From having a handful of tech companies to dozens and thousands of innovative new ventures, India’s startup ecosystem has grown immensely in the past decade

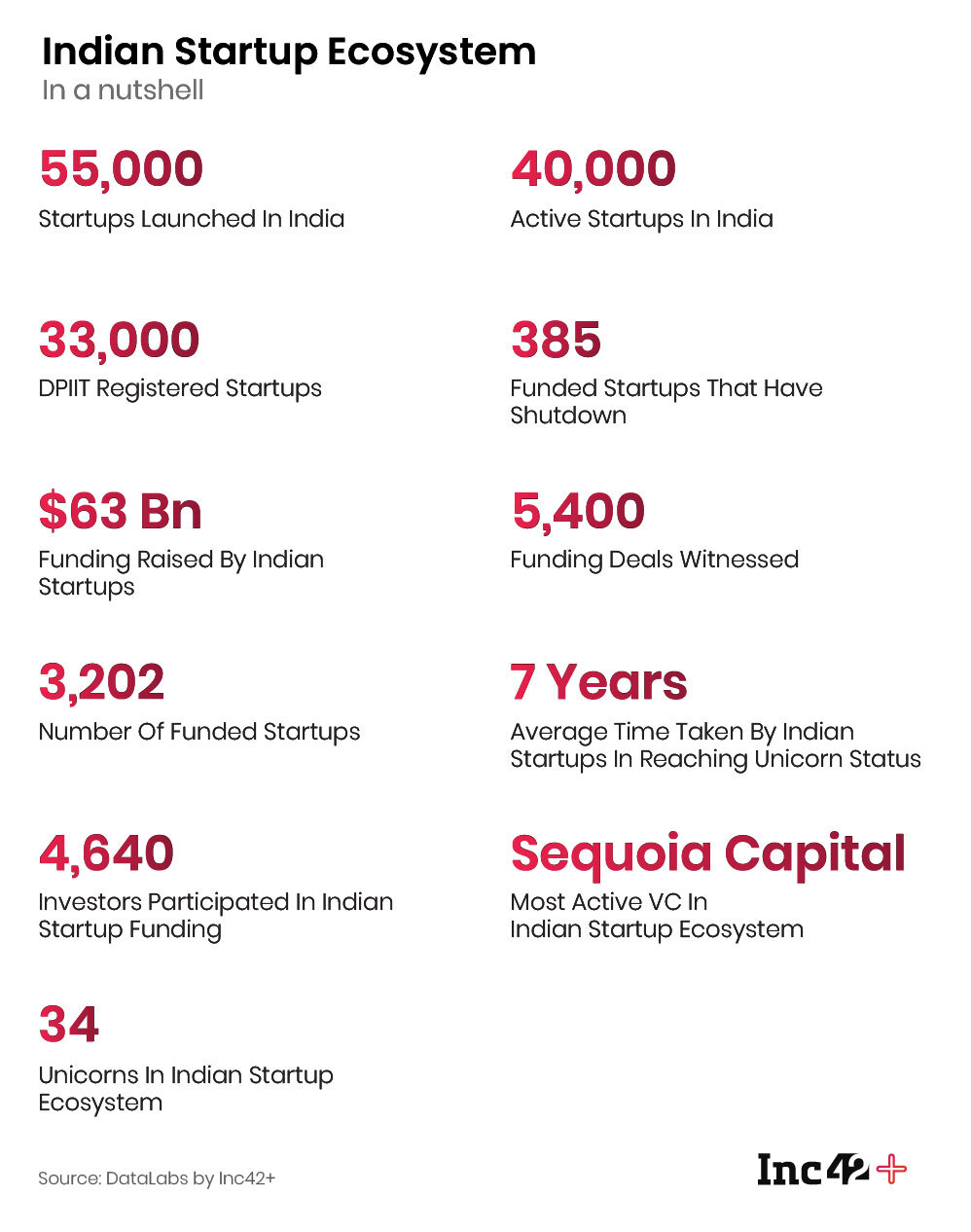

India has witnessed launch of more than 55,000 startups to date with more than 3,200 startups raising $63 Bn in funding in the last five and half years alone

Home to 34 unicorns, and 52 soonicorns with a potential to become unicorns by 2022, the world’s second largest startup ecosystem is poised for disruption

In just over half a decade (2014-2019), India has shown a great appetite for technology, data and the internet. The internet paved the way for thousands of startups to rise over the past decade, address unique problems, transform entire industries and create new segments!

From having a handful of tech companies to dozens and now thousands of innovative new ventures, India’s startup ecosystem grew immensely in the past decade. From 29K startups in 2014, the number has grown exponentially from 2015-2018 and will touch 55K startups by the end of 2020.

With overall funding skyrocketing to touch $63 Bn between 2014 to H1 2020 alone, India has seen entry of 34 startups in the unicorn club having a combined valuation of $115.5 Bn.

Celebrating the success of the startup ecosystem in the last decade, we are happy to announce the launch of the second edition of our flagship report — The State Of Indian Startup Ecosystem, 2020.

The report will act as a go-to-guide for just about everything one may want to understand about the Indian startup ecosystem. With deep, data-driven insights to influence strategic decision-making in governance, investments, growth, and other core aspects driving the Indian startup ecosystem.

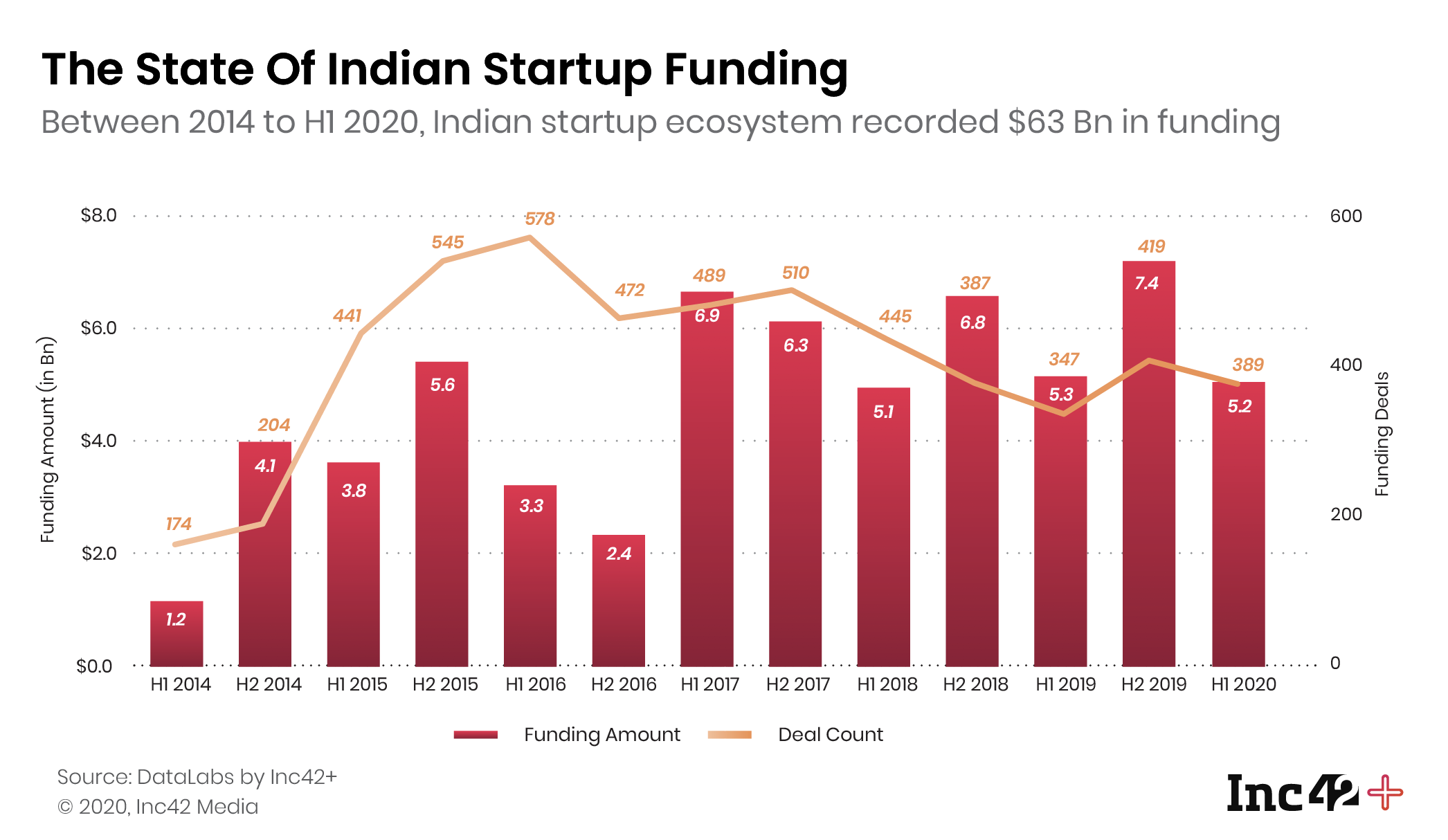

The State Of Indian Startup Funding

It won’t come as a surprise to anyone that 2020 has brought some very unprecedented changes in the business world. For Indian startups, the funding winter this year has begun in the middle of sweltering summers. While the ecosystem has come a long way since 2014, going through the golden period of funding between 2015 and 2017, after a couple of years of slow but mature growth, 2020 has been a year of decline.

Over the years, the growth of startups has brought in more international investors and boosted their confidence towards India. Fundraising reported by SEBI-registered (Category 1) venture capital funds grew from INR 326 Cr in 2014 to over INR 2,703 Cr in 2019 — an 8x surge in five years. Also, the share of actual capital raised to commitments in 2014 was 35% compared to 61% in 2019, indicating the growing investor interest towards investment opportunities in India.

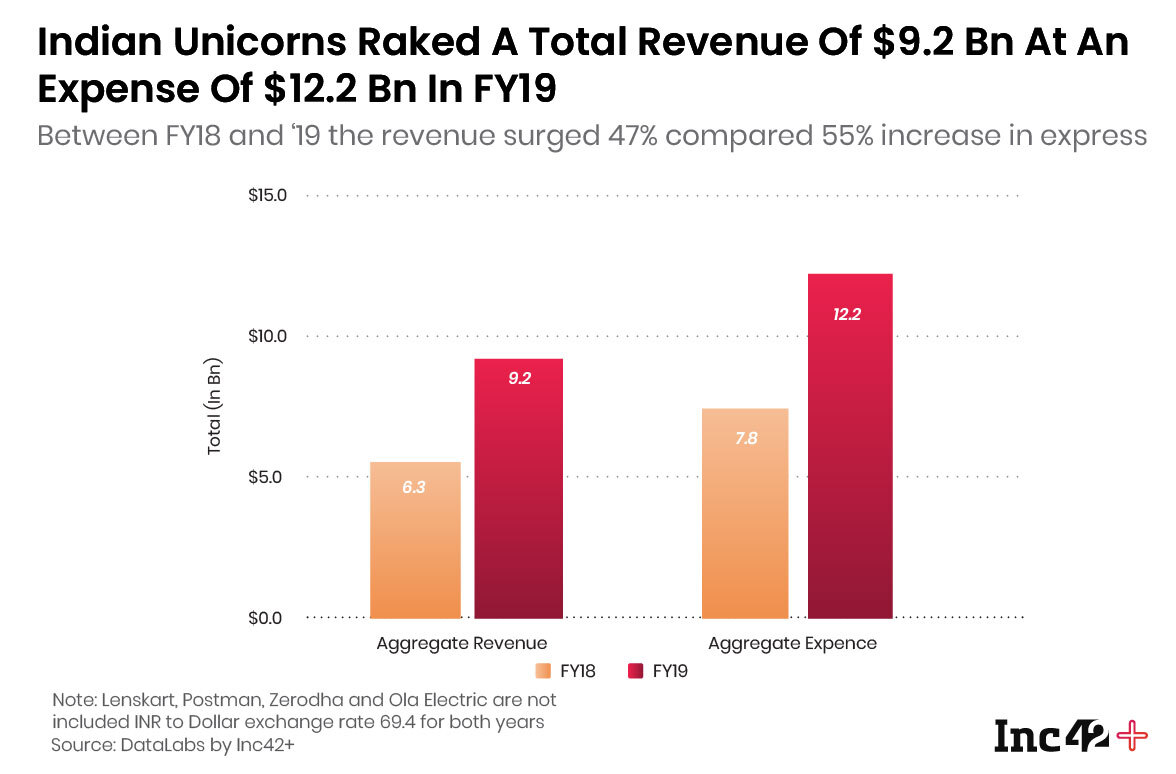

With such huge money at play, the Indian startup ecosystem has a lot to lose due to the pandemic. It has already left millions of people jobless and created a liquidity crisis in many places. Covid-19 has created a new market in almost every sense, for instance, once-lauded metrics such as the gross revenue and total addressable market has been usurped by sustainability-focussed goals like EBITDA and economies of scale.

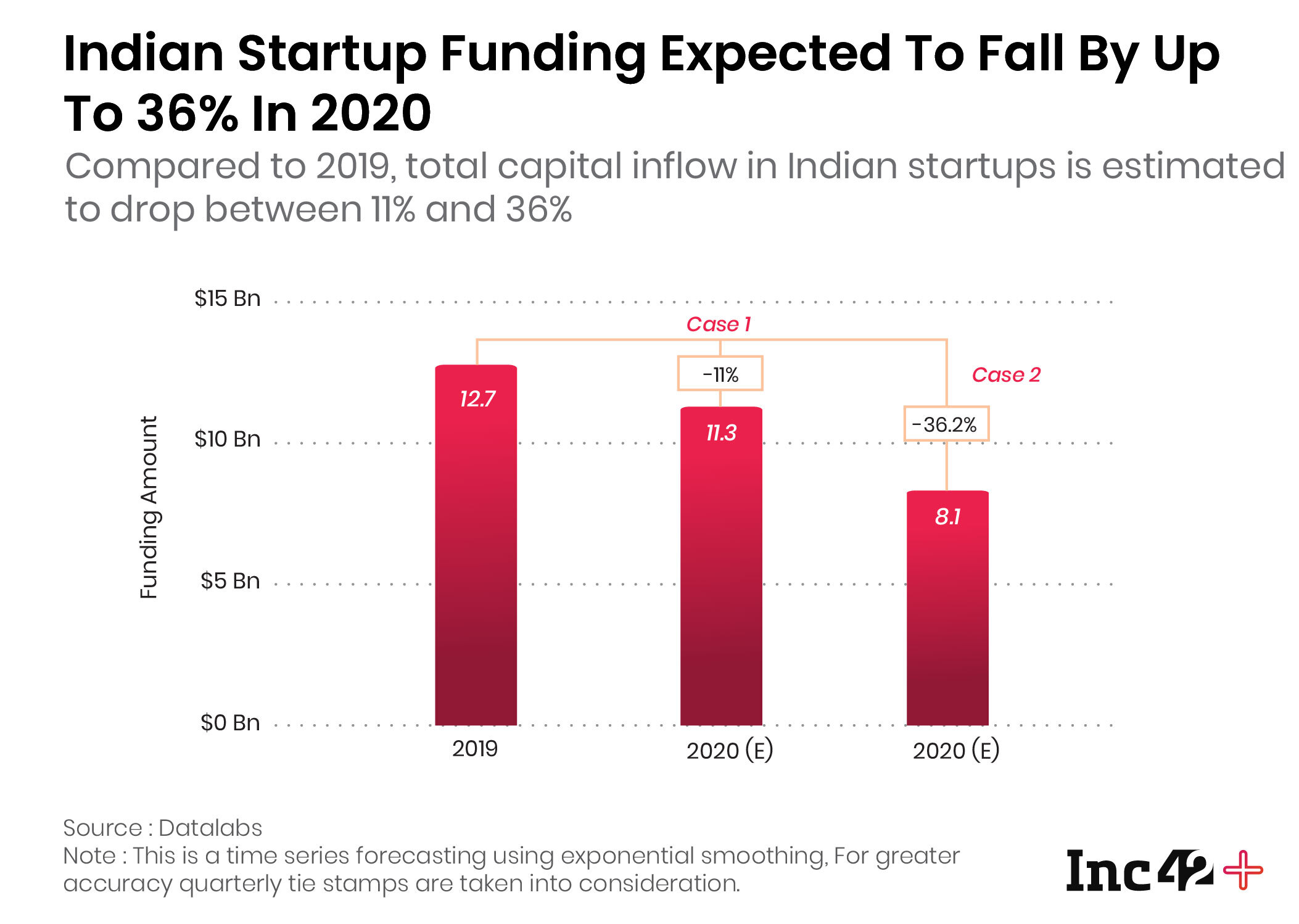

The numbers make it quite evident that investment activity in startups is slowing down post the pandemic. Therefore, in a scenario (i.e. Case 1) where high ticket value investments in established startups will continue to flow along with greater investor confidence towards the beneficiary sectors such as edtech, fintech, online gaming and OTT, ecommerce and enterprise tech. The total capital raised by Indian startups in 2020 is estimated to reach $11.3 Bn in this case, which can be termed the best-case scenario, an 11% decline compared to the previous year.

On the contrary, in Case 2, high ticket size investments will take a hit and there will be only moderate investor confidence towards the beneficiary sectors. Under this scenario, the total capital inflow in Indian startups is expected to dip in 2020 by as much as 36.2% compared to 2019, to reach $8.1 Bn. In both scenarios the total capital inflow in Indian startups for the year 2020 is expected to be the lowest since 2017.

State Of Unicorns And Soonicorns

From a single unicorn in 2012, 10 in 2016, India has seen 34 startups attaining unicorn status with a current combined valuation of $115 Bn.

In our recent analysis of the Indian startup ecosystem based on the current pace and growth and other factors we have identified 52 soonicorns which have the potential to enter the unicorn club by 2022.

There are 53 startups in India that have the potential to achieve $1 Bn plus valuation by the end of 2022 as per our analysis. Out of which the single highest number of startups (19) is from fintech. This is different from the same in unicorns where enterprise tech startups (7) have the highest number.

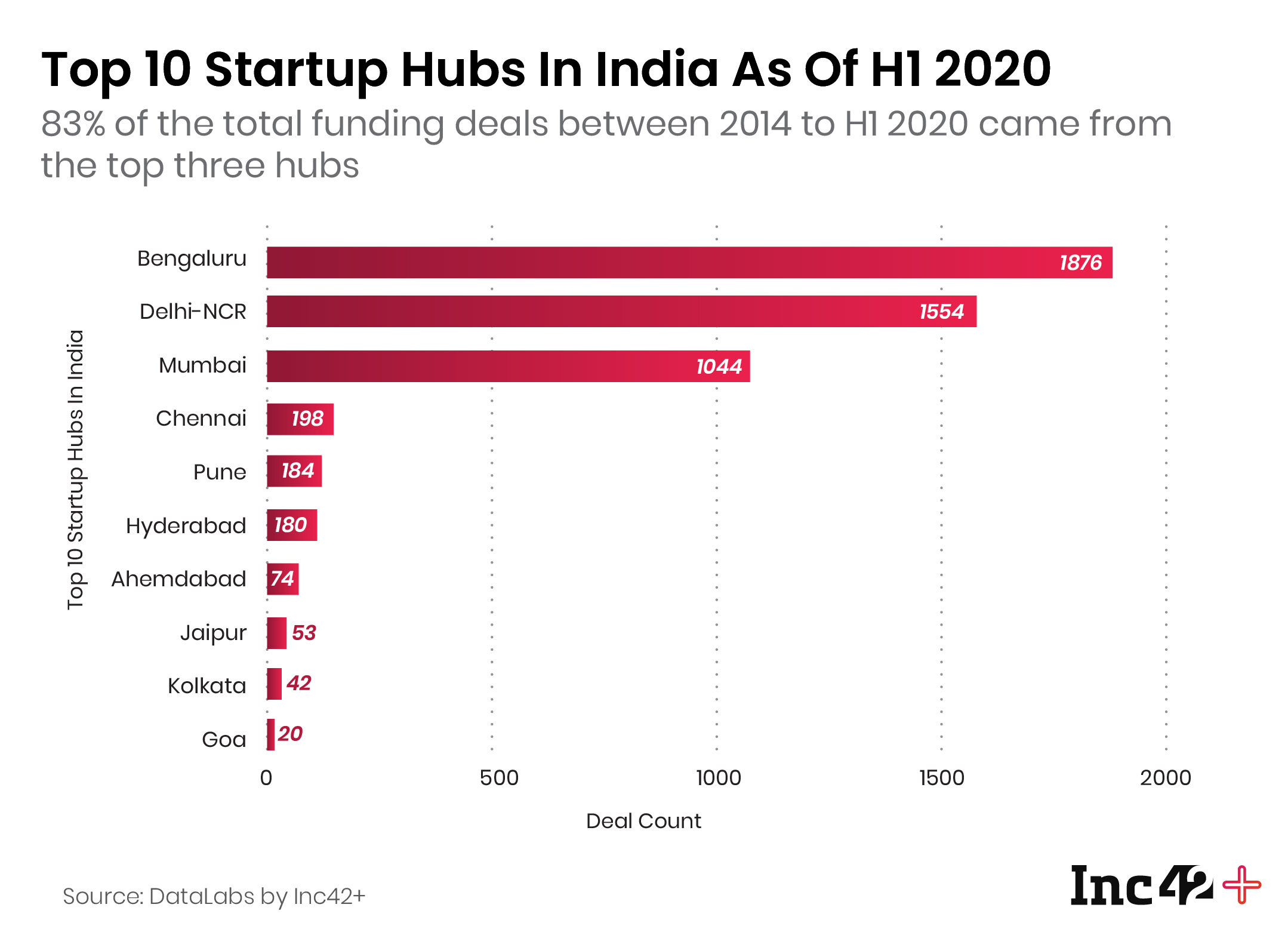

The State Of Indian Startup Hubs

As we closed the first half of 2020, Bengaluru the long hailed startup capital of India still has its crown intact with a total funding amount of $28 Bn across 1,876 deals between 2014 to H1 2020.

Lately, in addition to the top three hubs (Bengaluru, Delhi NCR and Mumbai) emerging hubs such as Pune and Hyderabad have recorded a compounded annual growth rate (CAGR) of 45% and 37% respectively.

In the tier segment, Jaipur and Goa have earned their spot in the top 10 startup hubs as of H1 2020 based on the number of funding deals. Interestingly, Jaipur a tier 2 city has outperformed Kolkata— a celebrated tier 1 metro.

The State Of Indian Investor Landscape

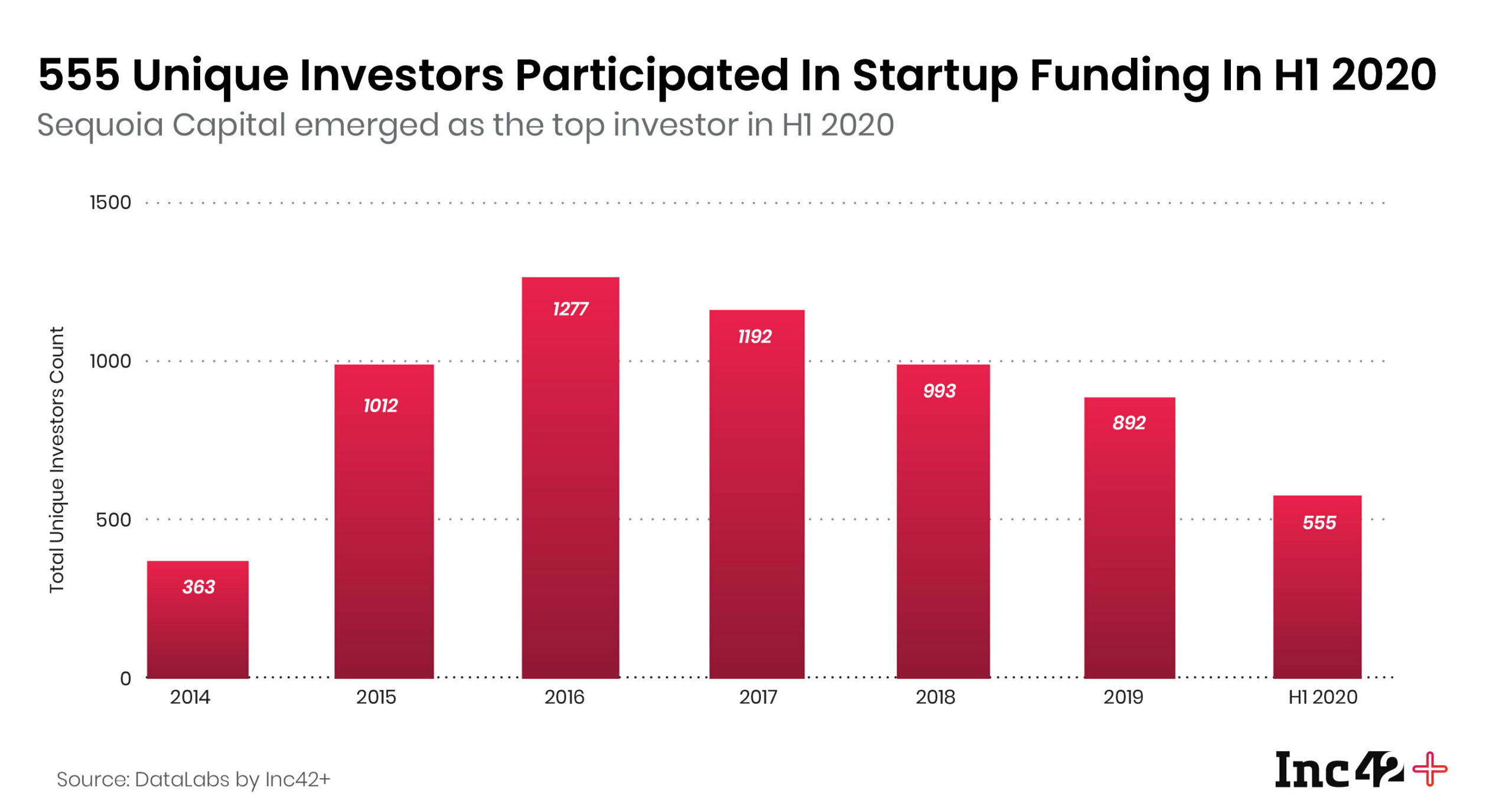

With the beginning of a new decade in the 21st century earlier this year, the journey of Indian startup ecosystem has entered a new phase. From a handful of investors and a few startups to over 49K startups and over 2,000 Indian and international investors, the startup ecosystem has come a long way in the past five years. International investors now routinely come to Indian shores to invest in the burgeoning tech ecosystem.

While angels and corporations undoubtedly have played a big role in funding trends, according to DataLabs by Inc42 analysis, 2019 was not one of the better years for venture capitalists.

As per our analysis, till the second half of 2020, there are approximately 4,640 active investors in India. Among these, the majority or 59% (2,751) are angel investors and 18.3% (849) are venture capital firms. Overall there is a downward trend in terms of unique investor participation similar to what has been observed in 2019. However, the frequency of participation by the existing investor is on the rise.

Looking Beyond 2020

While the first decade of the 21st century was all about bringing India’s cities and metros online, the past ten years have been about using the internet to create businesses and startups and take the digital torch to Tier 2, 3 markets and rural India. India is today home to the world’s largest working population and startups are expected to take full advantage of this in the next five years.

After steady growth in 2018 and 2019, in 2020 too, the Indian startup ecosystem was expected to remain stable in terms of funding and investor interest, but the pandemic has changed the game completely. With the funding winter coming in early, there’s a bigger focus on sustainability, which is also expected to play a part in the number of funding deals.

Nevertheless, there are several positives still in the Indian market to give us hope about the future of startups. Growing from a nascent stage to a flourishing ecosystem to the current stage of maturity and stability, Indian startups have some of the best market conditions to take advantage of with digital products and services adoption at an all-time high. Once the medium and long-term pandemic impact subsides, there’s no stopping Indian startups.

By 2025, the number of startups in India is expected to cross 100K, creating more than 3.25 Mn jobs in the process. At the same time, the total funding in Indian startups is likely to increase to over $150 Bn and with the total value creation exceeding $500 Bn.

Ad-lite browsing experience

Ad-lite browsing experience