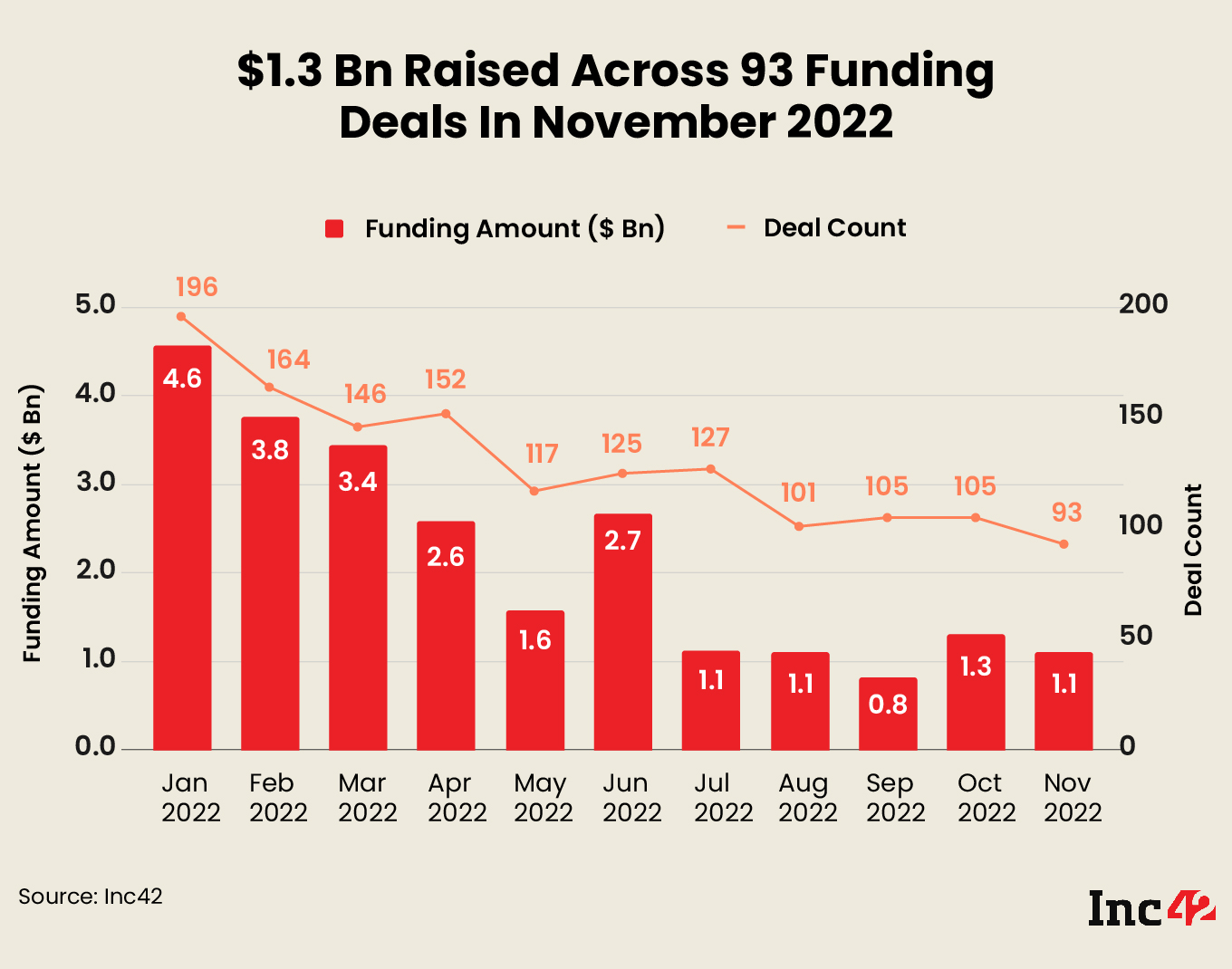

Indian startups raised $1.1 Bn across 93 funding deals in November 2022, down 73% and 11%, respectively, compared to November 2021

Bridge funding increased 5X compared to November 2021, while seed stage funding increased 30% YoY

Delhi NCR pipped Bengaluru in November in terms of startup funding, while Pune finished a close third

The Indian startup ecosystem continued to witness economic pressure, a funding crunch and layoffs in the penultimate month of 2022. Indian startup funding in November 2022 reached $1.1 Bn across 93 funding deals.

The funding raised by the startups declined not just on a year-on-year (YoY) basis but also month-on-month (MoM).

In October, Indian startups raised $1.3 Bn across 105 deals, translating to an MoM decline of 15.4% in funding amount and 11.4% in funding deals.

Indian startups had raised $4.1 Bn across 105 funding deals in November 2021. Compared with the bull run of 2021, November 2022 saw a decline of 73% in funding amount and an 11.4% decline in funding deals.

Speaking of outliers during November 2022, there were two mega deals – Icertis raising $150 Mn and Amagi raising $105 Mn during the month. Apart from this, there were five funding deals with Indian startups raising more than $50 Mn – Contentstack ($80 Mn), Bira91 ($70 Mn), HealthKart ($65.7 Mn), Lentra ($60 Mn) and Keka HR ($57 Mn).

These seven deals accounted for 53.3% of the total funding raised in November 2022.

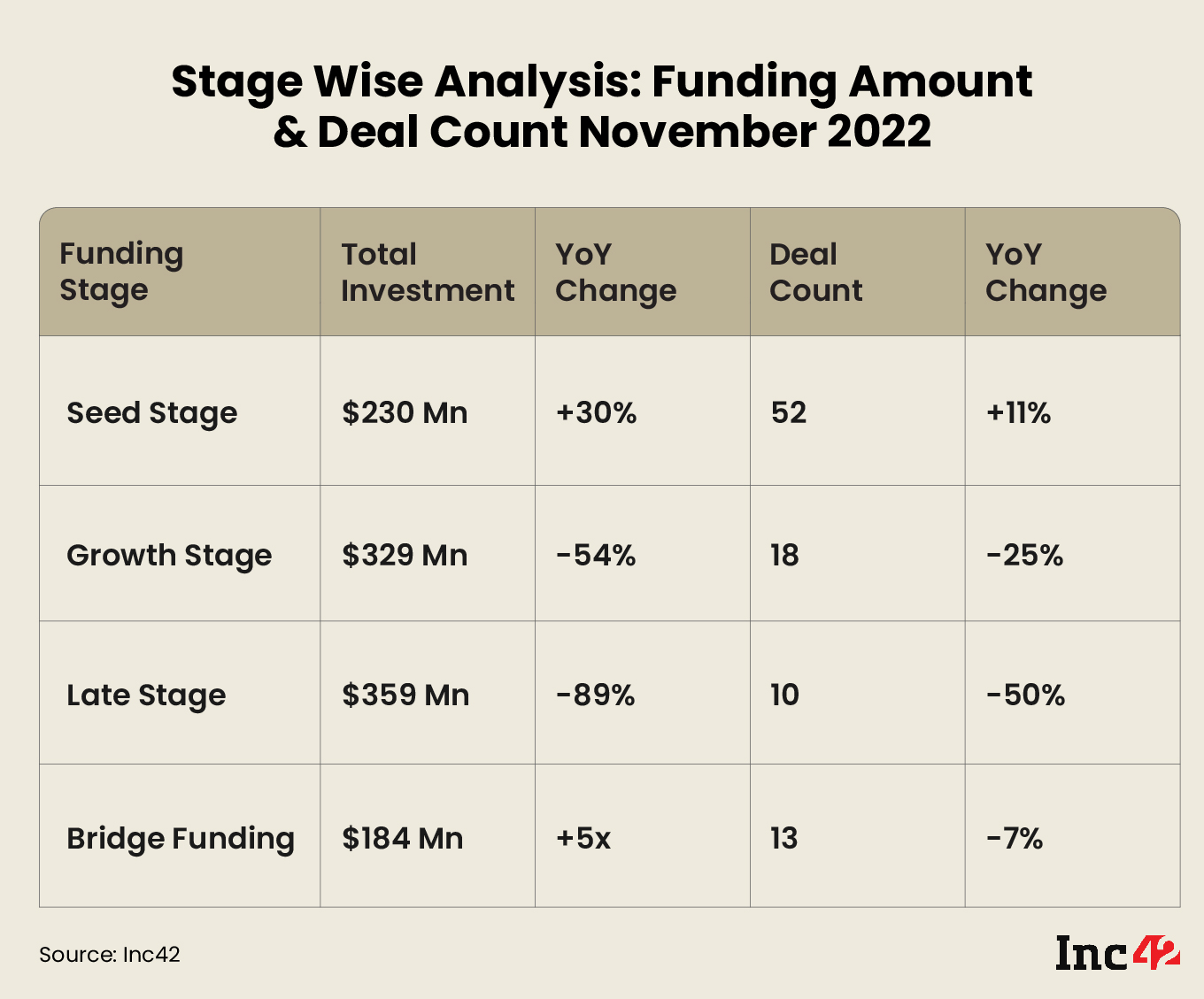

In terms of the startup stages, only the bridge and seed funding saw an increase during the month. Bridge funding increased 5X compared to November 2021 and seed stage funding increased 30% YoY.

However, late stage funding saw a sharp decline of 90% in November 2022 compared to the corresponding month of last year.

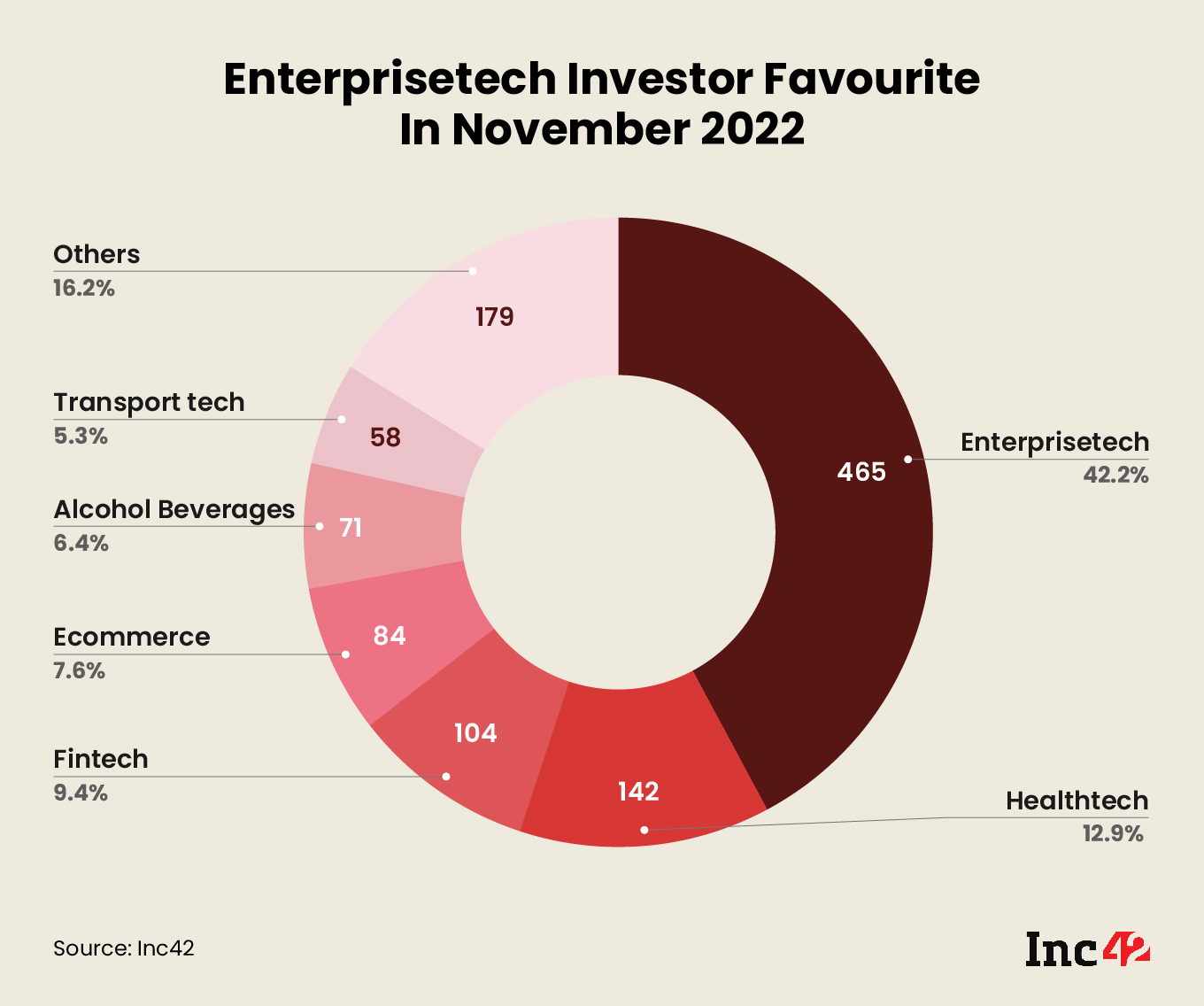

In October, edtech had emerged as investors’ favourite sector, mostly because of BYJU’S $200 Mn fundraise. However, November 2022 saw the dominance of enterprisetech firms (Amagi, Icertis, Lentra and Keka HR), with the segment raising the highest funding at $465 Mn.

Healthtech and fintech were the only other major startup segments which saw the funding amount cross $100 Mn.

Incidentally, the alcohol beverages sector was among the top segments to raise funds in November on the back of Bira91’s biggest fundraiser in its history. Similarly, transport tech made a second appearance in the top funded segments in a row.

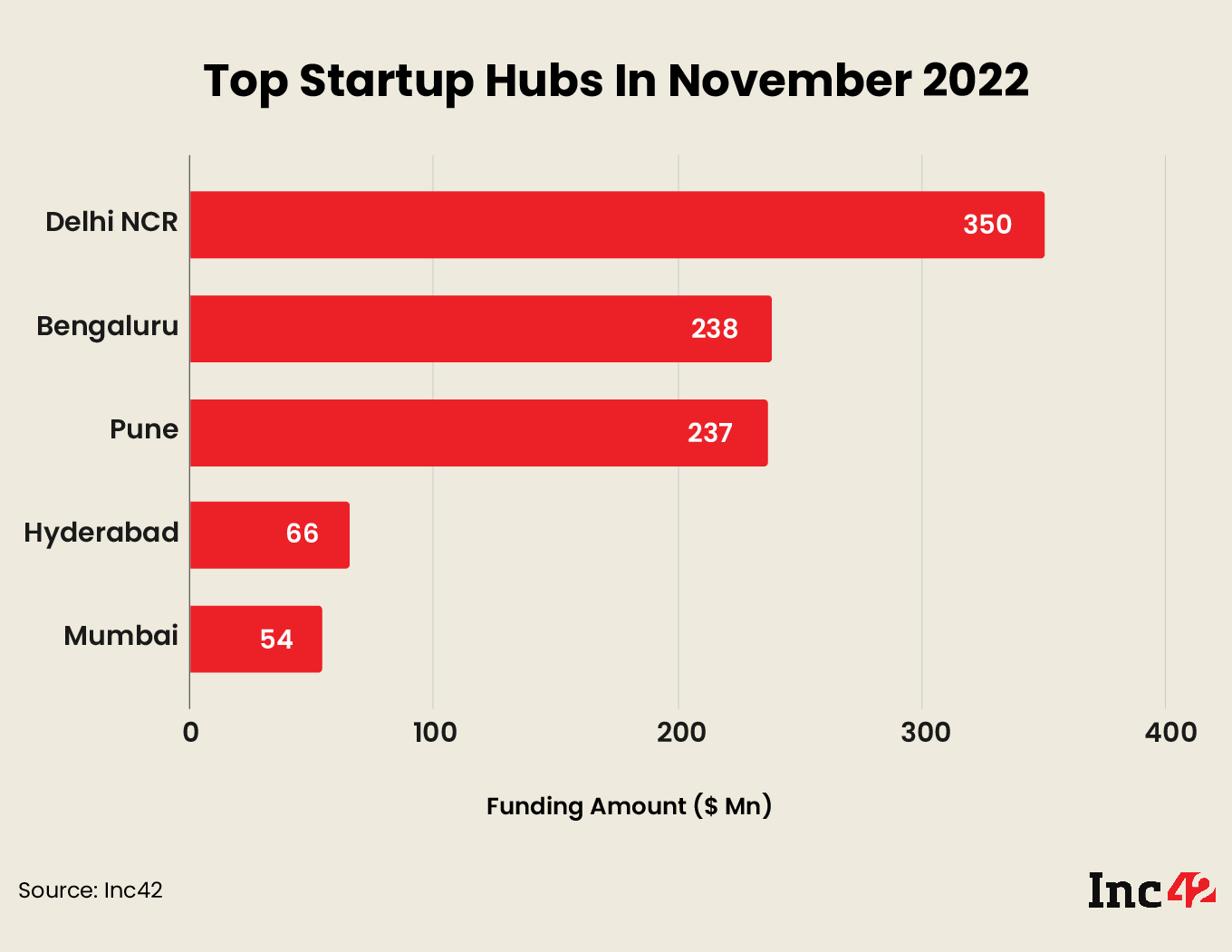

When it comes to cities, Bengaluru and Delhi NCR are the two biggest startup hubs in India and keep swapping places almost every month in terms of startup funding. Delhi NCR pipped Bengaluru for the top spot in terms of startup funding in November 2022.

Interestingly, Pune-based startups raised $237 Mn in November 2022, only $1 Mn less than Bengaluru, driven by the funding rounds of Icertis and Lentra.

In all, the total funding amount for 2022, as of November 29, reached $24 Bn. During the same period last year, Indian startups had raised nearly $37 Bn, nearly 54% higher than in 2022.

In Inc42’s ‘Indian Tech Startup Funding Report 2021’, we estimated a correction in startup funding in 2022 amid the negative macroeconomic scenario. In our year-end estimates in 2021, we estimated a 24% correction in 2022. However, the ongoing geopolitical tensions and their knock-on effects have caused a 35% correction in startup funding in 2022 so far compared to 2021.

Looking towards 2023 with the context of the funds announced by prominent investors this year, there is every possibility that Indian startup funding might reach 2021 levels. The Indian startups which survive the ongoing funding downturn are expected to emerge stronger with a clear path to profitability, a factor that was overlooked during the funding bull run last year.

Ad-lite browsing experience

Ad-lite browsing experience