SUMMARY

Ponzi schemes continue to dupe investors

India's Crypto Economy

India's Crypto Economy is a brand-new weekly newsletter (delivered every Thursday) from Inc42 to help you decode the rapidly growing crypto economy and its implications on business, work and life. We launched this newsletter on the 4th anniversary of our weekly series “Crypto This Week” which completed 190 editions in May, 2021.

Dear Reader,

Ponzi schemes are a seemingly lucrative affair to thug people as they promise incredible returns in the shortest possible time. After getting bail from the Bombay High Court, one of the main accused in the infamous GainBitcoin crypto scam (yes, another Ponzi scheme) told Inc42, “Showing huge returns and lavish parties in the Maldives… it was the most attractive tool that people fell for! I did, too.”

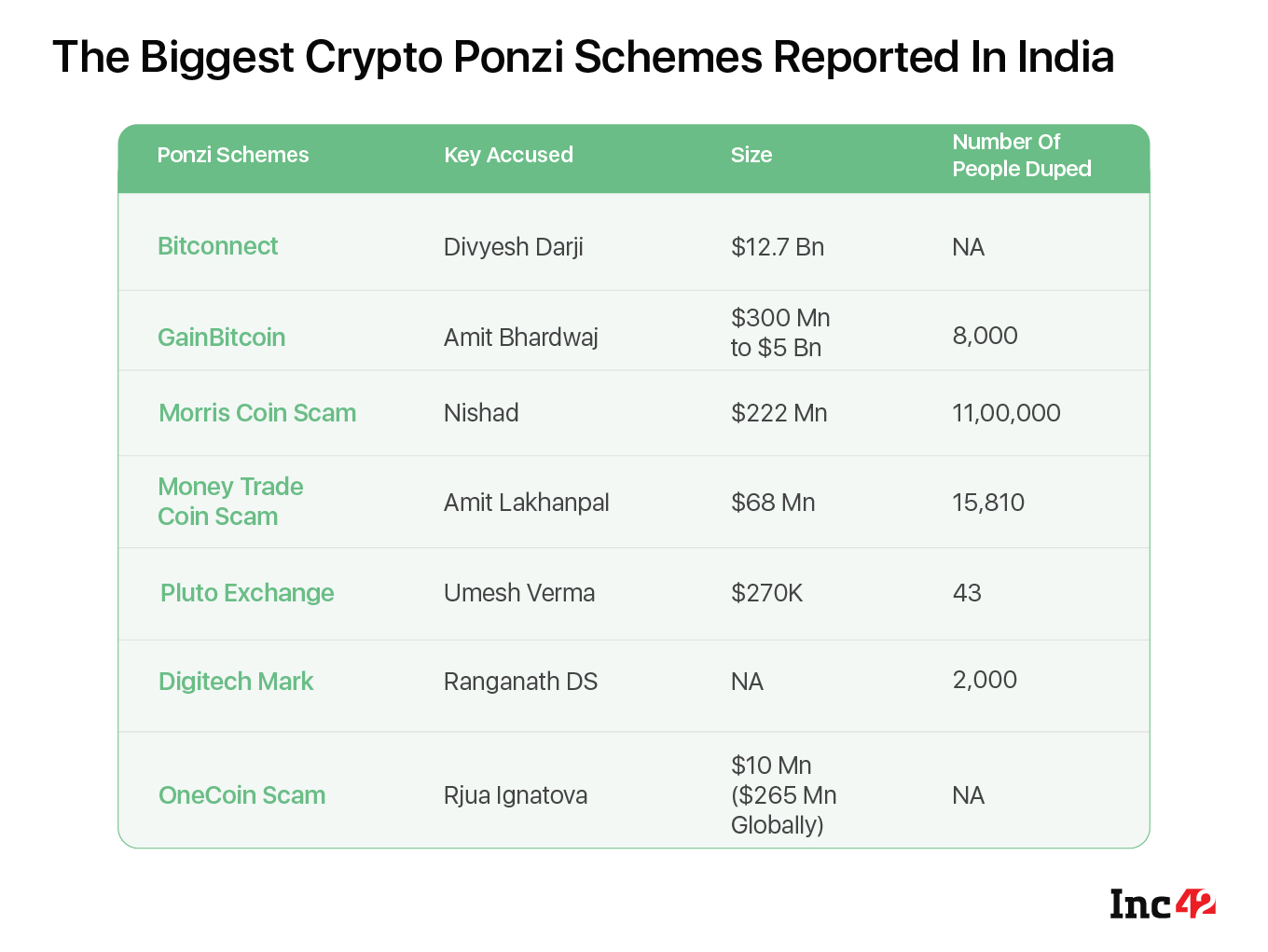

In the latest incident, the City Crime Branch (CCB) of Bengaluru Police arrested Chikmagalur resident Ranganath DS for allegedly running a Ponzi scheme under the fake company name DIGITECH MARK and cheating more than 2,000 people. A case has been registered with the cybercrime cell, and further investigation is underway. Ranganath has been booked under various sections of the IT Act, IPC and Prize Chits and Money Circulation Schemes (Banning) Act.

Since Bitconnect and GainBitcoin, these Ponzi schemes have thrived on the huge and hassle-free returns crypto investors are supposed to get.

Just like Amit Bhardwaj of GainBitcoin or Divyesh Darji of Bitconnect Gujarat Scam, Ranganath promised mind-boggling returns on crypto investments and his customers paid the sum. For example, he promised a fixed return of INR 1 lakh after 12 months if someone would put in INR 15,000. Similarly, an investment worth INR 50,000 had a guaranteed fixed return of INR 3 Lakh after 12 months.

According to Bengaluru Police, Ranganath had duped more than 2,000 people from Bengaluru, Hubli, Dharwad, Mysuru and Mangaluru.

This is not an isolated case. In the past five years, Indian crypto investors have lost billions. An exact figure will be difficult to ascertain as the high-profile investors in these Ponzi cases did not come forward to lodge complaints or claim their investments.

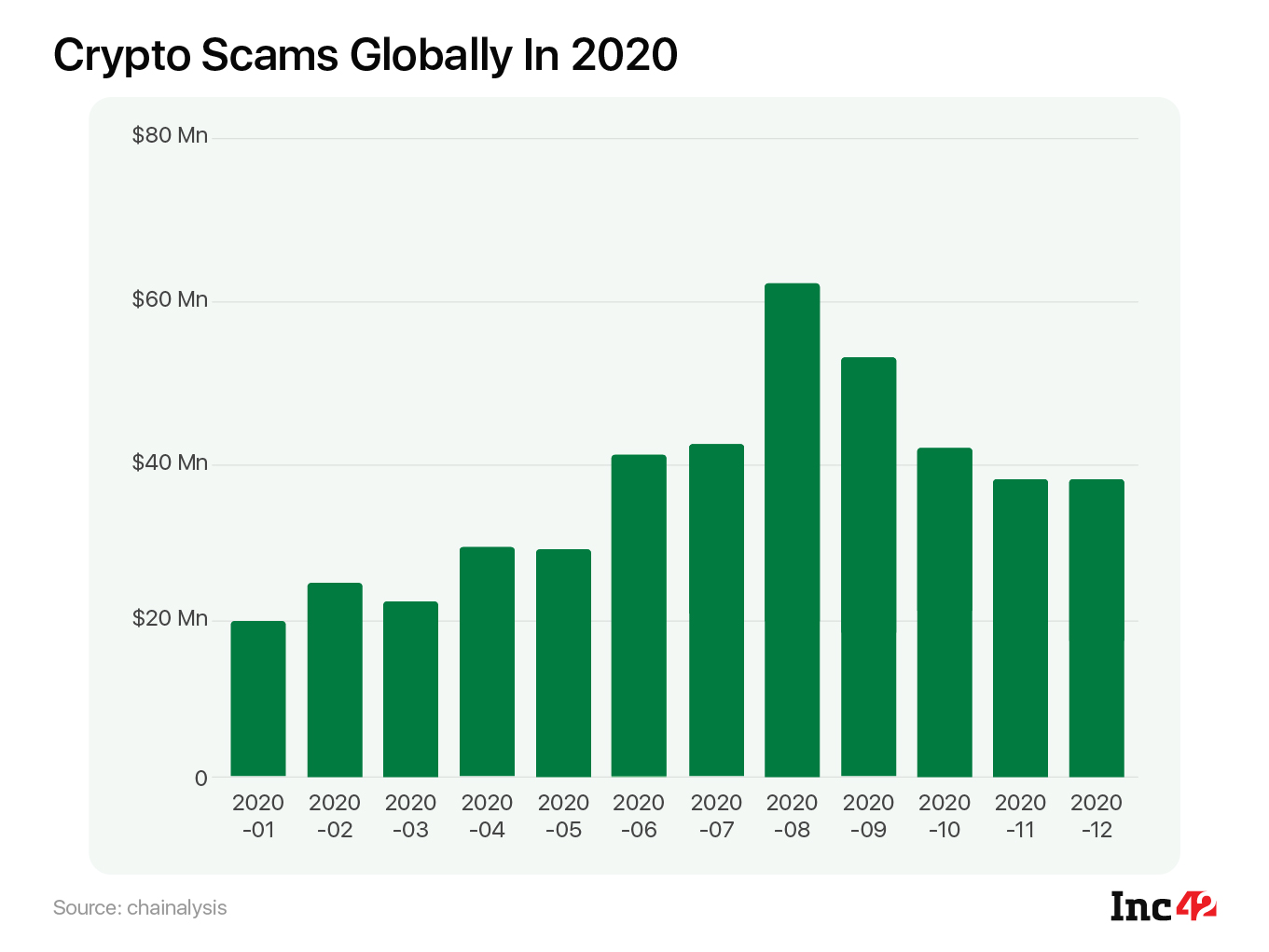

As we look into the details of the Ponzi schemes rooted in sham crypto investments, some interesting developments seem to have taken place in the past two years. According to a crypto crime report by Chainalysis, scams remained the highest-grossing crypto crime globally, but the total scam revenue fell drastically in 2020, from roughly $9 Bn to just under $2.7 Bn.

However, the number of individual payments to scam addresses rose from just over 5 Mn in 2019 to 7.3 Mn in 2020, suggesting that the number of individual scam victims rose by more than 48%.

One can gain numerous insights from the data gathered by Chainalysis. And it is quite worrying as the value of crypto Ponzi schemes is proportional to the economy, believe experts. For example, the extent of scams in value terms was largely down in 2020 as the overall economy shrank to a great extent due to the pandemic and the subsequent lockdowns implemented to contain the spread of Covid-19. But the number of people falling prey to scamsters continued to rise regardless of the pandemic.

Now that the second wave of Covid-19 seems to be slowing down and the economy is back on the recovery track, will the number of Ponzi schemes also go up?

For Binge Reading

Verkle Tree: Merkle tree has been popularly used by blockchains such as Bitcoin, Ethereum for creating proofs, a fundamental part of blockchain technology. However, as their proof sizes are lengthy, newly developed Verkle trees are now shaping up as the key component of Ethereum’s upcoming scaling upgrades. In his blog, Ethereum founder Vitalik Buterin explains the difference between Merkle and Verkle tree. “If a tree contains a billion pieces of data, making a proof in a traditional binary Merkle tree would require about 1 kilobyte, but in a Verkle tree the proof would be less than 150 bytes, a reduction sufficient to make stateless clients finally viable in practice.” Read it here.

Bitcoin Millionaires — It Is Up To You To Join This Club: In May 2020, there were more than 8 Mn bitcoin millionaires, and each needed more than 113 bitcoins (to retain their millionaire status) as the price of that crypto was as low as $8.8K. Since then, bitcoin price has skyrocketed and then plummeted from $60K to $35K. But one is now required to hold just a quarter of the bitcoins (compared to 2020) to become a bitcoin millionaire. Blogger Sylvain Saurel gets into the maths part of it and analyses how easy it gets as time passes. Read the blog here.

Tweet Of The Week

Responding to Elon Musk’s capabilities to move the entire crypto market by significant margins, Binance founder and CEO Changpeng Zhao said that the tweets that hurt other people’s finances are not funny but irresponsible.

Explained | India’s Crypto Taxation

Unlike previous years, FY21 saw a significant rise in the number of crypto traders and investments globally. In India, the number of crypto traders grew from 5 Mn to 15 Mn in the last year alone. The growing numbers, along with crypto-related frauds, have alarmed several regulatory bodies, including the Reserve Bank of India (RBI), the Income Tax (IT) department, the Enforcement Directorate (ED) and others. As filing tax returns remains the focus of most households and businesses right now, it has become imperative to understand the nitty-gritty of crypto taxation in India.

Should one declare crypto as a foreign asset or pay 18% GST on its purchase? Should it fall under capital gains tax or business income? Whichever way we look, there is not much clarity on how taxes on crypto transactions and earnings should be defined. This week, Inc42, spoke with experts to bring in some much-needed clarity. Read it here.

Crypto This Week | News Doing The Rounds

Coinbase To Expand India Team, Offers $1K In Crypto As Welcome Kit

US-based crypto exchange Coinbase is set to strengthen its India presence. Pankaj Gupta, the company’s India head and VP, engineering, announced its India expansion plans in a series of tweets. As part of its welcome kit, the company is also adding a one-time $1,000 incentive in crypto to the Coinbase accounts of new hires.

The global exchange is also planning to build a Crypto App Store similar to Apple’s App Store.

In his latest blog, cofounder and CEO Bryan Armstrong announced plans to build a crypto store at Coinbase.

UK’s Financial Watchdog FCA Bans Binance

Financial Conduct Authority (FCA), the UK’s financial regulator, recently banned Binance (Binance Markets Limited), the world’s largest cryptocurrency exchange. “BML is not permitted to undertake any regulated activity in the UK,” the regulator said.

It also noted that no other entity in the Binance Group holds any form of UK authorisation, registration or license to conduct a regulated activity in the country.

Crypto Enthusiast John McAfee Commits Suicide

Larger-than-life software mogul John McAfee, founder of the eponymous security software company and a crypto enthusiast, was found dead in his Spanish prison cell after he was held there for around nine months. His body was found hanging in his cell.

Autopsy reports confirmed that he had committed suicide. Several times in the past, McAfee had said that if he were ever found dead by hanging, it would mean he was murdered.

Besides McAfee Associates, which was acquired by Intel for $7.68 Bn, John McAfee had led several companies, including MGT Capital Investments and Luxcore, a cryptocurrency firm focussed on enterprise solutions.

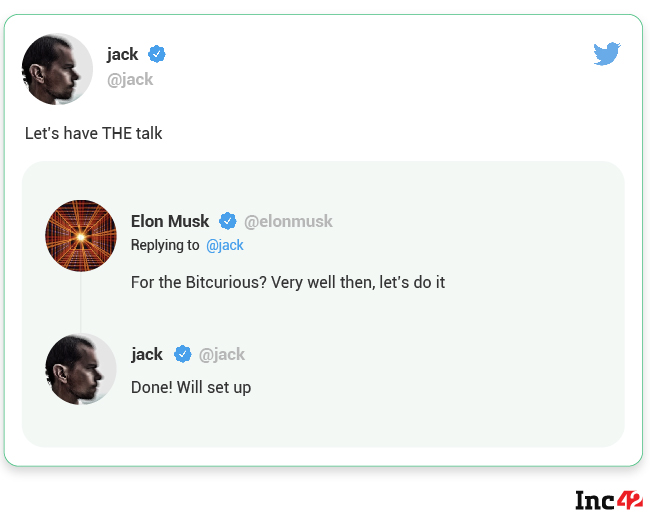

Let’s Have THE Talk: Jack Dorsey To Sit With Elon Musk On Bitcoin

Of late, a series of tweets by Tesla’s founder and CEO Elon Musk have impacted the crypto market by significant margins. As people continue to lose their investments, Twitter’s Jack Dorsey is now set to sit with the ‘Bitcurious’ Musk to talk about bitcoin. The event may take place sometime in July and will be part of the B Word, a bitcoin-focused initiative that aims to demystify and destigmatise mainstream narratives about Bitcoin.

Can Dorsey help change Musk’s opinion on bitcoin? What do you think?

Until Next Week,

Suprita Anupam