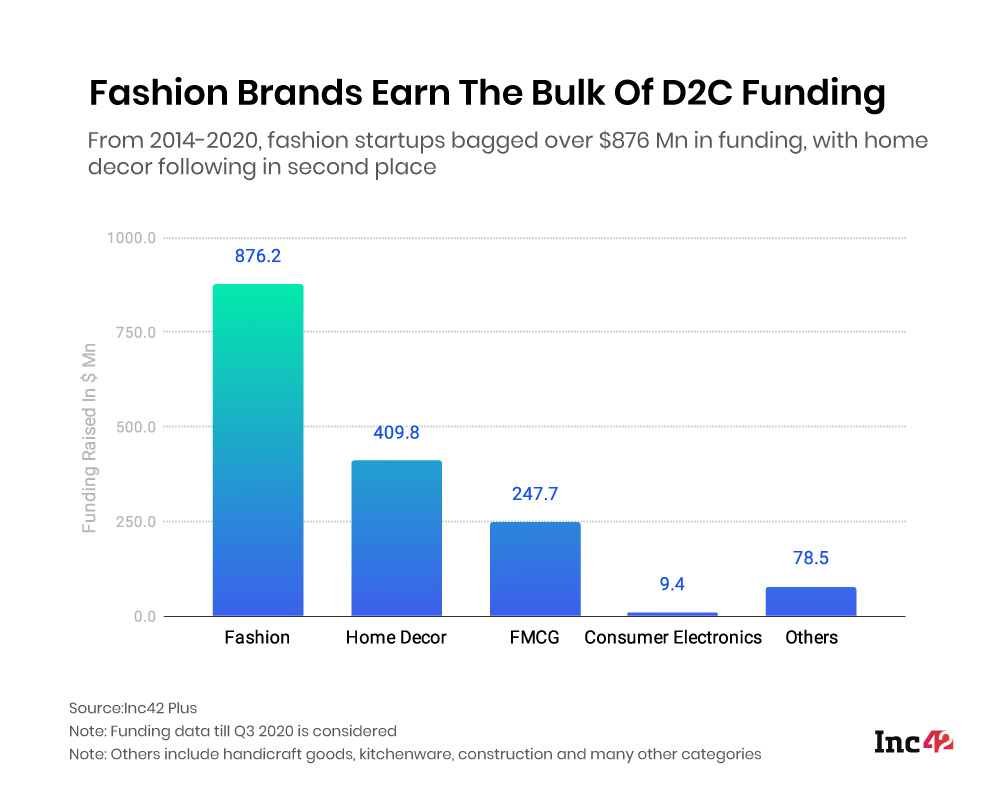

Investments in D2C brands declined by 69% from the previous year, with total funding of $117.6 Mn up till Q3 2020

Fashion brands secured the maximum funding, accounting to almost $876.2 Mn in funding

Read to find out which startups have made it to our D2C Startup Watchlist 2021

Startup Watchlist 2021

The Inc42’s annual series, Startup Watchlist brings together the list of top growth stage startups to watch out for in 2021 across various industries.

This article is part of the fifth edition of Inc42’s Startup Watchlist series, an annual series in which we list the top growth-stage startups to watch out every year from some of the most trending industries in the Indian startup ecosystem. Explore all the stories from the ‘Startup Watchlist’ 2021 series here.

You can view our early-stage discovery watchlist here.

The pandemic year has given rise to new attitudes, needs and behaviours among the consumers in India, and globally. As consumers have started to accept the new normal, their inclination toward brands and shopping experience has witnessed a massive shift.

The customers are now flocking towards trusted brands, across channels, which are throwing a lot of emphasis on sanitation, health, hygiene and nutrition, alongside convenience and supply chain localisation among other factors. According to several industry experts that we spoke to, this trend is here to stay!

While digital-first, consumer-focussed brands that adhered to direct-to-consumer (D2C) models witnessed a huge spike in their revenue and sales last year, traditional brands like Ajanta-Orpat, LG, Piaggio, Havells among others also shifted their focus towards the D2C model. For instance, the tech giant Apple, which was previously reliant on the offline retail presence, launched its native online store in India during the pandemic.

Despite several D2C brands establishing their dominance in the market, the pandemic had a negative impact on the overall sector in terms of investments. In D2C startups, investments declined by 69% (data available till Q3 2020) compared to the previous year, with total funding of $117.6 Mn through 30 deals, as per Inc42 Plus findings.

Since 2014, some of the notable segments in D2C that witnessed a spike in investments include fashion & cosmetics, home decor, consumer electronics, and FMCG among others. Inc42 Plus stated that fashion brands secured the maximum funding, accounting for almost $876.2 Mn in funding between 2014 and Q3 2020. The D2C fashion brands include Fablestreet, Clovia, Bewakoof, Lenskart and Bombay Shirt Company among others.

One of the core reasons for investors’ affinity towards D2C category clearly points at the fragmented nature of the consumer base, giving room to both small, niche, and large players to exist.

While fashion brands continue to be the showstopper in the D2C space, 2020 also saw the rise of niche brands across categories, including furniture, cosmetics, home decor and furnishing sector, which also witnessed the rise in investments. Between 2014 and 2020, Inc42 Plus noted that a total amount of $409.8 Mn was raised by home decor and online furniture startups, across 41 deals.

In the consumer electronics category, D2C lifestyle startup boAt became the fifth-largest wearable brand, globally, with a market share of 2.6%, as per IDC.

2021 is set to be an exciting year for D2C startups, celebrating the rise of growth-stage brands in the D2C landscape. In keeping with our annual Startup Watchlist, in its fifth edition, Inc42 has curated a list of D2C startups that are expected to make the biggest impact in the market. Here are our picks:

Editor’s Note: Please note that the startups listed below are in alphabetical order, and do not represent the ranking of the companies in any manner.

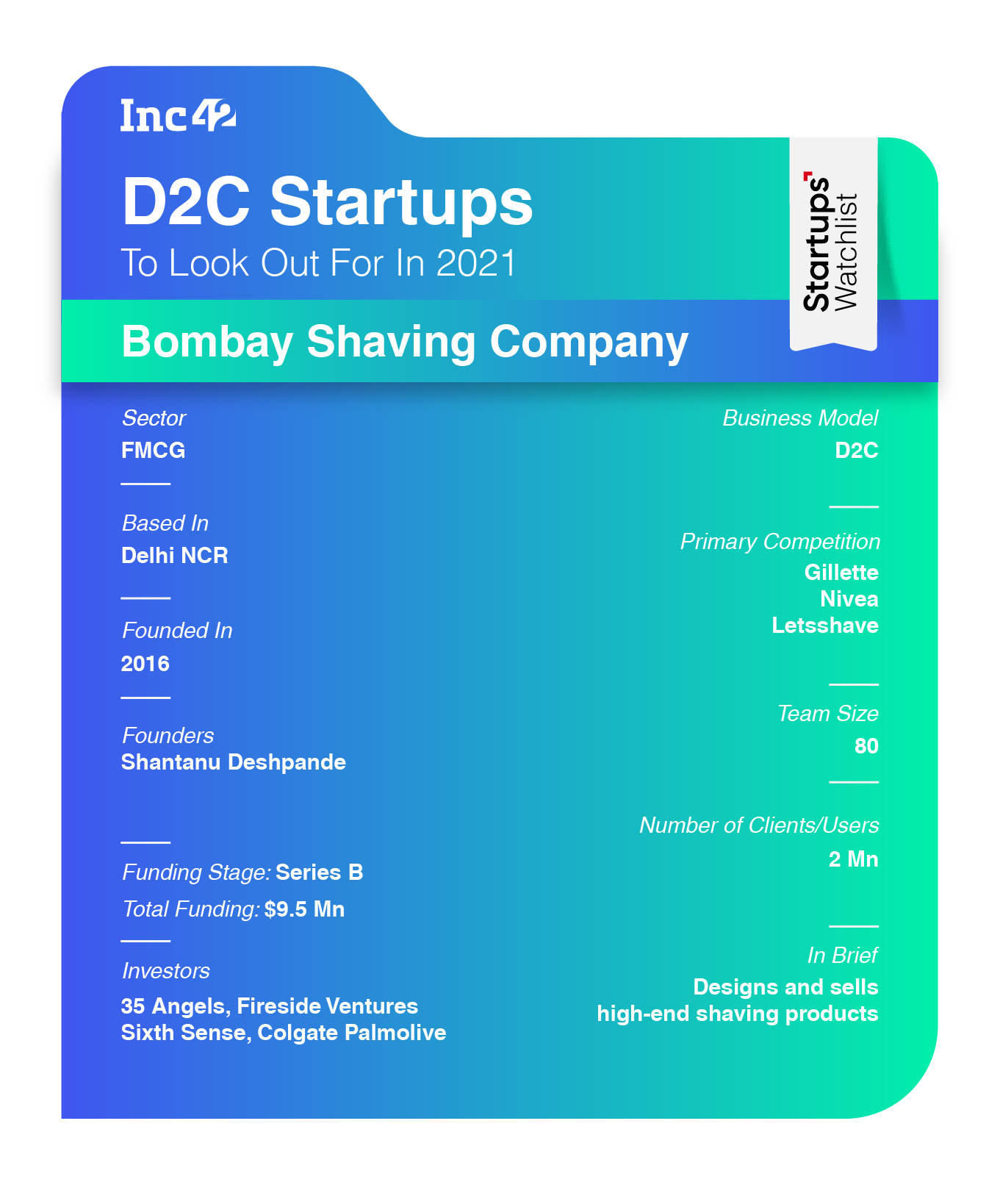

Bombay Shaving Company: Men’s Grooming Brand Powered By Superfoods

A smooth, close shave lets every man’s good looks do the talking. Men’s grooming startup Bombay Shaving Company is one such online-first, personal care brand that embellishes a very clear inflexion in consumer needs, globally. With its core focus on men’s grooming powered by superfoods, the company during the pandemic times launched a new range of do-it-yourself (DIY) offerings.

Omnichannel in its approach, Bombay Shaving Company generates close to about 100+ Cr in revenue, annually, and has about 80 employees with presence in over 25 cities across the country. The company told Inc42 that it is two quarters away from achieving profitability.

Bombay Shaving Company which boasts of 2 Mn users at the moment, is targeting a market size of $3.4 Bn shaving industry. “In the coming months, we are looking at venturing into new categories, cities and establishing brand equity,” said Shantanu Deshpande, the founder of Bombay Shaving Company.

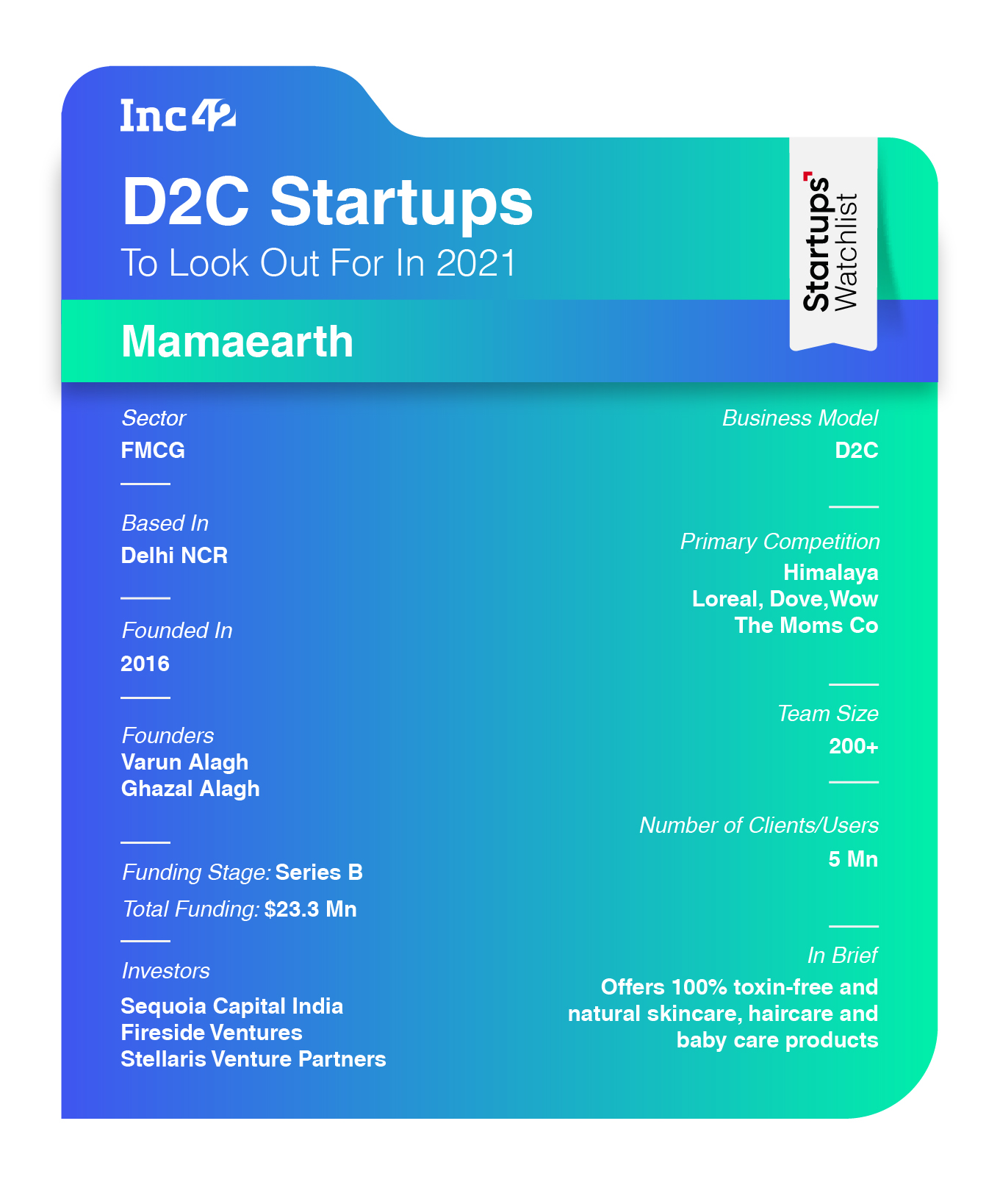

Mamaearth: Toxin-Free Personal Care Products For All Ages

It has been an interesting few months for Mamaearth. As consumers looked towards ecommerce for their personal care requirements, the company’s D2C presence, both on a native website, and marketplaces like Amazon, Flipkart, Nykaa, and Firstcry among others, helped the brand gain traction among the consumers in a big way.

Focussed towards millennials who are conscious of the product they use and also care about the environment, the company believes that the online was the best option for them to connect with its customers directly. Also, its larger pie of the revenue comes from online with the brand website being the highest contributor, swallowed by ecommerce market players.

Mamaearth has increased 3x in terms of revenue over 2019, with the user base growing in a similar manner. Also, with consumers in over 500 cities, the company has been servicing pan India through its online channels. “In order to sustain this growth, we have continued expanding our team,” shared Varun Alagh, cofounder of Mamaearth, pointing at the active hiring even during the lockdown.

Currently, the company is operationally profitable, where it is looking to constantly innovate its product portfolio to stay relevant to its customers. “We are planning on expanding our portfolio of Mamaearth and building newer brands like The Derma Co. and more,” revealed Alagh.

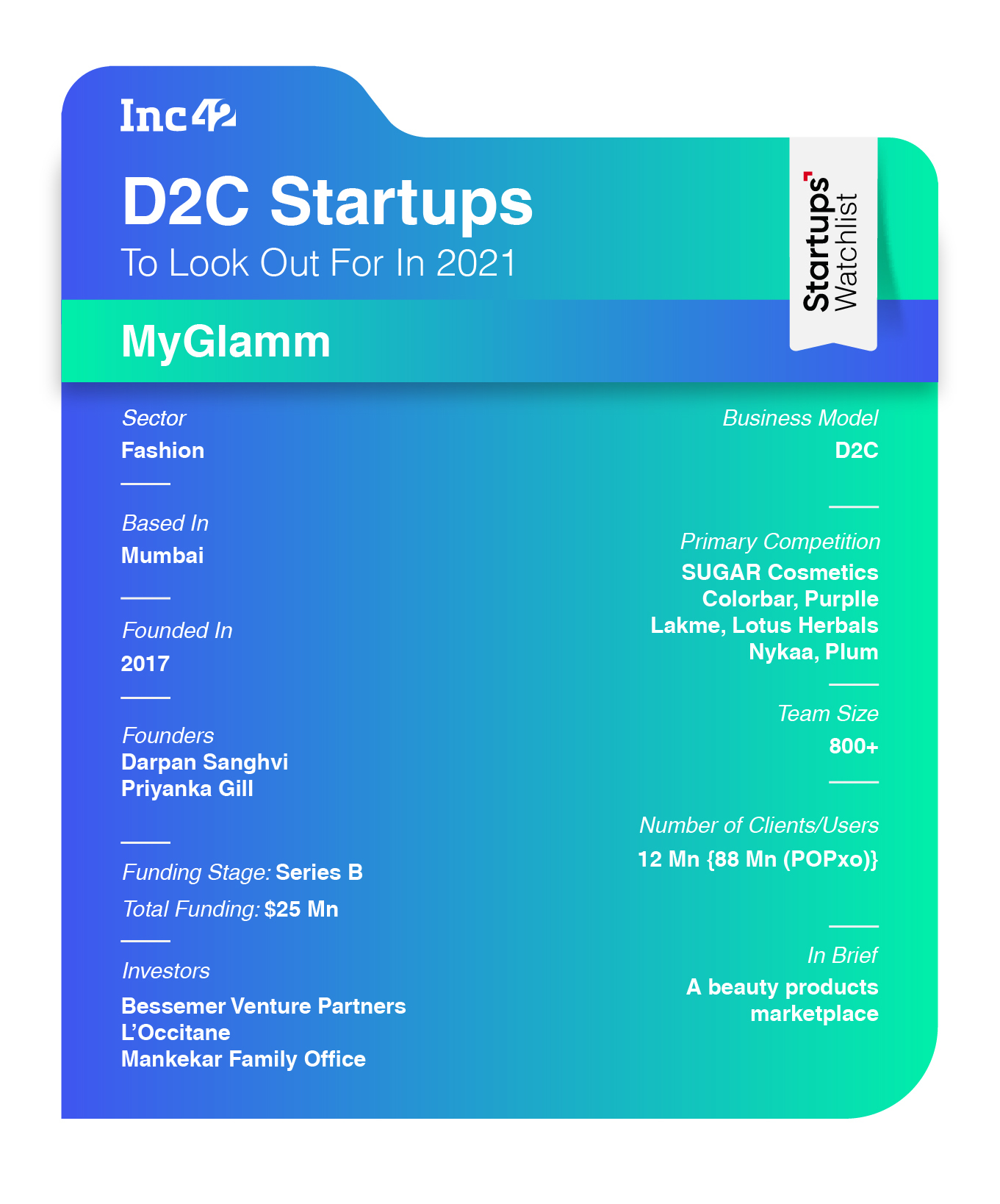

MyGlamm: Leverages Content, Community For D2C Commerce

MyGlamm created a buzz in the D2C ecosystem last year, after it acquired lifestyle content platform POPxo, thereby increasing its digital reach exponentially and creating the 3C funnel (content, community, commerce) to reach out to more consumers.

In other words, MyGlamm leverages content to reach out to consumers and engage with them through community and then get them to discover and purchase its beauty products. In addition to this, the company accelerated its product portfolio diversification from makeup into personal care, alongside creating an offline branding touchpoint by launching a beauty store and beauty experience store.

With 2 Mn active consumer base, MyGlamm’s target audience includes women in the age group of 16 to 35, where 60% of them come from Tier 2 and Tier 3 cities, and the remaining 40% come from Tier 1.

Revenue-wise as well, the company has been growing exponentially. From generating revenue of INR 8 Cr, INR 30 Cr and INR 100 Cr in FY17, FY18 and FY19, respectively, the company has grown to generate revenue of INR 200 Cr ARR in FY20.

In October 2020, the company turned profitable. Now, it is aiming to grow 300% in 2021, while maintaining positive EBITDA (i.e INR 500 Cr). Also, it intends to double POPxo’s MAUs to 100 Mn from the current 55 Mn, monthly users, along with increasing MyGlamm’s MAUs from 3 Mn to 10 Mn this year. “Our offline presence is currently in 50 cities in India, we are looking at expanding to 100 cities in 2021,” revealed Darpan Sanghvi, cofounder of MyGlamm.

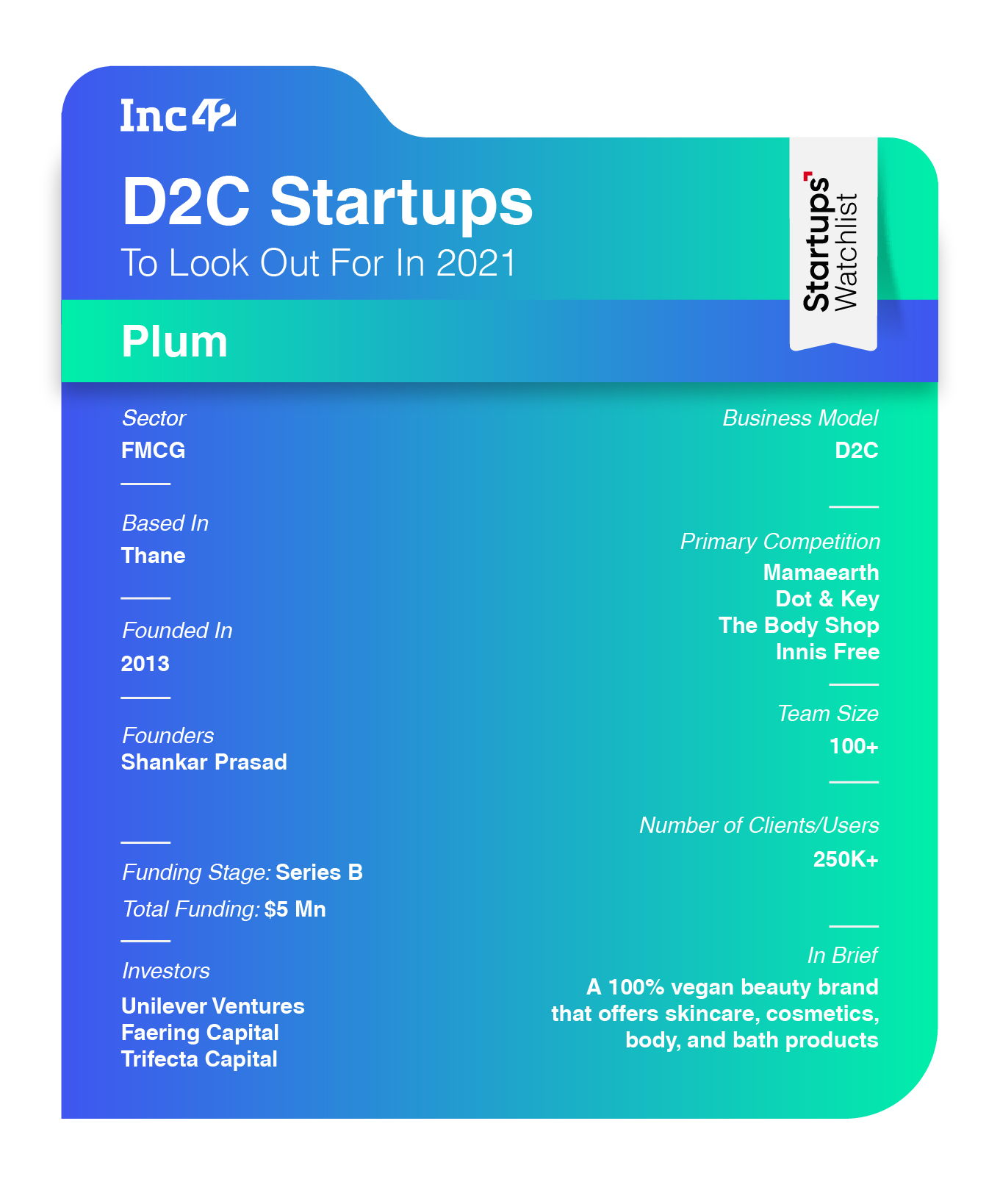

Plum: A New Age, Beauty & Personal Grooming Company

As a digital-first, omnichannel clean beauty and vegan brand, Plum was well-posed to take advantage of the consumer shift to digital, given the increased awareness in the self-care category amid pandemic. The company told Inc42 that they have been able to get back to pre-Covid numbers and beyond over the last six months or so.

Focussed on modern Indian women exploring beauty products across metro cities, Tier 1 and 2 cities, Plum’s revenue comes from direct product sales. The Indian beauty market is expected to touch $23 Bn by 2022.

Having witnessed a 2.5x growth this year, the company now looks to touch INR 200 Cr annualised run rate (ARR) by March 2021. The growth over the last year has been largely driven by digital, where two-third of company revenue comes from online channels. Also, its team size has close to doubled and the company is now catering to 250K+ customers every month.

Profitable since last one year, Plum looks to sustain this growth by focusing on customer retention, experience and low infrastructure costs associated with digital expansion. Besides Plum, its parent entity Pureplay Skin Sciences also houses two brands, including Plum BodyLovin’ and Phy (men grooming brand). “Over the next year, we plan to double our portfolio, expand into newer categories, deepen our portfolio in existing categories, enter new geographies (domestic and international) and new channels of sale,” said Shankar Prasad, the founder of Plum.

The Moms Co: Personal Care Brand For Moms

When it comes to personal care, mothers are the best! Helping moms make safe, natural, effective choices for themselves as well as their family is The Moms Co, a digital-first, personal care brand that creates and sells Australia-certified toxin-free products for prenatal, postnatal, mom and baby care.

Pre-Covid, The Moms Co, which used to sell its products, in both online and offline (particularly stores inside maternity hospitals). During the pandemic, unfortunately, it had to shut down its offline stores. Switching its offline strategy, the company decided to focus its offline resources on the more traditional forms of retail. “Once people started moving out and about, we saw the benefits flow through and we touched the highest ever numbers through offline retail in December 2020,” shared Malika Sadani, the cofounder of The Moms Co.

Currently, The Moms Co’s products are available across online and offline channels. Its revenue comes directly from the sales it makes. The company believes that the market size is about INR 50K Cr ($6.8 Bn).

In 2020, the company claimed to have achieved 3x growth despite Covid-19 (FY20 INR 40 Cr), alongside growing its team from 30 to 60 members and churning INR 100 Cr revenue run rate, catering to over 1 Mn moms across India.

Profitable at the unit level, The Moms Co. said that it will continue to grow, and will start seeing benefits of scale across its marketing and overheads, aiming to turn profitable at the EBITDA level soon. “In 2021, we are planning to expand our offerings across offline and online channels, along with expanding our business internationally,” said Sadani.

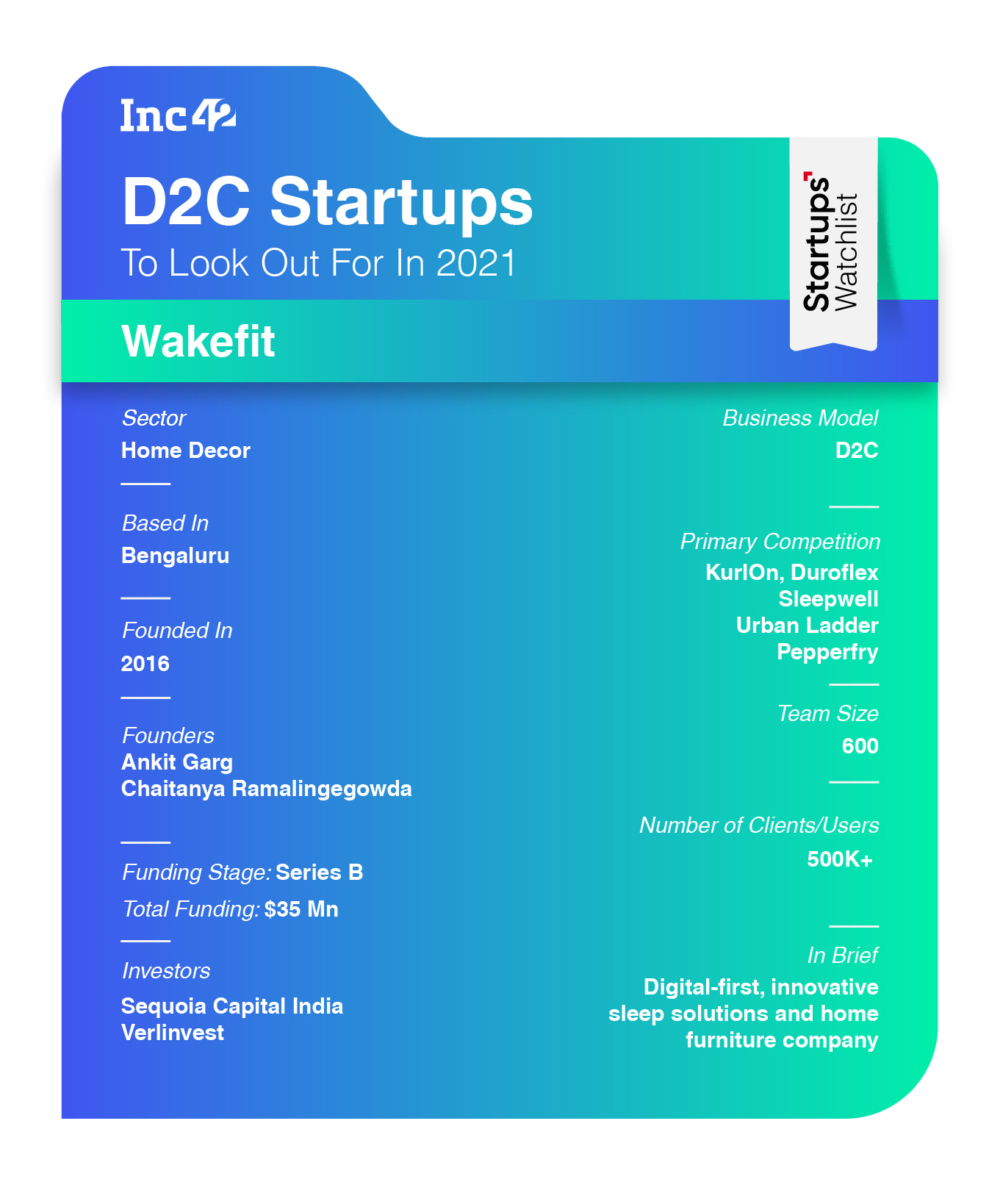

Wakefit: A Research-Driven, Innovative Sleep & Home Furniture Solutions Company

The pandemic has altered the work and lifestyle of consumers. More attention is being paid towards homes, furniture, interiors and ergonomics. For digital-first, sleep solutions startup Wakefit, this has awakened a myriad of opportunities in the home solutions space, thereby exceeding pre-Covid numbers since July 2020.

With its latest pivot, Wakefit caters to a diverse set of audience ranging from millennials to homemakers and sleep-deprived professionals. The company also said that it is looking to ensure that every Indian household with a monthly income of INR 30K and above can access its products. Interestingly, today its audience is not only limited to Tier 1 cities, but over 30% of its business comes from the Tier 2 and Tier 3 regions.

Since its inception in 2016, Wakefit claims to have recorded 2.5x to 3x revenue growth YoY. Further, the company revealed that it generated a revenue of INR 199 Cr in FY20, compared to INR 80 Cr in FY19. Wakefit told Inc42 that it is targeting INR 450 Cr for FY21 and INR 1000 Cr by FY23.

Till date, it has served close to over 5 lakh customers across 19K+ pin codes across India. Also, with a team strength of about 600 employees as of March 2020, Wakefit aims to increase its workforce by over 400% to 3000 employees by March 2021.

After setting up factories in Pune, Delhi, Jodhpur, Hyderabad and Bengaluru, Wakefit is now looking at doubling down in Tier 2 and 3 markets. “We are looking at driving 50% demand from these markets in the coming months. Also, planning to set up experience centres in a few cities as a pilot, in response to growing customer feedback,” said Chaitanya Ramalingegowda, cofounder of Wakefit.

Editor’s Note: The startups were selected on the basis of editorial discretion, keeping in mind various factors such as revenue growth, profitability, funding stage (Pre Series A to Series B), pivot and growth of the companies in the preceding year among other factors, and have been weighted thoroughly on the basis of the performance of the companies, and some of the information was also gathered from public and private sources.

Ad-lite browsing experience

Ad-lite browsing experience