SUMMARY

With an array of apps and services, Reliance Jio has slowly but surely cemented its place as a digital powerhouse over the past 4 years including the growth of JioMeet, JioMart in recent months

With an array of startup acquisitions and tech giants as strategic investment partners give Jio a huge advantage over rivals in India’s tech industry

But just like Google and Facebook have to balance being Jio’s partners and competition, startups too have to answer the big question when it comes to Jio — fight, collaborate or die

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

In 2016, a few months before the demonetisation, Reliance Industries chief Mukesh Ambani unveiled Reliance Jio to the public with free voice calls and 1GB of 4G high-speed data per day for just INR 300 (less than $5) per month. While demonetisation gave a huge push to cashless economy and online payments, Jio turned out to be a revolutionary service and catapulted India into the digital future.

Today, Reliance Jio has nearly 400 Mn subscribers to itself, and overall India has over 504 Mn active internet users. No wonder, India’s internet growth story is accredited to Jio. While not all Jio subscribers might be active internet users, Jio Platforms owns a major chunk of the market.

But beyond being a digital enabler, Jio Platforms, which Ambani claims is a startup, has raised a total of INR 1,52,056 Cr from leading investors like Facebook, Silver Lake, General Atlantic, KKR, TPG Capital, Abu Dhabi Investment Authority (ADIA), Mubadala Investment Company, Saudi Arabia’s Public Investment Fund, L Catterton, Vista Equity Partner and Intel Capital in the past three and a half months.

Jio Profits As Digital India Plan Comes Together

Beyond the capital, the investments are a testament to the digital ecosystem created by Jio — with over a dozen services and more being added, fulfilling the entertainment, communication and internet services needs of households across the country.

In doing so, over the past four years, Jio Platforms has invested a considerable amount in the Indian market and in its most recent financials the company announced record profits, reporting a total income of INR 1.75 Lakh Cr and a profit of INR 2,520 Cr for the quarter.

On a standalone basis, Reliance Jio reported a revenue of INR 1.68 Lakh Cr with a profit of INR 2,520 Cr for Q1 FY21.

Jio has largely spent on operating the network, followed by access charges and license fees. Notably, the company’s selling and distribution expenses have grown 29% on a M-o-M basis.

Further, if we compare the standalone selling and distribution expenses for Reliance Jio Infocomm (which runs the 4G network), the expenses have fallen 20% on a Y-o-Y basis.

With a bundle of products wrapped within Jio Platforms, the strategy has rubbed off well for Jio as the company’s diversified portfolio enables multiple channels of revenue and growth for the incumbent telecom player’s ambitions.

Power Of Jio Platforms

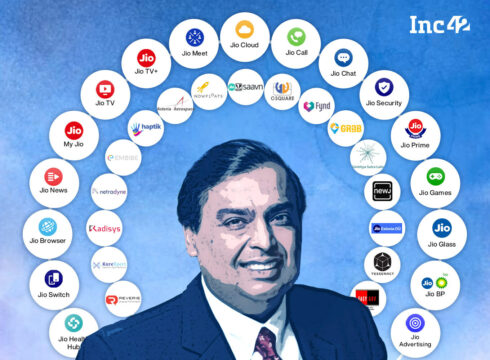

In November 2019, Jio Platforms was launched as an umbrella company for all of Reliance’s various digital services verticals. Jio Platforms would encompass Reliance-owned digital businesses including Reliance Jio Infocomm, My Jio, JioTV, JioSaavn, JioMeet, JioMart and other apps across entertainment, media, edtech and healthtech.

Overall, there are 30+ apps and services announced under the Jio name, with over 20 apps catering to the consumer market and others being dedicated for internal use or for partners.

As seen in the early success for JioMeet, today, the company not only managed to sell its 4G network vision to Indians, but has also managed to gain traction for many of these services. JioMeet is said to have over 5 Mn users in just a month since its launch.

The reason behind the growth of JioMeet in such a short span of time can also be attributed to the rising popularity of Made in India products in the country, filling the void created by the scrutiny on Zoom by the government due to data privacy issues and penetration pricing strategy adopted by it. To further challenge its competitor, JioMeet added security features which garnered it more attention.

Similarly, JioSaavn has been a success story for Jio. The app is said to have over 100 Mn monthly active users (MAU) with audiences across 150 countries. Mumbai-based JioSaavn received INR 140.35 Cr ($19.6 Mn) infusion from parent entity Reliance in February this year.

But other categories have been less than encouraging for Jio. For example, Jio Cinema and JioTV have not exactly competed strongly in the Indian market. JioTV was said to have 8.36 Mn unique visitors just after a year of launch in April 2016 and it currently has more than 100 Mn downloads, but that may not be a good indicator for the engagement.

Reliance’s next big focus area could very well be healthtech. Speaking at the AGM, Isha Ambani talked about the company’s vision of powering digital healthcare during the Covid-19 pandemic, through JioHealthHub, an integrated digital healthcare portal which will enable people to have online video consultations with doctors, securely store and share health records and book lab tests, among a host of other services.

Originally launched in 2017, the app has gained renewed traction during the Covid-19 pandemic and the ensuing lockdown, as people have sought online access to healthcare.

She added that digital healthcare services in India could be powered by three pillars, namely, Jio 4G mobile network and JioFiber broadband, JioMeet and JioHealthHub platform.

Built On The Back Of Startups

As we reported last year, Reliance has entered into nearly 49 merger and acquisitions, strategic investments and joint venture deals globally. Some have been completed while some are still in the process and are about to be completed by next year.

Reliance ventured into tech-dominant businesses with the acquisition of startups such as Haptik, Embibe, C-Square, Fynd, Grab, Netradyne, Tesseract and others. Apart from these, Reliance has made significant investments in global tech startups such as DEN, Hathway, Eros International Plc, Edcast, Karexpert Technologies, Vakt Holdings, Indiavidual Learning Pvt. Ltd, Radisys Corp, Videonetics, Kai OS Technologies and SkyTran Inc. among others.

The strategy has continued well into 2020 as well.

The Jio App Empire

After the company’s 43rd virtual AGM, we had noted that Jio might not tick-off requirements for being a startup, but it definitely is a kingmaker for startups. Clearly, Jio apps have made their footprints in several categories but there is a long journey to travel.

Jio apps are at par with the competitors in few categories such as entertainment, casual and sharing file tools while the other categories such as video conferencing, communication, browser, security, news & magazines, medical and productivity already witness a dominance by other major players namely Zoom, WhatsApp, Google Chrome, AVG Antivirus Free, Google News, Practo and Google Drive respectively and a lot needs to be done by Jio to gain traction in these categories.

Jio is creating a huge impact on the competitors with its price penetration strategy. Initially, Jio captured the market with its 4G services which were free services starting with the launch on September 2016 till 31st March 2017 which compelled the other rivals to operate with subsidised prepaid and postpaid plans for retaining their own customers.

After the end of the free services, Jio came up with a new subscription service of Jio Prime and announced its Summer Surprise Offer wherein the free services were provided to the users on recharge of INR 303 or higher with an existing Jio prime subscription. Just after the Summer Surprise Offer, it rolled out the Jio Dhan Dhana Dhan offer which provided several plans at very affordable prices for both prime and non- prime members.

By this time the entire industry dynamics changed due to the slash in the prices of telecom and internet services. Jio brought a drastic revolution in the telecom industry and made data and calling easily accessible for all the citizens.

Jio has made its bouquet of multimedia apps free for 388 Mn subscriber base as per 31st March 2020, as a complimentary subscription along with the prepaid plans as of now. This has garnered a lot of traction to its different offerings due to free cost.

Recently launched JioMeet has a list of enviable features at free cost, offering unlimited hours of calling, caused a huge revolution for the other competitors in the video conferencing market. Competitors like Zoom and Google Meet will be compelled to slash their prices in order to retain their own customers and thus, this will impact the industry margin at least in the short run.

What Next For Jio Platforms?

Jio Platforms is bringing a lot of drastic changes in the sectors where it has entered and is looking to change the cost dynamics of entire industries with its free offerings. In that sense, it is relying on the playbook that earned Jio its success and growing revenue.

As seen in the most recent financials, Reliance Jio’s average revenue per user has gone up to INR 140. This is the key metric that most of Jio’s competitors would have kept an eye on. Jio’s average revenue per user (ARPU) was on the decline till FY 2019. In the June 2019 quarter, it was at INR 122, down from INR 126.2 in March 2019 and INR 130 in December 2018. ARPU is the total revenue of the operator divided by the total number of users or connections on its network. A declining ARPU means subscriber additions on the network outpace its growth in revenue. In other words, every incremental user contributes less to the total revenue.

After competing with the likes of Airtel and Vodafone Idea on price, now it is looking to unleash the might of its services and ride on these to lift up its revenue. The question is will its new big tech investors be long-term partners or the competition?

While Google has made a strategic investment of INR 33.7K Cr for a stake of 7.7% in Jio Platforms, it will be competing with Jio in various ways. Google is showing dominance in many app categories with Google News, Files transfer and sharing app, Google Pay, Google Meet and Google Chrome, competing with Jio counterparts such as Jio News, JioSwitch, Jio Payments Bank and UPI, JioMeet and Jio Browser. Plus, Google Cloud is a rival to Microsoft Azure, which struck a deal with Jio last year to tap the burgeoning small business market.

Facebook, too, will be taking on Jio in some categories, even as it invests $5.7 Bn for 9.9% of Jio Platforms. Jio’s new ecommerce platform, JioMart will work closely with Facebook-owned WhatsApp, in order to create growth opportunities for millions of small merchants and kirana shops. But at the same time, Facebook will also take this to other countries and other companies, as it recently announced. And WhatsApp Payments will compete with Jio UPI, just like Google Pay.

In the OTT segment, more details are awaited on the upcoming JioTV+ which will supposedly aggregate content from the major OTT players namely Netflix, Amazon Prime, Hotstar and others. While the idea sounds great, striking deals with three of the biggest streaming platforms will be no easy thing, even for Jio.

Beyond these digital services, Jio’s big focus will be on the 5G network launch. The big picture is about securing the future for ‘Made in India’ — from 5G networks to smartphones and PCs. A big part of this is semiconductor fabrication, which is key to producing chipsets to power devices. Given that China has something of a monopoly on this, India needs to build up its capabilities in this direction, if Make in India has to succeed at all.

Just like tech giants that have to balance being Jio’s partners and competition, startups too have to answer the big question when it comes to Jio — fight, collaborate or die. It’s a peculiar position to be in. As seen with the much-hyped launch for JioGlass and in the growth achieved by Haptik, working with Jio can have its upsides and it can definitely help startups overcome the doubts that creep in when funding becomes scarce. Beyond funding, Jio offers startups a pedestal for their products, but at the same time, there’s always the fear that despite its self-proclaimed startup status, Jio is ultimately just a tech giant.

With inputs from Bhumika Khatri, Nikhil Subramaniam

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.