In a span of 18 months, Sequoia Surge has backed 29 Indian startups with $100 Mn in funding and these startups have already raised a further $250 Mn in subsequent rounds

More than half startups in Sequoia Surge’s India portfolio are founded by repeat founders, a phenomenon that’s gaining more and more ground in India

The Surge portfolio skews towards startups in Bengaluru and in consumer services, with a whopping 47% of the founders graduating from IIT, BITS and Ivy League colleges

In the context of startups, ‘seed funding’ or ‘seed money’ are terms that are getting more and more familiar to the casual audience. In fact, with startups becoming household term in India, chances are most people know at least someone who is looking to raise funds to kickstart the business. But that’s not to say that seed funding by itself is growing. After hitting a peak in 2016, seed-stage investments in the Indian startup ecosystem have continued to fall every year. With risk-averse investors in the ecosystem staying away from seed-stage deals but continuing to bet on growth and late-stage startups. In this funding climate, Sequoia India’s announcement of the Surge accelerator in January 2019 was seen as an ambitious exercise.

Sequoia Capital had launched its startup accelerator and incubation programme with the idea of investing $1 Mn- $2 Mn in early-stage startups working on innovations that could one day graduate up to the Sequoia growth-stage fund.

The idea wasn’t new— already tried and tested to great success by the likes of Y Combinator. Surge took the onus of identifying hot new startups and bringing them to the public (read: investors) eye with its big brand name attached.

Amid cheers and scepticism, in just one year, Surge swept the market.

This success was underlined by the high-profile appointment of former Google India head Rajan Anandan as MD of Sequoia Capital India, who joined the firm in August 2019. Being a prolific angel investor himself with a successful personal portfolio, Surge had hit the jackpot with Anandan and was ready to tap the pulse of India’s early-stage startup ecosystem.

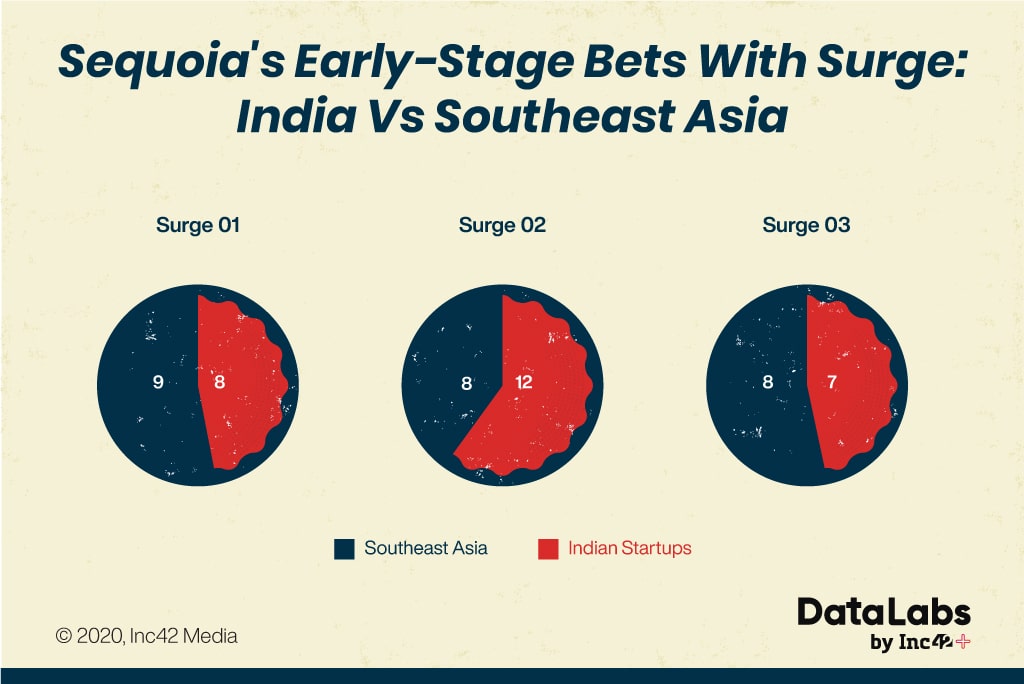

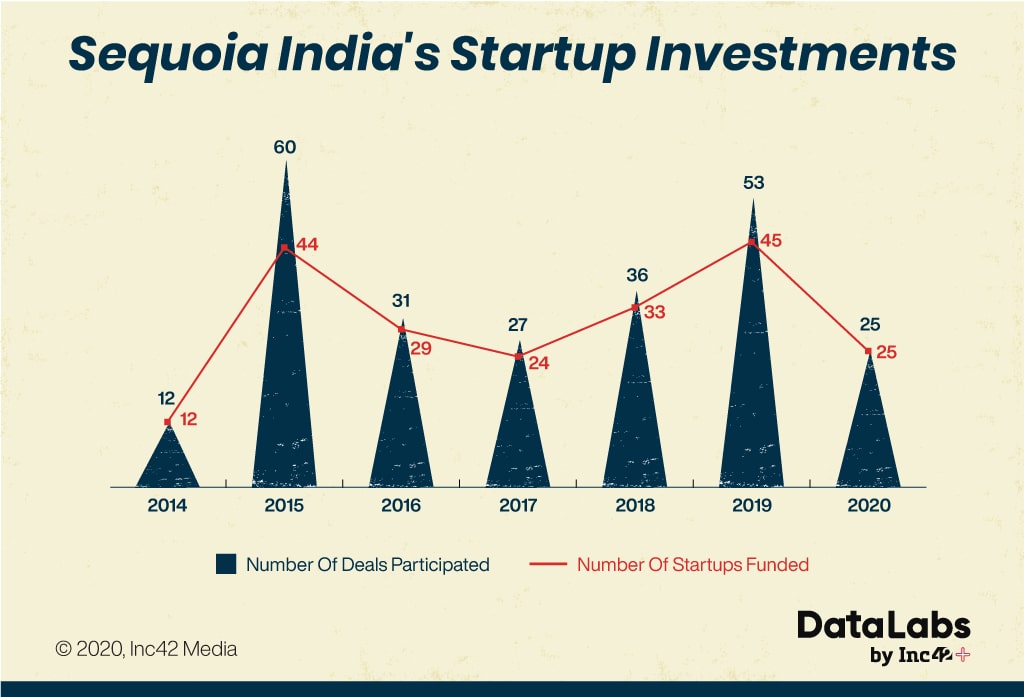

By January 2020, Sequoia India became the most active venture capitalist in India, doubling the number of deals it closed in the previous year and much of that is thanks to Surge. In 2019 alone, the venture capital firm funded 45 startups. Over the last 17 months, Surge has added 52 startups to its portfolio with more than two dozen Indian startups and the rest from Southeast Asia. In the context of Indian startups, while some have raised funding after arriving at Surge, others had some capital already when they entered the programme.

In its short life so far, given Sequoia’s standing in the ecosystem, Surge is not seen just as an accelerator, but also a gateway to massive rounds later on. Coupled with mentoring and Sequoia’s strong network, Surge has become something of a golden ticket to startup success. The insightful sessions with Surge founders and leading names in Indian startups that always create Twitter buzz can be seen as a testament of its stature.

Sequoia Surge’s Early-Stage Empire In India

Over three cohorts, Sequoia Surge has brought 52 startups on board, with half of them or 26 being from India. But Sequoia told us the number of Indian startups at the programme stands at 29, which includes Quolum from Surge 02 which only has a technology team in Bengaluru and two startups in Surge 01 and Surge 03 batch which are in stealth.

Given these figures, Surge’s Indian portfolio consists of 70 founders from India, excluding the six founders of the Indian startups in stealth mode. Given this wide coverage that Surge has achieved in just over a year, we decided to analyse the Surge’s Indian portfolio as well as the background of these founders to see what exactly has been Sequoia’s formula for early-stage bets.

Sequoia Surge’s portfolio stays true to macro trends in the startup ecosystem like betting on the experience of founders, their education, and more.

Note: In our analysis, we have excluded the two stealth mode startups as information about the startups could not be independently verified and Surge declined to share specific details.

Repeat Founders: More Than Half Indian Founders In Surge

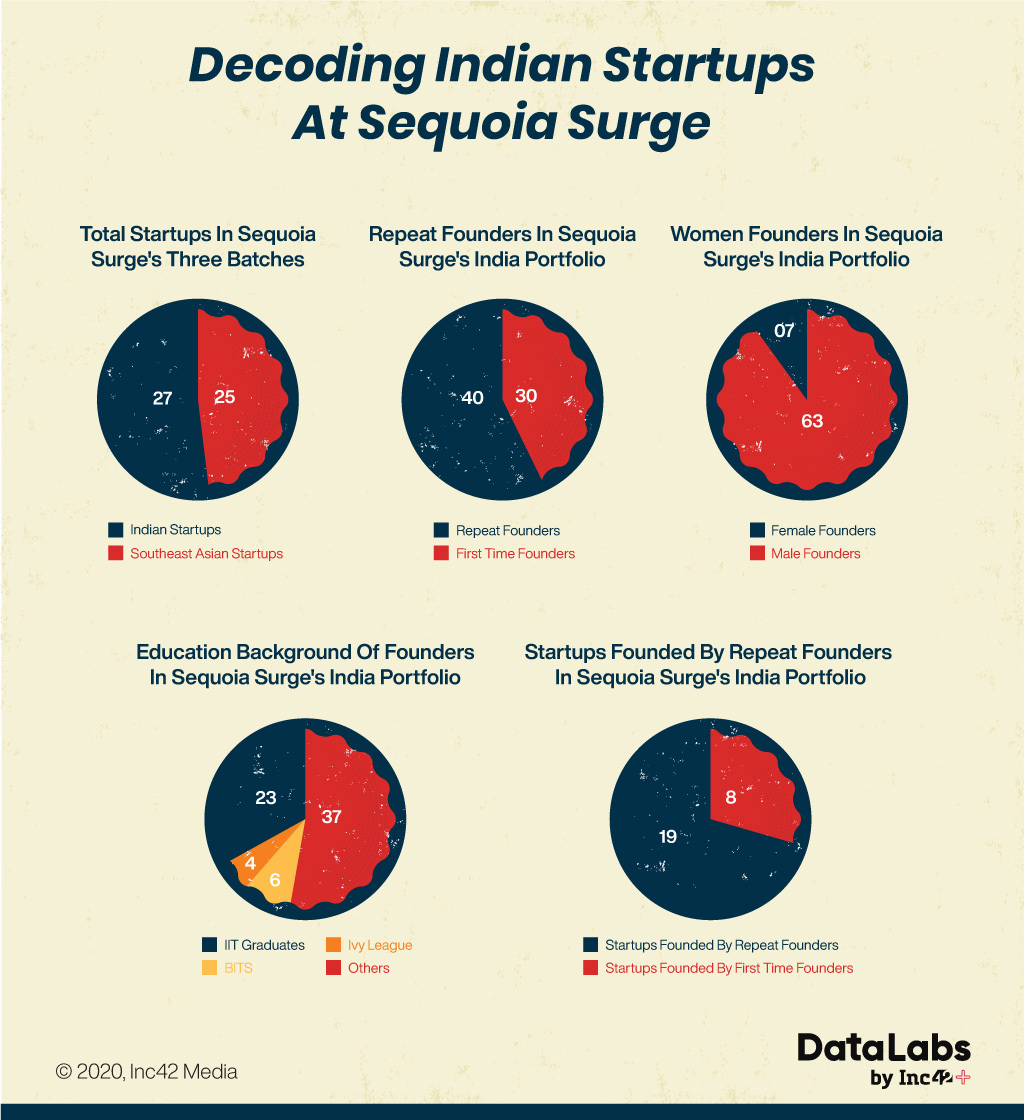

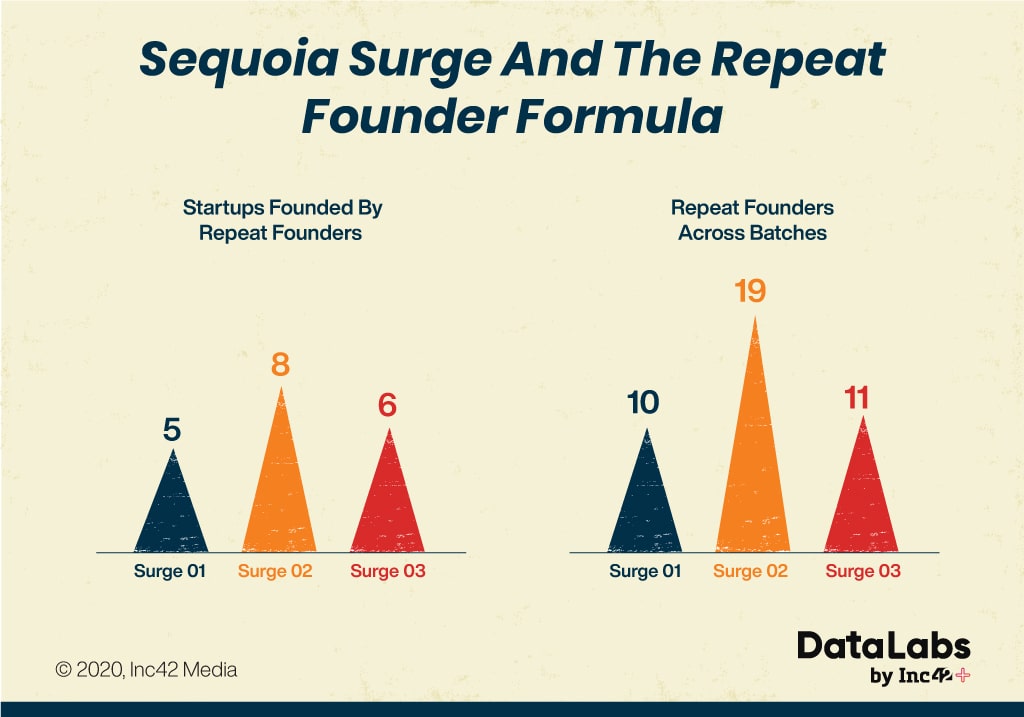

It’s no secret or surprise that in the early stage ecosystem, serial or repeat founders tend to attract investor interest. In the case of Surge’s India portfolio, across the three batches, 40 out of the 70 founders had launched other startups in the past. More than 50% (19 startups) of Surge’s Indian portfolio has been founded by repeat founders.

But according to Surge, it has 34 repeat founders in 16 startups, including 5 founders from two stealth mode startups. It emphasised that the majority of the founders are starting up for the first time. However, LinkedIn profiles of these founders say otherwise. It must be noted that Surge’s tally of repeat founders excludes 14 founders from six startups — Bijak, Freewill, Procol, Convosight, Trell, and Flynote. Although the startups that these founders had launched earlier were shortlived.

The likes of Bulbul TV (Surge 01), Seekify (Surge 02), Convosight (Surge 03) all have founders that had floated startups in the past. Some of the Surge startups have founders who have founded more than one startup before their current venture. For instance, BulbulTV cofounder Sachin Bhatia cofounded MakeMyTrip and then launched TrulyMadly in 2013, which he exited in 2018. While Bhatia’s MakeMyTrip has raised funds from Naspers, Ctrip etc, it went on to be listed on NASDAQ. In case of TrulyMadly, the investors include Helion Venture Partners, Kae Capital among others.

Bulbul’s other founders — Atit Jain (founded Gigstart and Pluss App) and Sichen Sianna Liu (founded Hawa & Wakaka) also led two startups before BulbulTV.

The case of social media engagement platform Convosight, which is part of Surge 03, is similar. It was founded in 2019 by Tamanna Dhamija and Tarun Dhamija — the latter had earlier launched Baby Destination in 2016, while Tamanna had founded Doctors for You in 2014. Convosight’s third founder Kartik Bansal had founded Fropcorn.

Overall, Surge 01 had 10 repeat founders, making it 45% of the total founders in the batch, while Surge 02 had 19 repeat founders making it 61.2% of the total founders in the same batch. Similarly, Surge 03 had 11 repeat founders, making it 64.7% of the total founders in the batch.

When asked if repeat founders is a key criteria for Surge, Anandan, the managing director, Sequoia Capital India and SEA declined the same.

“We have more first-time founders across our three cohorts than repeat founders. What we do look for is exceptional founders with a big vision,” Anandan said.

In our conversations with investors around the serial entrepreneur phenomenon, it became apparent that most VCs and seed funds look at the risk-return metric very closely and this holds a lot of sway in the decision making. The advantages that repeat founders bring include not repeating old mistakes and having the experience to deal with crises, thus requiring less handholding. Such founders are said to be better at managing teams as well, and have clarity on processes, culture and have a network to tap. Few even highlighted that repeat founder who start up in the same sector or segment have muscle memory, which is highly prized.

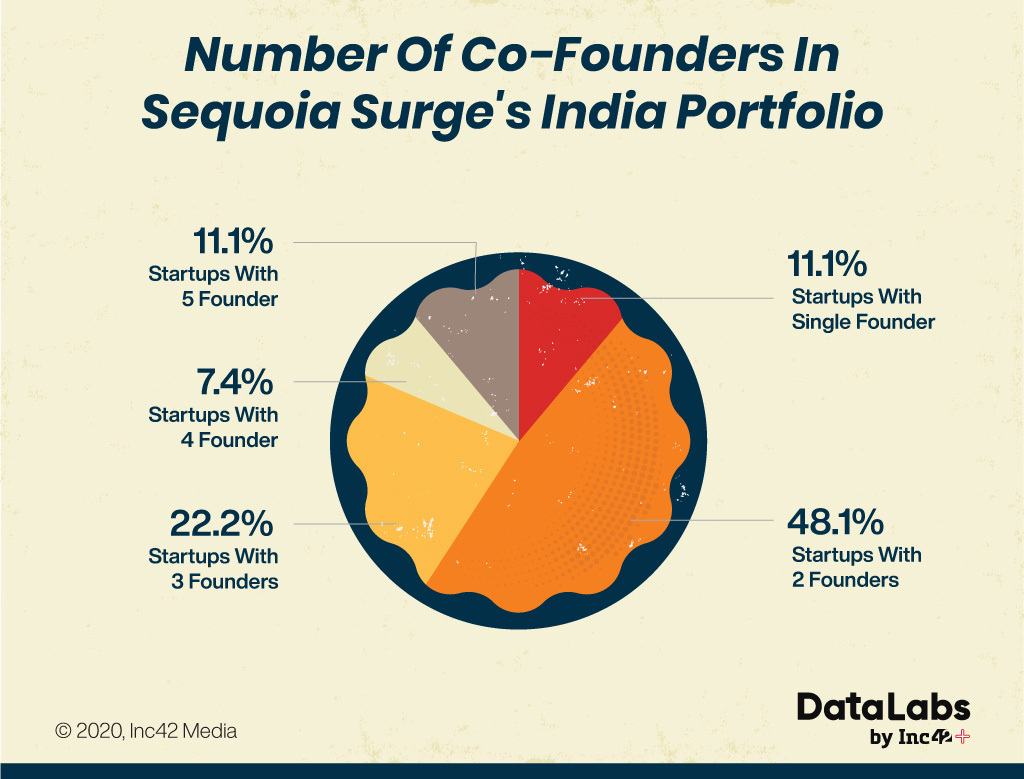

Interestingly, in line with the VC trend of betting on startups with at least two founders, Surge’s investments include only three startups with a single founder. Surge’s favourite flavour is clearly a two-founder team with 13 bets in startups with this constitution, followed by six startups with three cofounders.

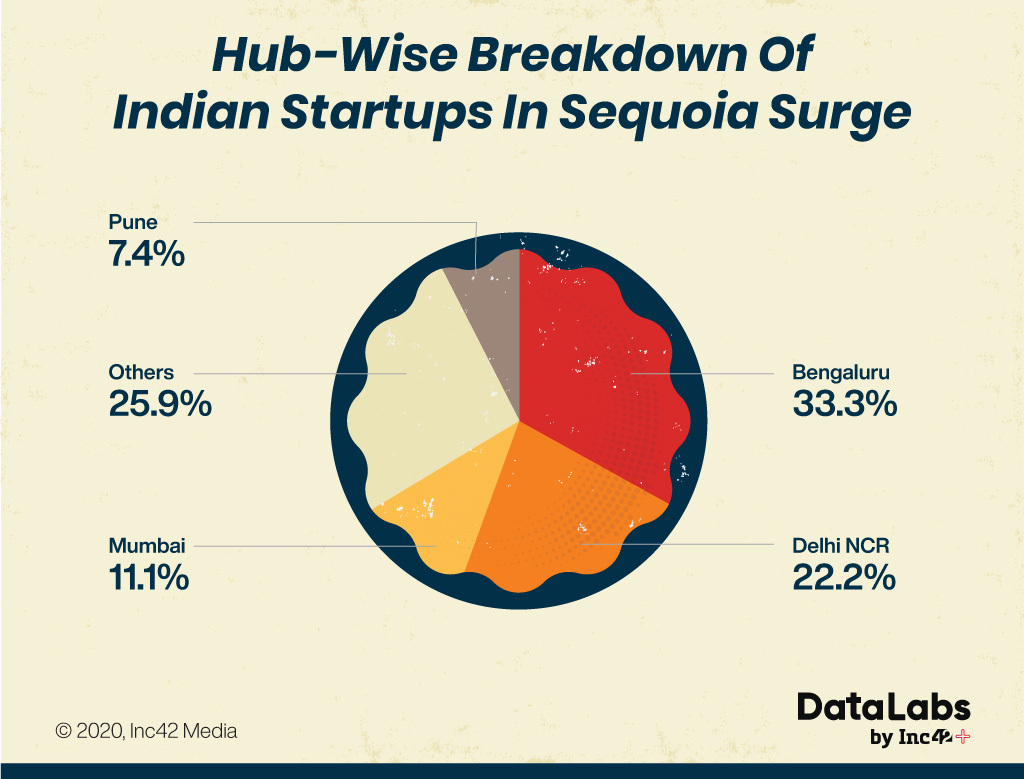

In terms of locations, among Surge’s portfolio, a third of the startups are based in Bengaluru, the biggest startup hub in the country, followed by 22.2% startups in Delhi and 11.1% in Mumbai.

Does IIT Tag Ensure Surge Pick?

There’s no doubt that the Indian Institute of Technology (IIT) is the most venerable engineering institution in India and those who graduate from IITs are often handpicked for success. It’s not a recent phenomenon either as IITs have given India tech leaders since the 1980s such as Vinod Khosla, cofounder of Sun Microsystems and an alumnus of IIT-Delhi, as well as the likes of Sundar Pichai, CEO of Alphabet and Google, who graduated from IIT-Kharagpur.

Most of the founders in India’s celebrated unicorn club — including founders of Flipkart, Zomato, InMobi, Yulu, Snapdeal, Ola and others — are also IIT alumni.

When startups first entered mainstream debate around 2014-15, discussions and rants about engineers are using the IIT badge to pull in funding were pretty common. These talks have been on for years about how investors and incubators bet on IITians and not necessarily on their ideas — and not all founders are lucky enough to have that IIT badge. While the presence of a strong alumni network with many role models and the confidence of having graduated from IIT are advantages for these startup founders, investors are accused of being blinded by the IIT tag as well. And this bias is also seen in these hiring trends, where startups and tech giants try to hire the cream of the Indian talent pool from IITs.

While Silicon Valley had the reputation of being built by college dropouts, the opposite seems to be true in India’s tech industry, despite several examples of dropouts.

Across Sequoia Surge’s 70 Indian founders, 47% founders are graduates of prestigious institutes— IITs, BITS, and Ivy League colleges. Of these 70, 32.8% i.e. 23 founders, were graduates from various IITs across the country. To Sequoia’s credit, the number of IITians in its third cohort has fallen — from 10 IIT founders in Surge 01 to 12 in the second batch and just one in the recent Surge 03.

However, Surge hasn’t responded to our specific query on backing IIT graduates. But did it take note of its choices and try to change its approach as indicated by the decline across batches? Perhaps Batch 4 would tell us and maybe bring a better perspective on its IIT or Ivy League preferences.

Investing In Innovation Or Window-Dressed Startups?

Success seems almost a given for Surge startups when they are introduced to the public eye — fan following and critical acclaim come in equal measure. But just like most other success stories, none of these early-stage startups got their share of the limelight overnight, but in fact have been years in the making.

For instance, Doubtnut, part of Surge 01, which claims to have been founded in 2017, actually began operations in 2009. It went by the name of Class 21A, which is Doubtnut’s parent company, according to the LinkedIn profiles of the founders Tanushree Nagori and Aditya Shankar.

Class 21A was initially a coaching institute for CBSE, ICSE, and IGCSE students in the four subjects. The company launched Doubtnut in 2016 as an online platform, which still offers similar courses but the focus is on digital and online learning. But Anandan explained, “What Tanushree and Aditya ran in 2009 was an offline tutoring service where they taught math and science to students from grade 9 to 12. This was called Class 21A. Doubtnut, which is a multi-lingual, AI-based online learning platform/app was launched in 2017 and has no connection to the 2009 business.”

The company has multiple entities registered with the ministry of corporate affairs, with the company registered in 2016 being the company used for raising capital etc. Another 2014 registered company with Class 21A name itself is under the process of being struck off, while yet another is a foundation.

Similarly, another Surge 03 company, Pentester Academy began operations in 2011, but is said to have been founded in 2019, as per Surge website. What changed for Pentester, founded by Vivek Ramachandran, is that it moved its operations online, which can be seen as a logical evolution for any learning company in the 21st century. It essentially provides the same services in a digital avatar. The company’s registered entity is based in Singapore, while PentesterAcademy.com has its copyright from 2013-2019, as per its website. Anandan clarified, “The 2011 launch date is for Vivek’s personal company where he used to train professionals on cybersecurity. Surge has invested in his newly launched cybersecurity product launched in 2019. This is an online lab that also operates under the same name but has a completely different model.”

Similarly, Fittr, known as Squats earlier, which has been around since 2016, but claims to have been founded in 2019. The company registered as Squats was registered in 2015, but the funding etc has started only with Surge. “Starting in 2016, Fittr has run fitness groups/training sessions first through WhatsApp groups followed by a Facebook community. Surge has backed their fitness product – the Fittr app. This was developed late 2018 and launched in March 2019,” Anandan explained.

Other Surge startups include Scaler Academy (now InterviewBit- founded in 2014, but newly registered in 2019) as well as neobanking startup Juno (which began in 2017 as Nuo, based in Singapore) seem to follow the same pattern.

Anandan said that the dates on the Sequoia Surge website reflect the launch dates of the product or the business that Surge has invested in. There are instances where the team could have been operating an adjacent business under the same company name before, he admitted.

Essentially, what seems to be a sudden success for these early-stage startups is actually down to years of hard work, scaling up, reshaping models and operations, which is underscored by the Sequoia Surge tag.

Same Old Story: Where Are The Women Founders?

The lack of gender diversity is not just a phenomenon in India but all over the world too. However, India is ranked 52nd out of 57 countries in terms of women entrepreneurs and the ratio of women tech founders in India is said to be less than 10%.

Surge’s India portfolio features just seven women founders among its set of 70 founders overall in India. But Sequoia claimed that Surge has eight women founders, so it would seem that one of the two stealth investments would have a female founder. However, Inc42 couldn’t independently confirm the information provided by Sequoia for the two stealth startups, which it claims have three founders each.

“We are very proud to have 17 female founders in our community across India and Southeast Asia, given Surge is just three cohorts and a little over a year old,” said Anandan.

Funded Startups In Surge Portfolio

Another interesting facet seen across the Surge portfolio is funded early-stage startups raising seed funding through the accelerator programme. We noted that Trell had raised over $1.25 Mn before joining Surge from investors like Rajan Anandan, Nitin Gupta, Anupam Mittal, BEENEXT, WEH Ventures and others.

Similarly, edtech startup Classplus raised over $2.6 Mn from 2017 to 2019 from Spiral Ventures, Times Internet, etc, before Surge funding in October 2019. Since then, it has raised two more rounds from investors like RTP Global, Blume Ventures etc till May 2020. Further, Hevo Data has raised $1 Mn from Chiratae in 2017, well-before joining Surge 02.

Surge claimed that nine Indian companies from Surge 01 and Surge 02 had raised capital before joining the programme.

“Startups who have raised seed money are still welcome to Surge — something we had stated when we had launched the program. In November 2018, we had run a series of polls to assess the problems that startups faced during early-stage fundraising and there were several,” said Anandan.

He added that Sequoia’s belief is that seed-stage startups were undercapitalised and had to dilute too early and spend an inordinate amount of time on the fundraising process. “The message was clear: early-stage founders are still underserved in India and SEA. Surge was set up not only to help companies raise a substantial seed — but also for startups who may have raised some seed money but not enough to get to a solid Series A.”

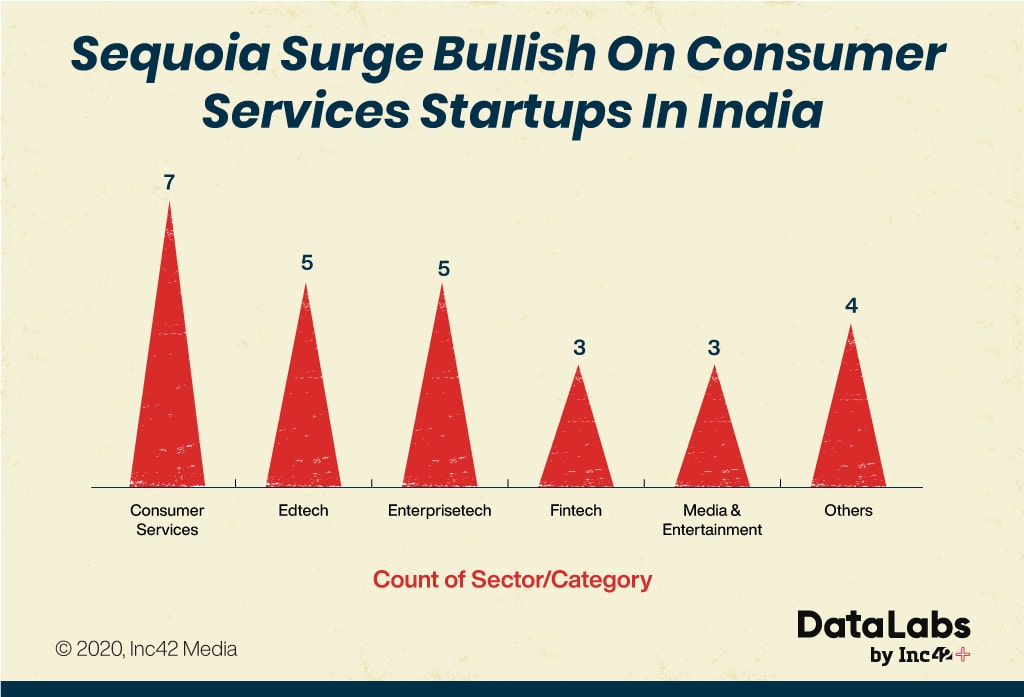

A look into the businesses of the startups in the Surge portfolio showed that Sequoia’s favourite sector is consumer services, followed by edtech, enterprise tech, and media and entertainment.

The Sequoia Tag: Is It The Real Reason Why Surge Matters?

There’s no denying the fact that Sequoia is one of the top VCs in the world, and perhaps the most valuable VC in India in terms of the network it offers startups. Its backing for early-stage startups in Surge is seen as a stamp of approval across the ecosystem. As per DataLabs, Sequoia Capital India participated in 219 deals across 105 startups between 2014-2019.

Surge claims to have invested approximately $100 Mn in all the startups across its three cohorts till date. This includes both the Surge round as well as the follow-on rounds. Anandan also revealed that Surge 01 and Surge 02 companies have already raised an additional $250 Mn in subsequent financing rounds post Surge.

In its website, the early-stage accelerator and VC claims the programme is even for founders with just an idea and a pitch deck. It says that early-stage companies that already have a product-market fit and some seed funding can also apply. But when we glance through the companies that have made it to the programme, very few are actually in the initial stages of their startup journey, with no details available on the stealth mode startups to say much about them. Other investors we spoke to emphasised that since Surge gets a huge amount of applications, its selection criteria has to be very clear-cut, which might explain why it seemingly goes after the tried-and-tested formula.

But Sequoia claims that it looks for several things while evaluating companies for Surge and this selection criteria hasn’t changed since launch.

“For pre-launch or newly launched companies, we focus on the founder’s vision, whether they are addressing a deep pain point, their early product ideas and features. For companies that have already launched, we look for proof of product-market fit. This could be through early user feedback, product reviews, product usage metrics, engagement and customer retention,” Anandan added.

The overall sentiment is that Surge is for companies that have a good product-market fit and decent traction. So, while several startups and investors expected Surge to be a game-changer — and in terms of early-stage funding deals it is — is it creating real value in the early-stage ecosystem? Surge does help startups broaden their network and management skills through sessions with various business leaders, but given that many of the startups have repeat founders, they already have that network and experience, with some also having investors on board.

In fact, the question is whether Sequoia is creating upper strata in early-stage startups. It is clear that Surge startups get bigger seed funding cheques than the average seed round in India. As per DataLabs by Inc42 research, median seed funding amount in Surge startups is 20% higher than the third quartile of the amount raised at seed stage in India. This is based on investments between April 2019 and April 2020.

Ad-lite browsing experience

Ad-lite browsing experience