I think the biggest risk for all countries across the board will be the money laundering aspect and also the aspect of currency being used for financing terror: FM Sitharaman

We haven’t said that this is currency. We haven’t said that this has intrinsic value, but certain operations are taxable for the sovereign and that is why we have taxed: FM

A report found that India’s crypto market grew 641% from July 2020 to June 2021, turning the country into one of the largest-growing cryptocurrency markets.

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

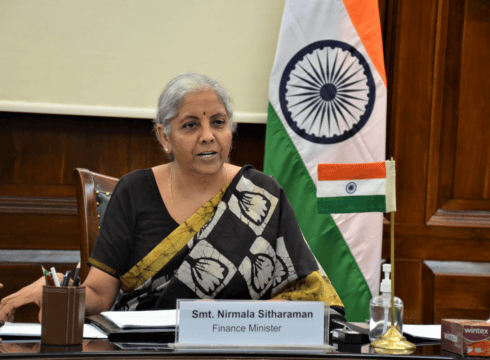

Reiterating the government’s stance on cryptocurrencies, Finance Minister (FM) Nirmala Sitharaman has once again called for stricter regulation of Virtual Digital Assets (VDAs).

Speaking at a panel discussion organised by the International Monetary Fund, Sitharaman said that cyptocurrencies can be used for money laundering and terror financing operations. “I think the biggest risk for all countries across the board will be the money laundering aspect and also the aspect of currency being used for financing terror,” she said.

The FM also said that the Centre’s move to tax cryptos should not be seen as legitimising them, but rather a way to keep an eye on these VDAs. “We haven’t said that this is currency. We haven’t said that this has intrinsic value, but certain operations are taxable for the sovereign and that is why we have taxed,” Sitharaman said.

Earlier in February as well, the FM had said that the government’s move to levy tax on gains from cryptocurrencies had nothing to do with the legality of private digital currencies.

During the panel discussion, the FM also said that VDAs were being taxed to ascertain the identity of those involved in the trade. She said, “We did announce that on the income that was generated from the transactions of these crypto assets will be taxed at 30% and over and above that, there is a 1% tax deduction at source which is also imposed on every transaction. So, through that, we will be able to know who’s buying and who’s selling it.”

In her Budget speech this year, Sitharaman had proposed a 30% tax on income from cryptos and also unveiled a proposal seeking 1% TDS on crypto assets’ transactions.

During the panel discussion, the minister also sought stricter global regulations for cryptocurrencies to alleviate risks of them being used for money laundering and terror financing.

She was further quoted by PTI as saying, “The risk which worries me more on the non-governmental domain is essentially you’re looking at unhosted wallets across the borders, across the globe… So, regulation cannot be done by a single country within its terrain through some effective method, and for doing it across the borders, technology doesn’t have a solution which will be acceptable to various sovereigns at the same time applicable within each of the territory.”

The FM also batted for digital currency initiatives led by central banks, saying cross border payments between countries could become very effective via government-led VDAs.

Regulatory Uncertainty

There is regulatory uncertainty about cryptocurrencies, with the government and central bank making vague announcements and statements about the crypto ecosystem in India. In February, the FM had stated that a decision on ‘banning or not banning’ cryptocurrencies would be taken after consultations.

Later in March, the Reserve Bank of India (RBI), in a public statement, said that disclosing its stance on the matter could jeopardise India’s economic interests.

While the government has shied away from expressing its opinions on the matter, the RBI top brass has left no avenue to publicly criticise cryptocurrencies. In one instance, RBI Governor Shaktikanta Das had said that private cryptocurrencies were a threat to macroeconomic and financial stability, adding that such assets had no underlying value whatsoever, “not even (worth) a tulip”, referring to the Tulip Mania of 1630s.

Prior to that, RBI Deputy Governor T Rabi Sankar had said that cryptocurrencies were worse than Ponzi scheme and banning them was the most sensible option for India to avoid the threat they pose to the financial and macroeconomic stability.

Other bureaucrats such as Finance Secretary T V Somanathan have also warned against cryptocurrencies, saying they would never become legal tender.

Meanwhile, the crypto market continues to flourish across the country. A Chainanalysis report found that India’s crypto market grew 641% from July 2020 to June 2021, turning India into one of the largest-growing cryptocurrency markets.

An Inc42 analysis also found that more than 350 blockchain startups were operational in the country in 2021, with the cryptocurrency segment receiving the highest funding last year. Despite over 80% of the startups still being bootstrapped, the sector received over $247 Mn in VC funding in 2021.

Overall, 2022 has witnessed a big spurt in funding numbers for the emerging sector. In March, Ethereum Layer-2 scaling startup Polygon raised $450 Mn from some of the biggest names in the venture capital ecosystem, led by Sequoia India.

Earlier today, crypto exchange CoinDCX announced raising $135 Mn in funding, more than doubling its valuation to $2.15 Bn. Another crypto investment startup, Flippy, raised $1.15 Mn in a seed funding round today..

Barely weeks ago, token powered social media platform Taki had bagged $3.4 Mn in seed funding, led by major Indian crypto exchanges including CoinDCX and Coinbase Ventures.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.