly return on Bitcoin investments for 18 months under multi-level marketing (MLM) schemes such as Bitcoin Growth Fund, Amit Bhardwaj in his grand yacht parties, made investors feel the power of Bitcoin and the importance of investing in GainBitcoin. The idea that “they are the real winners and the rest are just losers”, dancing to the tunes of some crappy Bollywood music as usually occur in the MLM’s MVP meets.

So, why to compare this Bitcoin Guru Amit Bhardwaj with the likes of Guevara and Osho?

Like them in their corresponding fields, Amit Bhardwaj actually played a big role in introducing Bitcoin to the Indian investors, traders and users. He educated, explained and made them think about the possible power of Bitcoin.

“He played a significant role in scaling up the Bitcoin race in India. Initially, it appeared that investors too were able to withdraw their returns. However, we have got no clue what happened thereafter,” says Shivam Thakral, CEO of BuyUCoin.

Like those leaders, the ending of Amit Bhardwaj too is apparently not exactly the RHS one should draw from the knowledge expertise he holds. “I believe the further investigation will spill the truth,” opines Shivam.

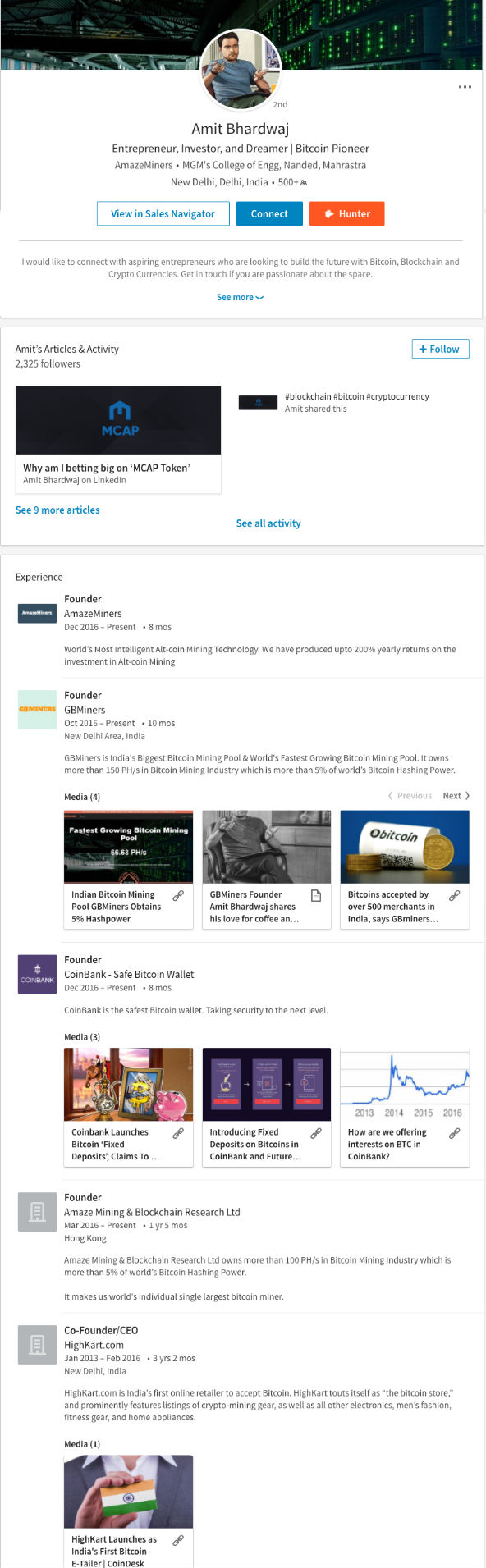

Calling himself a cryptocurrency guru and visionary, Amit Bhardwaj had established a slew of companies which were dealing with all the aspects of cryptocurrencies – mining, exchange, wallet, research and development, and MLM schemes.

These include AmazeMiners, GB Miners, GainBitcoin and CoinBank under the parent company Amaze Mining And Blockchain Research Ltd, registered in Hong Kong. He had even gone on to coin a new cryptocurrency, MCAP.

The ‘Arrest’

Accused of a series of scams worth $300 Mn, Amit Bhardwaj has now been arrested in Thailand and has been brought back to Pune, India. According to a report, he is also accused of being a Pakistani ISI handler.

Last year, a number of investors had filed non-bailable FIRs against Amit Bhardwaj. However, hiding in Dubai, Amit Bhardwaj didn’t respond to the police investigations.

On March 30, Bhardwaj reportedly staged or faked a heart attack at the Dubai airport and flew to Bangkok, where he got arrested after the Indian government’s intervention.

Confirming the same, the Economic Offences Wing (EOW) and Cyber Cell of the Pune police informed Media on April 5, that they have arrested the alleged cryptocurrency scamster Amit Bhardwaj, in connection with a multi-crore cryptocurrency scam.

From Delhi Airport, the Pune Police brought him back to Pune where the FIRs were originally registered against him i.e at the Dattawadi post, Pune. Amit has been in the police custody since March 31, 2018.

The complaint was registered under the Section 406, 420 and 34 including the Information Act 4 and 5 and the MPID Act 3. Another police complaint was registered at the Nigdi police station.

Bhardwaj will remain on remand till April 9, 2018 when the case hearing is expected to start.

The police informed that before Bhardwaj’s arrest, seven people in connection with the Bitcoin scam have already been arrested. This includes Hemant Vishwas, Hemant Babasaheb Chavan, Ajay Tanaji Saheb, Pankaj Srinandkishore and Chandrakant Bhope.

The ‘Scamster’

As his Linkedin profile says, A computer science engineer from MGM College of Engineering, Nanded, Amit Bhardwaj worked for the Infosys for three years and later one year for Hyderabad-based Reasoning Global before moving on an entrepreneurial journey.

Being a software developer in 2009, he set up Nextgen Facility Management which used to develop mobile apps and enterprise applications.

However, in 2012, as says his Linkedin profile, he closed the shutter of Nextgen operations and established a Delhi-based India’s first online retailer company HighKart.com which used to accept Bitcoin.

In 2016, begins the ‘Amit Bhardwaj’ scam story. In March 2016, Amit set an Umbrella company called Amaze Miners and Blockchain Research Ltd in Hong Kong under which he established GB Miners, Amaze Miners, GainBitcoin and CoinBank.

The ‘Mathematics’ That Went Wrong

Amit Bhardwaj who has also written a couple of books on cryptocurrency related stuff, had the benefit of joining the Bitcoin race in India, too early. A coder at heart, he got the entire mathematics of mining completely wrong.

While he must be given with the due credit for the merged mining, crazy pooling of all the three cloud mining, ICOs and trading, the harsh truth was that the promises he made were never meant to be fulfilled. In late 2016, he launched MLMs, multi-level marketing businesses, promising 10% monthly return for 18 months on every investment. Being an MLM business, there were incentives for everyone provided they add more investors under their teams.

However, while uplinks gained as promised, lower investors stated calling it Ponzi schemes.

What was wrong with the MLM?

The biggest problem of his model was the mode of investment and their return which was Bitcoin. As Bitcoin does not grow on trees but recedes with every Bitcoin mined.

“If you had taken money in conventional currencies and made a promise to return 10% on the same, it could have been a win-win situation for both; however, Amit took the money in Bitcoin and promised to return 10% in Bitcoin. This was not just an inflated idea but actually a fraud idea. No one can return more Bitcoins than they actually collect,” a person close to GB Miners told Inc42.

As per the latest Banning Of Unregulated Deposit Schemes Act, this could be clearly termed as Ponzi schemes, as Bitcoin or other cryptocurrencies are unregulated.

This could be better understood by an example. Suppose if someone invested x Bitcoin worth of $1,000 in April 2017, and after three months, as the Bitcoin price went up by 300%, he will be getting 1.3x Bitcoin which would then be actually worth of $3,900. Simply imagine the profit when Bitcoin was skyrocketing i.e. in November last year.

As per him, Amit used to tell investors that this could be possible only because of his cloud mining, big mining infrastructure that he set up in China. Frankly, it did not matter how big his mining pool was, it could never outpace the growing number of investors joining his MLM business.

As investors were coming in, Amit soon changed his payout policy, he introduced the MCAP tokens on April 27, 2017 which became an essential buyout to invest in the MLM schemes. As per Amit, “The reason why am I betting big on the ‘MCAP Token’ is that it opens the window for a long-term investor to the whole Blockchain-based assets. The ‘MCAP Token’ is a Mining and ICO Fund token, where it diversifies the portfolio for a long-term investor into the complete Blockchain based ecosystem.”

Further, the changed buyout policy stated that half of the investment will be returned in terms of Bitcoins and half as MCAP.

In September, 2017, he also introduced Ethereum Mining Contracts, and by November, GainBitcoin operations were shut down announcing a reboot in January 2018. Investors were promised full returns in MCAPS.

The 10% monthly return wasn’t for everyone. As per the payout policy change, if the 10% monthly return amount is less than a certain threshold, i.e. 0.025 Bitcoin, it won’t get reflected on the users’ wallet but will be added in the next cycle. And, if in the next cycle too, if it’s less than the threshold, people won’t get their return.

The ‘Chase’

While writing about how great the MCAP tokens could be, Amit in his Linkedin post said, “My investment philosophy is very much long-term. I don’t do any small trades, like, ‘Oh, I’ll buy this for a month’. I invest only in long-term trends. When I started Bitcoin Mining, it was totally a new and random thing and most people said, ‘No way, this thing is stupid’. I saw it differently.”

Further, “When I invest, I think, ‘What is the way the world should be and is this investment part of that end? Is this the right direction if the world moves in this direction?’ When I think about Blockchain that’s the framework in my mind.”

However, every investor did not believe in the same philosophy, especially when GB Miners or GainBitcoin stopped responding to their queries.

In July last year, Zakhil Suresh a GainBitcoin investor had started a petition on change.org. Signed by more than a thousand people, the petition appealed for Bhardwaj’s arrest for alleged fraudulent schemes.

Since then, hundreds of people claimed that it takes just a couple of minutes to invest in GainBitcoin. However, “you need to wait for months and months but you won’t be able to withdraw your money back”.

The investors also alleged that once the investment took place, Amit never addressed their issues or never replied to their emails.

Rajesh Raghav, one of the Investors commented, “Amit Bhardwaj, please return our money… we trusted you like anything but you have also become like any other Indian who believes in doing fraud. People have taken money on interest and invested in your scheme but in return, you have not given return to them as promised. People are cursing you, your near and dear ones. Listen to them and at least return their investments. Hope you will hear to the people’s cry.”

Like Che Guevara, Osho and other self-proclaimed visionaries could not run away from the hue and cry of the society, so couldn’t Amit too. Now that he has been arrested, the million dollar question, however, is: will the investors who believed in Amit’s vision get their money back?

Amit truly saw the future in Bitcoin, however, while running a number of cryptocurrency depository schemes which now being termed as Ponzi schemes, he perhaps undermined the interface, the window that evaluated and ultimately directly or indirectly regulated the price of Bitcoin. Osho, living in the lush green ‘wild wild country’ Oregon that he himself had bought, too had thought, at the peak of his career, that he could actually overpower the American democracy! However, as the FBI started investigating, with all his mightiness, he could not fly away from the US. There wasn’t enough fuel in his plane!