Will regulatory scrutiny and new competition actually eat into Amazon India’s empire enough to make it rethink its big bet on the Indian market?

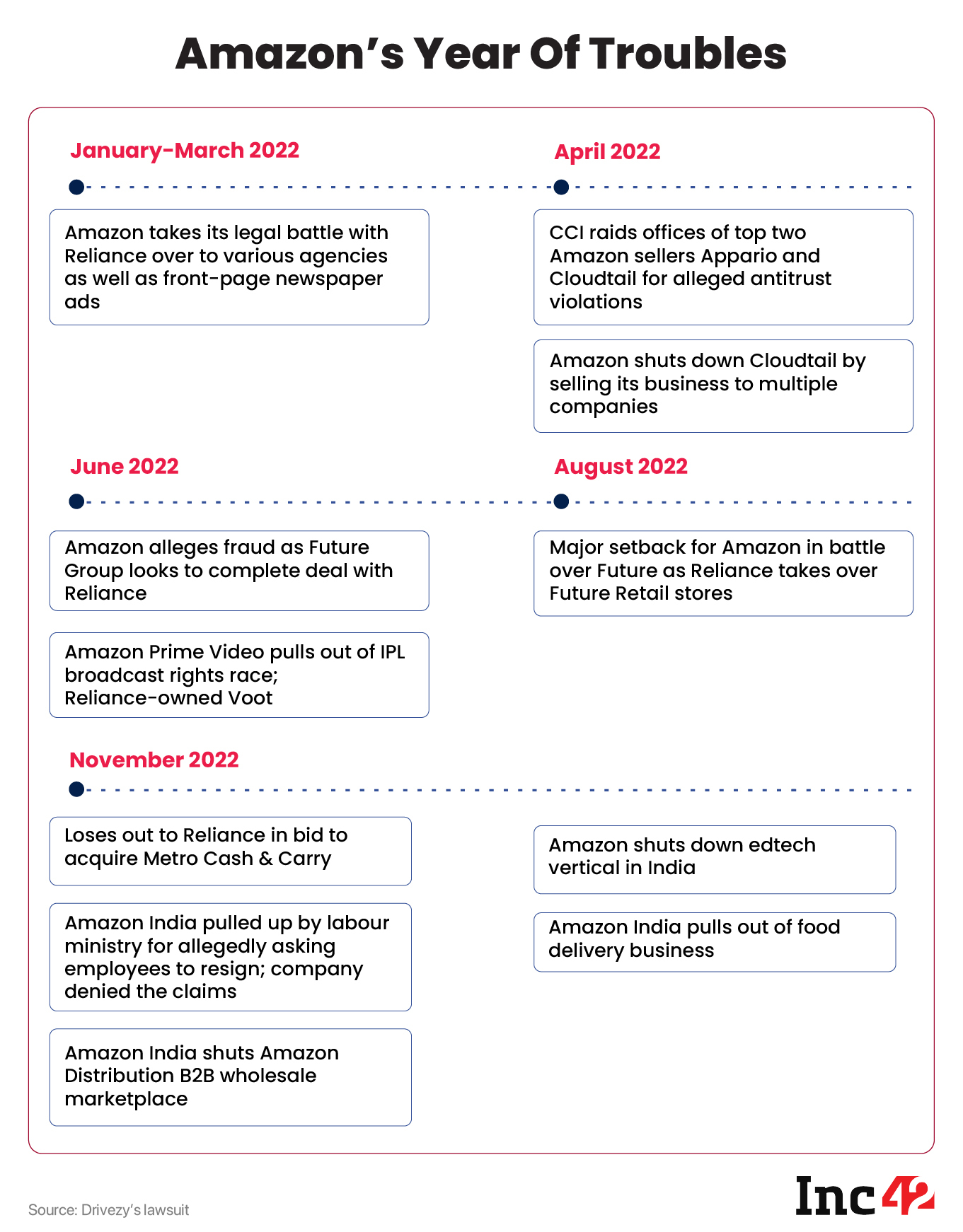

From layoffs to shutdowns in India, it has not been Amazon’s year — the first full one under the leadership of Andy Jassy, who took over after CEO Jeff Bezos stepped down in July 2021.

Of course, in the US, Amazon is far from the only company to take a stock market battering, but the situation in India has gone from pretty bad to worse for the tech and ecommerce giant.

When we say pretty bad, the focus is on not only on the slow revenue growth and lack of profitability for Amazon India, but also in relation to regulations, competition and scaling down of many verticals it had hastily entered.

What’s the Amazon India story for 2022? After these key stories of the week — don’t miss them:

- Massive Layoffs At OYO: OYO has fired over 600 employees, largely from the product and engineering teams, and will ramp up hiring for sales and customer support roles. Here’s our exclusive story

- Gig Economy & User Safety: Two separate incidents of alleged sexual abuse involving gig workers of mobility startup Rapido and quick commerce startup Zepto have turned the spotlight on women’s safety when dealing with platforms that engage temporary workers

Amazon’s Slide In India

Perhaps Amazon should have taken the hint in January 2020 when union minister for commerce Piyush Goyal snubbed Jeff Bezos’ comments about investing and creating jobs in India.

While those remarks were subsequently retracted by the minister, the mood for Bezos’ three-day visit was sombre, to say the least, before the pandemic changed so much.

Fast forward to the end of 2022 — almost three years later — Amazon finds itself in a position of weakness in the Indian market.

India Cutbacks After Global Layoffs

Having suffered multiple blows including losing out to Reliance on two key fronts — Future Retail and Metro Cash & Carry — Amazon ended its experiments in food delivery and edtech, and pulled out of the B2B wholesale distribution space in November.

While the closure of the edtech and food delivery businesses might be considered minor setbacks, the exit from wholesale ecommerce and distribution is particularly critical as it means that Amazon is giving up the battle with Flipkart Wholesale and Reliance’s JioMart.

The online B2B marketplace supplied products to kiranas and small retailers, and this is estimated to grow to a $90 Bn-$100 Bn opportunity by 2030, according to Redseer data. Amazon’s retreat is a major signal about its ability to compete for this pie.

The timing is something to note too: Amazon is cutting close to 10,000 jobs globally as part of downsizing due to macroeconomic pressures.

And now the shutdowns in India have come after allegations by employees of being asked to resign by the company, which Amazon India has denied when questioned by the labour ministry. But this is of course not the first brush against regulators for the ecommerce giant.

Amazon Vs Regulators

Much of the regulatory pressure has come in the context of allegations Amazon preferring certain sellers on its platforms as well as copying products of retail brands for its private label business. These allegations have been investigated by the CCI and other agencies over the past two years.

Earlier this year, antitrust watchdog CCI raided top sellers on Amazon and Flipkart, alleging that ecommerce companies had been unfairly promoting preferred sellers on their marketplaces.

Industry experts linked the shutting down of Cloudtail to Goyal’s strong statements in the past, widespread protests by traders’ groups and the CCI probe.

Besides this draft ecommerce policy, under the ‘Consumer Protection (E-commerce) Rules, 2020’, is seeking to ban flash sales and deep discounting in a bid to protect sellers from marketplaces that offer discounts at the expense of seller revenue.

The proposed rules also mandate that no online marketplace can own any stake in any seller entity, which is selling on its platform. After the shutdown of one such seller Cloudtail’s shutdown, it could be the turn of another Amazon-linked seller Appario to come in the regulatory crosshairs.

Reliance Changed The Game

While regulatory hurdles are definitely not going to go away any time soon, Amazon has been dogged by stiff competition from Mukesh Ambani-led Reliance in pretty much every new area it has sought to enter.

Losing out on a potential deal for Future Retail to Reliance has been a thorn on Amazon’s side and the company continues to cry foul play in the way Reliance took over Future properties.

Reliance also beat Amazon to the punch in acquiring German wholesaler Metro Cash & Carry’s India business in a deal reported to be worth INR 4,000 Cr – INR 4,500 Cr.

Interestingly, this came soon before Amazon shut down the Amazon Distribution business which would have potentially utilised Metro’s wholesale network in India.

Did losing out on this deal and Future Retail push Amazon to the brink when it comes to this vertical?

New Rivals Push Amazon To The Brink

Whatever the real reason is, there’s no doubt that the looming global recession has impacted Amazon’s faith to carry the loss-making India businesses. Its marketplace business managed to narrow its loss 23% year-on-year (YoY) to INR 3,649 Cr in FY22, with a total revenue of over INR 21,600 Cr.

Profitability remains elusive for US-based ecommerce giant Amazon in India nearly a decade after its entry in the country despite an investment of over $6.5 Bn. It lags behind Flipkart in the B2C space in terms of market share and the entry of Meesho, Tata Neu and JioMart in the marketplace segment has made it harder to compete.

“Newer players like the Softbank-funded Meesho ($5 Bn GMV) are winning the faster growing Tier 2/3 cities where Amazon has struggled to gain traction given low pricing and ‘zero commissions’,” brokerage firm Bernstein noted in September this year, ahead of tepid festive season sales for ecommerce players.

Meesho beat Amazon in the 2022 festive season sales, while Flipkart topped the list as per a Redseer report, which Amazon has contested.

Regardless of what the data shows, there’s little doubt that Amazon is in a tough spot in the Indian market.

Will the regulatory scrutiny, new competition and the growing long-tail D2C segment actually eat into Amazon’s empire enough to make it rethink its India bet?

Sunday Roundup: Startup Funding, Analysis, Top News & More

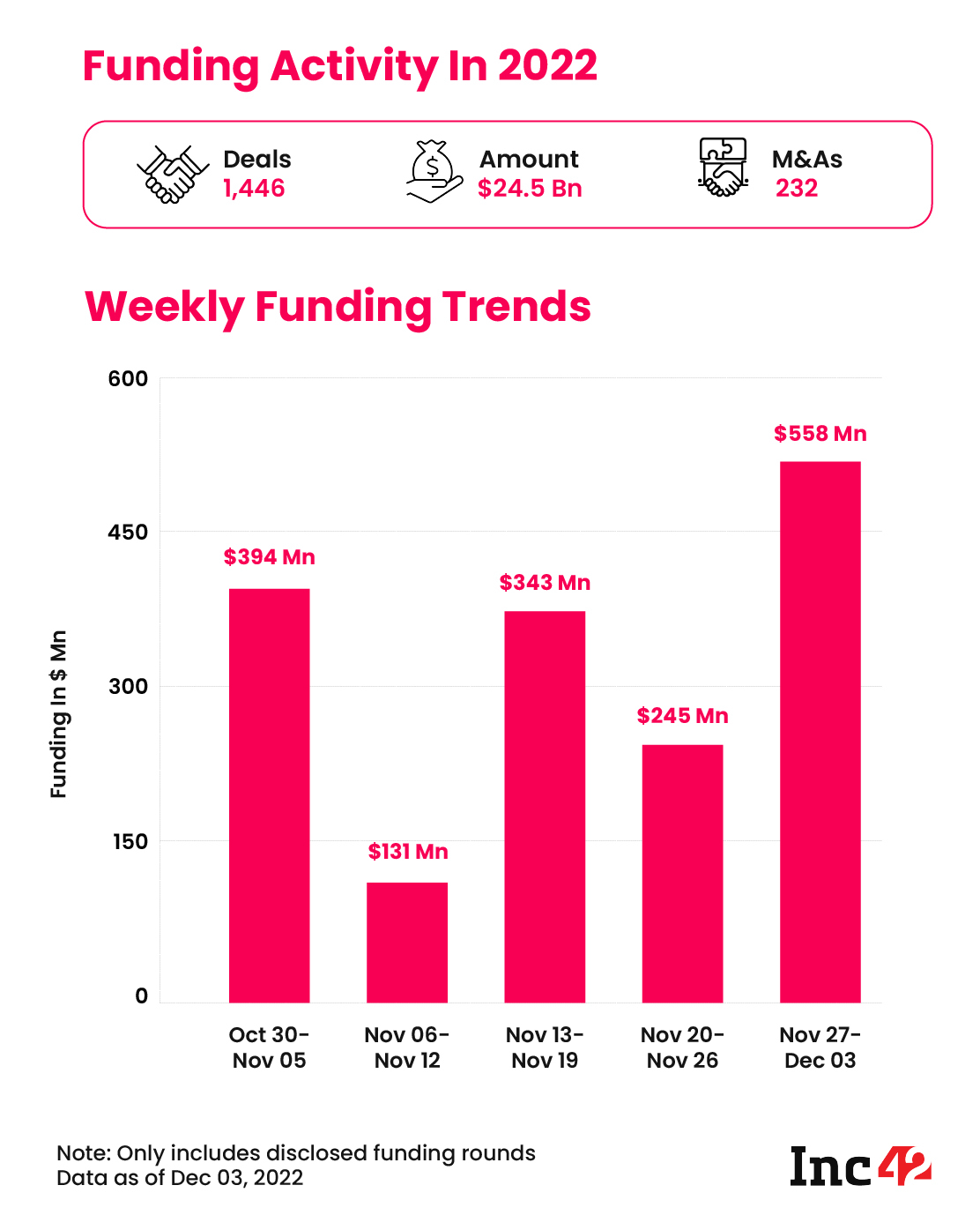

- Indian startups raised $558 Mn this past week, which is roughly half of what was raised in all of November. Startup funding touched $1.1 Bn for November 2022 , a staggering 73% lower than November 2021

- Micro VC fund Speciale Invest on the India deeptech opportunity and how it enabled spacetech and EV startups before these areas became trendy

- Indian crypto exchange Giottus estimates that the massive FTX collapse has impacted nearly 3-5 Lakh Indian crypto investors

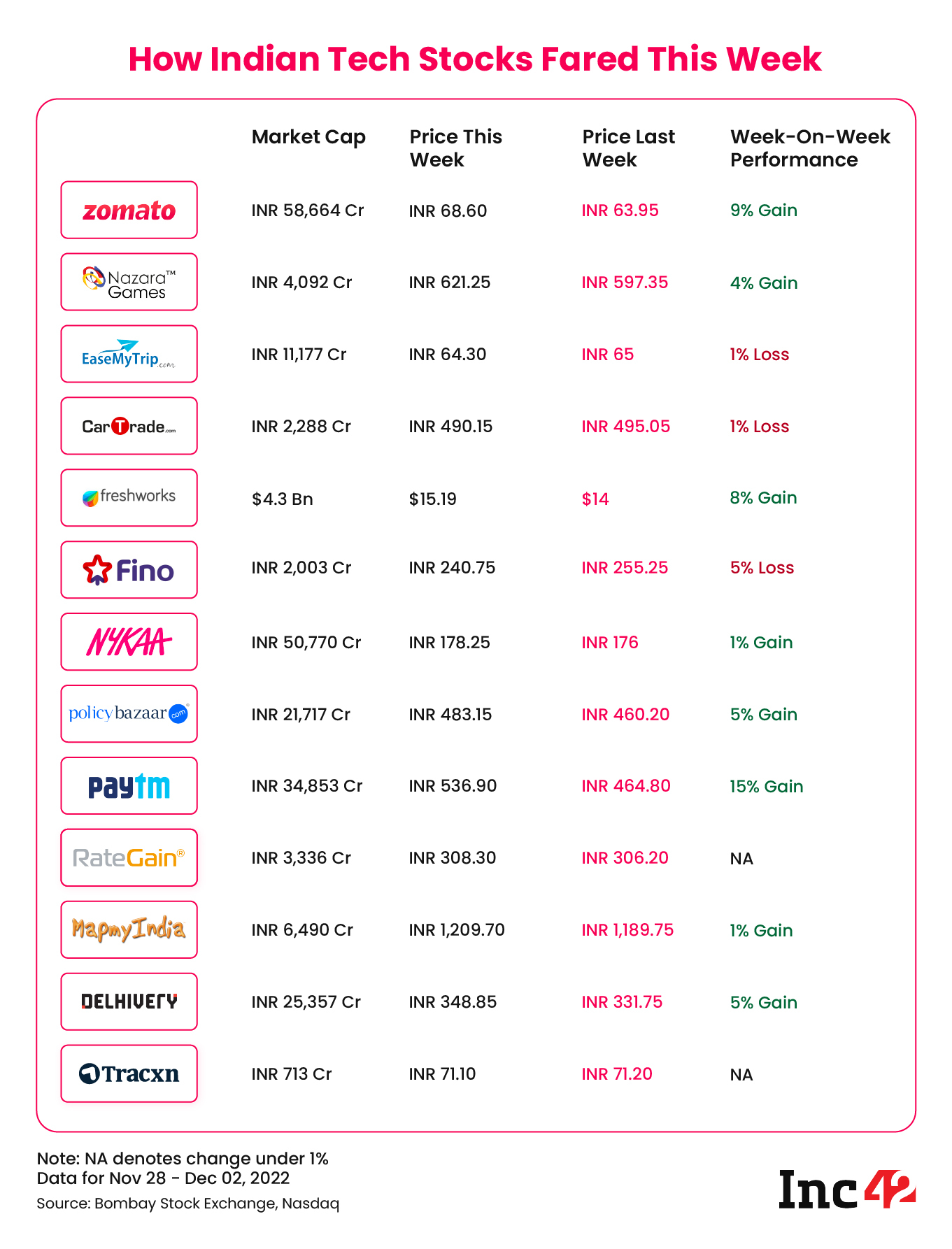

- PolicyBazaar stock soared nearly 6% on Friday after SoftBank was reported to be selling 5% of its stake in the company, while Paytm also rose after plummeting in the previous week

- The November edition of Inc42’s 30 Startups To Watch list highlights the most scalable startups in our view across fintech, SaaS, deeptech, ecommerce, healthtech and other sectors

- Indian-origin tech CEOs, Google’s Sundar Pichai and Microsoft’s Satya Nadella have received the Padma Bhushan award in the ‘Trade and Industry’ category

And that’s all for this week.

Ad-lite browsing experience

Ad-lite browsing experience