![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2020/08/Feature_Image_Funding-2-1.jpg)

Trell has bagged $11.4 Mn in Series A from KTB Networks, Samsung Ventures and others

Reliance Retail has acquired epharmacy startup Netmeds for $83 Mn

Sachin Bansal-led Navi Technologies may acquire two private life insurance companies

We bring to you the latest edition of Funding Galore: Indian Startup Funding Of The Week!

Bengaluru-based video-first experience discovery platform Trell has raised $11.4 Mn (nearly INR 85.3 Cr) in Series A funding round led by KTB Network. Other marquee investors Samsung Ventures; Teachable CEO Ankur Nagpal; Pinterest, Square and DoorDash board member Gokul Rajaram; and former head of Google Play Store Development Vineet Buch also participated via Firebolt Ventures. Even existing investors Sequoia’s Surge, Fosun RZ Capital and WEH Ventures joined this funding round.

The company has raised nearly $16.95 Mn till date. It has also witnessed a 500% growth rate since the Indian government decided to ban 59 Chinese apps, including TikTok, in June 2020. Trell has over 15 Mn creators on its platform receiving more than 5 Bn views since the Chinese apps ban. Overall, the company has 75 Mn downloads and 25 Mn monthly active users on its app. In the last 12 months, the company claims to have grown 27x, emerging as one of the prominent lifestyle social platforms in India.

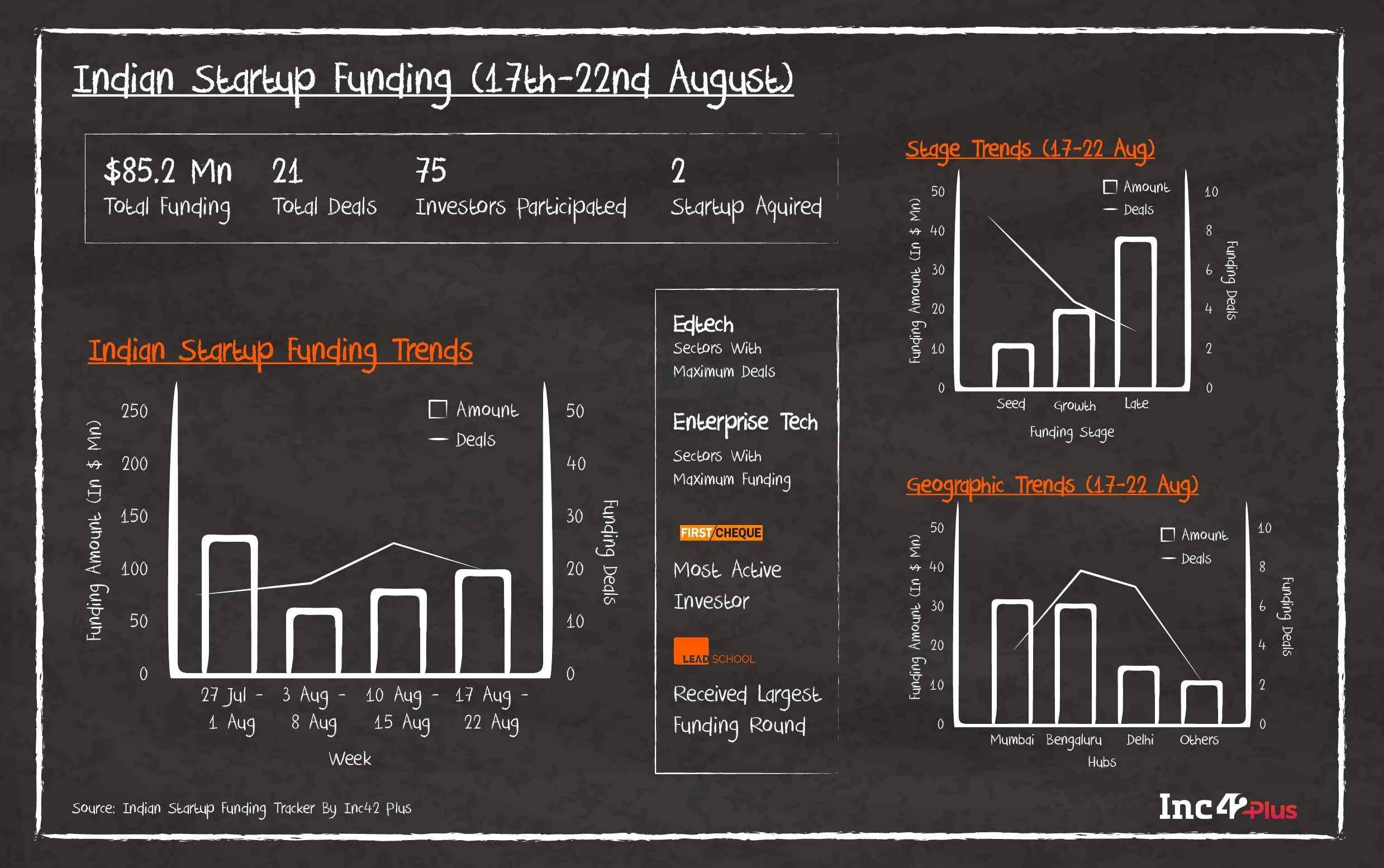

Overall, $85.2 Mn was invested across 21 Indian startups this week, and 2 acquisitions took place. (This funding report is based on startups that disclosed funding amounts).

Checkout Inc42 Plus’ Indian Startup Funding Tracker For Latest Funding Deals Info

Indian Startup Funding Of The Week

- Lead School: $28 Mn

- FarEye: $13 Mn

- Trell: $11.4 Mn

- FPL Technologies: $10 Mn

- Mitron: $5 Mn

- Pixxel: $5 Mn

- Masai School: $2.5 Mn

- Captain Fresh: $2.3 Mn

- Able Jobs: $1.8 Mn

- CometChat: $1.6 Mn

- GrayQuest: $1.2 Mn

- Square Off: $1 Mn

- SmarterBiz: $1 Mn

- Daalchini: $667K

- Text Mercato: $646K

- Language Curry: $92K

- LearningMate: Undisclosed

- Eden Smart Homes: Undisclosed

- Habbit Health and Nutrition: Undisclosed

- Mesh: Undisclosed

- Kaagaz Scanner: Undisclosed

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]](data:image/svg+xml,%3Csvg%20xmlns=%22http://www.w3.org/2000/svg%22%20viewBox=%220%200%20120%2040%22%3E%3C/svg%3E) Lead School: Mumbai-based edtech startup Lead School, which offers technology solutions to help schools and teachers digitise the learning experience, has raised $28 Mn in Series C funding round led by WestBridge Capital. The company’s existing investor Elevar Equity has also participated in this round. The fund will be used to target more Tier II and Tier III schools, grow its sales channels, sign up new customers, and enhance its technology offerings.

Lead School: Mumbai-based edtech startup Lead School, which offers technology solutions to help schools and teachers digitise the learning experience, has raised $28 Mn in Series C funding round led by WestBridge Capital. The company’s existing investor Elevar Equity has also participated in this round. The fund will be used to target more Tier II and Tier III schools, grow its sales channels, sign up new customers, and enhance its technology offerings.

FarEye: Logistics SaaS platform FarEye has raised $13 Mn as an extension to its Series D investment led by Korea-based investment firm Fundamentum Partnership, which is backed by Nandan Nilekani, Sanjeev Aggarwal and KB Global Platform Fund. The investment will accelerate FarEye’s global expansion.

FarEye: Logistics SaaS platform FarEye has raised $13 Mn as an extension to its Series D investment led by Korea-based investment firm Fundamentum Partnership, which is backed by Nandan Nilekani, Sanjeev Aggarwal and KB Global Platform Fund. The investment will accelerate FarEye’s global expansion.

FPL Technologies: Pune-based fintech startup First Principle Labs (FPL) Technologies has raised $10 Mn in funding from Sequoia India, Matrix Partners India and Hummingbird Ventures. The company said that it will be utilising the fund to further scale up its engineering and product development teams and customer acquisition.

FPL Technologies: Pune-based fintech startup First Principle Labs (FPL) Technologies has raised $10 Mn in funding from Sequoia India, Matrix Partners India and Hummingbird Ventures. The company said that it will be utilising the fund to further scale up its engineering and product development teams and customer acquisition.

Mitron: Homegrown short video platform Mitron has raised $5 Mn (nearly 37.3 Cr) from Nexus Venture Partners, 3one4 Capital and Arun Tadanki’s private syndicate LetsVenture also participated in the latest round. It will use the funding to accelerate its product development to increase user engagement and hire high-quality talent.

Mitron: Homegrown short video platform Mitron has raised $5 Mn (nearly 37.3 Cr) from Nexus Venture Partners, 3one4 Capital and Arun Tadanki’s private syndicate LetsVenture also participated in the latest round. It will use the funding to accelerate its product development to increase user engagement and hire high-quality talent.

Pixxel: India’s first Earth-imaging satellite startup Pixxel has secured a funding of $5 Mn in a seed round led by Indian venture capital firms Blume Ventures, growX ventures and Lightspeed India. Inventus Capital India and angel investors Stanford Angels and Ryan Johnson, a veteran in the Earth-imaging space, also participated in the funding round.

Pixxel: India’s first Earth-imaging satellite startup Pixxel has secured a funding of $5 Mn in a seed round led by Indian venture capital firms Blume Ventures, growX ventures and Lightspeed India. Inventus Capital India and angel investors Stanford Angels and Ryan Johnson, a veteran in the Earth-imaging space, also participated in the funding round.

Masai School: Bengaluru-based edtech startup Masai School has raised a Pre-Series A funding round of $2.5 Mn led by Unitus Ventures. The round also saw participation from India Quotient and AngelList India. It will be utilising the fund to strengthen its classroom and digital infrastructure, provide quality education to students and make them job-ready.

Masai School: Bengaluru-based edtech startup Masai School has raised a Pre-Series A funding round of $2.5 Mn led by Unitus Ventures. The round also saw participation from India Quotient and AngelList India. It will be utilising the fund to strengthen its classroom and digital infrastructure, provide quality education to students and make them job-ready.

Captain Fresh: Freshwater fish and seafood supply chain platform Captain Fresh has raised $2.3 Mn in Pre-Series A funding led by Ankur Capital with participation from Incubate Fund India and Silicon Valley-based angel investors. The proceeds of the round would be used to build its plans around computer vision, Internet of Things, automation bots, data analytics to digitise and drive efficiencies across the seafood supply chain. Additionally, it will expand to new cities and add key hires.

Captain Fresh: Freshwater fish and seafood supply chain platform Captain Fresh has raised $2.3 Mn in Pre-Series A funding led by Ankur Capital with participation from Incubate Fund India and Silicon Valley-based angel investors. The proceeds of the round would be used to build its plans around computer vision, Internet of Things, automation bots, data analytics to digitise and drive efficiencies across the seafood supply chain. Additionally, it will expand to new cities and add key hires.

Able Jobs: Entry-level hiring platform Able Jobs has raised $1.8 Mn in seed round from SAIF Partners, Y combinator, Titan Capital, Firstcheque and Neeraj Arora. The fresh raise will be used by the brand for the acceleration of its product growth and expansion of its team. The company also plans to build state-of-the-art training products for companies to hire talent reliably and expand into adjacent sectors like FMCG, BFSI, etc.

Able Jobs: Entry-level hiring platform Able Jobs has raised $1.8 Mn in seed round from SAIF Partners, Y combinator, Titan Capital, Firstcheque and Neeraj Arora. The fresh raise will be used by the brand for the acceleration of its product growth and expansion of its team. The company also plans to build state-of-the-art training products for companies to hire talent reliably and expand into adjacent sectors like FMCG, BFSI, etc.

CometChat: Mumbai and Denver-based CometChat has raised $1.6 Mn in a seed round from Colorado-based Range Venture, New York-based Silicon Badia and India-based iSeed Ventures. This capital will help CometChat fuel growth by entering new markets with their marketing approach and make investments towards product development.

CometChat: Mumbai and Denver-based CometChat has raised $1.6 Mn in a seed round from Colorado-based Range Venture, New York-based Silicon Badia and India-based iSeed Ventures. This capital will help CometChat fuel growth by entering new markets with their marketing approach and make investments towards product development.

GrayQuest: Education-focused fintech startup GrayQuest has raised $1.2 Mn in Pre-Series A funding round led by global investment firm Foundation Holdings. Mahansaria Family Office, Jeejeebhoy Family Office, Ambit Capital founder Ashok Wadhwa’s Family Office, fintech lending company SMECorner founder Samir Bhatia and angel investor Rohit Dhoot amongst others also participated in the round.

GrayQuest: Education-focused fintech startup GrayQuest has raised $1.2 Mn in Pre-Series A funding round led by global investment firm Foundation Holdings. Mahansaria Family Office, Jeejeebhoy Family Office, Ambit Capital founder Ashok Wadhwa’s Family Office, fintech lending company SMECorner founder Samir Bhatia and angel investor Rohit Dhoot amongst others also participated in the round.

SquareOff: Automated chess boards maker Square Off has raised $1 Mn via crowdfunding for their latest board gaming range – Square Off Neo and Swap. The crowdfunding campaign, launched on Kickstarter and followed up by Indiegogo, is 2000% funded over the goal amount of $50,000.

SquareOff: Automated chess boards maker Square Off has raised $1 Mn via crowdfunding for their latest board gaming range – Square Off Neo and Swap. The crowdfunding campaign, launched on Kickstarter and followed up by Indiegogo, is 2000% funded over the goal amount of $50,000.

SmarterBiz: End-to-end SmarterBiz has raised $1 Mn (INR 8 Cr) in Pre-Series A funding round from StartupXseed Ventures, former Microsoft India chairperson Bhaskar Pramanik, Daksh cofounder and former Partner Artiman Aravind, Ravi Viswanath, Ramesh Radhakrishnan, Ranjan Biswas, and MJ Aniketh.

SmarterBiz: End-to-end SmarterBiz has raised $1 Mn (INR 8 Cr) in Pre-Series A funding round from StartupXseed Ventures, former Microsoft India chairperson Bhaskar Pramanik, Daksh cofounder and former Partner Artiman Aravind, Ravi Viswanath, Ramesh Radhakrishnan, Ranjan Biswas, and MJ Aniketh.

Daalchini: IoT-enabled physical and digital vending machine startup Daalchini has raised $667K (INR 5 Cr) in Pre-Series A round led by Artha Venture Fund (AVF), angel investors former Jubilant Foodworks’ CEO Ajay Kaul, Beardo cofounders Ashutosh Valani and Priyank Shah, and others. Daalchini will utilise this fundraise to expand its footprint to cover all metros and to increase its product portfolio.

Daalchini: IoT-enabled physical and digital vending machine startup Daalchini has raised $667K (INR 5 Cr) in Pre-Series A round led by Artha Venture Fund (AVF), angel investors former Jubilant Foodworks’ CEO Ajay Kaul, Beardo cofounders Ashutosh Valani and Priyank Shah, and others. Daalchini will utilise this fundraise to expand its footprint to cover all metros and to increase its product portfolio.

Text Mercato: Bengaluru-based digital cataloging and associated content company Text Mercato has raised $646K (INR 4.85 Cr) in a funding round led by 1Crowd. Hong Kong-based startup accelerator Betatron, and angel investors Andrew Dell (former CEO of HSBC Africa) and Raaj Shah (the CFO of Sequent) also participated in this round.

Text Mercato: Bengaluru-based digital cataloging and associated content company Text Mercato has raised $646K (INR 4.85 Cr) in a funding round led by 1Crowd. Hong Kong-based startup accelerator Betatron, and angel investors Andrew Dell (former CEO of HSBC Africa) and Raaj Shah (the CFO of Sequent) also participated in this round.

Language Curry: Language learning app Language Currym has raised $92K from Rebalance Angel Community and a clutch of angel investors including Bollywood Singer Sukhbir Singh, SirionLabs’ cofounder Kanti Prabha, Chandigarh Angel Network, Sarcha Advisors’ managing partner Rohit Chanana. It now plans to focus on core product building, marketing, hiring and introduce new Indian languages.

Language Curry: Language learning app Language Currym has raised $92K from Rebalance Angel Community and a clutch of angel investors including Bollywood Singer Sukhbir Singh, SirionLabs’ cofounder Kanti Prabha, Chandigarh Angel Network, Sarcha Advisors’ managing partner Rohit Chanana. It now plans to focus on core product building, marketing, hiring and introduce new Indian languages.

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]](data:image/svg+xml,%3Csvg%20xmlns=%22http://www.w3.org/2000/svg%22%20viewBox=%220%200%20120%2040%22%3E%3C/svg%3E) LearningMate: Partners Global-backed content technology company SPi Global has acquired majority stakes in edtech startup LearningMate, giving a partial exit to decade-old investor Helix Investment. LearningMate’s founding team and senior management will continue to be a part of the company.

LearningMate: Partners Global-backed content technology company SPi Global has acquired majority stakes in edtech startup LearningMate, giving a partial exit to decade-old investor Helix Investment. LearningMate’s founding team and senior management will continue to be a part of the company.

Eden Smart Homes: IoT startup Eden Smart Homes has raised an undisclosed amount from Inflection Point Ventures. The company will be using the funds raised to set up their distribution channel across 30 major cities for driving more business in the Home segment. It is also in talks with large brands and SMEs to license a part of their technology for bundle up sales and even listing it online on targeted platforms for better visibility to the customers.

Eden Smart Homes: IoT startup Eden Smart Homes has raised an undisclosed amount from Inflection Point Ventures. The company will be using the funds raised to set up their distribution channel across 30 major cities for driving more business in the Home segment. It is also in talks with large brands and SMEs to license a part of their technology for bundle up sales and even listing it online on targeted platforms for better visibility to the customers.

Habbit Health and Nutrition: Delhi-based nutrition startup Habit Health and Nutrition has raised an undisclosed amount in pre-Seed round from 3one4 Capital and Utsav Somani of AngelList India. Singapore-based RB Investments, early-stage investors Better Capital and First Cheque, and multiple other angel investors (via AngelList) have participated in the round as well.

Habbit Health and Nutrition: Delhi-based nutrition startup Habit Health and Nutrition has raised an undisclosed amount in pre-Seed round from 3one4 Capital and Utsav Somani of AngelList India. Singapore-based RB Investments, early-stage investors Better Capital and First Cheque, and multiple other angel investors (via AngelList) have participated in the round as well.

Mesh: Internal social network for employees Mesh has raised an undisclosed amount from Silicon Valley-based incubator Y Combinator, US seed-stage fund Liquid 2 Ventures and angel investors like Xiaomi Indonesia head Alvin Tse, Sumon Sadhu,m Mercury founder Immad Akhund. The founders of India startups like Cure.fit, Meesho and CleverTap also participated in the round, among others.

Mesh: Internal social network for employees Mesh has raised an undisclosed amount from Silicon Valley-based incubator Y Combinator, US seed-stage fund Liquid 2 Ventures and angel investors like Xiaomi Indonesia head Alvin Tse, Sumon Sadhu,m Mercury founder Immad Akhund. The founders of India startups like Cure.fit, Meesho and CleverTap also participated in the round, among others.

Kaagaz Scanner: Indian document scanning app Kaagaz Scanner has raised an undisclosed amount from First Cheque and a few angels. The company has managed to get 2 Lakh downloads in three days organically to generate 1 Mn downloads on Google Play store.

Kaagaz Scanner: Indian document scanning app Kaagaz Scanner has raised an undisclosed amount from First Cheque and a few angels. The company has managed to get 2 Lakh downloads in three days organically to generate 1 Mn downloads on Google Play store.

Indian Startup Acquisitions Of The Week

- Reliance Retail has entered the online medicine delivery space by acquiring 60% equity stake in epharmacy startup Netmeds, formally known as Vitalic Health Private Limited, for $83 Mn (INR 620 Cr). The Mukesh Ambani-led company has got the 100% equity ownership of Netmeds subsidiaries — Tresara Health Pvt Ltd, Netmeds Marketplace Ltd and Dadha Pharma Distribution Private Limited. All these subsidiaries are collectively known as Netmeds, and are in the business of pharma distribution and sales, and business support services.

- Gurugram-based smart bus startup gogoBus has acquihired Ranchi-bases bus transport aggregator BusYar. The strategic acquisition is a part of gogoBus’s expansion plan. gogoBus is operational on several routes in Northern India. With this acquisition, their area of operations will expand to the Eastern region of the country. Some initial routes include Ranchi – Jamshedpur, Ranchi – Dhanbad, Ranchi – Hazaribagh and Jamshedpur – Patna.

Other Developments Of The Week

- Seattle and Bengaluru-based Unitus Ventures Fund II (formerly Unitus Seed Fund) has received $10 Mn (INR 75 Cr) from Small Industrial Development Bank of India’s (SIDBI) Fund of Funds for startups. Besides SIDBI, PepsiCo’s former CEO Indra Nooyi, AmSoft Systems’ president Raj Nooyi, former Cognizant CEO Lakshmi Narayanan have also joined as existing investors in the venture fund.

- US-based venture capital firm Lightspeed Venture Partners’s Indian unit, Lightspeed India Partners, has raised its Fund III with a commitment of $275 Mn (nearly INR 2,055 Cr at current conversion rate) from global institutional limited partners. Overall, the early-stage VC firm has invested nearly $750 Mn in India since its inception in 2007.

- Hotel and hospitality unicorn OYO founder and CEO Ritesh Agarwal has joined Mumbai-based integrated incubator as an advisor. He plans to boost entrepreneurship in India’s Tier 2/3 cities and beyond.

- Google is in talks to invest nearly $150 Mn to $200 Mn in regional language-focussed social media platform ShareChat, according to a recent report. Last week it was reported that Microsoft might invest $100 Mn in the social media platform.

- The India-Japan Fund of Funds in which Nippon India Digital Innovation AIF Fund is a part of has infused nearly $6.6 Mn (INR 50 Cr) in Hyderabad-based early-stage venture capital firm Endiya Partners’ Fund II. Overall, Nippon is looking to invest in approximately 15-20 venture capital funds in India across various verticals — manufacturing, electric vehicles, automobiles, financial services, healthcare, education, eCommerce, retail, pharma and others.

- IT minister Ravi Shankar Prasad launched the $574K (INR 4.3 Cr) ‘Swadeshi Microprocessor Challenge’ on the lines of the Aatmanirbhar Bharat App Innovation challenge. The challenge calls on innovators, startups and students to use microprocessors to develop various technology products.

- Mukesh Ambani-led Reliance Industries is reportedly in talks to acquire online furniture startup Urban Ladder and milk delivery platform Milkbasket in a bid to expand its ecommerce offerings.

- Sachin Bansal-led financial service company Navi Technologies is reportedly looking to acquire two private life insurance companies Future General Life Insurance and DHFL Pramarica Life Insurance to expand its loan offerings.

- Silicon Road Accelerator programme’s second edition has shortlisted six startups across the retail and food tech sector. These include BUYbot, Redesyn, BFore, Extovate Venture, Upperclimb and Supply 6. During the 12-week programme, Silicon Road will also invest an initial amount of money $33K (INR 25 Lakhs) in the qualifying startups with a possibility of follow-on investments and investment through syndicates and partner investor networks.

- T-Hub, in partnership with KOSME, has selected 10 startups for its ‘Startup Accelerator 2020’ programme. T-Hub will execute the acceleration program virtually in view of the pandemic, and the startups will undergo intensive training for two months. These include One beauty Korea (dental implants), A-virtual, Honour Farm, LabSD, Letsfarm, Braincolla, Coconut Silo, L’air Pur Co., Ltd, TAGHIVE Inc and Korean Aviation Lights.

- Food enterprise WayCool Foods have received $114K in grant from Dutch development bank FMO for procurement and distribution of personal protective equipment (PPE) kits and sol testing kits for farmers. The dual-purpose PPE kits will help protect farmers during the pandemic and also shield them during agricultural operations.

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![Funding Galore: Indian Startup Funding Of The Week [August 17- 22]-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience