The prominent telemedicine startups including myUpchar, Practo, Tattvan, Lybrate and mFine have witnessed an average of 40% to 60% increase in consultations since March 2020

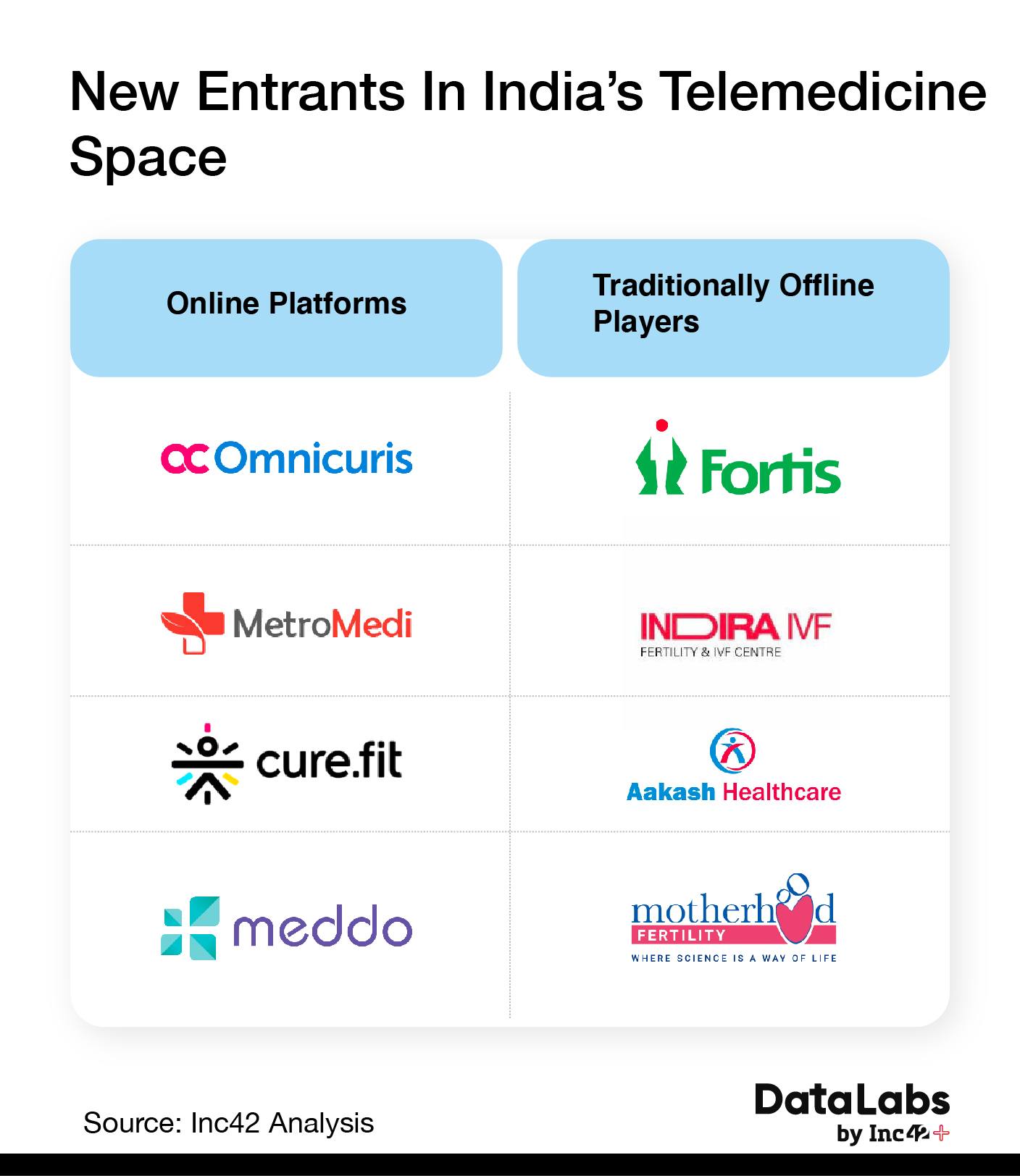

Regulatory clarity fuelled the expansion of healthtech startups such as Omnicuris, Metromedi, Curefit into telemedicine, backed by leading hospitals as Fortis, Max Healthcare, Fortis and others

But will the current uptick in demand and supply, and the diversification of models across telemedicine startups also usher in revenue growth in the long run?

Dissecting India’s Healthtech

India's healthtech startups were growing rapidly even before the pandemic, but Covid-19 has ushered in a new age. This series dives into the trends, startups business models emerging in the wake of Covid-19.

Hospitals teetering at full capacity, ICUs also equally packed and doctors overworked. It’s the story of every major economy in the world in the past three months. If nothing else, the pandemic has laid bare the capabilities of India’s healthcare system, and one thing is clear — nothing short of a major overhaul is needed.

But when one looks beyond Covid-19, the big question is about bringing access to healthcare to even the most remote part of the country. On the first day of the countrywide lockdown, i.e March 25, 2020, the Indian government notified the guidelines for telemedicine solutions. Previously, telemedicine operations were governed by several statutory guidelines in India.

These guidelines provided a more comprehensive framework for applications, mode of communication, medical ethics, data privacy and confidentiality, document requirements, fees, process, drug list, technological platforms and more. More importantly, the regulatory framework threw open the field for startups and new business models.

According to a McKinsey Digital India 2019 report, telemedicine in India can reduce in-person outpatient consultation load by half and is said to cost about 30% less for individuals. It seems like a win-win situation for both the provider and the patient, but adoption of telemedicine was limited to few urban cities through startups and public private partnerships such as Apollo Hospitals, Sri Ganga Ram Hospital, Narayana Hrudayalaya and others.

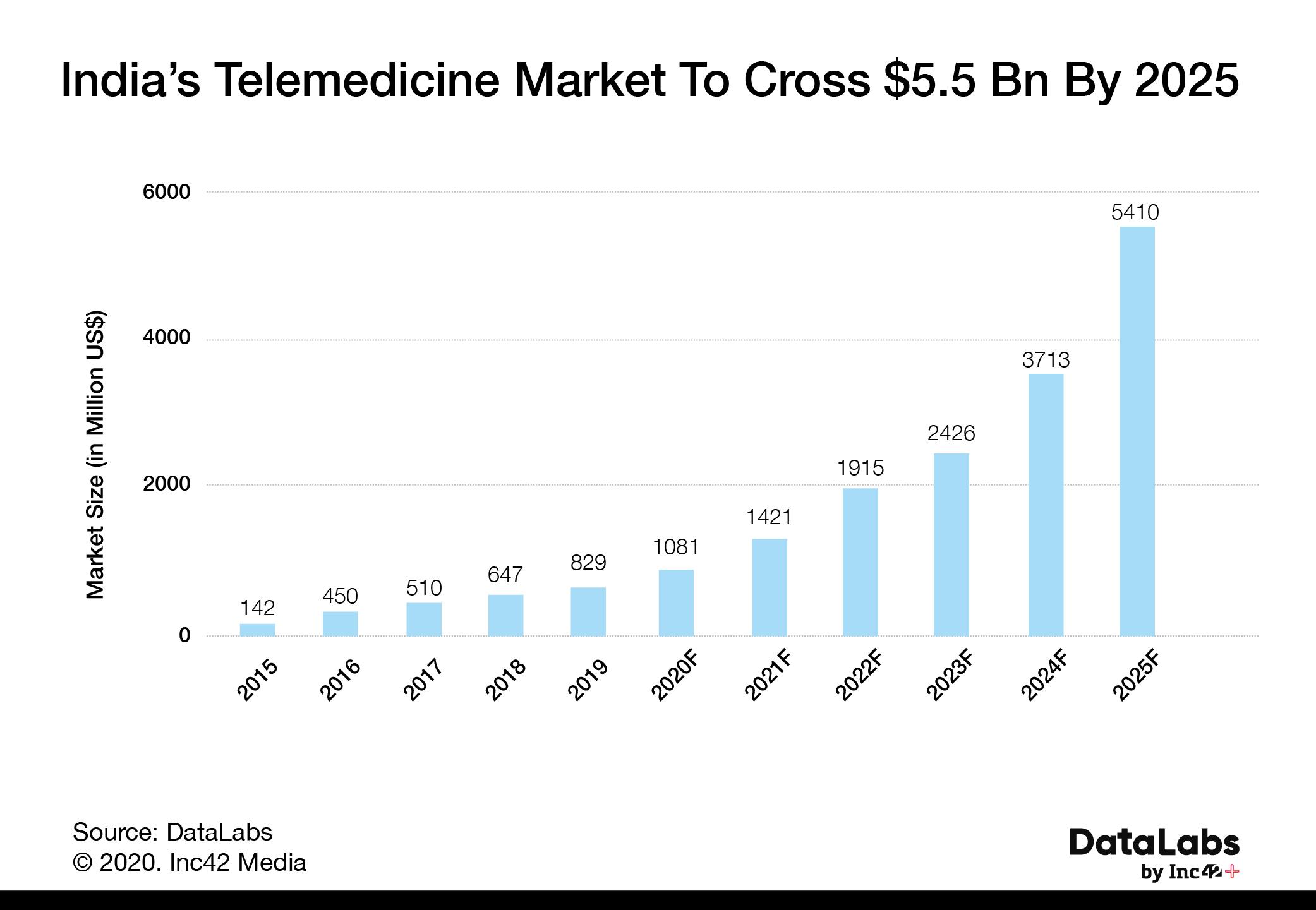

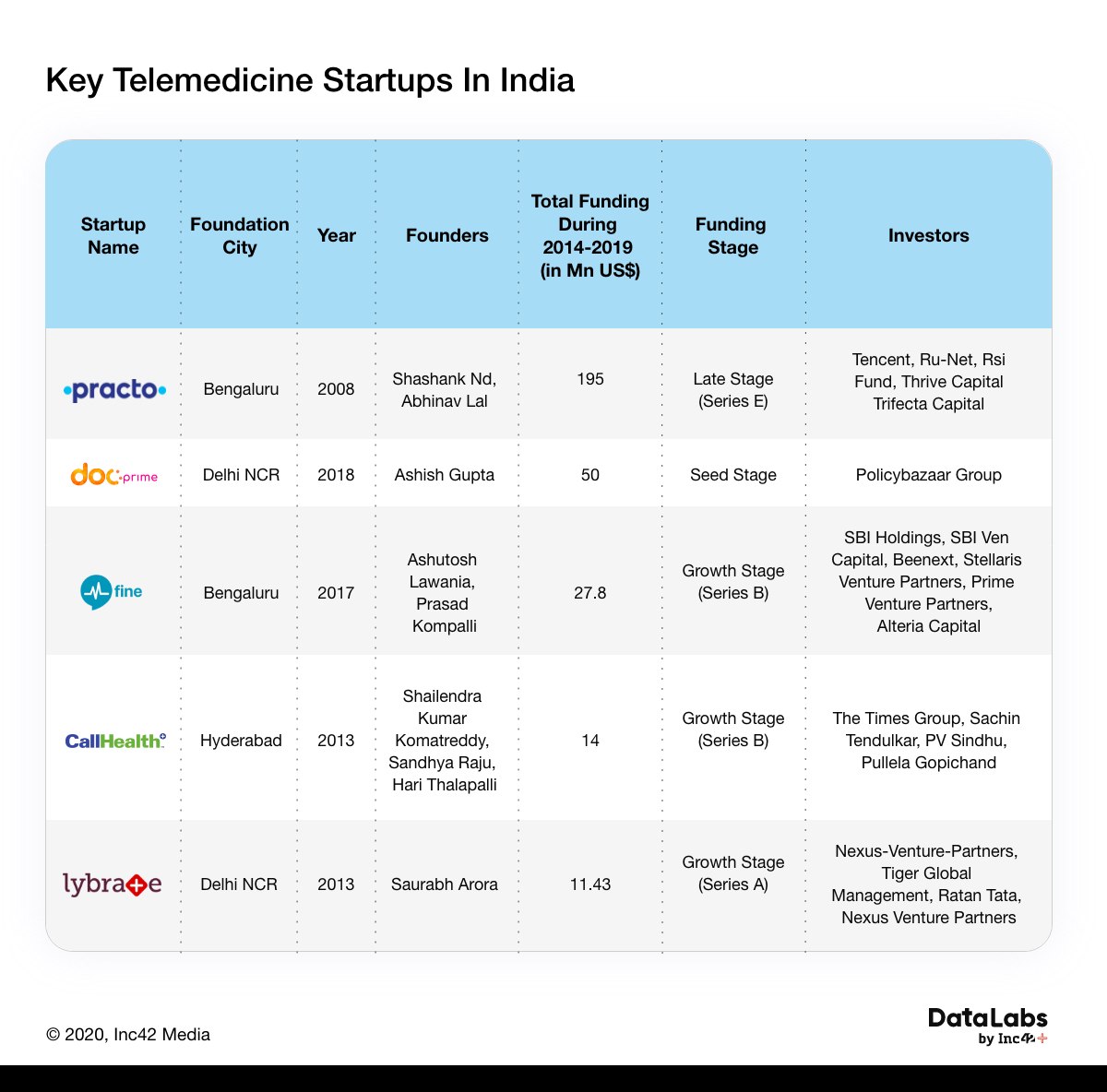

According to DataLabs, the telemedicine market in India is expected to reach a market value of $5.4 Bn by 2025 with a CAGR of 31% from the current year. With the likes of Practo, Lybrate and DocsApp, it won’t be incorrect to say that startups introduced telemedicine to urban India. The ease of consulting a doctor from your home and getting medicines delivered has become second nature to many Indians in cities, and the norm in the aftermath of Covid-19.

The increased demand also led to increased mergers and acquisitions early on. In 2015, Practo acquired four healthcare startups – Instahealth, Qikwell Technologies, Genii Technologies and Fitho. In 2016, Practo said that it had witnessed a 150% growth in online consultations on its platform. In August 2019, to increase its footfalls, DocsApp acquired DocWise that had a network of 1,000 doctors and had completed more than one lakh consultations by then. The company also acquired MediBuddy in June 2020 to rename itself to MediBuddy DocsApp. Among the notable startups in the telemedicine space in India, the likes of Tattvan E-Clinics, Portea, mFine, myUpchar, Practo, Lybrate and others also employ different revenue and service models.

Telemedicine On The Up, But Where Is The Revenue?

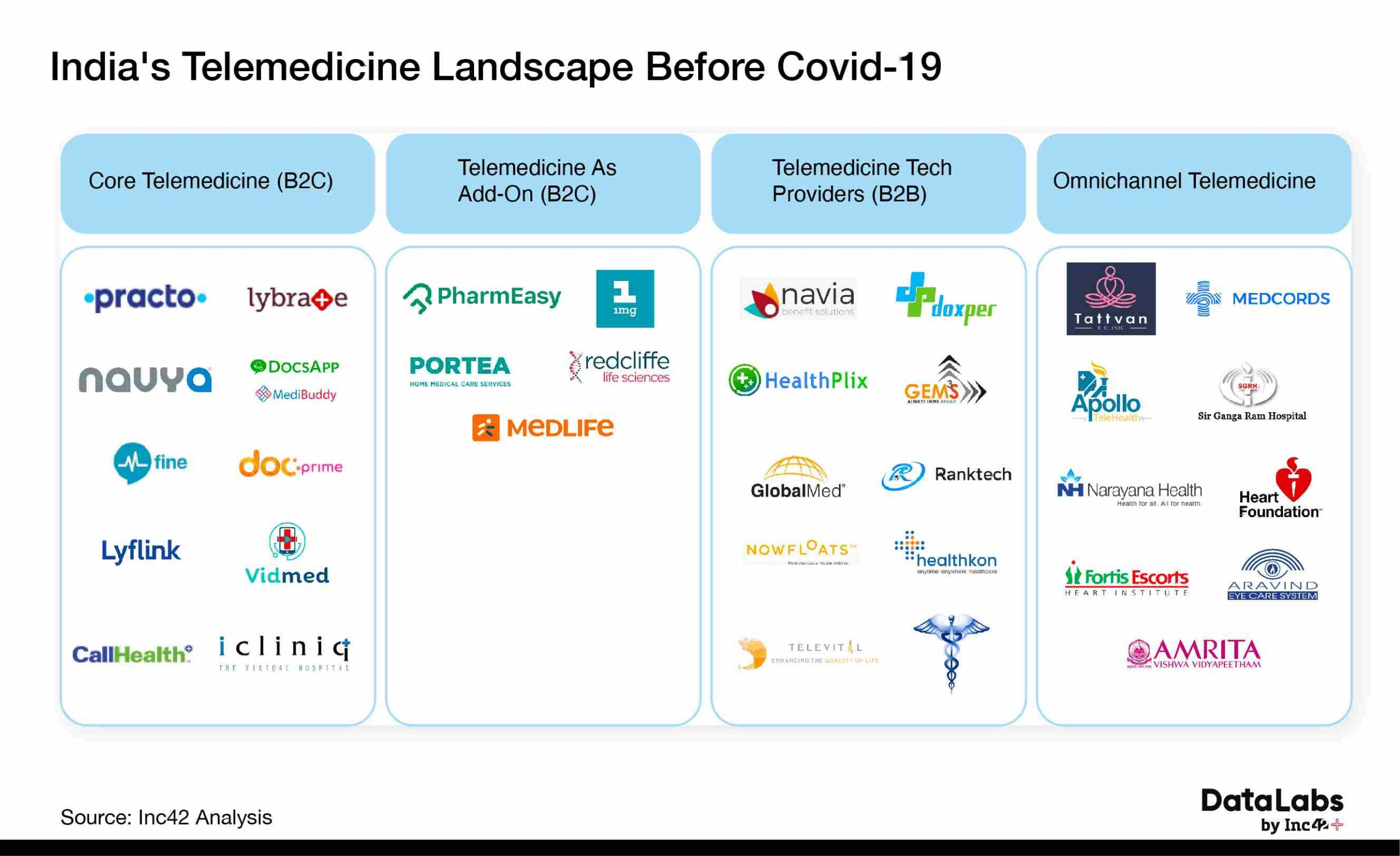

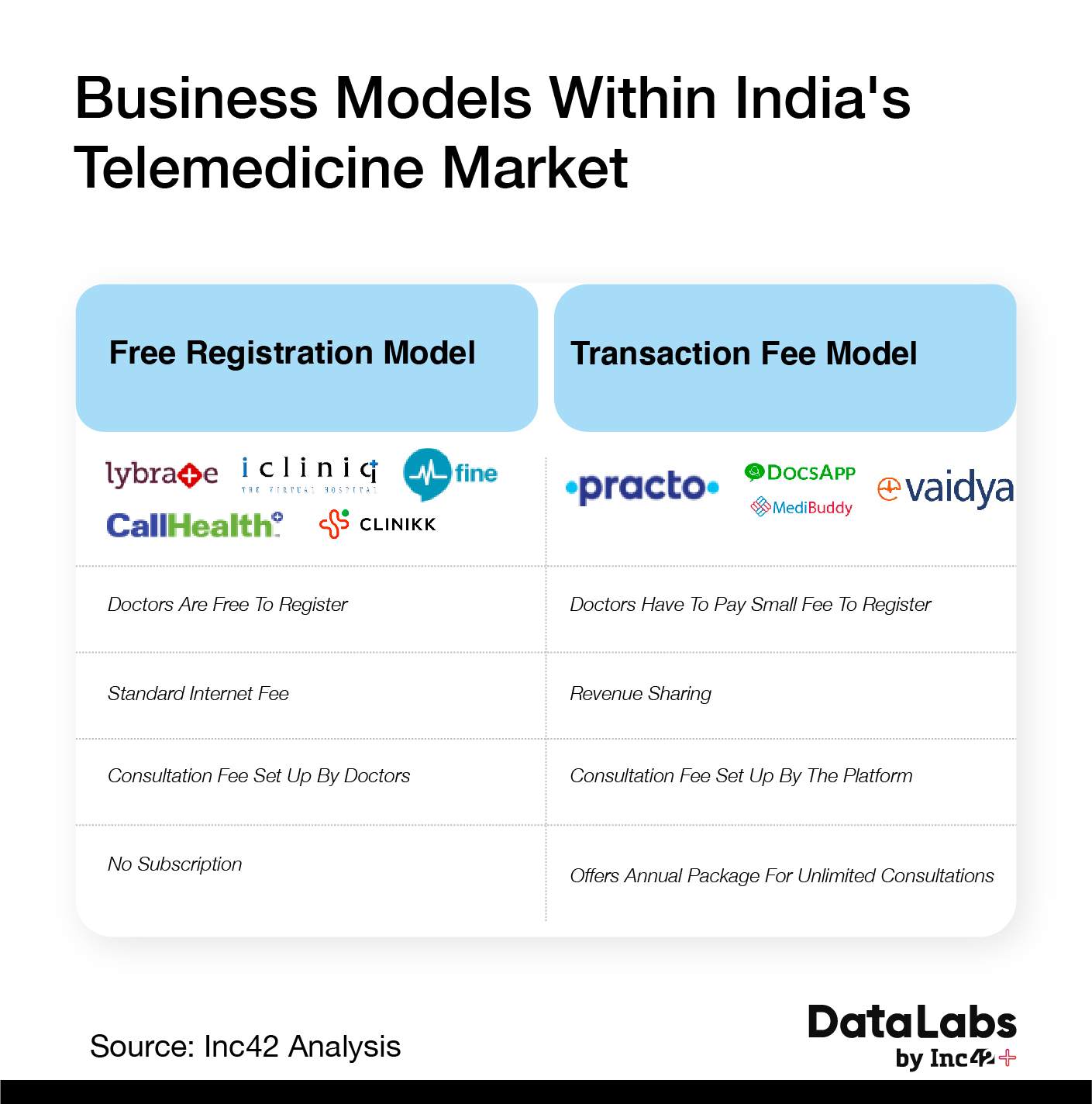

Despite the increase in demand from urban centres, telemedicine as a core and standalone model is not majorly prevalent in the Indian market. For instance, Practo, MediBuddy DocsApp and few others follow the platform or marketplace model, charging a platform fee to doctors and increasing the potential of their earnings through regular consultations.

Even for core telemedicine players, the revenue streams need to be diversified to earn steadily. Practo, for instance, has a SaaS offering for healthcare providers to digitise their hospitals and clinics for a monthly subscription. Besides these startups also offer ancillary services such as lab tests, health checks to keep revenue coming. The idea is that individuals may not need to see a doctor through the telemedicine app, but might need to utilise other services that help build customer relationships and repeat usage.

For Lybrate, its ecommerce platform Goodkart is the key revenue driver.

“Telemedicine has not been a highly successful revenue model. We position ourselves as a telemedicine company. That is our core product of focus. However, the source of revenue is more from Goodkart, which is our ecommerce platform,” said Saurabh Arora, founder and CEO at Lybrate.

Startups such as CallHealth, DocsApp, myUpchar, mFine and others offer services such as physiotherapy, medicine supplies, nursing, weight management and others in addition to telemedicine.

For online pharmacy players such as Pharmeasy, 1mg and Medlife, telemedicine is an additional service that helps shore-up the demand for medicine deliveries. In fact, in recent months the likes of 1mg and Medlife have particularly contributed in a big way to recent Indian telemedicine efforts with the Aarogya Setu Mitr portal and the Swasth collective.

Swasth is a coalition of top Indian hospitals and telemedicine players such as the Apollo and Manipal chains, healthtech startups such as Medlife, 1MG, and Curefit’s new CareFit telemedicine vertical among others.

But beyond consumer-focussed telemedicine players, there is also a growing B2B niche in the segment. Hospitals and clinics need systematised telemedicine stations, examination cameras, connected medical devices, video conferencing tools and SaaS for telemedicine as well for digitising medical records. The demand for these B2B solutions is primarily seen in rural healthcare where technology penetration is lower and therefore healthcare providers need more hands-on support for enabling telemedicine.

For B2B players too, the Covid-19 pandemic and the lockdown with its travel restrictions have resulted in a spike in demand. Startups such as Healthkon, Navia Life Care, World Health Providers, TeleVital provide a number of telemedicine solutions to clinics and hospitals.

“We have been offering telemedicine to our partners since 2018. With the imposition of lockdown and after the release of the official guidelines by MoHFW, we drastically scaled up our offering to cater to our large user base,” said Nupur Khadelwal, cofounder of Navia Life Care, a healthtech SaaS provider for telemedicine and electronic medical records for hospitals.

World Health Partners, which provides solutions to hospitals, has repurposed its telemedicine solution. The original solution required intermediation by rural entrepreneurs and the connection between the two ends was through computers. The revised solution uses smartphones which has been a boon for patients during the lockdowns as there is access to basic medical care.

Covid-19 Ushers In Telemedicine Boom

With leading hospitals such as Fortis, Max Healthcare, Fortis, Manipal and Aster Hospitals quickly designating both external and internal software solutions providers to roll out seamless video consultations, telemedicine has hit a growth spurt in recent weeks.

“We have seen a week on week growth in teleconsultations to the tune of almost 10% of our total consultation volumes,” said Meinal Chaudhry, head of strategy & transformation, Aakash Healthcare Super Speciality Hospital. In fact, across the healthcare spectrum and cutting through the class divisions, the demand for telemedicine has been cacophonous in the past three months.

According to a Ficci-NatHealth report on telemedicine, 1.7 Mn Covid-positive cases are expected to seek teleconsultation support in the next 100 days and just 15%-20 % of India’s doctors on telemedicine platforms can support 25 Mn hours of consultations in those 100 days.

Bengaluru-based Portea Medical, which primarily works with the healthcare at home model, is on the periphery of telemedicine, offering it as an add-on service. But this is not a new product launch. Portea Medical had the teleconsultation service from the beginning, however, it wasn’t scaled.

“We never focused on it as the regulations were a little murky around it and also it was not directly our priority,” said CEO and cofounder Meena Ganesh.

“After lockdown, teleconsultation was essential. So, we relaunched it and it picked up. That has made us realise this is something very important. So to make it broadbased we have started working with corporates as well,” Portea Medical’s Ganesh. Besides, teleconsultation has gained huge momentum through its home isolation management along with the government.

The prominent telemedicine and healthtech startups including myUpchar, Practo, Tattvan, Lybrate and mFine have witnessed around 3x jump with new users since the lockdown. Practo, which claims to be India’s largest digital healthcare platform has increased its doctor base by 50% in the past few months, as per a report it released this week. Alexander Kuruvilla, chief health strategy officer at Practo had earlier told Inc42 that each general physician on their platform now consults around 100 patients, which is four times more than the usual volume.

The regulatory clarity has fueled businesses to create different focus areas. For Practo, the biggest increase in consultation comes from pediatric queries, which saw a hike of around 350% and next from gynaecology consultations which grew by 250%.

DocsApp, which acquired MediBuddy during the lockdown, has seen an average of 60% increase in consultations across various departments. DocsApp connects patients to specialist doctors across 20 departments such as dermatology, weight management, sexology and more. It also allows users to order medicines and book diagnostic tests online. It claims to have a user base of 10 Mn and provide 200K consultations per month across the country.

Talking about Covid-19 related growth, Satish Kannan, cofounder & CEO, MediBuddy DocsApp said that the company has grown 60% in the last two months.

Kannan added that among daily users, 60%-70% are primarily for connecting with doctors and remaining are for ordering medicines and diagnostics.

Omnicuris, Metromedi and others that didn’t have telemedicine services for consumers or could not scale it up have also sprung into action in recent months. Omnicuris has introduced OC Connect app that allows doctors to perform multiple functions including obtaining online upskilling modules, offering tele-consultations among others. MetroMedi, an online pharmacy and e-health store that offers medicines, health foods, health check-ups, medical equipment, and other health products, has recently launched a telemedicine app and has on boarded more than 50 doctors.

Will Healthcare Giants Usurp Startups?

With a huge uptick in teleconsultations post lockdown, telemedicine is expected to see a boost. “This is a change which is fairly a permanent change, not just for doctor to doctor but other segments like physio,” Portea’s Ganesh said. She expects that India’s healthcare will follow a hybrid model where both physical consultations and telemedicine will work together for omnichannel healthcare.

However, the bigger question is will bigger hospitals take the share of online startups?

Once things are back to normal, hospitals and multispeciality clinics may not completely focus on telemedicine in urban areas, say experts Inc42 spoke with. That’s because of the revenue aspect, as well as service quality “The primary advantage of telemedicine is reduction in anxiety for the patient and potential ability for the physician to assess any major reason that an in-person assessment is necessary. This is excellent to discuss symptoms around cold, flu, or assess a healing wound. A full and meaningful consultation to diagnose a new condition is neither feasible nor recommended,” said Gitika Srivastava, founder of Navya, a clinical informatics startup, which provides online expert opinions to cancer patients.

Additionally, for hospitals, a telemedicine will not give any extra points for doctor consultations.

“Most telemedicine consultations are those that don’t require clinical examination and thus pure consultations. India being price sensitive will drive consumers to better prices which hospitals will find it difficult to offer due to the intrinsic model being based on real estate,” said Anup Jain, managing partner, Orios Venture Partners.

Orios Venture Partners has invested in diabetes management app Beato, healthcare financing platform LetsMD, online pharmacy Pharmeasy as well as medical supply chain startup PinkBlue.

Others also added that scaling up telemedicine is not a viable option for bigger hospitals, whose main profit driver is not the out-patient department but admissions. Telemedicine cannot replace personal consultation and is only complementary to it. “A physical examination is very important in our field of medicine. However, telemedicine has come to our rescue in these tough times and the number of teleconsultations is increasing every day,” said Vijayarathna Venkatraman, CEO, Motherhood Hospitals, Bangalore.

Hospitals will still prevail in situations where the condition is more serious in nature and thus, deeper expertise like surgery or other invasive therapy may be warranted. For others, the doctors attached to these hospitals may approach startups.

“We can expect more hospitals and doctors to line up to teleconsultation on the platforms, as patients have been found very comfortable and adaptive to this system which again is a positive sign for startups to focus more on this area,” said Nitiz Murdia, marketing director Indira IVF, which claims to have helped patients in 20 states.

Telemed’s Future: Just Another Offering Or A Core Focus?

Despite the lack of regulations in online pharmacies, this is clearly the most-preferred sector for startups — and investors — in India. Given the maturity in ecommerce models, epharmacies have the network to tap to and don’t even have to create new user behaviours.

This marketplace model is expected to continue to rule the roost even when it comes to telemedicine. In fact, with great demand for medicine delivery and telemedicines, it will not be a surprise if there is an alignment in models for startups in either segment. Portea Medical, 1mg, Medlife, Curefit and others, for whom telemedicine is not the core model, are also expected to scale it up. “Telemedicine will become a key business proposition as part of our aim to provide end-to-end healthcare,” added Portea’s Ganesh.

Additionally, there could be more offline-online collaboration like Apollo Telehealth’s smart health kiosks which can be installed at any location, including malls, metro stations, corporate offices etc.

“These kiosks are compact quasi-digital clinics that will enable the screening and diagnosis of various health parameters with the help of smart tech, connected devices and integrated technologies like patient health records, electronic medical records, and cloud based services.,” Vikram Thaploo, CEO, Apollo TeleHealth told Inc42.

Telemedicine was simmering away in the healthtech cauldron, and the Covid-19 pandemic has simply turned up the heat and with this comes the next wave of remote healthcare models — cohesive, homogenous and tech-driven. Startups and hospital chains told us there will be an evolution in the service delivery and distribution. Electronic medical records, high-speed internet and 5G connectivity, advanced video conferencing tools and robotics may come into play and these might be the revenue generators or USPs that telemedicine startups bank on. Telemedicine services are increasingly leveraging facial recognition, data analytics, app-based services, voice recognition, AI/ML algorithms for diagnosis and IoT devices for monitoring.

On the other hand, startups with telemedicine as a core model — the likes of Practo, mFine, Lybrate, DocsApp and others — medicine delivery, offline appointments, follow-up appointments and diagnostic tests are expected to further bring in the revenue and complete the patient lifecycle.

In a way, telemedicine and epharmacies are merging their models and soon the lines may be blurred and these distinct models may emerge as one.

Ad-lite browsing experience

Ad-lite browsing experience