SUMMARY

Trell’s total revenue grew by a massive 1085% to INR 144.7 Cr in FY22 from INR 12.2 Cr a year ago

While losses piled up, cofounders - Pulkit Agrawal, Bimal Kartheek Rebba, Arun Lodhi - took home a salary of INR 74.78 Lakhs each in FY22

Trell was reportedly the subject of a forensic audit launched by cohort of its investors after allegations of alleged financial surfaced last year

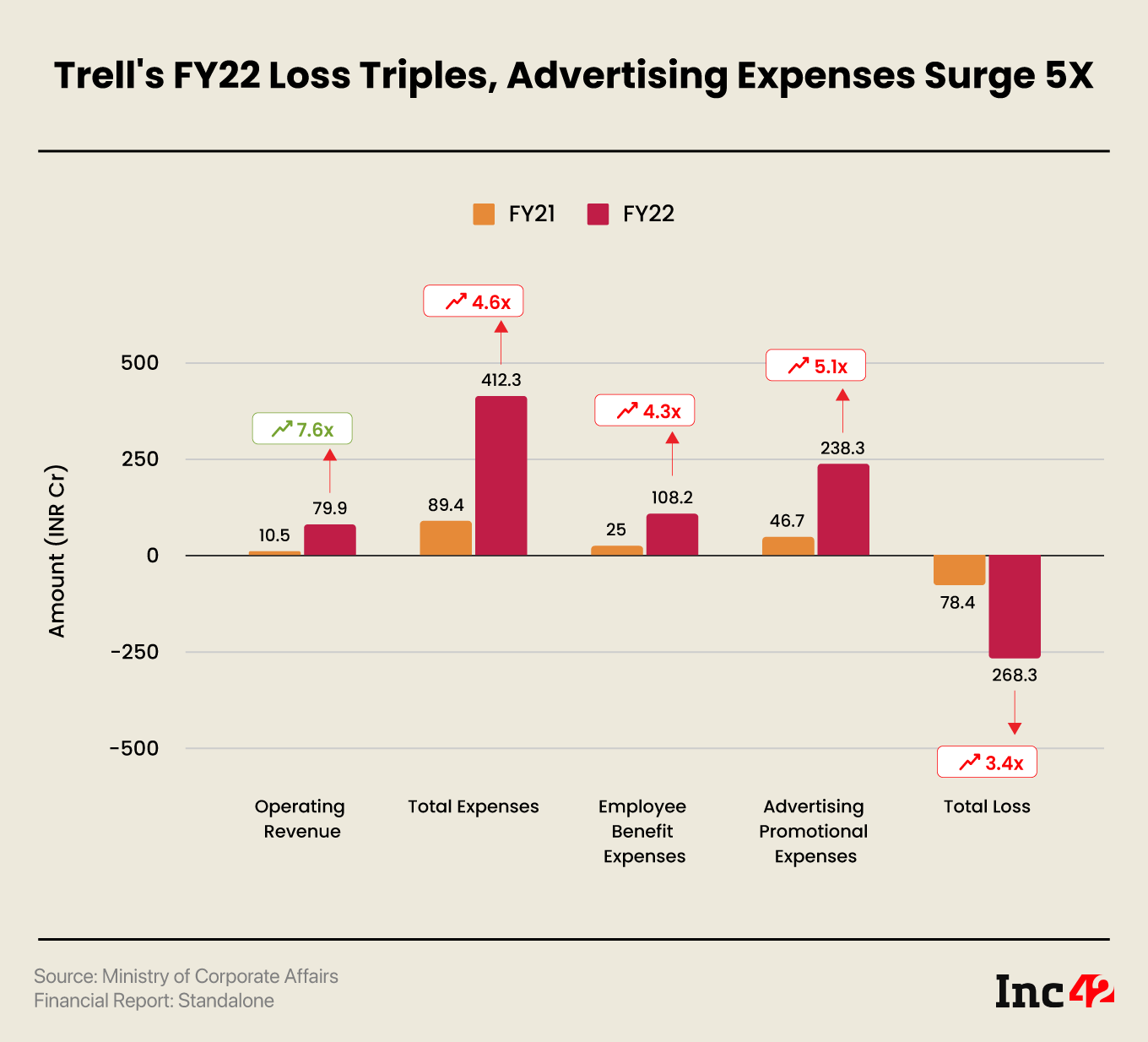

Beleaguered social commerce startup Trell more than tripled its consolidated net loss to INR 268.34 Cr in the financial 2021-22 (FY22) largely on account of soaring employee benefit expenses. In comparison, Trell reported a net loss of INR 78.42 Cr in FY21.

Revenue from operations also surged 7.56X to INR 80.12 Cr in the fiscal year ended March 2022, compared to INR 10.59 Cr reported in FY21. Overall, Trell’s total revenue grew by a massive 1085% to INR 144.7 Cr in FY22 from INR 12.2 Cr a year ago.

Even as its revenues took a major leap, so did the expenses. The startup’s total expenditure during the period under review ballooned more than four times to INR 413.04 Cr in FY22. In contrast, Trell raked up an expenditure of INR 89.49 Cr in FY21.

Of these, employee benefit expenses accounted for INR 108.2 Cr while ‘other expenses’ hovered around the INR 299.79 Cr mark. Curiously while losses continued to pile up at the startup, the three cofounders – Pulkit Agrawal, Bimal Kartheek Rebba, Arun Lodhi – took home a fat cheque of INR 74.78 Lakhs each in FY22.

The FY22 numbers present a picture of the financial health of Trell right before allegations of financial irregularities at the startup surfaced.

Founded by the trio along with Prashant Sachan (who left the startup in 2020), Trell is a social commerce platform that operates at the intersection of content and ecommerce.

At the outset, Trell wooed investors as multiple venture capital firms including the likes of Sequoia, Elevation Capital and Matrix Partners lined up to invest in the company. It raised a $45 Mn Series B funding round in the July of 2021 and was reportedly mulling raising a $100 Mn fundraise somewhere in 2022.

As 2022 dawned, it was reported, at the time, that a group of Trell investors launched a forensic audit at the company through Ernst & Young (EY) over allegations of financial mismanagement. As the drama unfolded, Trell laid off half of its workforce, or 300 employees, as the funding talks fell through and pressure mounted over heavy expenditures.

What followed was a public fracas that saw cofounder Agrawal sending a note to investors accusing the latter of meddling and ordering an audit without any authorisation from either the company or its board of directors.

Agarwal even went on to say that the founders would not take a ‘hit on their reputation lying down’ and would do everything within their command to protect the startup’s reputation, if forced.

Months later in August, Pulkit Agrawal told a publication that speculations about any financial irregularities at the startup were ‘totally baseless and unfounded’, adding that Trell would reach break-even by the end of FY23.

Since then, the same set of cofounders have been leading the company while there has been no clarity on the contents of the audit report submitted by EY in the matter. Unlike fellow Sequoia-portfolio companies BharatPe and Zlingo which saw top executives fight pitched battles with investors publicly, Trell appears to have circumvented that fate.

Trell still appears to be in the middle of a shaky financial situation and has grabbed the headlines for all the wrong reasons from layoffs to facing a funding crunch. While competitors such Woovly and similar offerings by YouTube and Facebook have scaled up heavily in the past one year, it remains to be seen what trick Trell has up its sleeve as it continues to bleed cash heavily.