SUMMARY

The year 2022 started on a great note for the Indian startup ecosystem, with 13 startups turning unicorns in the first 3 months as compared to 8 in first 4 months in 2021

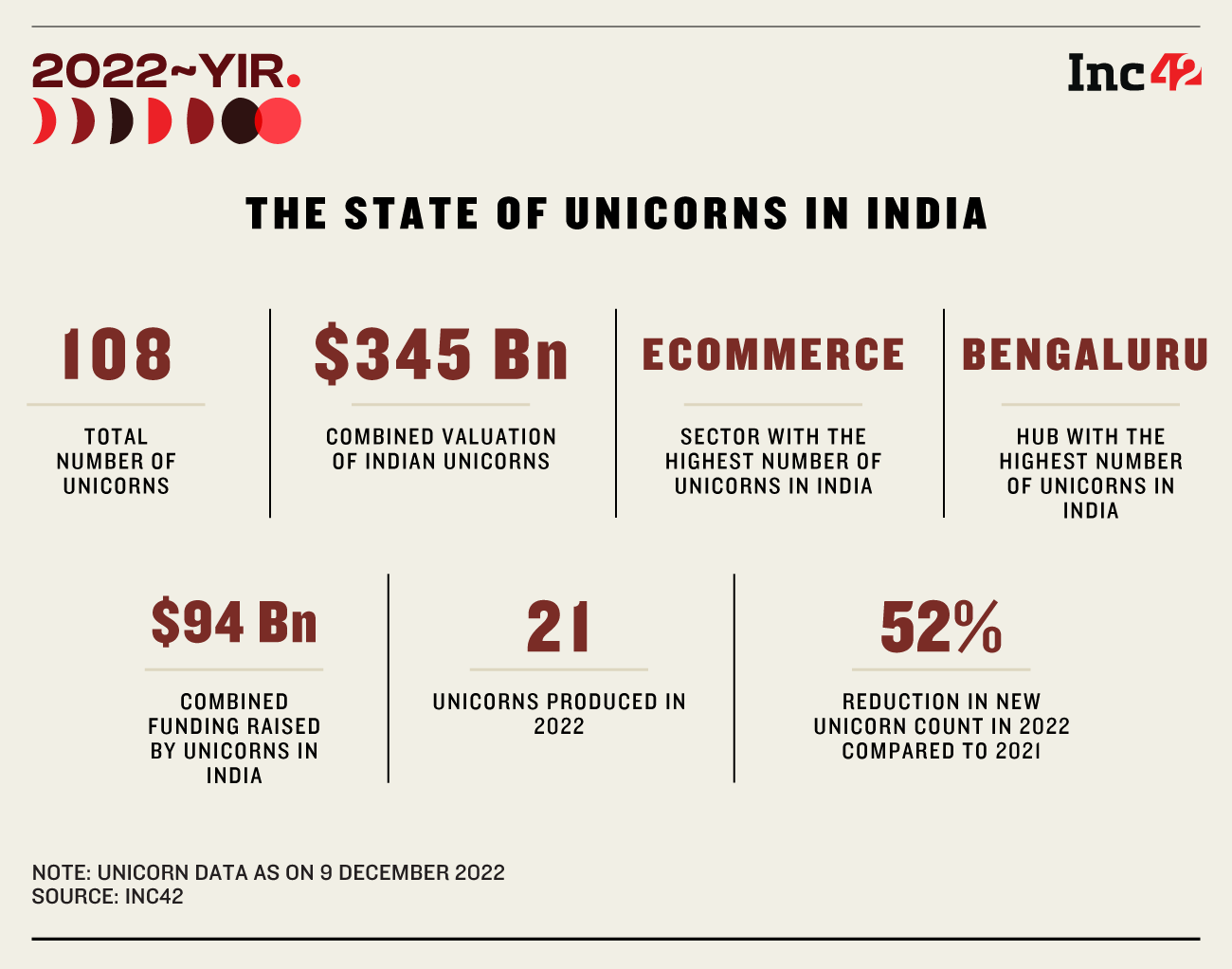

However, as the funding winter set in, the pace of startups turning unicorns dropped and only 21 of them entered the coveted club in 2022 as against 44 in 2021

With the ongoing downturn expected to last for at least another 6 months, the pace of startups entering the unicorn club is expected to increase only in the second half of 2023

As 2020 neared its end, the COVID-19 virus was wreaking havoc around the world. There were fears about the anticipated second wave of infections disrupting the country’s economy and the startup ecosystem. The fears of the second wave turned out to be true in 2021 and it crippled everyday life and caused misery across the country. Despite this, 2021 turned out to be the year of unicorns for the Indian startup ecosystem.

Riding on the back of an unprecedented funding boom, a record 44 Indian startups turned unicorns in 2021. The stay-at-home mandates amid the pandemic gave a boost to digitisation in the country, and investors pumped in over $42 Bn in Indian tech startups during the year.

Download Annual Funding Report 2022The unicorn momentum continued in 2022 as well, with 13 Indian startups entering the unicorn club in the first three months of the year as against eight in the first four months of 2021. It seemed as if nothing could go wrong for the Indian startup ecosystem. However, the world then began to feel the economic impact of the Russia-Ukraine war. Rising inflationary pressure and fears of a looming recession turned investors cautious across the world and a dark funding winter engulfed the Indian startup ecosystem.

Consequently, the funding raised by Indian startups fell sharply in 2022. The Indian startup ecosystem raised only $24 Bn in 2022 till November as against $42 Bn raised in the entire 2021. As a result, the number of startups which turned unicorns fell 50% year-on-year to 21 in 2022.

Decoding India’s Unicorn Club Of 2022

Before we move to the different trends around what India’s unicorn looks like, let’s first take a look at some unique yet interesting points about the unicorns of 2022:

- In the month of January, 21-year-old SaaS startup Fractal.ai became unicorn after raising $360 Mn from TPG

- Bengaluru-based neobanking startup Open became the country’s 100th unicorn after it raised $50 Mn from IIFL in May

- PhysicsWallah became the first profitable Indian edtech startup to turn unicorn

- Two Indian startups turned unicorn with their Series A round of investment – PhysicsWallah and Oxyzo

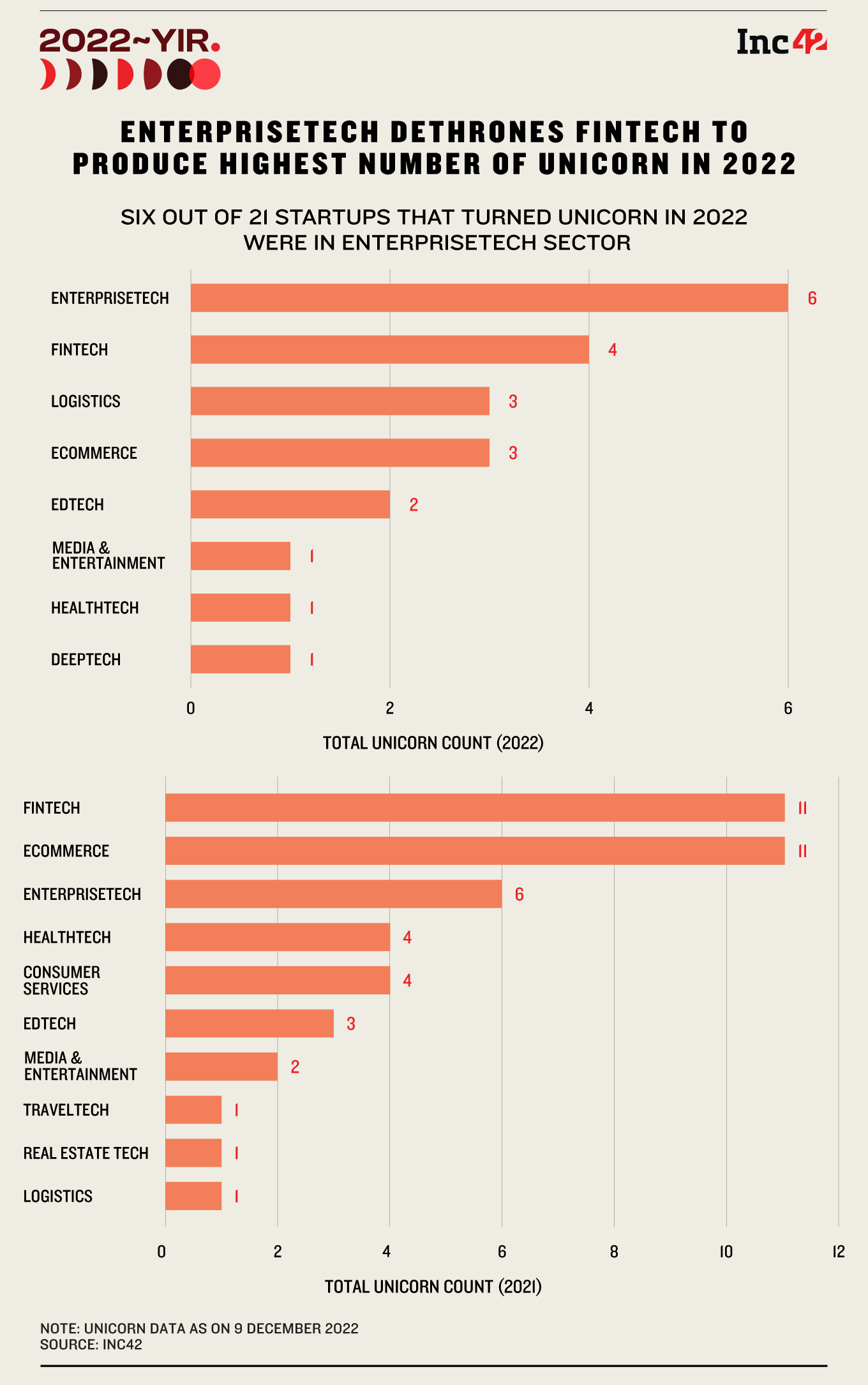

Enterprisetech Dethrones Fintech To Emerge The Top Unicorn Producer

The enterprisetech sector produced the highest number of unicorns in 2022. Six startups from the sector turned unicorns during the year, which was 29% of the total startups entering the unicorn club in 2022.

The increasing digitisation post the pandemic seems to have made investors turn their focus to the enterprisetech sector. Amagi, Darwin Box, Fractal, Hasura, LeadSquared, and Uniphore were the six startups from the sector which turned unicorn.

In 2021, fintech and ecommerce produced the highest number of unicorns (11 each). Together, they produced 52% of the total unicorns in the year. However, the tables turned in 2022 as the fintech sector came under the regulatory gaze of the Reserve Bank of India, while the cash-guzzling ecommerce sector saw many startups shutting down verticals to cut expenses.

According to an Inc42 analysis, the enterprisetech sector garnered $8 Bn in total funding during January-November 2022, while the fintech and ecommerce sector raised just $4.3 Bn and $3.8 Bn, respectively, during this time. Consequently, the number of startups from the fintech sector entering the unicorn club declined to just four in 2022, while the count was at three for the ecommerce sector.

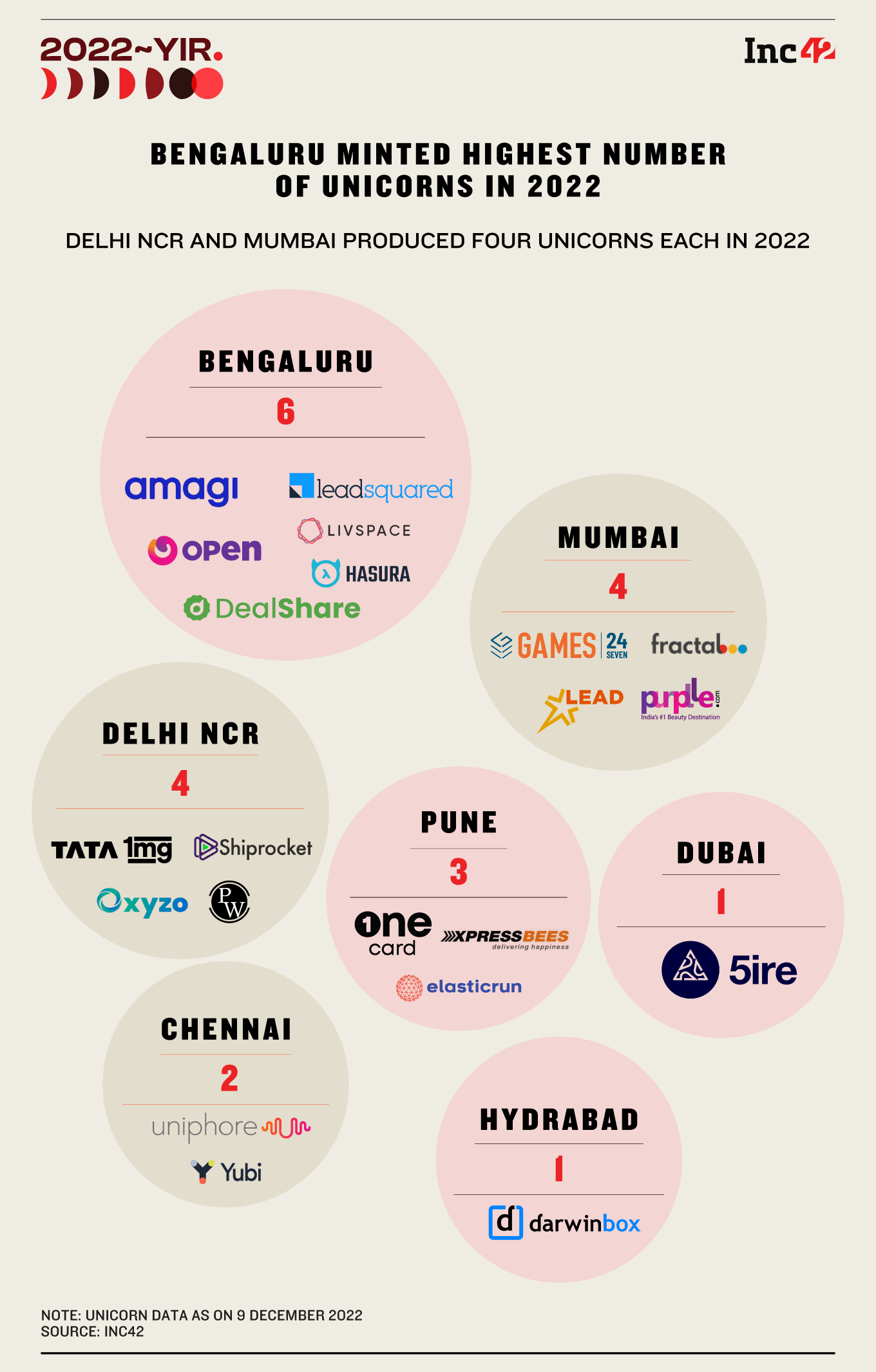

Bengaluru Again Tops Unicorn List

Bengaluru, just like last year, topped the charts when it came to producing the highest number of unicorns. The startup hub of India produced six unicorns this year, translating to 29% of the total number of unicorns produced. Amagi, Hasura, Leadsquared, LivSpace, and Open were the startups from Karnataka’s capital which turned unicorns in 2022.

Delhi NCR and Mumbai were tied at the second spot, having produced four unicorns each.

While the Delhi NCR region saw Tata 1Mg, Oxyzo, PhysicsWallah, and Shiprocket cross the $1 Bn valuation mark, Mumbai witnessed Fractal, Games 24×7, Lead School, and Purplle turn unicorns.

Besides, more startups with female founders-led turned unicorns this year compared to 2021. Seven startups founded by eight female founders turned unicorns in 2022 as against six such startups in 2021.

5Fire, LivSpace, Lead, Hasura, Amagi, Open, and Oxyzo were the seven startups with female founders to enter the unicorn club in 2022.

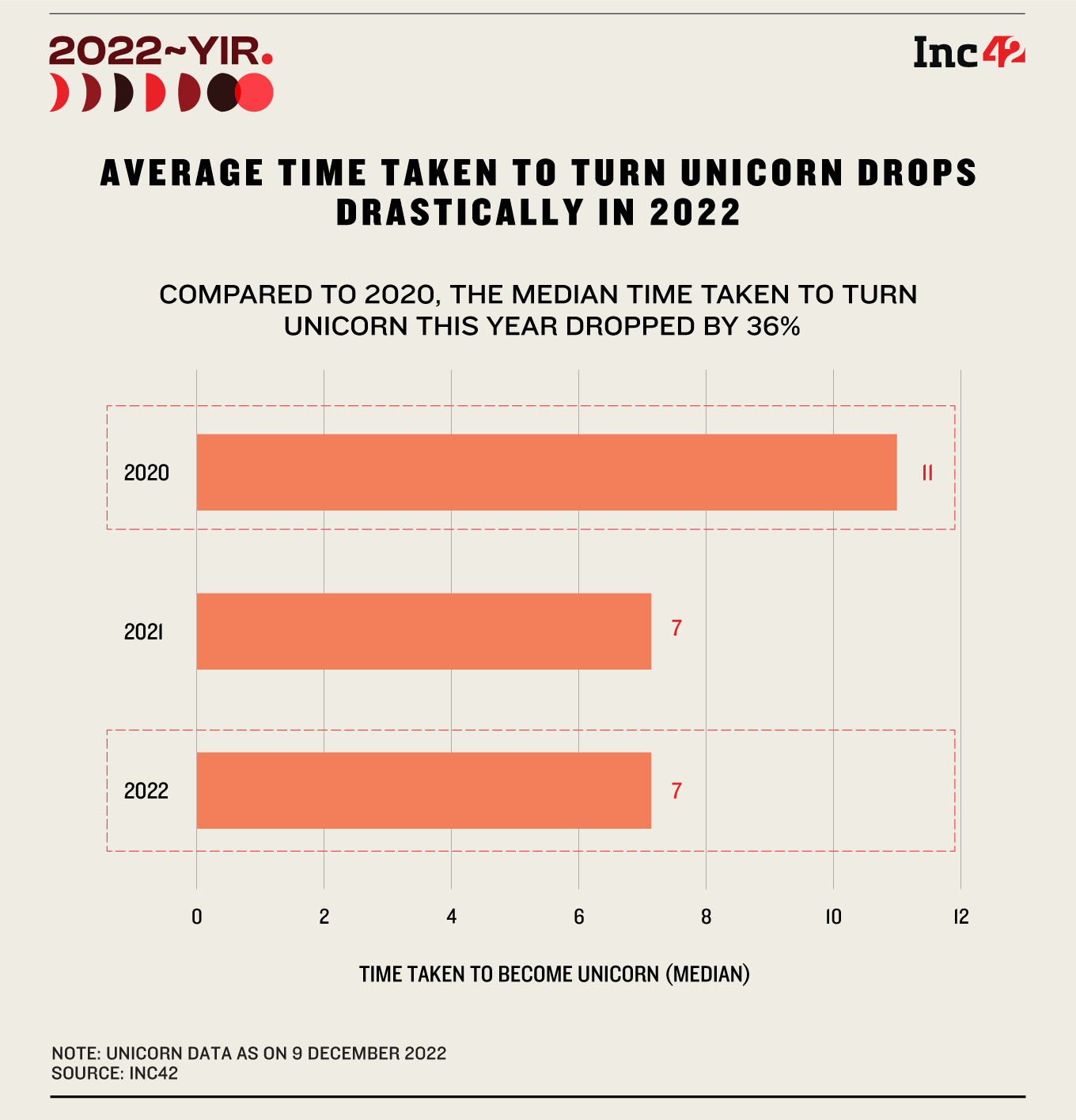

Still, Indian Startups Take 7 Years To Turn Unicorns

Despite the fall in the number of startups turning into unicorns in 2022, the time taken by the startups to enter the unicorn club remained flat. As per Inc42 data, the median time taken to cross the $1 Bn valuation mark declined to 7 years in 2021 and 2022 from 11 years in 2020.

In fact, some of the startups turned unicorn within a year of incorporation. For example, Mensa Brands, turned unicorn within six months of incorporation in 2021. Globalbees, backed by FirstCry and SoftBank, turned unicorn within 7 months of beginning its operations. Meanwhile, startups such as Apna and Ola Electric achieved the unicorn status in two years after their incorporation.

Will Valuations Take Further Hit?

If 2021 was all about startups turning unicorns at sky-high valuations, 2022 was about the startup ecosystem getting a reality check amidst the funding winter and fears of recession. The public market was even more unsparing as the listed startups got a hammering on the stock exchanges.

For instance, Vijay Shekhar Sharma-led Paytm, which went public eyeing a valuation of $18 Bn valuation, is currently valued at just $4 Bn. The market capitalisation of Deepinder Goyal-led Zomato, which went public last year at a valuation of $12 Bn, currently stands at $6.4 Bn.

Things are grim in the private market as well. As per media reports, PharmEasy may raise a new round of investment at a 50% valuation cut. Meanwhile, Ritesh Agarwal-led OYO’s prime backer SoftBank cut the hospitality unicorn’s valuation on its books by 20% to $2.7 Bn from $3.4 Bn.

With market experts predicting the current downturn to last for at least another six months and the fears of an upcoming recession still lingering, the valuations of many startups are expected to fall to “reasonable levels” in 2023. Cautious investors are also not expected to take big bets, thus bringing down the size of the deals.

A deal size of $100 Mn and above is crucial for startups to enter the unicorn club. However, as per an Inc42 analysis, the year 2022 saw only 45 mega deals (with a combined value of $11.6 Bn) as compared to 90 mega deals (with a combined value of of $28 Bn) in 2021.

Besides, the participation of large global tech investors such as Tiger Global and SoftBank in mega deals also fell sharply. While Tiger Global’s mega deal count dropped 73% to 7 in 2022 from 26 in 2021, Masayoshi Son’s SoftBank was part of just two mega deals in 2022 as against 14 in 2021.

The trend is expected to continue in 2023 as investors look for safer bets in growth-stage startups rather than late-stage startups.

Crystal-Gazing Into 2023

While there seems to be a consensus about the current funding crunch lasting till June 2023, many experts believe that the second half of 2023 would be much better for the Indian startup ecosystem. As such, it won’t be a surprise if there is a sudden burst of unicorns in H2 2023. There is a precedent for this as well. After producing just 14 unicorns in the first half of 2021, the Indian startup ecosystem saw 30 startups turning unicorns in the second half of the year.

While sectors like enterprisetech, SaaS, fintech and ecommerce are expected to be investors’ favourites in 2023 as well and may produce unicorns, startups from emerging sectors like agritech, cleantech, and spacetech may also cross the billion-dollar valuation mark.

In the agritech sector, startups such as DeHaat, Waycool, and Ninjacart are almost on the verge of crossing the $1 Bn valuation mark. Meanwhile, the electric vehicles (EVs) sub-sector under the cleantech category has also been garnering a lot of interest from the investors as the adoption of EVs is on a rise in the country. While Ola Electric is already a unicorn, its competitor Ather Energy may be the next in line to join the unicorn club.

Spacetech is another sector which has been grabbing eyeballs over the last couple of years or so. In November, Hyderabad-based Skyroot Aerospace became the first private Indian company to launch a rocket into space. The startup successfully launched its Vikram-S rocket from the Satish Dhawan Space Centre in Sriharikota.

On the other hand, Agnikul Cosmos, another Indian spacetech startup, has built its own launchpad and mission control centre at Satish Dhawan Space Centre in Sriharikota. Achievements like this have resulted in spacetech startups drawing big cheques from investors. While Agnikul Cosmos is in talks to raise a $40 Mn round, Skyroot Aerospace has already raised $51 Mn in a round led by Singapore’s GIC this year.

While only time will tell if the funding situation improves in 2023, the Indian startup ecosystem will be hoping for it to normalise at least in the second half of the year, if not in the first, so that it can get back to producing unicorns like in 2021.

Download Annual Funding Report 2022