Through Make In India, India aims to reduce its reliance on imports of defence equipment and technology and increase its defence exports to seize a share of the $2.1 Tn global defence market

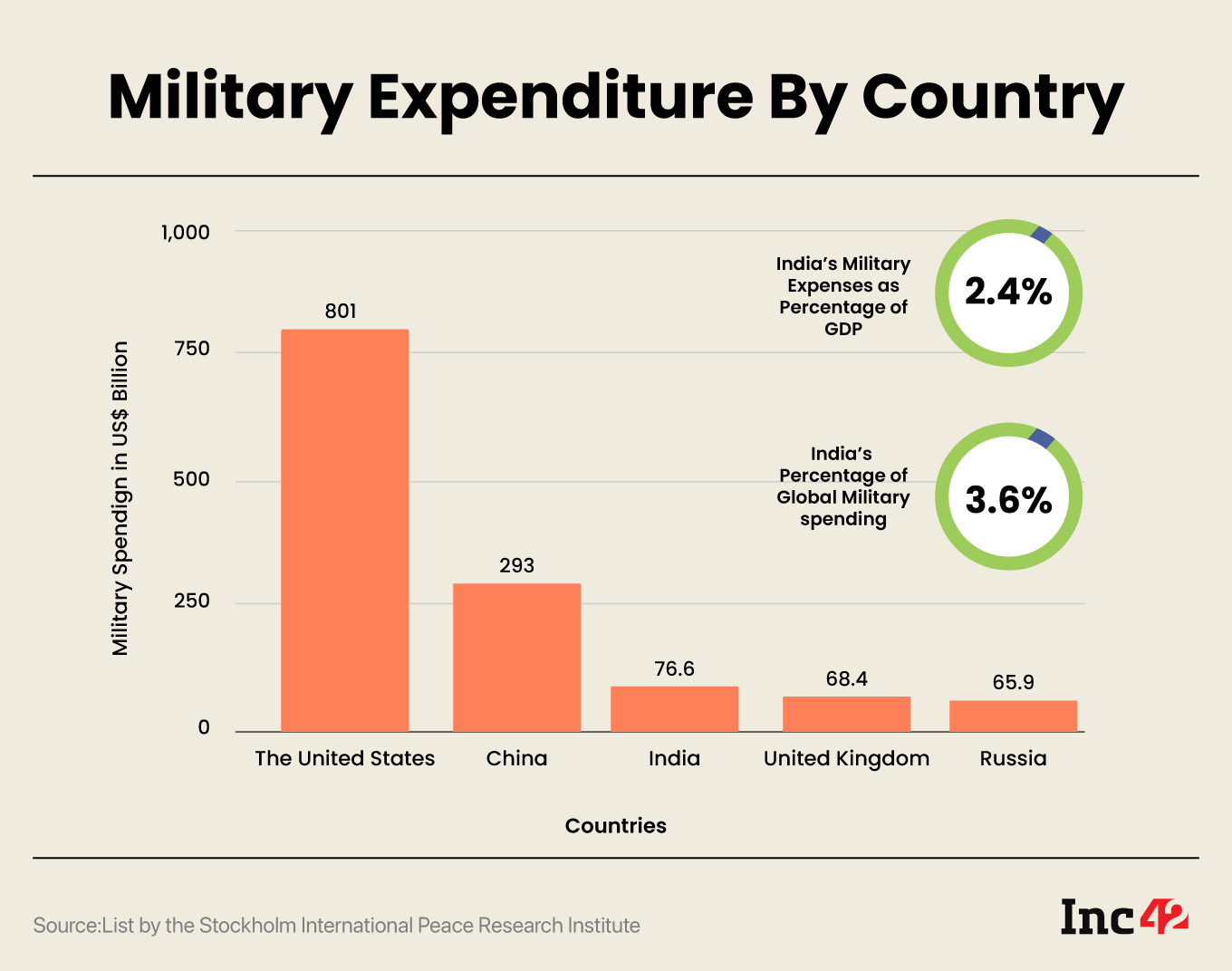

India today accounts for 3.7% of global military spending, making it the third highest military spender ($76.6 Bn in 2022) in the world after the U.S. and China

Read on to understand the opportunities and challenges faced by defence startups in India, highlighting some success stories as well as sharing the investor perspective on identifying good opportunities in this sector

India is embarking on a new path to boost its defence and attack capabilities through the Make in India initiative. The country aims to reduce its reliance on imports of defence equipment and technology and increase its defence exports to seize a share of the $2.1 Tn global defence market.

The Make in India initiative aims to encourage the indigenous production of defence equipment by established firms as well as emerging startups and SMEs through tax incentives and favourable policies. Additionally, the Indian government has also launched the Innovation for Defence Excellence (IDEX) programme to foster innovation and promote startups in the defence sector.

This article discusses the opportunities and challenges faced by defence startups in India, highlighting some success stories as well as sharing the investor perspective on identifying good opportunities in this sector.

Rising India: Transforming Its Defence Landscape

India today accounts for 3.7% of global military spending, making it the third highest military spender ($76.6 Bn in 2022) in the world after the U.S. ($801 Bn) and China ($293 Bn). It is also the second largest defence force in the world, with 14 Lakh active personnel and 13 Lakh reserve personnel across the Indian Army, Navy and Air Force. Defence expenditures constitute nearly 2.4% of GDP. A question that arises is, what percentage of this expenditure is sourced from India?

Until a few decades ago, India’s ability to meet its expenses was less than 20%. In fact, India was the largest importer in the defence sector until about eight years ago. “It is a paradox that while India has one of the largest defence industrial complexes in the developing world, yet it continues to be overwhelmingly dependent on imports for arms and equipment”, Richard McCallum, Vice Chair, UKIBC India, said in a UK India Business Council.

But now, time is changing. India’s defence manufacturing sector is maturing, with both established and emerging players of various sizes gearing up to seize the lucrative opportunities in the defence and aerospace industries that they have been anticipating for years. According to senior officials, this is due to India’s plan to invest an average of INR 1.5 Lakh Cr ($18.3 Bn) per year until 2030 in order to modernise its military capabilities.

At the same time, the government is taking strong measures to increase domestic procurement. The Ministry of Defence (MoD) previously released three positive indigenisation lists, which included a total of 310 items that must be sourced domestically and contain at least 50% domestic content.

During the opening ceremony of DefExpo 2022 in Gandhinagar, Gujarat on October 19, 2022, the Prime Minister announced the fourth positive indigenisation list, which consists of 101 items to be sourced domestically. This step by the government has been a big catalyst to encourage domestic companies to invest and build capabilities either organically or through technology transfers with global OEMs.

The emphasis is not only on reducing defence equipment imports, but also on increasing India’s exports of defence equipment and technology by relaxing export regulations, encouraging public-private partnerships, and inviting global delegations from emerging countries to consider India as a defence supplier.

In March 2023, the Indian government invited army chiefs or their representatives from 31 African nations to showcase the capability of the Indian defence industry at the maiden India Africa Army Chiefs Conclave in Pune. India is now exporting to over 85 countries, according to a recent statement by the Ministry of Defence.

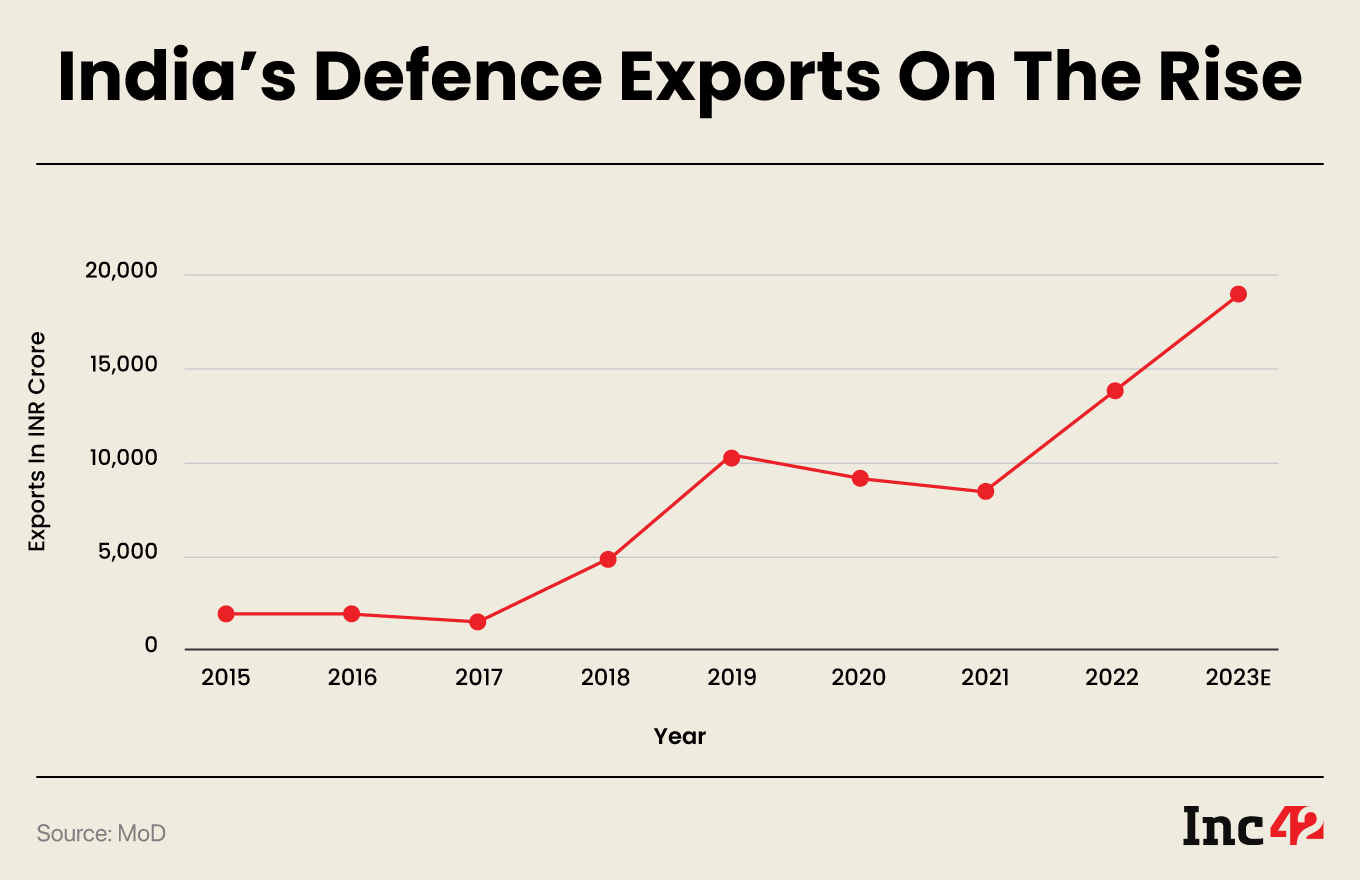

“Defence exports have now grown eight times in the past five years. India’s defence exports in 2021-22 have touched INR 13,000 Cr ($1.6 Bn). And in the coming years, India has set itself a target to reach INR 40,000 Cr ($5 Bn)” Said PM Modi in the DefExpo 2022.

The private sector defence manufacturing ecosystem has seen a surge of pioneering energy after the $128 Bn opportunity that is expected to be available over the next seven years. However, it’s still possible that this figure is an underestimate. In the upcoming fiscal year of FY24, the capital outlay for defence modernisation and infrastructure development is projected to be INR 1.63 Lakh Cr ($20 Bn).

As a result of various systemic events influencing global factors and major changes in defence procurement policy by the Government of India, we see four major trends:

- High defence expenditure as a percentage of GDP

- The economic substitution of expensive foreign inputs with Indian alternatives

- The significant growth of defence exports from India

- Scale-up of defence startups and SMEs who will seize the opportunity through differentiated technology or products and partnerships with larger system integrators

What’s In There For Startups: The Struggle To Succeed

Every day, the major private companies in India make headlines. Tata Advanced Systems, a Tata Group subsidiary that develops and manufactures aerospace, defence, and security products, recently collaborated with Airbus Defence & Space (DS), a division of Airbus, to manufacture and assemble the C-295 medium-lift transport aircraft. The deal worth INR 21,935 Cr ($2.67 Bn) for producing 40 fly-away C-295 aircraft and providing MRO (maintenance, repair and operations) services for 56 aircraft is considered to be the biggest development since the involvement of the private sector in the Indian defence industry.

Bharat Forge’s order book, which primarily comprises guns and mounted vehicles, exceeds INR 2,000 Cr ($240 Mn). Meanwhile, Mahindra Defence Systems is currently executing an order worth INR 1,056 Cr ($129 Mn) for light combat vehicles from the army and another order worth INR 1,350 Cr ($165 Mn) from the navy for an integrated anti-submarine warfare defence suite.

This clearly shows that the large defence conglomerates are already playing a significant role in achieving the goal of the Make in India initiative, but what is the contribution of emerging startups and SMEs in this sector? Despite the fact that the defence industry is booming, only a few defence startups have emerged in recent years. Let’s explore why this is the case.

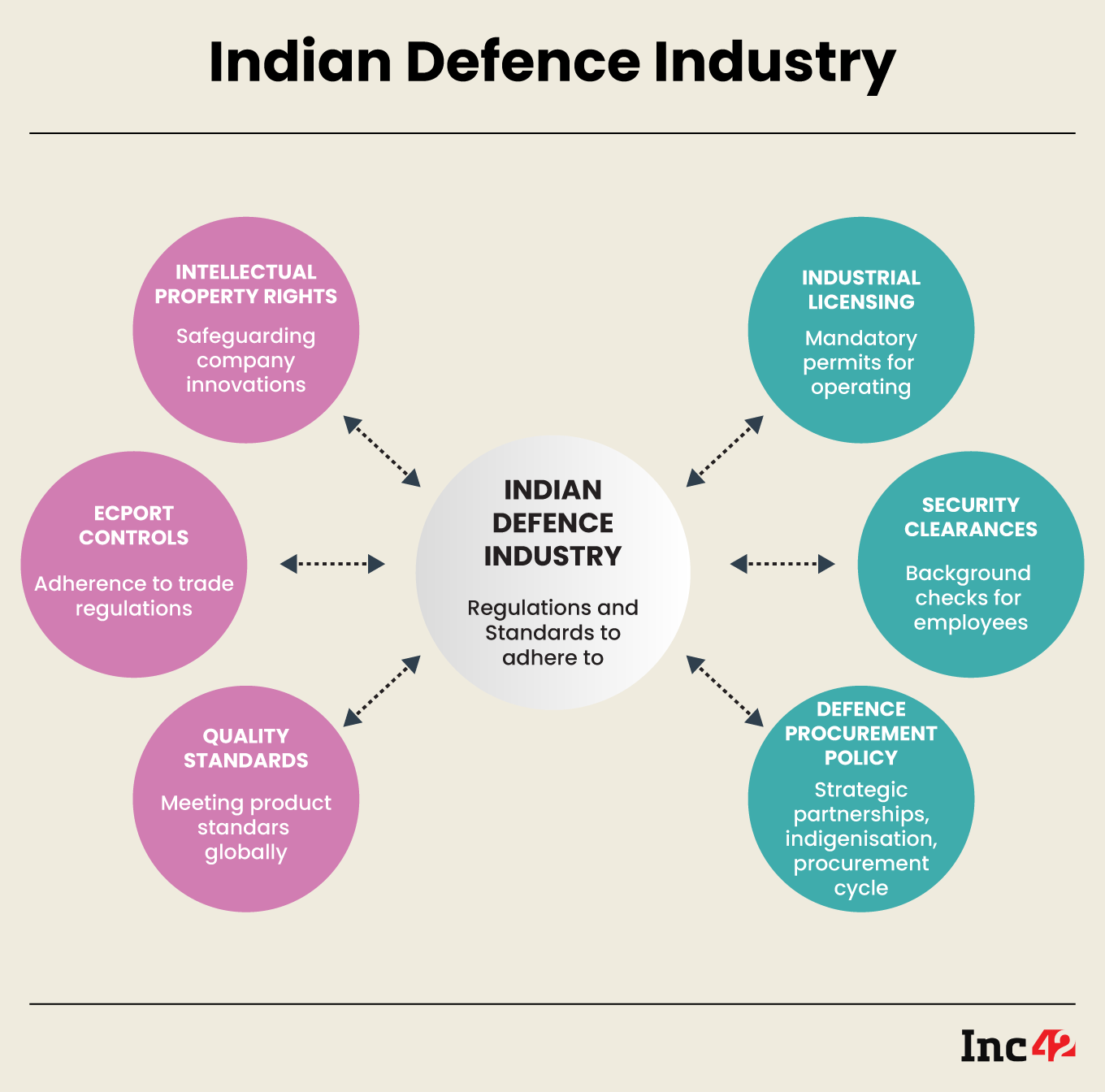

Strict Regulations And Standards

India’s defence sector is subject to strict regulations and standards like industrial licencing, security clearances and defence procurement policies, among others. All of which defence startups must adhere to. Moreover, the procurement process for defence equipment is intricate and lengthy, posing a challenge for startups with limited resources.

Additionally, the defence sector demands substantial investment, which can be a hurdle for startups, whether it’s equity or debt funding. Even when startups succeed in getting orders, raising working capital finance is still a challenge due to the limitations of the Indian banking system in lending to loss-making companies.

Startups Being Pushed To The Sidelines

In India, companies such as Larsen and Toubro (L&T), Tata Advanced Systems, Bharat Electronics (BEL), and Hindustan Aeronautics Ltd (HAL), dominate as system integrators. They source components from smaller startups and assemble them under their brand name for supply to the armed forces.

Also, the Defence Research and Development Organisation (DRDO) serves as the gatekeeper of defence technology, commissioning companies to develop technology that it pays for. Afterwards, the technology is handed over to a public sector unit (PSU) like BEL for mass production. This approach sidelines small and medium enterprises (SMEs) and requires startups to relinquish their intellectual property to DRDO.

The Funding Conundrum

Private capital is the sole means for companies to circumvent the DRDO, procurement process and system integrators. However, this is a formidable challenge since the defence sector has an extended gestation period (5-6 years) and procurement cycle.

Additionally, the need for liquidity poses a significant issue. As a result, investors have remained cautious to date. A lot of venture capital funds do not have the mandate from their LPs to invest in the defence sector and may not even have the fund life to see the fruits of their investment in this sector. As a consequence, at the early stage, defence startups will have to rely on funding from large family offices and HNIs that have understood the potential of the defence sector in India over the next decade and are willing to deploy patient capital to support these startups.

The government is aware of the challenges faced by these defence startups and has rolled out initiatives such as Innovations for Defence Excellence (iDEX) under the Make in India programme to address these challenges and create a more balanced ecosystem.

Shielding Defence Startups: Government Schemes To Overcome These Challenges

With the Make in India initiative and the iDEX programme, the government is attempting to lower entry barriers for defence startups in India and provide them with a level playing field.

Make In India

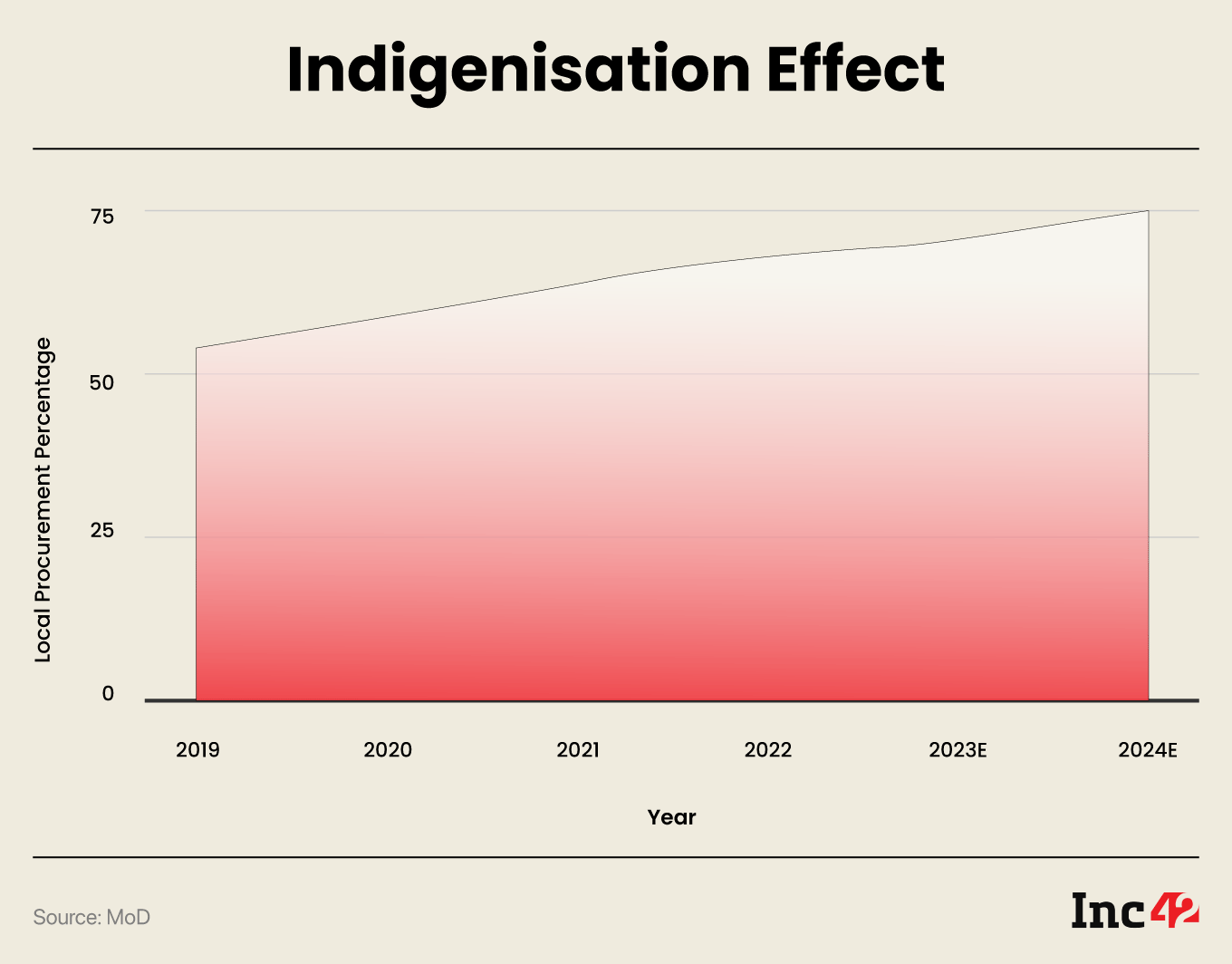

The Make in India initiative aims to increase domestic defence production from 54% in 2019 to 75% by 2024, and it has created a supportive ecosystem for domestic manufacturers, opening up new markets for startups, with the government’s procurement process prioritising indigenous products.

The government has banned the import of 411 weapons, platforms, and systems, which will be indigenised in phases from 2022 to 2030. This ban includes high-value imports such as lightweight tanks, naval utility helicopters, artillery guns, various missiles, destroyers, light combat, transport and basic trainer aircraft, as well as other lower-value imports like spare parts.

Moreover, the government has released three lists of 3,738 components that are imported by defence public sector undertakings (DPSUs) worth INR 39,000 Cr ($4.75 Bn) per year. The majority of these components will be indigenised in the coming years, and 25% of them will be reserved for the private sector.

iDEX

Well aware of the shortcomings of traditional domestic defence contractors, the Indian government also set up a novel programme in 2018 called iDEX, or Innovations for Defence Excellence, under the Make in India programme. The scheme, with budgetary support of INR 500 Cr ($60 Mn) for the next five years (from 2021-22 to 2025-26) is aimed at providing financial support to nearly 300 startups, MSMEs, individual innovators and 20 partner incubators. The initiative has introduced several schemes and programmes to support defence startups, including:

- Defence India Startup Challenge (DISC): A programme that aims to identify and support startups and innovators with disruptive defence technologies. In February 2023, the Defence Minister launched the ninth edition of the Defence India Startup Challenges (DISC 9) programme, which focuses on cybersecurity and offers 28 problem statements. Additionally, he has inaugurated the iDEX Investor Hub, which has received pledges of over INR 200 Cr from prominent Indian investors.

- Defence Innovation Organisation (DIO): iDEX is funded and managed by a “Defence Innovation Organisation (DIO)” formed as a “not-for-profit” company in accordance with Section 8 of the Companies Act 2013. It was established to promote innovation and technology development in the defence sector.

- Technology Development Fund (TDF): A fund that provides financial support to startups and innovators to develop defence technologies. In June 2022, the Defence Minister approved the enhancement of funding under the TDF scheme of the MoD to INR 50 Cr per project from INR 10 Cr.

Breaking Barriers: Success Stories Of Defence Startups

These initiatives have helped several defence startups in India scale fast, develop their products and technology and win orders from the defence forces. According to a report by Inc42, in 2020, there were 194 defence technology startups operating in India under the Startup India mission, with 44 of them actively participating in the iDEX initiative. Now the number has grown to more than 300 defence startups, having received grants worth more than INR 200 Cr from the iDEX. Some of the notable startups include:

ideaForge

Founded in 2007 by IIT Bombay alumnus, Ankit Mehta, Ashish Bhat, Rahul Singh and Vipul Joshi, ideaForge specialises in the design and development of unmanned aerial vehicles (UAVs), commonly known as drones.

ideaForge’s primary focus is on developing UAVs for defence, homeland security and industrial applications. With a market share of around 50% during the fiscal year 2022, IdeaForge is the foremost and pre-eminent market leader in the Indian UAV market. The company’s products include the SWITCH, Q4i, NETRA V4+, NINJA, RYNO and Q6 UAVs, which are used by the Indian Armed Forces, state police departments, disaster management forces, forest departments, government and private contractors and enterprise sectors, among others.

In total, it has so far raised $38.4 Mn in funding and venture debt from marquee names such as Qualcomm Ventures, Florintree Capital Partners and Celesta Capital, among others. The company’s annual revenue stood at $19.65 Mn in FY22 which grew roughly fivefold from its revenue of $4.4 Mn in 2020-2021 and the company delivered a profit of $5.4 Mn in FY22.

The company claims that its customers have completed over 300K flights using their UAVs. It has filed 62 patents, out of which 28 have been filed in India and 34 in international markets. ideaForge is a classic example of a startup making its mark in the Indian defence industry. But as an investor, patience is key, as even this company has taken 15 years to get here. ideaForge has filed its Draft Red-Herring Prospectus (DRHP) for a $100 – $125 Mn IPO soon at a $700 Mn valuation.

Tonbo Imaging

Tonbo Imaging is a Bangalore-based defence startup founded in 2003 by Arvind Lakshmikumar, Ankit Kumar, Sudeep George and Cecilia D’Souza. The company develops advanced imaging and sensor systems for military applications. The startup has raised over $45 Mn in funding to date from investors such as WRV Capital, Qualcomm Ventures and Artiman Ventures.

In February 2023, HBL took a 34% stake in Tonbo for INR 150 Cr ($18.3 Mn), valuing the latter at INR 450 Cr ($54.9 Mn). Having raised capital, it is now focusing on expanding its revenue sources by offering licences for its technology and electro-optic subsystems to rival original equipment manufacturers (OEMs), including Elbit of Israel and Qioptic of the UK.

Tonbo’s products are more cost-effective than those of its competitors, as they utilise lighter materials. According to The Ken, Tonbo’s CEO, Lakshmikumar, stated that the company intends to provide internal components to other entities and larger system integrators rather than solely selling thermal weapon sights.

Alpha Design Technologies

Alpha Design Technologies is a Bangalore-based defence electronics manufacturer that was founded in 2004. The company specialises in researching and developing, manufacturing, assembling, testing, qualifying, integrating, and installing defence electronics, avionics, and space satellite systems.

It was acquired by Adani Defence on 20th April 2019 for INR 400 Cr ($48.7 Mn). Its annual revenue stood at $87.7 Mn in 2021, displaying a growth of 46% over its last year’s revenue of $60.2 Mn, according to a report by Tracxn.

Its product portfolio consists of a range of command, control, communications, computers, intelligence, surveillance and reconnaissance (C4ISR) technologies, such as smart switchboards that can be mounted on vehicles for local communication, receivers that use radar, up and down converters that operate in the c-band, compact jammers, and target acquisition systems that use laser and thermal technology and are equipped with night vision capabilities.

Sagar Defence Engineering (SDE)

Founded in 2015 by Nikunj Parashar, Sagar Defence Engineering (SDE) manufactures products in three categories: drones, aircraft, and USVs (unmanned surface vehicles), with products for military and commercial use. USVs are unmanned weaponised boats or autonomous ocean boats.

SDE specialises in designing, developing and manufacturing ammunition handling systems, missile components, radar and avionics systems. The company’s products are designed to meet the high-performance requirements of the defence industry, and its solutions have been successfully deployed by the Indian Air Force, Indian Navy and Indian Army.

In early 2021, a total of 30 multicopter drones were supplied by the company, which have since been introduced into the Navy. SDE also recently secured a contract with the Indian Coast Guard (ICG) for the supply of 10 multicopter drones. These drones are designed to fly up to 20 km and can operate from moving ships that are travelling at a speed of up to 30 kmph. They are also capable of withstanding wind speeds of up to 45 kmph. The ICG plans to add another 100 of these drones to their fleet by 2025.

The company made headlines last year with the introduction of its heavy-lift utility drone called Varuna, which is India’s first fully electric and autonomous human-carrying platform. The Indian Navy has plans to integrate Varuna into its operations soon. Varuna has a range of 25 km, can carry a payload of up to 130 kg and has a flight time of 25-33 minutes.

SDE has a dedicated R&D centre that focuses on developing cutting-edge defence technology solutions. It even won the national award from the GoI for outstanding performance in the robotics industry in 2022. The startup has so far raised $6.5 Mn from ONGC and IDBI Capital. Its annual revenue is expected to increase significantly in the current financial year from the $1 Mn in revenue it delivered in FY22.

Recently, SDE has also been testing Autonomous Underwater Vehicles and Autonomous Underwater Swarm Drones. These drones have the ability to operate up to 8 km away from their main platform and are useful for conducting surveillance. They were developed domestically in partnership with Mazagoan Dock and iDEX. SDE and Israel Aerospace Industries (IAI) have recently signed a Memorandum of Understanding to develop autonomous weaponized boat swarms for the Indian Navy.

Optimised Electrotech

Founded in 2017 by Anil Yekkala, Dharin Shah, Kuldeep Saxena, Purvi Shah and Sandeep Shah, the startup provides electro-optic systems. These systems can be used for both defence and civilian use cases, ranging from AI-enabled border surveillance to advanced electro-optics to go with weapon systems as well as surveillance of smart cities.

The startup asserts that its products utilise the electromagnetic spectrum, with different segments of the spectrum offering distinct perspectives on the images captured. Its operations cover a range of 400 nm to 12μ, which is within the visible light spectrum. By leveraging this range, the company can provide image analysis for various purposes, including machine vision and border security.

The initial product line of the startup is called InfiVision, which uses VIS+NIR wavelength to detect tanks as well as human and animal movement from a range of over 30 km. The MistVision series employs SWIR wavelength to provide an electro-optics system that can penetrate fog over long distances. The ClearVision series operates on the VIS-NIR and MWIR spectrums and is useful for conducting high spectral-range surveillance in any weather condition.

Finally, the NoctVision series uses VIS-NIR and LWIR wavelengths to perform night surveillance. The startup is a two times winner of the iDEX competition. The startup raised INR 20 Cr ($2.44 Mn) as part of its pre-series B funding round in March 2023, led by the Rajiv Dadlani Group, with participation from Equanimity Investments, Venture Catalysts and other HNIs. Prior to this, it had raised $2.8 Mn across four rounds from multiple investors. The company has many policy tailwinds in its favour, such as the third positive indigenisation list, which names Long Range Reconnaissance & Observation System (LORROS) up to 30 km to be sourced entirely from domestic manufacturers.

NewSpace Research & Technology (NRT)

Founded in 2017, Rajinder Rana and Sameer Joshi saw the potential of the Bengaluru-based startup in pushing the envelope in defence technology. NRT manufactures cutting-edge solutions for aerospace in industrial UAVs, collective robotics, GPS-denied visual-inertial navigation, AI modules, and and virtual reality simulations.

The company specialises in creating durable drones to monitor the earth and facilitate communication. Their NRT system can function within a range of 5 to 20 km and has varying levels of endurance. Additionally, the company intends to emphasise the use of drones for civilian logistical operations.

In December 2022, it raised INR 26.6 Cr ($3.24 Mn) in a pre-series B funding round from existing backer QRG Investments and holdings. This marked the second funding round of the year for the company, following a Series A round in February, in which it raised $21 Mn from Pavestone Technology Fund. In total, it has raised $33 Mn in funding so far.

These startups have shown significant potential in the Indian defence sector and have raised substantial funding to support their growth. Their success is a testament to the supportive ecosystem provided by the iDEX initiative and the huge growth potential of the Indian defence sector to foster innovation and entrepreneurship.

Understanding The Investor Perspective

In our view, the government is doing a great job through the iDEX programmes to encourage startups to take on challenging projects and develop innovative technologies, but we believe more is needed to be done to support the defence startups, especially when it comes to offering lines of credit to these startups to manage the working capital needs of the defence sector while executing large orders.

India could look at how the Defense Advanced Research Projects Agency (DARPA) or the Defence and Security Accelerator (DASA) fund innovative solutions through grants, soft loans and contracts to sustain defence startups through the product development and approval process.

From an investor perspective, a few institutional venture capital (VC) funds are exploring the sector considering the deep tech nature of many of these defence startups, but overall, many VC funds do not have the mandate from their limited partners (LPs) to invest in defence-related ventures. In our experience, the initial funding support for the defence startups has come from HNIs and large family offices that are supporting these startups in their initial years of product development, testing and approval.

As the Indian defence sector continues to grow, startups in the sector are expected to attract more investment and attention. Investors can expect potential exits through IPOs or strategic buyouts by larger defence companies or even global majors looking to set up a base in India. The key evaluation criteria from an investor perspective while assessing which defence startup revolves around

- The team and their technical capabilities as well as prior experience of selling to the defence forces

- The intellectual property (IP) developed and their use cases for the defence forces

- The size of the addressable market

- The competitive landscape for the product or the technology

- Relationships with larger system integrators such as PSUs like BEL, BDL, HAL and large private sector companies such as L&T Defence and Tata Advanced Systems

Considering the huge tailwinds in this sector, early investors in defence startups can expect to see significant returns in the future but they will need to be patient for the story to play out over the next five years.

The article was penned by Jatin Karani, Partner at Samarthya Investment Advisors, Karan Goshar, Partner at Samarthya Investment Advisors and Nikhil Kalwani, Analyst at Samarthya Investment Advisors.

Ad-lite browsing experience

Ad-lite browsing experience