A restrictive business model drove enthusiastic stakeholders out even before the launch of the payments banks

Existing stakeholders seem to be addressing different use cases instead of savings and investments

An aggressive, revenue-focussed strategy may still save the day for payments banks

In January 2014, the Nachiket Mor Committee on ‘comprehensive financial services for small businesses and low-income households’ floated the idea of creating a new category of financial institutions called payment banks (PBs) in its recommendations. The idea behind this new category was to take banking services to the country’s hinterlands with the help of the private sector via a profitable model.

The initial euphoria around the new concept was stupendous. And it was visible in the launch statement of Airtel, the country’s largest telecom player at the time.

“Just like mobile telephony leapfrogged traditional telecom networks to take affordable telecom services deep into the country, Airtel Payments Bank aims to take digital banking services to the unbanked over their mobile phones in a quick and efficient manner. Millions of Indians in rural areas will get their first formal banking experience with Airtel Payments Bank,” said Sunil Bharti Mittal, Chairman, Bharti Enterprises, during the formal launch of Airtel Payments Banks in 2017.

Mittal’s vision was in line with other PB peers who believed that the new initiative would give them access to millions of small-ticket financial customers, paving the way for financial inclusivity and a larger payments economy. And there would be more leverage when digital outreach reaches the grassroots and makes a massive dent in a cash-loving rural economy. An M-Pesa dream of sorts within a banking format. Four years down the road, the hype and the vision around PBs have taken a severe beating, and the revenue crunch is choking them.

Too Many Stumbling Blocks

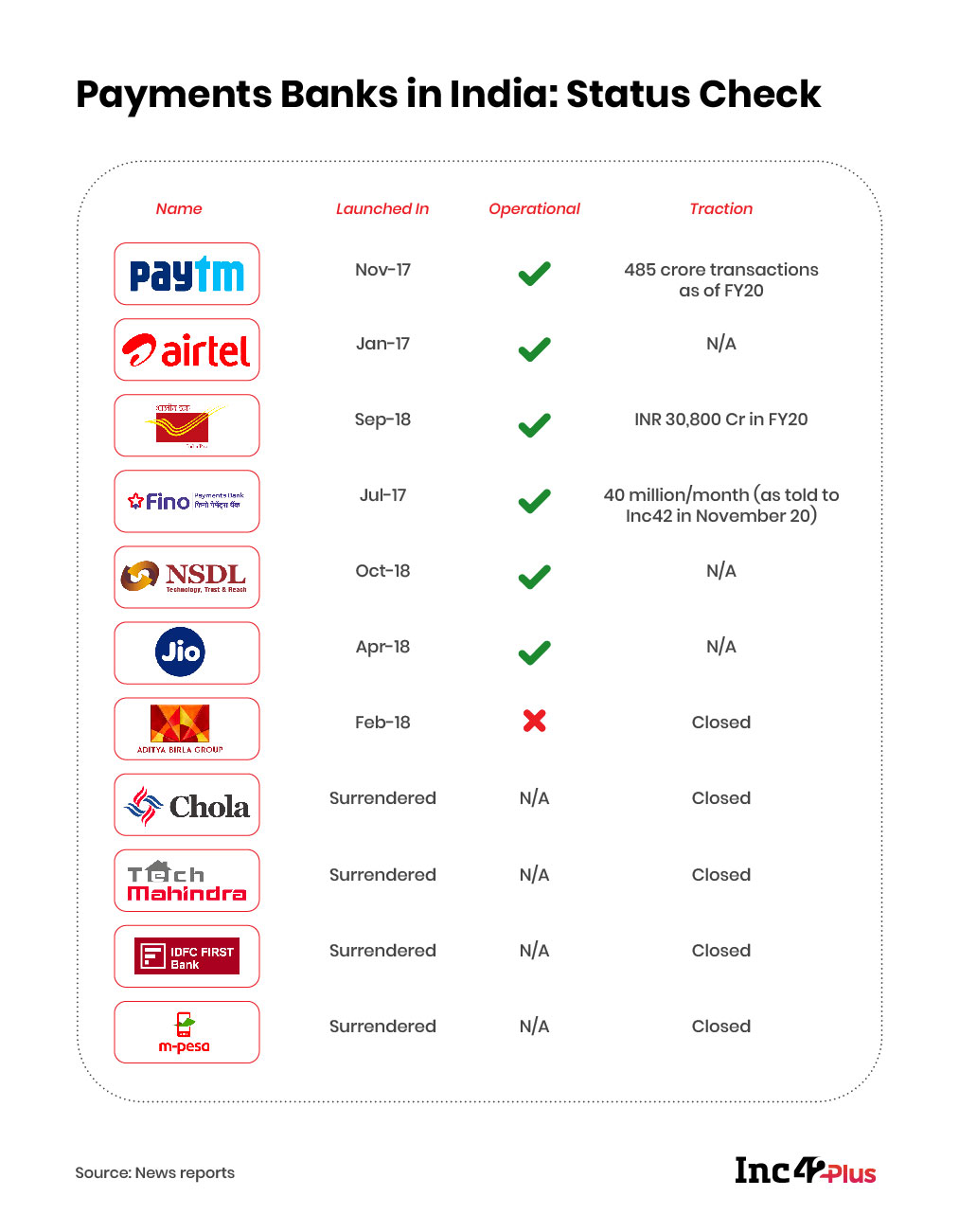

In August 2015, the Reserve Bank of India (RBI) gave in-principle approval to 11 applicants to set up their payments banks by February 2017. In November 2016, Airtel launched the first payments bank of India even as the country was reeling under demonetisation. It was followed by IndiaPost and Paytm payments banks in the next six months.

But all was not well in the payments bank space. Out of the 11 applicants who sought PB licences from the RBI, Cholamandalam Investment and Finance, Tech Mahindra and a consortium, including IDFC Bank, Telenor Financial Services and billionaire Dilip Shanghvi (in a personal capacity), dropped out by late 2016. Aditya Birla Idea Payments Bank shut shop in September 2019, 20 months after commencing operations.

The PBs which have remained operational include Airtel, IndiaPost, Fino, Paytm, NSDL (National Securities Depository Ltd.) and Reliance Jio. Of these, Paytm Payments Bank has the highest revenue and financial performance metrics backed by substantial funding in the Paytm ecosystem. Reliance Jio, another telecom major, entered the space with a 70:30 partnership between Reliance Industries Ltd (RIL), the parent company, and the State Bank of India.

The G-Sec Hurdle

A look at the investment structure and the revenue stream will further clarify what has gone wrong with their viability. For starters, the minimum paid-up equity capital requirement for each payments bank is INR 100 Cr. They are required to maintain 75% of their deposits in government securities, or G-Secs, for a year and only 25% of the deposits could be parked with small commercial banks. But there is a cap on user deposit here.

Each customer can only deposit a maximum of INR 100K in his/her PB account, which means the total deposit would never reach the levels of a traditional bank and the overall earning on the deposit would be much less. The mandatory G-Sec deposit for a specific period does not help either, thanks to steadily dipping interest rates. The yield on one-year G-Sec was 7-8% for the past three-four years, but in the past few months, it has fallen below 5.5% and will further squeeze their earnings.

The payment banks’ customised service bouquets cannot rake in the moolah too. PBs are allowed to offer remittance services as well as other day-to-day banking services, including deposit charges as applicable, mobile payment, doorstep banking, bill payments, fund transfer across the interbank payment network, withdrawal via ATM/debit cards and shopping at merchant PoS. Additionally, they can deal in third-party financial products such as insurance, carry out transactions for other banks who deploy their business correspondents (BCs) and undertake non-risk activities such as Aadhaar enrolment or become members of clearing houses. PBs charge up to 1% commission on each transaction, but unless it is done on a massive scale, the revenue stream will remain weak.

Why Lending Matters

What hinders payments banks most is the underlying no-lending business model – they cannot lend money from their deposits, and hence, they have no scope to earn high interest on a user’s borrowed capital. Credit as a product does not exist for PBs, placing them at a great disadvantage against commercial banks. The idea is to protect them against non-performing assets (NPAs), a major bane of the Indian banking ecosystem in the current decade, but it has taken its toll on the revenue stream.

A weak revenue stream and consequential losses incurred by most of the PBs (more on that later) are bound to hinder customer acquisition at scale. The PBs entered the market with high-interest rates on deposits as their operational costs were estimated to be low, given the low-cost infrastructural footprint and greater usage of technology. In 2017, Fino, Airtel, Paytm and IndiaPost were offering 4%, 7.25%, 4.5 and 5.5%, respectively, which proved to be quite lucrative.

As of November 2020, the big four are offering 2.75%, 2.5%, 2.75%, and 2.75%, respectively as they sought to safeguard their margins, even below what most banks pay for low-value savings deposits. The slide in interest rates may easily lead to a dwindling customer base and a major loss of business as ‘scale’ lies at the heart of payments banks. They must grow their users and leverage low-value transactions to the hilt in a bid to survive.

UPI Vs Payments Banks

Payments banks are also facing stiff competition from totally unexpected quarters. The Indian payment ecosystem was quite different in 2017. India was still reeling under demonetisation; the Unified Payments Interface was yet to catch the fancy of the masses, and the wallets ruling the digital payment space were plagued by regulatory headwinds. None of the PB aspirants was prepared for the sudden popularity and the wide adoption of the UPI in the next couple of years. Its seamless interoperability, stringent security and huge cashbacks from third-party payments apps on the platform soon made UPI the star of digital transactions. And much like the wallets, the transaction side of the payments banks has been hugely impacted by the third-party UPI apps ecosystem.

Unlike payment banks, the UPI app (third party) has a simple interface that is not subject to banking regulations. It is a single-tap solution that a user can directly initiate without the need for KYC. In contrast, the PBs have targeted the unbanked millions, especially in the non-urban areas, and aimed to monetise their vast user databases for credit risk profiling, insurance sale and other purposes. The telecom and fintech companies in play also wanted to leverage and grow their existing databases. But it is unclear whether the PBs are exploring this possible usage of bank data or have a long-term analytics strategy in place to boost their revenues.

“The payments bank model did not take off the way it was intended because they were subject to regulations on risk and securities much like other banks, but no revenue model exists for them. In a way, UPI was able to tap into that space because it was much more technology-driven,” Shilpa Mankar Ahluwalia, who leads the fintech practice at law firm Shardul Amarchand Mangaldas & Co told Inc42 in a recent interaction.

Interestingly, most of these fundamental constraints, especially the non-lending parameter, were known to the stakeholders from the beginning. Experts, however, say that most of the licensees wanted to come in for a different reason. Eventually, they were planning to expand to mainstream (banking) roles and building the expertise and a captive user base required for the same. For telcos, it was all about ensuring better engagement with their subscriber base and providing complementary services.

“The PB model was an experiment that did not work, and the RBI has, in some ways, accepted it by allowing PBs to apply for SFB licensing after five years of operations,” says Tamal Bandyopadhyay, a veteran banking journalist and senior advisor to Jana Small Finance Bank.

In fact, an internal report by the RBI working group last week has recommended that a PB should be allowed to apply for a small finance bank (SFB) licence after three years of operations instead of five years as mandated earlier this year. Unlike payment banks, SFBs cater to small borrowers and can lend up to INR 25 lakh (subject to RBI norms). The report also recommended that NBFCs with an asset size of INR 50,000 Cr and above, including those which are owned by a corporate house, may be considered for conversion into banks subject to completion of 10 years of operations. Is it one way of resurrecting the fast-dwindling payments banks?

What Is Happening On The Ground?

Going by the latest policy twist by the RBI, things may not look up for the payments banks anytime soon. A deep dive into operational costs and earning trends would throw light on what has been happening on the ground.

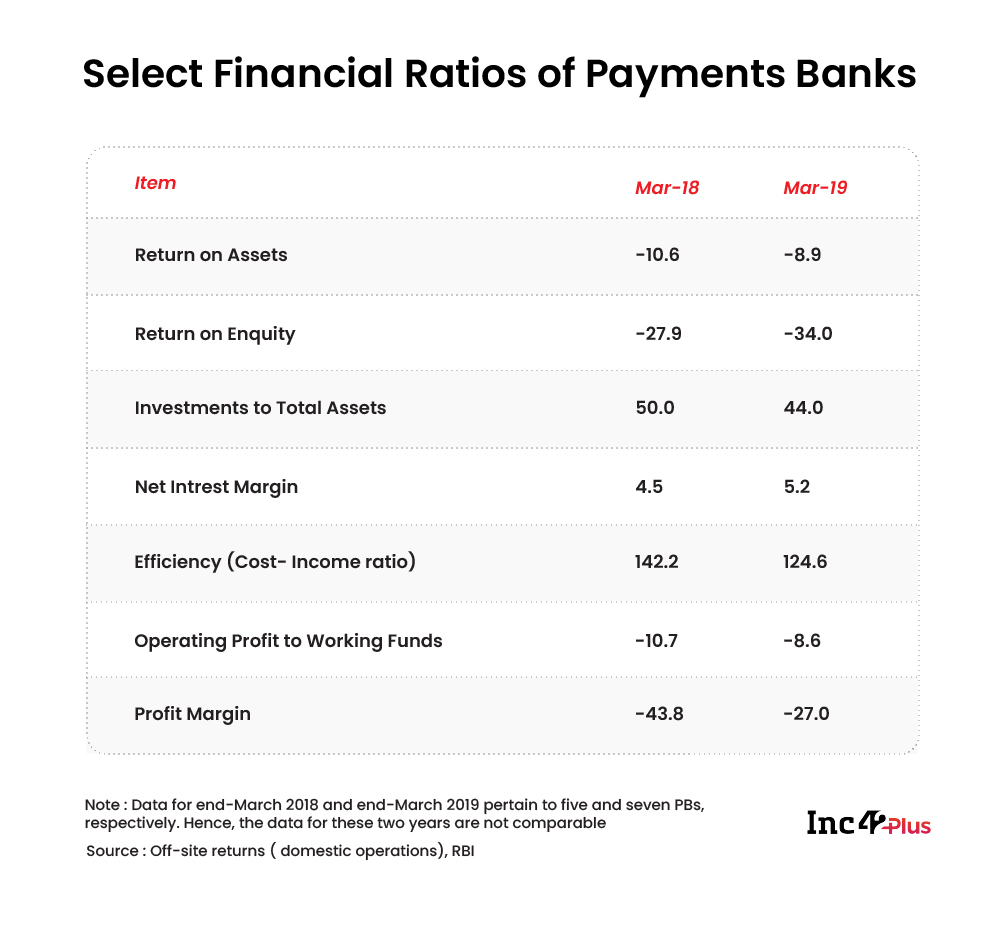

According to a December 2019 report by the central bank, in spite of an improvement in net interest income and non-interest income, a rise in operating expenses resulted in overall negative profits for PBs in FY2018-19. The limited operational space available to them and the large initial costs involved in setting up the infrastructure would take them longer to break even. However, they have managed to expand their customer base.

Understandably, PBs must invest to expand their reach across the payment landscape, but their revenue structure is not in sync with it. According to RBI data for FY2018-19, the ratio of operating expense to total income was around 1.24, showing high input cost, even though the majority of the PB revenue comes from low-return SLR (statutory liquid ratio) investments in G-Secs. SLR investment indicates the proportion of deposit a bank has to keep in assets (gold and government bonds and securities) as specified by the RBI.

As of FY2019-20, Fino, Airtel and Paytm PBs reported revenues of INR 689 Cr, INR 474 Cr and INR 2,100 Cr, respectively. As consolidated revenue and profit data for payments banks are not available, the select financial ratios provided by the RBI demonstrate the PBs’ return on investments in the first two years of operations. Interestingly, Paytm PB reported a profit INR 29.8 Cr, up 55% year on year while Fino PB said it had turned operationally profitable in FY20.

“PBs hoped to reach a scale that would help them earn from transaction charges. But that scale has not been achieved yet even though the scope exists. They have been working aggressively on cross-subsidisation solutions like insurance products, but they were disadvantaged right from the conceptual stage,” says a fintech veteran who does not wish to be quoted.

Seema Prem, cofounder and CEO of FIA Technology Services, which deploys BCs for different banking entities, notes that the limited products offered by PBs also limits the revenue opportunities for the agents. “As traditional banks offer credit, they need additional services for EMI, loan processing and recovery. All of these increase the revenue potential for BCs working with those banks. While public-sector entities have a social responsibility towards BCs operating in far-flung regions, private players in the financial services space feel less inclined to ensure the same,” she says.

Business correspondents are bank representatives (either on direct payroll or via agencies) who help account holders in unbanked regions open accounts and transact for a stipulated fee commission.

Suhasini Verma, Associate Professor at the School of Business & Commerce, Manipal University, sums up the situation well. “As of now, the payments banks have wafer-thin margins. They have to keep a large part of their funds (75%) in G-Secs and the remaining with small commercial banks. The majority of their revenue was supposed to come from remittances, insurance and other financial services. But the competition is tough and it is difficult to earn a significant chunk of revenue from those segments. So, even a government-owned entity like India Post PB is struggling in spite of high transaction volumes,” she said.

Payments Banks Playing To Their Strengths

As Indian payments banks fail to find their revenue dreams, most of them are trying to leverage their core strengths to reach the market. For instance, each operator in the ecosystem is servicing different financial products. Some have enabled PoS transactions or got into FasTAG partnerships or focussed on utility payments in rural areas. But these are only a few scattered solutions and not well-orchestrated, long-term strategies.

Take, for instance, IndiaPost PB (IPPB). Based on its massive presence in 650 districts and among 3.5 crore customers, the IPPB has set up a full suite of banking services and strong linkages with all interoperable payment and settlement systems. It is now focussing on pan-India G2C (government-to-citizen) payments, especially rural DBT (direct benefit transfer) disbursements under the Pradhan Mantri Garib Kalyan Yojana.

Unlike other payments banks, IPPB does not use PoS devices or issue debit cards. Its local agents – postmen, postwomen or BCs, initiate transactions by taking a customer’s biometrics and Aadhaar number which are stored in a QR card. Unlike debit cards which need personal identification numbers (PINs) for payment initiation, QR cards use the QR code to scan and pay. In spite of these benefits, the bureaucratic weight has held IPPB back from utilising its full potential and taking digital payments to remote regions, say industry experts.

In contrast, Fino PB has utilised its massive BC network to reach out to people. “We cannot sell Mercedes to a customer who wants a Maruti,” says Rishi Gupta, managing director and chief executive officer of Fino.

“The focus has been on distribution in a way that could compete with our telecom peers, and we did it without any fanfare,” he says, explaining the BC-first approach that Fino has taken to expand its market presence.

In Fino’s case, experts see a good model that utilises the existing BC network. But it has not helped the company realise the ‘digital’ vision of the payments banks.

Gupta, however, thinks that the ability to enable microcredits will most certainly give it an edge in the PB model. “With our deep BC penetration across the country, we are poised to take care of recovery as well. We are not a small finance bank, but we want to use our infrastructure to complete the portfolio of solutions with microcredit for our last-mile customers if the RBI allows it,” he says.

Most fintech experts concur, saying both IndiaPost and Fino have demonstrated the best use cases in the current PB ecosystem.

Both Fino PB and IPPB have enabled an Aadhaar-enabled payment system (AePS) for maximum convenience. Airtel PB has also set up a cardless cash withdrawal system called Instant Money Transfer (IMT), which can be used via its mobile app. Apart from this recent e-PoS initiative, its AePS can be used to transact at micro-ATMs manned by BCs. During the Q3 earnings call of Bharti Airtel, the company indicated new initiatives for the PB business, which would be rolled out soon. With a network of more than 10 lakh retailers, Airtel PB has the most extensive merchant reach in the country.

Paytm, on the other hand, has several payment solutions in its portfolio. For the PB business, the company has roped in a number of big-ticket partnerships, including tie-ups with major auto manufacturers for FASTags under the National Electronic Toll Collection programme. But a large number of products across its ecosystem often dilutes Paytm’s PB performance.

“Today, only Paytm’s payments bank appears to be a success story with profits coming in, but the company is doing so many other things to achieve this. In fact, the customer acquisition cost is huge in this sector,” says Verma of Manipal University.

Will The Fault Lines Widen?

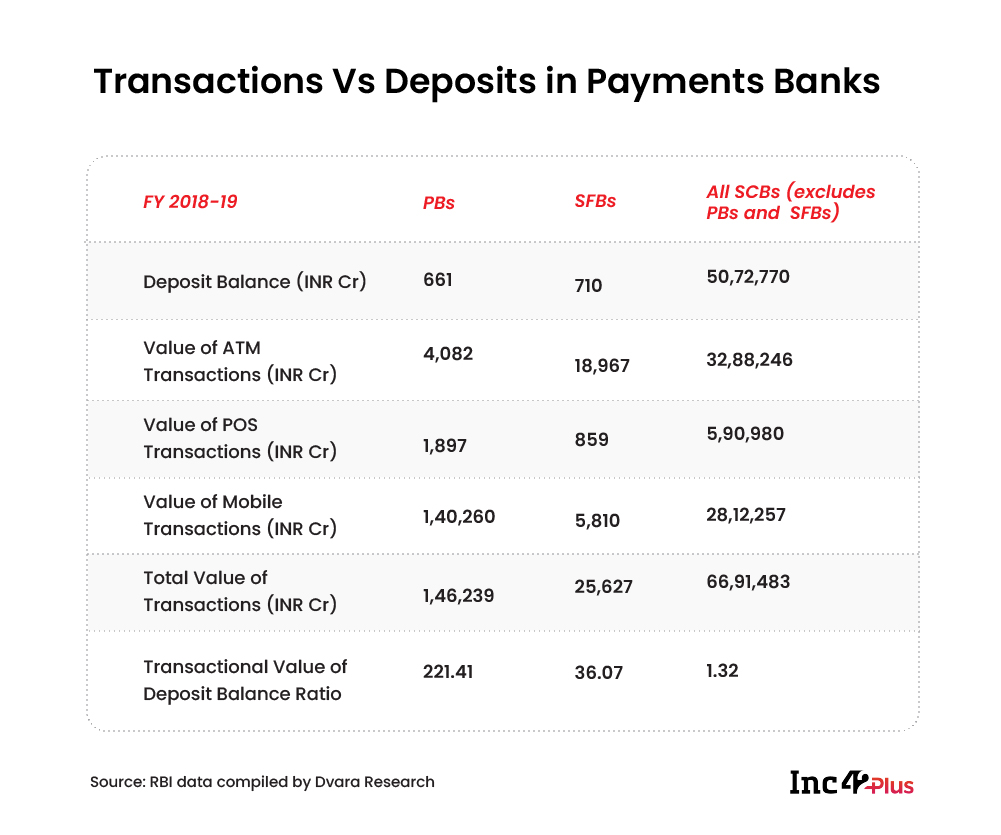

According to independent fintech consultants, each payments bank seems to be targeting different areas and business/operational models. But these performance metrics have not necessarily served the target PB customers (read the rural unbanked) as expected. According to a report compiled by Dvara Research in September 2020 and based on the RBI data for FY2018-19, payments bank accounts are overwhelmingly used for transactions instead of deposits.

The high volume and value of transactions compared to deposits clearly show that PB account holders have been transacting more than depositing in these accounts, which beats the fundamental principle of consumer banking – making it easier for people to save and invest. Currently, RBI data on the number of accounts and deposit balances in payments banks is not available.

“The PBs might not be able to viably reduce interest rates further as they operate on tight margins due to the regulatory requirement (75% G-sec deposits). Therefore, the PBs’ business model is not favourable to fulfilling the objective of providing small savings accounts to the underserved. However, given the high number of transactions against the total deposit amounts held at PBs compared to that of SFBs or select SCBs, it can be concluded that the users of PB accounts have employed them not as a store of value but as a checking account for undertaking payment transactions with a formal bank,” write Amulya Neelam and Anukriti Tiwari of Dvara Research.

The report also notes that transaction-focussed payments bank accounts can still exist alongside deposit-focussed accounts of full-sized banks.

According to banking experts, PBs either need to align themselves with mainstream banks or introduce customer-centric solutions (again to a non-smartphone using base) if they want to build a sustainable future.

Vijay Mani, Partner at Deloitte India and head of digital payments, digital banking and other digital services, notes that most payments banks sell multiple products — their own payments products as well as other products like insurance from partners. But in many of these product markets, the competitive landscape has changed since the inception of PBs. They now face very focussed, aggressive and often deep-pocketed competitors such as the UPI payment service providers or large merchant acquirers/aggregators (say, Billdesk). The latter has been able to grab bigger market shares than PBs in many of those market segments.

“Payment banks may need to re-examine their customer and merchant acquisition/retention strategies and associated revenue models in the light of the changing competitive landscape. Lending can be a useful element in this effort, but it should not be seen as a panacea; it has to go hand in hand with customer focus,” says Mani.

However, the central bank’s proposal for setting up a National Umbrella Entity (NUE), which will work in parallel with the National Payments Corporation of India (NPCI) to expand the digital payments ecosystem, could be a positive development for payments banks. As it will be a for-profit entity (or entities, depending on the final structure), it is an opportunity for PBs to seek out profitable use cases. Think of real-time cross-border remittances, micropayments (beyond what the UPI is addressing), payments to a long tail of billers and so on, says Mani. The headroom for growth is large enough to enable payments banks to grow with others in the market if they clearly define their place in it. For instance, various semi-urban/non-urban and some urban customer segments are still underserved.

“We have more than 500 Mn smartphone users (and at least a couple hundred million more addressable feature phone users), but maybe no more than 175 Mn users of mobile payments. The next five years will see the market aggressively realising this growth potential. Therefore, it is going to be a critical period for payments banks,” says Mani.

Ad-lite browsing experience

Ad-lite browsing experience