The tedious commuting, long working hours, rising internet penetration and of course smartphone wave are giving space to online grocery players to serve the consumers. Time has changed and buyers are now quite comfortable ordering apparel, shoes, electronics, among others, online. With improving comfort with online payments, selling groceries online has become relatively easy.

Though the challenges of selling groceries online remain in place, however startups like Bigbasket, PepperTap, ZopNow are using combination of different business models and technology to overcome them. The buzz around online grocery space in India has reached new heights in the past few months with investors started pouring millions into this space and big corporates like Tata and Reliance and Ecommerce giants like Flipkart, Amazon & Snapdeal foraying to capture this multi billion dollar market. But the million dollar question is:

WHY biggies have started entering into online grocery space?

Despite knowing the fact that selling perishable goods online is far more difficult than selling non-perishables items. It is an entirely different ball game with low-margin and requires expensive investments to build high-end IT infrastructure, an efficient supply chain, quality warehousing and storage facilities, and an efficient delivery system, which is again varies from place to place.

Quick Facts About Indian Grocery Market

The retail market in India is expected to hit $725 Bn (about INR 43 lakh crore) by 2017. Retail consultancy Technopak estimates online grocery business to grow at a rate of 25-30 per cent y-o-y basis in major cities of India.

- India is the 6th largest grocery market in the world

- Only 5-8% of grocery stores are organized corporations. The vast majority are “mom & pop” type shops that are similar to convenience stores in the US and are referred to as “kiranas”

- The online grocery market is growing at 25-30% annually in metropolitan areas and large cities

- Margins are below 10%

- 43% of the country’s roads are not suitable for vehicles. Paired with checkpoints, and duty collection points that slow down traffic, infrastructure is an obstacle

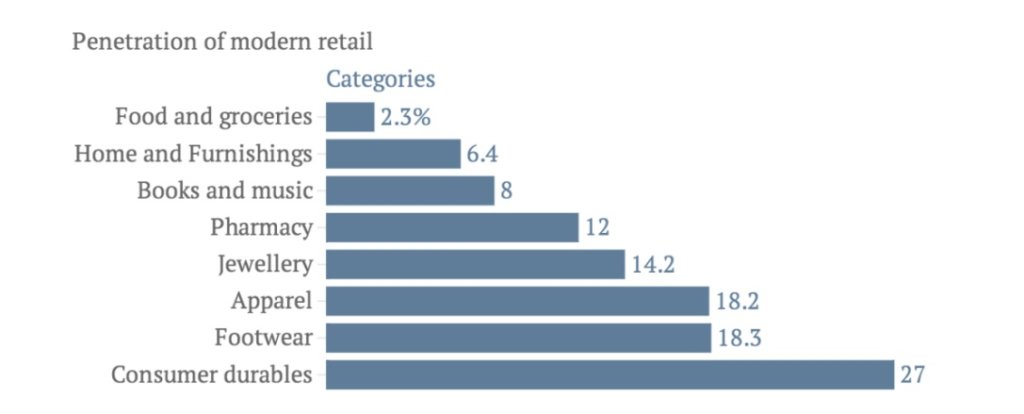

Modern Retail

Business Models

Pure-play online grocery retailers are at the forefront of the boom in grocery ecommerce, which has over tripled in size by number of players year-over-year. These companies build large warehouses and distribution centers outside of major cities and own fleets of GPS-enabled vehicles in order to serve online demand. BigBasket, LocalBanya & Reliance Fresh Direct are the main players leading in this space.

Hyperlocal Delivery players provide a front-end and logistics management service for smaller chains, as well as independent grocers for a recurring monthly/annual fee or commission basis. This model has been praised due to its lack of inventory investment. Peppertap, AaramShop, Grofers are few major players in this space.

Growth Drivers

In developed countries like US, driving/walking to the grocery store, park, shop for yourself, load up your car, and drive home, it is very doable. However, India’s infrastructure and overcrowded major cities do not provide this flexibility and make it more difficult, time consuming for in and out shopping. In a variety of the major cities, there are very few parking lots for grocery stores, and the prohibitive traffic makes the time commitment and risk even higher when driving to crowded city centers that feature more full-service grocery stores or modern retailers.

Besides, the industry infrastructure is also a challenge as only 5% to 8% of all grocery stores in the country are organized corporations or entities. In terms of demand, growing younger population, rising internet penetration, increasing disposable income, quality products and customer driven mechanism are some of growth factors. And in terms of supply, multiple channel distribution, flexible delivery options, presence of major players, convenience and multiple mode of payments like Credit Cards, Debit Cards, Net Banking, Mobile Payments are important growth factors.

Nitan Chatwal, Promoter of Shrem Strategies & Investor in LocalBanya says, “The online grocery market is set to grow very rapidly in India over the coming years and we felt now is a good time to get in. Making a great investment decision involves various factors of which potential scale and timing are key. We felt these two crucial factors are perfect right now and it falls in line with our investment philosophy.”

Who Is Shopping Grocery Online

The online grocery delivery market in India has some very unique demographic statistics –

- Women ages 30-35 are the largest adopters of online grocery shopping

- 11% of orders are done in 10pm – midnight slot.

- Institutional clients make up 29% of orders for select major retailers

The report suggests that that women-influenced sales will be 35% of Indian ecommerce by 2016. The rise of women in ecommerce has been attributed largely to convenience, as well as increased privacy and safety. The middle class is also expanding in India and these consumers will subsequently find that grocery shopping via the internet is a high value-add service.

Recent developments

Recently, Flipkart’s main market rival Amazon India announced its plans to launch an express delivery platform in partnership with mom-and-pop stores, calling it Kirana Now. The company has already started a pilot exercise of it in Bangalore. Homegrown online marketplace, Snapdeal also partnered with gourmet food retailer Godrej Nature’s Basket in January to sell about 400 of its products online, with orders delivered the next day. Reliance Fresh also forayed into online groceries market with the launch of its new website last year.

Apart from this, the multi-domain INR 5,000 Cr. plus SRS Group had announced the launch of SRSgrocery.com, a one-stop destination for grocery requirements. According to a recent report, Taxi aggregator Ola is also firming up plans to launch a delivery platform using its fleet of taxis, beginning with groceries – to cater to everyday home necessities. Just recently, Tata Group launched grocery eretail shop My247market and Alibaba backed, One97′s flagship brand, Paytm also launched a new app called Paytm Zip to connect users to both local offline as well as online grocers.

Key Players

AaramShop.com, EkStop.com, BigBasket.com, AtMyDoorSteps.com, MyGrahak.com, ZopNow.com, Omart.in, LocalBanya.com, RationHut.com and SeaToHome.com are some of the online stores retailing groceries. Most of the existing etailers offer their service in metros and major urban centres.

The Money Game

There are many recent fundraising and acquisition activities that took place in this particular space ranging from early stage to growth stage. PepperTap, a hyperlocal grocery delivery service platform, raised an undisclosed amount of seed funding from Sequoia Capital to expand its business geographies. Mumbai-based Localbanya had raised undisclosed amount of funding from Shrem Strategies. Grocery Etailer, BigBasket is also in final talks to raise about $15-16 Mn from Bessemer Venture Partners.

Besides, Godrej Group owned premium food retailer, Godrej Nature’s Basket has acquired Mumbai-based online grocery store, Ekstop.com and another Hyper-local delivery startup Grofers has acquired My Green Box. Earlier this year, Kris Gopalakrishnan Co-founder Infosys, has invested undisclosed amount in food tech startup, FreshWorld. The funds raised is planned to be used for scaling the retail network by employing 250 employees, upgrading the electric carts system and improving technology.

Speaking on the investment in Freshworld, Kris Gopalakrishnan said, “He dreams of more such ventures that will come out in the form of ‘Green Carts’. FreshWorld is in line with my vision of supporting sustainable technologies in solving problems. I feel this is the next-level disruption in the fruits and vegetables industry.”

Challenges For New Players In Online Groceries Market

- Alteration in Business Model For Different Cities

- Competition from Local Stores

- Difficult for New Players to Attract Investments

- Lack of Trust in Online Mode of Shopping

- Existing Players in the City

“Fresh is an entirely different category from standard ecommerce SKUs since it is perishable, sourcing is not standardized; there is also a lot of local and seasonal variability. Maintaining consistent quality is a huge challenge. Any company in this space has to build its own brand of staples and other items. Again this requires deep sourcing expertise on where and how to source the best products at a competitive price The company’s own brand items provides most of the profit in this category,” said K Ganesh.

Positive Side of Online Grocery Platforms

Frequent Buyers – Grocery etailing has the advantage of high percentage of repeat orders. All you need to do is impress a customer with the first order. Once a customer is satisfied, you can have one more regular in your clientele.

Limited Area To Focus On – Given the nature of the business, online grocers are in a different league from other eretailers. Most online grocery e-stores cater to a specific city or certain areas due to the logistic limitations.

Advantage Over Giant Online retailers – Perishable products are also a challenge for online retailers. Vegetables, dairy and meat products cannot be stored for long. So many etailers stick to packaged food items, giving room to grocery platform to perform.

You Can Start With Bare Minimum Cost – The cost of owning a domain and hosting an online store is negligible when compared with the investment in its physical infrastructure.

Investor’s Take

K Ganesh, Promoter & Investor of BigBasket.com says,

Grocery is the ‘mother of all categories’ in terms of size, repetitive need and addresses one of the biggest pain points from a consumer’s viewpoint. There are several startups and some large funded players attempting to enter the space from multiple directions and with different approaches. However, it is important to cut through the noise and establish a few fundamentals. Although online grocery is poised to be one of the biggest categories in online retail, this is not the typical “one more category” within a horizontal ecommerce portal; it is a very different business and an extremely tough category that needs specialized industry experience. Technology and analytics including predictive demand estimation, routing algorithms, last mile logistics are absolutely critical to success in being a success in this category. It requires ongoing and huge investments to scale and make it viable.”

He further adds, “This is not a game for angel investors and early stage VCs or poorly funded companies as margins are low and scale is important. To illustrate, in 2012, there were 40 companies; of these only three managed to raise any money, and 30 of them have shut shop since.

Ravi Adusumalli, Managing Director of SAIF Partners & Investor In PepperTap said

“Grocery in India is a huge market and grocery shopping on mobile is already seeing strong adoption. We believe that PepperTap’s hyperlocal marketplace approach is the most efficient way to cater to this market, and can scale very rapidly. We are very excited to partner with Navneet in making PepperTap a big success.”

Online Grocers Need To Keep A Tab On Following Points

- Many e-grocery shops have been set up now, but the segment is far from saturated. Many of them are catering to a few metros and many cities. The potential market size also ensures that there would be room for multiple players, even within cities.

- Big retailers have started to enter the segment and of course the direct competition from local grocery stores that provide home-delivery services.

- Given the low operating margin in the segment and the challenge of offering better deals, it is important for online grocery players to optimise their supply network.

In end, the online grocery market is going to be a big thing in near future if the issues like infrastructure and taxation regime are improved properly. Currently, the online grocery delivery industry is both small and fragmented.

With the zero inventory option, hyperlocal delivery model might turn up as the best option. Besides, there are multiple areas of opportunity for players like Payment gateways, real estate, logistics to get benefit from the ongoing boom in online grocery space.

Mohan Kumar, Director at Norwest Venture Partners is of the view that the grocery delivery is a operationally intensive space, and technology is only an enabler. “The team which can manage large fleets of logistics and manage those staff will come ahead, and in the end only a couple of pure-play, on-demand logistics players will survive.”

Ad-lite browsing experience

Ad-lite browsing experience