SUMMARY

India is fast becoming a hotbed of crypto scams, but probes are taking too long or getting stuck

India's Crypto Economy

India's Crypto Economy is a brand-new weekly newsletter (delivered every Thursday) from Inc42 to help you decode the rapidly growing crypto economy and its implications on business, work and life. We launched this newsletter on the 4th anniversary of our weekly series “Crypto This Week” which completed 190 editions in May, 2021.

Dear reader,

Amid a spurt of crypto ads, the crypto community across the country is growing exponentially. It is not wishful thinking. According to stockbroker analytics group BrokerChooser, more than 100 Mn people in India have actively or passively invested in crypto, the highest in the world.

But every growth story has a dark side ?

So, it is not surprising that India has become a hotbed of crypto frauds. What’s even more worrying is that most of the probes into these alleged scams have reached nowhere even after years.

Before we delve deeper into this darknet, let us take a quick look at the key highlights of the week from the world of crypto:

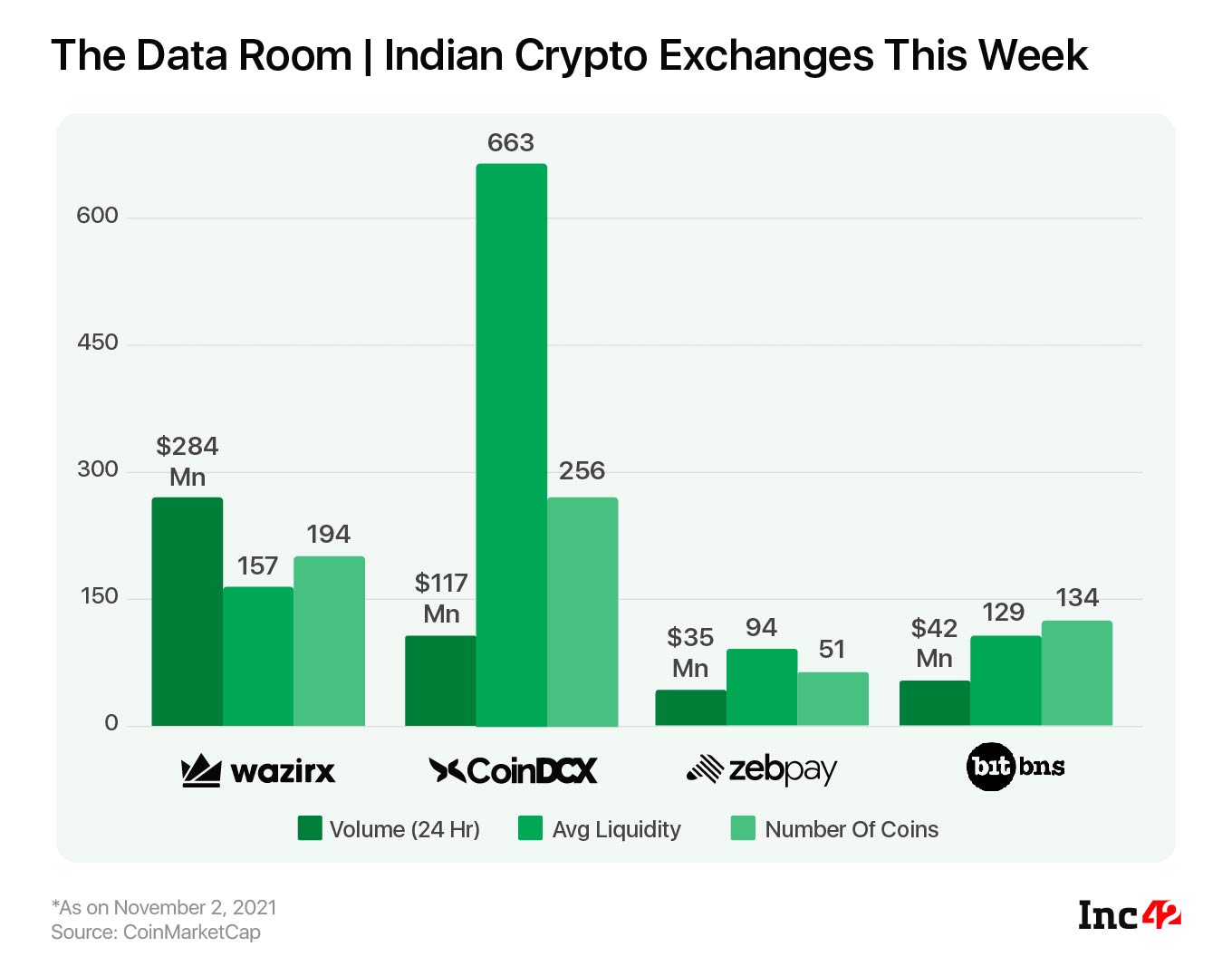

- CoinSwitch Kuber saw the highest number of downloads (8.1 Mn) among crypto exchange apps in India in 2021. Read the details in our latest report.

- Coinbase marked its first India acquisition this week. The global crypto exchange acquired Bengaluru-based AI startup Agara for around $40 Mn.

What’s Taking So Long To Probe Crypto Scams? ⌛️

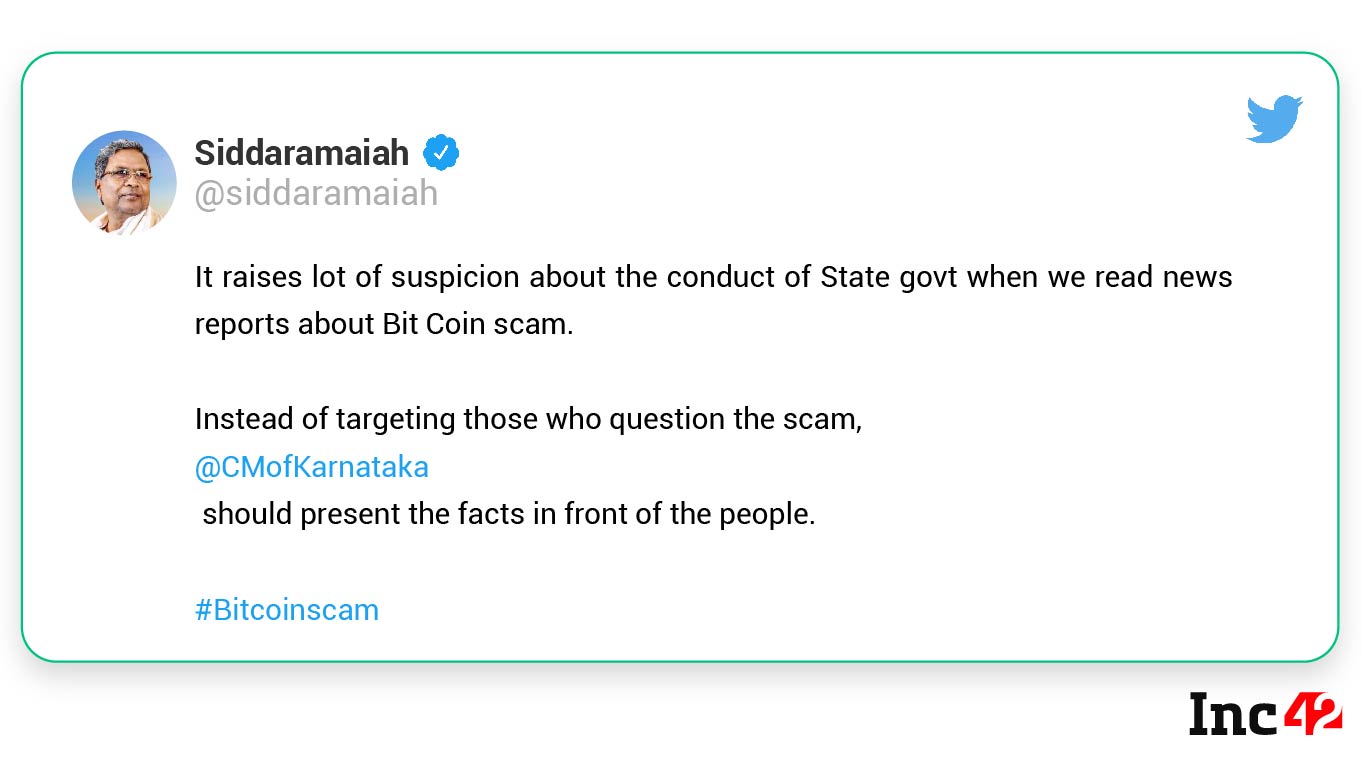

?The Allegation: In a series of tweets, Siddaramaiah, the former chief minister of Karnataka, has alleged that the current state government is trying to close the investigation into an infamous Bitcoin scam by handing it over to the ED and the CBI.

?The Background: In November 2020, Bengaluru Central Crime Branch (CCB) arrested Srikrishna Ramesh, aka Sriki, for procuring drugs on the darknet. Sriki, a drug peddler and hacker used bitcoins to purchase drugs and distributed them among his clients, allegedly influential politicians and business people.

?The Full Story: Further investigation by the ED established Sriki’s links with crypto cybercrimes such as ransomware attacks, money laundering and more. He is also accused of hacking the Karnataka government’s e-procurement portal and siphoning off INR 11.55 Cr. The money was diverted to several bank accounts located in Nagpur and Uttar Pradesh. Besides, he had allegedly hacked multiple portals, including Bitfinex (the bitcentral exchange), BTC2PM.me, Paytiz, MPEX.

?The Booty: CCB claimed to have recovered 31 bitcoins worth INR 14 Cr but later retracted its statement. According to Ramalinga Reddy, former home minister of Karnataka, it could be INR 10,000 Cr worth of bitcoin transactions. “As per news reports, in the chargesheet filed by CCB police, it is recorded that the accused has looted 5,000 bitcoins through unethical hacking. Who holds these bitcoins now? Have they got it transferred to the accounts of investigating agencies?” questioned Siddaramaiah.

According to the CCB charge sheet, Sriki is also accused of stealing 2,000 bitcoins from the Bitfinex exchange.

?Partners In Probe: The high profile ‘scam’ involves a slew of investigating agencies, including the CCB, Karnataka CID, the ED and now the CBI. The case was first booked by KG Nagar police station in Bengaluru but was later transferred to CCB and the CID cybercrime cell.

?The Timeline: The CCB filed a charge sheet in February 2021. But in March, the Karnataka government handed over the case to ED and the Interpol wing of the CBI. The latter is yet to take up the case, but the ED has provisionally attached an amount of INR 1.44 Cr lying in 14 bank accounts in a cybercrime case against Nimmi Enterprises and others — beneficiaries of the crime allegedly committed by Sriki.

⁉️The Big Question: Siddaramaiah questioned the move, asking why the case was transferred to central agencies when a charge sheet was already filed. “@CMofKarnataka has said that the state investigating agencies have conducted a comprehensive investigation & the case has now been referred to ED & CBI. What was the need to hand it over to ED & CBI if the state agencies had done it properly?” he tweeted.

?Government Speak: Responding to the allegations, Karnataka CM Basavaraj Bommai said, “There is no question of hiding anything or anyone. No matter how influential a person is, if Siddaramaiah can provide an iota of evidence to back his claim, we will investigate. We referred the bitcoin and money laundering case to ED in March 2021 and the hacking cases to the Interpol wing of the CBI in April 2021 while our crime branch is investigating the drugs case.”

Is India Turning Into A Crypto Scam Hotbed? ?

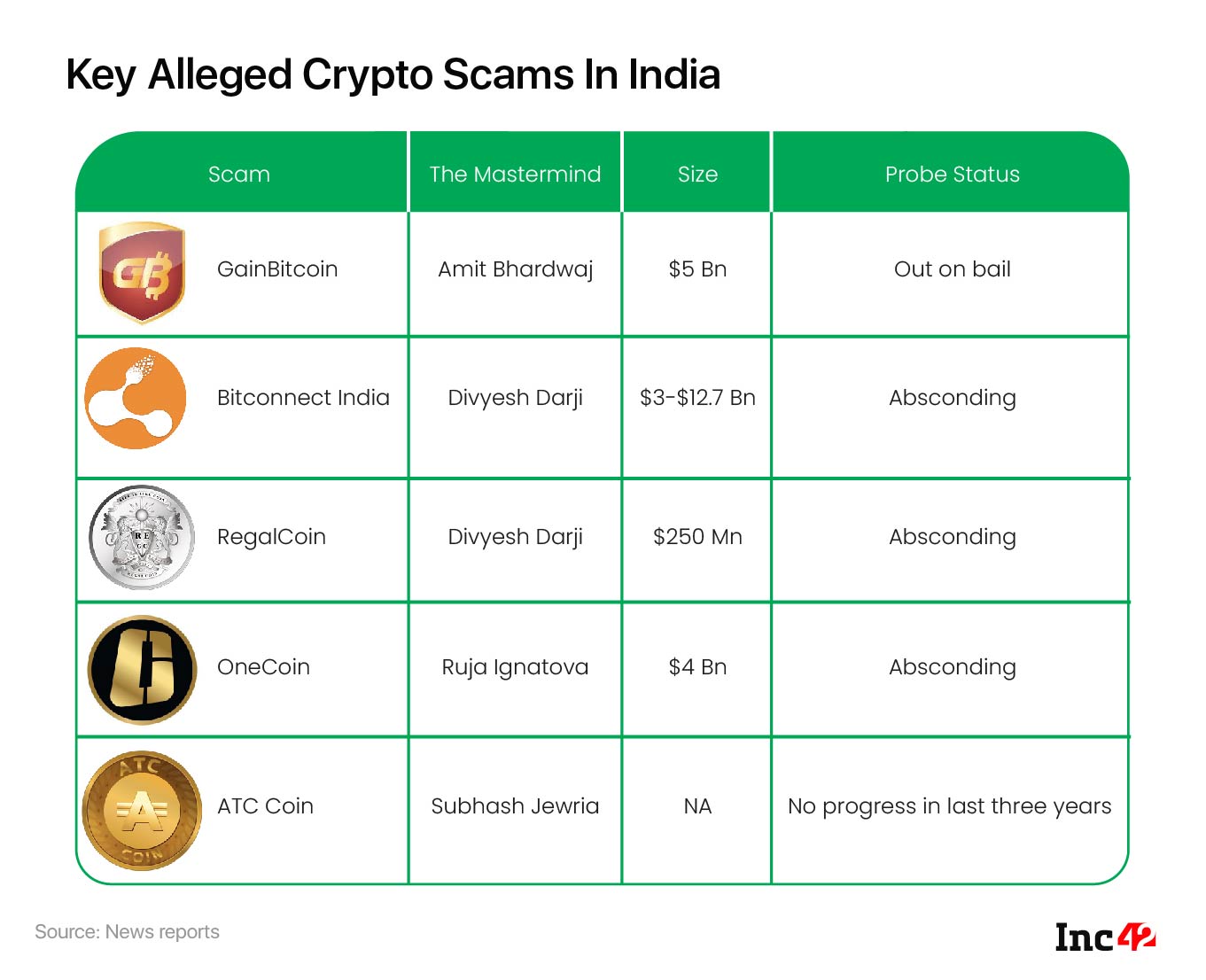

Sriki’s story is just one of the many scams where investigations seem to be going nowhere. Among the bigger cases are Amit Bhardwaj-led GainBitcoin scam, The Bitconnect fraud and other crimes involving OneCoin, ATC Coin and more.

While sources in ED earlier told Inc42 that Bhardwaj had access to more than 82,000 bitcoins worth $5 Bn today, the Bitconnect scam might have involved $3-15 Bn.

Interestingly, all the accused have been granted bail, and quite a few have been absconding since.

For Binge Reading ?

The Google Of DeFi: The FEG team, founders of the FEG token and the FEG exchange have announced a mega project to build a Google of DeFi. “Our developers have put all the pieces of the puzzle together correctly; these pieces together will make us the Google of DeFi,” the team claims. Read the blog.

Crypto Vs Banks: Legacy banks first tried to kill crypto. However, having failed terribly in doing so, banks are now slowly moving towards crypto and embracing blockchain, claims this New York Times article.

News Doing The Rounds

- ?The $200 Mn Fund: Smart contracts platform Avalanche’s parent organisation Avalanche Foundation launched a $200 Mn fund called Blizzard. The fund will support development and innovation across the developer-user ecosystem leveraging the Avalanche public blockchain. Avalanche Foundation, Ava Labs, Polychain Capital, Three Arrows Capital contributed to the fund.

- ?OKEx To Pump In $100 Mn: Commemorating the legacy of Satoshi Nakamoto, the pseudonymous inventor/s of bitcoin, OKEx Asia set up a $100 Mn fund to help build and accelerate the blockchain ecosystem across Asian countries.

- ⚖️Ashish Singhal, Sumit Gupta To Co-Chair BACC’s Crypto Council: Ashish Singhal of CoinSwitch Kuber, and Sumit Gupta of CoinDCX, were recently appointed co-chairs of IAMAI’s Blockchain and Crypto Assets Council (BACC). It focusses on evolving as a self-regulatory body for crypto entities in India, enabling e-KYC guidelines, crypto ad policy and other crypto-related regulatory issues.

Going by all that is hot and happening across the crypto landscape in India — the growing user base, big funding rolling in and the crypto and blockchain startups getting into an innovation spree, this sector is booming. But with big growth comes big loopholes and vulnerabilities, and big scams will continue to thrive if the wait for justice is too long.

Meanwhile, this Dhanteras, Diwali, have you bought gold or crypto? Do let us know your thoughts about crypto investments and about our newsletter at [email protected]

Stay safe and happy Diwali! ?

Till Next Week,

Suprita Anupam