SUMMARY

NBFCs and Fintechs Are Leveraging An Integrated Technology Approach And Great Customer Service To Corner Banks In The Lending Market

Until 10 years ago, taking a loan was a cumbersome process. Borrowers had no option but to approach banks for loans, getting caught up in time-consuming paperwork and trying to prove their creditworthiness. Credit underwriting, which mostly relied on human judgment, took time and it could be weeks or even months before loans were sanctioned and processed. Most banks gave loans only to their own CASA (current account savings account) holders and some only approved loans of applicants who held salary accounts at the bank. Consumption loans, where the lender pays a merchant directly and gets repaid in EMIs, were virtually unheard of.

As any observer of the Indian credit market knows, Bajaj Finance, followed by other nimble lenders such as Tata Capital and Capital First, upended this model of consumer lending and took the lead in a race that left the banks playing perpetual catch-up. Bajaj Finance, which was established in 1987, crossed $73.5 Mn (INR 500 Cr, in annual disbursement back in 2000). In the following six years, the company doubled it to $147 Mn (INR 1,000 Cr). By 2014, the company claimed to have crossed $2.95 Bn (INR 20,000 Cr) mark for its assets under management.

These non-bank finance companies (NBFCs) put in place teams of motivated and efficient employees and created a menu-driven process for consumer lending, which cut down the lag between an application and a credit decision from weeks to days or even hours. Almost overnight, the consumer lending NBFC was born and the consumer finance revolution arrived in India. However, the lending process remained human-intensive — an army of trained salespeople and credit officers honed a manual process until they squeezed all the productivity gains out of process innovation.

Today, something even more dramatic — led by digital — is happening in the consumer lending space in India. The second revolution in consumer and SME finance is here. For people in the industry, the new buzzwords are eKYC, eSign, eNACH, India Stack, APIs and the all-encompassing “fintech”. Just like the first revolution freed borrowers from the shackles of bank lending, by making it easier for someone with a high CIBIL score to avail of a loan in a relatively quick and hassle-free manner, this second revolution is bringing fast and affordable credit to those who traditionally found the doors of finance closed to them — a category of borrowers who are new-to-credit (NTC).

Just as the first revolution made household names of companies such as Bajaj Finance, this one has its own set of champions — companies that’re leveraging innovation and technology to transform the consumer borrowing experience. Some such companies are fintech startups like Moneyview and IndiaLends, who are focused on bringing new borrowers into the ecosystem by providing them with convenient and intuitive web and app-based interfaces.

The others are a breed of new-age NBFCs such as DMI Finance, Capital Float, and LendingKart and a select group of banks such as RBL, who are embracing a tech-first or tech-only approach to underwriting and are providing balance sheet support to fintech companies. In many instances, the lag time for credit underwriting has been slashed to mere seconds and borrowers are seeing money in their bank accounts or payments made to their merchant-seller in a matter of hours and minutes, not weeks and days.

Consumer Lending: Banks Play Catch-up With NBFC-Fintech Teams

Once again, large banks are playing catch-up with a smaller but nimbler and more innovative competitor. This time, it is the tag team of fintech players and new tech-driven NBFCs.

For instance, DMI Finance, a Delhi-based NBFC, has partnered with over 40 fintech companies to act as the lender-on-record for a variety of consumption and personal loan products. Its partners are active in aggregating loan demand across India from diverse categories of borrowers. Some of DMI’s fintech partners, such as Bangalore-based Slicepay, work with students while others such as ZestMoney work with ecommerce companies like Flipkart and Amazon. Some other DMI partners work with travel portals or directly with SMEs. They bring a tech-only ethos to the customer experience and most of them, being technology companies, need a balance sheet partner. NBFCs such as DMI speak their language and the result is a seamless experience for the borrower.

“400mm smartphones coupled with a tech-savvy millennial population are bringing large numbers of the hitherto unserved or underserved into the mainstream of finance and building distribution funnels at a speed not seen earlier. This is truly a disruptive moment for banks and traditional NBFCs as these new borrowers demand a completely different paradigm for the engagement and fulfillment experiences than the older generation of borrowers,” says Shivashish Chatterjee, co-founder DMI Group.

Out with the paperwork, uncertainty over sanction of loans, and long wait periods post sanction. These fintech startups and NBFCs are leveraging machine learning techniques and data analytics to assess borrowers’ creditworthiness and harnessing the power of APIs to deliver these results in close to real time. They promise instant credit decisions, little or no paperwork, transparency in their offerings, and great customer service — a significant upgrade from the earlier experience — and some of them are actually delivering on this promise. DMI, for instance, reportedly processed over 100,000 loans in the month of May with a small dedicated team of 24 professionals, with more than 90% of the loans receiving a credit decision in less than a minute.

The shares of banks in the lending market have fallen while NBFCs have registered a remarkable growth of 28% compared to the previous year. According to a BCG report, between 2014 and 2017, the share of NBFCs in total loans was estimated to have increased from 21% to 44%, whereas for public sector banks, it fell from 49% to 28%.

According to the Fintech Trends Report — India 2017 by PWC, “Alternative lending is the second most-funded and one of the fastest growing segments in the Indian Fintech space.” More than 225 alternative lending companies had been founded in India as of 2017. Alternative lending refers to digital lending platforms catering to different borrowing needs, including consumer, MSMEs, student loans, and mortgages.

Alternative Lending: Tech-powered Credit Solutions For All

Technology and innovation — smooth processes enabled by data and digital tech, machine learning and AI-powered credit rating algorithms, loans on mobile apps with smart UX — are redefining lending solutions. These technologies have also helped integrate lending solutions — from automating the lending process to extending personalised and real-time services to clients. The loans that banks used to take 35-90 days to process are now for the taking in minutes, and that too at the tap of a smartphone.

Much of this innovation is being built on the rails of India Stack, the digital India backbone championed by both the UPA and the NDA governments. Aadhaar-driven eKYC has enabled the new ecosystem to validate a potential borrower in a matter of seconds rather than days. Aadhaar driven eSign has allowed a path to a completely paperless process for many applicants.

Meanwhile, the National Payments Corporation of India (NPCI)’s eNACH initiative has enabled lenders to move away from physical cheques and manual deposits to electronically transferring EMI payments from Aadhaar-linked bank accounts. Thanks to this technological progress, the new Indian consumer credit ecosystem is one of the most advanced in the world today.

However, the technology that can unlock the true potential of digital lending is blockchain. The existing system of evaluating, lending, and credit disbursement has neither made lending transparent nor optimised its efficiency. Shifting the entire process to blockchain will eliminate the ‘trust’ factor, bringing more transparency in lending and reflecting how trustworthy a borrower is.

SMEs & NTCs: NBFCs Extend Loans Where Banks Fear To Tread

For a long time, the Indian banking system was stagnant in its approach and rigid about not extending credit facilities to SME enterprises and other borrowers. In case they did extend credit, the terms and conditions were stringent. In the process, they lost out on a big segment of borrowers. “The major driver of growth in this sector is a large unmet demand for loans from MSMEs, with a gap of roughly ($200 Bn) in credit supply, and a significant under-banked and new-to-bank population,” the Fintech Trends Report added.

While, once upon a time, banks with strong balance sheets were able to better manage the business of lending, NBFCs, with better-quality capital, strong balance sheets, and integrated technology approach, have successfully penetrated the SME lending sector, mitigating the latter’s lower structural liquidity and filling the gap in inadequate supply of credit to NTC consumers and SMEs.

Sunil Kanoria, president of ASSOCHAM, in a PwC report, stated: “NBFCs’ ground-level understanding of their customers’ profile and their credit needs gives them an edge, as does their ability to innovate and customise products as per their clients’ needs. This makes them the perfect conduit for delivering credit to MSMEs.”

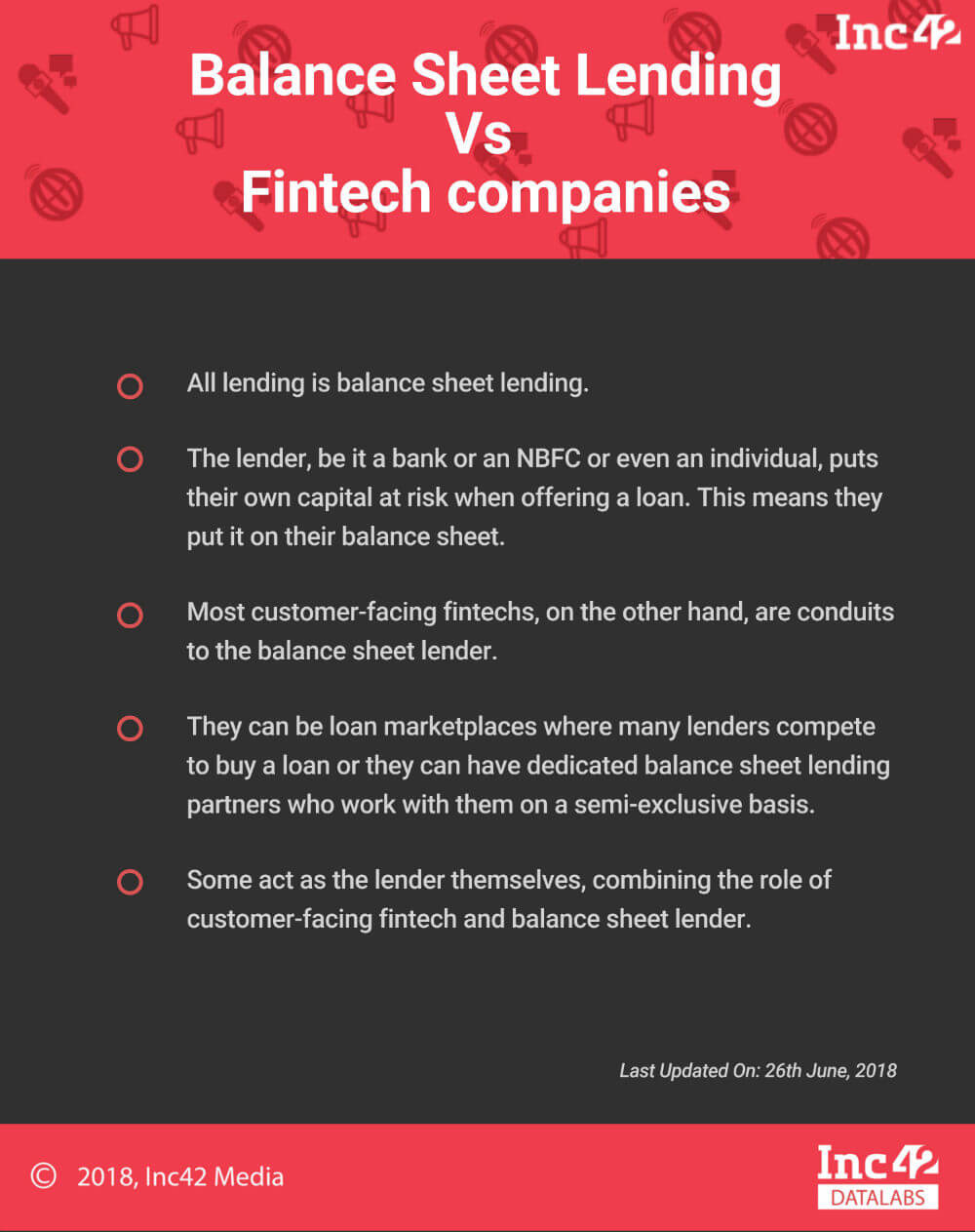

All lending is balance sheet lending. The lender, be it a bank or an NBFC or even an individual, puts their own capital at risk when offering a loan. This means they put it on their balance sheet. Most customer-facing fintechs, on the other hand, are conduits to the balance sheet lender. They can be loan marketplaces where many lenders compete to buy a loan or they can have dedicated balance sheet lending partners who work with them on a semi-exclusive basis. Some act as the lender themselves, combining the role of customer-facing fintech and balance sheet lender.

Armed with tech-powered solutions and the Aadhaar tools, NBFCs have readily filled the gap where banks feared to tread and are reshaping consumer lending among SMEs and NTCs with a high demand for small-ticket credit. They also offer lower rates of interest.

There has been an explosion in small-ticket credit, being driven by NBFCs’ willingness to experiment with alternative data. Traditional underwriting relies on a “thick file” credit history, but significantly less than 100 Mn of India’s 1.3 Bn population qualifies for that. Hence, to cater to the hundreds of millions who are “thin file” or “new to credit”, lenders need to take a leap of faith and adopt a different way to evaluate their creditworthiness.

Fintechs such as Tala, RedCarpet, and Slicepay are building their own credit history, starting out with micro-loans and slowly graduating their borrowers to bigger credit lines. Ecommerce and wallet companies are mining their transaction data to determine which of their buyers qualify for the pay-later credit. Even the traditional credit bureaus — CIBIL and Experian — are making a bid to stay ahead of this revolution in credit assessment. Time alone will tell whether any of these alternative approaches has any real merit or whether traditional lenders will be the ones laughing when the dust settles.

“We are experimenting with credit. Traditional underwriting models require many inputs that are unavailable in today’s real time decisioning framework. We are evaluating the efficacy of alternative data sources. As the volume of data grows, we are developing statistical and ML models that require far more input data than the traditional models and, hence, take time before they can be used effectively,” says Arindam Das, CEO, DMI Consumer Finance.

The NBFC Advantage: Flexible Interest Rates and bigger loans

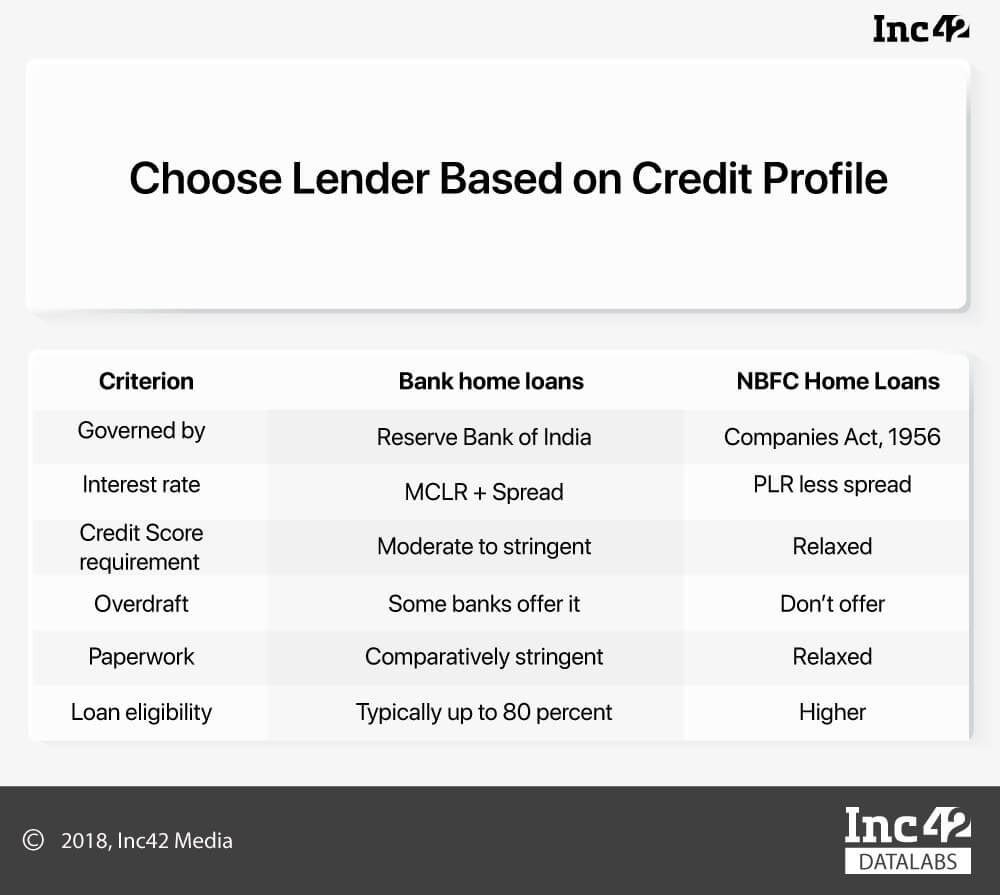

A big advantage of taking a loan from NBFCs is that they can vary their rate of interest, which banks can’t due to RBI norms. When banks offer new loans with floating interest rates, they are linked to the Marginal Cost of Lending Rate (MCLR), which mentions the intervals at which the interest rate automatically changes. However, since NBFCs are linked to the prime lending rate (PLR), which is outside the ambit of the RBI, they can offer varying rates.

According to Adhil Shetty, CEO, BankBazaar, “While banks can’t lend at rates below the MCLR, PLR-linked loans do not have such restrictions. NBFCs and HFCs (housing finance companies) are free to set their PLR. This allows NBFCs greater freedom to increase or decrease their loan rates as per their selling requirements. This suits customers and provides them more options, especially when they fail to meet the loan eligibility criteria of banks.”

Also, compared to banks, NBFCs can lend more amount against the same collateral. This is because while both NBFCs and banks are not allowed to fund stamp duty and registration costs, NBFCs can include these costs as part of a property’s market valuation.

Licensed Vs Unlicensed Lenders

Even though consumer loans have become faster and way more accessible, borrowers need to be careful while selecting lending partners. The first thing a consumer needs to check is whether the lending partner has a license.

As per IndiaFilings, if a company’s financial assets constitute more than 50% of its total assets and its income from financial assets constitute more than 50% of its gross income, it must have an NBFC license. However, the ground reality is that many private lenders are running their businesses without licenses or with expired licenses, charging exorbitant rates of interest and forcing people in need of loans to sign blank forms or documents. If your lender is neither an NBFC nor a bank, be very careful!

Also, while the market has varied solutions for different requirements, it is advisable for borrowers to go with a lending partner offering an integrated technology solution, a strong management team, deep experience and knowledge base, and a focus on customer service. Favourable terms, a personal touch in lending, and balance sheet clarity are some of the other things one must check while selecting the right partner.

Borrowers should also be aware of the identity of their lender. In this integrated ecosystem where fintech companies and NBFCs join hands to provide a product, the borrower is usually exposed to the fintech at the front end and not the lender.

The presence of unlicensed lending companies in the market damages the credibility of licensed NBFCs and a handful of bad experiences can tarnish the entire sector while severely hampering the development of the right regulatory framework.

Flip Side: Technology Also Boosting Online Credit Seeking

Just as technology has transformed consumer lending from the point of view of services offered by NBFCs and fintech companies, it has also impacted borrowing. Fuelled by the Indian government’s pro-cashless policies and initiatives such as demonetisation and UPI implementation, there has been a strong impetus for consumers to shift online when seeking credit. Further, digital marketing channels are being optimised in line with rising consumer appetite to bring increasing numbers of borrowers online.

Besides, with the rise of eKYC and online banking, which enables borrowers to upload all required loan application documents online, the disbursal time of loans too has been shortened. This helps speed up the way people do business or buy new homes.

With loan payments being spread out over years, the need of the hour is a seamless technology that enables borrowers to make their payments electronically. The introduction of UPI 2.0 is a significant step in this direction and will improve efficiency in loan collection as well as payment timeline compliance across the board. This, in turn, will enhance borrowers’ trust in the credit lending system and increase options available to them.

With an increased emphasis on value based-lending and the rise of integrated technology solutions based on AI and machine learning, the efficiency of lending solutions has increased and customers can access the most beneficial lending options available.

NBFCs To Lead The Lending Game?

Even as Indian banks are grappling with non-performing assets (NPAs), NBFCs, in the last three years, have aggressively captured the space, leveraging their deep regional reach, latest innovative technology-based solutions, closer relationships with customers, and alternative credit appraisal systems.

NBFCs, in recent years, have witnessed a huge exponential growth, both in terms of volumes and the number of service offerings. These financial institutions by providing credit to infrastructure projects, also help in building the nation. On a comparative note, (As of March 2013), NBFCs have lent over one-third or 35.8% of their total assets to the infrastructure sector, as compared to banks which lent a mere 7.6%.

No Level Playing Field For NBFCs

That NBFCs are getting ahead in the game is evident from the fact that until FY16, the banking system met 50% or more of the lending requirements of Indian businesses, but in FY17, banks’ share in new credit slumped to 35%, while non-bank sources met 65% of the financing requirement. Non-bank sources lent as much as $136 Bn (₹9.25 lakh crore) to businesses, dwarfing the bank credit flow of $73 Bn (₹5.02 lakh crore).

However, NBFCs operate under certain regulatory constraints, which put them at a disadvantage vis-à-vis banks. “While there has been a regulatory convergence between banks and NBFCs on the asset side, on the liability side, NBFCs still do not enjoy a level playing field. This needs to be addressed to help NBFCs realise their full potential and thereby perform their duties with greater efficiency,” explains Kanoria.

Moreover, with the banking system clearly constrained in terms of expanding its lending activities, the role of NBFCs becomes even more important now, especially with the government’s strong focus on promoting entrepreneurship so that India can emerge as a country of job creators instead of one of the job seekers.

Thus, unlike banks, NBFCs are currently faced with lack of a level playing field and, more importantly, stiff competition from unlicensed private lending players. The government must address these issues to help the sector, which is growing at a fast pace.

Despite these constraints, NBFCs seem poised to outpace banks in the long run. According to reports, non-bank institutions have been expanding their loan books by 27% per annum in recent years, while public sector banks have been barely expanding at all. And the reason for that is their integrated technology approach, greater freedom from regulation, and focus on customer service.

“Unlike banks, new-age NBFCs and fintechs focus exclusively on solving a specific segment or problem. This enables them to improve the customer experience and hone credit underwriting in a very localised way. In future, we can expect to see many more highly specialised lending institutions and fintechs in a divergence from the typical broad-based lenders,” says Yuvraja Singh, co-founder, DMI Group.

The question is can banks even survive in the consumer lending space that NBFCs are now starting to dominate?