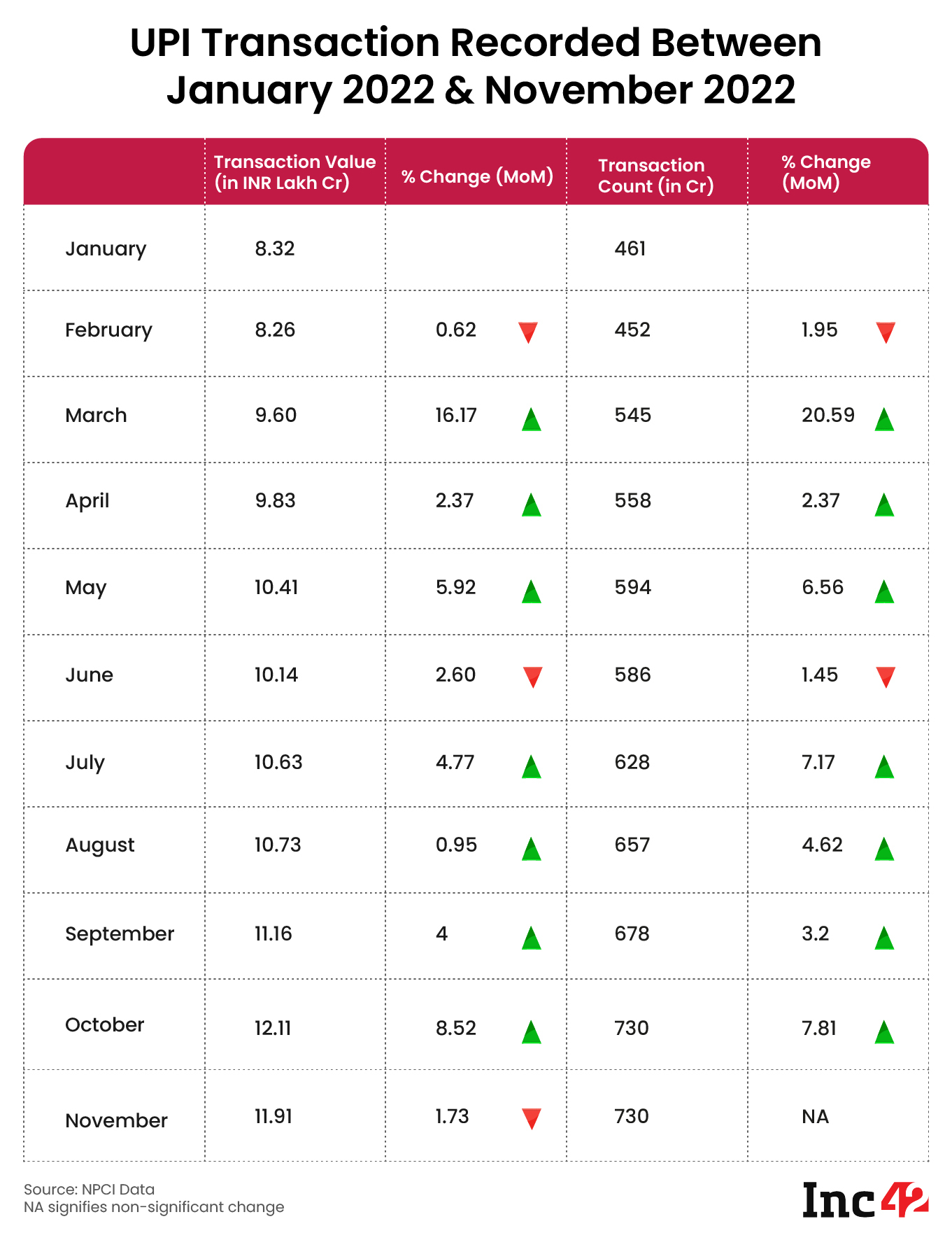

At 730 Cr transactions worth INR 11.91 Lakh Cr, UPI recorded a 1.73% monthly decline in November 2022

In 2022, the total transaction value of the UPI stands at INR 113.13 Lakh Cr ($1.4 Tn)

Beginning 2023, the UPI ecosystem is likely to face a temporary setback if NPCI approved the TPAP guidelines

Indian brands celebrated the Black Friday season sale like never before, with some brands marking a 30-40% growth from business as usual. Yet, transaction volumes on one of the most preferred payment options, the Unified Payments Interface (UPI) dipped marginally in the month of November 2022.

The National Payments Corporation of India (NPCI) which governs UPI, recorded 730 Cr transactions worth INR 11.91 Lakh Cr in November 2022 – a 1.73% month-on-month (MoM) decline from October 2022. In the previous month, UPI registered its ever highest numbers at 730 Cr transactions worth INR 12.11 Lakh Cr.

With this, by November 2022, the total transaction value of the UPI stands at INR 113.13 Lakh Cr ($1.4 Tn).

As November ends, UPI apps are en route to facing their biggest challenge. Over the past week, NPCI has been in talks with the Reserve Bank of India (RBI) officials to implement the 30% market cap deadline by December.

When implemented, the TPAP rule will limit the volume of the UPI to 30% per app. While it is unlikely to affect 60 UPI apps out of the top 62, PhonePe and Google Pay, which hold the largest market shares, will face severe payment failures.

Currently, PhonePe holds nearly 50% share in the UPI market while Google Pay holds nearly 35%.

PhonePe has already put in a formal request to defer the December 2022 deadline by at least three years while several others have sought an extension of at least five years.

NPCI is likely to reach a final decision on the issue soon as it is consulting with the apex bank officials on the matter. It is also examining the UPI apps’ representations since restricting users to pay when an app reaches the 30% threshold, will limit the user experience of the end consumer.

Update: December 12, 2022 | 12:12 PM

The previous version of the story mistakenly mentioned a 3.17% decline. It has been updated to 1.73%

Ad-lite browsing experience

Ad-lite browsing experience