CRED is said to be eyeing a bigger digital lending play and compete more directly with the likes of Paytm and PhonePe

There’s a funny dichotomy in fintech. It’s one of the hardest sectors for profitability but at the same time, the answer is relatively simple: lending. Even apps like Cred

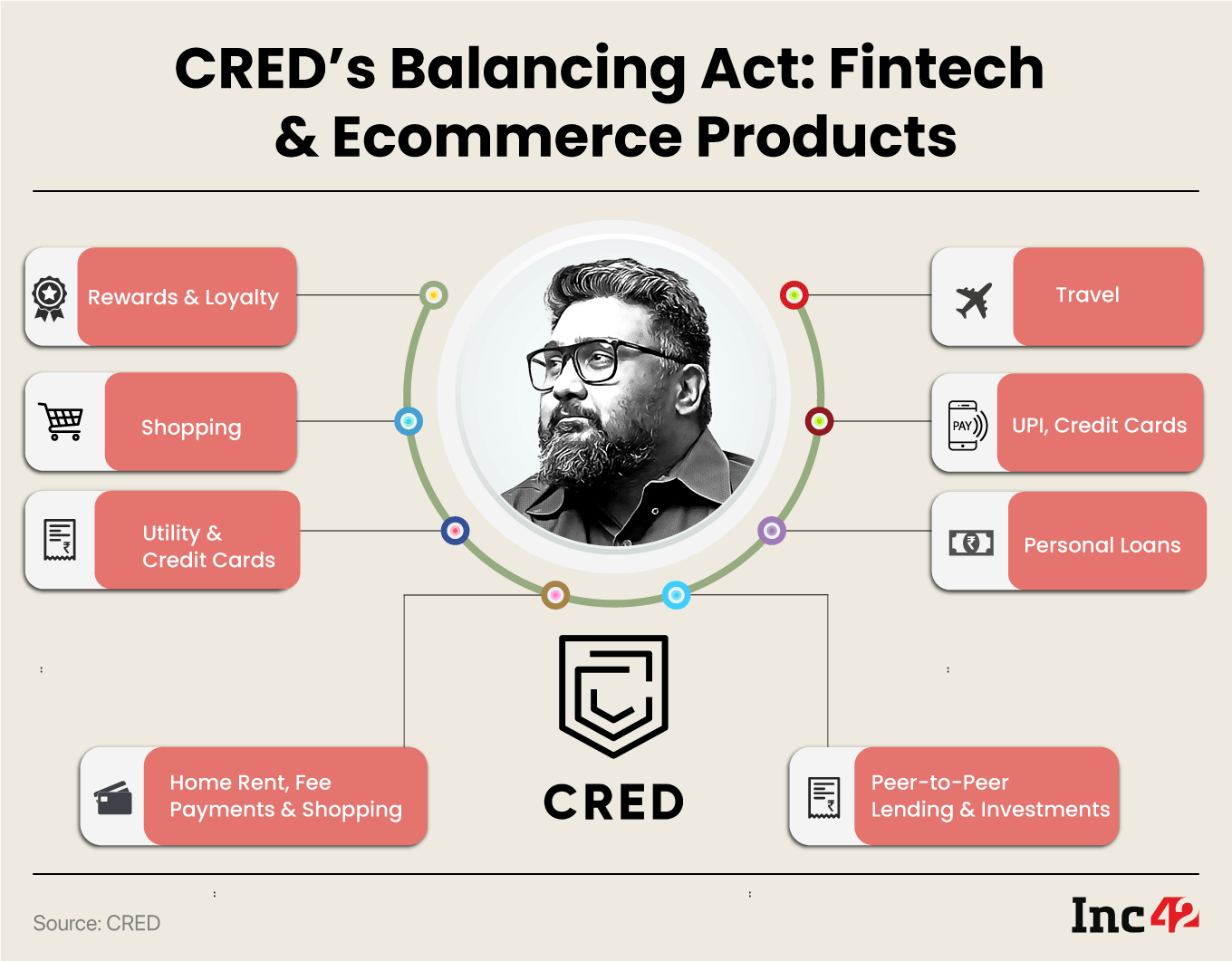

CRED has long relied on its product sophistication and design to set itself apart, but when it comes to the model, these things play only a minor role. Its model has undergone a big change and now it’s moving closer to being another fintech super app, à la Paytm and PhonePe.

Indeed Paytm’s improved financial situation at the end of Q4 FY23 might have signalled to founder Kunal Shah and CRED that lending might be the answer, but does CRED risk losing some of its DNA in the process? Our take on this balancing act that’s coming for CRED, but do read these big stories from our newsroom this week:

- Rahul Yadav’s Latest Disaster: Rahul Yadav is at the centre of yet another major controversy at Broker Network after the Housing.com fiasco. Our investigative story about the alleged financial web spun by founder Yadav that has left the company on the brink of collapse

- Angel Tax Battle Not Over: Despite some positive changes in regards to the so-called angel tax on foreign investments, the funding outlook could yet worsen for growth-stage startups

- Paytm’s Trump Card? Paytm Payments Bank is in many ways Vijay Shekhar Sharma’s key to building India’s first $100 Bn tech company. But regulatory headwinds are the biggest hurdle

CRED’s New DNA

We’ve, of course, written about CRED and its efforts to eke out more revenue from its relatively captive user base. This saw the launch of a Scan&Pay UPI product for its members in October 2022, which was perhaps a bit too late.

Soon after, CRED jumped into the BNPL space and tap-to-pay for credit cards followed by UPI-based peer-to-peer payments in April. It forayed into the luxury travel space with CRED escapes. This despite the UPI push not working out particularly well.

UPI remains a tough nut to crack. As per the National Payments Corporation of India (NPCI) data, UPI logged 868.5 Cr transactions in March 2023, out of which CRED processed 4.2 Cr transactions (less than 1%).

So it wasn’t a surprise this week, when ET reported that the fintech unicorn is looking at expanding and casting a wider net for its lending products. This means the company will start targeting even those users who do not have a credit card or may not even have a credit history.

Of course, this approach is a lot more risky and requires regulatory pieces to be in the right places.

The Pieces In CRED’s Lending Play

CRED’s big advantage in the lending space could be its acquisition of CreditVidya, which operates Prefr, a digital lending platform that has developed underwriting and risk assessment models. Besides this, it also has access to Newtap Technologies, another NBFC owned by CEO Shah.

Prefr and NewTap are likely to be integrated as CRED looks to scale up its lending capabilities, but the CRED product which targets premium users is likely to be separate from the Prefr app for lending to the wider masses (more on this later).

Unlike UPI payments which do not have a big revenue upside and credit card-based fintech services that have a limited addressable market in India, the push for loans is likely to be a major revenue source for CRED in the next few years.

Paytm, which has made a bigger push in the lending space, has reaped the rewards. In Q4FY23, Paytm’s payments revenue grew by 41% YoY to INR 1,467 Cr, revenue from lending surged (183%) to INR 475 Cr. The number of loans disbursed grew a whopping 82%, and the total value of loans saw a massive leap of 253% YoY.

PhonePe is also looking to move in this direction, but its failed ZestMoney acquisition bid may have set it back a few months.

Will Product Strategy Work?

CRED is said to have helped create a loan book of INR 10,000 Cr for its lending partner through its CRED Cash offering so far. But the claimed multi-product strategy means Prfer might not have access to CRED’s existing user base.

Given that CRED itself has spent millions on marketing, does a separate app really make financial sense for the company? CRED is already packed to the gills with features. But besides financial services and payments, it has a store and travel vertical in the same app, which are said to be catering to a premium audience as well.

So the biggest reason for separating the two products could be that the products are not meant for the same audience, which means Prfer might offer low ticket size loans to start with.

Another strategy — perhaps more unit economically sound — would have been to pay off the high customer acquisition cost of CRED by simply turning on the lending tap.

The Pressure Of Profits

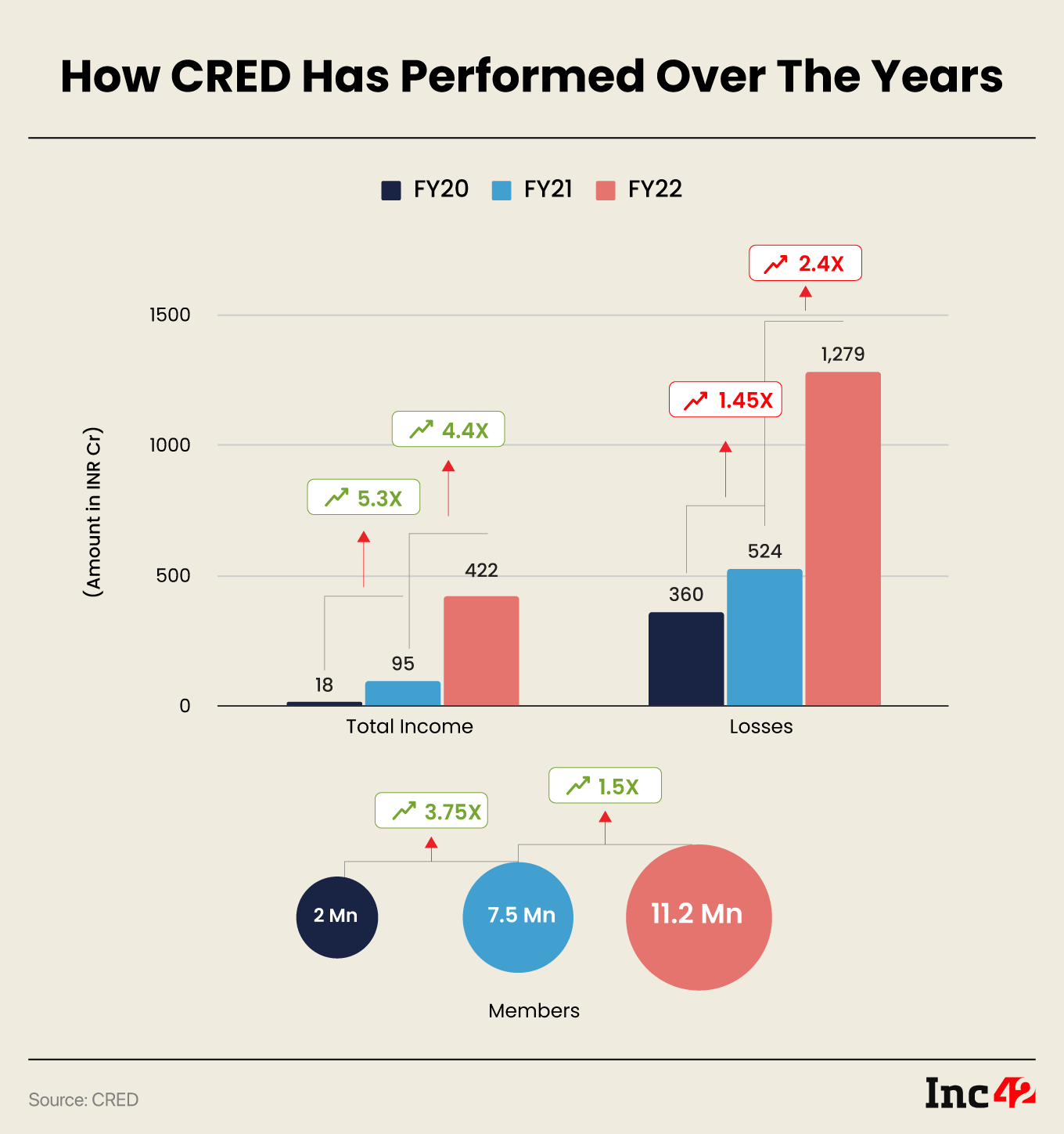

Lending may be an answer, but it’s also arguably the biggest sign so far that CRED is feeling the pressure to get to profits. It has also had to rationalise employee costs and laid off about 35% of Happay’s workforce.

After all, we are in the midst of a markdown season. Unicorns GupShup, Pharmeasy, BYJU’S, Meesho all saw valuation markdowns this past week as several US-based investors trimmed the fair value of their investments in these Indian startups.

Admittedly a markdown is not a sign of the startup actually losing its valuation, but just that the investors believe the capital they invested is worth lower (on paper) than it was at the time of the infusion.

As far as CRED is concerned, it is valued at $6.4 Bn and has raised over $800 Mn in funding since its inception with Singapore’s GIC, Sequoia Capital, Tiger Global, Alpha Wave, and Dragoneer Investment Group among its backers.

The company spent nearly INR 1,000 Cr in FY22 on the marketing front and made a net loss of INR 1,279 Cr. It will be interesting to see if the product separation will work out or will it further stretch CRED’s marketing budget and losses?

We don’t know yet if CRED will go through such a markdown, but the fact is that the company is under pressure to prove that it can generate revenue rapidly and sustainably without requiring hundreds of millions of dollars.

This is where we have to once again question the product strategy.

The Next Phase

CRED is one of the most recognised startup brands in the country thanks to its IPL sponsorship deals, but launching a separate app nullifies this brand equity accumulation, said the founding partner of a Bengaluru-based early-stage fund.

In terms of the competition, CRED will also be up against the likes of Paytm, Moneytap, Bajaj Finserv, Moneyview, Navi as well as a host of other apps such as Slice, Jupiter Money, Lazypay that have pivoted to personal loans in recent months after RBI’s changes for PPI-based lending products last year. It won’t be easy to cut through this clutter.

There’s little doubt that fintech startups cannot rely on payments alone to scale up sustainably. As CRED comes up on its sixth year, the company has to diversify and expand its growth horizons.

While India’s credit card base has the potential to grow at a fast enough pace to meet CRED’s ambition in the future, for now, the company has to look beyond this cohort of 77 Mn credit card holders.

The Kunal Shah-led company’s potential path to profits has long been questioned, and the bigger push on the personal loans front could be a signal that the heat is getting to the company. Will its loans-for-revenue bid work?

Startup Spotlight: EMO Energy’s Tech Stack For Safer Batteries

With 2022 unfortunately becoming known as the year of EV fires, there’s plenty of focus on how the EV ecosystem will solve this as temperatures continue to rise each passing season.

Bengaluru-based EMO Energy thinks the answer lies in its portable battery solution with a 30-minute charging time and full-stack technology for two and three-wheelers, and is currently testing a 30 kWh battery pack for heavy vehicles.

EMO Energy is targeting EV players across the chain with its vertically-integrated battery tech stack from charging to swapping given its software-plus-hardware hybrid approach.

Read how EMO Energy plans to change EV batteries

Sunday Roundup: Funding, Tech Stocks & More

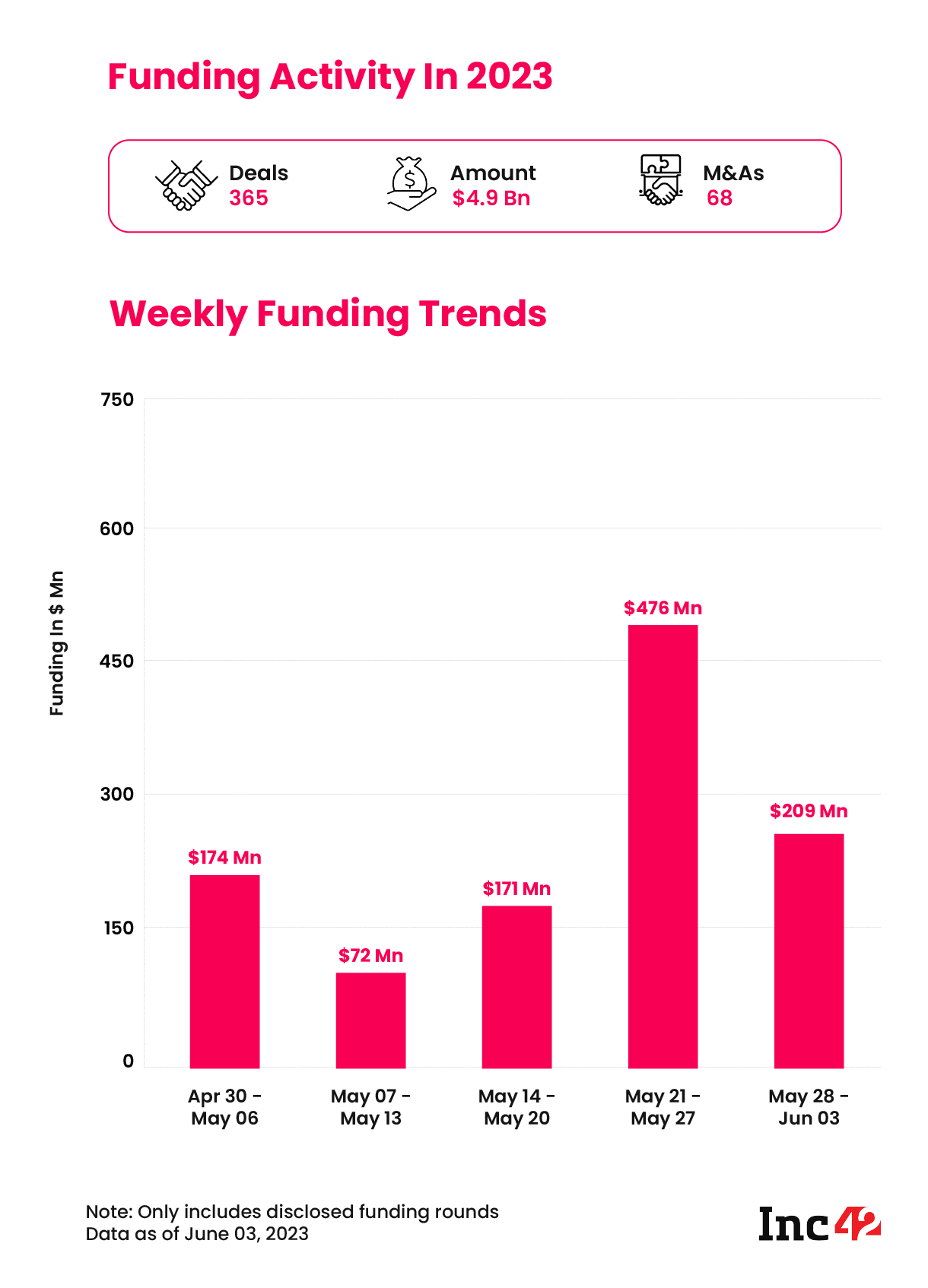

- Funding Deals Become Rare: June began with one of the slowest weeks for startup funding as far as number of deals are concerned — not that the past few months were good. With just 13 deals and $209 Mn raised, startups are still not out of the slowdown

- Nestaway Fire Sale: From its all-time valuation of $220 Mn in 2019, home rental startup Nestaway has been acquired in a distress sale for around $11 Mn

- Bhavish Aggarwal’s New Plans: The Ola boss incorporated a company named Krutrim Si Designs Private Limited in April and is said to be eyeing the AI sector for this venture

- Zomato’s Comeback? Zomato started a rally this week after months of uncertainty around the stock and ended Friday’s trading with 5% gains since last week

- EV Milestone: Electric two-wheeler registrations crossed the 1 Lakh mark for the first time in May, with Ola Electric continuing to lead the way

We’ll be back next Sunday with more. Till then, follow us on Instagram, Twitter and LinkedIn for the latest news as it happens.

Correction note | June 5, 2023; 11 PM

An earlier version of this article referred to Dragoneer Investments as an investor in CRED, instead of Dragoneer Investment Group. We regret this error

Ad-lite browsing experience

Ad-lite browsing experience