Low-ticket size purchases, and demand for unbranded fashion products from Tier-II towns and beyond propelled Meesho ahead of Amazon in terms of order volume: Redseer

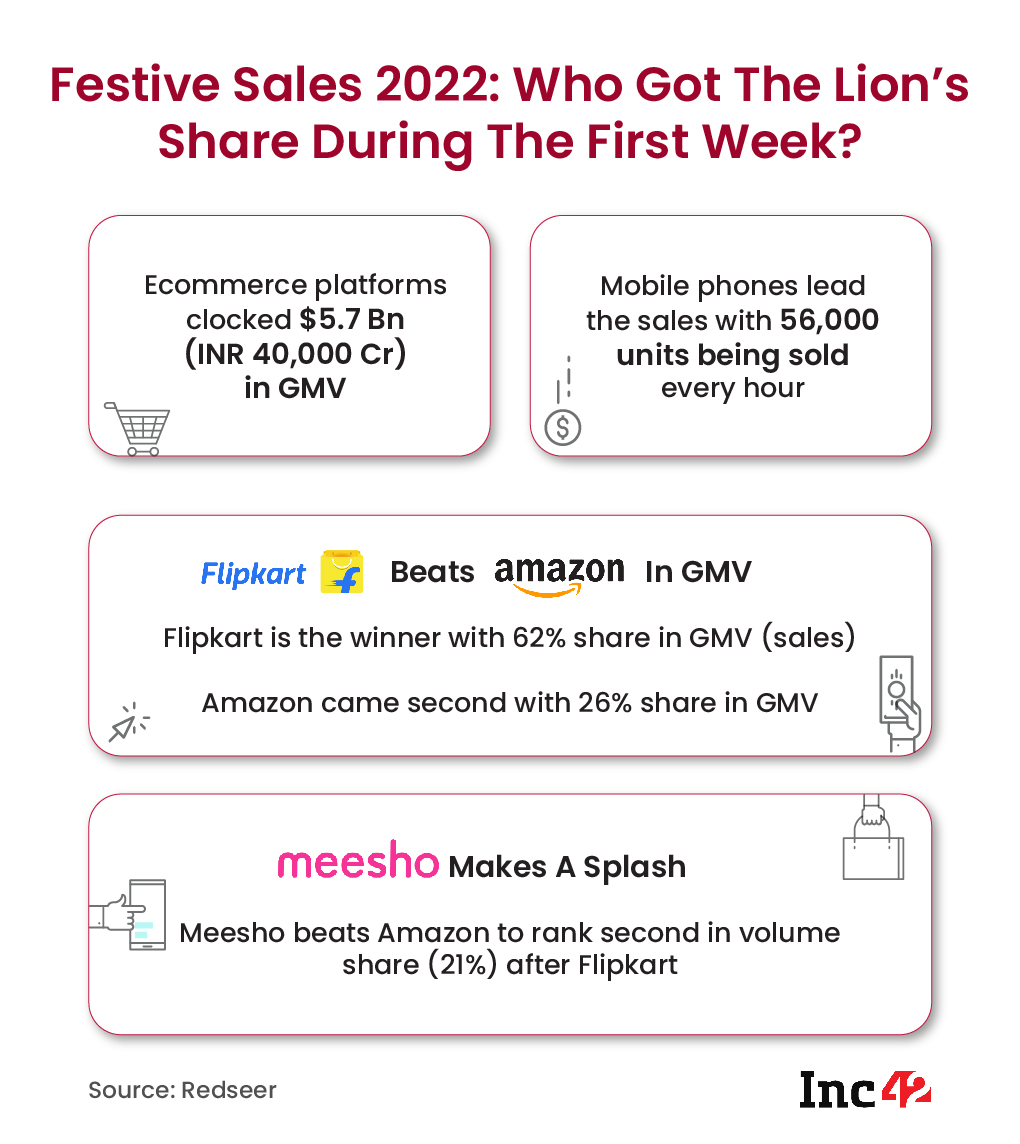

Flipkart and Amazon together clocked 88% of $5.7 Bn GMV during the first week of the festive season

Mobile phones continued to lead festive season sales this year as well, with 56,000 units sold every hour on various ecommerce platforms

SoftBank-backed Meesho beat ecommerce behemoth Amazon to secure the second position during the first week of the ongoing festive season in terms of the number of orders placed (order volume) on the back of strong demand from Tier-II cities and beyond and surge in sales of unbranded fashion products, consulting firm Redseer said in a report.

Walmart-backed Flipkart was at the first position during the first week of the festive season with a 62% share in total gross merchandise value (GMV) and 49% in order volumes, the report added.

Ecommerce marketplaces clocked total sales of $5.7 Bn (INR 40,000 Cr) during the first week, a growth of 27% year-on-year (YoY). In GMV terms, Flipkart (62%) and Amazon (26%) captured 88% of the overall sales, Redseer said.

Notably, new entrants like Reliance JioMart and Tata Neu failed to capture a large share in terms of GMV despite their high-profile launches last year.

On a standalone basis, JioMart’s sales grew 2X this year (YoY terms), and the platform is now selling electronics besides groceries, Ujjwal Chaudhry, partner at Redseer, told Inc42. Tata Neu didn’t announce mega sales for the first festive season after its launch last year, he added.

However, Meesho, which transitioned from a social commerce platform to ecommerce marketplace, clocked aggressive sales growth due to higher demand from Tier-II cities and beyond and its strong positioning in the fashion segment, in which it competes with the likes of Myntra and AJIO.

“Flipkart Group (Flipkart, Myntra and Shopsy) continues to maintain its leadership position with 62% market share in GMV during the festive sale week 1. In terms of order volumes, Meesho, with its low AOV (average order value) and high penetration in Tier-II cities emerged as the second largest player capturing ~21% of the market share, while Flipkart Group leads here as well,” Sanjay Kothari, associate partner at Redseer, said.

Meanwhile, Amazon India countered Redseer’s claims of the ecommerce company being trumped by Meesho on order volumes.

“We are delighted by the wonderful customer response to the Amazon Great Indian Festival 2022, with our first 12 days receiving the highest ever orders. We cannot comment on speculative reports without robust and transparent methodology especially as these have not been shared with us,” An Amazon India spokesperson said in a statement.

Mobile phones continued to lead festive season sales this year as well, with 56,000 units sold every hour on various ecommerce platforms, as per Redseer. While mobile phones had a 41% share in the total GMV during the first week, the fashion segment’s share stood at 20%.

However, the average user spend rose only a marginal 3% from last year, Chaudhry said.

The average user spend was at INR 5,200 during the first four days of the festive season, nearly a 30% decline from INR 6,750 in the 2019 festive season and over 41% lower than INR 7,350 in the festive season of 2018.

Delayed Deliveries

As per Redseer’s estimates, the turnaround time (the total time between order placement and its delivery) was higher during the first week of the festive season compared to usual days. This, as per Chaudhry, was largely due to third-party logistics players (3PL) fulfilling a majority of the orders and the highest numbers of orders coming from Tier-II towns and beyond.

“40-50% of the total orders were fulfilled through third-party logistics players. On the back of high demand, 3PL logistics players added workforce in Tier-2+ cities to fulfill the expectation of the platforms in a seamless way,” the report added.

When asked about order cancellations and returns, Chaudhry said it constituted a small proportion of the overall sales and was accounted for in the GMV figures.

Shopper Base

The number of online shoppers rose 24% YoY this year, with about 65% of shoppers coming from Tier-2+ cities. A whopping 75-80 Mn shoppers placed orders across all ecommerce platforms during the first week, while Tier-2+ cities witnessed the highest YoY growth in online shoppers.

“While the beginning of the last quarter was slow on demand, there was a good uptick in consumer sentiment and consumption in late August/ September. This, Redseer expects, will further lead to demand recovery building up to Diwali,” the report said.

Update | 6th October, 20:25 IST

Story updated to include Amazon’s statement.

Ad-lite browsing experience

Ad-lite browsing experience