SUMMARY

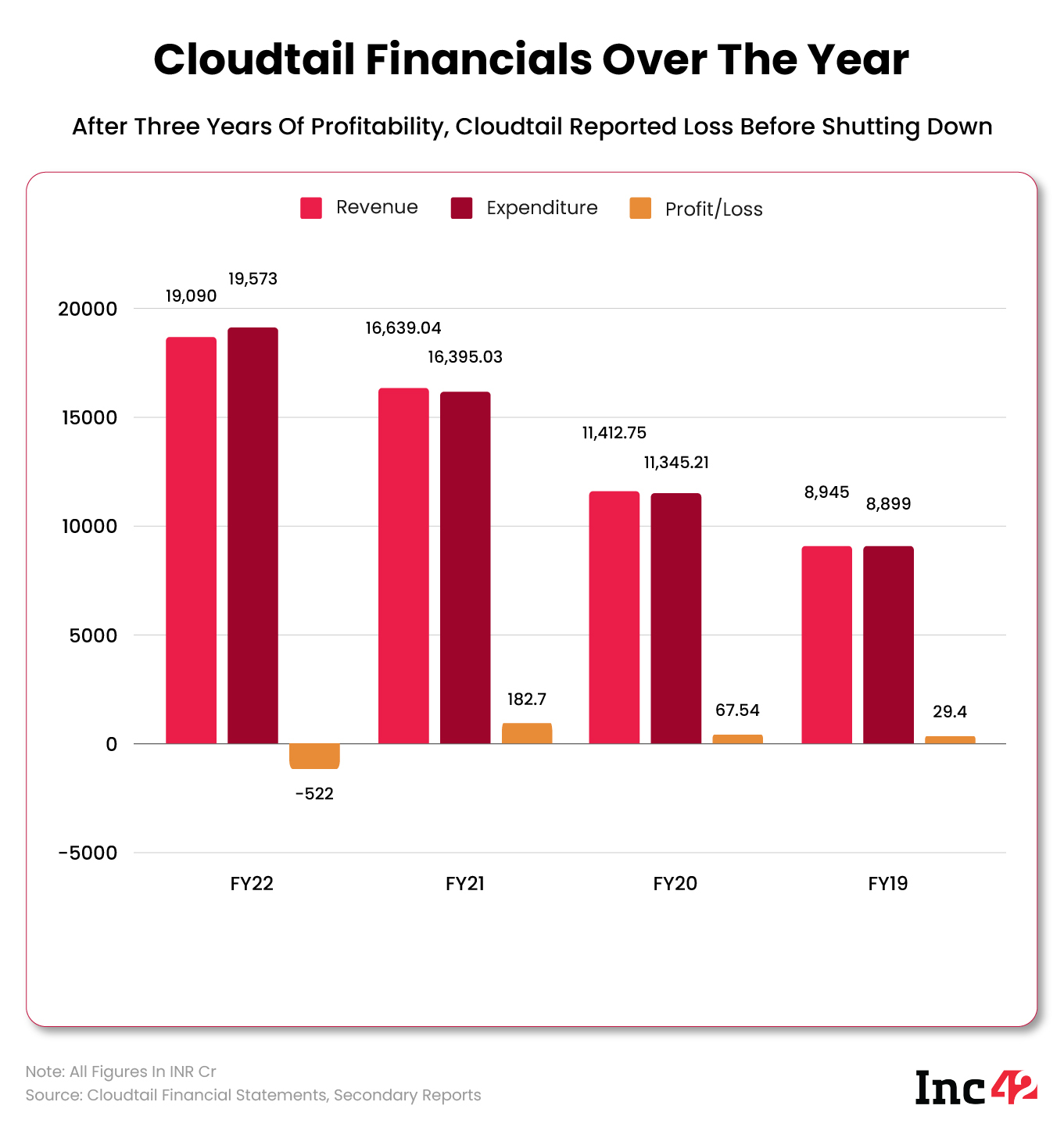

In the previous financial years, the online retailer maintained INR 182.7 Cr (in FY21), INR 67.54 Cr (in FY20) and INR 29.4 Cr (in FY19) in profits

In FY22, Cloudtail posted total revenue of INR 19,090 Cr (a 15% year-on-year rise) and total expenses of INR 19,573 Cr (a 20% year-on-year rise)

The said period is also shortly before Cloudtail underwent dissolution

Narayan Murthy and Amazon India’s joint venture Cloudtail India has posted a loss of INR 522 Cr in the financial year ending March 2022. In the previous financial years, the online retailer maintained INR 182.7 Cr (in FY21), INR 67.54 Cr (in FY20) and INR 29.4 Cr (in FY19) in profits.

According to the Tofler report, Cloudtail posted total revenue of INR 19,090 Cr (a 15% year-on-year rise) and total expenses of INR 19,573 Cr (a 20% year-on-year rise).

Purchase of inventory accounted for its biggest expense at INR 15,492 Cr (a 6% YoY rise) while employee costs fell by 45% to INR 105 Cr.

The said period is also shortly before Cloudtail underwent dissolution and the lowered employee cost suggests that the etailer had already begun streamlining its operations.

In August 2021, Amazon India and NR Narayan Murthy’s Catamaran announced that they would not continue their joint venture of Cloudtail parent Prione Business Services beyond May 2022. In April 2022, it sent contract termination notices to its vendors, stating that it would be liquidated, and sell all the previous stocks by May 2022.

It is noteworthy that Prione Business Services’ subsidiary Cloudtail drove over 40% of the sales of Amazon India until 2021.

It was one of the most ‘preferred’ sellers on Amazon, owing to the fact that it partnered with several vendors and sold virtually everything including electronics, stationery, fashionwear and more (and thus, had great reviews as a seller).

Secondly, industry experts had for a long time considered Cloudtail an extension of Amazon India, since it was a first-party seller with Amazon’s stake in it.

Amazon first held a 49% stake in Cloudtail parent but restructured its shareholding after the draft ecommerce rules asked for the removal of related parties and associated enterprises as sellers. By 2020-21, Amazon had only 24% of Prione, and subsequent to the dissolution of Cloudtail sought to acquire a 100% stake in Prione.

Meanwhile, Amazon Seller Services reported narrowed losses of INR 3,649 Cr (a 23% YoY drop) and a revenue jump of 32% to INR 21,633 Cr in FY22. Amazon Pay (India) reported a revenue jump of 16% to INR 2,052 Cr and a net loss of INR 1,741 Cr (15% YoY rise).