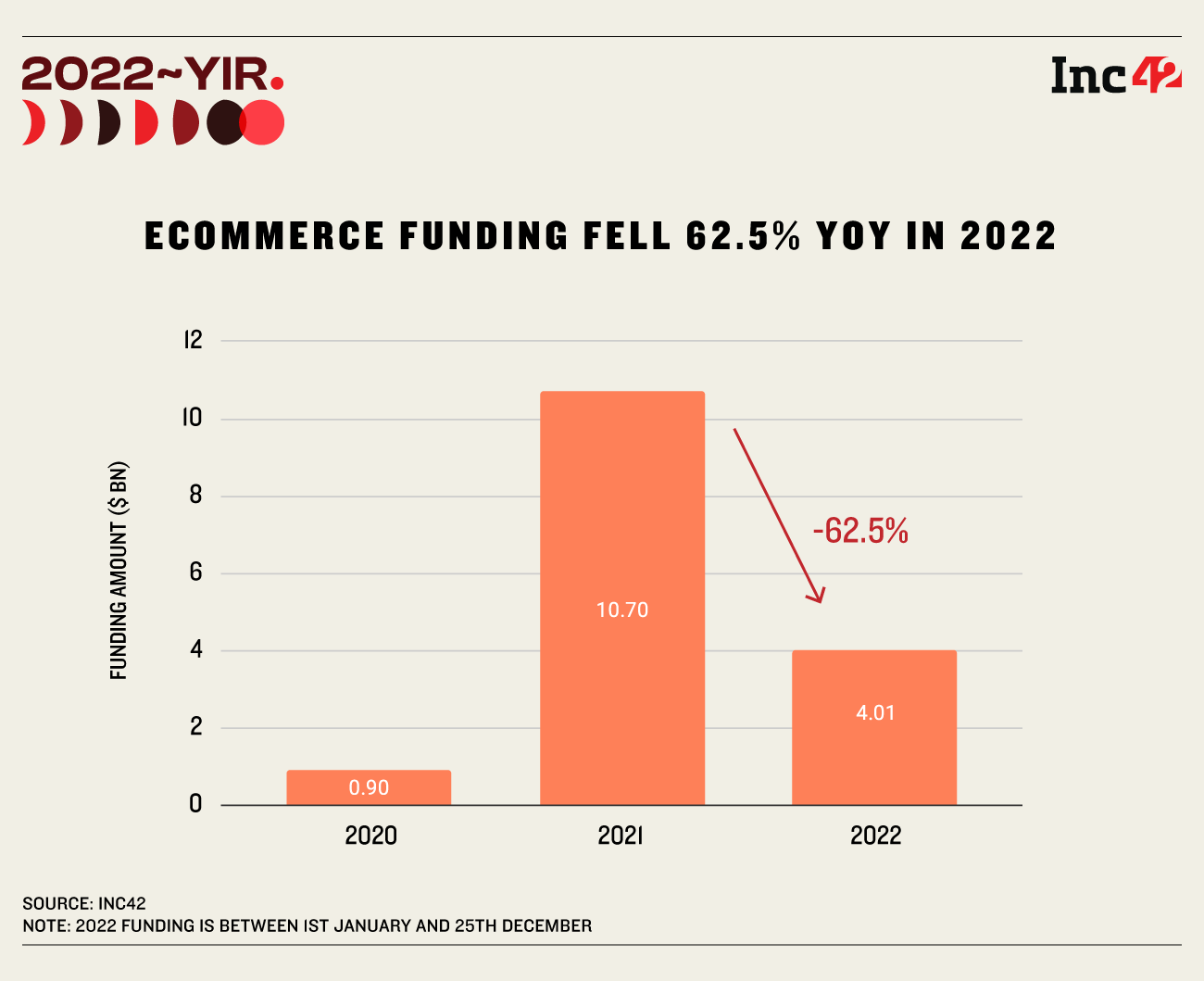

Indian ecommerce startups could raise only $4.01 Bn, compared to $10.7 Bn in 2021

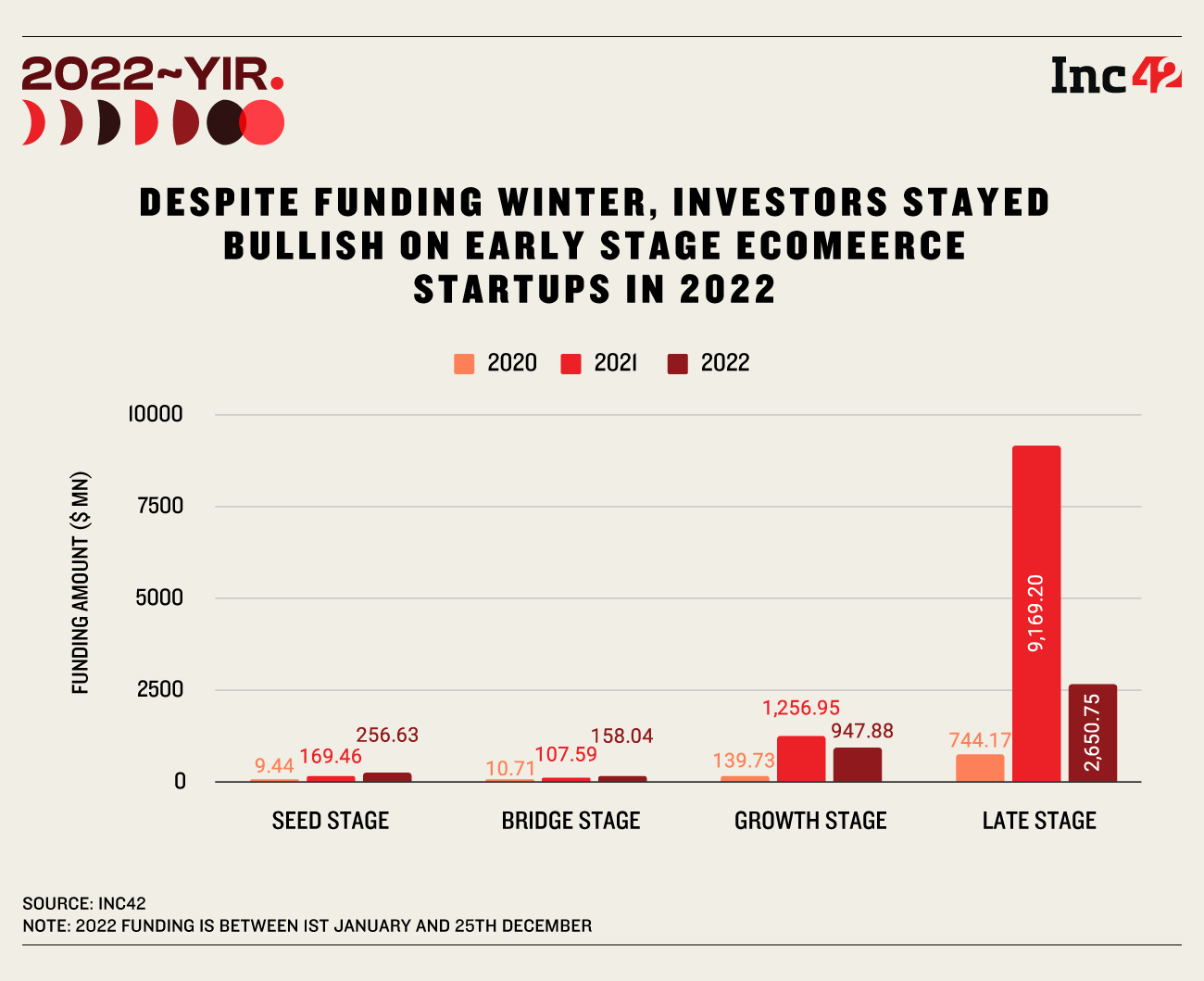

While late-stage funding in the ecommerce sector nosedived 71% YoY to $2.65 Bn in 2022, growth-stage funding was down 25% to $947.88 from $1.25 Bn raised a year ago

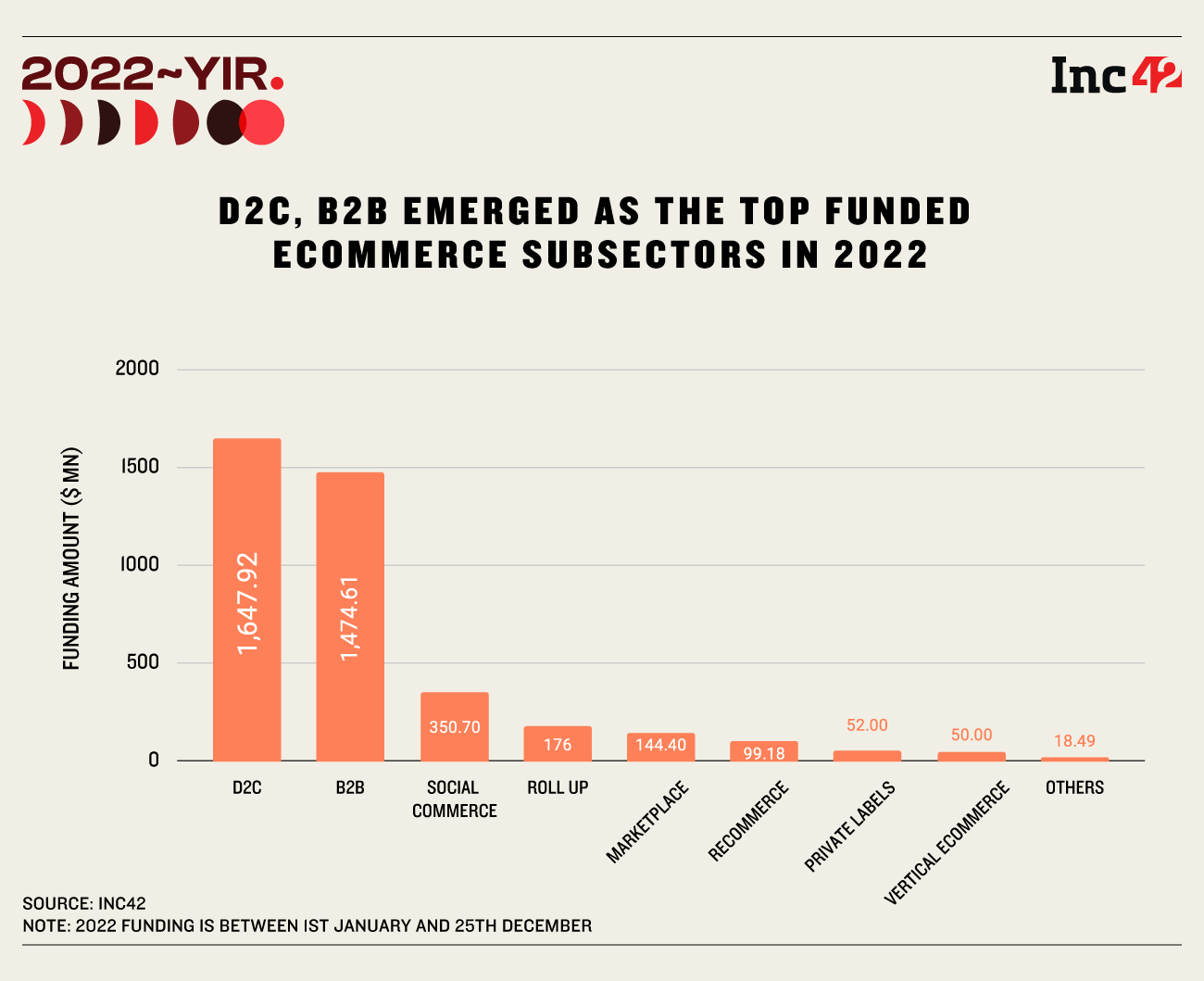

D2C and B2B emerged as two of the biggest subsectors, having raised $1.65 Bn and $1.47 Bn in 2022, respectively

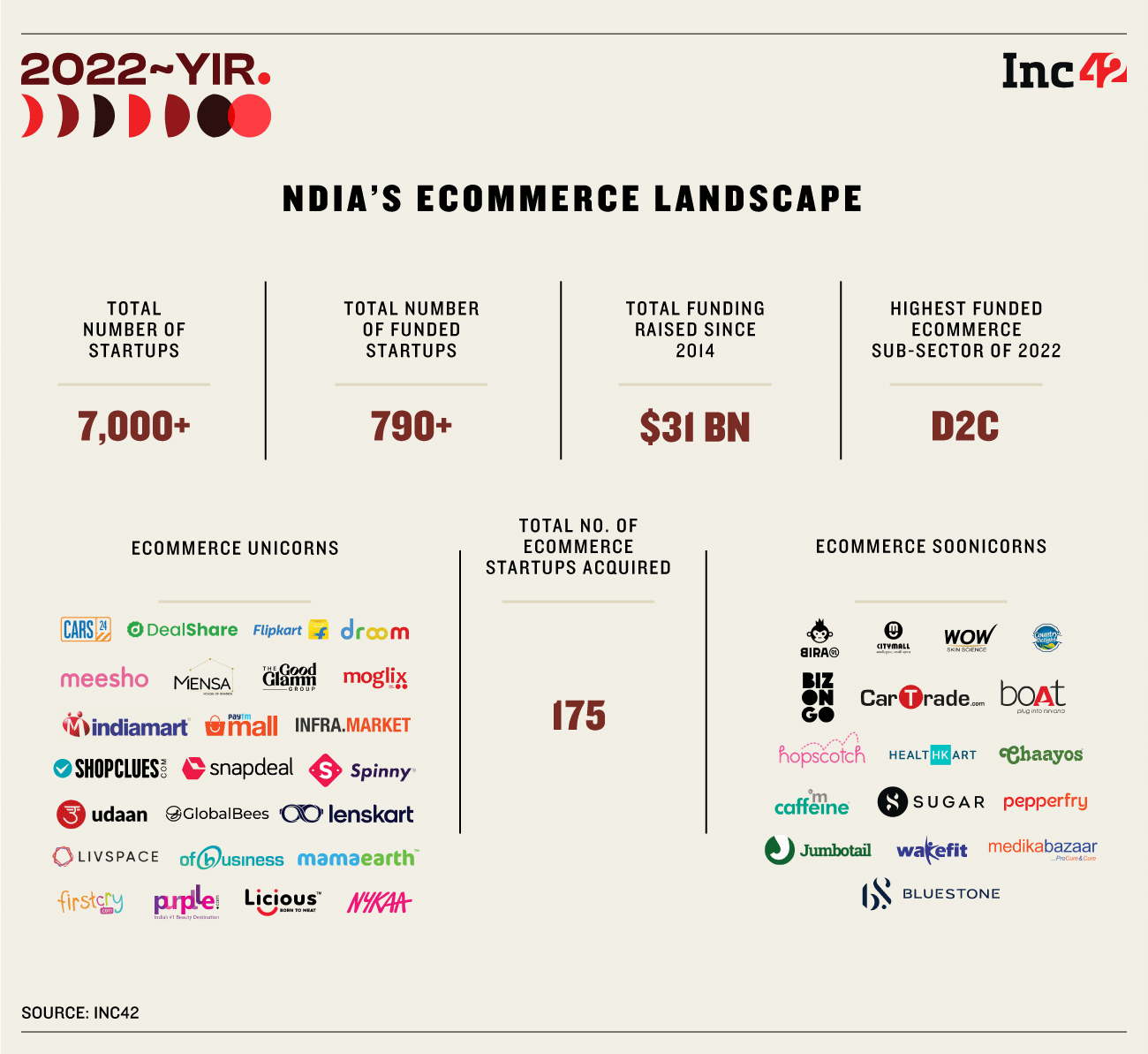

With more than 790 funded startups operating across the country, the maximum number of unicorns and funding deals, the ecommerce segment is definitely one of the strongest pillars of the Indian startup ecosystem.

According to Inc42’s ‘Indian Tech Startup Funding Report, 2022’, India is set to have more than 1.3 Bn internet users by the turn of the decade, of which 500 Mn would be ecommerce users.

Despite the luring projections and the country being the largest ecommerce market in the world, after China, the segment could not escape the funding lull of 2022. It remained at the forefront of investors’ neglect to infuse money into the country’s burgeoning startup space.

Compared to edtech, healthtech, fintech, consumer internet, and media and entertainment, which registered a 40-45% YoY fall in funding, the ecommerce sector was down 62.5% YoY in 2022.

Before we go any further, it is pertinent to note that between 2014 and 2022, Indian ecommerce startups raised $31 Bn in funding across more than 1.4K deals, making it the most-funded segment in the country’s startup ecosystem. The sector saw a funding inflow to the tune of $10.7 Bn in 2021, more than 30% of the total amount secured by the sector between 2014 and 2022.

Then came the funding winter of 2022, and the cash-starved startup ecosystem had to make do with whatever was available, as investors tightened their purse strings.

As a result, the ecommerce sector registered a 62.5% year-on-year (YoY) fall in funding and could only raise only $4.01 Bn in 2022.

Further, there was a major shift in investor sentiments in terms of funding across various startup stages. While late-stage funding in the ecommerce sector nosedived 71% YoY to $2.65 Bn in 2022, growth-stage funding was down 25% to $947.88 from $1.25 Bn raised a year ago.

Interestingly, seed funding rose 1.5X in 2022 – from $169.46 Mn in 2021 to $256.33 Mn last year – representing a reinforced stress on early-stage ecommerce startups from investors.

Within ecommerce, D2C and B2B emerged as two of the biggest subsectors, having raised $1.65 Bn and $1.47 Bn in 2022, respectively. Others in the top subsectors included social commerce, rollups, marketplace, and recommerce.

Surprisingly, D2C was the only subsector, which recorded a rise in funding in 2022 compared to 2021. The subsector, with the likes of Mamaearth, boAt and others, saw startups lap up $1.65 Bn in 2022, up 2.16X compared to $760.75 Mn raised in 2021.

However, fortunes failed to favour the remaining subsectors, which registered a fall in funding compared to 2021.

Driven by mega funding rounds raised by Flipkart, Meesho and others, marketplace emerged as the biggest subsector in 2021, as it accounted for $4.46 Bn of the total funding raised in 2021. Unfortunately, the marketplace subsector could only raise

$144 Mn last year, representing a YoY decline of nearly 97%.

Recommerce and vertical commerce were also among the sectors, which registered more than a 90% YoY decline in funding. The two sectors could only raise $99 Mn and $50 Mn, respectively, last year.

2022: The Year of Transition?

Undoubtedly, 2022 will be remembered as a year when investors returned to their shells, and, of course, everything that happened as a result – layoffs, shutdowns, and consolidations.

For ecommerce, however, it was a transitional year – the one which reiterated the importance of having strong business fundamentals, positive unit economics, and a clear path to profitability.

As investor funding declined, many ecommerce players realised they were walking on a tightrope by depending on external funding or runways, which forced them to cut costs. Interestingly, while the marketing costs stayed up to attract more customers, many livelihoods were sacrificed.

Since the beginning of 2022, as many as 10 ecommerce startups have laid off a total of 2,606 employees, according to Inc42 Layoff Tracker.

Surprisingly, not everything was gloomy. Ecommerce startups had a strong 2022 from a sales point of view, especially during the festive season.

According to a report by Redseer, ecommerce companies operating in India recorded $5.7 Bn worth of sales during the first week of last year’s festive season.

Further, throughout the festive season, the likes of Flipkart and Meesho surpassed traditional players such as Amazon, Tata and Reliance in terms of the number of orders received.

In 2021, India’s ecommerce startups could only record $4.6 Bn in gross merchandise value (GMV) during the first week of the festive season. The same stood at $3.7 Bn in 2020, according to Redseer.

However, the average user spend remained stagnant in 2022 at INR 5,200 per shopper, compared to 2020 and 2021 – although this was 41% and 30% lower than pre-Covid levels of 2018 and 2019, respectively.

According to the report, the festive week saw 75-80 Mn shoppers in India, up 24% compared to 2021’s festive week.

Meanwhile, in sync with last year’s ecommerce wave was an increased stress on customer satisfaction, which paved the way for quick commerce startups and the likes of Zomato, Swiggy, Blinkit, Zepto and others getting on the quick commerce bandwagon.

Another development concerning all aspects of ecommerce in India was the launch of the government’s ambitious digital commerce project, the Open Network for Digital Commerce (ONDC).

To enable smaller businesses to sell their goods and services more efficiently online, the network uses an open-network methodology that is not limited to a single platform. The ONDC acts as a platform with a buyer app on the customer’s end and a seller app on the seller’s end, thus creating a value chain.

The government has much in store for the ONDC. Within the next two years, the ONDC plans to have 900 Mn buyers and 1.2 Mn sellers on the network and achieve a gross merchandise value (GMV) of $48 Bn.

Although the digital commerce project has already been piloted in Delhi, Bengaluru, and Meerut, the initial response has been lukewarm, with several operational challenges haunting it.

Is There Light At The End Of The Tunnel?

Ecommerce startups could learn a lot from 2022, and some of the most important lessons to consider going further are related to achieving profitability, making operations leaner, and keeping spending under control.

According to industry experts, 2023 will continue to witness innovation in marketing and customer experience. Overall, ecommerce businesses will look to adopt sustainable growth strategies instead of growth at all costs. They believe that the next ecommerce wave is set to come from the smaller cities and towns of India.

Further, experts anticipate that the ONDC will also play a key role in driving the localisation of ecommerce in 2023, as more and more local brands and stores will join the government’s ambitious digital commerce project.

Overall, the next few years will be about realising the maximum potential of ecommerce, expanding into smaller towns and rural areas of the country and building for the upcoming wave of ecommerce users.

Ad-lite browsing experience

Ad-lite browsing experience