Mukesh Ambani’s digital ambitions show no signs of slowing as Reliance has backed Dunzo in a major way.

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Mukesh Ambani’s digital ambitions show no signs of slowing as Reliance has backed quick commerce and hyperlocal delivery startup Dunzo in a major way.

The investment has been speculated for months and is the opening salvo for Reliance’s plans in 2022, which will undoubtedly hinge around adding more services before the 5G assault. More on that in a bit.

Here are two stories that caught our attention in the first week of 2022.

- ⚖️ Another Win For Future: The Delhi HC has temporarily halted Singapore International Arbitration Centre’s hearing on Amazon’s plea

- ? Almost A Trillion! UPI registered $970 Bn worth of transactions in 2021, a year-on-year rise of over 110%.

Reliance ? Dunzo

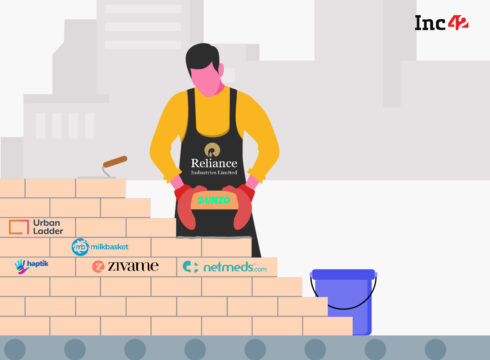

What Reliance wants, Reliance gets. After acquiring JustDial and Milkbasket last year, Reliance has now taken a big chunk of Dunzo through Reliance Retail. The company has invested $200 Mn for a 25.8% stake in the hyperlocal deliveries startup.

The investment is part of a $250 Mn round and has pushed Dunzo closer to the unicorn club with its current valuation close to $775 Mn. Dunzo will enable hyperlocal logistics for the retail stores operated by Reliance Retail. It will also facilitate last mile deliveries for JioMart’s merchant network.

✨ Ambani’s Shiny New Toy: While it’s not a full acquisition, Reliance’s investment is seen as a precursor to one, similar to how Zomato invested in Grofers (Blinkit). For now though, the investment is expected to drive JioMart’s ambitions to take on Amazon and Flipkart in the ecommerce game.

Dunzo will also be critical to any quick commerce ambitions that Reliance has, which is proving to be a key battleground for big tech companies. It’s the latest addition to the ecosystem of platforms such as Urban Ladder, Netmeds, Zivame, Milkbasket and others that fit into the Reliance plan.

? What’s In It For Dunzo? The Bengaluru-based startup will look to strengthen its position in the growing quick commerce segment as competitors such as Blinkit, Zepto, Swiggy and others look to capitalise on the momentum for this category. As per a RedSeer report, the quick commerce market in India is expected to reach $5 Bn by 2025 from the current $0.3 Bn.

Dunzo has launched dark store-enabled deliveries in Bengaluru and presumably, this will be extended to other cities with the funds raised. Besides this, it will also expand its B2B business vertical to enable logistics for local merchants in Indian cities.

The Big Picture: With 5G slated to launch later this year, Reliance would be keen to get its ducks in a row when it comes to services and products. It will also be looking to bring them together in a cohesive way before the big 5G launch takes centre stage.

The Dunzo and JustDial deals have enabled Reliance to lay down the digital foundation to go with its offline retail reach.

The conglomerate also has to deal with competition from Tata Group which will launch TataNeu this year after several acquisitions of its own in 2021. Besides Dunzo and 5G, the other big expectation for Reliance will be that it can wrap up the Future Group deal, which will allow it to truly extend its retail reach.

?IPOs Amid Covid Fears

With quite a few tech startups lining up to hit the public markets in 2022, market analysts are bullish about the prospective IPOs in the year ahead, despite grave concerns of a resurgent Covid-19 and the Omicron variant, as well as fears of a correction after a bullish 2021.

Manan Doshi, cofounder of unlisted securities trading platform Unlisted Arena, said, “Post a weak listing of Paytm due to high valuation, now companies have turned a bit conservative regarding valuations and hence we should be seeing good listings in the year ahead. The pipeline of IPOs, including those of startups is quite strong and the outlook for these offers also is positive.”

Tech Stocks Tracker

Here’s the weekly performance of listed tech companies in the first week of the new year:

Indian Startup Funding Tracker

?2022’s First Unicorn: Fractal Analytics bagged $360 Mn from TPG, while overall startups raised around $1.3 Bn in funding across 35 deals in the first week of 2022

Diving Into A Record-Breaking 2021

Besides 42 new startups in the unicorn club, and over $42 Bn in funding, the Indian startup ecosystem broke several other records in 2021. For instance, the 108 individual mega funding rounds over $100 Mn is a new yearly benchmark for the Indian startup ecosystem, accounting for 67% of all funding in 2021.

Moreover, with 1,436 startups launched in calendar year 2021, the count of new startups grew by 15%. And India now has over 73 soonicorns, many of which have emerged in the past 2-3 years. Watch out for more breakdowns of 2021’s historic funding boom through the week.

Get The Indian Tech Startup Funding Report, 2021Top Stories

Finally, here’s a look at the other major stories and developments from the week that went by:

- ?? Ola Cofounder’s New Venture: Ankit Bhati has launched SaaS startup Amnic Technologies which has already raised $20 Mn

- ? Satya Nadella Backs Groww: The Microsoft CEO has made his first investment in India by backing the fintech unicorn

- ?? Unacademy Takes On MasterClass: The edtech unicorn has ventured into celebrity-taught courses with Unacademy Icons

- ? RBI Opens Credit Bureau Data: Fintech companies and NBFCs can now access data from credit information bureaus to assess potential borrowers

- ?️ Sanjay Bhargava Resigns From Starlink: Amid Starlink’s India setbacks, the country director has stepped down citing personal reasons

- ? Google News Vs CCI: CCI has ordered a probe on Google after the tech giant was accused of abusing its dominant position in the digital news business

- ? 11 Jobs Per Startup: The government has claimed that Indian startups have created 6.5 Lakh jobs till date, with another 20 Lakh expected in the next four years

That’s all for this week, folks. See you next Sunday with another weekly wrap-up.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.