From the beacon of the edtech sector, K-12 startups are now fast turning into a wasteland amid a fund crunch, reopening of schools and business model transitions

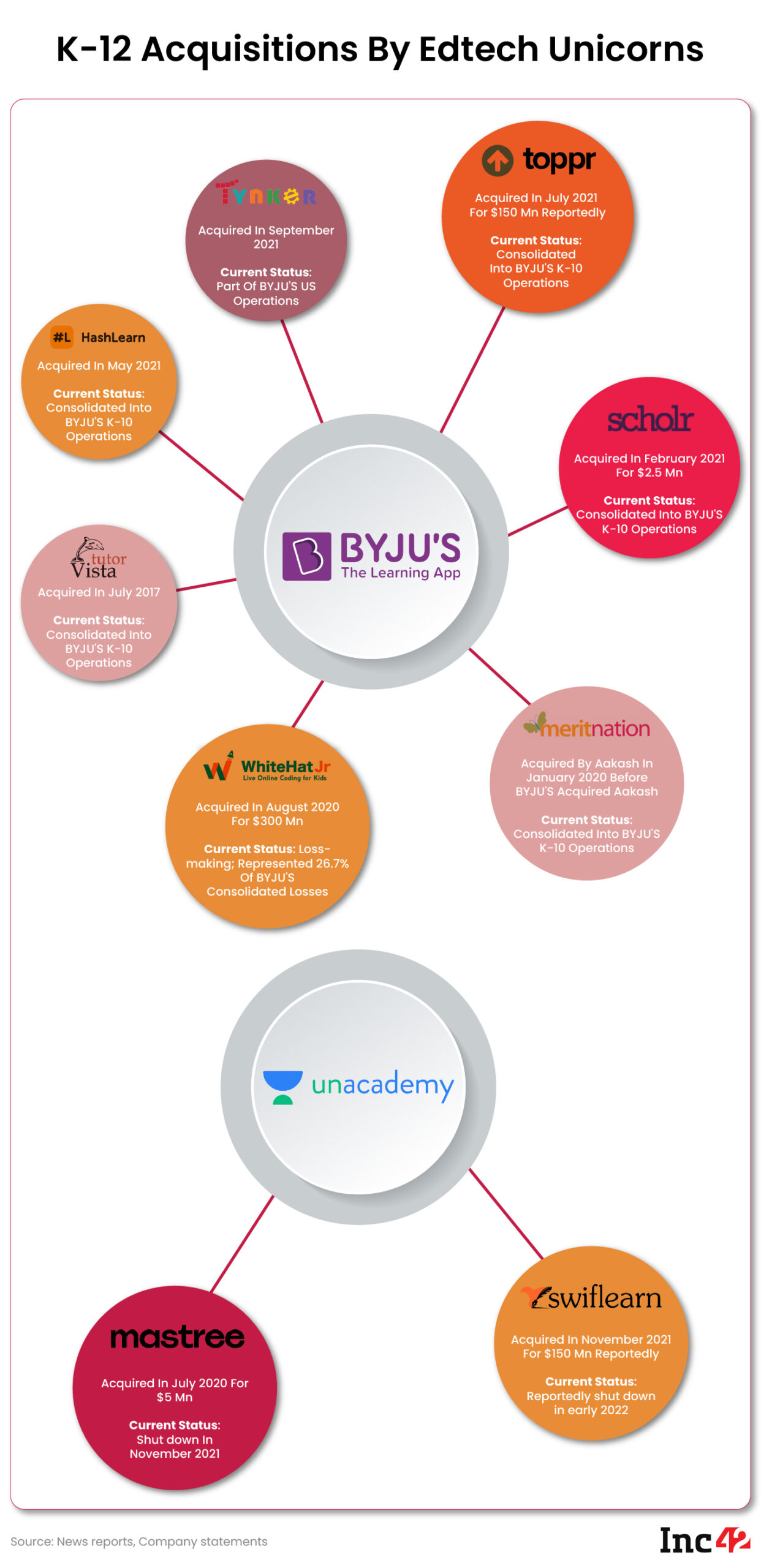

BYJU’S, which laid off 2,500 employees this week, is consolidating its K-10 operations, while Unacademy has pulled out of the segment after two acquisitions

Downturn-hit K-12 startups are now moving to cohort-based extracurricular learning, soft skills training and skills coaching to move beyond school-centric courses

When edtech found its feet in India in the early 2010s, it was all about supplementing school or K-12 education. And there’s little doubt that BYJU’S was at the heart of it from the very beginning.

Everyone knows the BYJU’S story by now — how Byju Raveendran used his own celebrity to fill up large stadiums for live coaching, before seeing the tech opportunity in 2015, when the BYJU’S app was launched. Since then there’s been no turning back.

Seven years ago, the company was a disruptor, but today it has grown to become something of a flagship for not just edtech but also the Indian startup ecosystem.

With a valuation of close to $23 Bn, BYJU’S has raised investments from pretty much every large investor in India. But the billions raised have not yet delivered the results in terms of profitability and sustainable growth.

In 2022, after the edtech boom triggered by the pandemic, BYJU’S seems to be as shaky as it has ever been. The company announced its FY21 financials belatedly and reported record losses of nearly INR 4,600 Cr.

Even though it claims to have hit INR 10K Cr in revenue in FY22 (ending March 2022), its most recent announcement of layoffs of 2,500 employees and the consolidation of the K-10 business signals a major paradigm shift in the edtech sector.

From the beacon of the edtech sector, K-12 startups are now fast turning into a wasteland amid a fund crunch and reopening of schools. And the focus has shifted to test prep as a growth area as well as skill development. So what exactly happened in the past two years that led to K-12 becoming something of a wasteland in the edtech world?

The Pre-Covid Picture

More than two years ago, just a day after all of India went into lockdown on March 26, 2020, we published the ‘periodic table of edtech’ highlighting some of the major startups in India at the time. You can view it here and click through to see the startups that existed back then.

We say back then because two and half years later, this periodic table is more or less decimated. Companies such as MadRat Games have since shut shop, while Toppr, Meritnation, WhiteHat Jr were acquired by BYJU’S. Another startup Genext VEMS was acquired by education major Navneet in September last year.

The acquisition has not gone very well for Toppr or Meritnation (acquired via the Aakash deal). Both have now essentially been consolidated in BYJU’S most recent layoffs of 2,500 employees. Plus, BYJU’S cofounder and CEO Byju Raveendran called WhiteHat Jr the underperformer of BYJU’S lineup in an earlier interaction with Inc42.

Delhi-NCR-based Lido Learning, which missed out on our periodic table narrowly, has shut down and filed for insolvency, in addition to Udayy and SuperLearn.

As for layoffs, the number of edtech employees let go has now gone over 7,000 with BYJU’S latest downsizing.

So we have to ask whether K-12 and edtech are dead in the water in India, particularly in late 2022, when all schools and colleges have reopened.

K-12 Edtech Giants Cut To Size

The K-12 edtech bloodbath is particularly significant, given that it follows the period when startups should have been able to show the highest revenue and user growth. Our periodic table captures the picture at the beginning of the lockdown, but now after the boom, the edtech downturn looks particularly bad.

The upheaval at the top of the K-12 food chain is enough of an indicator of how bad things are right now. BYJU’S was once the only major K-12 startup in India, facing competition from relatively smaller startups such as Vedantu before Unacademy also entered the fray, thanks to a bevy of acquisitions in 2019 and 2020.

But BYJU’S is the poster child of the K-12 space as it is the highest-valued startup in India (excluding Flipkart) and the world’s highest-valued edtech startup.

To date, BYJU’S has raised more than $6.3 Bn in funding and this includes some of the world’s largest private investors and sovereign wealth funds. But after announcing a loss of INR 4,600 Cr in FY21, BYJU’S is under immense pressure to unlock profits. The company claims to have recorded a revenue of INR 10K Cr in FY22, with the core K-12 business bringing in roughly 75%, according to Raveendran.

Despite this, BYJU’S is consolidating its K-10 acquired businesses, including Toppr, Meritnation, TutorVista, HashLearn and Scholr into one business unit. This streamlining or downsizing will likely bring some measure of profitability for BYJU’S, at least at the EBITDA or contribution margin level, if not at the bottom line.

After raising nearly $840 Mn since its inception, Unacademy was best placed to benefit the most from any slip-up by BYJU’S. But the Gaurav Munjal-led company has reportedly shut down its K-12 business to focus mainly on test prep and is expanding the offline coaching class business. Unacademy has laid off more than 1,100 employees this year across its products.

Another Bengaluru-based edtech unicorn Vedantu is also struggling to gain traction as schools have reopened. It has also turned to offline learning to eke out growth.

The startup laid off more than 700 employees and restructured parts of its business, besides reducing the prices of its K-12 courses to INR 5,000 a year from INR 25,000.

It is looking to make a major offline test prep expansion with the $40 Mn acquisition of coaching chain Deeksha. Deeksha offers courses across subjects for classes 11-12 apart from test-prep services.

As most edtech companies look to reduce course pricing to acquire more users in the current downturn, the unit economics situation will worsen. As it is, the CAC is a huge cost weighing down the unit economics of many companies.

Like it was in the case of WhiteHat Jr based on what Raveendran told us. In our previous conversation, the CEO claimed that the product was still a hard sell in India. Although it is gaining traction in the US, the high CAC situation is a persistent problem.

In earlier conversations with investors, we were informed that even in the funding winter, startups with a lean acquisition strategy would attract funding. This was what test-prep startup PhysicsWallah banked on when it raised $100 Mn to enter the unicorn club in June this year.

The only other edtech startup to have raised major funding is higher education and placement-focussed upGrad, which operates in a space where education costs are always slightly higher than K-12. However, upGrad has not released its financials for FY22 and had losses of INR 211 Cr in FY21.

K-12 Startups Go Beyond School

The downturn-hit K-12 startups are now moving to cohort-based extracurricular learning, soft skills training and skills coaching to move beyond school-centric courses.

Early-stage startups like SDRO have also launched cohort-based STEM courses for spacetech, astrophysics, astronomy, artificial intelligence, satellite and helicopter development and more for kids between 7 and 14.

Even at the peak of the pandemic and edtech adoption, high screen time was a concern for parents. So, the viability of extracurricular learning startups is uncertain today when most schools have reopened and occupy a lot of a child’s day.

Ironically, the current funding winter has already claimed an extracurricular learning startup, the Matrix-backed Crejo.Fun. But that has not dampened the enthusiasm of companies with a lot more working capital on their hands right now to pursue new lines of business.

BYJU’S has also taken the plunge into celebrity classes for sports, music and other extracurricular areas for standards 4-10 students. It must be noted that Unacademy entered this space last year with Icons. Even if BYJU’S looks to make a bigger play in the extracurricular space, its core business does not align with that model. For instance, BYJU’S K-12 business is built around hardware and software sales — tablets with videos and software installed.

Besides, the celebrity edtech space did not gain as much traction as initially believed. FrontRow, for instance, laid off more than 75% of its workforce.

Profitability Or Scale?

The edtech bandwagon is at a tipping point as far as the K-12 space is concerned. It is a do-or-die situation for many, and perhaps a lesson can be learnt from how Airtel fought the telecom wars after the entry of Reliance Jio.

As Jio competed on price, Airtel zagged and shed its low-value customers. It preferred to retain those who were contributing the highest per-user revenue and upsold services to them, thereby increasing its revenue momentum.

Similarly, in the past few weeks, investors are starting to believe that BYJU’S, Unacademy, Vedantu and others need to shed scale.

As we wrote a couple of weeks ago: “Sales being the centre of operations has skewed the belief of startups that massive scale will eventually beget profits. Time to bring the focus back on education in edtech.”

These giants have reached a scale where profitability might remain elusive for many years. Supporting a scale of hundreds of millions of users requires unusually high resources. But so far, the scale of edtech giants in the K-12 space has been built around a sales-first mentality, rather than being driven by learning outcomes.

Tweaking the pricing to reach the masses may not deliver immediate profits either. So, to survive, edtech giants have to downsize. And that’s what this year has been all about.

Ad-lite browsing experience

Ad-lite browsing experience