SUMMARY

Fino is confident that through greater cross-selling of financial products, it can continue to raise its margins and improve income options for merchant partners

The payments bank does not want to enter the race for a massive user base like its peers and wants to increase per-customer revenue

The company plans to stick to its asset-light format and emerging India-specific solutions as it expands into new products and regions

A broad consensus across the startup ecosystem is that most consumer tech businesses eventually have to get into either lending or advertising to make money. Some companies venture into both in the same way tech giants like Amazon and Facebook have done it. But to generate returns through these functions, businesses first need to build a large enough decoy called the marketplace where users can spend their time and perhaps some money.

Even the digital banking and neobanking companies — often assumed to be the precursors of full-fledged digital banks of the future — are not immune to the marketplace syndrome. For Paytm or Google Pay or Policy Bazaar, the basic concept is to get the consumers hooked to a digital marketplace ecosystem.

IPO-bound Fino Payments Bank (FPBL), a wholly-owned subsidiary of the financial inclusion services company Fino Paytech (FPL), is competing for users and resources in a similar market without owning a solid B2C app-centric ecosystem.

The odds are heavy on several counts. For instance, many fintech analysts have written off the core payments bank model, saying it is bound to fail due to limited revenue scope. They are not wrong either, as four out of 11 RBI-licensed payments banks dropped out of the race even before fully launching their services.

But even after 14 years in the fintech space and almost four years into operations as a payments bank, Fino’s ambitions are not capped, and it continues to focus on its core user base of rural customers.

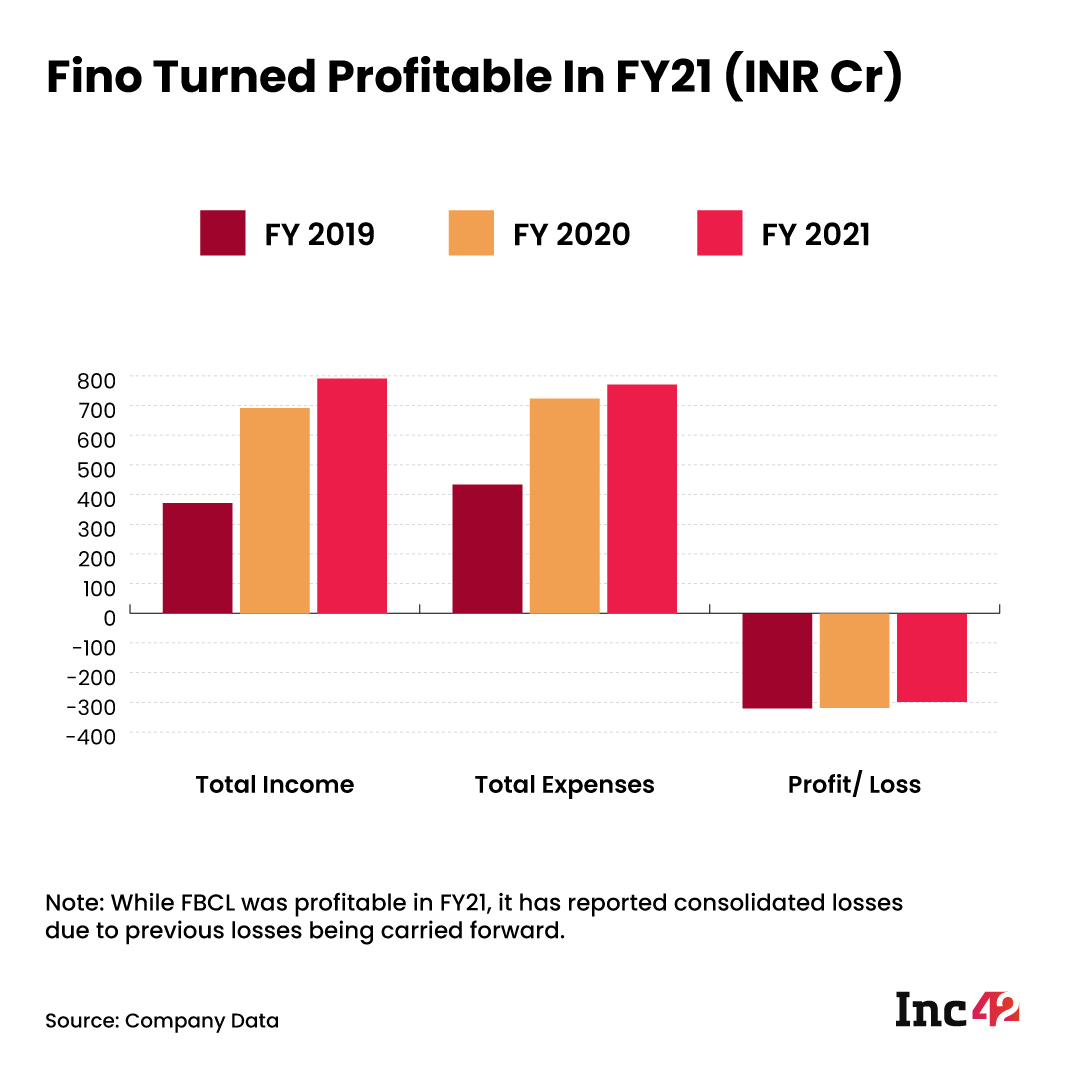

Fino Payments Bank turned profitable in FY21, reporting INR 20.4 Cr in profits and a total income of INR 791 Cr, up 14% YoY. However, the company could not rein in its expenses in FY21. Its total expenditure increased by 6.5% to INR 770 Cr compared to INR 723 Cr in FY20 and INR 433.5 Cr in FY19.

Its only other peer in black is Paytm Payments Banks that offers a host of financial services and UPI transactions to its customers.

So what is it that has kept the business alive and kicking all this while?

According to persons close to Fino management, there has been a certain method in its operations throughout these years. Although the company has made a few pivots as far as the business model is concerned, its focus on specific ‘banking plus’ solutions tailored for rural markets will help drive investor returns in the long run.

Here is a look at Fino’s top offerings that the company is banking upon to entice investors ahead of its INR 1,300 Cr IPO.

First, The Basics

Fino’s biggest challenge lies in the fact that the company is pursuing rural and non-digital native customers who are unlikely to grow its user base by registering on the company’s app or drive its transaction volume by making frequent UPI payments.

Its biggest strength is that the company’s target customers heavily depend on remittance services and need a partner like Fino to help them with transactions and figure out their financial investment plans. Here is how the company has built its strategy around these requirements.

How Fino’s Banker Babus Are Central To Its Offerings

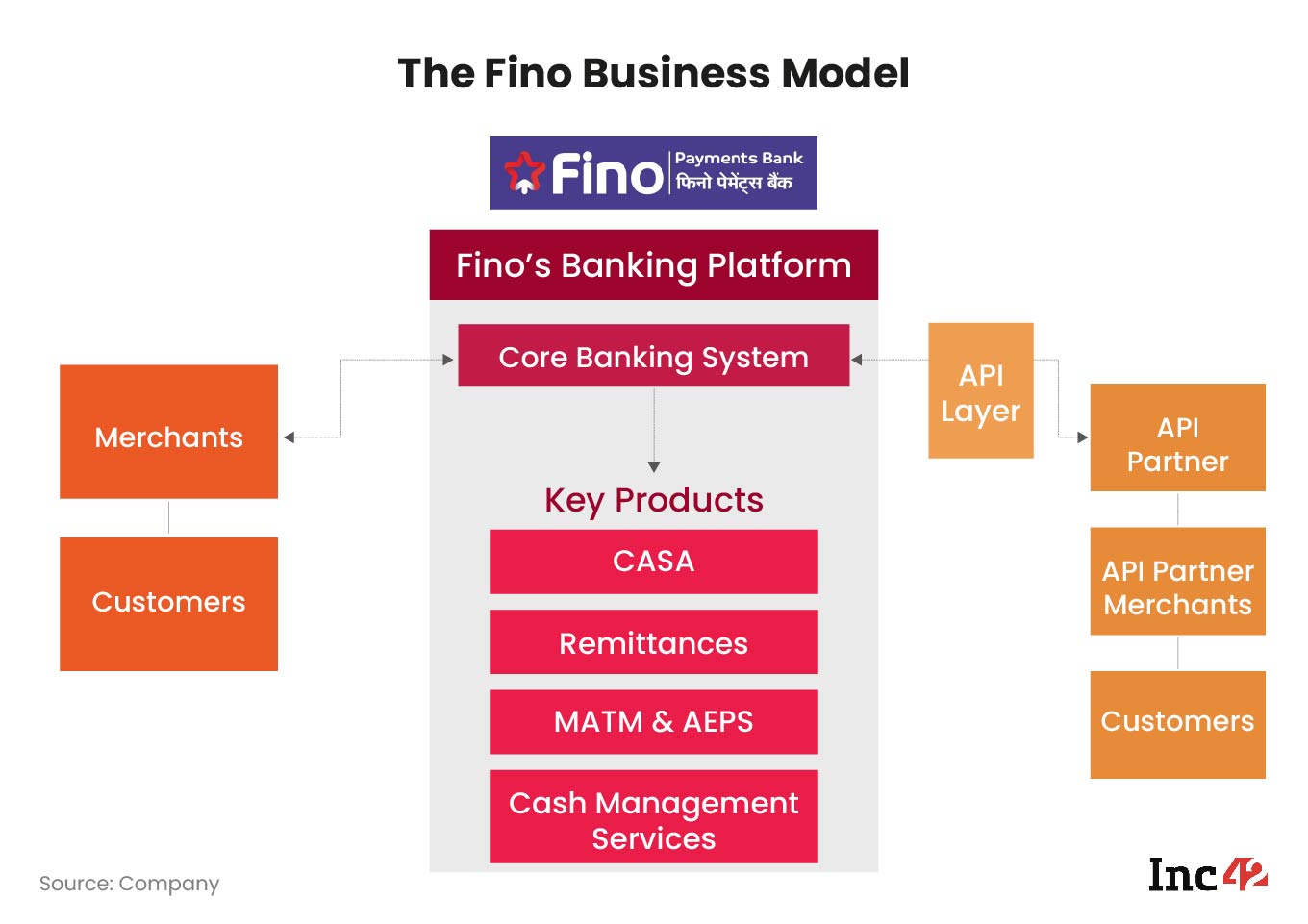

Led by CEO and founder Rishi Gupta, Fino Payments Bank is a scheduled commercial bank serving the emerging Indian market. The primary drivers of Fino’s revenue are the fees and commissions charged for products and services. Its service bouquet includes deposits, withdrawals and fund transfers; micro ATMs and debit cards; recharges and bill payments; a cash management system (CMS); third-party business correspondent (BC) services for banking solutions on behalf of other banks and more.

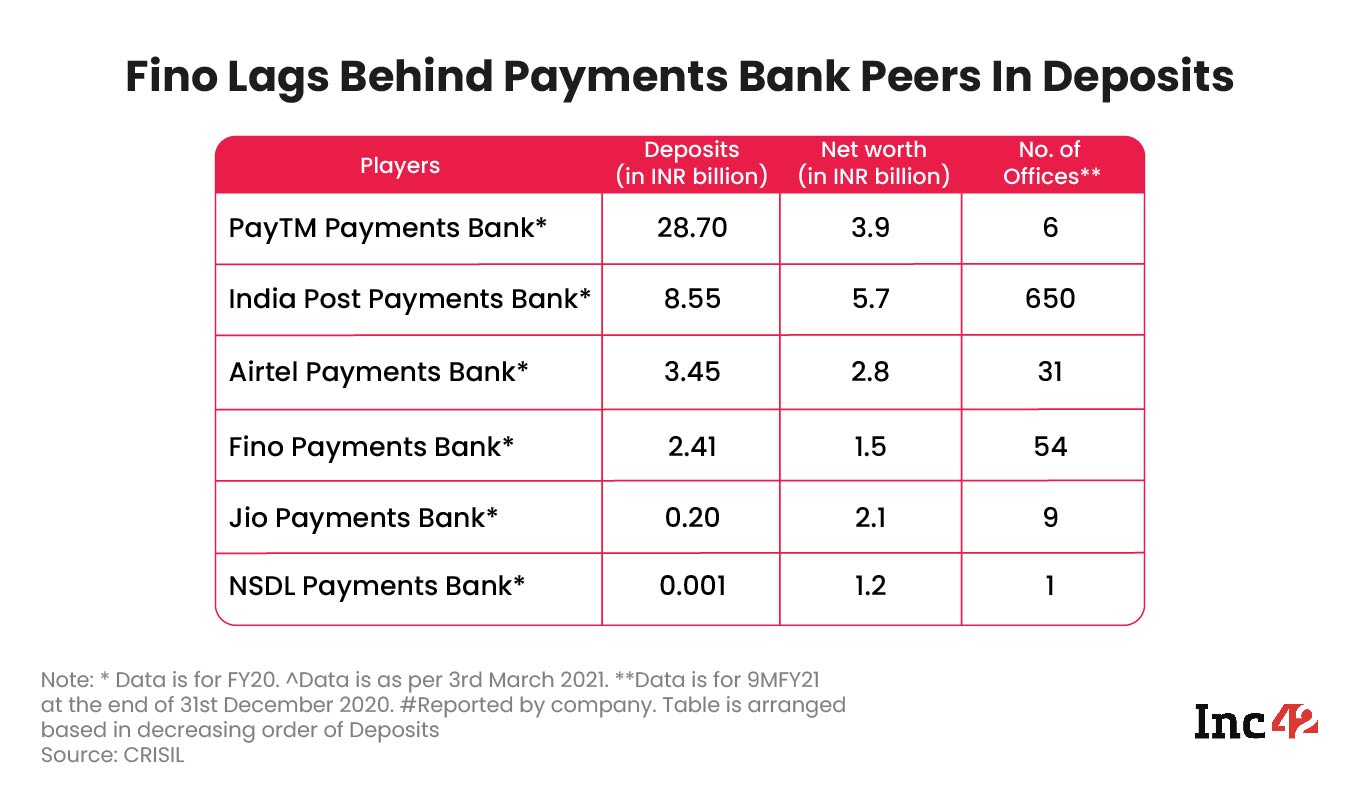

The company has 54 physical branches, 143 customer service points (which do not require the RBI’s approval) and more than 17,000 BCs on the ground. But Fino’s mainstay is its vast network of merchants and BCs through which it offers its products and services at the B2C level.

Merchants are small, owner-operated neighbourhood shops and businesses that tap into Fino’s asset-light branchless model to serve the banking and financial needs of the communities and thus earn additional transaction incomes.

Again, around 65% of the Indian population live in rural areas, but only 20% of ATMs are in rural centres. Thus, there is a huge requirement for micro ATM deployment (serviced by BCs) in India to make this service available to underserved people.

According to the RBI and CRISIL data (as of March 2021), 55% of the micro ATMs deployed in the country are serviced by Fino’s BC network.

But the question is: Are transaction fees and commissions sufficient to drive the growth of digital banking business in a country where most internet-based startups incur huge losses?

As per payments bank regulation, FPBL cannot service loans, but it extends the credit through third-party providers. What’s more, the company offers its vast network of merchants and business correspondents to third-party financial service providers for this purpose.

“Fino has built its model around both push and pull products. On the one hand, there are essential solutions like cash withdrawal and remittance that take the BCs to last-mile users in rural and semi-rural India. But it is the long-term trust that helps these banker babus (as they are popularly known) cross-sell insurance, loans and other financial products and services to the customer base,” said a source close to the Fino management on condition of anonymity.

This ‘trust’ has enabled the bank to clock a 14% growth in total income in FY21 at INR 791 Cr compared to INR 691 Cr in the previous financial year. The growth was triggered by an 11% increase in commission and brokerage from transactions across micro ATMs, AePS, CMS and current and savings accounts (CASA).

However, Fino lost revenues from remittances and cross-selling of financial services during pandemic-induced lockdowns as a large number of migrant workers returned home during this period.

Additionally, the company reported a 40% jump in miscellaneous income at INR 95.8 Cr due to the onboarding of more than 1.45 Lakh merchants on its platform, taking the number up to 6,41,892, according to its DRHP. Merchants pay Fino for payment devices, training and onboarding. This is an integral part of the business model as the company does not offer a B2C app or a digital marketplace like Paytm or Airtel Payments Bank. Instead, the consumer-level operations are run by trained merchants and BCs.

In contrast, Paytm Payments Bank features everything upfront — it is a window into the entire suite of Paytm’s financial services across investments, insurance and lending. Airtel offers gold investment options and a limited number of subscription-based digital banking services, which are also linked to the telecom giant’s master app called Airtel Thanks.

Incidentally, Fino has a B2B app, and its merchants use it to cross-sell financial products. According to sources close to the management, the company earns up to 40% of its commission earnings by cross-selling third-party insurance and loan products, while the rest comes from in-house solutions.

“A lot of Fino’s peers are focussing on upselling credit-based solutions to the merchants themselves. But Fino has always looked at creating more cross-selling opportunities for its merchant base so that they also have higher income opportunities,” added the person quoted before.

How Big Can Fino Become?

Despite operating in an array of segments, Fino is nowhere near the top bracket of fintech players. While Paytm clocks around 700 Mn transactions per month, and both PhonePe and Google Pay see more than a billion monthly transactions, Fino is way behind with 400 Mn transactions in the past year.

Of course, those are UPI platforms and are bound to witness huge volumes. But in the consumer internet space, more transactions translate into user stickiness, thus creating the ability to upsell high-valued products in the future.

Fino also lags far behind its peers like Paytm, India Post and Airtel Payments Bank in terms of deposits. However, Paytm already had a massive deposit base to start with as it managed to convert its wallet users to its payments bank customers. On the other hand, India Post Payments Bank is a key channel for the direct transfer of government subsidies, and hence, it holds an edge in the volume game.

Fino also faces a bigger risk — its products may soon be featured on other platforms. Worse still, they may lose relevance as the pace of digitisation accelerates across the country, especially in rural India.

Fino wants to build on its original ‘banking correspondent’ model to grow its presence in rural and semi-rural markets. But it has not depended on third-party products to drive cross-selling initiatives.

“One thing that has worked for Fino is the focus on creating demand for value-added banking products instead of chasing higher deposits. Competing with the likes of Paytm for higher deposits would have barely added 1% in terms of interest margins to its earnings. But Rishi’s vision has always been on adding higher-value customers within its target segment,” said the person who was quoted earlier.

According to the source, Fino’s ability to move customers to annual subscription-based bank accounts instead of charging them for every transaction has created customer stickiness. “Fino has managed to earn more per customer and also incentivised people to transact more through subscription-based accounts,” the person said.

Moreover, it is still focussing on customers from ‘emerging India’ who need assistance and guidance. This segment is characterised by low financial literacy and technology use and a lack of financial inclusion. Customers from this segment typically do not have access to basic banking services and are often referred to as the unserved and the underserved population. According to CRISIL data (2021), this is an INR 0.85 Lakh Cr market opportunity, and Fino is all set to tap into it.

Currently, 45% of Fino’s business comes from states like Uttar Pradesh, Madhya Pradesh and Bihar. The company is working on expanding its presence further east and south.

The IPO And Beyond

Earlier in the week, Fino received market regulator SEBI’s nod for its IPO. The payments bank submitted its draft red herring prospectus (preliminary IPO papers) to SEBI in the last week of July and obtained the latter’s observation letter on October 1, according to the SEBI website. SEBI’s observations are necessary for any company to launch public issues like IPO, follow-on public offering (FPO) and rights issue.

But how lucrative will it be for investors to participate in this IPO when peers like Paytm are also awaiting the SEBI nod to go public? What’s more, can payments banks and digital banking solutions designed for an emerging India turn profitable in the long run?

Industry experts that Inc42 spoke to believe that depending on transaction fee-based banking solutions alone may not be the best bet for fintech and neobanking companies.

“Theoretically speaking, a purely tech-driven and asset-light bank may be able to reduce costs to the extent that it can survive off transaction fees alone. But with so much technology-driven customer profiling done, credit becomes a natural progression for such businesses. So, some lending-based banking licence becomes a necessity for these banks,” said a fintech expert who did not wish to be quoted.

In December 2019, the RBI released the guidelines for ‘on-tap’ licencing of small finance banks in the private sector and opened the window for applicants to approach the regulator at any point in time. Additionally, existing payments banks, which have completed five years of operations, can also apply for an SFB licence. Many saw this move as an acceptance that the RBI had painted itself into a corner with payments banks and finally offered them a way out to more lucrative earning opportunities. But Fino is not just banking on turning into an SFB to drive lending-based growth.

“From the RBI perspective, Fino ticks all the boxes to evolve into an SFB. But even if it turns into an SFB, Rishi will not switch off Fino’s asset-light model. The company is building its lending portfolio with third-party products and will eventually develop its own products when it becomes an SFB. But lending as a product remains a key use case,” said the anonymous source mentioned earlier.

The person added that the company is banking more on lending than credit interest to drive transaction commissions. In fact, Fino has found loans to be a huge driver of customer stickiness, even when it comes to third-party lending products. Moreover, transaction commissions on loans are 15-20% higher than cash withdrawals, CMS and other solutions.

“Lending on its own books will also help Fino increase margins by 5-6%. That will automatically drive deposits and benefit Fino’s merchants who earn from these transactions,” the person said.

According to people close to the company, one thing is certain. Fino will not slip into a cycle of freebies to attract users, unlike many of its peers. Even during the pre-IPO discussions, Gupta had always maintained that “Fino isn’t in the business of offering free services because customers don’t value such services”.

So, the profit-making fintech giant expects to build a revenue model around each of its offerings. But how effective these models will be for the company and its investors cannot be surmised immediately.

Deepsekhar Choudhury contributed to this story.