SUMMARY

In the wake of the funding boom, Indian startups are in a hiring frenzy, but is it sustainable?

Dear reader,

There is optimism in the air. How quickly things have turned for tech startups in India. If last year was all about tightening the belt and letting go of employees that are excess to requirement, in 2021, the Indian tech industry has become a hiring market. Demand has gone through the roof for tech talent, and the talent war has only just begun.

One only needs to look at the amount of funding raised by Indian startups in the past year to gauge the growth trajectory they have set for themselves. Key in these growth plans is having the right talent and people leading the various aspects of the operations. Startups are paying record salaries to junior and senior employees across functions, which came to a head this week with BharatPe’s announcement of perks such as superbikes, gadgets and foreign trips.

It’s not just BharatPe; a host of well-funded startups are waging the talent war by not only offering material perks, but also ESOP payouts, wellness leaves and more — reminiscent of how competitive the IT services hiring had become in the late 1990s and early 2000s.

What’s Fuelling The Talent War?

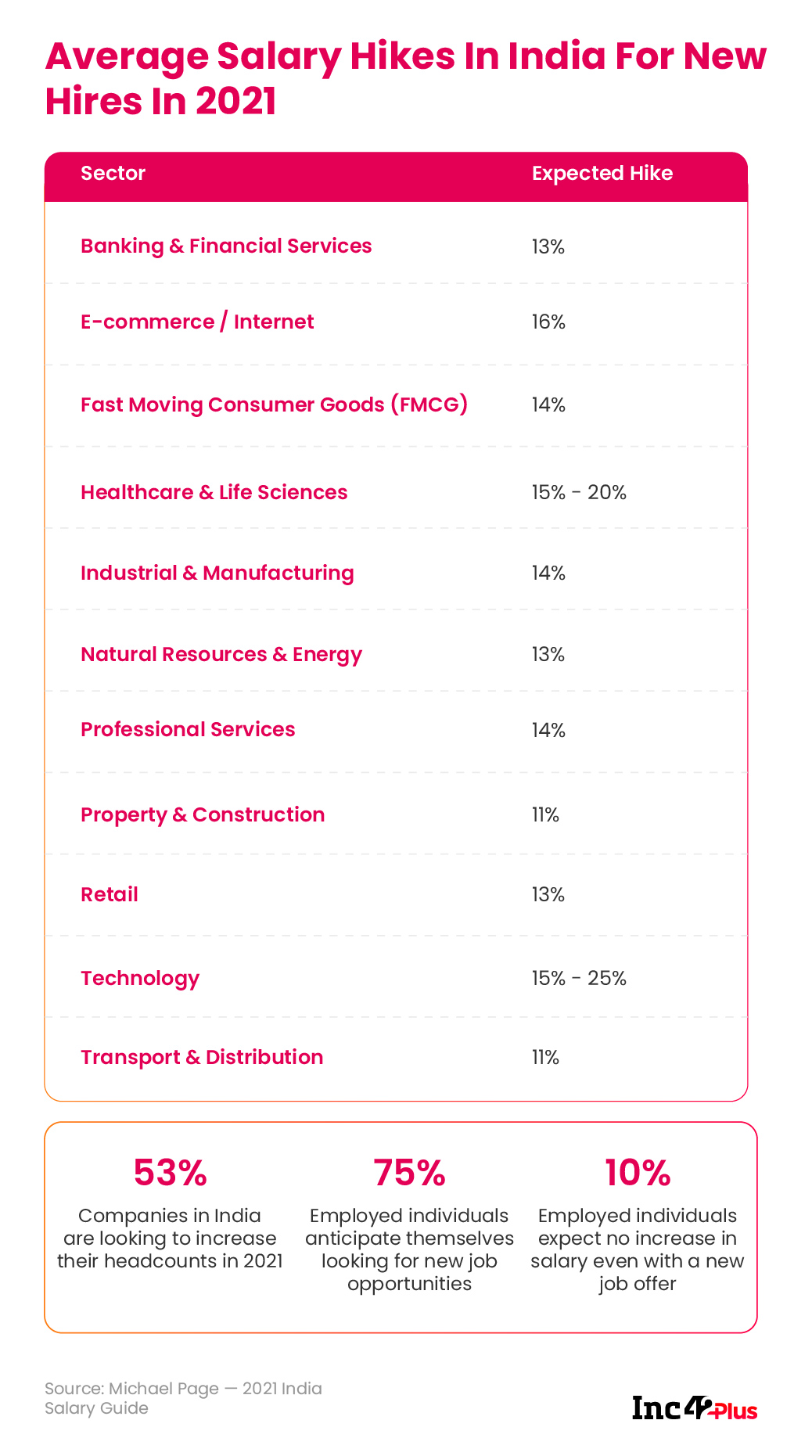

According to an employment outlook survey by Manpower Group which included almost 1,500 employers in India, in 2021, sectors such as ecommerce, finance, real estate, manufacturing are expected to see a huge surge in employment. In the group’s survey, 65% of employers showed positive signs of returning to pre-Covid hiring by August this year.

Some of the top startups had managed to roll out minor hikes in 2020, but the situation has improved in 2021 for those startups that have managed to eke out growth even amid the crisis. Now VCs are backing these startups with mega-rounds. Clearly, while the pandemic and the following lockdowns had earlier led to massive reduction in employee benefits cost, this year there is a sharp rise in demand for skilled tech talent.

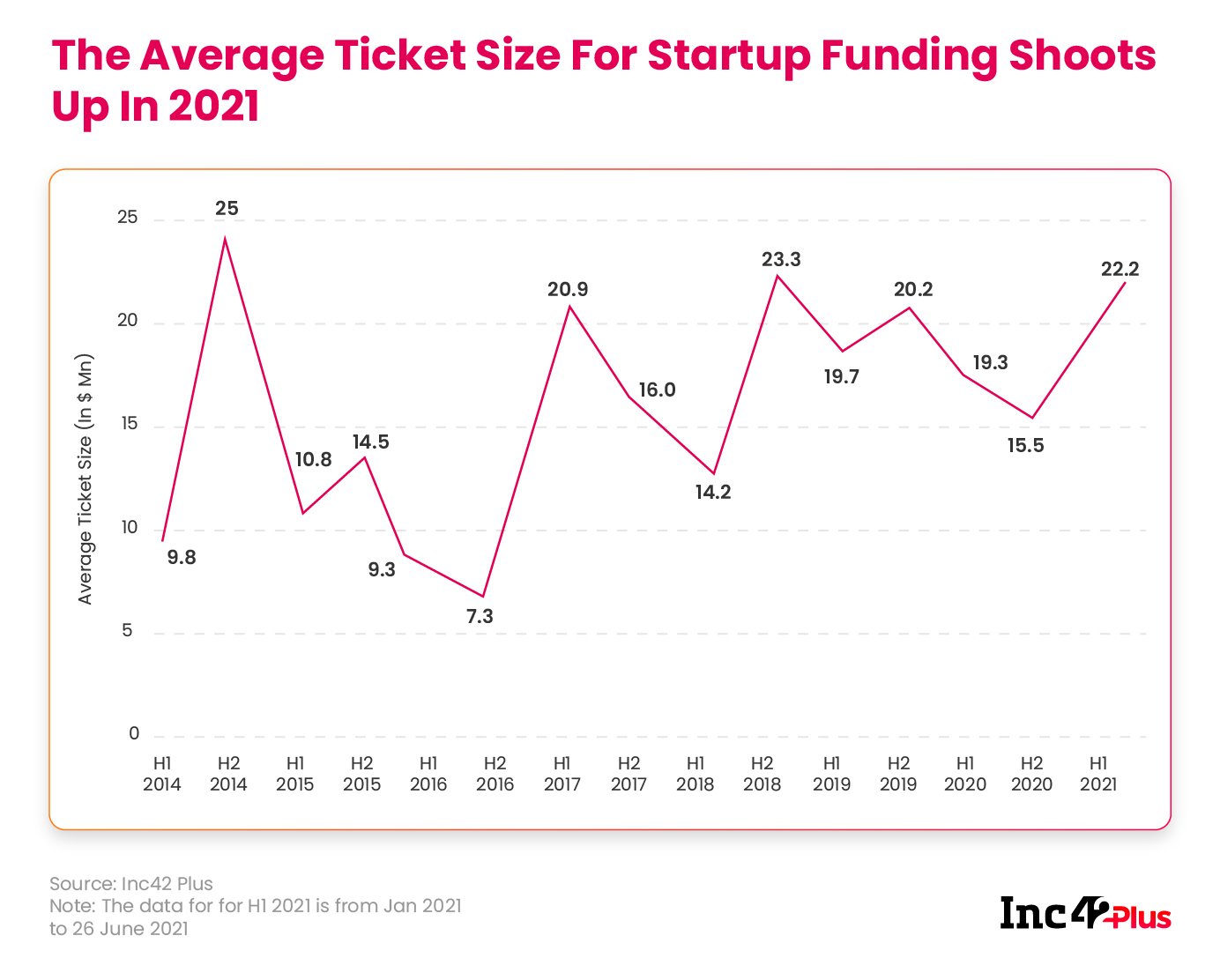

Unsurprisingly, the spurt in hiring stems from the influx of funding for startups that have built a warchest for the talent war. Those startups, which have recently raised funds, are in the best position to offer higher pay and therefore rule the job market. Nearly $20 Bn has been raised this year already, led by mega-rounds for Flipkart ($3.6 Bn) and Swiggy ($1.25 Bn).

At the same time, the number of unicorns has increased by 15 this year, which has resulted in these massively valued and funded startups dictating the job market. With too much VC money targeting and investing in few startups, unicorn startups have become far too common in 2021. The average time taken by startups founded in the early 2000s to turn into unicorns was 10 years, which is now five years for startups founded after 2010. Between 2014 and 2017, only 10 startups achieved the much-coveted unicorn status. But in 2021 alone, 15 have crossed the $1 Bn valuation mark.

These unicorns — BYJU’s, Unacademy, OYO, CRED, Groww, Lenskart, Swiggy, Zomato and others — have also raised back-to-back mega rounds this year to underline their growth ambitions. In essence, funding is getting concentrated, a trend already on the radar of market regulator SEBI.

The surge of unicorns has turned the competitive landscape on its head, even without counting the IT majors which are also looking at the same talent pool. For instance, Tata Consultancy Services (TCS), one of the largest IT services companies in the world, said that it planned to roll out salary hikes for its entire workforce in April 2021, the second such hike in the six months. TCS, Infosys and Wipro are planning to hire more than 1 Lakh candidates from Indian colleges.

Most startups cannot match this pace of appraisals and therefore even IT services companies are back in demand among the talent. The big companies are likely to suck up most of this talent, creating a lopsided market. Already, there is a shortage of digitally-skilled workers in India, who currently represent 12% of India’s workforce, according to an AWS report. The report said that the number of workers in India requiring digital skills will need to increase 9x by 2025 to meet the hiring demand of the tech industry.

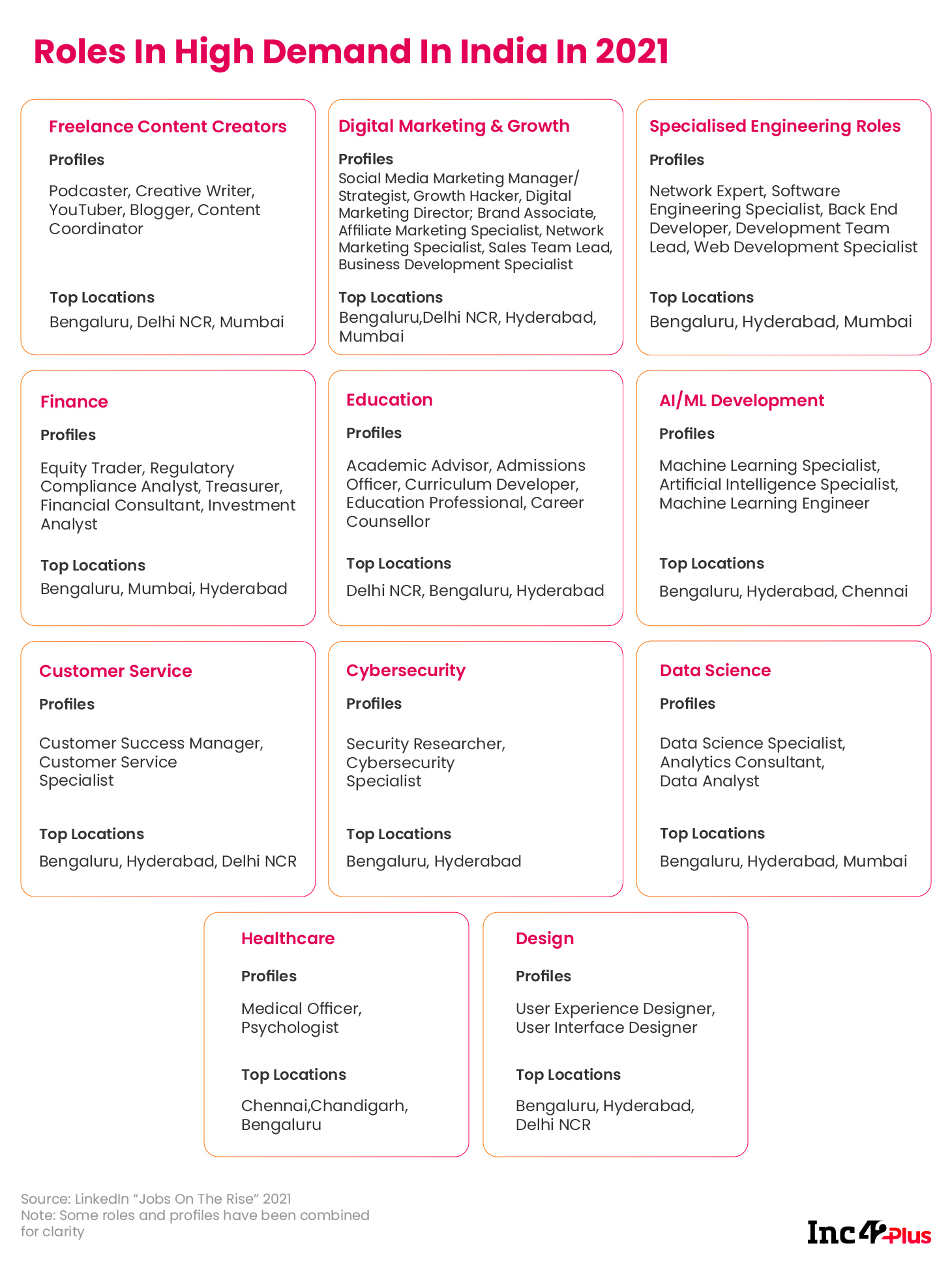

Among the most prized assets for startups are specialised engineers, AI and ML coders as well as backend developers. The demand and pay packages for these positions have naturally shot through the roof over the last few years, due to their specialised skill sets, other functions including growth marketing, content operations and customer success are also said to be attracting two or three times the money, according to Manpower.

The waves of lockdowns in India over the past 18 months have boosted consumer and business demand for tech products and services. In particular, the ecommerce sector has seen a surge in hiring across the sector for roles such as customer success managers, content specialists and growth marketers as companies have to create a raft of engagement for customers.

Can Smaller Startups Even Compete?

The stark reality is that hiring has already become too competitive, and such large packages by late-stage startups and unicorns will make it harder for early-stage startups to acquire new talent, according to Siddarth Pai, founding partner of 3one4 Capital.

He added that with the increased pace of hiring, early-stage startups may find themselves losing talent at a faster pace than earlier. This attrition will further lead to unicorns and massive startups dominating the talent market. “Even If a startup raises $2 Mn or $3 Mn, it will have to compete with a Swiggy, which has just raised $1.25 Bn,” Pai said, adding that the contest is not even close.

The intense competition for talent has prompted newly-turned unicorns to guard their key people with big employee stock options payouts and throwing cash at the most sought-for talents and roles. Nearly every big funding round this year has been followed by a major ESOP buyback by the startup to create wealth for employees.

Unicorn startups such as CRED ($6.2 Mn), Zerodha ($30 Mn), Udaan ($23 Mn), Razorpay ($10 Mn), Sharechat ($19 Mn), as well as soonicorns Zetwerk ($8 Mn) and Whatfix ($3.2 Mn) have collectively have bought back ESOPs worth nearly $100 Mn this year. Besides this too, other startups like Acko and Wakefit have also bought back employee stocks this year worth $4 Mn overall.

Paytm wants to take it a step further and expanded its ESOP scheme to $604 Mn, which is the largest among Indian startups, while Flipkart is considering a buyback worth INR 600 Cr ($85 Mn). These are just some examples of how startups guard their skilled tech talent these days.

Smaller startups, who may not have the ability to initiate ESOP buybacks or pay high salaries, will not be able to compete for the talent based on pay. The communication of a startup’s values and culture will become paramount in the hiring process. Plus founders at smaller startups will have to take up more responsibilities within the operations.

“Bootstrapping is the only way out for many of the smaller startups. Founders may have to develop the platform themselves or get hands-on with AI and ML coding in the first year or so, before looking at hiring. Besides this, they can rely on training and upskilling programmes for their tech talent, which will give these employees a sense of belonging,” Pai added.

But again, these are intangibles in a world where cash is king. So startups will have to constantly be on the lookout for new hires or have to bootstrap with their existing resources to fill the talent gaps. This cannot be sustainable for the Indian tech startup ecosystem even in the medium term.

Investors and those watching the startup hiring spree believe that new startups will fall by the wayside if VC-funded major startups continue to offer high pay. But there is another perspective, one that would be bad for all startups involved, and not just the smaller ones.

But Are Startups In A Hiring Bubble?

In 2015, India saw a major funding boom, particularly in the hyperlocal and ecommerce space, but the consolidation of the market subsequently led to shutdowns, employees losing jobs or startups not being able to sustain the higher pay, said Santosh N, managing partner, D&P Advisory India.

Today, the startups that have raised funds at high valuations are feeling the pressure of metrics promised to investors. Very few would be in a position to raise funds at a higher valuation if the performance or growth is not up to the mark, he added.

The startups, which raised Series A funding in 2018 and 2019 based on targets set for 2020, are in a precarious position if they have missed the milestones they agreed upon. They will now find it difficult to close the next round as investors look into their performances. This makes their valuations bloated and adds more pressure on them.

Downrounds and equity dilution due to investor pressure are already a problem in the Indian startup ecosystem, but right now the noise around hiring is loud, which drowns out the critiques of such profligacy. Will the hiring boom lead to the same issue that happened in 2015 when salaries were inflated at junior levels, which eventually became unsustainable?

Valuation Warning For Zomato After IPO

Speaking of unsustainable, Zomato has received a caution from the man known as ‘Wall Street’s Dean of Valuations’. Zomato listed on the stock exchanges on Friday (July 23) at INR 120, a nearly 53% premium over the issue price of INR 79 per share. However, New York University finance professor Aswath Damodaran said that even assuming that Zomato will be the market leader in India’s food delivery sector with 40% market share, the company’s stock price should not be worth more than INR 41.

“The assumption that will make or break Zomato as a company, since so much of the potential in the company is dependent on how the food delivery/restaurant market in India evolves over the next decade… Even allowing for robust growth in India and improved digital access, I find it hard to see the total market exceeding $40 Bn,” he added, indicating that Zomato’s stock price may be inflated at the moment.

We wonder whether the same will apply for other startups — Paytm, Policybazaar and others — that are looking to list soon.

Till next week,

Nikhil Subramaniam

Featured image & graphics: Aprajita Ashk

![[The Outline By Inc42 Plus] New Breed Of Big Tech In India](https://asset.inc42.com/2021/12/Outline-97-_Featured-490x367.jpg)

![[The Outline By Inc42 Plus] Funding Boom Before The Bubble?](https://asset.inc42.com/2021/12/Outline-96-Featured-490x367.jpg)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Startup Vs Startup In India’s Talent War-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)