The Union Budget reinforces the government’s ignorance of the startup ecosystem’s problems

Dear Reader,

There was a glimmer of hope when the government kick-started the long-pending startup seed fund with a corpus of INR 945 Cr just two days ahead of this year’s Union Budget. The ecosystem was duly thrilled after years of waiting and hoping with every mention of startups in policy announcements. Founders and investors saw it as a prelude to bigger reforms, to be brought forth by Finance Minister Nirmala Sitharaman when she would present a never-before budget on Feb 1.

But there was darkness at noon. The budget speech was replete with generic promises and there was nothing exciting in it.

T.V. Mohandas Pai, former Infosys CFO and partner at Bengaluru-based VC fund Aarin Capital, was among the few big names from India Inc who expressed his disappointment with the 2021 Budget when it comes to startups. According to him, the government has once again missed an opportunity to boost the startup sector that is flourishing on its own but needed a mild boost from the authorities.

This should have been the year when the ivory towers of policymaking realised ground realities and gave startups a liftoff. They delivered food, medicine and other essentials when the country was under a series of lockdowns to combat the spread of a deadly pandemic. They enabled brick-and-mortar businesses to go online. They employed enough ‘jugaad’ to get the supply chains up and running after in the wake of a debilitating shutdown. And they brought millions of new households under the formal fold of the digital economy. Not just this, but startups in India also raised $11.5 Bn funding in a year that was supposed to witness an action replay of the deal drought post the Lehman Brothers’ collapse.

As no concrete measures for startups were announced by the government across the Covid-19 stimulus packages, the ecosystem was hoping for something concrete on D-Day. But the outcome was nought.

“We thought that the government would recognise how startups led India out of a recession. It was the first time when Indian startups became the flagbearers of an economic turnaround. No one can deny their contribution in the last 12 months. But where is the recognition of that in the budget? This really should have been a budget for defining the next nine years of India’s startup journey,” says Anirudh Damani, managing partner at Artha Venture Fund.

Echoing this sentiment, Kunal Kislay, cofounder and CEO of the SaaS startup, Integration Wizards, says, “While the government has clearly focussed on boosting the infrastructural growth of our country, it has ignored the very core of India Inc., the startups. Our government’s focus on the startup ecosystem of our country is, unfortunately, not reflected in the budget.”

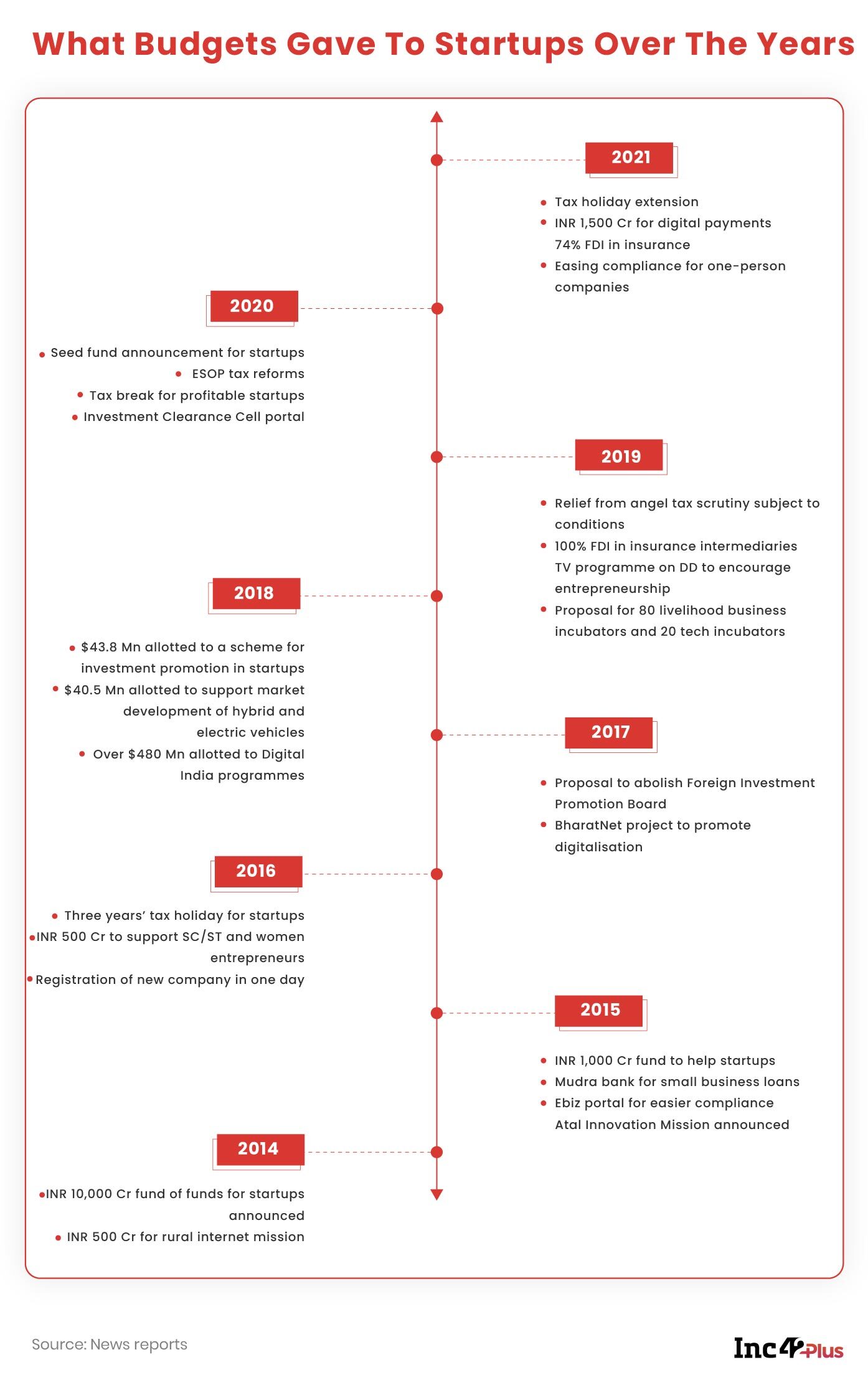

Before we proceed further, a look back may help to put things in context. India’s startup ecosystem came into the limelight with Prime Minister Narendra Modi’s ‘Startup India’ clarion call in his Independence Day speech in 2015 and the launch of a namesake initiative in the following year.

These initiatives have helped them become household names in India, and the growth spurted — more than 12,000 startups were launched between 2015 and 2016 alone. However, the government’s role has been limited, and its policies have barely scratched the surface when it comes to making them more inclusive towards startups. This absenteeism of the government has cost the ecosystem in more ways than one.

Take, for instance, the retrograde angel tax provision. Despite repeated pleas made by founders and VCs on how the law hurt early-stage funding and killed many startups in their infancy, the government did not bat an eyelid for years.

After years of efforts, it got scrapped in 2019, but the damage was done by then. The opportunity cost was that early-stage deals were few and far between in those years. Also, given the pace at which the tax regime moves, it is still uncertain if the notices received by startups prior to the decision have been fully resolved yet.

Talking about funding, here are some more puzzles. The government had announced a fund of funds (FoF) in February 2018 with a corpus of INR 10,000 Cr, and the entire amount was planned to be disbursed by March 31, 2025. As of March 31, 2020, the government committed INR 3,798 Cr, and the amount disbursed stood at around INR 1,050 Cr, roughly 10% of the entire corpus.

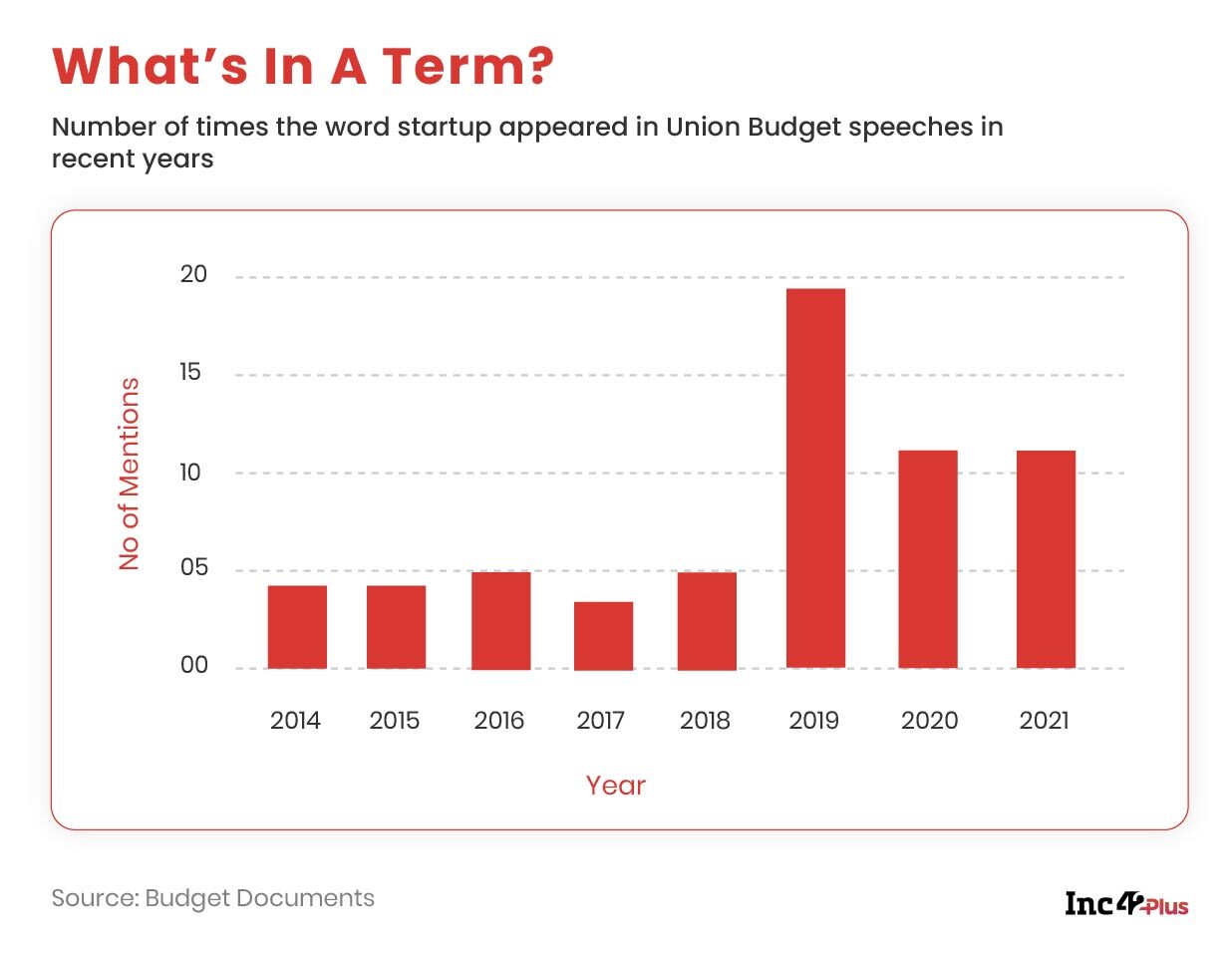

All these amply prove that the term ‘startup’ has remained a buzzword that the government liberally sprinkles in its speeches, action plans and the MoUs signed with other countries. When it comes to the ‘Budget Day’, these businesses get a few baubles like tax holidays (for which most of them are not eligible), big promises to promote entrepreneurship, easing of compliance pains (mostly, the government’s own doing) and big-bang announcements which take years to bear fruit.

Half-Baked Policies Litter Startup Land

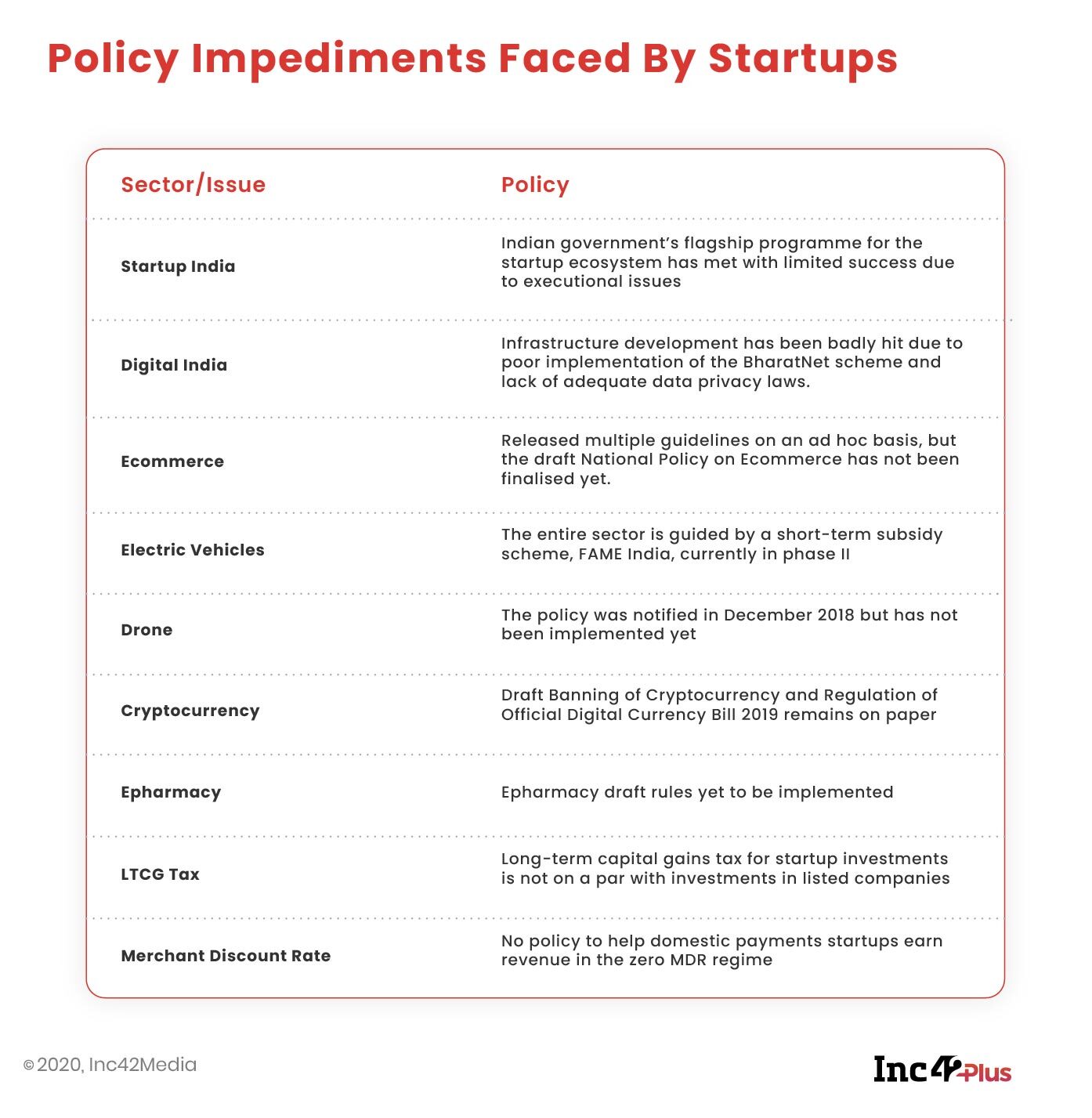

What do startups want? Not much. They do not expect the kind of sops the heavy industry demands all the time. But neither do they seek ill-conceived policies which hinder their growth and earnings.

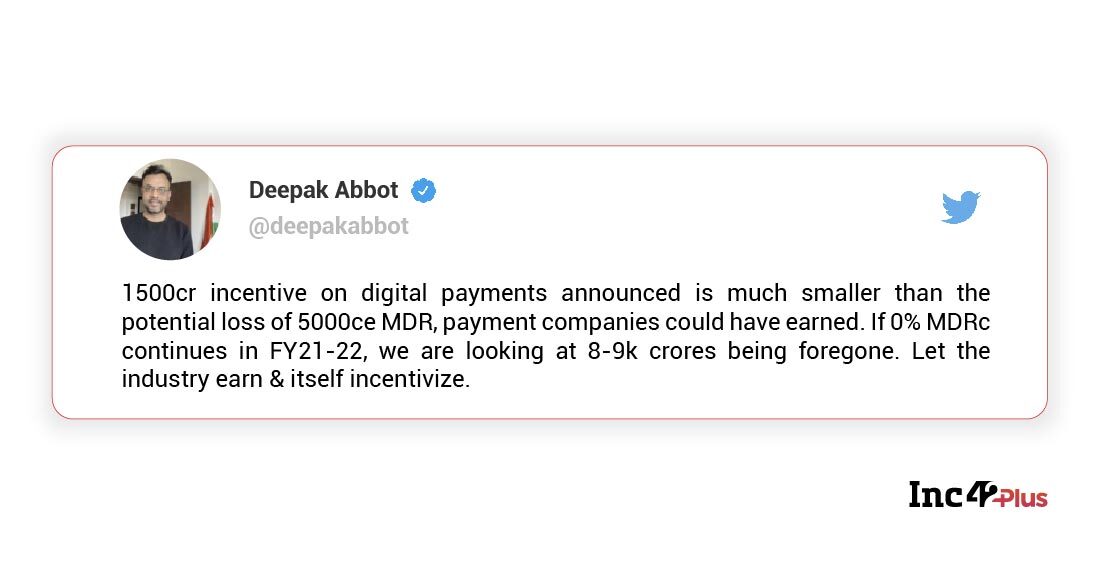

For instance, the zero merchant discount rate rule that prevents UPI and RuPay payments companies from charging online sellers for transactions. Initially implemented to promote digital transactions throughout the country, this regulation has far-reaching consequences, and domestic startups are suffering now. In fact, it no longer provides a level playing field for Indian payments startups as only the fintech arms of global tech giants have the means to burn cash in search of a monetisation avenue that may or may not materialise in the distant future.

Several stakeholders in the fintech sector think that the INR 1,500 Cr corpus allocated in Budget 2021 for promoting digital payments could be used to subsidise zero MDR. But the amount is too paltry to plug the revenue holes in a segment that is growing rapidly and handles more than 2 Bn transactions per month.

Another sector facing an existential threat is cryptocurrency. Just before the budget, a Lok Sabha bulletin appeared saying that private cryptocurrencies would be banned. It threw the sector into another fit of introspection about the future of crypto in the country.

“A possible ban means more than 7 Mn Indians, with assets worth $1 Bn+, will be left in the lurch. Eventually, it may have an adverse impact on an economy already battered by the pandemic,” says Sumit Gupta, cofounder and CEO of CoinDCX.

Policy flip-flops and vague strategies have become the order of the day for startups — the new businesses of the new economy. On the one hand, the prime minister lauds startups and entrepreneurs for wealth creation and innovation in his Mann Ki Baat. But the government leaves no stone unturned in chalking out policies which eventually confuse founders and investors.

There are plenty of examples. In 2018, the Modi government promised to introduce a stable EV policy encompassing all aspects of this niche sector. Subsequently, the government’s think tank NITI Aayog came up with a policy framework, but a national policy on EVs never materialised.

“The charging infrastructure needs huge investments, and policy clarity would have attracted that,” Anand Anndurai, the founder of Bengaluru-based bike-rental platform VOGO, earlier told Inc42.

The EV market in India will require a cumulative investment of $2.9 Bn in the charging infrastructure to meet the government’s FY30 target of making the country a 100% EV nation, according to a study by the CEEW Centre for Energy Finance.

To achieve the target, the government started the FAME India Scheme in 2015 that sought to promote manufacturing of electric and hybrid vehicle technology through various sops. But it was essentially a subsidy scheme adopted on an ad-hoc basis, is more consumer-centric and does not provide any stability or direction to the industry. As a result, big automakers and investors have been extremely cautious about funding the segment.

“The Union Budget could highlight a few critical sectors every year, like the UN has development goals, and take a startup-focussed view on those — be it healthcare, fintech, electric vehicles or anything else of immediate impact to the nation. Further, I do not see any policy push for encouraging startups to take a lead in the export market. There are so many product companies in the country across every sector, but yet there are no big benefits for them to cater to the global market. We should have capitalised on the current global anti-China sentiment,” says Sreedhar Prasad, a veteran management consultant who specialises in internet businesses.

Funding Bottlenecks Remain Unresolved

Funding is the lifeblood of tech startups (or all of them, for that matter). But the long-term capital gains tax of 20% on the sale of shares in unlisted companies remains a perpetual hindrance for startup investors. Interestingly, the sale of stocks in listed companies may attract only 10% LTCG.

Anand Lunia, the founding partner of the venture capital firm India Quotient, told Inc42 on an earlier occasion that the proportion of Indian capital should go up in the overall market.

“If we want Indians to own and control tech companies as per Atmanirbhar Bharat, we need to have a larger amount of domestic money. This changes and allows a lot more domestic capital to go into startups.”

Removing the LTCG tax for unlisted companies’ shares will lead to more startups being set up and give the government higher tax and revenue returns in the long run, says Lunia.

Another avenue for startup funding that the government has not unlocked yet is pension funds. Globally, pension schemes and funds are the biggest source of money for venture capital funds and indirectly, that cash goes to startups. But in India, there are restrictions on pension funds investing in AIFs, including provisioning norms and certain exposure levels, which are meant to protect these funds.

“We have seen the pension funds of Australia, Canada, California and other geographies from across the world invest in Indian firms… If these companies are safe enough for the largest pension funds in the world to invest, why are Indian pension funds or provident funds prohibited?” asked Siddarth Pai, founding partner of 3one4 Capital, while speaking to Inc42 on an earlier occasion.

It is interesting to note that 85% of investments in Indian startups come from abroad even though the country’s pension and insurance funds are sitting on a cash pile of INR 1.5 Lakh Cr.

These bottlenecks can only worsen the current situation when early-stage startups are flipping their structures to shift their base abroad in search of a better funding environment. Many stakeholders also hoped that the budget would unveil measures to incentivise late-stage startups looking to list overseas. But the government has failed to bring about any such policy. It increasingly seems as if the clarion call for atmanirbharta means just one thing for startups: Look out for yourself.

A Startup India Moment!

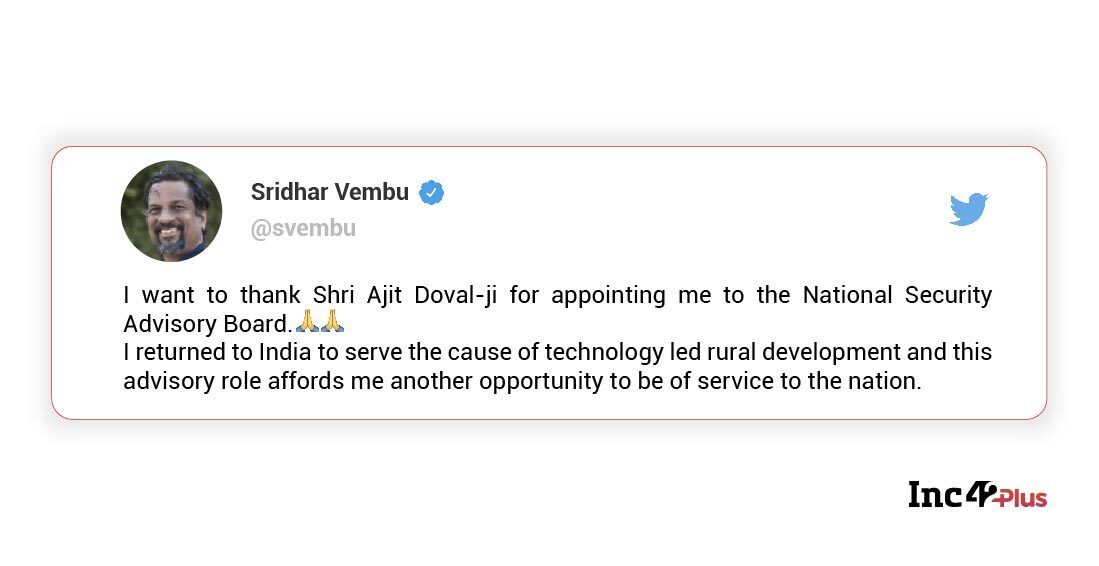

Sridhar Vembu, the founder of India’s SaaS giant Zoho and a recent Padma Shri awardee, said on Feb 3 that he was appointed to the National Security Advisory Board. The board comprises a group of eminent national security experts outside of the government, and usually includes senior retired officials, civilians and military personnel, academics and distinguished members of the civil society with expertise in various domains pertinent to national security.

At long last, a startup representative has been accorded a prominent position in the government’s top echelons. But there is still a long way to go before more accolades come to the startup community as a recognition of their capabilities and excellence.

Big Tech’s Atmanirbhar Scare?

The Supreme Court has sought responses from Facebook, Google, WhatsApp and Amazon to a plea that questions the data-sharing practices of the UPI platforms operating under these big tech companies. While data localisation concerning digital financial transactions has been a thorn in the flesh for the American tech giants for the past few years, WhatsApp’s recent privacy policy update has brought more vitriol to the ongoing controversy.

Meanwhile, lobbying groups in the US and the country’s Congressional Research Services report in January have raised concerns about India’s upcoming foreign direct investment (FDI) rule changes for the ecommerce sector. This is expected to impact Amazon India as well as Walmart-owned Flipkart’s marketplace business.

The bipartisan research wing of the US Congress claims that in the US view, “India’s weak regulatory transparency and other issues, such as IPR and localisation policies, add to concerns about FDI barriers.”

At a time when numerous stakeholders in the country’s tech startup ecosystem are questioning the government for not doing enough to ease policy barriers for domestic companies, it will be interesting to see how the powers-that-be respond to a new administration in the US that is perceived to be close to big tech companies.

Atmanirbhar Startups Punch Above Their Weight

Despite the entry barriers created by tech giants, Indian entrepreneurs continue to do what they are best at — churning out products which can solve difficult problems and creating value.

While the glitz of unicorns and mega funding rounds are important milestones of startup success, umpteen young companies are labouring in isolation and away from the media glare. That is why Inc42 identifies promising startups, which are punching above their weight every month. In the January edition, we have a heady mix of edtech, agritech, fintech, ecommerce and deeptech startups, each of which has a unique reason to make it to the list — be it product ingenuity, early traction or a new take on a crowded category.

Even as these young companies hustle to make a mark in their markets and become the next pot of gold for investors, they hardly speak about the policy friction that often slows them down. In a way, the country’s startups have internalised that being Atmanirbhar is the only way to survive and thrive. One can only hope that the government will recalibrate its priorities to listen to the startups’ ‘mann ki baat’ and take things forward and upwards for them.

Until next time,

Deepsekhar

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/featured.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/academy.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/reports.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Startups’ Atmanirbhar Challenge-Inc42 Media](https://asset.inc42.com/2023/09/twitter1.png)

Ad-lite browsing experience

Ad-lite browsing experience