Founded in 2010 by Karthik Reddy, Ashish Fafadia and Sanjay Nath, Blume Ventures’s previous three funds closed at $20 Mn, $60 Mn and $102 Mn in 2011, 2016 and 2020 respectively

Targeting a $200 Mn fund corpus, the fund size is $175 Mn with a greenshoe option of another $50 Mn

Its focus areas include consumer internet, SMB marketplaces, SaaS and enterprise tech startups with the potential to go global

Mumbai-based early-stage venture capital (VC) Blume Ventures has raised $105 Mn, making the first close for its fourth India-dedicated fund. The startup plans to make a final close by FY22, with a target of $200 Mn. Currently, the fund size is $175 Mn with a greenshoe option of another $50 Mn.

The startup, which invests in seed to pre-series A stage of Indian startups, plans to continue investing in consumer internet, SMB marketplaces, SaaS and enterprise tech startups with the potential to go global.

Founded in 2010 by Karthik Reddy, Ashish Fafadia and Sanjay Nath, Blume Ventures closed its debut fund in 2011 at $20 Mn. Five years later, in 2016, it closed its second fund with a corpus of $60 Mn. The fourth fund, visibly larger, targets double the corpus of the third fund at $102 Mn in 2020.

Blume’s portfolio of 150+ startups includes Smartstaff, Exotel, Euler, Yulu, Koo, Purplle, Cashify, among others, and 20+ exits. Yet, interestingly, Blume’s portfolio has produced only one unicorn (startup with a valuation of $1 Bn+) — soonicorns include slice and Spinny.

“Overseas institutional investors, domestic wealth management platforms and family offices have backed us. Our LP base also includes unicorn operators and seasoned founders who mentor and advise our portfolio founders on critical challenges of building, scaling, hiring and growth,” Fafadia, a partner at Blume said in a statement.

Presently, Blume writes cheques between $1 Mn and $2.5 Mn, and the startup claims to have written 25 cheques with Fund III. Moving ahead, Fund IV will help the VC firm write bigger cheques, as early-stage startups are increasingly raising bigger amounts in Series A or before.

Indian Startup Funding At All-Time High

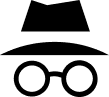

The Indian start-up ecosystem presents a blossoming opportunity for global investors. India is set to surpass the record level of total investment it saw last year when venture funding totalled $33.8 Bn, where $26 Bn was raised till August 2021 alone.

In H1 2021 (January to June 2021), Indian startups raised $10.8 Bn raised over 614 funding deals, and 338 deals have been recorded since then, coming to an average of over five deals per day from July 01, 2021-August 30, 2021.

Further, since 2014, over 6,500 Indian startups have raised over $81B in funding and this is growing exponentially year on year. This includes 75+ startups that are in the unicorn Club (valuation > $1 Bn).

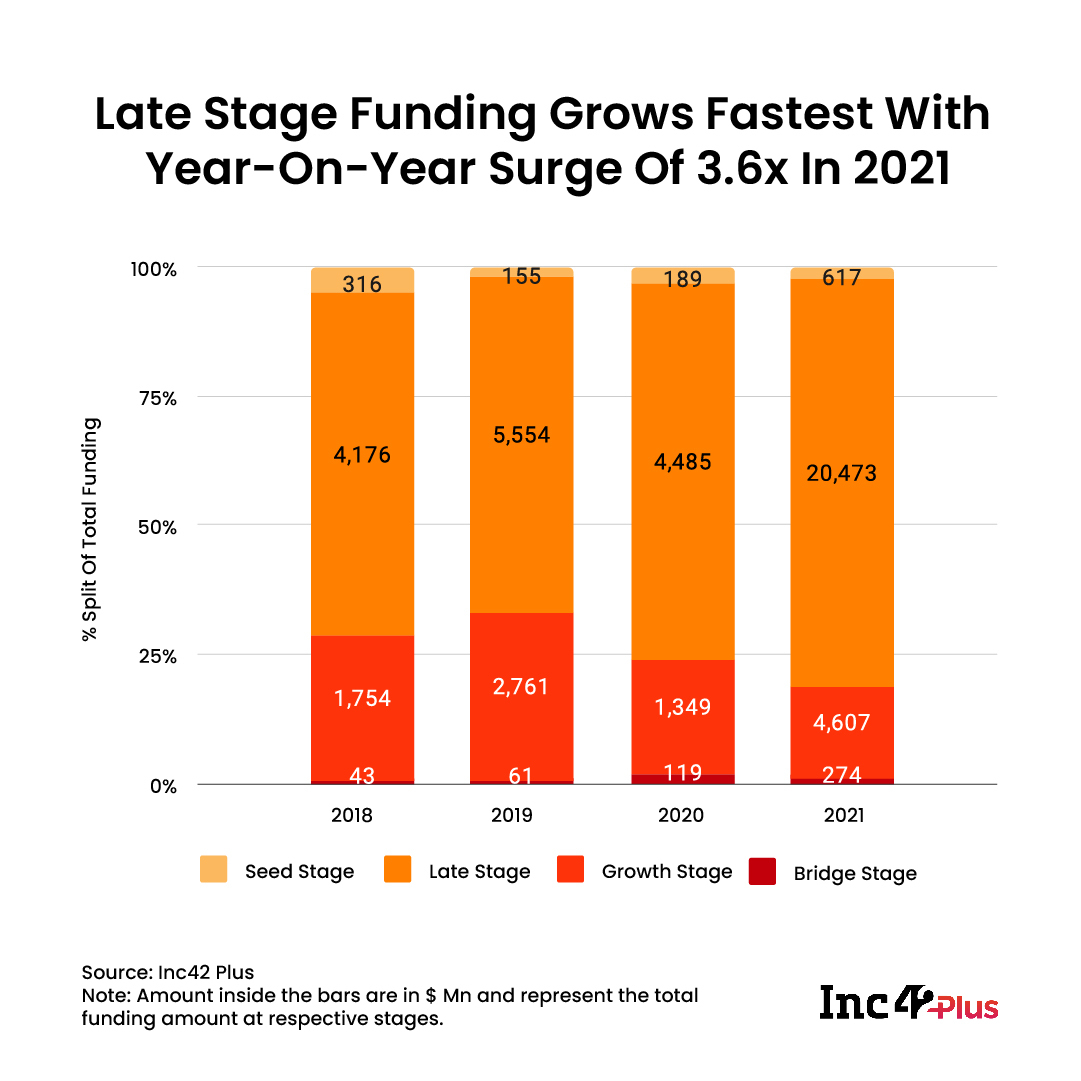

While late-stage funding has grown 3.6x from 2020 to 2021, enabling a large amount of funding inflow, the amount of early-stage deals have grown >3x, as well. Primarily these startups are backed by:

- Some prominent yearly accelerator programmes like Y Combinator, Airtel Startup Accelerator Program, Reliance’s GenNext, Google For Startups, Microsoft Accelerator, The Facebook Accelerator Program, Angel Pad, Huddle among others and

- Micro VC firms with fund size at sub-$30 Mn, such as Artha Venture, Atrium Angels, Gemba Capital, Capital A, Sequoia India’s Surge, Investment Syndicate Seeders, Better Capital among others.

- Early-stage VC firms with fund size over $100 Mn such as Leo Capital, Stride Ventures, Prime Ventures, Kalaari Capital, Matric Partners, 3One4 Capital, agritech-focussed Omnivore, Chiratae Ventures, among others.

Further, in the year 2020, a total of $ 403 Mn was raised at the seed stage. And, the number has already reached $ 617 Mn till August of 2021.

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech