Two separate class-action lawsuits have been filed with the US District Court, California, against Do Kwon, others related to TerraForm Labs and Binance US

Over a dozen Indian investors, along with approximately 400 other Terra-LUNA investors, are also exploring filing a lawsuit against Kwon and others in Singapore

The South Korean law enforcement agency has issued a red corner notice for the arrest of TerraForm Labs founder Kwon

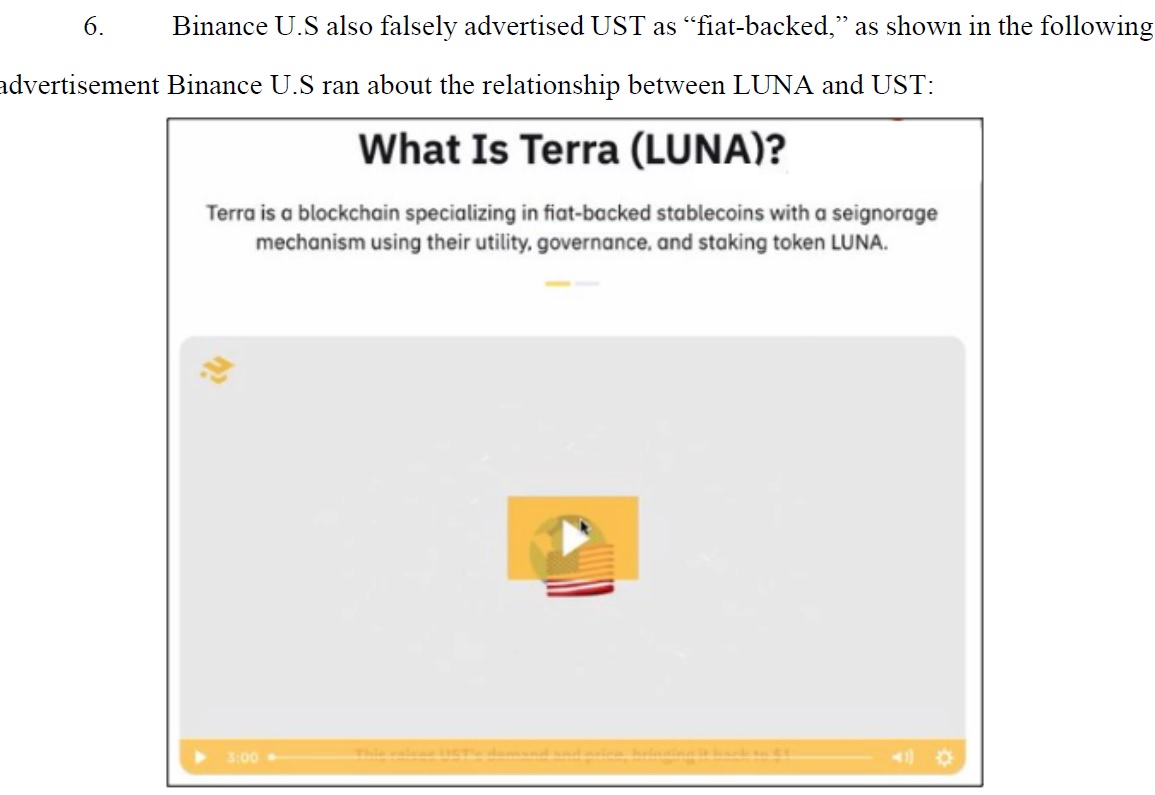

Over a dozen big Indian investors have joined the legal proceedings in the US against TerraForm Labs (TFL), the company which operated the Terra blockchain and promoted LUNA token and stablecoin Terra USD (UST), its founder and CEO Do Kwon, and crypto exchange Binance US for falsely advertising UST as “fiat-backed” stablecoin.

Besides, Jump Crypto, which provided funding to the Terra blockchain project, has also been named as one of the defendants. Jump Crypto’s founder and president, Kanav Kariya, is one of the six members of the governing council of LUNA Foundation. Kariya is accused of using its relationship with Wormhole to secure a favourable exit from its UST-LUNA holdings prior to the complete collapse of the Terra ecosystem.

While the class lawsuits have already been filed with the US District Court, Northern District of California on behalf of approximately 4,000 investors, over 400 investors, including about 12 Indians, are exploring filing a similar case in Singapore High Court, according to documents accessed by Inc42.

The Collapse

Earlier, an Inc42 investigation found that nearly 2.3 Lakh Indians had lost millions of dollars in the Terra-LUNA collapse earlier this year, one of the biggest crashes in the cryptocurrency ecosystem.

The UST, which was supposed to be a stablecoin, and its derivative token LUNA collapsed by approximately 91% and 99.7%, respectively, during May 9-13, 2022.

UST, which is pegged to the US dollar (USD), fell to $0.15 on May 13 from $1 on May 9, and is currently trading at $0.125. Similarly, its market cap stands at $1.4 Bn currently as compared to $18.62 Bn on May 9, according to Coinmarketcap.

For the uninitiated, stablecoins are cryptocurrencies where the price is designed to be pegged to a cryptocurrency or fiat money or to an exchange-traded commodity such as gold.

The Lawsuit May Take 4 Years To Conclude: Indian Investors

Speaking to Inc42, an Indian investor, who is part of the lawsuit in the US and had invested over $160K in UST-LUNA said, “The class action lawsuits normally take around four to five years in the US. So, considering the credible lawyers appointed for class action, it’s a guarantee that at least within four years, we will know whether we will get our funds back or not.”

Besides, the US Securities and Exchange Commission (SEC) is separately investigating if TFL violated any federal investor protection rules, he added.

TFL is a Seoul-based company with its registered headquarters in Singapore. On January 19, 2022, it announced the formation of the Luna Foundation Group – a Singapore-based non-profit organisation – to facilitate the growth of the Terra ecosystem and improve the sustainability and stability of Terra’s algorithmic stablecoins.

Talking about filing a separate lawsuit in Singapore, another Indian investor told Inc42 that, unlike the US, the legal counsels are not confident about a favourable outcome in the country as Kwon is currently absconding and not in Singapore.

Besides, according to court documents from South Korea’s Supreme Court Registry Office, he shut down TFL’s headquarters on May 4, 2022, and the Seoul branch on May 6, 2022. The South Korean law enforcement agency has issued a red corner notice for the arrest of Kwon.

What Is In The Lawsuit

The class-action lawsuit has made a series of allegations against TFL, its founder Kwon, and others associated with TFL. The petitioners have alleged that the accused concealed facts and presented half-truths to retail investors and must be held accountable for violating the Securities Act, and the Racketeer Influenced and Corrupt Organizations (RICO) Act.

They have alleged that TFL and its associated firms misled investors while promoting Terra tokens to artificially inflate their price and trading volume so that Kwon and other promoters could sell their Terra Tokens for substantial profits.

As per the lawsuit, despite many people, including British economist Frances Coppola, pointing out the faults in the algorithm of the Terra blockchain, Kwon refused to address the concerns and dismissed the entire argument saying, “I don’t debate the poor on Twitter, and sorry I don’t have any change on me for her at the moment.”

Citing another such instance, the lawsuit points out that on December 30, 2021, the co-founders of Maker DAO, a rival stablecoin, posted a Twitter thread with their predictions for the crypto sector in 2022.

In particular, they predicted that “UST will collapse in a death spiral with LUNA hyper-inflating to try to cover the peg” and made the following remarks – “Look, UST and MIM are solid ponzis and I respect that. You can make good money off them for sure. But they are not built for resilience and they are going to 0 once the market turns for real . . . . Now stop trying to scam users looking for actual stability into being ur exit liquidity.”

When asked if he was willing to place a bet that MakerDAO founders were wrong, Kwon simply replied, “I don’t gamble against the poor.”

Later, Remi Tetot, another member of the LUNA Foundation’s governing council, revealed that the offer of a 20% yield was a marketing ploy to increase investment in the Terra ecosystem.

“They called Luna a Ponzi because of the 20% yield on Anchor, while a proposal was being worked on to have new parameters and make the yield sustainable around 10–12%. Unfortunately, It didn’t have time to make it . . . 20% yield was essentially the marketing budget and the cost of customer acquisition, we knew it wasn’t sustainable, but I think it was acceptable for the time being, the yield should have been dynamic as the system grew,” he said.

Meanwhile, an Indian investor also raised questions about the governing council of Terra blockchain. “The six-member governing council, which includes an Indian too, were supposed to defend the fund, but very hastily, they sold/withdrew 80,000 Bitcoin from the fund that was backing the stablecoin without even discussing it with anyone, we don’t know what happened with the rest of the fund,” the investor said.

Kwon had initially assured that the rest of the fund would be disbursed among small retail investors. However, it has been five months since his announcement, but nothing has happened.

Lawsuit Against Binance For Promoting UST As A “Safe” Asset

A separate class-action lawsuit has also been filed in the US against Binance US for promoting and advertising Terra tokens as a “safe” asset and falsely advertising UST as “fiat-backed”. Binance US was an early supporter of and investor in TFL, it said.

“Despite enjoying those fantastic profits, Binance US failed to comply with federal and state securities laws. Binance U.S. failed to disclose that UST is in fact, a security and that it is selling these securities, even though (i) there is no registration statement in effect for them, and (ii) Binance US itself has refused to register with the US Securities and Exchange Commission (“SEC”) either as a securities exchange or as a broker-dealer,” according to the lawsuit.

Ponzi Schemes: People Believe In Influencers’ Words

Time and again, investors have been duped by showing the benefits of decentralisation, while keeping the entire system centralised. Unlike Bitcoin and Ethereum, Terra/LUNA too was centralised, investors accuse.

Commenting on the fiasco, Ethereum founder Vitalik Buterin earlier tweeted, “With the one quibble that “algostable” has become a propaganda term serving to legitimise uncollateralized stables by putting them in the same bucket as collateralized stables like DAI/RAI, and we need to really emphasize that the two are very different.”

In the case of most of the crypto Ponzi schemes, it’s the influencers who misled the public. Thanks to the lack of awareness among people and hence they have to rely on influencers’ word of mouth. We saw this in the case of GainBitcoin which benefitted from celebrities like Shilpa Shetty, Huma Qureshi, Neha Dhupia and others tweeting about its founder late Amit Bhardwaj and helped create an aura of authenticity.

Similarly, a lot of investors believed and invested a hefty amount of money in Vauld, due to influencers’ paid promotions on Youtube and other social media platforms. Terra/LUNA too was promoted by numerous crypto celebrities including the like billionaire crypto investors Michael Novogratz and Binance CEO Changpeng Zhao.

Since the rising popularity of Bitcoin and crypto at large, over a million Indians have been duped through Ponzi schemes. Some of the biggest crypto-based Ponzi schemes have had their roots in India. However, thanks to the slowest pace of investigation by Indian law enforcement agencies, and lack of legal clarities, not one case has been resolved so far.

Ad-lite browsing experience

Ad-lite browsing experience