According to Inc42, the volume of large deals declined 50% year-on-year to 45 until November 2022 from 90 deals in 2021

Not a single billion dollar cheque was issued in the favour of Indian startups in 2022

The largest dealmakers of 2021, SoftBank and Tiger Global, refrained from mega deals, worth $100 Mn or more, in 2022

After concluding a remarkable 2021, the current year, 2022, remained a drag for Indian startups in terms of attracting large investments. This was because the markets across the world remained highly volatile, triggered by the ongoing war between Ukraine and Russia.

Further, as tech stocks plunged to their record lows towards the second half of 2022 and global investors sounded alarm, large funding rounds received a big blow. According to Inc42 analysis, the volume of large deals, worth $100 Mn and above, declined 50% year-on-year (YOY) to 45 until November 2022 from 90 deals in 2021.

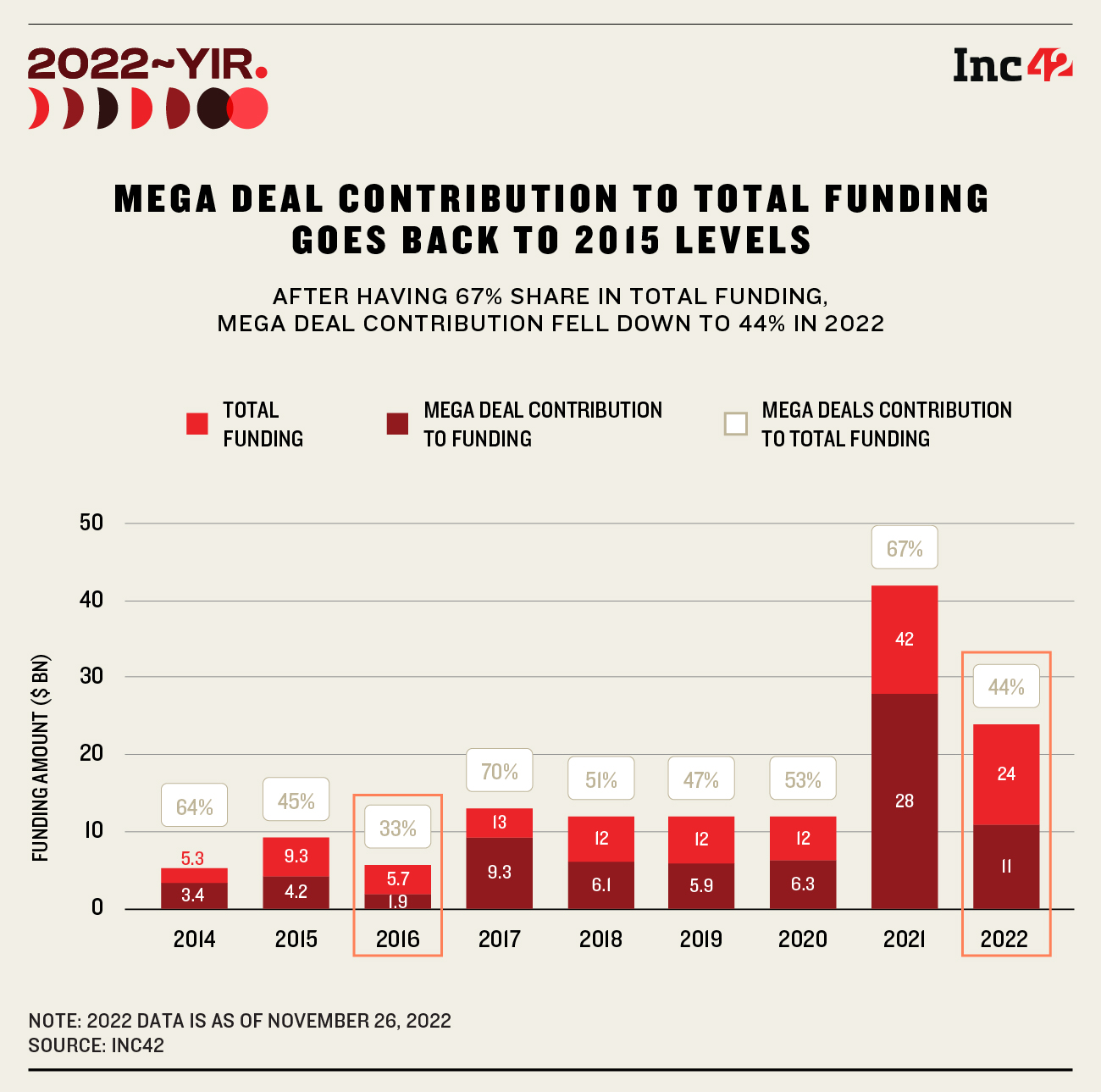

Meanwhile, total mega deals across the startup ecosystem in 2022 nosedived as much as 58% to $11.6 Bn in 2022 against $28 Bn in 2021. The share of mega deals to the overall investments pumped into Indian startups stood at 44% in 2022 compared to 67% last year.

Download Annual Funding Report 2022Large global tech investors such as SoftBank and Tiger Global remained cautious this year and participated in fewer mega deals compared to the last year, our estimates suggest. In their quarterly reports earlier this year, both the investment majors announced that they would not participate in bigger rounds, and one can only see their participation in Series A or B rounds.

The funding crunch, however, wasn’t just restricted to India. In the face of a struggling macroeconomy, global investment sentiments remained weak in nations such as China, the UK and the US, which, too, did not see a lot of action around big fundraising activities.

The growing geopolitical tensions between Europe and Russia at the outset of 2022 and the reports of a looming recession in the US reiterated the focus on profitability and returns against the investments made in 2021.

According to experts, in India, venture capitalists (VCs) resisted writing big cheques due to a falling rupee against the dollar, the plight of tech stocks and ballooning startup losses. This trend could be seen in the first few months of 2023 as well, experts said.

Amid a dearth of big investments, growth to late stage startups (including unicorns) had to resort to cost-cutting measures, thereby reducing marketing and operational spends, shutting down loss-making business units and laying off human capital.

Mega Deal Drought Leaves Startups High & Dry

There seems to be a marked difference in the trends of mega deals this year when it comes to the deal sizes and the sectors that drew major investments.

For instance: In 2020 and 2021, fintech, edtech, and ecommerce garnered much of investors’ attention, giving birth to many unicorns with fairly large deal sizes.

According to Inc42’s estimates, media and entertainment, deeptech, Software-as-a -Service (SaaS), edtech, logistics and fintech bagged the biggest investments in 2022.

However, unfortunately, there wasn’t a single billion dollar cheque signed for any startup in 2022. Josh and Daily Hunt’s parent VerSe Innovation’s $805 Mn funding round, raised from Canada Pension Plan Investment Board, Ontario Teacher’s Pension Plan Board, Luxor Capital and Sumeru Ventures, made the biggest mega deal of 2022.

This was followed by edtech giant BYJU’S $800 Mn funding from founder Byju Raveendran, Vitruvian Partners, BlackRock, and Sumeru Ventures.

For the top 10 mega deals of the year, the average ticket size stood at $473.5 Mn. Some of the notable names that made it to the top 10 funding rounds were startups such as Ethereum scaling platform Polygon; SaaS firm Fractal Analysis; and logistics firm XpressBees, amongst others.

For some of the IPO-bound startups, where the earliest investors were looking at an exit, the plans for public listing were either delayed or are still awaiting a nod from market regulator SEBI. As per media reports, these startups, including Ola, OYO, and BYJU’S, were looking to raise big money but failed to secure any after investors shifted their focus on profitability from doubling their bets.

“This year, India added 21 unicorns to its club as compared to 42 last year, indicating a slowdown due to the funding winter. This can be undoubtedly attributed to the global macroeconomic conditions and the fears of a global recession. “Further, there has been a rate hike in developed markets, causing a retreat of global capital from illiquid and exotic assets such as startups,” said Sagar Agarwal, cofounder and MD of Beams Fintech Fund.

“Indian Venture Capital and private equity investors experienced a good run with IPOs but several other companies with high valuations performed poorly after listing. These conditions, in turn, impacted the funding environment, making it difficult for startups to obtain a high valuation to attract investments,” Agarwal added.

SoftBank, Tiger Global Take A Defensive Stance

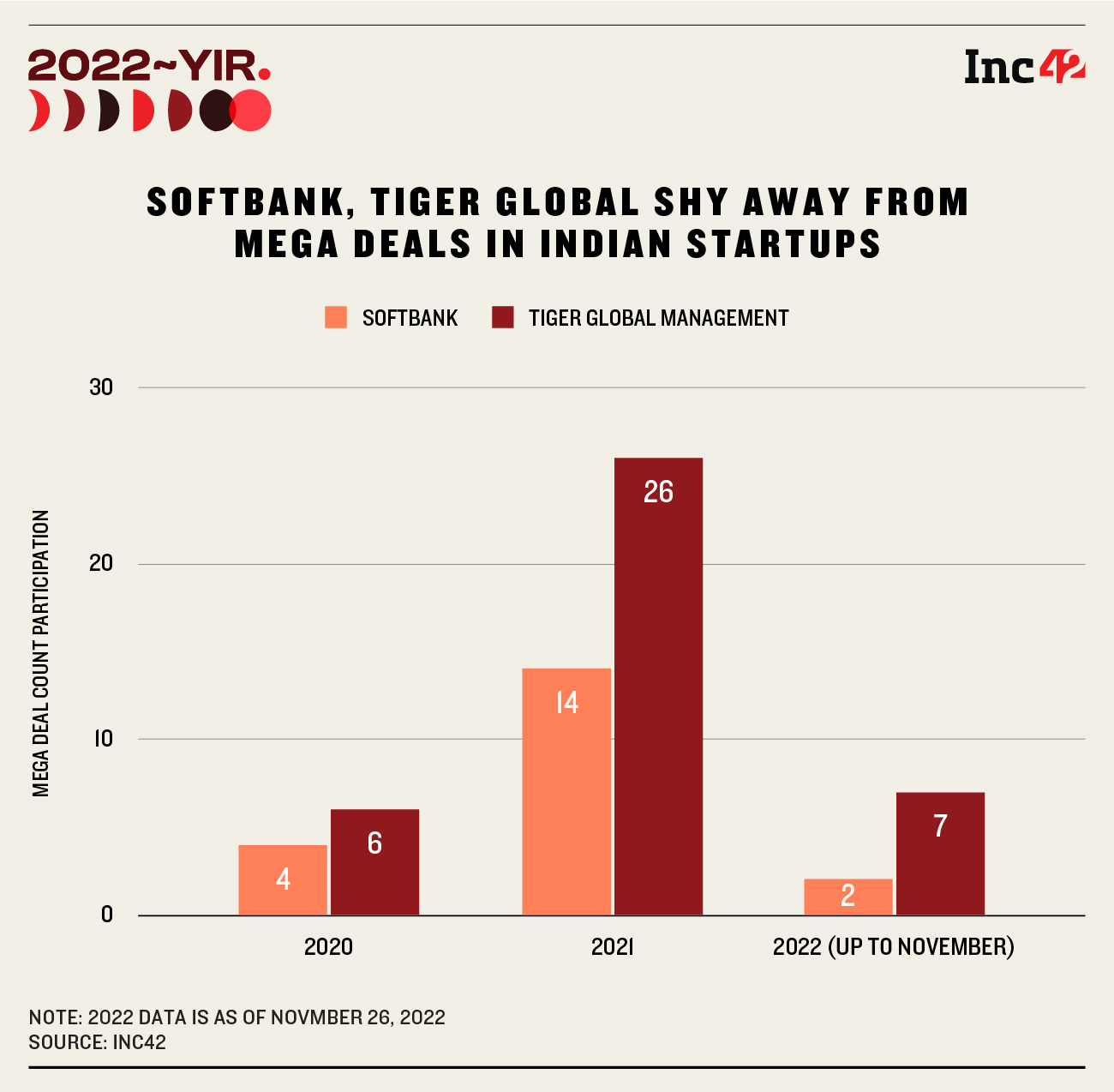

The contribution of Japanese tech investment major SoftBank and New York-based hedge fund Tiger Global to the Indian startup growth story has been phenomenal. Inc42’s analysis suggests that since 2014 these two global investors have participated in roughly one out of every three mega deals (30%) in Indian startups.

Tracking SoftBank’s and Tiger Global’s investment journey since 2020, Inc42’s estimates indicate that in 2021 the two global investors were very active in India. While SoftBank invested in 14 large rounds in 2021 compared to just 4 in 2020, Tiger Global participated in 26 mega deals across the startup ecosystem versus 4 such rounds in 2020.

However, in 2022, the two dealmakers were seen practising refrain when it comes to big ticket investments in India. Further, there was a rapid decline in terms of deal volume and value for the two biggest investors, SoftBank and Tiger Global. In 2022, SoftBank invested in two mega deals, whereas Tiger Global participated in seven big fundraises, a significant decline on a YOY basis.

The two investors have lately slashed valuations of their portfolio companies globally, including the new-age Indian firms, after tech stocks tumbled this year due to the volatility in capital markets. The correction in the valuations of portfolio companies have come at a time when a few among them were headed for IPOs.

As the fears of a looming recession and inflation continue, SoftBank’s founder Masayoshi Son, who recently stepped away from the investment firm to focus on an allied chip business, Arm, said, “Inflation isn’t going to be controlled any time soon, and it’s going to be tough even for listed firms, much less unlisted ones. We have to tighten our defence.”

In an earlier letter to its investors, Tiger Global blamed inflation as the losses continued to pile up in the first half of 2022. “Our portfolio composition and exposure levels were not well suited for the volatilities that followed,” Tiger Global said, though it intended to continue to increase ownership in the best companies at what it saw as interesting prices,” the hedge fund’s letter to investors said, according to Reuters.

Is The Worst Yet To Come?

If the take of analysts, quarterly reports of VC firms or public statements of company founders are to be believed, the funding winter in the startup ecosystem has only started. Edtech unicorn Unacademy’s founder Gaurav Munjal, for instance, has been very vocal when it comes to the ongoing funding crunch and the resultant cost-cutting measures that are being adopted by Indian startups.

Listing out steps for fellow founders to adopt in this prolonged funding winter, Munjal took to Twitter several times this year. In one of his tweets, the CEO of Unacademy said that 2023 will be worse for tech than 2022.

“The funding winter seems to be a prolonged one and would probably extend for a better part of 2023, as the global market corrects itself further in the rising interest rate environment. Certain sectors, which predominantly focus on being profitable, wouldn’t face the impact of the funding winter as investors would be picky in deploying their ‘Patient Capital’ in the market,” said Umesh Uttamchandani, cofounder and chief growth officer, DevX Venture Fund.

Sequoia, which has been an all-weather friend for Indian startups, had earlier warned the founders of its portfolio companies to not expect a fast V-shaped recovery in the current downturn.

“We do not believe that this is going to be another steep correction followed by an equally swift V-shaped recovery like we saw at the outset of the pandemic,” Sequoia said during an investors meet earlier this year.

The warning bell comes on the back of the tightening monetary policies by central banks across the world to make capital costlier and increased interest rates. This, as per the VC firm, will impact consumer demand, labour markets and supply chain costs.

A US-based early stage startup accelerator, Y Combinator, also issued a list of advisories to backed founders on how to ensure that their startups stay afloat in the roiling waters of a global downturn.

As a cost-cutting measure, Indian startups have till date laid off over 18,000 employees, as per the Inc42 layoffs tracker. The funding value, on the other hand, has also constantly declined since the start of 2022. After lapping up $4.6 Bn in January, Indian startups could only raise $1.1 Bn in November, down 73% as compared to $4.1 Bn in November 2021.

Our estimates indicate that the total funding in startups halved to $24 Bn until November 2022 compared to $42 Bn last year.

The startup funding, henceforth, is not likely to see any imminent pause, especially for early stage ventures. However, when it comes to late stage or big startups, their founders cannot afford to loosen the purse strings for at least several quarters ahead. In this situation, they will only have to wait for the global economy to get back on track and investors’ sentiments to revive.

Download Annual Funding Report 2022

Ad-lite browsing experience

Ad-lite browsing experience