SUMMARY

While companies constantly advertise their worker-focused relief schemes, why are gig workers protesting across the country?

Dear Valued Customer,

It was January 1982, when around 250,000 textile workers in Mumbai participated in the largest strike in the Indian subcontinent — that’s a quarter-of-a-million people. Their demands included bonus payments and wage increases. It pretty much ended the Mumbai textile industry as neither owners nor workers clung on to their positions. It may be over 38 years since that massive strike, but the atmosphere is eerily similar to 1982 as gig worker strikes and agitations have resurfaced across the country.

Covid-19 was the final straw for gig workers who had shown signs of growing discontent with platform companies and aggregators in the past couple of years. Since June 2020, gig workers contracted to Zomato, Swiggy, Rapido, Dunzo, Ola, Uber among other companies have gone on strikes to demand better wages, simpler pay structure and better incentives.

Most recent are the strikes by Swiggy delivery executives in Hyderabad and Noida — where thousands of such riders have gone on an indefinite strike, echoing a similar strike by Zomato delivery executives last year.

Drivers for Ola and Uber also organised strikes in 2017 and 2018 and there have been isolated strikes in various cities over incentives too. But Covid seems to have brought these various gig economy workers together.

“One key factor here is that venture capital allows these platforms to scale quickly by initially providing deep discounts to customers and high incentives to workers. However, once the need to pivot towards profitability sets, platforms begin to dial down these incentives and offers,” Pradyumna Taduri told Inc42. Taduri is a research consultant for Fairwork Project, which is primarily focussed on understanding the conditions of work for platform economy workers.

He has a point too. Last year, in the middle of the major IPL tournament when the number of orders went up, Swiggy offered delivery workers between INR 750 and INR 7,500 as a weekly bonus. But outside such peak seasons too, incentives are a significant portion of a delivery workers’ earnings and these have dwindled since then, Taduri added.

While tips and such extras have been introduced lately, there’s just not enough money in the job for many of these delivery workers.

Discontent over pricing has also affected restaurant partners of foodtech companies and recently, NRAI has stated its intentions to avoid food-delivery platforms by creating its own platform.

Complex Pay Structures

“Sometimes I feel powerless. These people are sucking our blood. They aren’t providing any proper payout,” a Swiggy delivery executive going by the pseudonym Lord Beerus told us in a conversation about the ongoing strikes against the company’s revised pay structure.

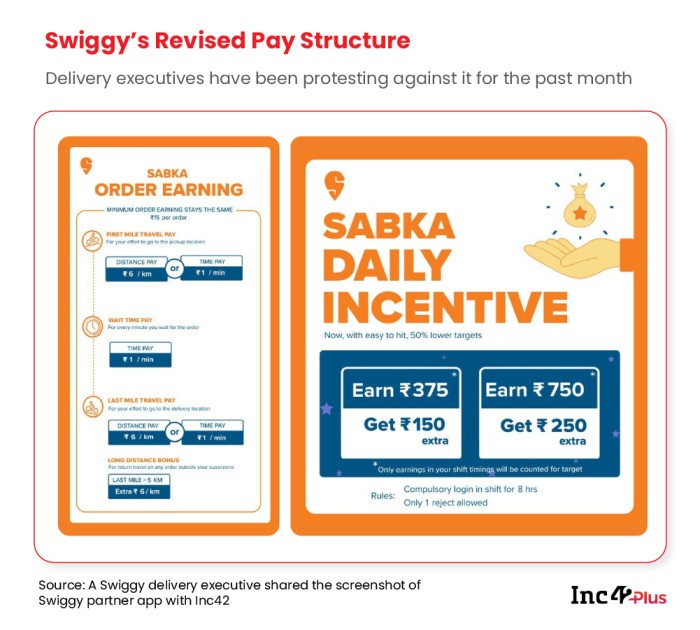

Multiple gig worker unions and delivery executives have similarly claimed that their daily earnings have reduced astronomically under the new pay structure for incentives. The average earnings per day are said to have gone from INR 700-INR 1,000 to about INR 300 for most zones. Further, many incentives are also said to have reduced in this revised scheme.

A Swiggy spokesperson confirmed that monthly incentives for delivery executives have been discontinued. “We found that our monthly incentives were benefiting a very small percentage of our delivery fleet. Therefore, Swiggy has actively reinvested that spend to ensure a higher daily incentive component for more delivery partners and made them easier to achieve at the same time. The objective is to ensure more partners make incentives and earn from it on an everyday basis,” the company told Inc42.

“Earlier, surge pay and rain mode bonus were also included in order earnings. Now they are not including it for daily incentives,” ‘Beerus’ added.

Like ‘Beerus’, executives have also said that the new targets to earn incentives are hard to achieve given the drop in per-order earnings.

A source close to Swiggy told us that surge bonuses are still active at Swiggy. They also noted that daily incentive targets for delivery executives logging in for 8-10 hours and the ones logging in for 4-5 hours might be different. Delivery executives have denied these claims saying that an 8-hour shift is mandatory to earn a daily incentive.

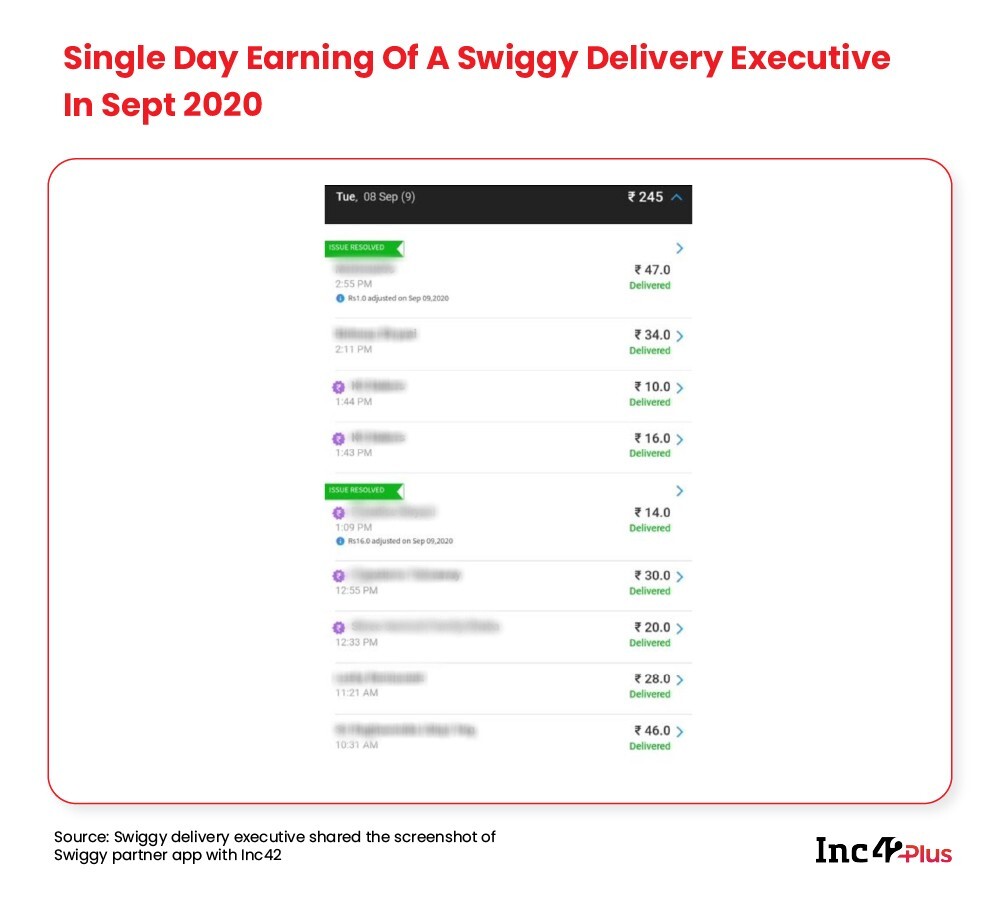

While Swiggy claimed that no delivery executive earns just the basic INR 15 pay for deliveries because of additional components like restaurant waiting time, shift completion etc., however, screenshots of dashboards on the Swiggy Partner app for delivery executives tell a different story. In cases where delivery executives are earning above INR 35, they claim to have travelled up to 6-7 Km to make the delivery. The delivery partners have to pay for petrol by themselves so end up making a negligible profit on each delivery. Many have opted for bicycles in this case, but bicycle deliveries have a limited range on Swiggy and Zomato, and as such there’s not much scope of earning incentives.

However, Swiggy claims most delivery partners in Hyderabad, for instance, make an average of INR 45 per order. For long distance deliveries, after a certain distance threshold, they are paid 2x the per-kilometre amount for each additional kilometre travelled, compared to short distance deliveries.

It should be noted that, in the following screenshot, some of the orders where the delivery executive has earned INR 10 are batch orders (two orders delivered in the same area), like the third and fourth order which were delivered 2 minutes apart.

Another reason for delivery executives earning lower is the outsourcing of orders to third-party companies like Shadowfax. Interestingly, Shadowfax is paying delivery executives more than what Swiggy does and is somewhat comparable to what Swiggy used to pay earlier.

“Delivery executives work for more than 12 hours on road, and are still earning only about INR 300 per day. This is open exploitation of the delivery executives by the Swiggy Management. Swiggy takes delivery charges from the customer, and commission from the restaurants but they are still paying very less to delivery executives,” said Shaik Salauddin, the national general secretary of the Indian Federation of App-Based Transport (IFAT).

Swiggy’s Hunger Saviour Fund was supposed to help delivery partners impacted by Covid-19 and suffering loss of pay due to 14-day quarantine and recovery period. But this has also been criticised by delivery executives. The benefit is only offered to those delivery executives who were quarantined in hospitals, and not the ones in home quarantined even after they might have tested positive for Covid-19, one such home-quarantined Swiggy delivery executive told us.

Crowdfunding Relief

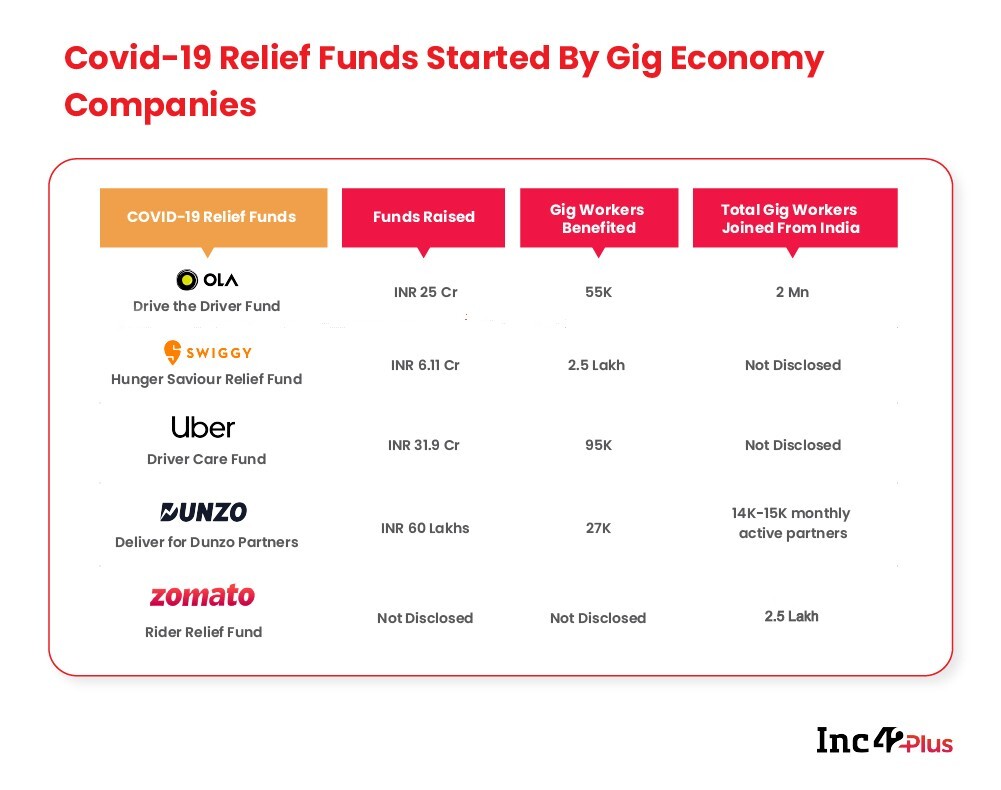

Specifically for Covid-19, many gig economy companies announced crowdfunding campaigns to raise money to support driver-partners and delivery executives through the coronavirus slowdown. Ola claims to have touched the lives of 55,918 families through its Drive the Driver Fund, enabling 9.3 Mn meals and aiding 843 medical emergencies across 25 cities.

Similarly, Swiggy launched a Hunger Saviour Relief Fund which is said to have supported 2.5 Lakh delivery executives. Swiggy told Inc42 that 90% of the INR 6 Cr raised for this fund was contributed by internal stakeholders. Further, the company claimed that during the first lockdown, when many cities were shut, the company financially aided delivery partners who continued to log in to work despite not being able to deliver any orders. The company claims to have supported about 40K delivery partners across the country with INR 18 Cr given as earnings guarantee. Swiggy did not share the total number of active gig workers on its platform.

Uber also launched the Uber Care Driver Fund which had an INR 25 Cr commitment from Uber and the rest was raised through crowdfunding from employees, citizens, NGOs and corporate partners. The company claims to have benefited about 100K drivers through this.

“We are providing financial assistance to either those who’ve been diagnosed with COVID-19 or have been placed in quarantine by health officials. We’ve distributed over 3 Mn masks and 400,000 bottles of disinfectants and sanitisers to drivers free of cost.” claimed an Uber spokesperson.

However, the company did not disclose the assistance amount given to the drivers who contracted Covid-19. Uber also did not share the number of gig workers that earn from the company in India.

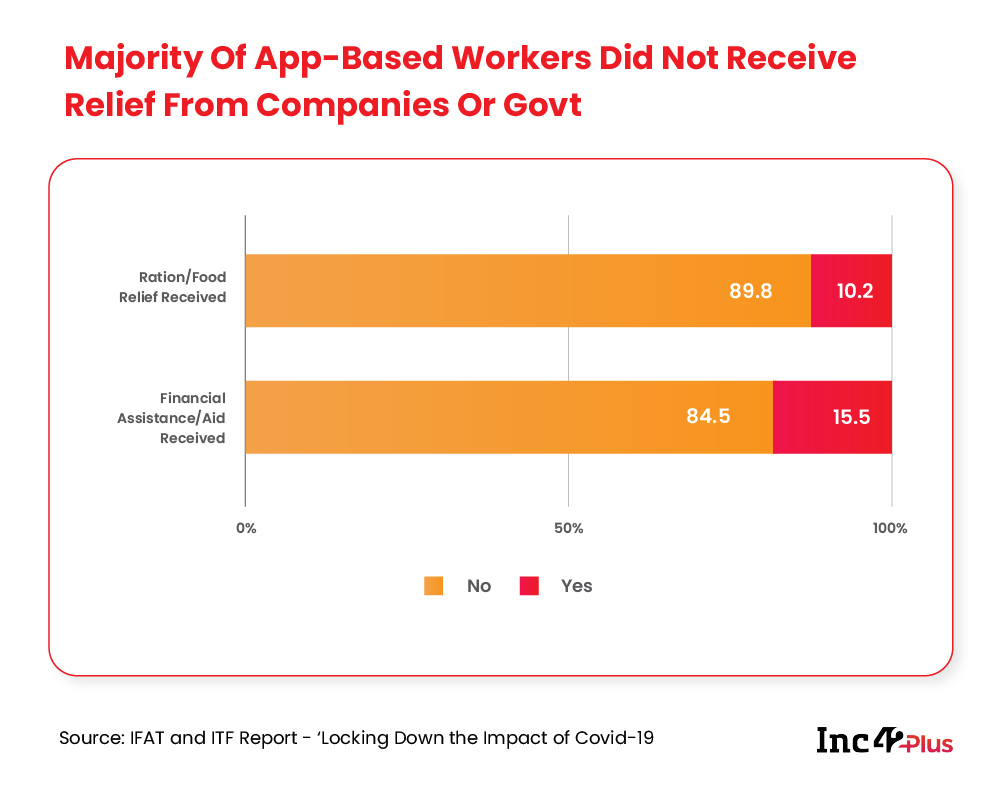

While most companies declined to give us numbers, worker associations claim that on the ground only 20-25% of the gig workers have actually reaped the benefits of these Covid-19 relief funds.

Out of the 1,299 survey respondents in IFAT and (International Transport Workers Federation) IFT’s survey of app-based workers from 55 cities in 15 states, 89.8% of workers said they did not receive any ration or food assistance, and 84.5% did not receive any financial assistance from either companies or governments. The respondents include workers associated with Swiggy, Dunzo, Rapido, Uber and Zomato as well as in IT and the travel industry (presumably fleet drivers).

“A fundamental challenge has been regarding the transparency with platform companies that have operated (and continue to do so). They have refrained from sharing any data publicly, and any information shared has been to virtue signal, thereby lacking any useful granularity,” said Aayush Rathi, policy officer at The Centre For Internet and Society (CIS).

The Gap Between Promises And Reality

The IFAT-IFT survey added that, “Ola and Uber have their own eligibility criteria based on which they are selecting the driver who shall receive the relief funds.”

Caveats and conditions in relief schemes were observed with other companies too.

For instance, Zomato had pledged that it would reimburse the cost of grocery and other essentials for delivery partners but the bills “need to be GST compliant”. For a Zomato delivery partner whose family is dependent on a monthly income of INR 15,000 income, it is simply not feasible to shop for daily essentials at retail stores that print GST compliant bills. The rather obtuse criteria leaves out a lot of delivery partners.

Even before questioning the impact of these relief funds, the bigger question is why these multi-billion dollar companies have to depend on fundraising campaigns to offer security for such a critical component in their value chain. Who will deliver if not these contracted workers? They form the backbone of these platform companies and aggregators in every sense of the word.

Zomato acknowledged this in its blog and without a hint of irony claimed, “We really want to, and we are keen on safeguarding every family associated with us, but there is only so much we can do to help in this situation. It’s beyond our financial viability to support our delivery partners.”

It is interesting to note that Zomato has plans to go public in 2021 and has recently raised a $100 Mn funding from Tiger Global. Also, in the first quarter of 2020-21, the current fiscal year, Zomato’s earnings stand at $41 Mn while the losses were at $12 Mn.

Fairwork Foundation’s Pradyumna Taduri argues that raising relief funds through crowdfunding is another way for these tech giants to distance themselves from their obligations to workers. “What is clear is that platform workers typically spend over 48 hours a week working on these platforms and so, their jobs on the platforms is their main and often only source of income. Yet, platforms label workers as ‘partners’ or ‘independent contractors’ sidestepping obligations to workers such as fixed salary, social security benefits (e.g. PF and ESI),” he added.

Can alternatives exist? And if so, why have companies with huge funding not tried them? Is it just because contracting these part-time workers is the less burdensome option, financially speaking?

Alternate delivery service models such as Pidge which has delivery executives on payroll are being seen in India. Pidge claims to have fully preserved the salary and benefits of its delivery executives through the lockdown, including for those who were occasionally unable to work because of evolving containment zones. However, Pidge did not share the average monthly earnings of its payrolled delivery executives.

Will policy push companies to change? The Draft Code on Social Security, 2019 is the first bill in India to explicitly mention ‘platform workers’ and has also indicated that ‘gig workers’ and ‘platform workers’ be covered by a social security scheme. Recent media reports have noted that the new social security code might make it mandatory for platform companies to contribute to social security funds for gig and contracted workers from their books. The code was approved by the union cabinet in 2019 and will now be tabled in the Lok Sabha’s ongoing monsoon session.

Public Companies On The Rise

As the world goes through the worst recession since World War II, and even as India’s GDP shrank by 23.9% in the first quarter, startups are gearing up for IPOs. Just a week after Zomato announced its plans to go public by the first half of 2021, three more startup heavyweights have thrown their hats into the IPO ring. After orchestrating the biggest acquisition deal from India, Walmart-owned Flipkart is looking to go public next year at a valuation of $45 Bn – $50 Bn. It will list either in the US or other international stock exchange, given Walmart’s global brand value.

Next in line is the SoftBank-backed logistics unicorn Delhivery, which is looking to list itself in the next 12-18 months. COO and CBO Sandeep Barasia noted that Delhivery wants to list in India, but it is awaiting the government’s rules on international listing for Indian companies. In the financial year 2019, Delhivery had reported a consolidated loss of INR 1,772.77 Cr with a revenue of INR 1,694.15 Cr and expenses of INR 3,466.99 Cr.

Even payments major Mobikwik is eyeing a 2022 with the stock market. However, there is no clarity on whether the company will be listed in India or abroad. Mobikwik’s annual report 2019-20 revealed that the fintech company’s revenue grew 133% year-over-year to INR 379 Cr, while EBITDA loss was reduced by 63% year over year to INR 45 Cr.

Given that these startups are still loss-making entities, the success of their public offers might have certain dependence on the location of their listings. Analysts have earlier said that overseas listing gives startups access to global investors and also makes exits easier for the existing investors who are usually from these global markets.

Valuations On The Rise

In the past few years, Indian startups have become the flag bearers of domestic innovation and in some cases even attracted global brand recognition. India is today home to 36 unicorns, with Unacademy being the latest to enter the elite club. Besides, there are over 52 Indian startups that have the potential to enter the unicorn club by 2022, according to Inc42 Plus.

A positive correlation between the development of a startup ecosystem and the number of unicorns can be inferred from the state of the two most prominent startup ecosystems in the world — the United States and China have 228 and 122 unicorn startups and both are also the two biggest startup markets in the world in that order.

On the third spot is India which has over 55K startups out of which 36 managed to enter the unicorn club (few dropped out as well). India has outpaced more developed economies and emerging startup ecosystems such as the UK (25), Germany (13), and South Korea (10).

Having closely followed this space for many years now, we have constantly kept our soonicorn and unicorn trackers updated for internal use and for our exclusive reports. And now, we are opening these up for Inc42 Plus members. Hope you enjoyed our latest trackers and let us know if you think you want to see more such trackers in the future.

As we bid goodbye to another week, let us take a moment to be thankful to the hundreds of thousands of delivery executives and cab drivers around India who have worked tirelessly through the lockdown to keep our cities and towns going — and making our work-from-home life so much more bearable.

Let us not overlook the hardworking men and women who have allowed us to enjoy these creature comforts even in the most desperate of times. They are unlikely to read this, but here’s us giving them a standing ovation.

Delivering Your Outline,

Yatti Soni

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike](https://asset.inc42.com/2020/09/image-20-2.jpg)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[The Outline by Inc42 Plus] India’s Gig Economy On Strike-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)