As Tata Group enters the race for India’s super app, it will need to overcome its own legacy

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Dear Reader,

There’s something fascinating about the prefix ‘super’. It makes things look larger than life, an all-encompassing idea or entity that can serve us everything we want. This is why billions love and adore superheroes, the ones who have the solution to every problem.

And even in the real world, the one where mobile apps are often the solution to a problem, the word ‘super’ brings up images of all-powerful apps for every need — saving consumers from the drudgery of downloading and using scores of apps. And that’s the fuel driving India’s super app brigade.

Hike tried it and gave up, while Paytm, PhonePe, Amazon and Flipkart are still giving it a go.

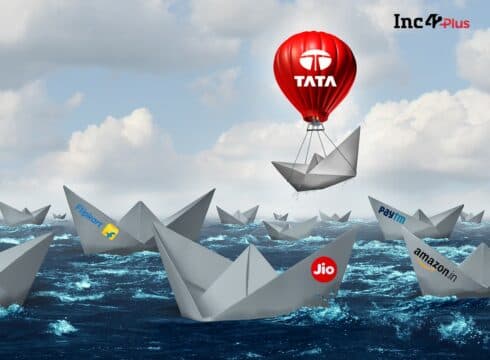

The list of the companies that have tried to build a super app for India features the who’s who of the tech ecosystem, with even global tech giants only scratching the surface. But, none have managed to ring in success in a manner that super apps have in China, Indonesia and other Southeast Asian countries. Will the latest entrant in the race, 150-year-old conglomerate Tata Group, be able to build what many startups have tried and failed at?

In a recent media interview, Tata Sons and Tata Group Chairman Natarajan Chandrasekaran revealed that the conglomerate is planning to offer a range of services on its super app, including food and grocery ordering, fashion and lifestyle, consumer electronics and durables, insurance and financial services, education, healthcare, and bill payments.

Of course, all that is standard super app fare, but while most companies may take several decades to add these services, the thing that gives Tata a slight edge is that it already has a presence in all the above areas. To a large extent, even Reliance is a major player in these categories, but while Reliance and Jio are banking on acquisitions, foreign investments and partnerships to build the multi-sector expertise, the Tata Group is aiming to build a digital layer on top of its existing consumer products and services, despite arriving late to the digital party.

The biggest challenge, however, for the conglomerate with a collective annual revenue of $113 Bn (2018-19) and a history of 150 years is its agility and ability to change itself according to consumer needs. Even with this announcement, many have questioned whether Tata is late to the ongoing digitisation wave in India?

Speaking to Inc42, Dr. Shashank Shah, visiting scholar’17 at Harvard Business School and author of ‘The Tata Group’, a biography of the Indian conglomerate, noted that the Tata Group undergoes a lot of collaborative and consultative decision-making before announcing new business plans.

He noted that before making any business decisions, Chandrasekaran who is chairman of Tata Sons and other Tata Group companies would have to engage with the board of directors of all the related companies because they are all independent entities in which the Tata Sons have holdings. Each of these multiple stakeholders and their interests have to be incorporated before going ahead with these kinds of strategies rollout.

“They are not a promoter-driven company like Reliance, where the managing director takes the call. While most of the things get attributed to Ratan Tata, in my interviews and discussions, he would always say that for all business-related things I think Chandra (Chandrasekaran) should take a call. There is a very clear division of decision making in the Tata Group,” the author told us.

There’s no doubt about the tremendous brand equity that the Tata Group enjoys in India, but can the conglomerate compete with new-age startups like Paytm, Flipkart, Amazon — whose biggest moat in the market is their ability to move fast and make quick decisions with the changing consumer requirements.

The Tata Group’s conviction about a super app stems from its ability to sustain itself in the Indian market for decades. In fact, both Reliance and Tata Group have made it clear that the super app is part of the strategy to be in the market for the long haul. They are not building a tech product with an exit strategy in mind, which is the case for many tech startups. The goal is long-term profitability.

Convergence Catalyst, which did an in-depth analysis of the key success factors for building a successful super app in 2019, said the six key criteria include critical mass and scale, stickiness, adjacencies, strong brand, efficient rollout plan and execution capabilities.

Convergence Catalyst founder Jayanth Kolla noted that legacy companies like Tata and new-age startups such as Paytm have varying strengths and weaknesses when it comes to the above six factors.

“It is possible for a company like Tata to build a super app for India, but the company needs to move and execute fast,” Kolla added.

Why The Rush For Super App?

Given WeChat’s success in China, it is no surprise that businesses around the world are trying to replicate a similar model in India, home to about 12% of the world’s internet user base. Further, India is expected to have more than 800 Mn smartphone users by 2022 and with data rates decreasing this is a huge opportunity for internet companies. But what is there for the consumers to gain in this arrangement?

Companies argue that a super app model increases the efficiency of their services and provides a better user experience. Another argument in the favour of super apps is that consumers in India and other similar markets have limited device space and internet data and hence would find it easier to download a single app that can provide them access to a range of services. It also reduces the cost of access for consumers and for the businesses, the cost of creating awareness for a variety of products and services.

Sheji Ho, an ecommerce analyst for the Asia market, recently said, “If you think Chinese users enjoy going ten layers deep into an app to consume a certain service then you’re too naive. This is all done so companies can make more money by paying less for customer acquisition.”

He added that fundamental user behaviour does not change across cultures or markets. Regardless of whether the consumer hails from a developing country or if they are in a mature economy, the basic need is finding the right information or product with ease and quickly. It’s not just about having every product or service one can imagine, but just as crucial is fast access to these services and ease of use, including in payments.

There are definitely a lot of unanswered questions in this regard for the Tata Group. The company is in talks with regulators to launch its own payments entity such as the NPCI. The New Umbrella Entity (NUE) licence that Tata has applied for would allow it to own and operate a pan-India retail payments network. But there’s no clarity on when this entity would be able to start operations, if at all.

While Tata definitely has the tech expertise with Tata Consultancy Services (TCS) and the market experience along with the distribution and supply chain know-how, the bottomline remains that the success of any super app — for Tata or any other player — will depend on their understanding of the digital consumer and seamless customer experience delivery.

While the Tatas work on figuring out the digital architecture of its super app, Reliance Jio is busy adding new features and services to its digital stack. The latest being the addition of consumer electronics products on JioMart, currently operational in Navi Mumbai.

This announcement was closely followed by Reliance Jio’s announcement to relaunch of its made-in-India mobile web browser called JioPages. Claiming to be “conceptualised and designed entirely in India,” the browser built on Chromium Blink engine, offers users a choice of eight regional languages, which include Hindi, Marathi, Tamil, Gujarati, Telugu, Malayalam, Kannada and Bengali.

Further, even though 5G is not yet available in India, Reliance Jio has already announced the prices of its upcoming affordable 5G-enabled smartphones. Reliance Jio is claiming these will be the cheapest 5G-enabled smartphones in India — with an initial price of around INR 5,000, which will be subsequently lowered to around INR 2,500 as production scales up, compared to INR 27,000 price range of the existing 5G phones.

The Ambition Of The Times

Besides Tata and Reliance, another heavyweight trying to build a super app is Times Internet and this is not its first time into the arena. In 2016, Times Internet tried to build a super app ecosystem with the acquisition of chatbot company Haptik but ultimately sold it to Reliance Jio in 2019.

The plan initially was to embed a chatbot across the entire ecosystem of products and make it easy for users to avail services outside the platform — for instance, booking a movie ticket while reading a review.

“We learned that creating super apps is not as simple as just putting stuff in front of customers. The truth is that when a user is reading the news on Times of India, they aren’t looking to book a movie ticket,” Satyan Gajwani, vice chairman of Times Internet, said at The Product Summit.

But that doesn’t mean the company dropped the plan entirely — instead the concept of a super app ecosystem has been adapted by embedding music streaming service Gaana and a games section within MX Player. The idea was to build tangential use-cases for the consumer on a single platform rather than going all out and offering a sprawling array of products.

As Gajwani said, there is more to a super app than just building a tech interface. And any new entrant will have to learn from its product iterations and customer interactions. Understanding Indian customers is the one thing that Tata Group has excelled at over the years. Keeping the consumer and society first has been a significant facet of Tata’s legacy. Will the same practices follow Tata into its digital journey or will the conglomerate’s traditional approach prove to be a deterrent?

Tata,

Yatti Soni & The Inc42 Team

Correction Note: Some sections of this article have been edited post-publishing to fix typographical errors and improve the clarity of language.

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.