As a less-than 4 yrs old company, Jio is “still very much a startup” for Mukesh Ambani

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Dear Members,

Like most weeks during the lockdown, this one too began with Reliance announcing a major new investor. After the mega deal with Facebook at the tail end of April, Jio has been on an unprecedented spree. This week, it started with a $100 Mn investment from Qualcomm Ventures, which would otherwise have been a massive amount, but for Jio it was just a drop in the ocean. Just a couple of days later, it followed this up with a mega $4.5 Bn investment from Google for 7.73% equity stake, just short of Facebook’s 9.99% stake.

Alphabet and Google CEO Sundar Pichai added that this investment is part of the company’s $10 Bn Google for India Digitization Fund, which was also announced this week. This means almost 50% of Google’s committed investment for India has gone towards Reliance Jio.

“Our investment of $4.5 Bn in Jio is the first — and the biggest — investment we will make through this fund,” said Pichai.

In his ‘Google For India’ virtual keynote, Pichai noted that this fund would focus on four areas important to India’s digitisation — empowering Indian businesses in their digital transformation journey, leveraging AI for social good in healthcare, education and agriculture, and building new products and services crucial to India’s unique needs, and backing regional language content and localisation.

Interestingly, most of the announcements made at Reliance’s 43rd AGM easily fit under these focus areas for Google.

India’s Big Tech Moment Is Here

Like Facebook, Google’s investment has a strategic aspect beyond just pouring in capital into Jio. With Google’s support, Jio said it would build a version of Android specifically for affordable 4G or even 5G smartphones. The overarching vision is to move the 350 Mn+ 2G feature phone users in India to an affordable 4G device. As Reliance Industries chairman, Mukesh Ambani said in his address, “Jio is determined to make India 2G-mukt”.

A 4G smartphone seems like the next logical step for Jio after winning the telecom race and a smartphone OS will further help Jio streamline its services to the new wave of smartphone users. It’s also expected to loosen the stranglehold of Chinese smartphone brands such as Xiaomi, Vivo, Realme, Oppo in the affordable segment — and of course, being Android, it gives Google access to millions of new users for its location services and the Play Store.

Similarly, the Facebook-Jio partnership is looking to enable the digital transformation of small businesses. India is said to have over 60 Mn small businesses, with millions of households relying on them for their livelihood. “Now, with a lot of communities around the world in lockdown, it’s even more important now than ever that people have the tools to connect with each other, and their businesses can find ways to operate online. This is something that we think we can help with,” Facebook chief Mark Zuckerberg said at the Reliance AGM, while talking about the company’s investment in Jio.

Soon after the Facebook deal was announced, Reliance had launched its new commerce initiative JioMart on Facebook-owned WhatsApp. JioMart claims to be doing 250K orders per day in 200 cities where it was piloted in May. The platform is now evolving into an omnichannel platform to unite customers, kiranas and producers. JioMart will also start delivering electronics, pharmaceuticals, fashion and healthcare products soon.

This means the entry of a third major player in the Indian ecommerce space, which was until now dominated by Amazon and Flipkart who both collectively own 62% of Indian market. With WhatsApp being so familiar to Indians, JioMart would have great competitive advantage in ‘Bharat’. WhatsApp already has over 400 Mn users in India, JioMart has a huge base to target from the outset.

Facebook and Google aren’t the only big tech companies to get into a strategic partnership with Jio. Last year, Reliance Jio announced a partnership with Microsoft and its Azure cloud business to bring ‘free’ Jio connectivity and Jio-Azure cloud services for tech startups and small businesses in India by 2021.

With the Google partnership now cemented, three of the biggest tech giants in the world — Microsoft, Google and Facebook — have joined hands with India’s biggest conglomerate Reliance Industries.

Jio & The Startup Life

“I believe that there is no better partner for Indian startups than Jio,” Ambani said during the virtual address. He even said that Jio being a fairly new entity is “still very much a startup” and thus sees startups as its brothers-in-arms.

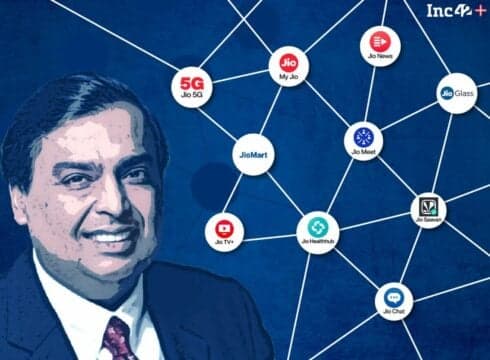

Jio Platforms claims to have partnered with over 20 startups since its launch, out of which 11Cu startup acquisitions were announced in 2018 and 2019. These include C-Square, EasyGov, Embibe, Fynd, Grab, Haptik, Netradyne, Reverie, Saavn, SankhyaSutra, Nowfloats and Tesseract.

Isha Ambani also noted the contribution of the company’s acquired startups. “Jio’s education platform Embibe will address the shortage of quality teachers in India. It is built on three foundational blocks: unprecedented personalisation, incredible content, and teacher empowerment.”

The AGM also saw Jio solidifying its healthtech play, with details about the Jio HealthHub being announced. The integrated digital healthcare platform will enable people to book online video consultations, securely store and share health records, and book lab tests and more. HealthHub is said to have delivered more than 1,500 consultations in four weeks, with the help of Reliance’s video conferencing app JioMeet, which now has over 5 Mn users, having only launched this month.

The acquisition of deeptech startup Tesseract last year meant Jio has also been quietly working on mixed reality (AR+VR) hardware called JioGlass. Weighing just 75 grams, JioGlass can be used for 3D virtual meetings, watching and creating holographic content and up to 25 mixed reality applications. Can Jio succeed where its partners Facebook (Oculus) and Google (Google Glass) have seen mixed results so far?

Why Jio Is Pivotal To ‘Make In India’

A Greyhound Research report noted that there are six Cs in Jio’s vertical integration plan — connectivity (telecom and enterprise tech), community (social networking), content (edtech, gaming and entertainment), commerce (health, grocery, fashion), currency (digital payments and cryptocurrency), and capital (SMEs and startups).

So beyond the tech giants that are looking to grow vicariously in India through Reliance, the big picture is about securing the future for ‘Made in India’ — from 5G networks to smartphones and PCs. A big part of this is semiconductor fabrication, which is key to producing chipsets to power devices. Given that China has something of a monopoly on this, India needs to build up its capabilities in this direction, if Make in India has to succeed at all.

Qualcomm Ventures, which picked up a 0.15% equity stake in Reliance Jio, is the world’s largest smartphone chipset maker and is also a key driver of the current wave of 5G devices. In December 2019, Qualcomm was reported to be working with Reliance Jio to build new 5G use cases. Intel Capital’s $253 investment in Jio Platforms will undoubtedly involve manufacturing in India for affordable laptops and other mobile devices.

Jio building an indigenous 5G mobile network in India is no secret. But it’s ‘Made In India’ pitch was particularly relevant now, given the calls to boycott Chinese tech after the border clashes between India and China in Ladakh’s Galwan Valley last month.

As former a16z partner Benedict Evans said in a tweet, “Closure of China makes India high on every big company strategy team’s list of ‘we need a deck for that’. It (Jio) has political clout in a political market. And it says digital a lot. But it’s still a telco. I have pattern recognition here.”

He also added that, every five years or so, a telecom company thinks it can move up the stack and compete with the internet giants. “This is a little like a municipal water company trying to get into the soft drinks business,” said Evans.

Despite the jocular tone, one cannot ignore the seriousness with which Jio is pursuing its goals. Reliance has always wanted to take Jio beyond connectivity and these partnerships are the fuel to realise that grand vision. It is similar to how Reliance Industries follows vertical integration in the petrochemical and energy value chain. With that experience and buckets of capital, can Jio finally break the pattern and emerge as the world’s only full-stack tech player?

Future Past Of Reliance

From Wankhede stadium in 1994 to a virtual AGM in 2020 — Reliance has always held a special place in the heart of Indians. This week, more than 3 Lakh viewers tuned in to the live stream on JioMeet as Asia’s richest man laid out the roadmap for Jio.

Image Credits: Napol Stock Image, Reliance Industries

A Strategy Called Investment

Besides Reliance, the only companies that have earned the investor interest in India are in the edtech and enterprise tech sectors. The latest is Vedantu, which announced a $100 Mn Series D round led by Coatue, which valued the edtech startup at $600 Mn. Vedantu said it would use the funds to invest in developing content and technology for live classes.

Adding to the edtech growth story, Softbank-backed Unacademy made its third acquisition in four weeks by acquiring a majority stake in K12 learning platform Mastree. The acquisition has given Mastree’s investor Blume Ventures an exit. Talking of acquisitions, Kolkata-based RP Sanjiv Goenka Group (RPSG) also acquired a 51% majority stake in AI-powered news app Editorji. The company was founded in 2018 by veteran journalist and former NDTV CEO Vikram Chandra.

While some startups have raised funds to boost operations and development capacity, others are looking to recover from the negative impact of the Covid-19 crisis. Ecommerce giant Flipkart has orchestrated four fund infusions in its marketplace entity since the nationwide lockdown in India. The most recent one being a $1.2 Bn funding round led by majority stakeholder Walmart.

A Promise Called Healthcare

While Ambani did not dwell too long on Jio HealthHub during the AGM, the service aligns with Google’s efforts to back healthtech projects. It’s also in line with the government’s efforts in terms of integrated wellness and healthcare.

The National Health Stack, which is a set of essential APIs, recently went live for testing. When implemented in the right manner, it will make telemedicine and other healthtech possibilities a reality with safety, interoperability, security and reliability being the primary pillars.

Envisioning an India Stack-like cohesive future for healthcare, over a dozen organisations and companies — National Cancer Grid, Swasth Alliance, LiveHealth, DRiefcase and others — have begun testing the newly built National Health Stack APIs in the past few weeks. But there’s still a long way to go before there’s full-fledged innovation built on the health stack.

Can the Indian government and the healthcare ministry win the trust of people amid lack of privacy laws, a Data Protection Authority and a National eHealth Authority? And with no oversight in place, should India even be accelerating its healthtech efforts?

Speaking to Inc42, Justice BN Srikrishna, chairman of Financial Sector Legislative Reforms Commission and the man behind Personal Data Protection Bill, indicated that India may not be ready.

“The Personal Data Protection Bill has not been passed through the parliament. There is no law that currently governs it except the fact the Supreme Court of India has recognised Right to Privacy as our fundamental right. In the case of new developments, we have to check if it compromises any fundamental rights or does it comply with the three core directive principles with regards to the fundamental rights,” he added.

Critical healthtech policies such as the epharmacy policy, DISHA and Data Protection Bill among others, that are essential to the healthtech infrastructure have been pending approval for years. This policy limbo in the healthtech sector has even impacted the efficacy of many healthtech startups. So, has India got its healthcare policies and priorities wrong?

“While, centre had rightly imposed a nationwide lockdown, the lack of coordination among states and preparation at the state level has backfired at many levels. This could have been avoided if healthcare were in the concurrent list,” a Niti Aayog official told Inc42.

In spite of having the best of Indian healthcare systems, the most affected states of Tamil Nadu, Delhi and Maharashtra have been suffering a huge crunch of beds, ventilators. As a result, the Delhi government recently announced a complete reservation of state-backed hospitals as well as private hospitals for the local residents, creating a furore among the residents.

While the decision was later turned down by the centre, it sparked a debate on whether “public health and sanitation: hospitals and dispensaries” should be categorised in List II (as a state subject) or List III (as a concurrent subject). Is the infighting between policymakers at the central and state level to blame for the current state of Indian healthcare system, or is the rot deeper?

As India’s coronavirus infection count crosses 1 Mn confirmed cases (July 16), these questions are not about to wither away, but may only intensify. Private players like Reliance have shown interest in revamping this healthtech space, but the healthtech policy needs to also empower startups and not just tech giants.

Yours truly,

Yatti Soni

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.