According to Salone Sehgal, founding general partner at Lumikai, the digital media and entertainment [including interactive media] pie in the Indian market is at least worth $25 Bn

Out of that, games, anime, VFX and the like account for $12 Bn. This segment is growing at a CAGR of 20% and is expected to hit $30 Bn in the next five to seven years

"We have made three investments from Fund II and will announce a few more in the coming months. Then, we will probably look into three more deals this year," said Sehgal

As the world stayed indoors during the pandemic years and actively looked for distractions to compensate for social isolation, gaming in all formats was a boon and none could escape their addictive attraction. India, too, was at a loose end and took to gaming as never before. The country recorded about 455 Mn online gamers in 2023, per a Statista report, an 8% YoY increase.

The number is likely to surpass 491 Mn by the end of 2024. More interestingly, about 90 Mn gamers paid for online games last year although India is traditionally a utilitarian and price-conscious market.

The adoption of interactive media is surging as well, driven by the rise in non-money gaming and over-the-top (OTT) audio/video content. Despite a slowdown in digital advertising spend, a risky bet on behavioural shift now that life has returned to normalcy and a regulatory upheaval impacting the real-money-gaming (RMG) space, the outlook remains strong. At least many game-makers are doubling down on their businesses and are not in a mood to cut back anytime soon. In essence, gaming and interactive media is emerging as a sunrise sector in India, with immense potential and promise.

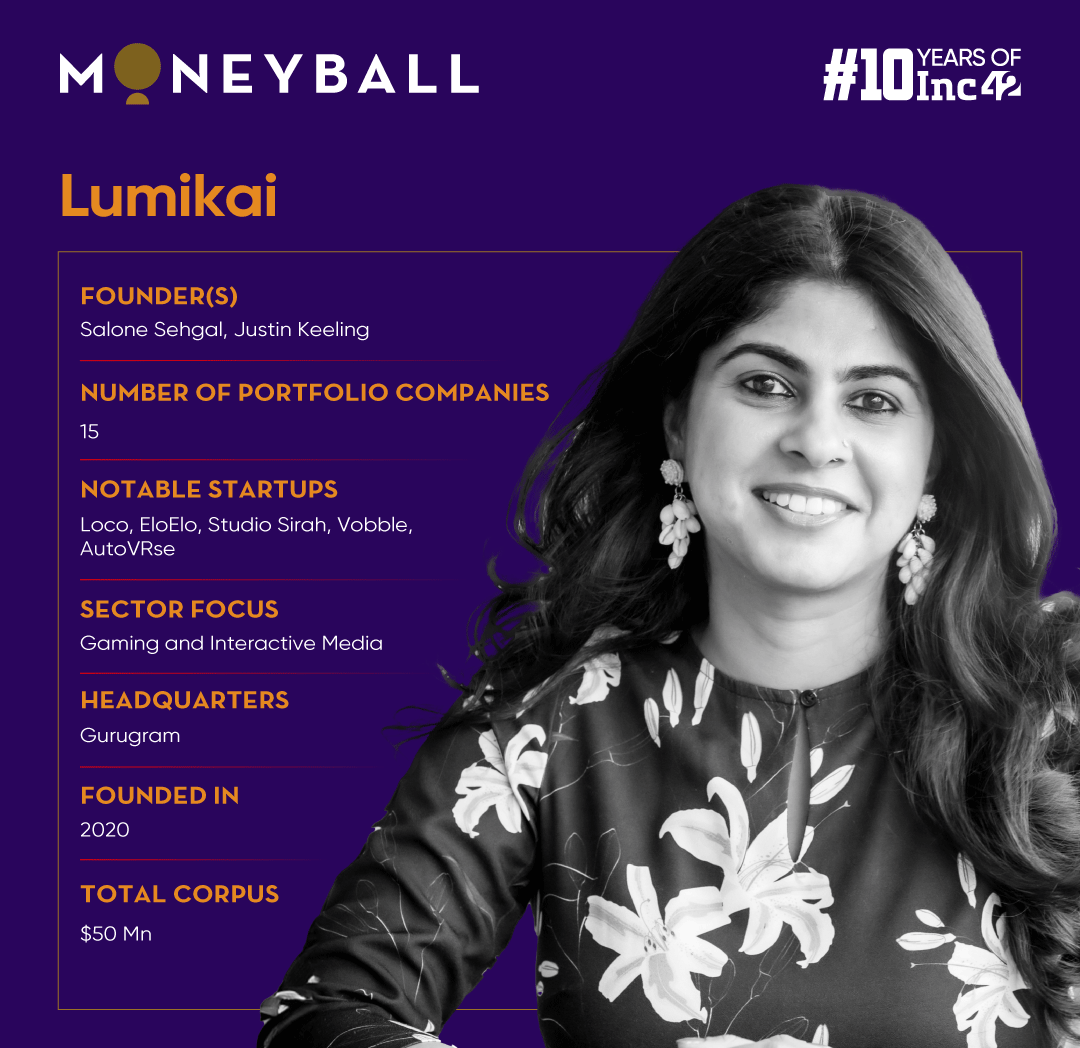

One of the early stage investors leveraging the India opportunity is Lumikai, a specialised VC fund focussed on gaming and interactive media.

The fund is led by founding general partner Salone Sehgal, who has donned many hats during her 18-year career as an entrepreneur and a global investor. She was the principal at London Venture Partners (LVP), a seed-stage fund backing the gaming ecosystem, with a track record of investing in 40+ companies and achieving $20Bn+ in shareholder value.

Sehgal is the cofounder of TrulySocial, a UK-based venture-backed gaming company. Its vision is to reinvent the gaming experience for the female audience by creating social worlds through interactive narratives and bringing in global celebrities, influencers and brands for a dash of glamour.

She also worked for global bulge bracket banks and financial institutions like Barclays, Morgan Stanley and KPMG. In the course of her work, she executed M&A deals worth $10 Bn+ across sectors.

Sehgal believes that her experience as an entrepreneur and a VC, as well as the time she spent working across global markets such as the EU, and North America, gave her a crucial vantage point to watch and understand the gaming industry.

“It did two things. First, it helped me build a very large global network. Second, it enabled me to look at the trends from a global perspective and see what was happening in the Indian market. That’s precisely what drove me to come to India in 2019,” she added.

As part of Inc42’s ongoing Moneyball series, we had an exclusive interaction with Sehgal to delve deeper into Lumikai’s investment thesis for India’s gaming and interactive media space and the secret sauce to help startups succeed. Here are the edited excerpts.

Inc42: Lumikai entered the Indian market in 2020. Was it the right time to launch a gaming and interactive media fund?

Salone Sehgal: I would say so. Around 2019, we saw inflexion points in India similar to what had taken place in China in 2007. Smartphone proliferation led to high data consumption, and an average person consumed about 30 GB of data. It fuelled the growing adoption of games and media.

So, we thought it would be a good idea to bring in horizontal and generalist venture funds here for at least one VC cycle. But as the market deepens, so does the VC industry, and we have more verticalised strategies to ensure better outcomes. That’s how we started our early stage investments in gaming and interactive media. It’s a privileged and exclusive opportunity.

While 2020 felt like the right time for such a fund, Covid-19 struck us at the same time. As people had to sit at home for months, interactive media took off in a big way across all sub-segments, from gaming and apps to interactive audio streaming [think Spotify or Apple Music] and more. Everything started to go through the roof.

Due to our global exposure [I was both a founder and a funder], we could zero in on this opportunity to launch a fund and build a team around it. Fund I came in 2020 with a corpus of $40Mn, as we aimed to support pre-seed to Series A stage startups with cheque sizes ranging between $200K – $1.5 Mn. We started deploying in early 2021 and rolled out Fund II worth $50 Mn in 2023, just after a span of three to four years.

If you look at digital media and entertainment [including interactive media], the Indian market is at least worth $25 Bn. Out of that, games, anime, VFX and the like account for $12 Bn. This segment is growing at a CAGR of 20% and is expected to hit $30 Bn in the next five to seven years. We have forayed into this category as a very early stage investor and want to make a significant impact.

Inc42: How did the first fund perform before you decided to raise the second? What kind of investments did you make?

Salone Sehgal: So far, Lumikai has backed 15 companies using both funds. This includes companies such as All Star Games, AutoVRse, Bombay Play, BuyStars, Cloud Feather Games, Eloelo, Giga Fun Studios, House of X, Loco, Qurious Bit, Singularity, Stealth, Studio Sirah, Super Nova, and Vobble.

The idea is to invest between $80 Mn and $90 Mn in the interactive media ecosystem here.

We make frontier bets [explore untapped but innovative startups] and cover a vast range, including content, game streaming and social app platforms, gaming infra [say, tool stacks for automation], mixed reality, GenAI, spatial computing and game development studios creating casual, hypercasual, or mid-core games and more. We aim to find category-leading bets and catalyse their growth with specialist capital and sector-specific strategy because that’s what we understand best.

We also work on game systems where the principles of interactive game mechanics can be used to disrupt a number of industries like edtech, fintech or healthtech. We have a business called Supernova, which is in immersive game mechanics and has created an AI tutor to disrupt the edtech space. This 24/7 interactive AI tutor has been developed to teach spoken English to kids. It’s the company’s first educational module and the business is growing incredibly fast.

As for our investment thesis, we have been consistent throughout. There’s not much difference between Fund I and Fund II. The first fund focusses on very early stage startups and we may write small cheques as low as $200K. Or it may go up to a little over $1 Mn for a first cheque. Then, we will have enough capital for follow-on rounds. We mostly stick to this strategy.

Inc42: How has the Indian gaming ecosystem evolved in the past three to four years?

Salone Sehgal: The ecosystem has grown significantly in three ways. The first is talent growth. When we entered India, we thought there would be hardly 100 deals in this space. But we grossly underestimated the entrepreneurial talent. In the last decade, we saw major players like Zynga, Glu Mobile, EA, Ubisoft, GSM Scopey and RocQ in the gaming space alone, and they operated in this country. Also, several teams now handle P&Ls between $50 Mn and $100 Mn.

We have seen successful exits, and the number of companies securing substantial venture capital has also gone up. A new wave of entrepreneurial talent is now emerging. They want to build their own companies and are very ambitious. This talent influx has changed the ecosystem enormously. More companies are coming up, and we have already evaluated more than 1,800 startups.

Next comes investment. Domestic players initially hesitated to put their money in the interactive media. But that has now changed. We have 30+ global co-investors and the likes of General Catalyst, Lightspeed, Fireside Ventures and Peak XV [the last two are India-based venture firms] did deals with us. Lumikai also partnered with Griffin Gaming, Courtside Ventures and Play Ventures to infuse more capital into the follow-on rounds for the companies we have backed.

Finally, we have seen some very very aggressive strategies for the Indian market. There are companies like Krafton saying: Hey, we want to invest $150 Mn in India. Then it launches titles suitable for the Indian palate to gain traction. Or think of Mixi Inc, a Japanese conglomerate now looking at the India market, both as an investor and a partner [read mentor]. Sony, too, recently announced a partnership with Airtel for running a 24×7 anime channel for the Indian market.

All this tells us that the work we have been doing for market education, evangelism and analysing market numbers is paying off, and we can see the progress.

Inc42: Indian startups such as Nazara, Dream 11 and MPL have cornered the market. But most ecosystems here are still very niche. What early-mover advantage do you foresee as a VC?

Salone Sehgal: Broadly speaking, if things are done right in the media and gaming business, companies can start monetising very early.

In an ecommerce or B2C business, when a user visits a platform but doesn’t spend – doesn’t make a purchase or buy a subscription – that person becomes redundant. But a game or a media business is all about the attention economy. If it has high retention power and a user lands there, there will be multiple ways to monetise. One can get ad revenue, leverage IPs, or sell subscriptions. So, the user gets monetised in every possible way. This differentiates gaming and interactive media from other industries.

This is very important for our portfolio companies. We have 15 of them, all young companies, most of which are generating revenue. It would be best if one came in early to back such companies. Other investors recognise them only when they start to make money and turn a profit.

The industry has become more lucrative now that UPI allows users to do micro-transactions. For instance, the ARPPU (average revenue per paying user) in India is about $19 [around INR 1,600] a year. But micro-transactions worth INR 29-30 tend to work for the masses to buy add-ons and enhance their gaming experiences. It eventually leads to very high margins.

Additionally, gaming companies can better leverage ad monetisation as the eCPM rate [effective cost per mille indicates how much an advertiser pays per 1K ad impressions] in India has increased. In 2008, it used to be 30-35 cents. Now, it has exceeded $1 or even $1.5. So, one can check the likes of Chartboost to add more value and set the pricing accordingly.

Inc42: You have also funded global startups. How does it differ from investing in gaming and interactive media in India?

Salone Sehgal: Investing in India requires a mindful business approach. First, we have to look for category-leading bets and find out if they are building for India or the world. If they are targeting global customers, how do they plan to compete with the global best? That is a key criterion for us.

There will be more questions. Have they found a white space? Is there a particular niche to explore and develop that will help them compete with industry leaders? What is their right to win – the ability to navigate a competitive market for short- and long-term success? Can they leverage something intrinsically valuable, say, best-in-class user acquisition expertise or a deep understanding of their target market/consumer base for whom they are developing?

Here is a case in point. When Eloelo was building an India-first solution, it had in mind Tier II and III Bharat consumers, with women accounting for 40% of the audience. Those are the fundamental lenses we need to apply.

Suppose a startup is building a global product from India. In that case, Lumikai would try to provide access to global best practices, talent, performance marketing expertise and more. These are the lenses we apply when identifying target companies for investment.

Inc42: How would you assess the Indian government’s stand on gaming and interactive media from a regulatory perspective?

Salone Sehgal: Things have improved in the last two years, especially in the interactive media space, as the government has broadly done a few things right. From data privacy laws to digital security compliance, things have been laid out right.

New tax laws have also come in. From October 1 [2023], the finance ministry implemented the amended provisions to levy 28% GST on full face value of bets. If a company is in real-money gaming, earning on cash-based outcomes, it has to pay that tax, but it does not apply to all formats. No tax is levied on games which are IP- or act-based, with provisions for in-app transactions. Also, eSports is now recognised as a bonafide sport, which is good news.

As the government has demarcated the verticals and created specific rules and tax laws around them, it has brought much more clarity.

The authorities also understand this is a bona fide sunrise sector and needs to be legislated and taxed in a certain way. The AVGC [The Animation, Visual Effects, Gaming and Comic] promotion task force also talks a lot about promoting India as a hub for technology development in animation and VFX by leveraging AI. It won’t be for games alone but also for movies and the overall arts and media landscape.

All these are a step in a really good direction for the interactive media industry.

Inc42: Given the market trends and regulatory landscape, what should be the focus areas for a gaming/interactive media startup?

Salone Sehgal: The first step is deciding whether to build a venture-scale [powered by VC money] business or a self-generating, self-sustaining one. Both have different paths. As an entrepreneur who has gone down the path of building first, I would advise young companies to take that decision first.

For those looking to build a venture-scale business, it is crucial to understand the opportunity landscape for creating, let’s say, category-leading bets. Because those are the bets that attract investors.

More queries will follow. If they are building for global markets, what untapped opportunities or white space have they identified? How do they position themselves as category leaders if they target the local market? What unique insights do they possess that can help them build very large and valuable entities? What real problems are they solving for their users?

The next parameter: How does a business build best-in-class products and services, as Indian users are very discerning? Unlike China, we are not a walled garden. We are exposed to the global best. And when consumers are exposed to the best products, apps, mechanics, or art aesthetics, Indian companies must be able to service them on a par with that quality. Anything less than that, and people will say: Hey, I have already used Instagram, or I use something else. What is so uniquely appealing in your product?

I think startups should carefully consider these factors. Although capital is available and one can be bold, they should also keep in mind that they have companies to build. Therefore, they must think about revenue generation and distribution first.

I also advise startups to start thinking more on how they can integrate AI or GenAI into their development pipelines. They need to identify which areas they can use AI smartly. It can be in development, marketing, quality check, testing, debugging, data analytics among others.

Startups should also consider integrating AI/GenAI into their development pipelines. This technology has a vast potential and businesses need to identify how it can be smartly used for development, testing, debugging, quality checking, marketing and data analytics, among other areas. In fact, this can be a game-changer for startups building an interactive media. It will save time, enhance efficiency and build better products.

Inc42: Finally, do you see specific challenges for the startups in this space? What are your plans for 2024?

Salone Sehgal: A couple of challenges are there, I would say. The first challenge will be around talent – our ability to attract and retain them. Finding the best talent could be difficult, as the skillsets here are more specialised. But this is important.

The second is thinking about distribution first: How does a company reach its consumers, and when and how can it manage user acquisition costs? These are the areas founders should think very deeply about.

At Lumikai, we have already broadened our thesis. We have made three investments from Fund II and will announce a few more in the coming months. Then, we will probably look into three more deals this year.

Currently, we are really excited about companies leveraging GenAI and thinking distribution-first. We are also bullish on companies that are looking to build for India and from India for the world. As founders get more ambitious, it becomes very interesting for investors focussing on innovation, quality and global reach.

[Edited by Sanghamitra Mandal]

Ad-lite browsing experience

Ad-lite browsing experience