Will India see a truly ‘Made In India’ smartphone in the near future, or is it a distant dream?

Dear Smartphone User,

“I’m a huge believer in the opportunity in India,” — Apple CEO Tim Cook, February 2020.

When Apple first announced the plans of opening an online store in India, the threat of the pandemic was only on the horizon. Now after seven months of trudging through the worst phase for businesses in India’s history, Apple is ready to execute its plans. The Apple online store is up and running in India, right in time for Diwali and the festive season which usually lasts till the end of the year.

Though it was obviously possible to buy Apple products in India before, this was through Apple-authorised resellers or marketplaces like Amazon and Flipkart. The Apple Store fills the gap of bringing that quintessential Apple experience even in the purchase journey.

Besides allowing Apple to directly sell products to consumers, the Apple Store also brings other benefits such as Apple’s premium customer service programmes and customisability for Macbooks and Mac desktops to a greater extent, though as ever, the prices are not a direct reflection of the dollar price in the US. In India, the highest-end Mac Pro, for example, is priced at INR 53 Lakh, whereas the same in the US is $ 54,547 (INR 40 Lakh).

Customers will now be able to exchange their old iPhones through the official trade-in plans, configure products to their requirements, access AppleCare+ for upto two years, speak to Apple support on call or chat, and even get free one-on-one online sessions with a specialist to make the buying decision.

But why is it important for Apple to launch its online store in India? The answer is twofold. First, the company has time and again disapproved of the deep discounts on Apple products which were offered by ecommerce players. The company had said that, while these practices improve gross merchandise value (GMV) of ecommerce platforms, it degrades Apple’s brand image. With its own online store, Apple gets to efficiently control the online pricing.

Second is the market opportunity that the world’s second largest smartphone market offers, which Apple has long looked to conquer but has only marginally dented. Even as smartphone sales in the premium segment have slowed down in most Western economies, India is still seeing a growth in this regard — Apple had nearly half of the market share in the premium segment in the quarter ended June 2020.

The biggest question in Apple’s growth in India continues to be around the high price points its devices occupy. The company owns a meagre 2% of the smartphone market in India. Although India has shown progress in terms of per-capita income, 21% of the population is still earning below the poverty line.

The average smartphone selling price in India was around INR 11.8K in 2017-2018, which is a 16% drop from the INR 14K average price in 2008-2009. According to CMR, the premium smartphone segment (INR 25K-INR 50K), where Apple’s phones are positioned, is a niche in India, contributing to about 5% of the total smartphone shipments in India in the first half of 2020.

Despite the average selling price of a smartphone falling, Apple has actually managed to improve its market share through launches in the lower end of the premium spectrum such as the iPhone SE (2020), iPhone XR, iPhone 11 and others.

As the Indian smartphone market matures, the average selling price in India is expected to rise and come closer to the typical price of an entry-level iPhone, similar to other Western economies. This is when Apple is likely to make a big capitalisation move in the Indian market through its primary competitive advantage i.e. the vertical integration of hardware manufacturing, software and services. The Apple Store is a key piece in this chess move, and the launch of the Apple Store in retail format next year will also bolster Apple’s brand recall in the market further.

But at the moment, Apple has a minuscule percentage of the market with Xiaomi and Samsung owning the biggest chunks at 29% and 26% market share each. There is a herd of other brands such as Vivo, Realme and Oppo — all belonging to the same company — that have also eked out considerable market share in India with a sharp focus on the affordable segments.

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone](https://inc42.com/wp-content/uploads/2020/09/Market-Share-Of-India-Smartphone-Shipments-In-Q2-2020-100.jpg)

To its credit, Apple has tried to widen its market share by trying to reduce the final price of the phone and making in India rather than importing and paying high excise duty. It has set up assembly units in Chennai and Bengaluru, where its manufacturing partner Foxconn and Wistron are assembling iPhone XR and iPhone 7 respectively. The company is also reportedly planning to manufacture its iPhone 12 Series in India, which would be ready by mid-2021.

Assemble In India?

A lot of the impetus to Apple and other smartphone vendors making in India is down to the policy push from the central and state governments to set up plants in the country. The Make in India programme from the central government, various state-specific manufacturing policies and disincentives to import devices to India through high excise duty have attracted massive investments from tech giants — Apple, Xiaomi, Samsung, BBK Electronics and others included.

While some smartphone manufacturers — Samsung, for instance — operate their own units, many have partnered with contract manufacturers to set up local manufacturing units in India. This helps smartphone manufacturers to get that Made in India tag, as local assembly of smartphones is also counted under the government’s Make In India scheme.

According to a 2019 report by mobile industry body ICEA (India Cellular & Electronic Association), over 225 Mn handsets were assembled and/or manufactured in India between 2017 and 2018. Further, the report noted that individual OEMs like Micromax, Lava, Samsung make about 34% of the manufacturing facilities in India, while contract manufacturers made 66% of these facilities. A total of 6.7 Lakh jobs were created in India as a result of smartphone and accessories manufacturing in 2019, according to ICEA and KPMG analysis.

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone](https://inc42.com/wp-content/uploads/2020/09/Smartphone-Companies-Investments-Towards-Mobile-Manufacturing-In-India-100.jpg)

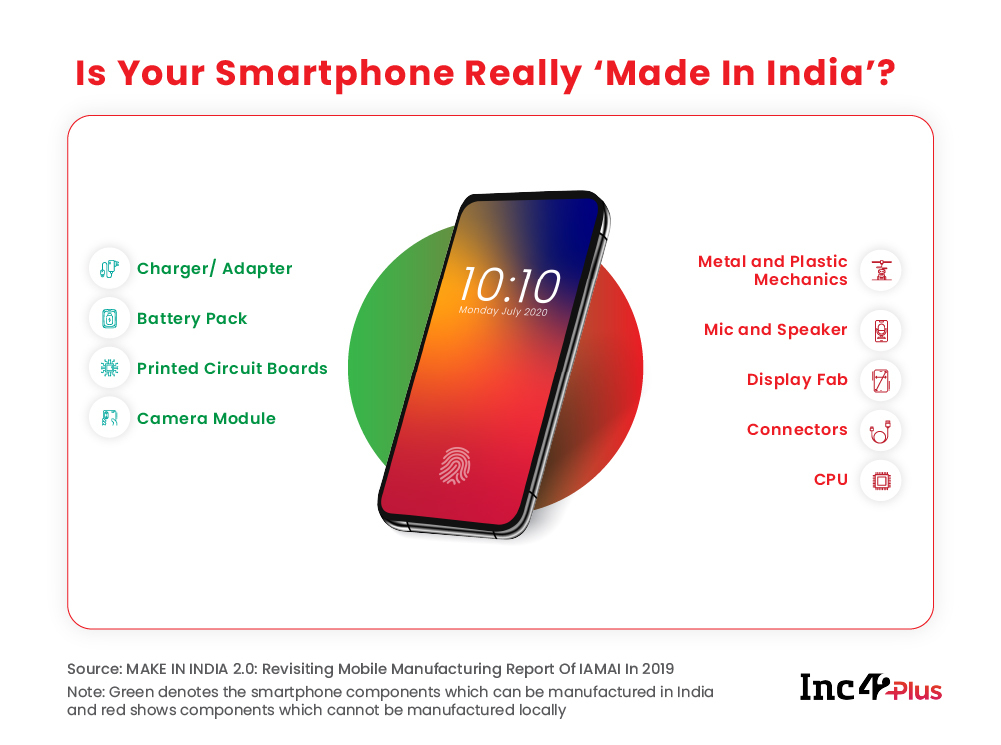

These investments in local manufacturing plants have definitely benefited smartphone manufacturers by taking import taxes off the table, however, most of these setups are just assembly units. The majority of the essential components in a smartphone cannot be manufactured in India and are usually imported from China, South Korea, Taiwan, Vietnam and Japan. India also lacks in terms of infrastructure, technology and R&D capabilities required to locally manufacture all the smartphone components and go beyond assembling the imported parts.

However, some market leaders and Indian smartphone companies are trying to increase the share of local components inside a smartphone. Noida-headquartered smartphone company Lava, for example, claims that 45% components (by value of end product) of all Lava feature phones are made in India, and in the case of smartphones, the share is 25% for locally manufactured components (by value).

Lava locally makes components such as printed circuit board assemblies (PCBA), mechanical housings, chargers, batteries, earphones, camera modules, window glasses and packaging items for the phone.

Further, the two biggest players by market share in India, Xiaomi and Samsung, have also made considerable investments in the country’s manufacturing ecosystem.

Xiaomi India head Manu Kumar Jain had earlier said that up to 99% of the company’s smartphones are made locally in India which amounts to 65% of the value of a Xiaomi smartphone.

Samsung set up the world’s largest mobile factory in Noida in 2018 to double its earlier production in Noida from 68 Mn units a year to 120 Mn units a year. Given the import taxes in India, Samsung depends on local production to compete with its rivals on price. The company is also reportedly planning to shift major parts of its smartphone production to India from Vietnam and other countries.

Counterpoint Research research analyst Shilpi Jain added that most mobile accessories such as chargers, cables and earphones are being produced in India. When it comes to smartphone displays, these are also usually imported into India, but Samsung has announced plans to set up a display fabrication unit in India with an INR 5400 Cr investment, and given that Samsung is one of the world’s largest supplier of displays to other vendors, this could mean a lot more phones could have Indian-made parts soon.

“Smartphone cameras too are being assembled in India but we expect CKD (completely knocked down) assembling for cameras to start by next year. Currently local contribution in total value addition is around 12%. This is expected to increase as PLI (Production-linked incentive scheme) manufacturing is getting a boost,” Jain told Inc42.

Can India Usurp China, Vietnam?

Assessing the India’s potential to become a global mobile manufacturing hub, India scores high in terms of ability to export mobile phones across the world (indicating high access to global markets), cheap and easy access to labor, presence of global brands, and access to technology because of the presence of leading global firms which can enable technology transfer.

The gaps lie in areas like high cost of inputs (the price at which mobile phone components are procured), domestic manufacturing ecosystem (limited capacity to produce components and subcomponents like semiconductors, CPUs etc), and limited investments from global value chains (GVC) like Apple, Oppo, Motorola etc (most manufacturers’ operations are limited to assembling in India).

Further, in comparison to manufacturing hubs like China, and Vietnam, India has several cost disadvantages like high cost of debt, lack of utilities (high quality power and water), and logistics etc. That’s also the reason why large companies like Apple manufacture phones or source components from China.

According to ICEA, if one assumes that the cost of production for a mobile phone is INR 100, then the subsidies and incentives offered by India reduce this cost by around 5.88% – 6.7%, whereas in Vietnam, this cost is subsidised by 9.4% – 12.5% and in China, the subsidies can be as high as 19.2% – 21.7% of the total cost of production. This goes a long way towards explaining why India is still behind these countries.

According to Sanjeev Agarwal, chief manufacturing officer of Lava, the Indian government has to make and implement policies which will enable local entrepreneurs to co-invest to create the component manufacturing ecosystem both in terms of investment and technology to manufacture components like semiconductors, CPUs, silicon chips, displays and battery cells and more.

How Indian Is A Made-In-India Smartphone?

According to a 2019 report by IAMAI, India’s imports of mobile specific parts increased by 185.9% (value of imports growing from $2.8 Bn to $7.9 Bn) between FY2015 and FY2019 despite smartphone brands such as Samsung, Lava, Intex, Karbonn, Micromax manufacturing more and more components locally. The reality, many experts say, is that a fully made-in-India smartphone is decades away given that India has no semiconductor or display fabs.

The Dream Of Data Localisation

While the ban on over 200 Chinese apps in India mostly covered social media and entertainment apps, the government is now reportedly shifting focus to fintech companies, which are guardians of particularly sensitive financial data. And if there was so much concern over user data shared by short video and gaming apps, financial data on taxes, Aadhaar-linked accounts and more come with a greater security risk.

Reports this week claim that several app-based digital lenders could be added to the list of banned apps in India. All this while the government is yet to formalise the personal data protection bill.

The parliamentary committee examining the all-important data privacy bill was handed an extension this week to submit its report during the winter session.

The uncertainty around data protection also puts India at a disadvantage in the global dialogue on data security and localisation. Speaking at a G20 trade talk, India’s commerce and industry minister Piyush Goyal said the country was not in a position to promote the ‘Data Free Flow with Trust’ (DFFT) initiative across nations.

“In view of the huge digital divide among countries, there is a need for policy space for developing countries who still have to finalise laws around digital trade and data,” Goyal said.

The Dream Of Global Products

While the Made-in-India smartphone story tells us the state of India’s hardware manufacturing, there’s no doubt that India can already compete with the world’s biggest software nations. When it comes to digital products for consumers and businesses, Indian startups have made a huge impact on the global tech market.

“In the B2B space, India is already there (in global markets)… We have companies like Freshworks and Zoho that have global customers… I think now the time of B2C has come,” Chingari founder Sumit Ghosh told us in a recent interview.

And beyond the B2B boom, India’s OYO, Ola, Zomato, Zoho, Paytm and other massive unicorns have also carved out niches in overseas markets, having found the ideal product-market fit for each geography and market.

For instance, competing with bigwigs like Microsoft and Salesforce, Zoho Corp is one of the biggest SaaS players in the Indian startup ecosystem and has offices across seven countries including, US, Netherlands, Singapore, UAE, Japan, and China. The company has more than 50 Mn customers and more than 9K employees globally.

These success stories are undoubtedly laudable, but with thousands of early-stage startups looking to replicate their success, there’s definitely a need for more community-driven product-centric engagements. According to WhileHat Jr founder and CEO Karan Bajaj, while 70% of the learning for a product owner happens on the job, the rest comes from interacting with the product community and makers.

And that’s exactly what we hope to achieve with the upcoming The Product Summit, hosted by Inc42 and The Product Folks on October 10 and 11, 2020.

We are bringing together a stellar lineup of speakers — a literal who’s who of the Indian startup ecosystem. Join us and get to listen to and interact with Zerodha’s Nithin Kamath, WhiteHat Jr’s Karan Bajaj, OYO’s Ritesh Agarwal, Zoho’s Sridhar Vembu and Times Internet’s Satyan Gajwani, among other prominent founders, product leaders and VCs. It’s this year’s biggest product conference and it’s completely virtual.

As we conclude another edition of The Outline, holding out hope that India will move beyond the cautionary tales such as the Freedom 251 scam and build its stature as a global mobile manufacturing hub.

PS: The Product Summit tickets are available at a 50% discount for Inc42 Plus members. Hope to see you there!

Until next week,

Yatti Soni & Inc42 Team

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] The Dream Of A Made-In-India Smartphone-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience